As fund investing keeps growing in popularity with American families, so has the fortunes of one of the industry's biggest players.

Fidelity Investments says it works with nearly 50 million individual customers and employs 74,000-plus workers worldwide. During an average day, its platforms process an estimated 2.6 million trades — including a growing lineup of alternative investment products. By the end of 2023, Fidelity reported $4.9 trillion in total discretionary assets, which included all investment dollars managed through mutual funds, exchange-traded funds and managed accounts.

The venerable Boston-based funds manufacturer, which traces its roots to 1946, manages more than 300 mutual funds. Besides running such a plethora of investment vehicles, Fidelity is a major competitor in brokerage services, asset custody, wealth management and institutional retirement services. In 2018, it opened a dedicated business focused on handling and executing trades for institutions dealing in Bitcoin and other cryptocurrencies.

Given its global reach across financial services and brand recognition as a long-tenured investment manager, we thought it might be instructive to put under our research microscope Fidelity's family of actively managed mutual funds.

Typically, active managers give us fits in trying to find enough funds to study over periods that can be considered as statistically significant. This can be due to a nasty tendency in the industry to play a sort of shell game with investors. In short, active managers will often shutter or merge a lagging fund into a different member of its fund family.

Although it might sound like a good idea at first, the net effect is to create what's known as "survivorship bias." Such a bias is referencing the fact that in these circumstances, fund companies usually report the existing manager's data, effectively wiping out the old fund's track record. Along these lines, our research methodologies for this study include adjusting for survivorship bias.

We've also been able to take advantage of Fidelity's sheer size to dig deeper into this fund family's performance. It provides us with enough actively managed mutual stock funds to analyze risk and return data spanning 30 years or more. That's key since a smaller data set statistically brings into question whether or not there's sufficient information about a fund's performance to scientifically draw conclusions — or whether we're simply being fooled by randomness in market returns.

The following analysis of Fidelity is a part of our Deeper Look research series. We've also conducted similar studies on fund families from the likes of Vanguard, Morgan Stanley, Goldman Sachs, Franklin Templeton, T. Rowe Price and Prudential, to name just a few. (To read other IFA research reports along these lines, you can search on our site — or, the IFA App — using "Deeper Look" as the search criteria.) One universal conclusion: Active fund managers have failed to deliver on the value proposition they profess, which is to reliably outperform a risk comparable benchmark.

Controlling for Survivorship Bias

It's important for investors to understand the idea of survivorship bias. While there are 136 active mutual funds with 30 or more years of performance-related data currently managed by Fidelity, it doesn't necessarily mean these are the only strategies this company has ever offered. In fact, there are 35 mutual funds with 30-plus years of data that no longer exist. This can be for a variety of reasons including poor performance or the fact that they were merged with another fund. We will show what their aggregate performance looks like shortly.

Fees & Expenses

Let's first examine the costs associated with Fidelity's surviving 101 mutual fund strategies. It should go without saying that if investors are paying a premium for investment "expertise," then they should be receiving above average results consistently over time. The alternative would be to simply accept a market's return, less a significantly lower fee, via an index fund.

The costs we examine include expense ratios, sales loads — front-end (A), back-end (B) and level (C) — as well as 12b-1 marketing fees. These are considered the "hard" costs that investors incur. Prospectuses, however, do not reflect the trading costs associated with mutual funds.

Commissions and market impact costs are real expenses associated with implementing a particular investment strategy and can vary depending on the frequency and size of the trades executed by portfolio managers.

We can estimate the costs associated with an investment strategy by looking at its annual turnover ratio. For example, a turnover ratio of 100% means that the portfolio manager turns over the entire portfolio in one year. This is considered an active approach, and investors holding these funds in taxable accounts will likely incur a higher exposure to tax liabilities, such as short- and long-term capital gains distributions, than those incurred by passively managed funds.

The table below details the hard costs as well as the turnover ratio for the 101 surviving active mutual funds offered by Fidelity that have at least 30 years of complete performance history. You can search this page for a symbol or name by using Control F in Windows or Command F on a Mac. Then click the link to see the alpha chart. Also, remember that this is what is considered an in-sample test; the next level of analysis is to do an out-of-sample test (for more information see here).

| Fund Name | Ticker | Turnover Ratio % | Prospectus Net Expense Ratio | 12b-1 Fee | Max Front Load | Global Broad Category Group |

