Once a strictly Canadian insurance brand, Great-West Lifeco is now a global financial services conglomerate. Like its bigger parent, Power Corp. of Canada, these days the insurance provider operates across North America and Europe selling everything from investments and back-office retirement plan services to fintech and wealth management.

In fact, subsidiary Empower counts itself as one of the largest U.S. recordkeepers for retirement plan sponsors. As Baby Boomers keep multiplying, the 401(k) plan marketplace has become a gateway for the company to market itself to retail as well as institutional investors.

By early 2022, the Great-West funds family had been rebranded under the Empower emblem. On the heels of such a move, Empower closed a deal to buy Prudential Financial's retirement services arm for a reported $3.55 billion. As a result, Empower estimated its defined contribution plan and defined benefit plan business would increase to serve more than 17 million plan participants and boost retirement plan assets under administration to $1.3 trillion.1

Less than two years earlier, Empower had completed an acquisition of California-based Personal Capital in a deal valued at as much as $1 billion.2 According to industry analysts, the deal represented a deeper move into the fintech field for the Great-West/Empower conglomerate. Through its Power Corp. parent, Great-West/Empower also competes in fintech with sibling connections to Wealthsimple, Portag3 and Diagram.

As Great-West's reach keeps growing across insurance, retirement plan administration and investment management, so does its asset base. In the most recently completed financial quarter, the company reported C$2.3 trillion in consolidated assets under administration.2 Based in Winnipeg, Canada, Great-West has 28,000-plus employees and trades on the Toronto Stock Exchange under the ticker symbol GWO.

Given its continued expansion into investment management, we thought it'd be worthwhile to put under our research microscope the Great-West/Empower family of active mutual funds. This analysis is part of our ongoing Deeper Look series, which investigates claims by managers of peer performance superiority by holding them to a higher standard — i.e., how they've done over longer periods against their respective indexes.

Controlling for Survivorship Bias

It's important for investors to understand the idea of survivorship bias. While there are 21 active mutual funds with five or more years of performance-related data currently offered by Great-West/Empower, it doesn't necessarily mean these are the only strategies this company has ever managed. In fact, there are nine mutual funds that no longer exist. This can be for a variety of reasons including poor performance or the fact that they were merged with another fund. We will show what their aggregate performance looks like shortly.

Fees & Expenses

Let's first examine the costs associated with Great-West/Empower's surviving 21 strategies. It should go without saying that if investors are paying a premium for investment "expertise," then they should be receiving above average results consistently over time. The alternative would be to simply accept a market's return, less a significantly lower fee, via an index fund.

The costs we examine include expense ratios, sales loads — front-end (A), back-end (B) and level (C) — as well as 12b-1 marketing fees. These are considered the "hard" costs that investors incur. Prospectuses, however, do not reflect the trading costs associated with mutual funds.

Commissions and market impact costs are real expenses associated with implementing a particular investment strategy and can vary depending on the frequency and size of the trades executed by portfolio managers.

We can estimate the costs associated with an investment strategy by looking at its annual turnover ratio. For example, a turnover ratio of 100% means that the portfolio manager turns over the entire portfolio in one year. This is considered an active approach, and investors holding these funds in taxable accounts will likely incur a higher exposure to tax liabilities, such as short- and long-term capital gains distributions, than those incurred by passively managed funds.

The table below details the hard costs as well as the turnover ratio for all 21 surviving active funds offered by Empower that have at least five years of complete performance history. You can search this page for a symbol or name by using Control F in Windows or Command F on a Mac. Then click the link to see the Alpha Chart. Also, remember that this is what is considered an in-sample test; the next level of analysis is to do an out-of-sample test (for more information see here).

| Fund Name | Ticker | Turnover Ratio % | Prospectus Net Expense Ratio | 12b-1 Fee | Global Category |

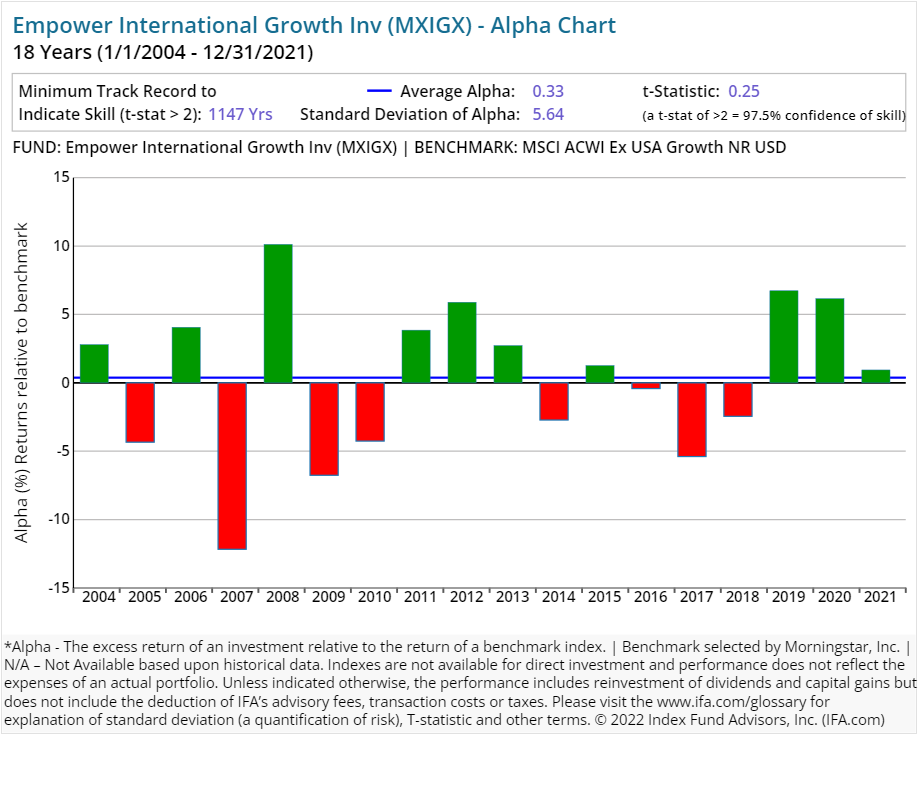

| Empower International Growth Inv | MXIGX | 34.00 | 1.20 | 0.00 | Global Equity Large Cap |

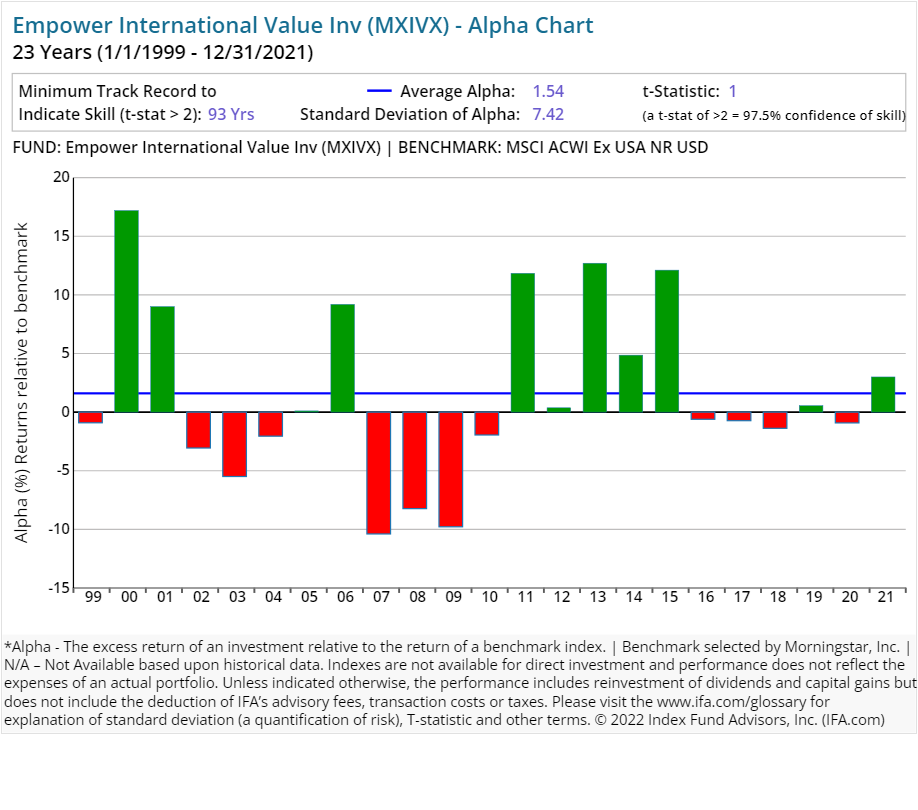

| Empower International Value Inv | MXIVX | 17.00 | 1.07 | 0.00 | Global Equity Large Cap |

