Since 1994, independent investment research firm Dalbar Inc. has published its annual Quantitative Analysis of Investor Behavior report, or QAIB.

This research series studies investor performance in mutual funds. Its goal is to shed light on how investors can improve portfolio performances by managing behaviors that cause them to act imprudently.

If you've been following Dalbar's research over the years, you're well aware that one consistent theme keeps cropping up. Namely, the set of longer-term data analyzed in these QAIB reports clearly shows that people are more often than not their own worst enemies when it comes to investing.

Often succumbing to short-term strategies such as market timing or performance chasing, many investors show a lack of knowledge and/or ability to exercise the necessary discipline to capture the benefits markets can provide over longer time horizons. In short, they too frequently wind up reacting to market maturations and lowering their longer-term returns.

In the 2025 edition of the study, Dalbar also concludes something that we often tell our prospects and clients: Investment results are more dependent on investor behavior than on fund performance.

The latest QAIB reaffirms past research finding that fund investors who remained patient and didn't focus on short-term market gyrations were significantly more successful than those who let their emotions override a longer-term strategy to build wealth.

Another key caveat suggested from such a study is that a comprehensive financial plan is only as good as an investor's ability to stick to it through thick and thin. This is why our wealth advisors find it so important to make sure you understand your risk capacity and utilize tools such as the retirement analyzer to give you a level of confidence in your ability to achieve long-term financial success. It's also the reason why IFA offers each client an individualized financial plan as a complimentary service.

Investor Performance

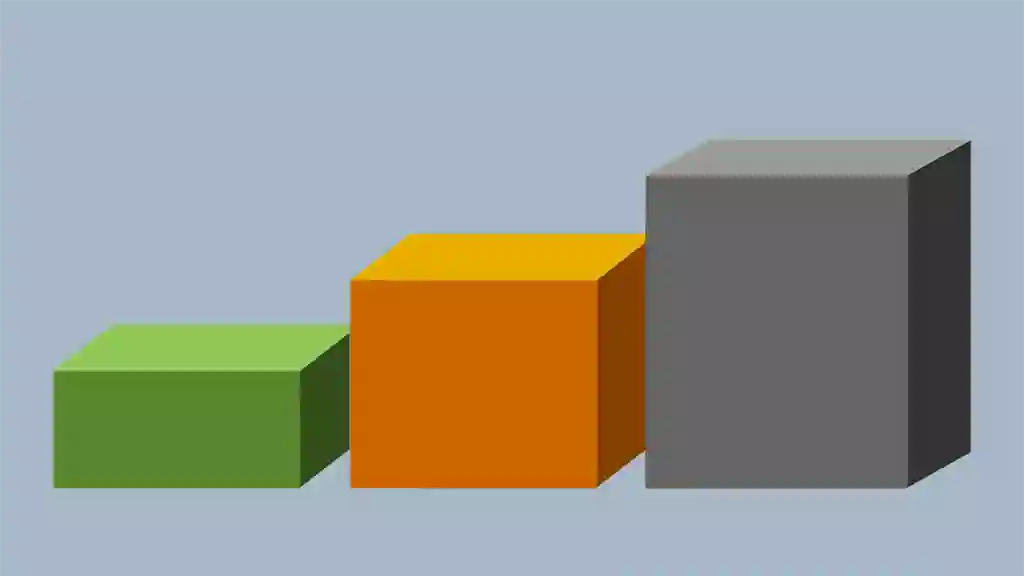

The bar chart below shows the difference in performance as well as the growth of $100,000 between the average equity investor and the S&P 500 Index for the past 20 years (through 2024). It also compares the average annualized return of such an initial investment to the rate of inflation and a short-term bond index over that same period.

As you can see, the average equity fund investor's efforts to outguess markets has resulted in performance during this extended period that falls well-behind the blue chip S&P 500 Index, often referred to as a bellwether of large company stocks in the U.S.

As true fiduciaries to our clients, this behavioral finance study serves as another piece of evidence that IFA's greatest value is keeping them disciplined and committed to their long-term financial plan. Put another way, our wealth advisors are committed to objectively working with investors to make sure they don't become their own worst enemies. Please feel free to reach out to an IFA wealth advisor by calling (888) 643-3133 or connecting online.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Investing involves risks, including possible loss of principal. This is intended to be informational in nature and should not be construed as tax advice. IFA Taxes is a division of Index Fund Advisors, Inc. For more information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.