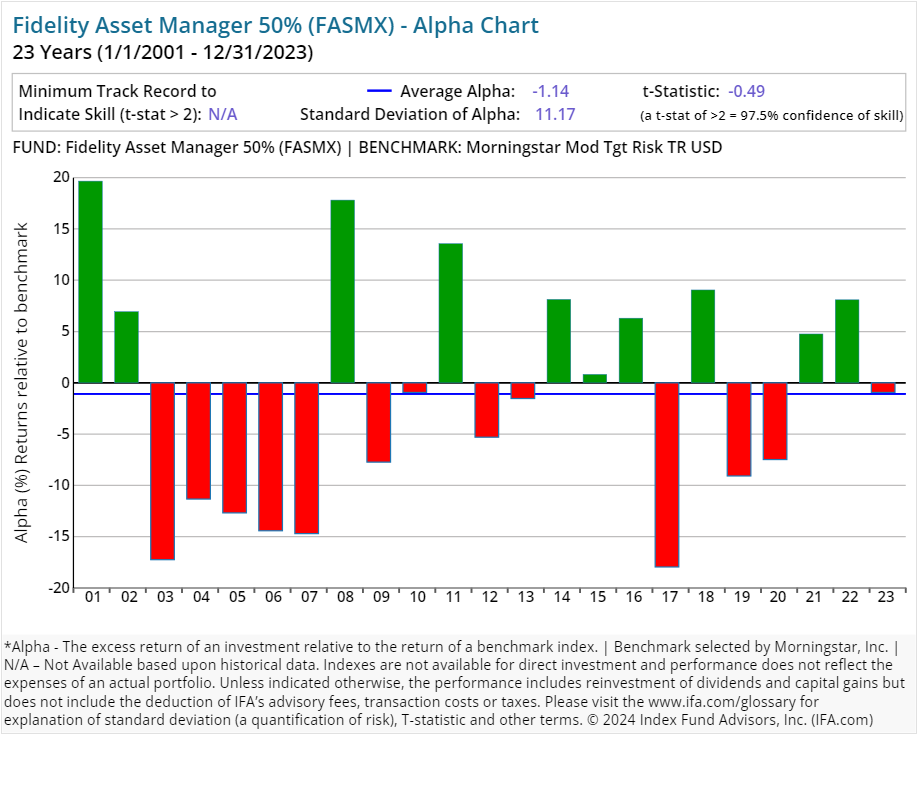

| Fidelity Asset Manager 50% | FASMX | 20.00 | 0.62 | Allocation | ||

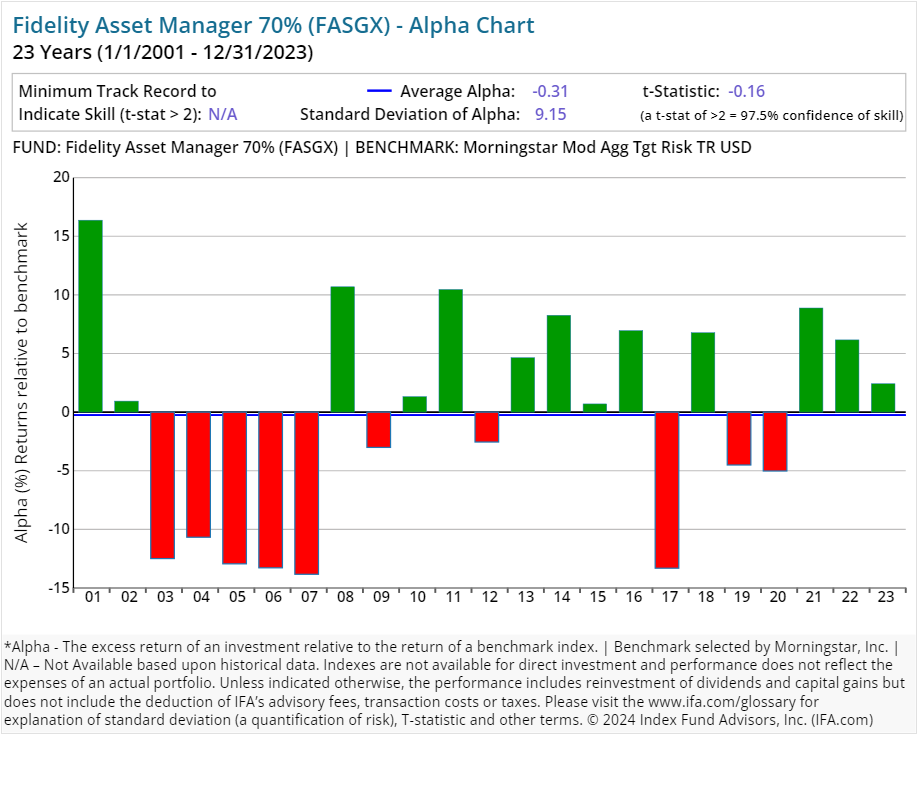

| Fidelity Asset Manager 70% | FASGX | 19.00 | 0.68 | Allocation | ||

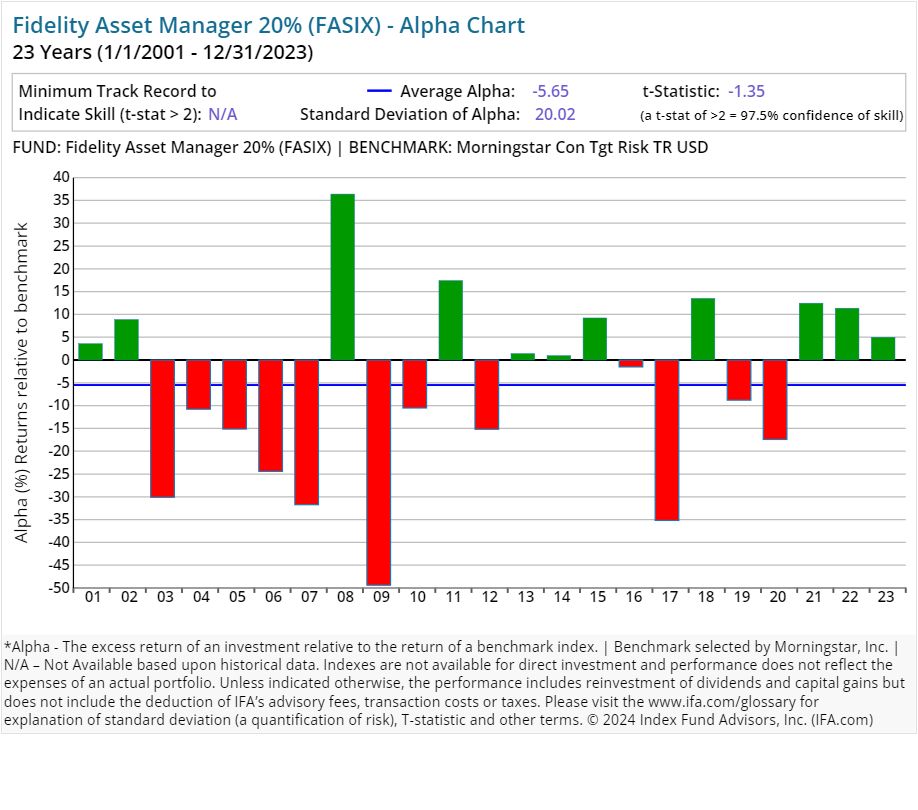

| Fidelity Asset Manager 20% | FASIX | 28.00 | 0.52 | Allocation | ||

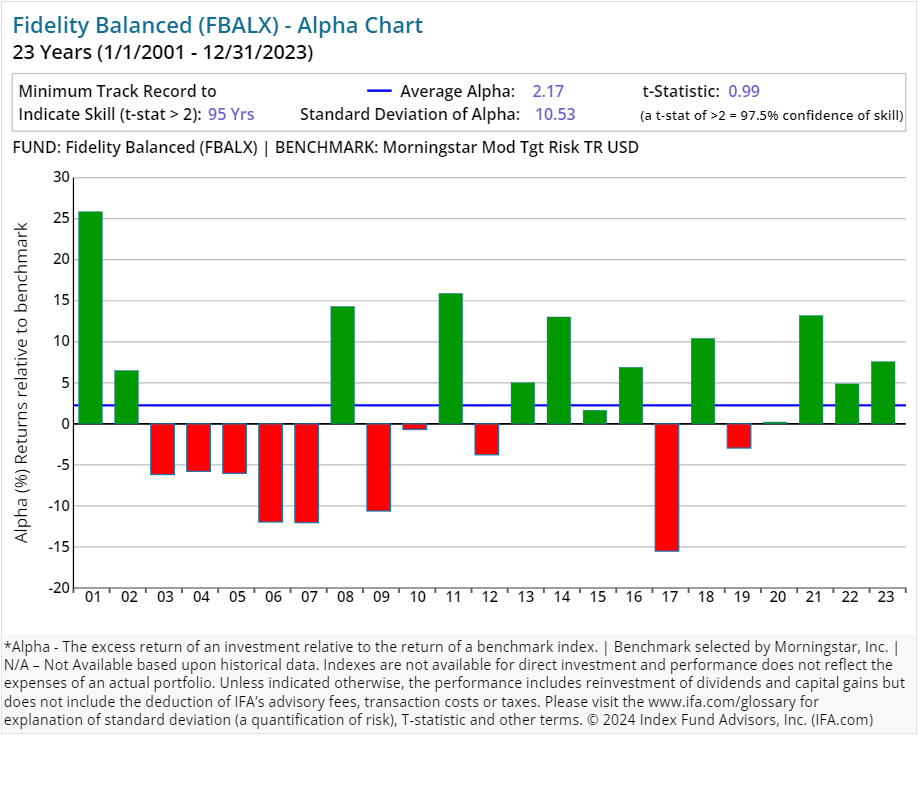

| Fidelity Balanced | FBALX | 29.00 | 0.51 | Allocation | ||

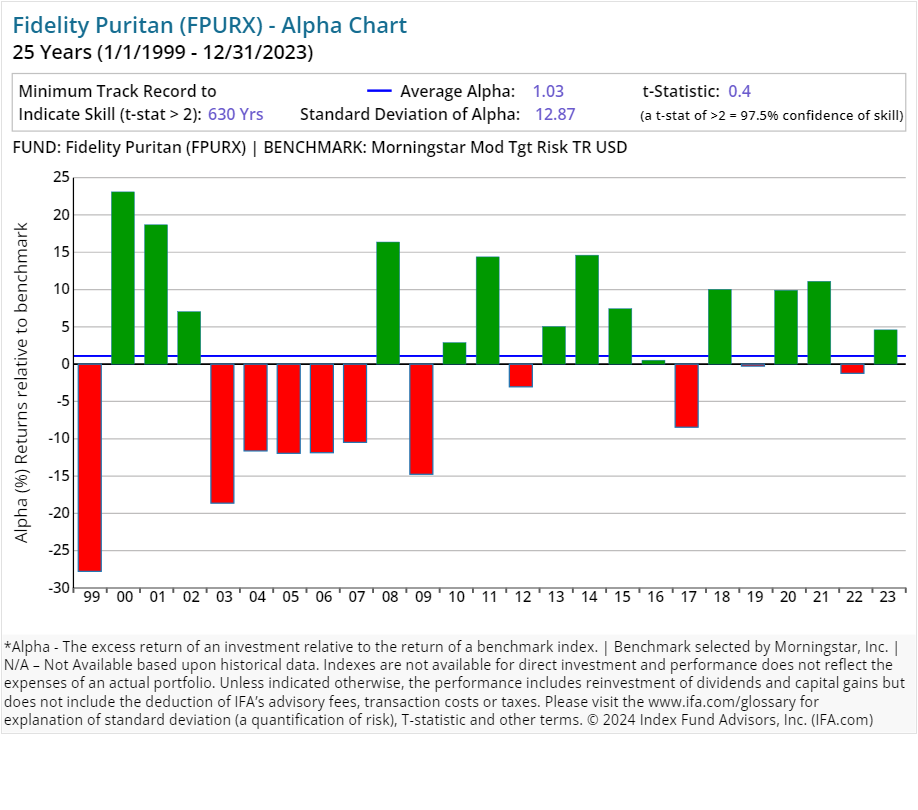

| Fidelity Puritan | FPURX | 52.00 | 0.51 | Allocation | ||

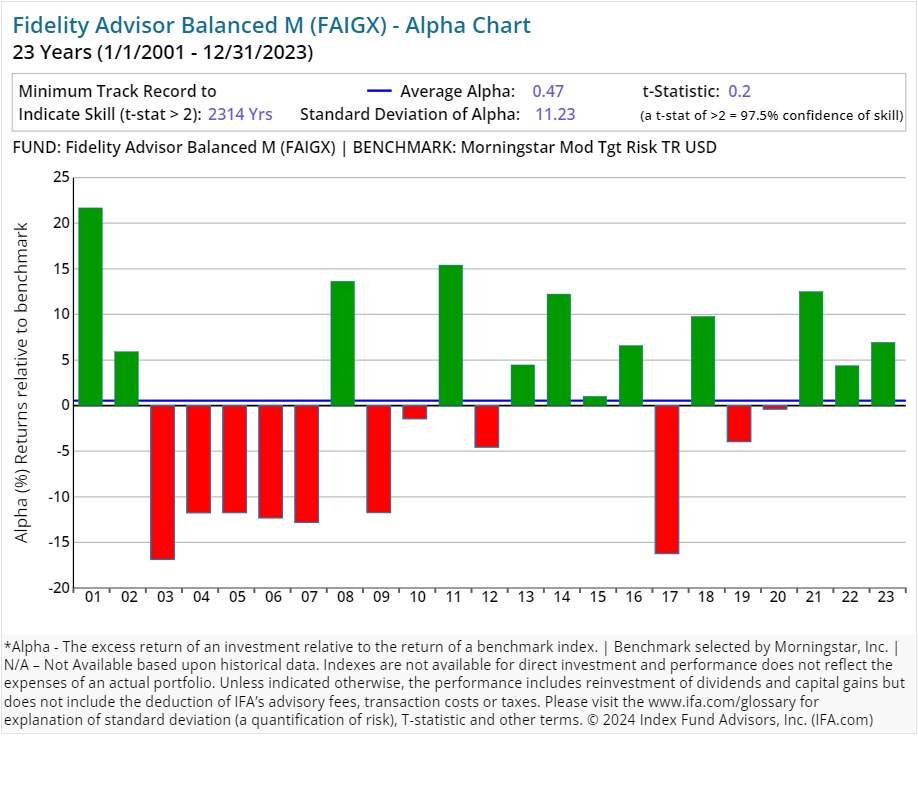

| Fidelity Advisor Balanced M | FAIGX | 30.00 | 1.07 | 0.50 | 3.50 | Allocation |