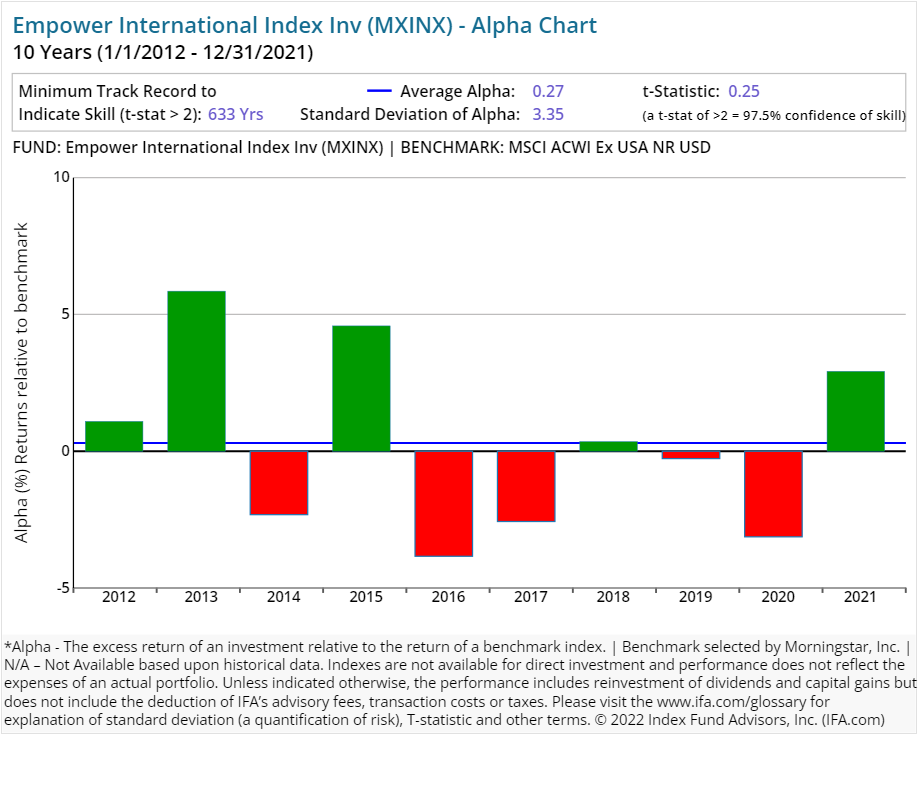

| Empower International Index Inv | MXINX | 13.00 | 0.65 | 0.00 | Global Equity Large Cap |

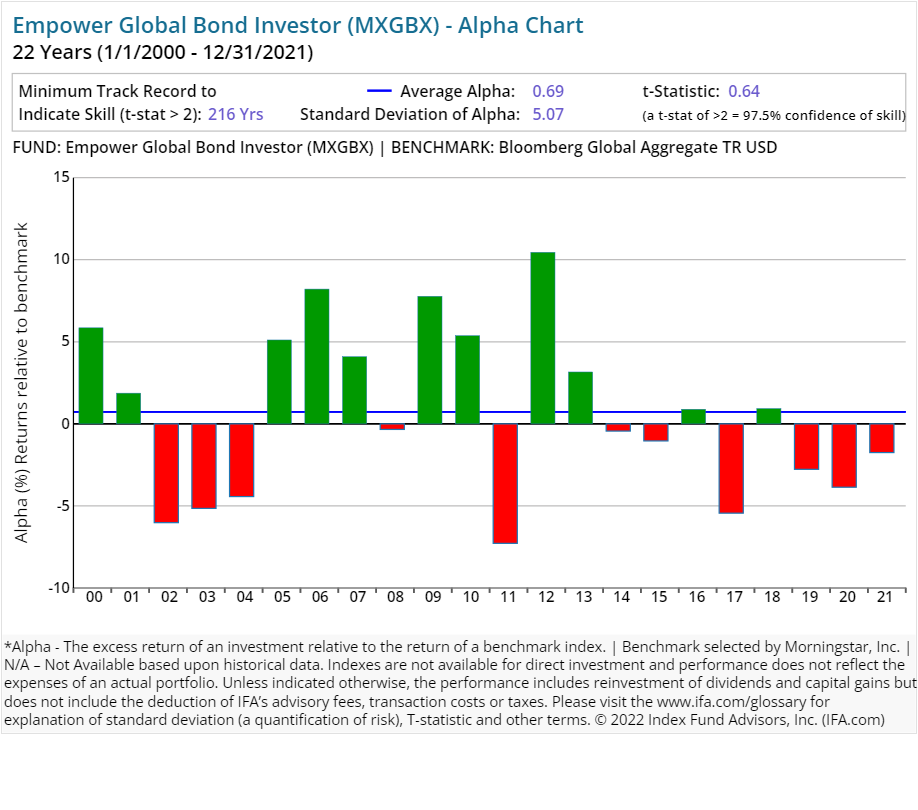

| Empower Global Bond Investor | MXGBX | 184.00 | 1.00 | 0.00 | Global Fixed Income |

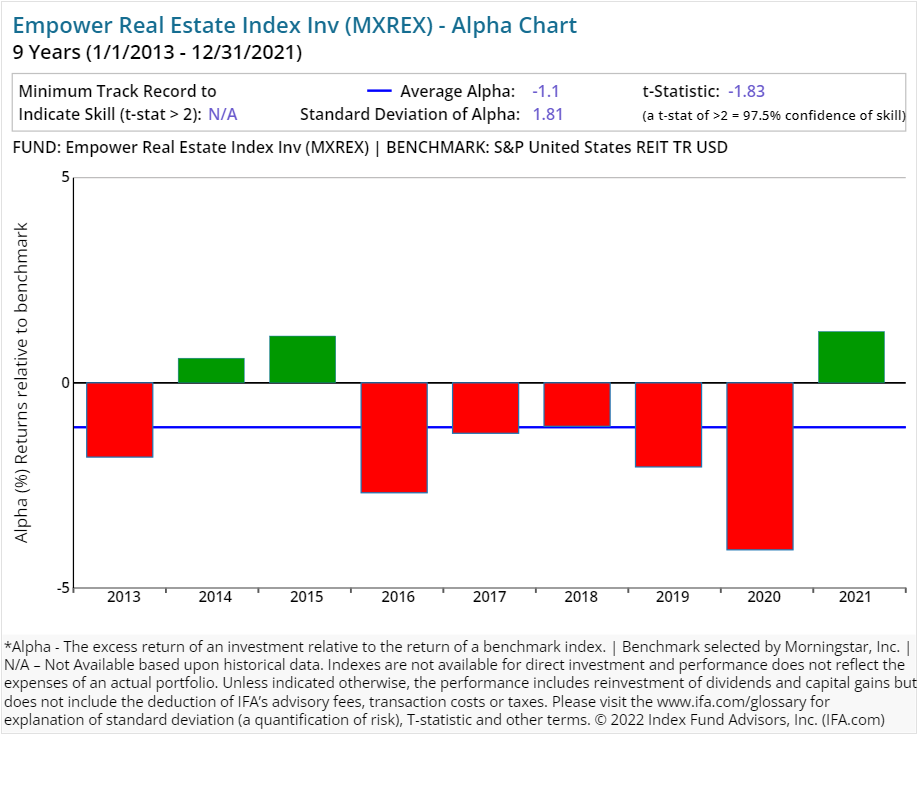

| Empower Real Estate Index Inv | MXREX | 33.00 | 0.70 | 0.00 | Real Estate Sector Equity |

