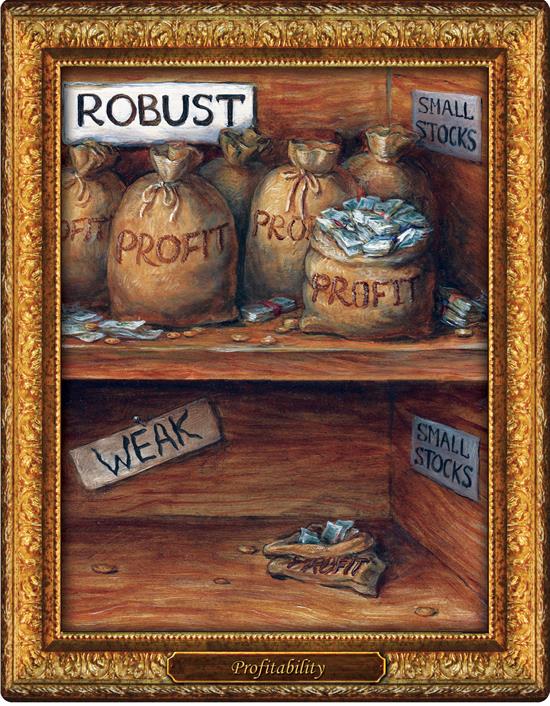

Research into common characteristics of stocks that've produced better results for investors keeps evolving. Along these lines, an important discovery in the field of financial economics is identification of the profitability premium.

In such a view, profitability is measured by the ratio of operating profitability minus interest expense to book value. In essence, this is a calculation to drill into a company's income statement, which shows differences between revenues, costs and expenses. To investors, such a breakdown is crucial to understanding if a business is generating profits or running in the red.

In one of the most comprehensive research reports we've seen yet assessing the characteristics of profitability for investors, Dimensional Fund Advisors dug into market and company data spanning 50-plus years (1964-2016). The conclusion of DFA's analysis — which was first published in early 2017 — found that not only does "current profitability hold information about future profitability" but "firms with higher profitability have had higher returns than those with low profitability."1 (This relationship, while observed over past data, does not guarantee similar outcomes in the future.)

Other highly cited academic work over the years leading to similar insights includes research by professors Eugene Fama and Kenneth French2 as well as Robert Novy-Marx.3

For IFA's investment committee such in-depth research continues today to stand as fundamentally significant — not to mention relevant — in our implenentation of broad and long-term focused investment strategies. As a result, IFA offers a dedicated "high profitability" implementation. It's designed as an alternative for IFA clients whose investment plans might benefit from a larger tilt to such a premium.

Of course, traditional implementations of IFA Index Portfolios already incorporate such an added dimension of returns. This is largely accomplished through our preferred fund company, DFA, and its specialized stock screening process. Besides profitability factors, Dimensional targets stocks with characteristics related to market, size, value, profitability and investment premium — each of which have also been identified by leading academic researchers as long-term drivers of higher expected equity returns. (See graphic below.)

Before deciding on a profitability implementation, an IFA wealth advisor can provide a high-level overview of what exposure to our profitability implementation means in a practical sense. As an example, let's consider an IFA high profitability asset-allocation strategy utilized in IRA accounts. For this implementation, IFA replaces the Schwab S&P 500 fund with the DFA US High Relative Profitability fund.

On the developed ex-U.S. equity side, we can use the DFA International High Profitability fund in place of the DFA International Value fund. (Besides an implementation for tax-deferred acounts, it's also probably worth noting that IFA offers a high profitability implementation for taxable accounts.)

Both of these funds land in the U.S. large-cap blend category and don't diverge much in terms of market capitalization size, according to Morningstar data. The rest are divvied up among mid caps. Traditionally, neither has provided much (if any) exposure to small caps.

Differences emerge between each fund's exposure to different major sectors of the U.S. market. Through October 2022, the DFA US High Profitability fund held notably more stock than the S&P 500 fund in some industries that can be considered as more growth-oriented in style — technology, consumer defensive and consumer cycles, per Morningstar. By comparison, the domestic profitability fund had less invested in financials, energy and utilities.

The DFA profitability fund, on the other hand, is more concentrated. Greater diversification, of course, aims to provide a smoother ride for investors through a lifetime of investing. On the whole, though, such a greater focus on profitability comes as part of an already globally diversified IFA Index Portfolio that provides tilts to size, value and profitability. The end result is a portfolio alternative that provides a targeted tilt towards the profitability premium, incorporating supported metrics while maintaining a diversified approach.

While historical data suggest that our high profitability implementations have resulted in comparable return profiles relative to traditonal IFA Index Portfolios, future performance remains uncertain and dependent on various factors, including market conditions. No guarantee exists that past performance patterns, such as the profitability premium, will persist. Current and future market conditions may produce materially different outcomes.Yet, as the scatterplot below illustrates, risk and return profiles for each type of implementation wound up so close that you've needed to click on a portfolio's dot to distinguish results from the alternative. (Click on the "Standard Implementation" button and the "High Profitability Implementation" to compare either option.)

Since these alternative portfolios don't come along with profiles suggesting higher expected returns, a natural question is: "Why should an investor pick a profitability implementation as opposed to a regular IFA Index Portfolio?"

Professor Novy-Marx, who is perhaps the most highly cited academic researcher in this area, observes that "we really think about the profitability premium in very much the same way as we think about the value premium."4

Simply put, screening stocks by a company's level of profitability "helps you get a more informative price signal," he says. "And so, if you're looking at two firms that have similar relative prices … it makes relative price more informative."

In explaining the importance of implementing a company's profitability into the valuation mix, Novy-Marx likes to pass along a lesson from famed value investor Warren Buffett. That is: "It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price."

The profitability factor, suggests Novy-Marx, helps investors to identify "wonderful companies" selling at "fair" prices. "The wonderful companies are the ones that have high profitability," he says. "They on average have higher future expected cash flows and are going to return more capital to you."

Footnotes:

- Dimensional Fund Advisors, "Evolution of Financial Research: The Profitability Premium," April 3, 2017.

- Eugene Fama and Kenneth French, "Profitability, Investment, and Average Returns," Journal of Financial Economics, vol. 82 (2006), 491–518.

- Robert Novy-Marx, "The Other Side of Value: The Gross Profitability Premium," Journal of Financial Economics, vol. 108 (2013), 1–28.

- Robert Novy-Marx, Dimensional Fund Advisors investment seminar, June 16, 2020.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, or service. There is no guarantee investment strategies will be successful. All quoted research conclusions (e.g., DFA, Novy-Marx) represent historical observations and not forward-looking guarantees and should not be relied upon to predict future performance.

Investing involves risks, including possible loss of principal. Any performance results shown may include hypothetical, backtested, or simulated outcomes. Hypothetical performance is based on past data and assumptions, does not reflect actual investment results, and may differ materially from future results due to changing market conditions and other factors. All data provided is for illustrative purposes only, does not represent actual performance of any client portfolio or account, and should not be interpreted as an indication of such performance.

IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc., including our portfolio construction methodologies and assumptions, please review our Form ADV brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.