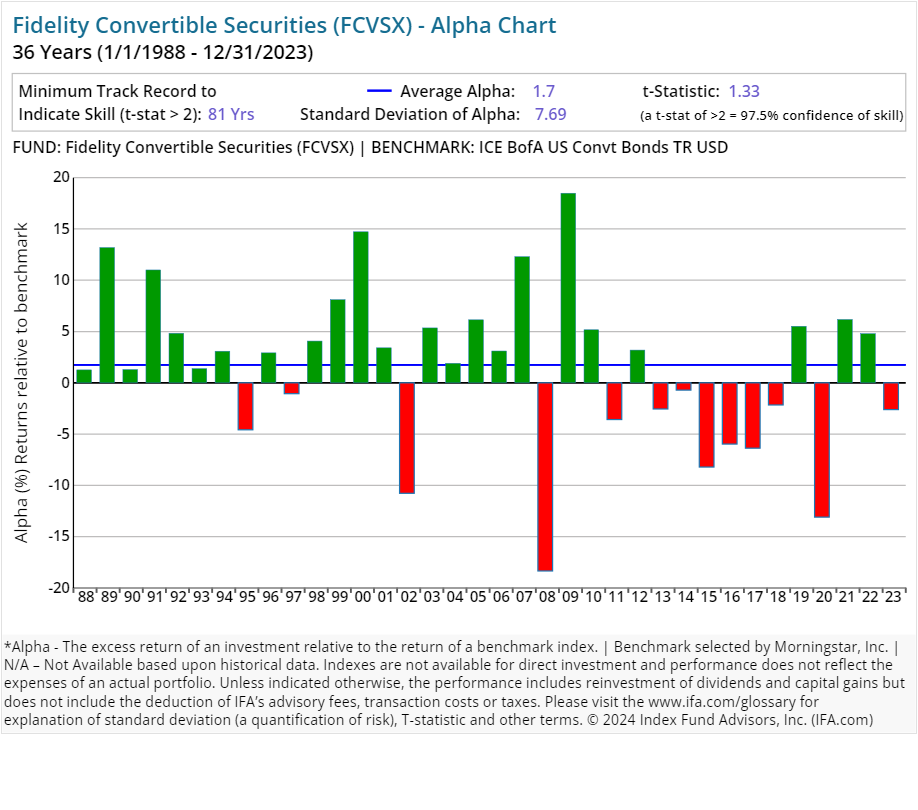

| Fidelity Convertible Securities | FCVSX | 89.00 | 0.75 | Convertibles | ||

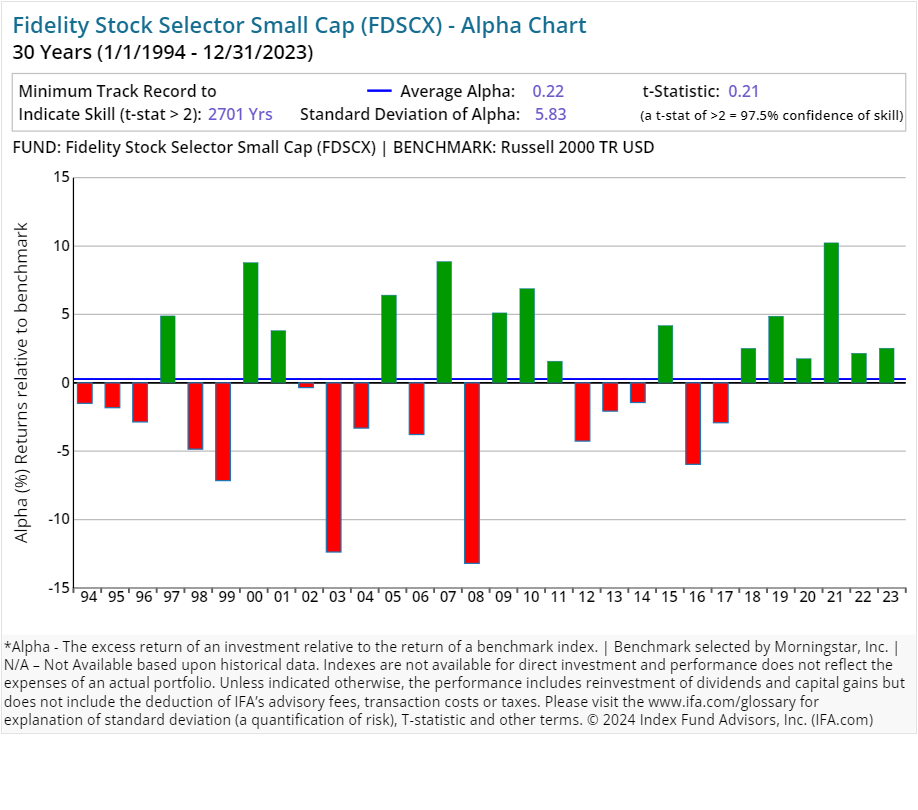

| Fidelity Stock Selector Small Cap | FDSCX | 38.00 | 0.95 | Equity | ||

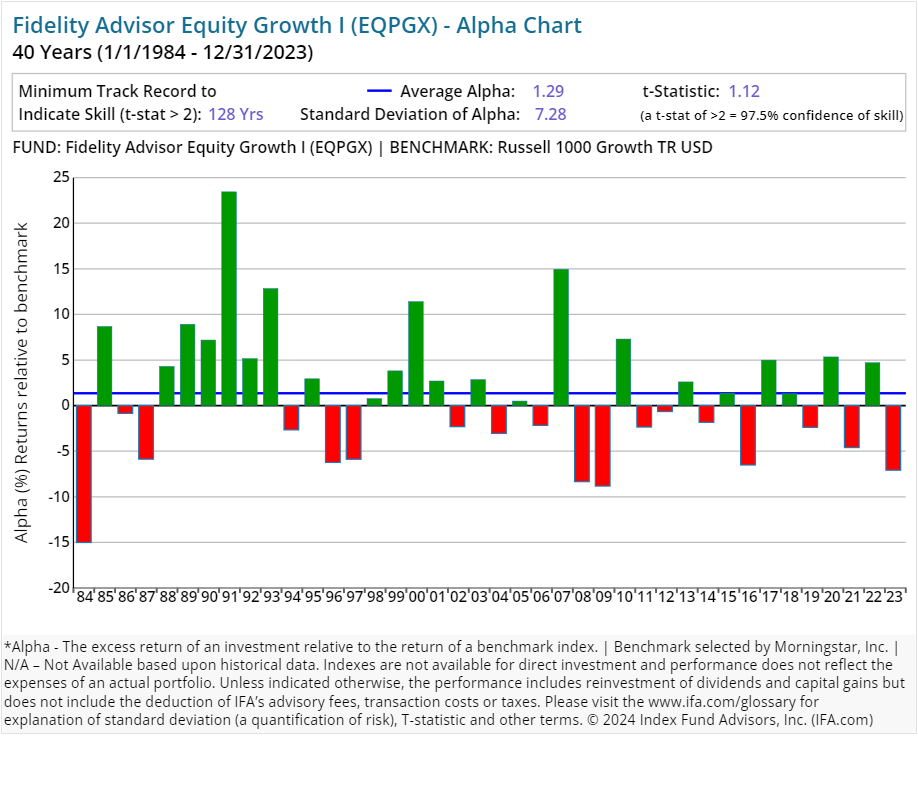

| Fidelity Advisor Equity Growth I | EQPGX | 43.00 | 0.71 | Equity | ||

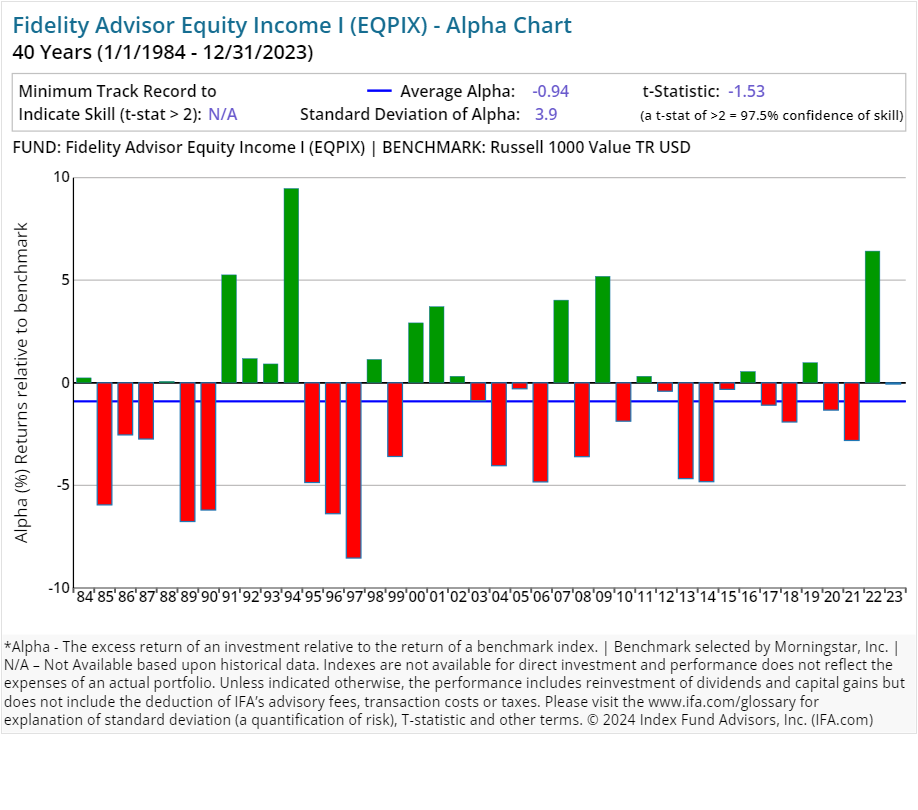

| Fidelity Advisor Equity Income I | EQPIX | 47.00 | 0.65 | Equity | ||

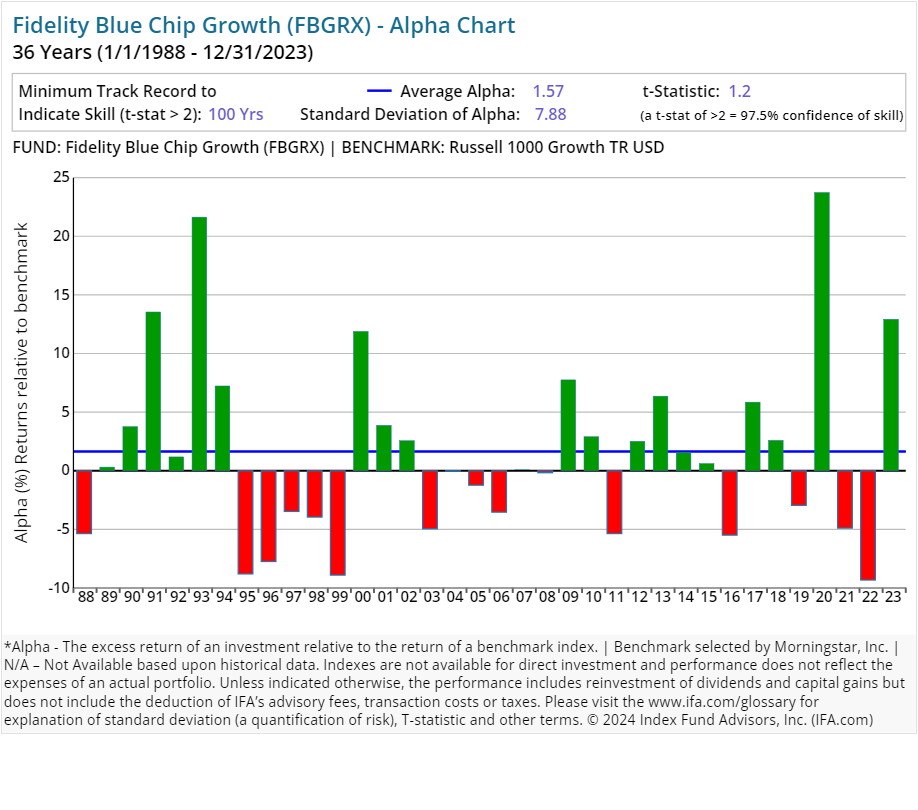

| Fidelity Blue Chip Growth | FBGRX | 19.00 | 0.69 | Equity | ||

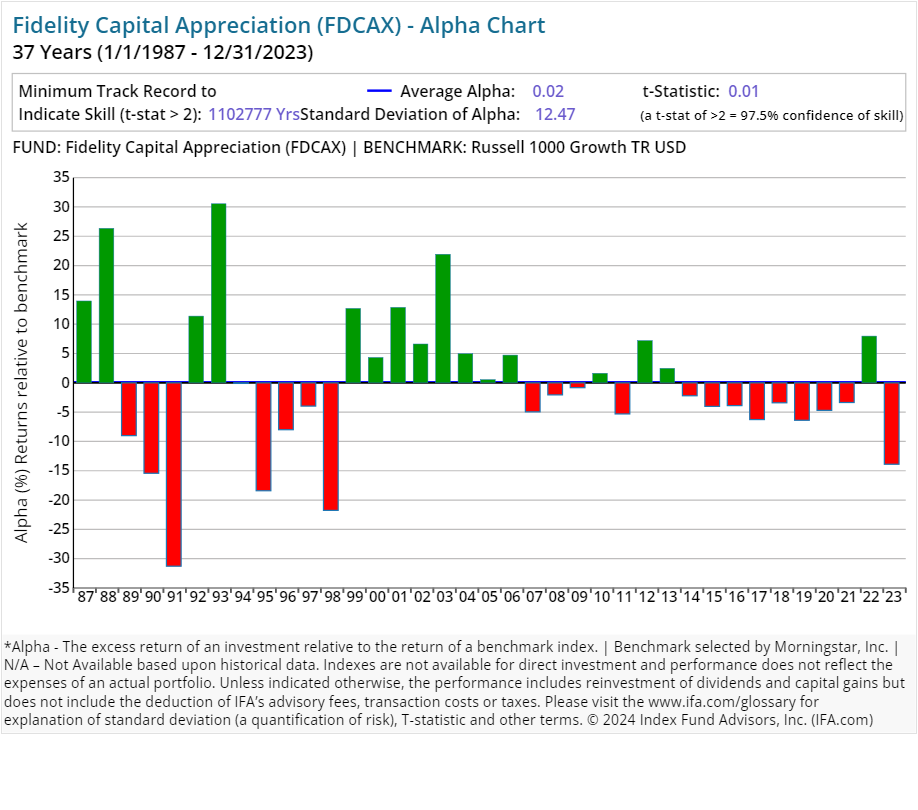

| Fidelity Capital Appreciation | FDCAX | 49.00 | 0.64 | Equity | ||