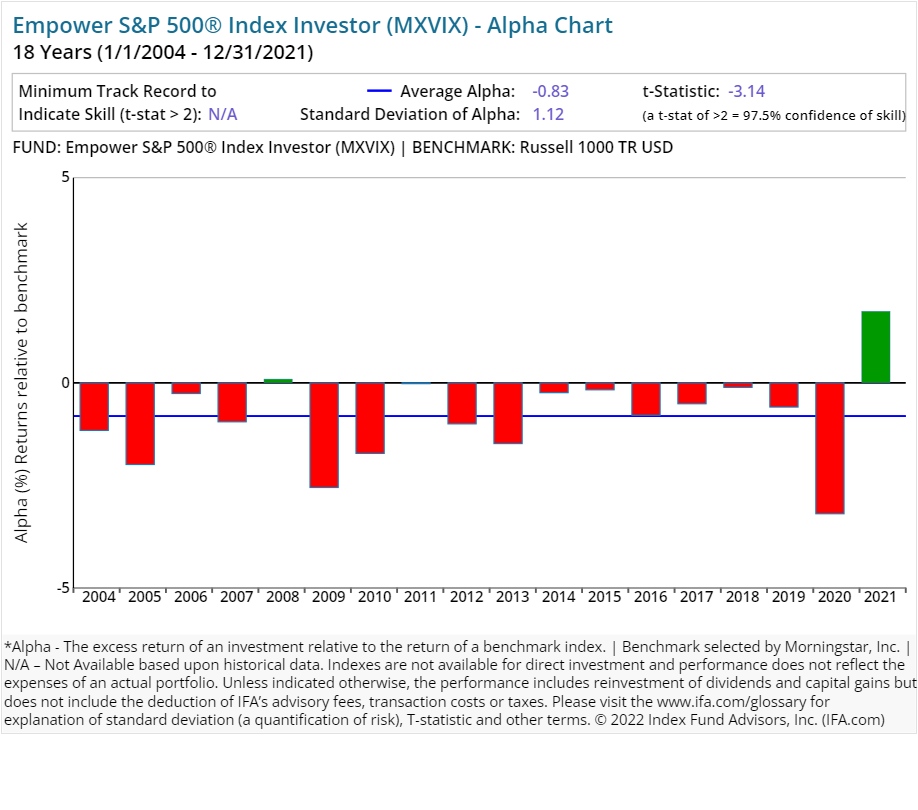

| Empower S&P 500 Index Investor | MXVIX | 9.00 | 0.51 | 0.00 | US Equity Large Cap Blend |

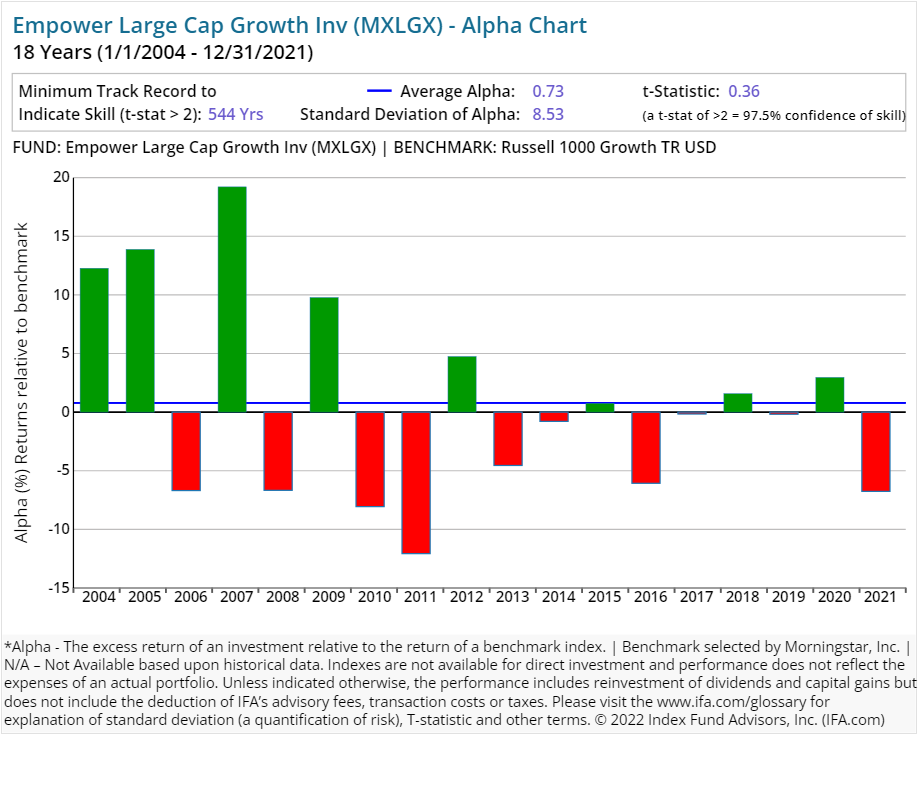

| Empower Large Cap Growth Inv | MXLGX | 46.00 | 1.00 | 0.00 | US Equity Large Cap Growth |

| Empower Large Cap Value Inv | MXEQX | 28.00 | 0.96 | 0.00 | US Equity Large Cap Value |

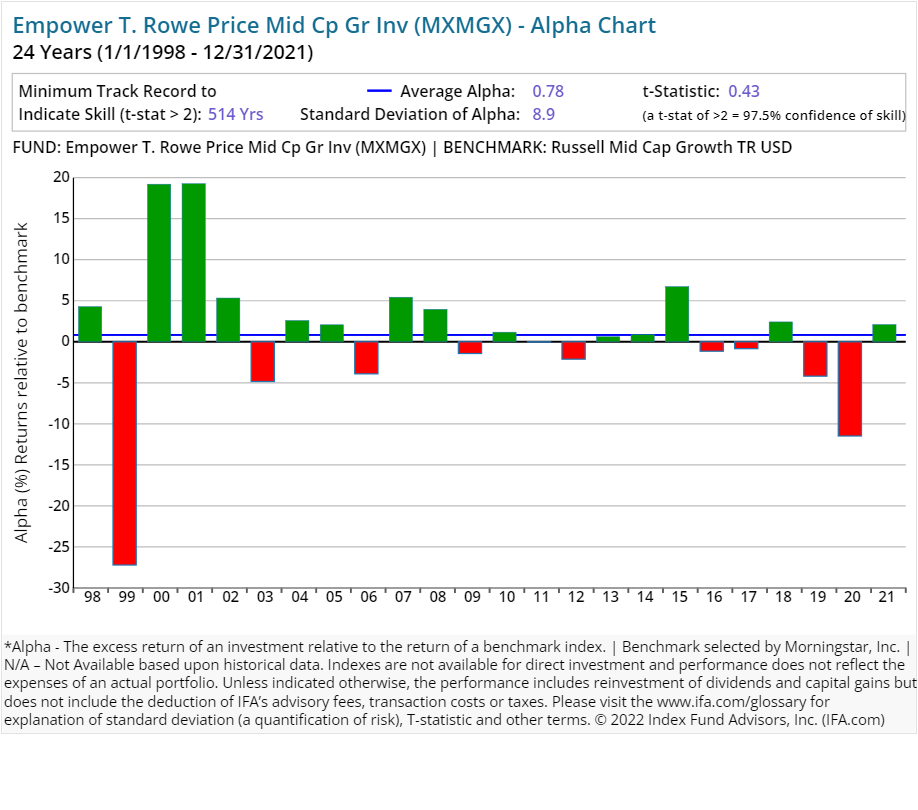

| Empower T. Rowe Price Mid Cp Gr Inv | MXMGX | 21.00 | 1.02 | 0.00 | US Equity Mid Cap |