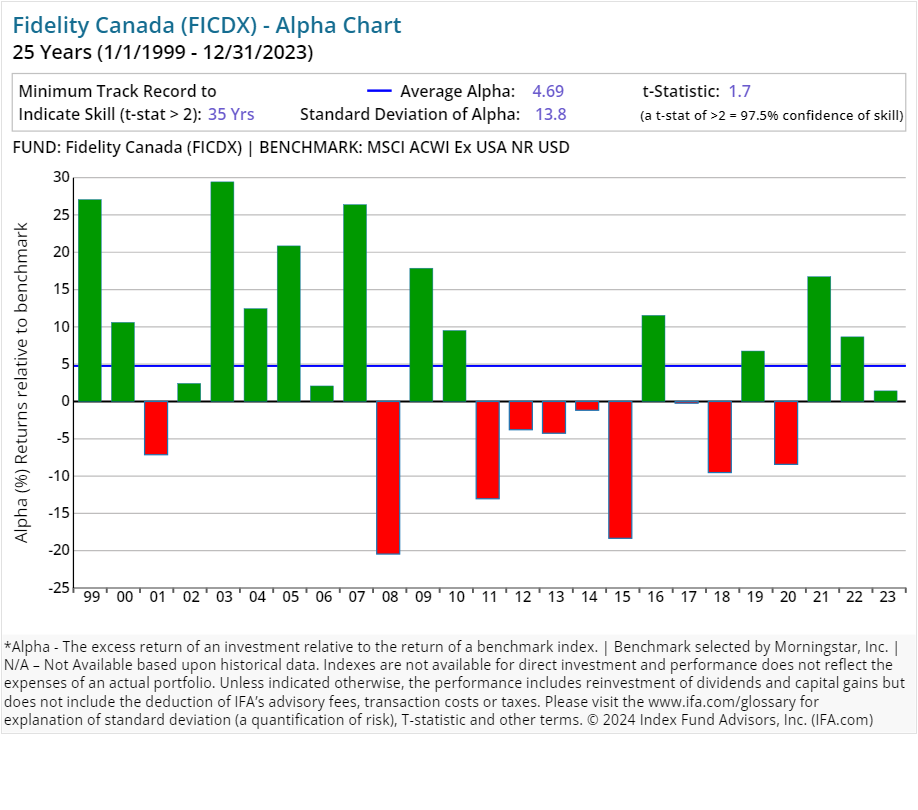

| Fidelity Canada | FICDX | 9.00 | 1.05 | Equity | ||

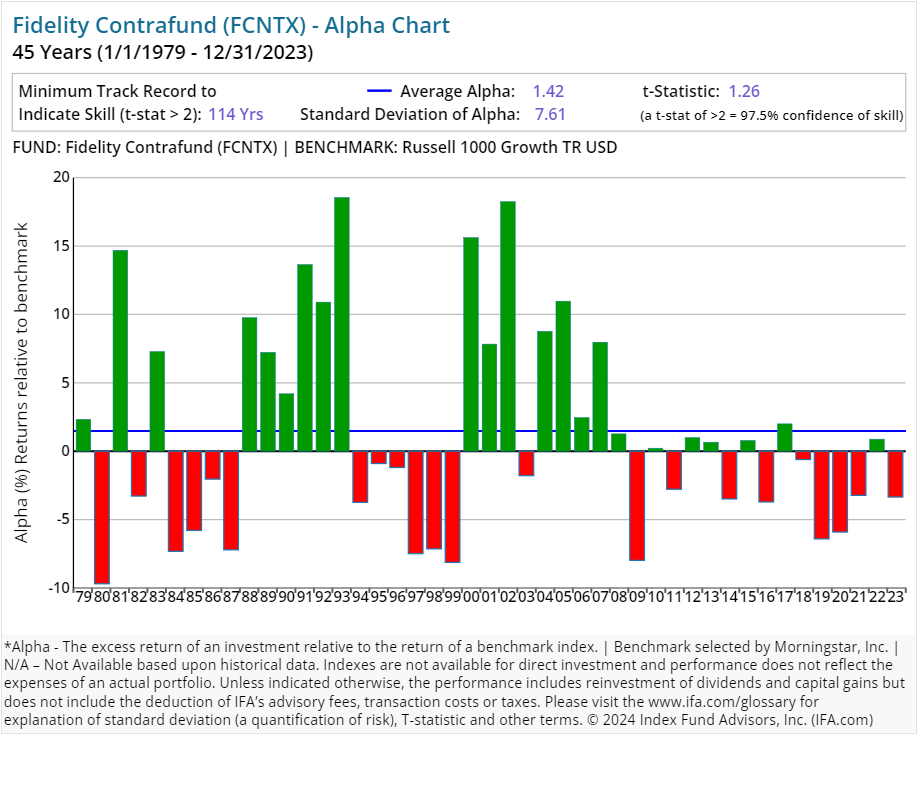

| Fidelity Contrafund | FCNTX | 16.00 | 0.39 | Equity | ||

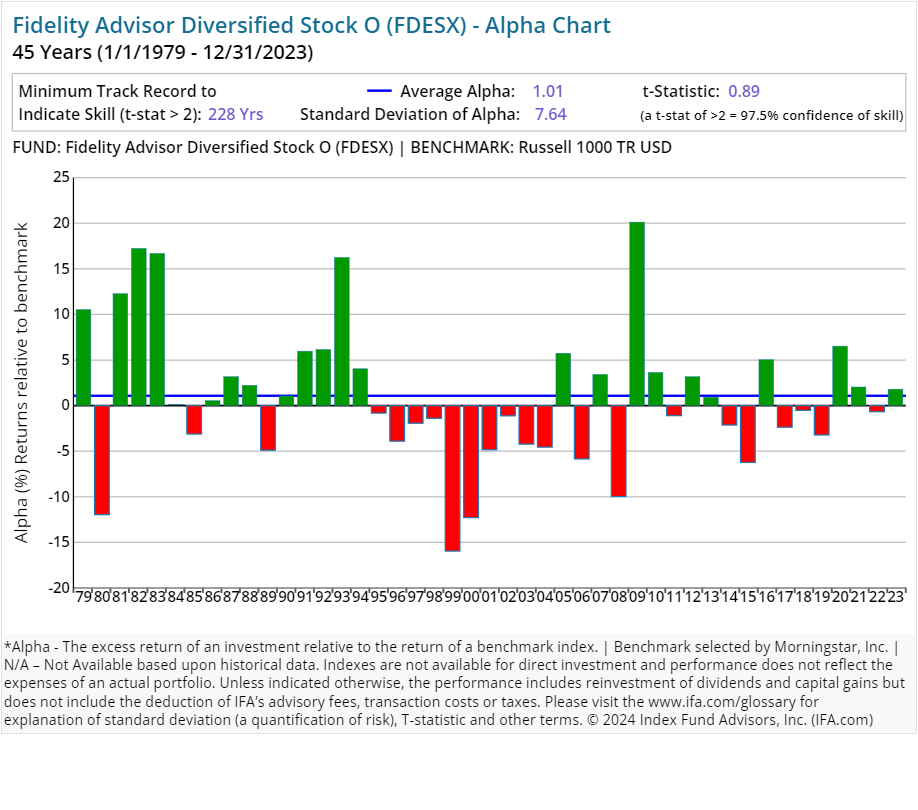

| Fidelity Advisor Diversified Stock O | FDESX | 85.00 | 0.44 | Equity | ||

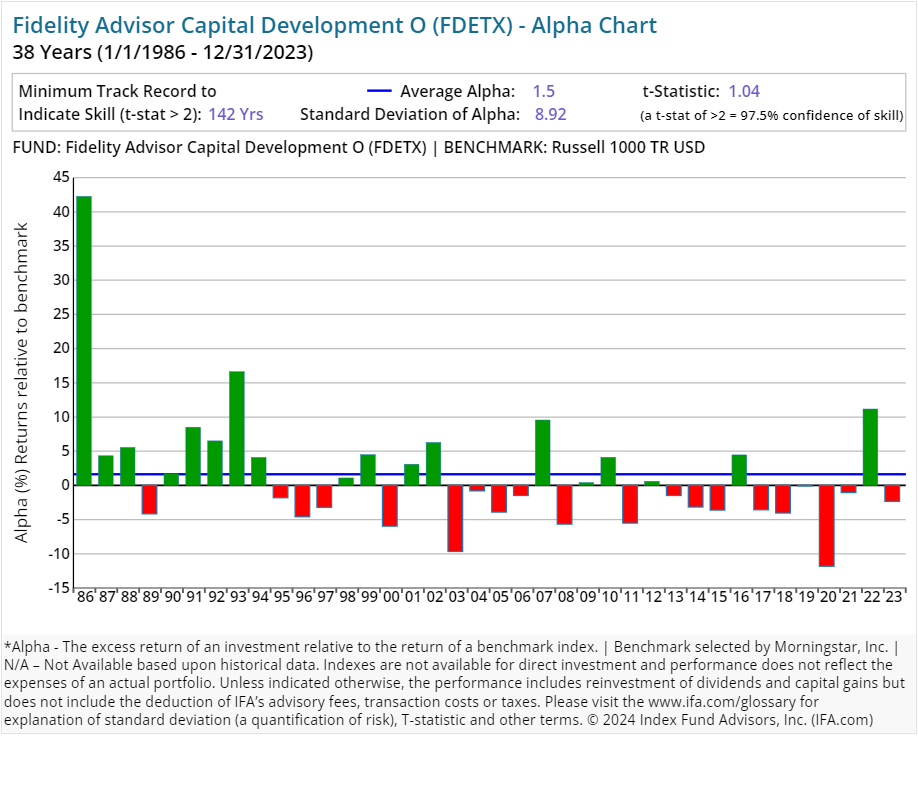

| Fidelity Advisor Capital Development O | FDETX | 12.00 | 0.56 | Equity | ||

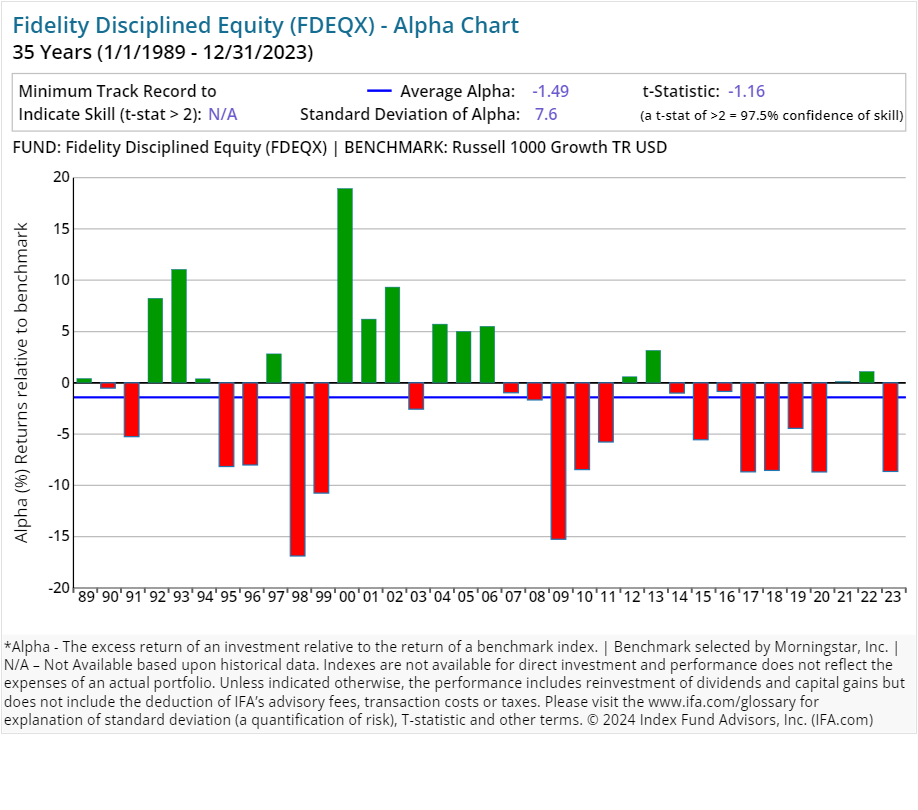

| Fidelity Disciplined Equity | FDEQX | 36.00 | 0.48 | Equity | ||

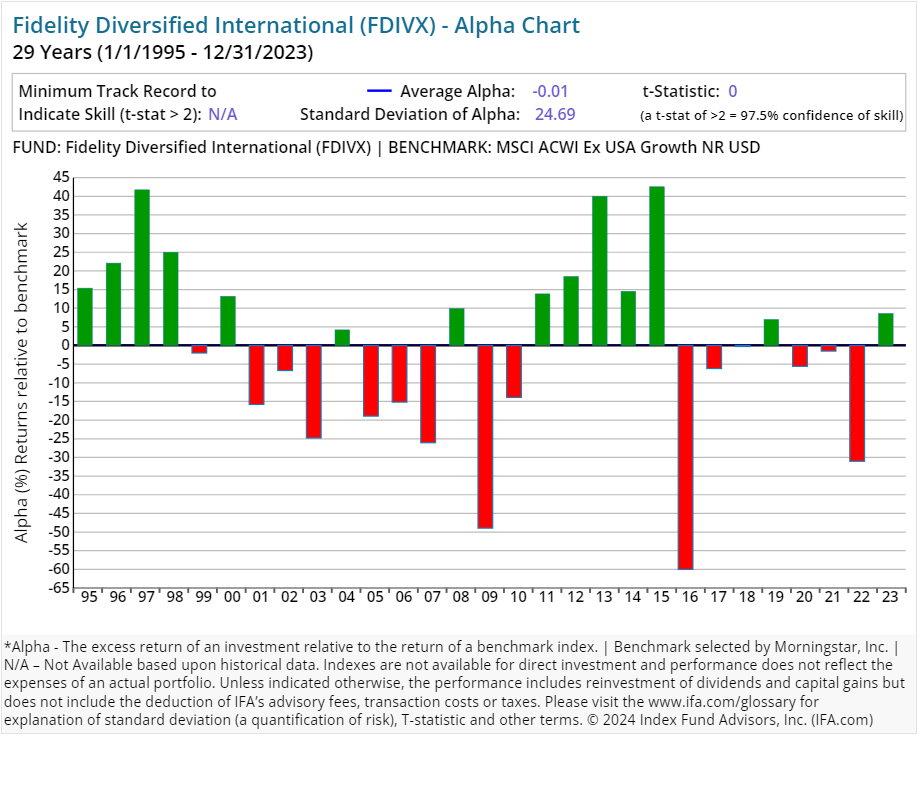

| Fidelity Diversified International | FDIVX | 22.00 | 0.65 | Equity | ||

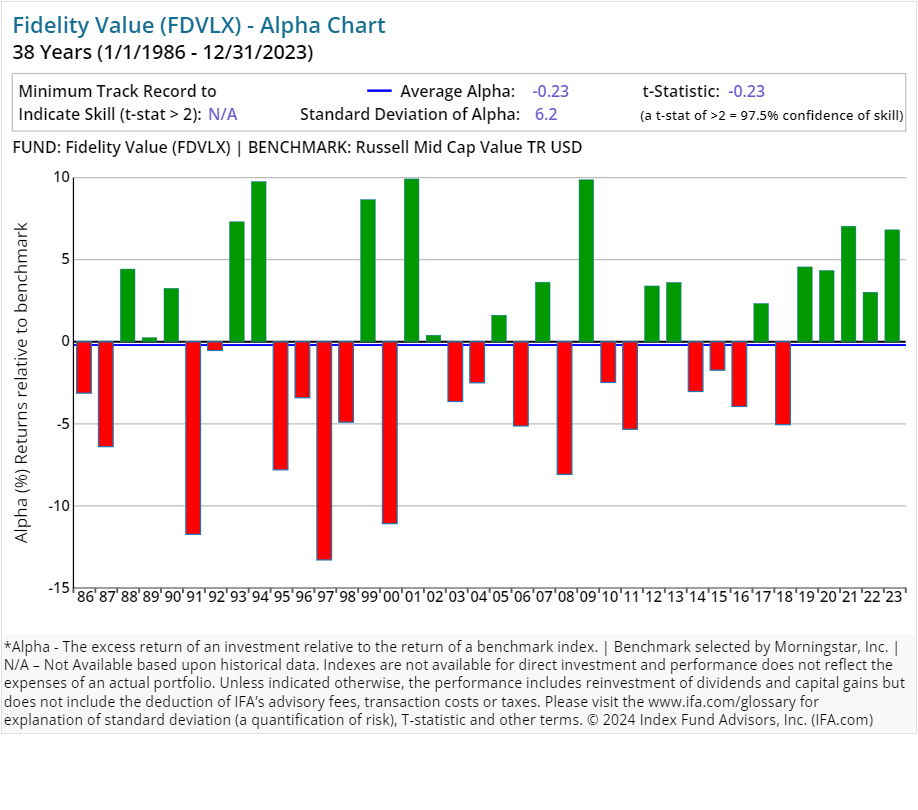

| Fidelity Value | FDVLX | 69.00 | 0.87 | Equity | ||

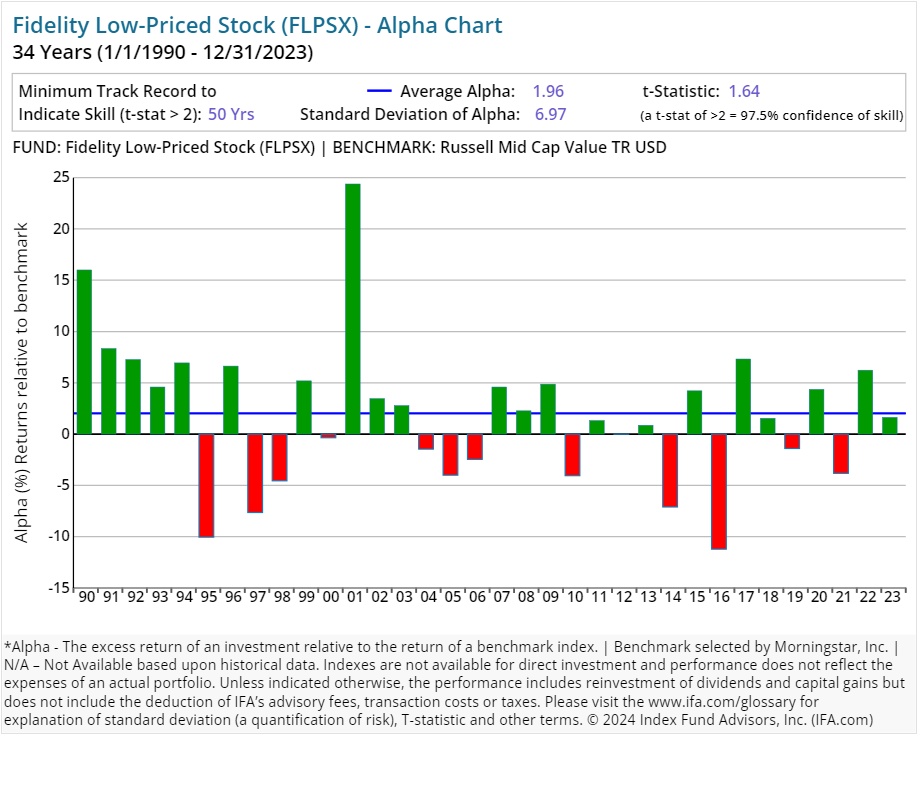

| Fidelity Low-Priced Stock | FLPSX | 39.00 | 0.92 | Equity | ||

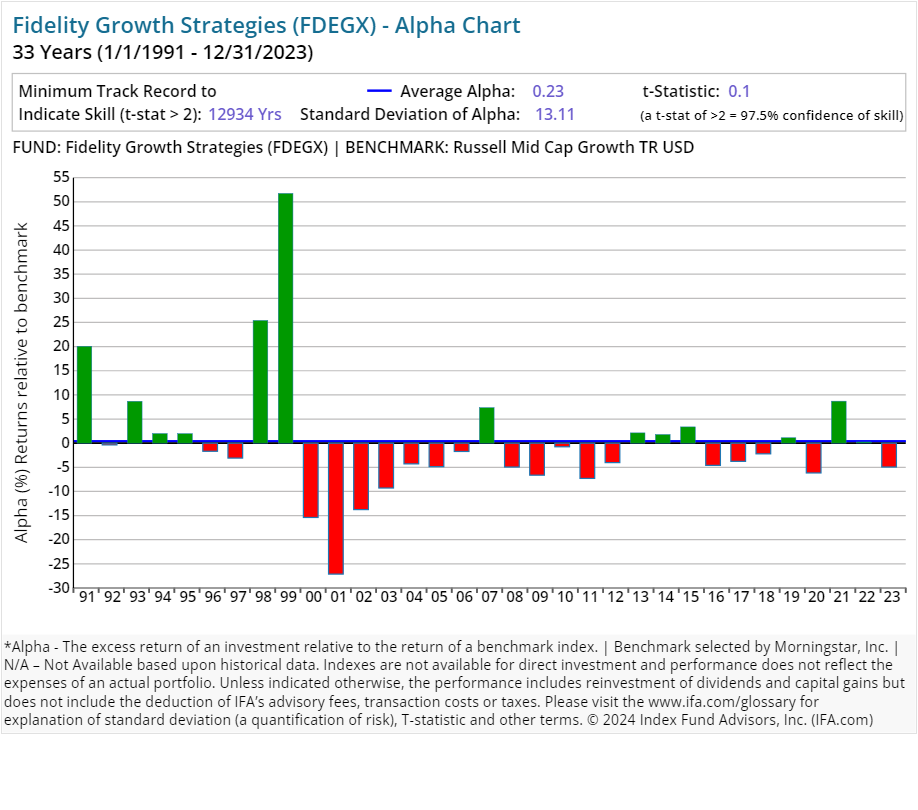

| Fidelity Growth Strategies | FDEGX | 75.00 | 0.75 | Equity | ||

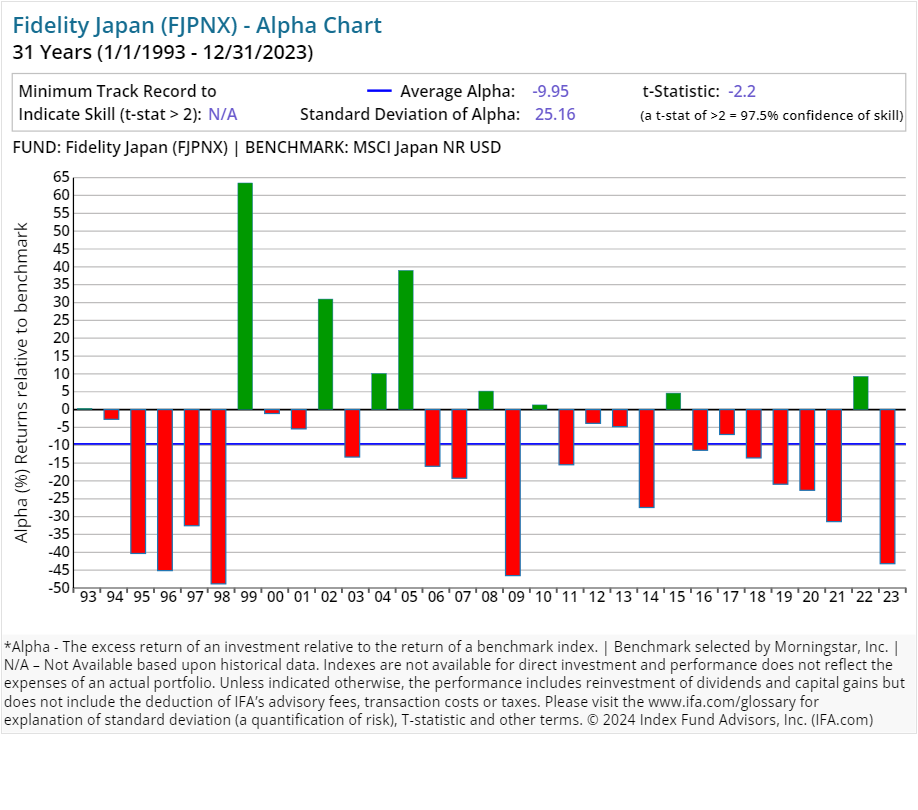

| Fidelity Japan | FJPNX | 25.00 | 0.95 | Equity | ||

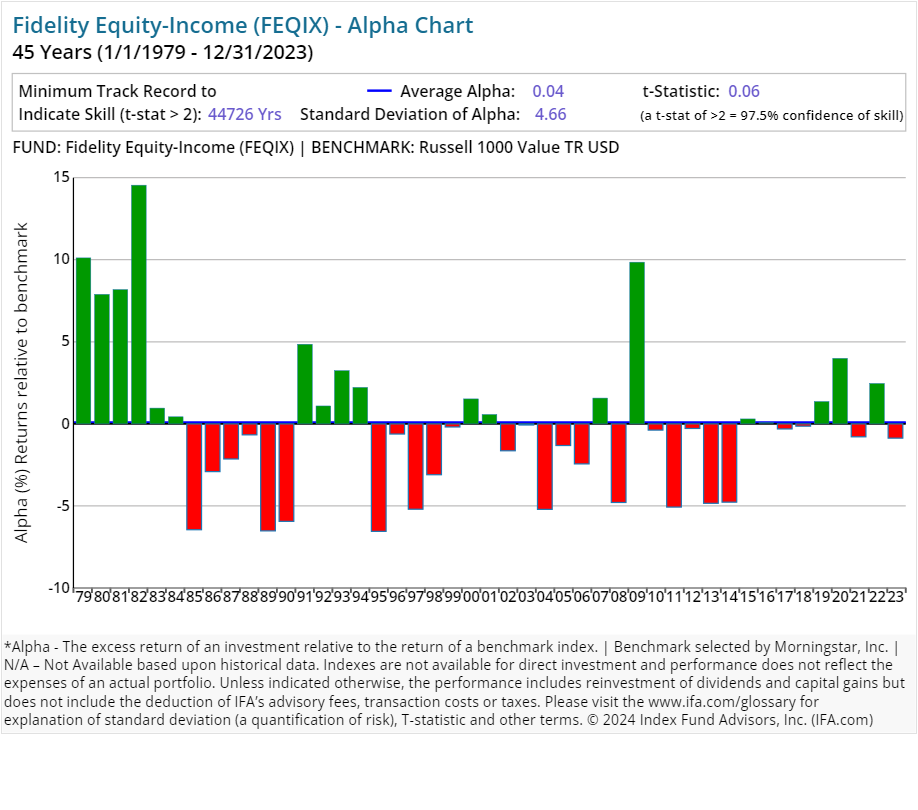

| Fidelity Equity-Income | FEQIX | 22.00 | 0.57 | Equity | ||

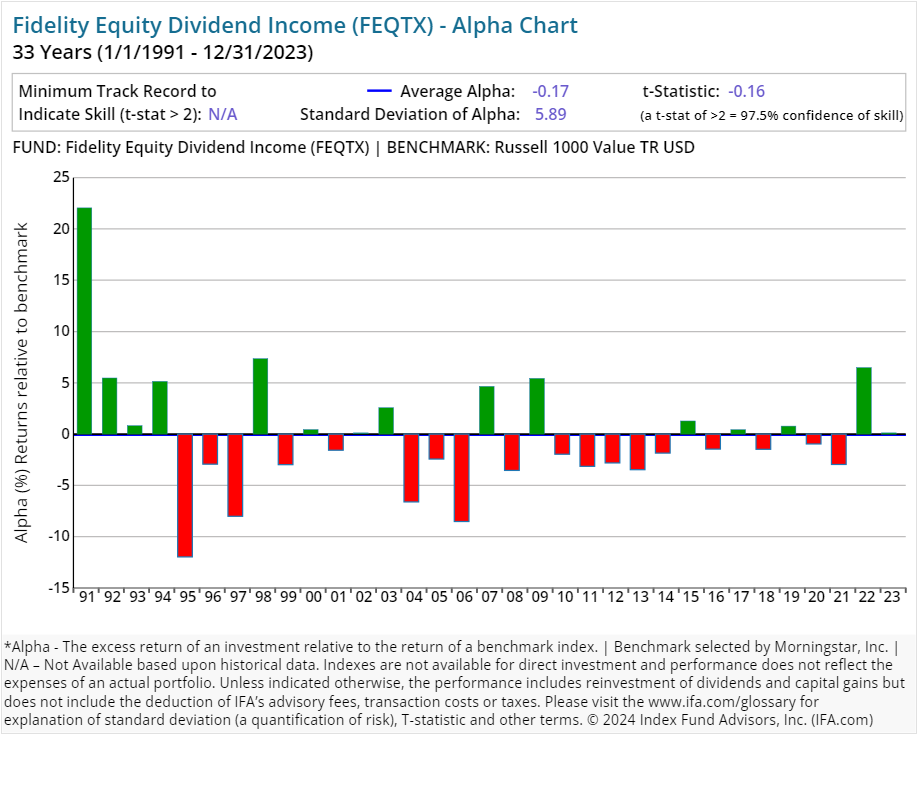

| Fidelity Equity Dividend Income | FEQTX | 45.00 | 0.58 | Equity | ||