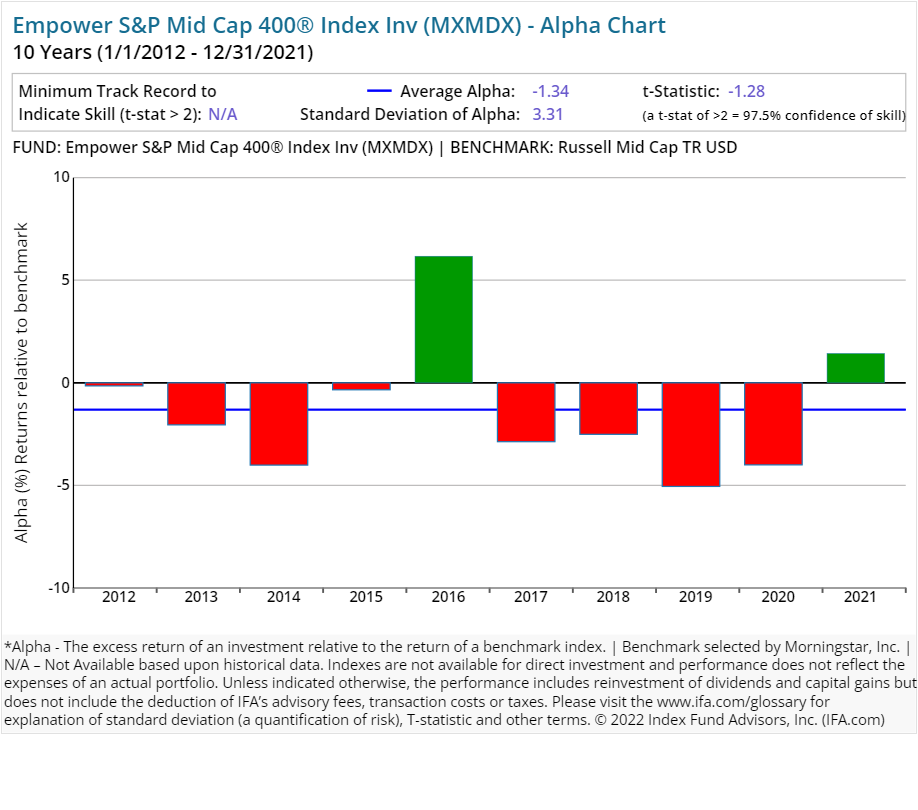

| Empower S&P Mid Cap 400 Index Inv | MXMDX | 25.00 | 0.55 | 0.00 | US Equity Mid Cap |

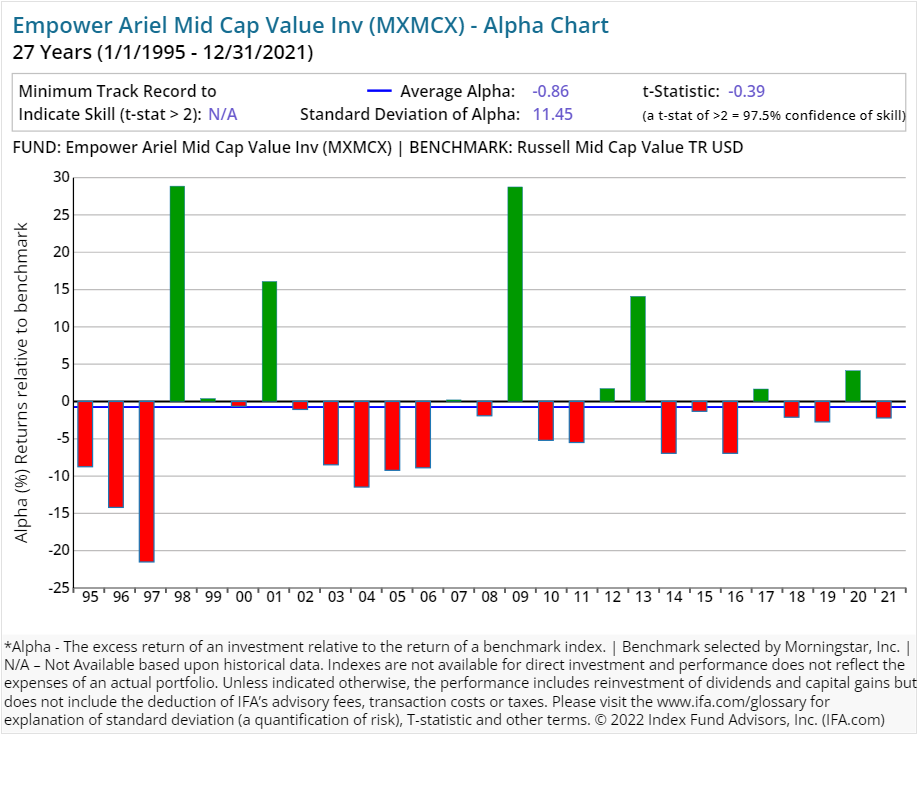

| Empower Ariel Mid Cap Value Inv | MXMCX | 42.00 | 1.05 | 0.00 | US Equity Mid Cap |

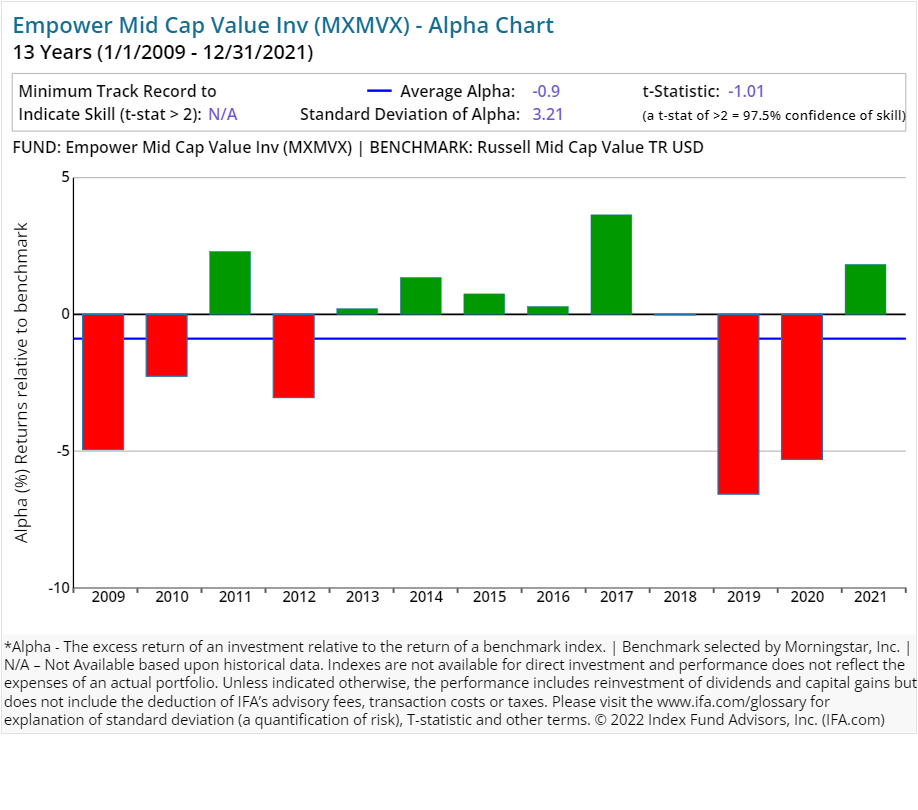

| Empower Mid Cap Value Inv | MXMVX | 227.00 | 1.15 | 0.00 | US Equity Mid Cap |

| Empower Small Cap Growth Instl | MXMSX | 60.00 | 0.84 | 0.00 | US Equity Small Cap |

| Empower S&P SmallCap 600 Index Inv | MXISX | 20.00 | 0.56 | 0.00 | US Equity Small Cap |

| Empower Small Cap Value Inv | MXLSX | 40.00 | 1.09 | 0.00 | US Equity Small Cap |