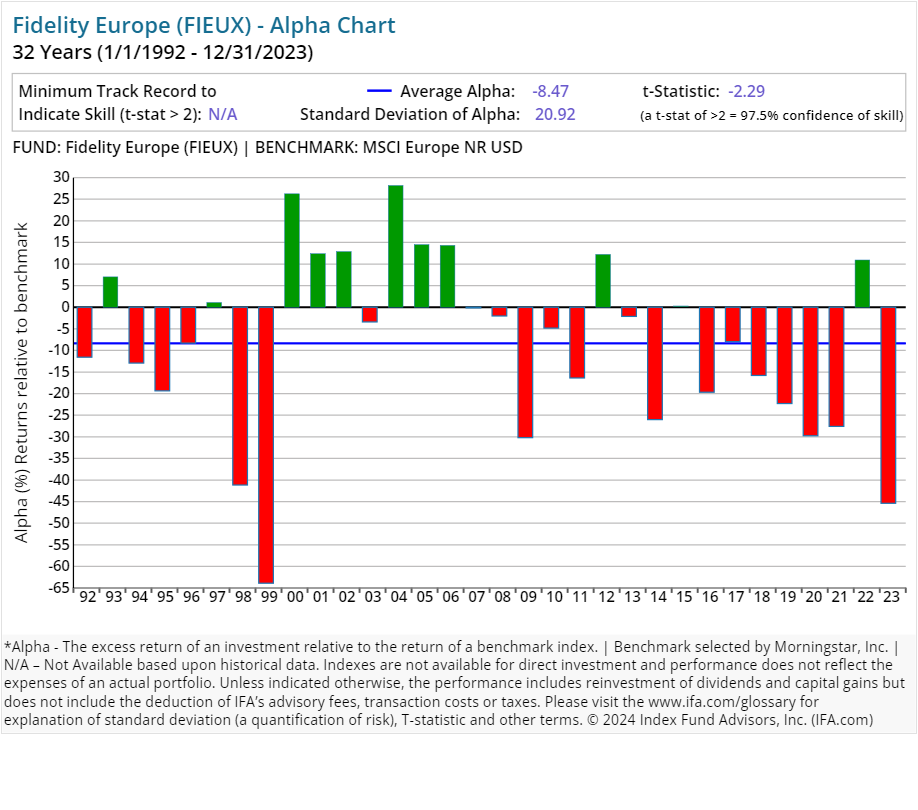

| Fidelity Europe | FIEUX | 37.00 | 0.69 | Equity | ||

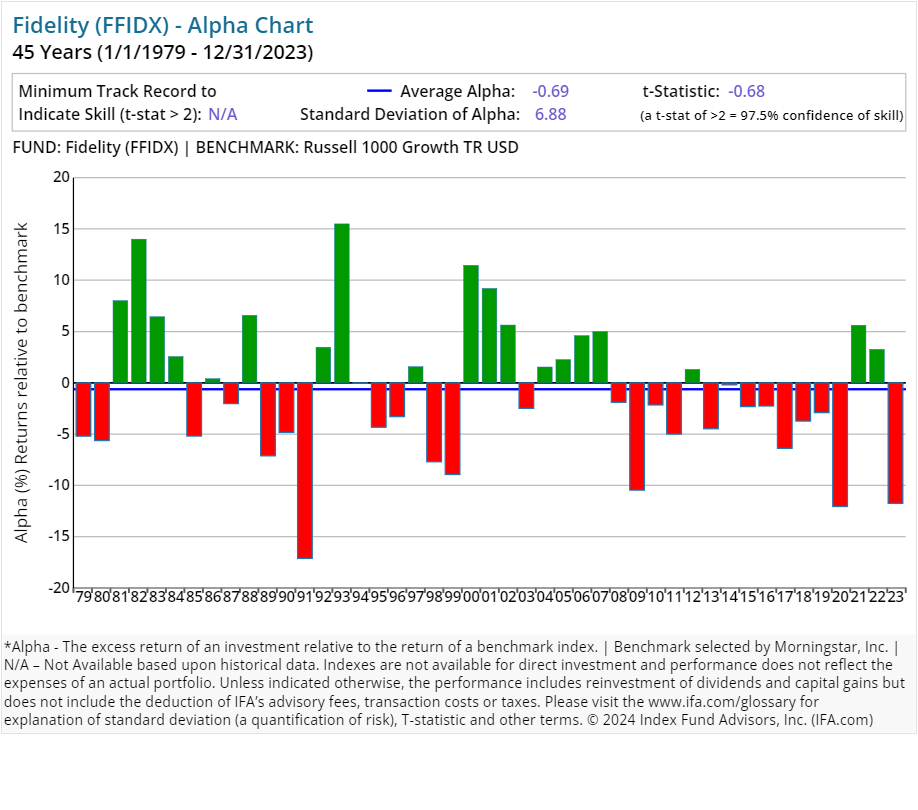

| Fidelity | FFIDX | 43.00 | 0.46 | Equity | ||

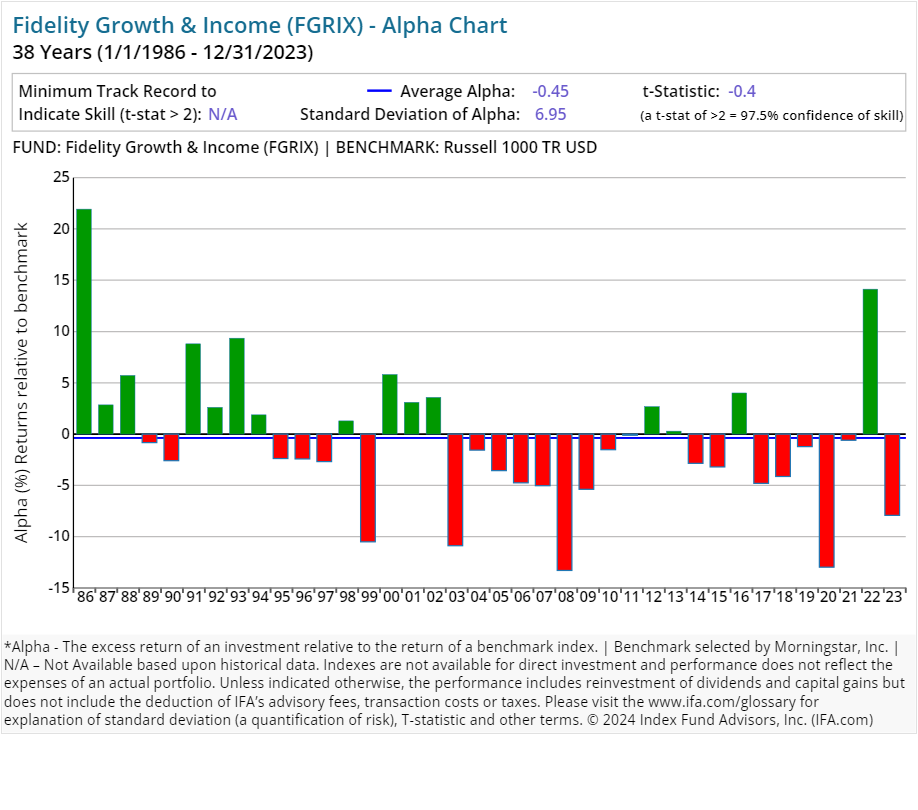

| Fidelity Growth & Income | FGRIX | 13.00 | 0.58 | Equity | ||

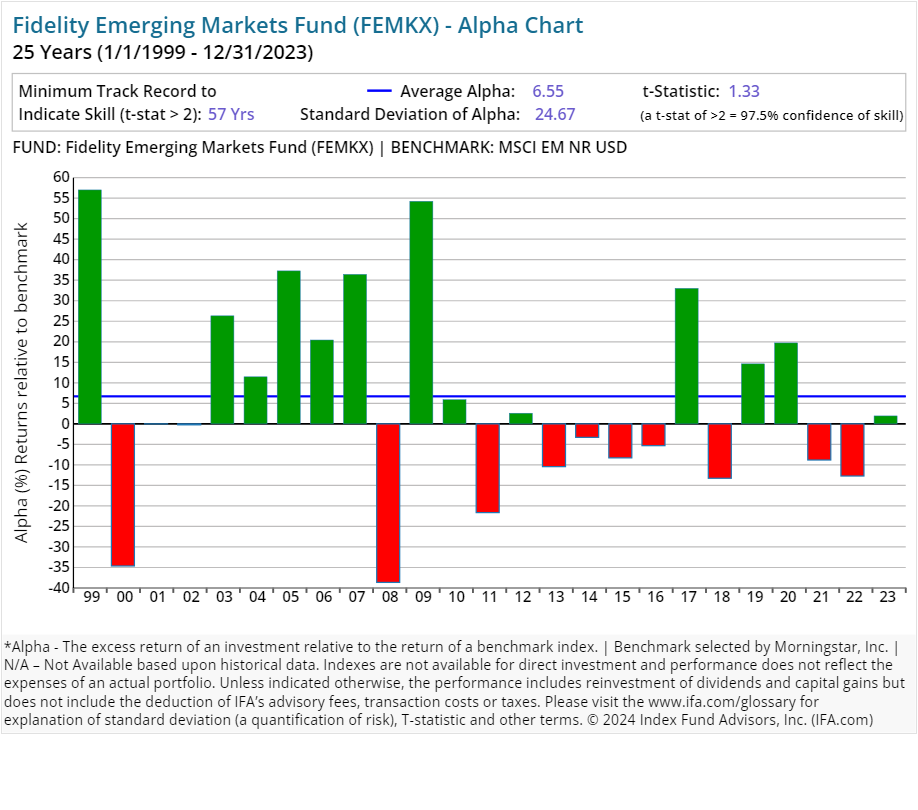

| Fidelity Emerging Markets Fund | FEMKX | 23.00 | 0.90 | Equity | ||

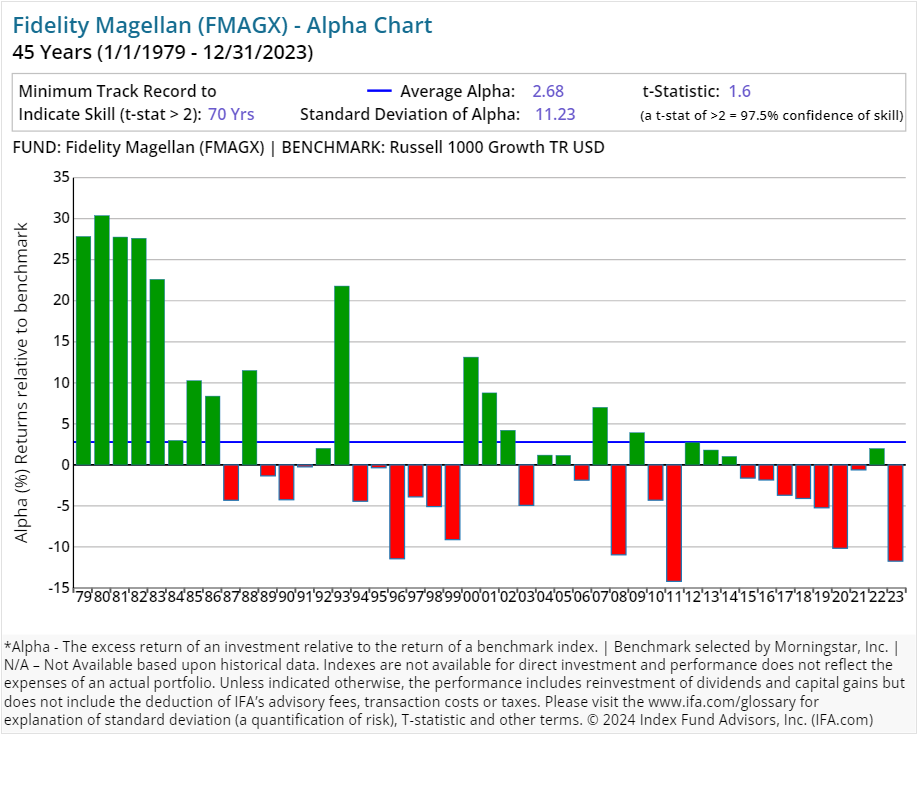

| Fidelity Magellan | FMAGX | 86.00 | 0.52 | Equity | ||

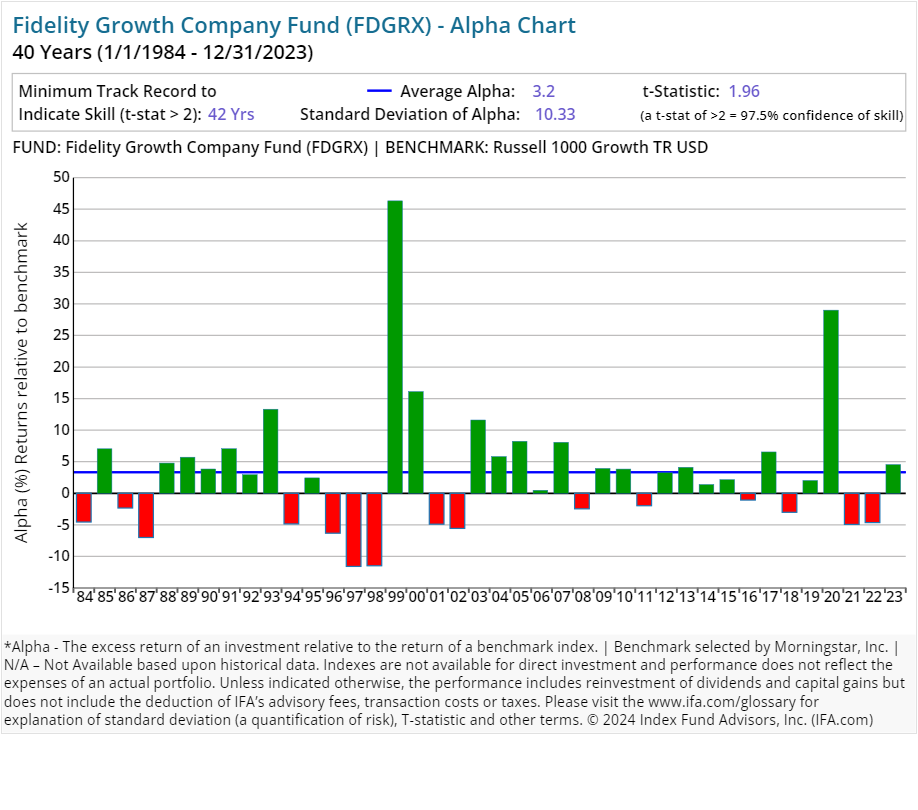

| Fidelity Growth Company Fund | FDGRX | 12.00 | 0.72 | Equity | ||

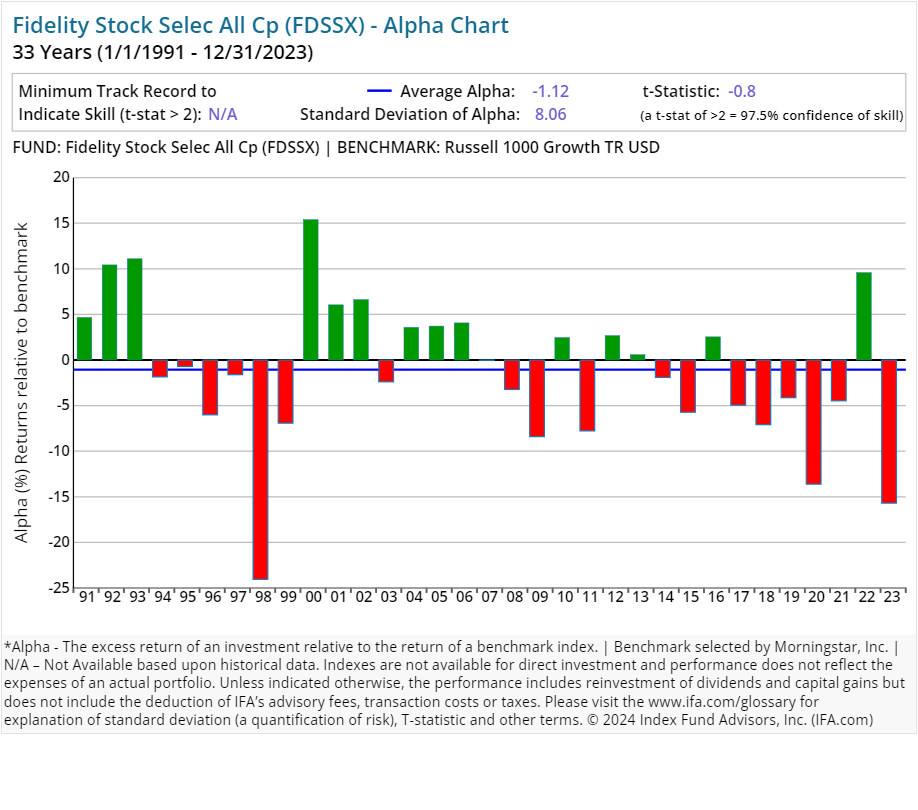

| Fidelity Stock Selec All Cp | FDSSX | 7.00 | 0.60 | Equity | ||

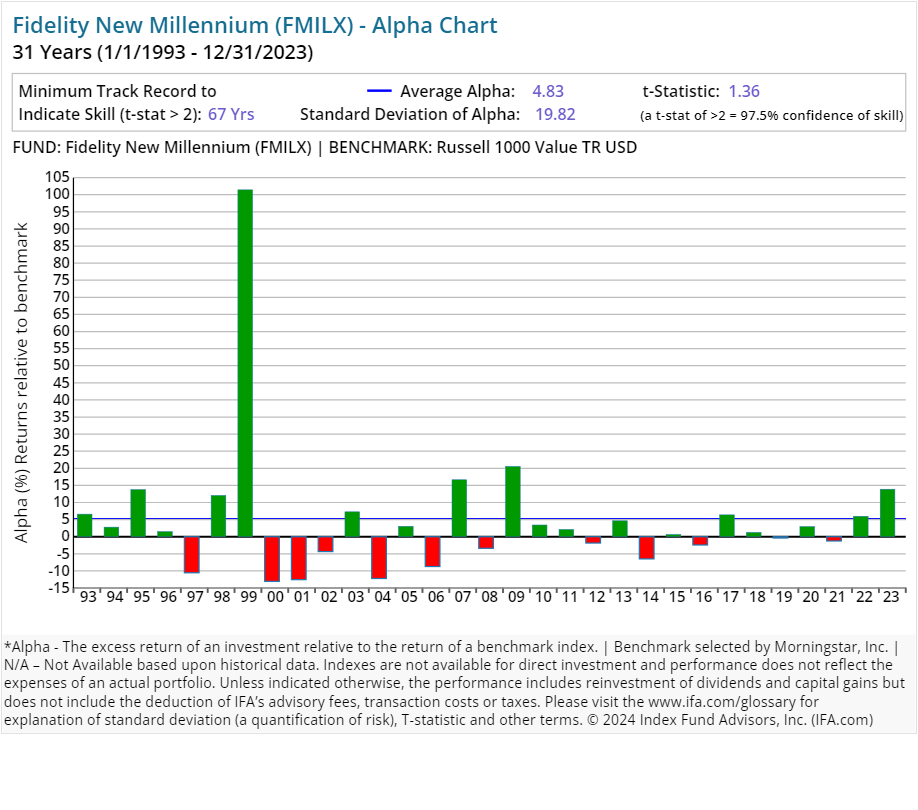

| Fidelity New Millennium | FMILX | 59.00 | 0.89 | Equity | ||

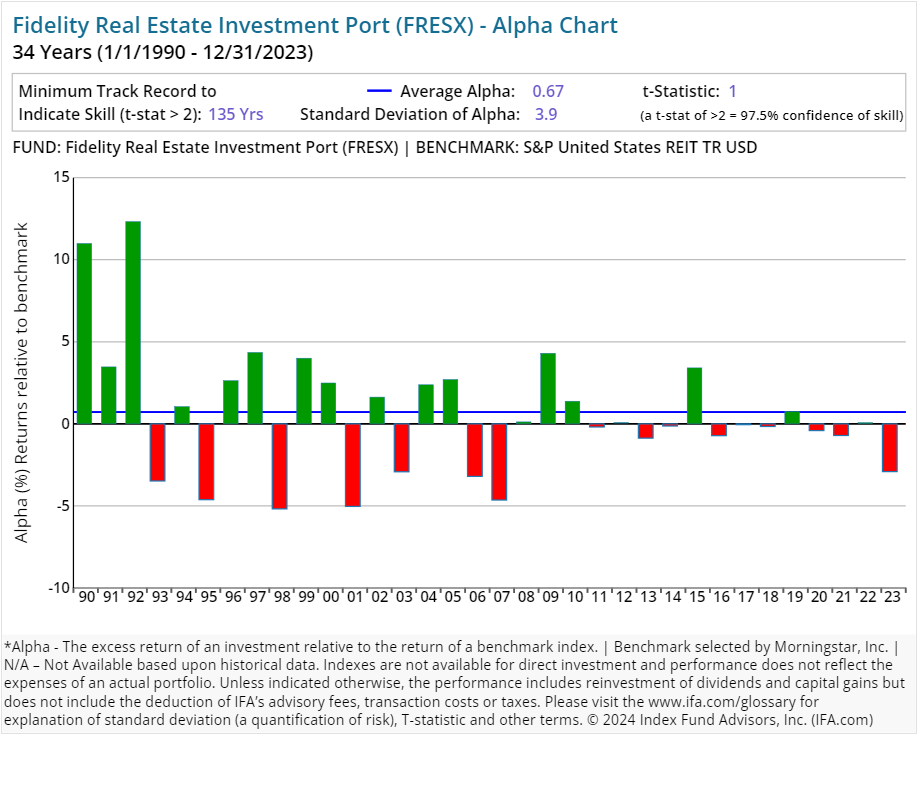

| Fidelity Real Estate Investment Port | FRESX | 13.00 | 0.72 | Equity | ||

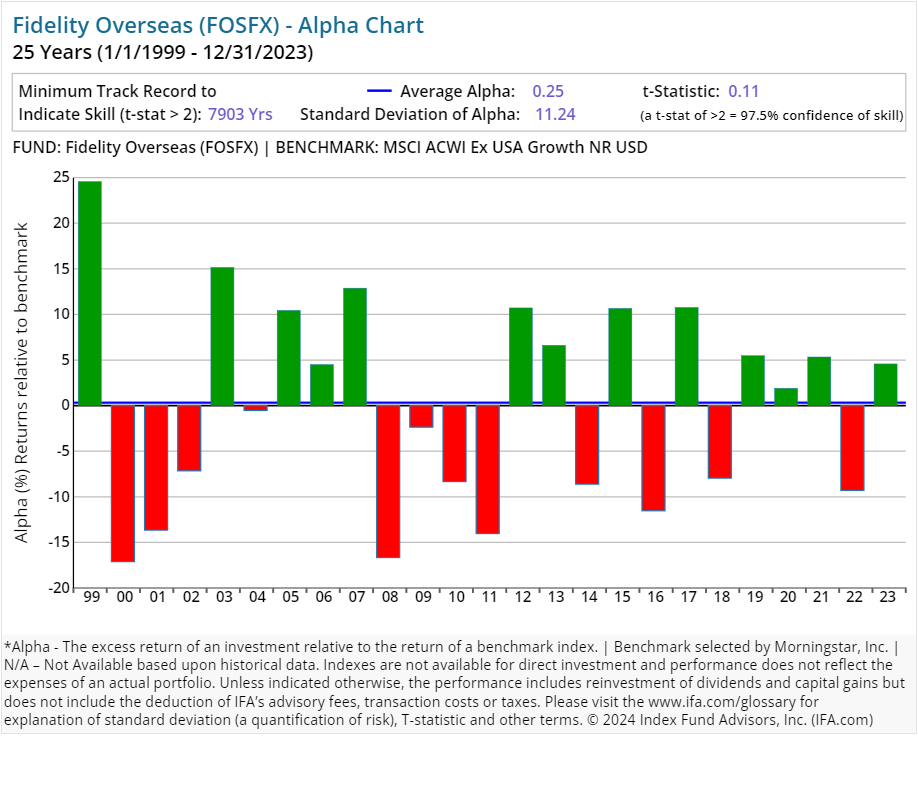

| Fidelity Overseas | FOSFX | 34.00 | 0.72 | Equity | ||

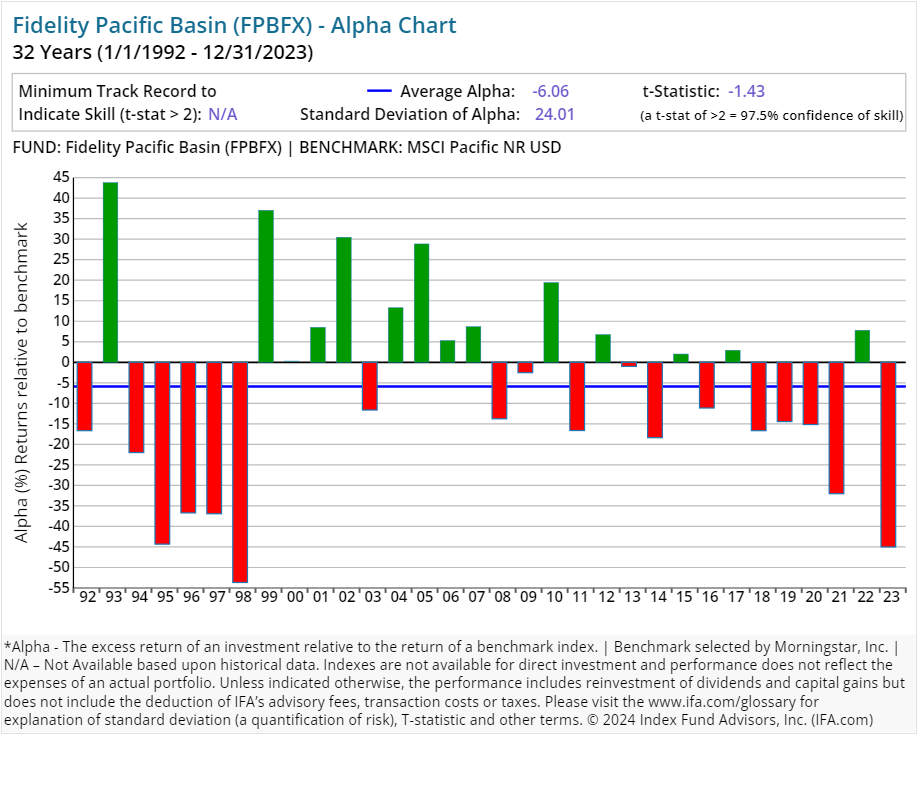

| Fidelity Pacific Basin | FPBFX | 46.00 | 1.07 | Equity | ||

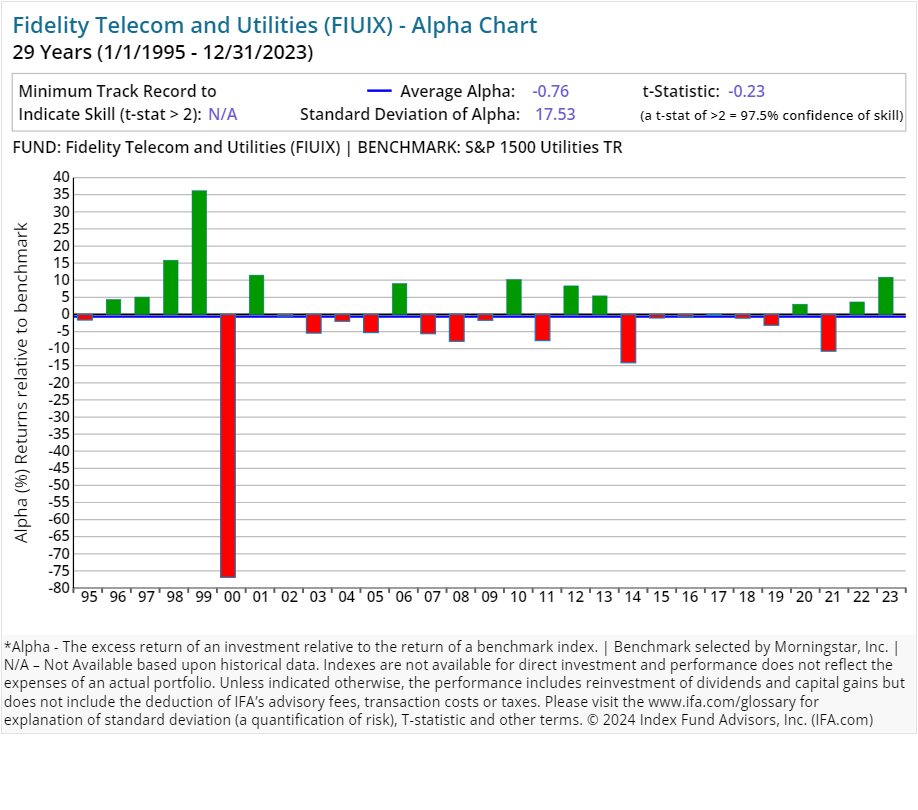

| Fidelity Telecom and Utilities | FIUIX | 34.00 | 0.73 | Equity | ||