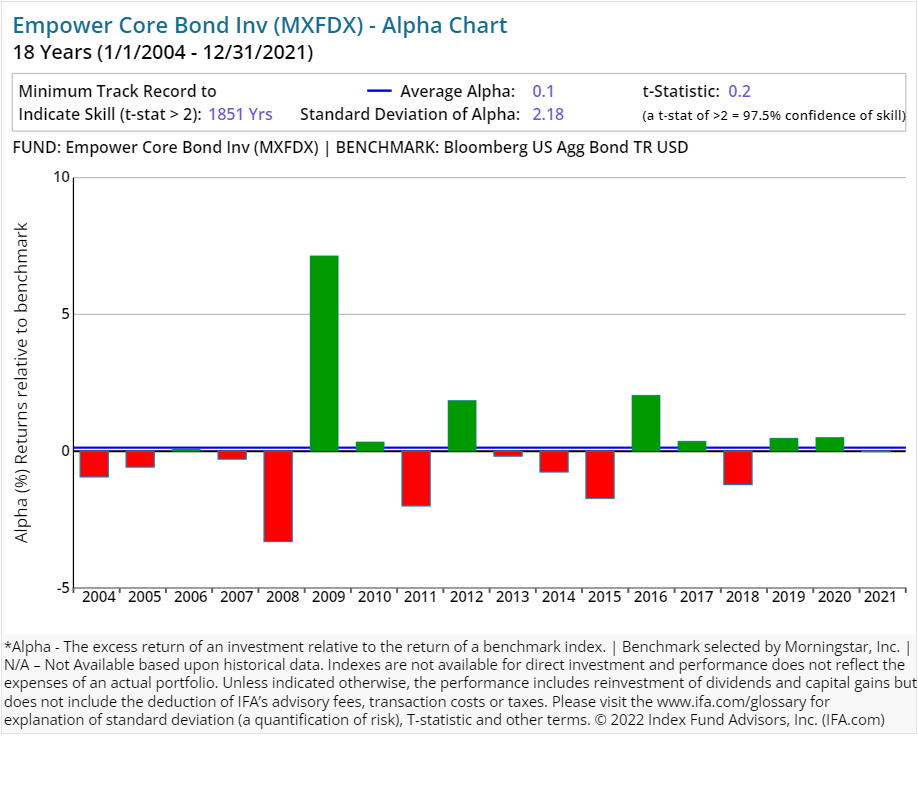

| Empower Core Bond Inv | MXFDX | 72.00 | 0.70 | 0.00 | US Fixed Income |

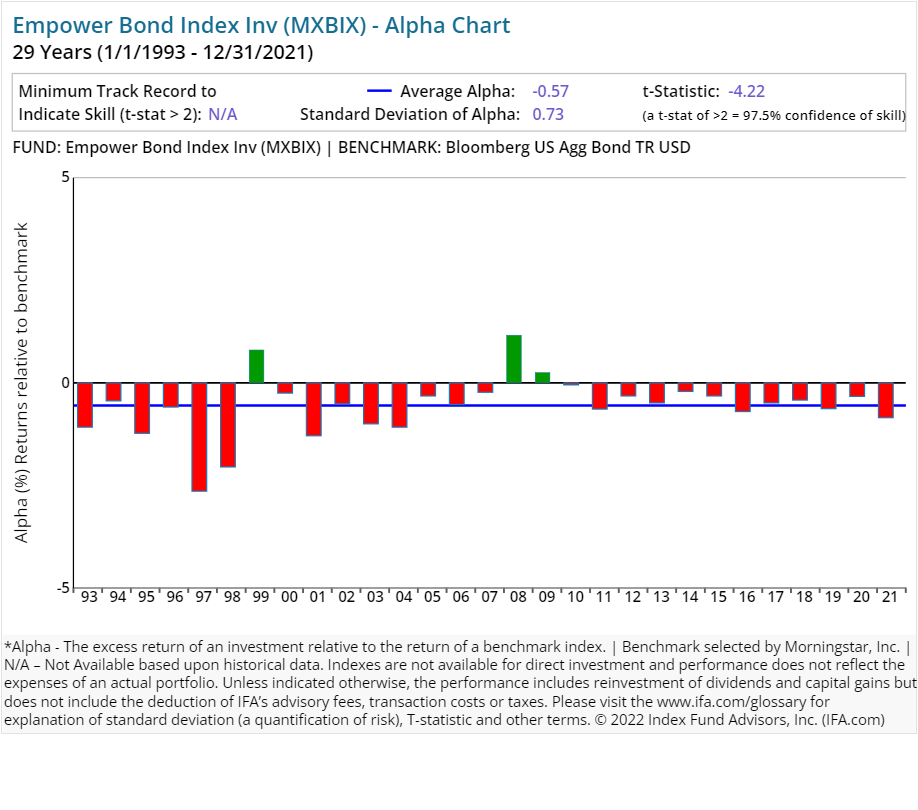

| Empower Bond Index Inv | MXBIX | 39.00 | 0.50 | 0.00 | US Fixed Income |

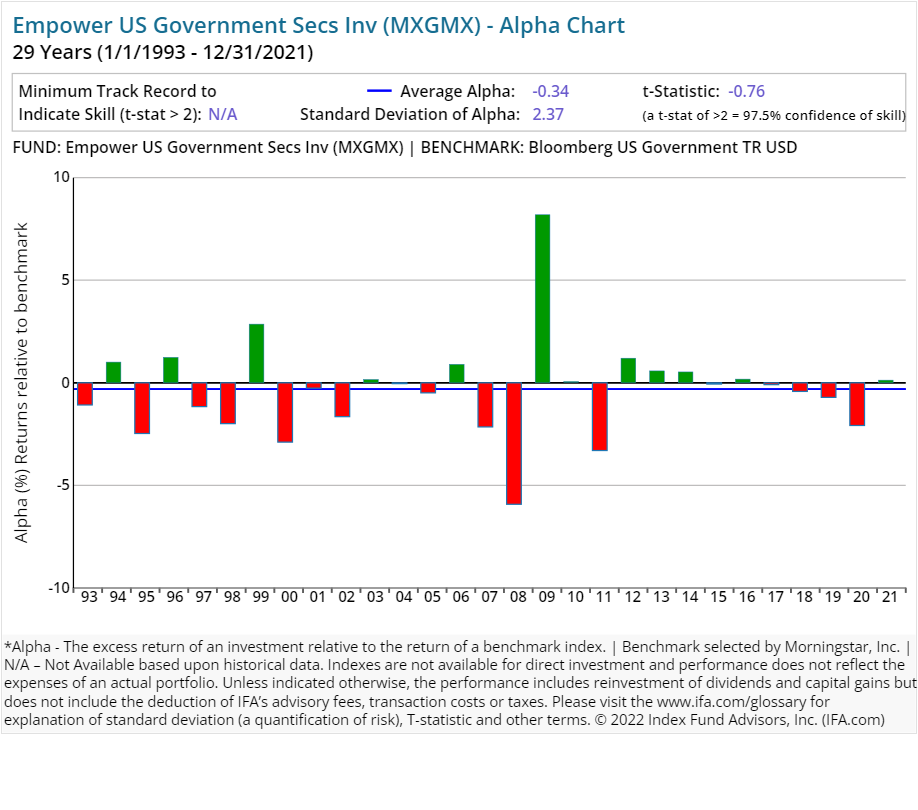

| Empower US Government Secs Inv | MXGMX | 85.00 | 0.60 | 0.00 | US Fixed Income |

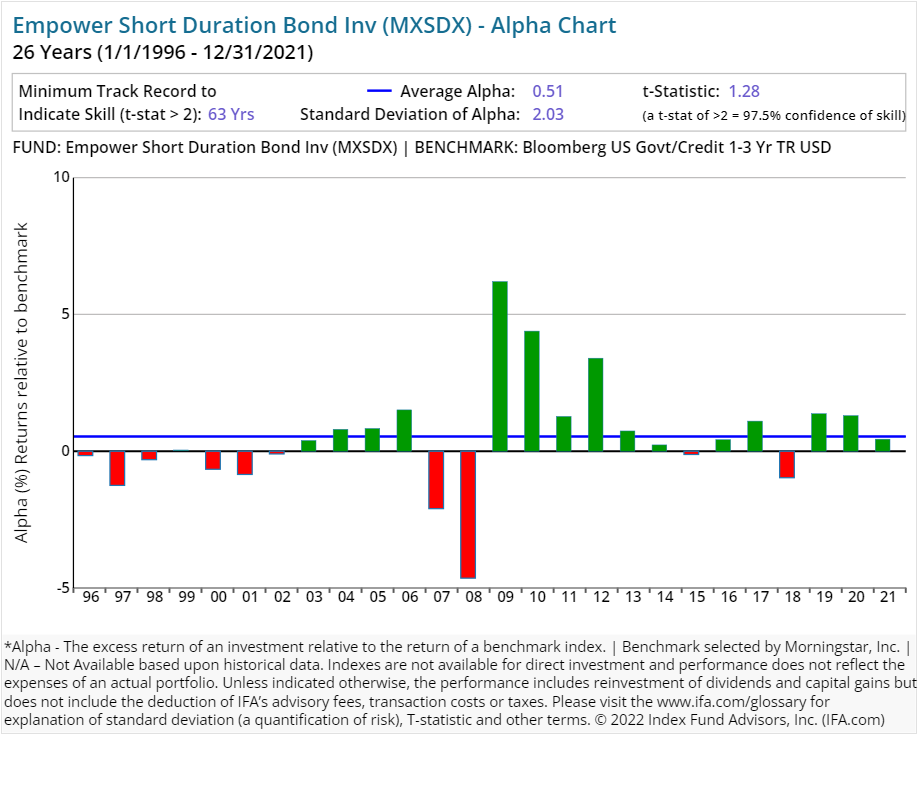

| Empower Short Duration Bond Inv | MXSDX | 123.00 | 0.60 | 0.00 | US Fixed Income |

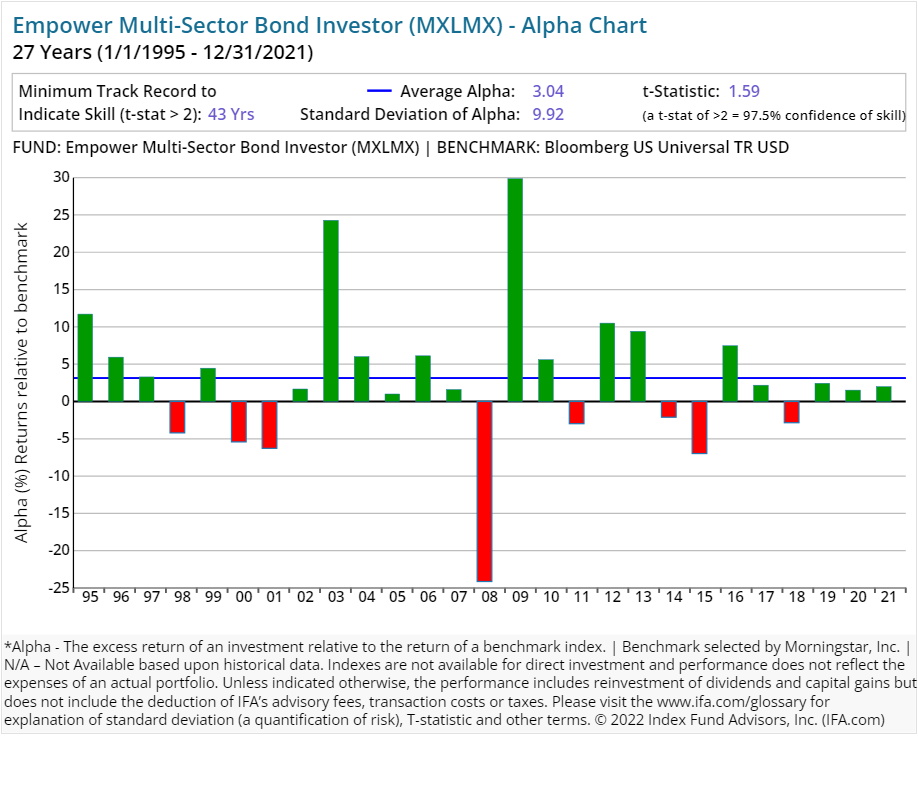

| Empower Multi-Sector Bond Investor | MXLMX | 67.00 | 0.90 | 0.00 | US Fixed Income |

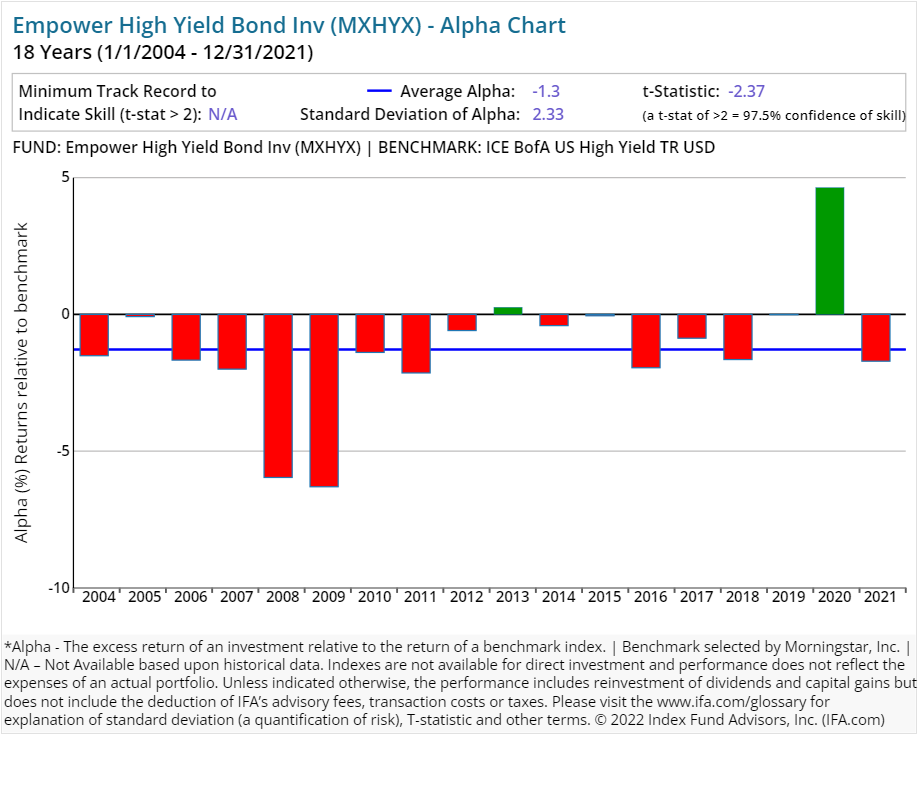

| Empower High Yield Bond Inv | MXHYX | 58.00 | 1.10 | 0.00 | US Fixed Income |

Please read the prospectus carefully to review the investment objectives, risks, charges and expenses of the mutual funds before investing. Great West mutual fund prospectuses are available at greatwestfunds.com.

On average, an investor who utilized a surviving active equity mutual fund strategy from Empower experienced an expense ratio of 0.88%. Similarly, an investor who utilized a surviving active bond strategy from the company experienced a 0.77% expense ratio.

These expenses can have a substantial impact on an investor's overall accumulated wealth if they are not backed by superior performance. The average turnover ratios for surviving active equity and bond strategies from Empower were 43.93% and 89.71%, respectively. This implies an average holding period of 13.38 to 27.32 months.

In contrast, most index funds have very long holding periods — decades, in fact, thus deafening themselves to the random noise that accompanies short-term market movements, and focusing instead on the long-term. Again, turnover is a cost that is not itemized to the investor but is definitely embedded in the overall performance.

Performance Analysis

The next question we address is whether investors can expect superior performance in exchange for the higher costs associated with Empower's implementation of active management. We compare all of its 30 strategies, which includes both current funds and funds no longer in existence, against its Morningstar assigned benchmark to see just how well each has delivered on their perceived value proposition.

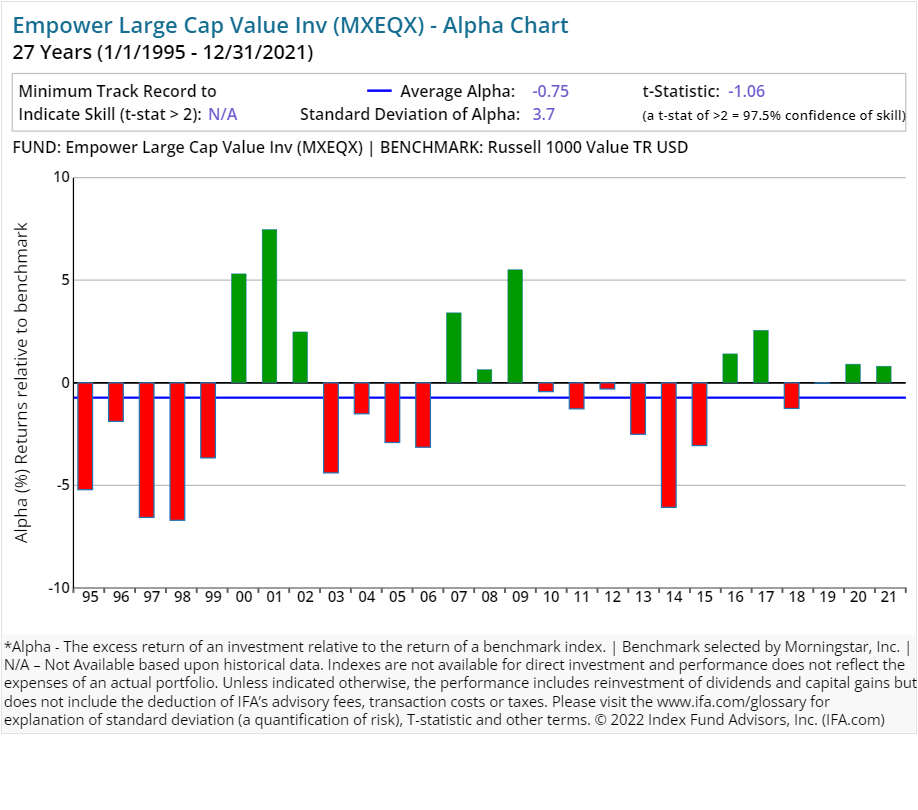

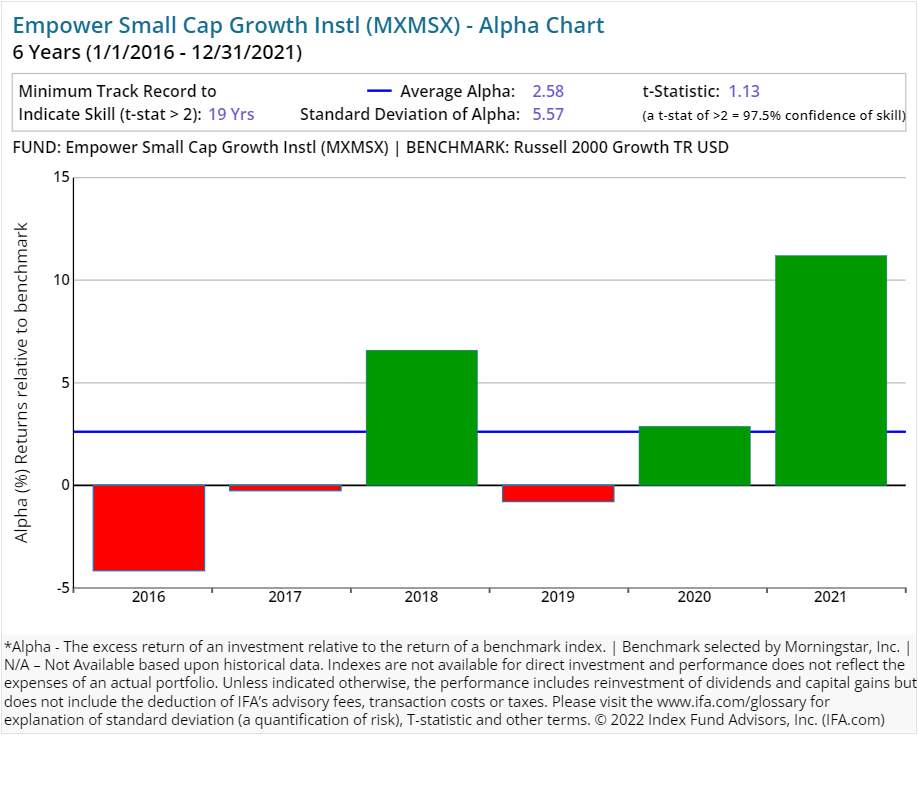

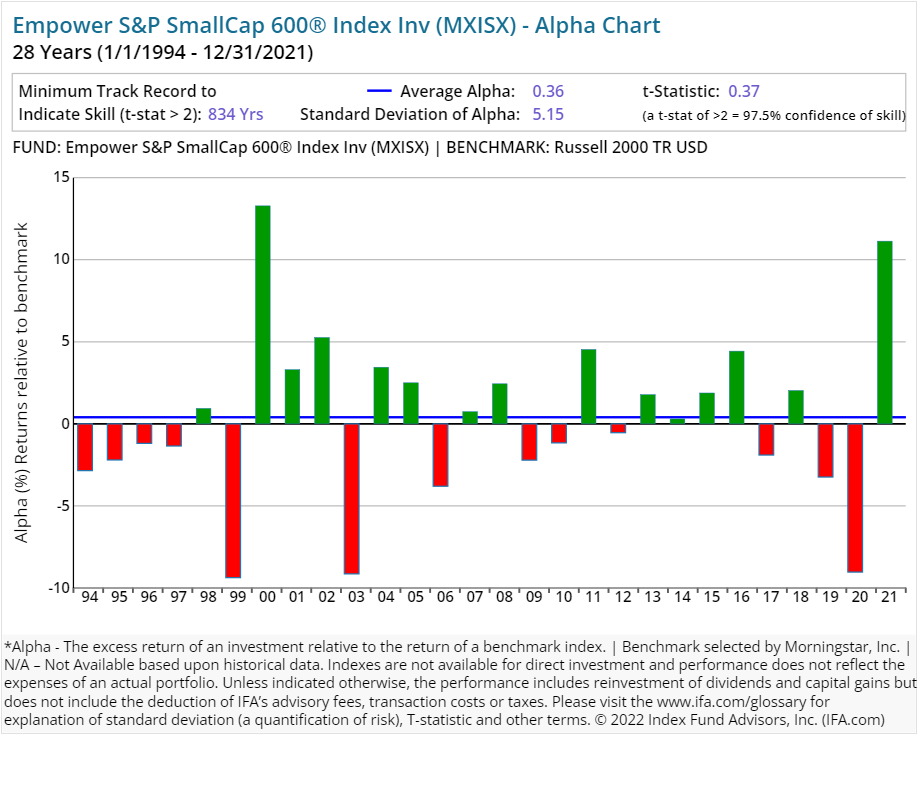

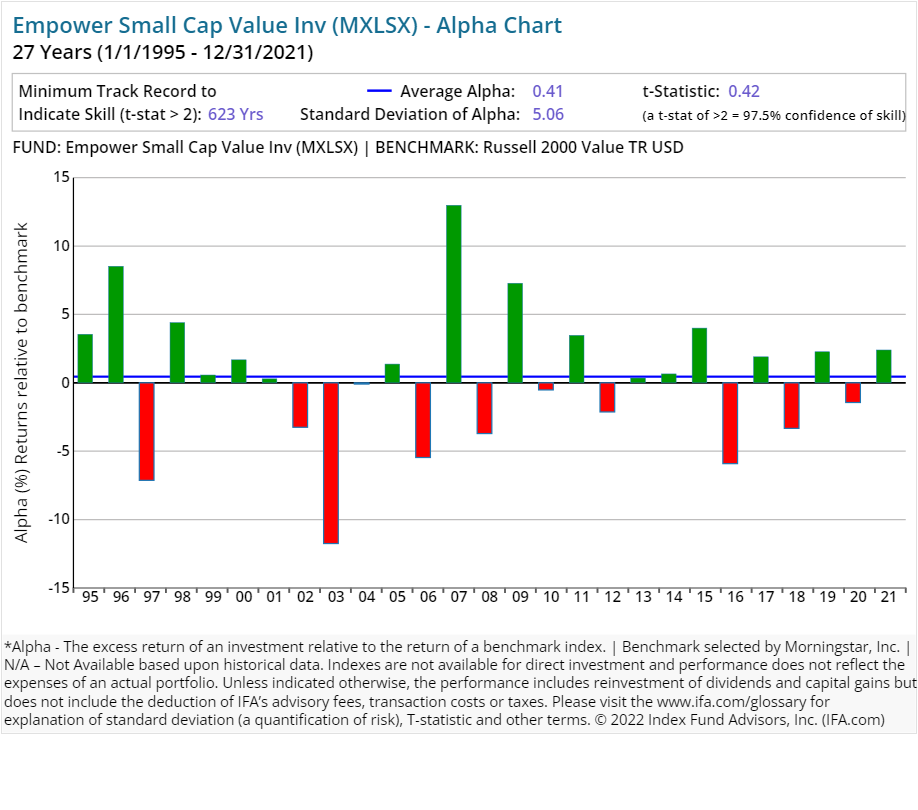

We have included alpha charts for each of their current strategies at the bottom of this article. Here is what we found:

-

60% (18 of 30 funds) have underperformed their respective benchmarks or did not survive the period since inception.

-

40% (12 of 30 funds) have outperformed their respective benchmarks since inception, having delivered a POSITIVE alpha.

Here's the real kicker, however:

- None (0 of 30 funds) wound up outperforming their respective benchmarks consistently enough since inception to provide 97.5% confidence that such outperformance would persist (as opposed to being based on random outcomes).

As a result, this study shows that a majority of funds offered by Empower have not outperformed their Morningstar-assigned benchmark. The inclusion of the statistical significance of alpha is key to this exercise, as it indicates which outcomes are due to a skill that is likely to repeat and those that are more likely due to a random-chance outcome.

Regression Analysis

How we define or choose a benchmark is extremely important. If we relied solely on commercial indexes assigned by Morningstar, then we may form a false conclusion that Empower has the "secret sauce" as active managers.

Since Morningstar is limited in terms of trying to fit the best commercial benchmark with each fund in existence, there is of course going to be some error in terms of matching up proper characteristics such as average market capitalization or average price-to-earnings ratio.

A better way of controlling these possible discrepancies is to run multiple regressions where we account for the known dimensions of expected return in the U.S. (i.e., market risk, size and relative price) as identified by the Fama/French Three-Factor Model.

For example, if we were to look at all of the U.S.-based strategies from Great-West/Empower that've been around for the past 10 years, we could run multiple regressions to see what each fund's alpha looks like once we control for the multiple betas that are being systematically priced into the overall market.

The chart below displays the average alpha and standard deviation of that alpha for the past 10 years through 2021. Screening criteria include funds with holdings of 90% or greater in U.S. equities and uses the oldest available share classes.

As shown above, only two of the mutual funds had a positive excess return over the Fama/French Three-Factor Model. However, none of the equity funds reviewed produced a statistically significant level of alpha, based on a t-stat of 2.0 or greater. (For a review of how to calculate a fund's t-stat, see the section of this study that follows the individual Empower alpha charts.)

Why is this important? A t-stat of the alpha which is 2.0 or greater would give an investor confidence that a manager's results would be attributable to skill and repeatable. A t-stat of less than 2.0, would indicate that a manager's performance was attributable more to luck.

Conclusion

Like many of the other largest financial institutions, a deep analysis into the performance of Great-West/Empower has yielded a not so surprising result: Active management is likely to fail many investors. We believe this is due to market efficiency, costs and increased competition in the financial services sector.

As we always like to remind investors, a more reliable investment strategy for capturing the returns of global markets is to buy, hold and rebalance a globally diversified portfolio of index funds.

Below are the individual alpha charts for the existing Empower actively managed mutual funds that have five years or more of a track record.

Here is a calculator to determine the t-stat. Don't trust an alpha or average return without one.

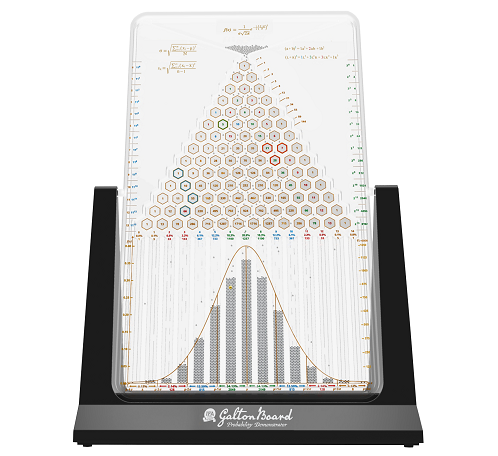

The Figure below shows the formula to calculate the number of years needed for a t-stat of 2. We first determine the excess return over a benchmark (the alpha) then determine the regularity of the excess returns by calculating the standard deviation of those returns. Based on these two numbers, we can then calculate how many years we need (sample size) to support the manager's claim of skill.

Footnotes:

1.) Great-West Lifeco, Second Quarter 2022 Results, Aug. 2, 2022.

2.) Great-West Lifeco, Press Release, Aug. 18, 2020.

3.) Great-West Lifeco, Second Quarter 2022 Results, Aug. 2, 2022.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.