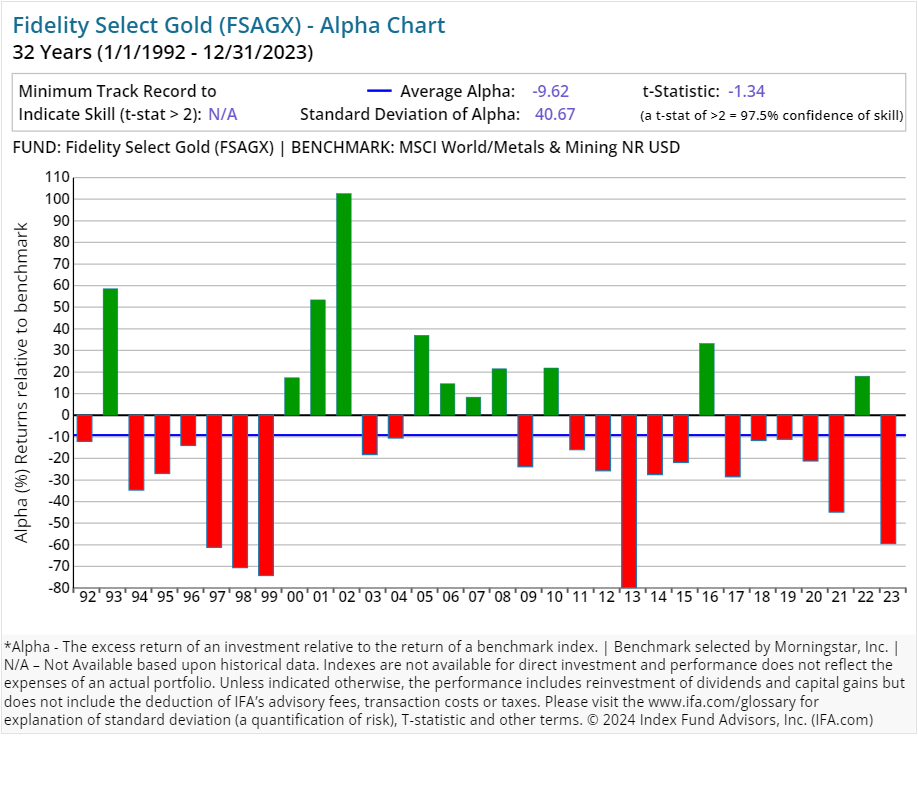

| Fidelity Select Gold | FSAGX | 46.00 | 0.78 | Equity | ||

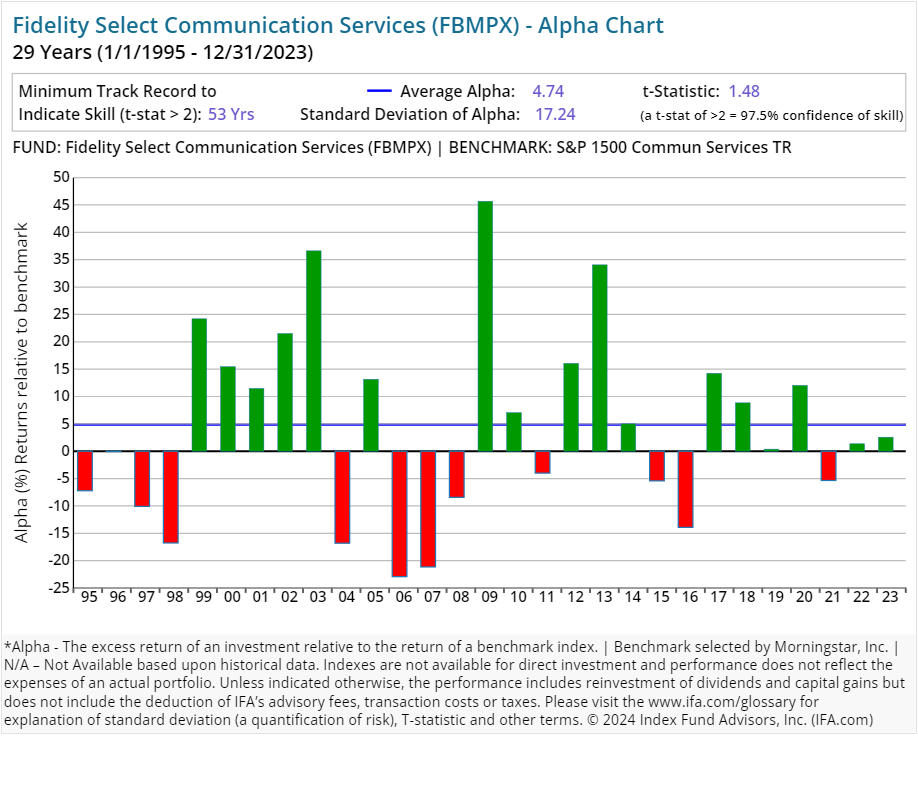

| Fidelity Select Communication Services | FBMPX | 45.00 | 0.80 | Equity | ||

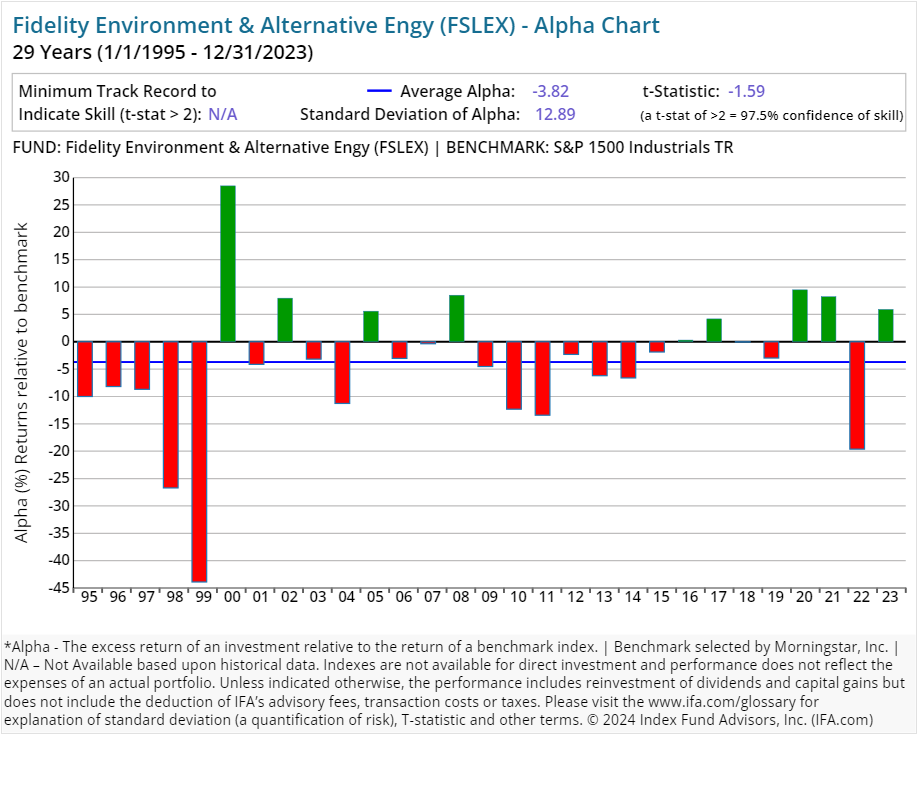

| Fidelity Environment & Alternative Engy | FSLEX | 34.00 | 0.79 | Equity | ||

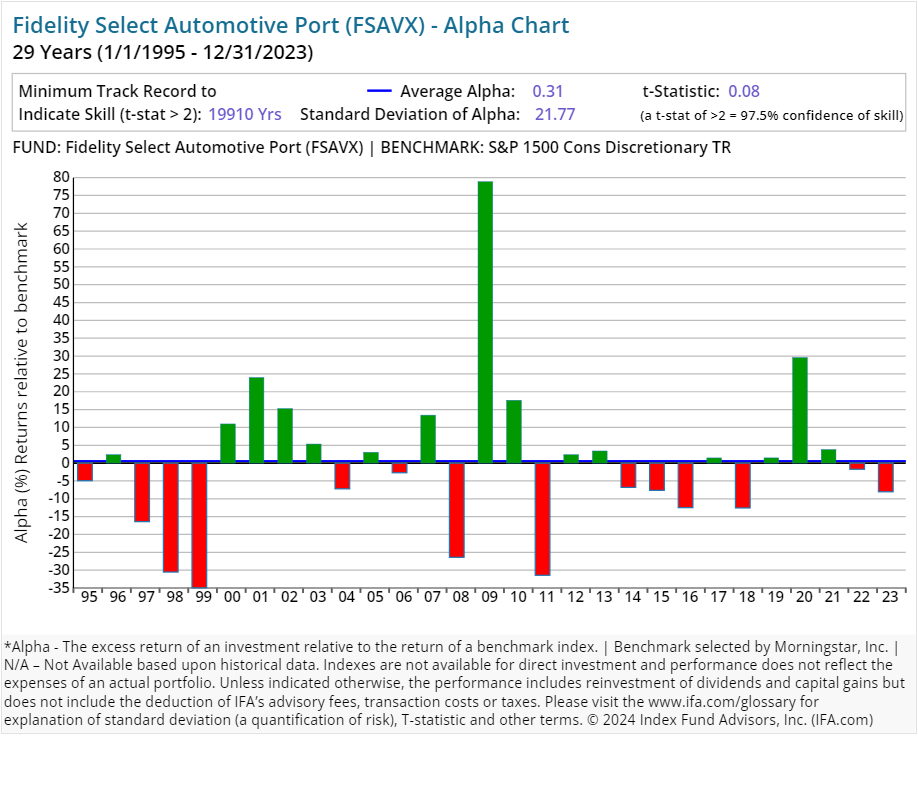

| Fidelity Select Automotive Port | FSAVX | 54.00 | 0.89 | Equity | ||

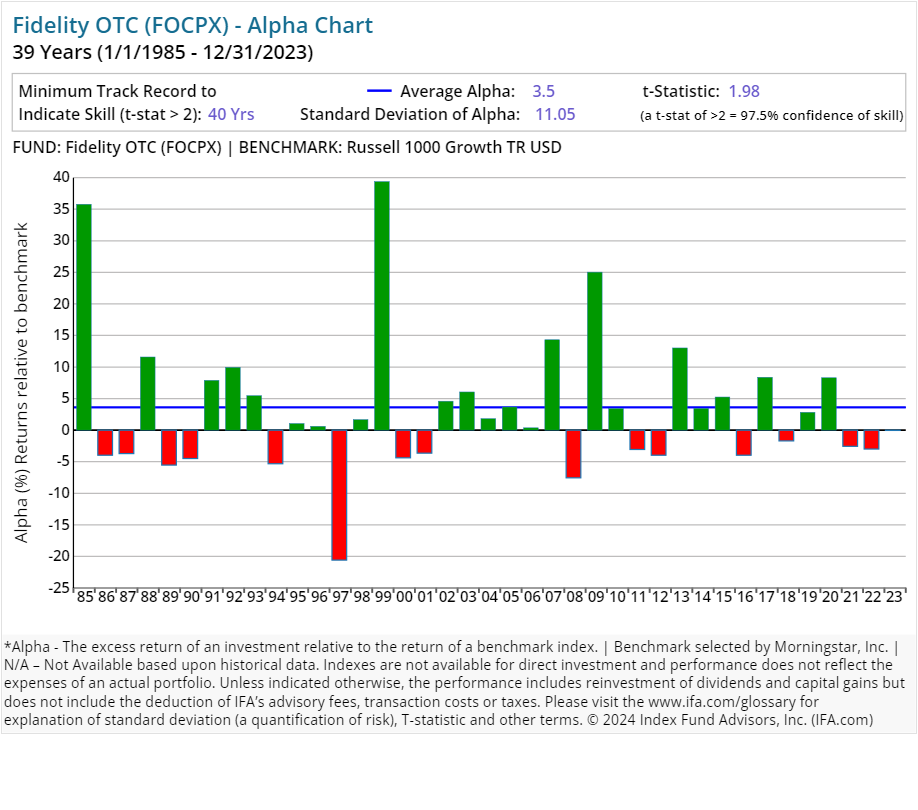

| Fidelity OTC | FOCPX | 15.00 | 0.79 | Equity | ||

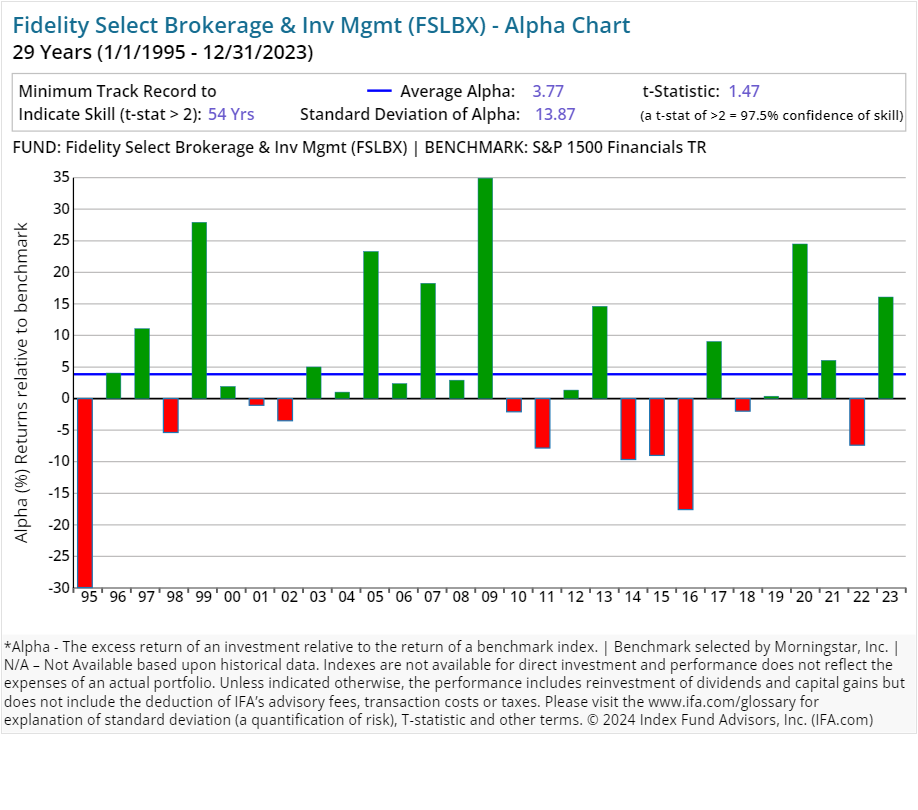

| Fidelity Select Brokerage & Inv Mgmt | FSLBX | 4.00 | 0.75 | Equity | ||

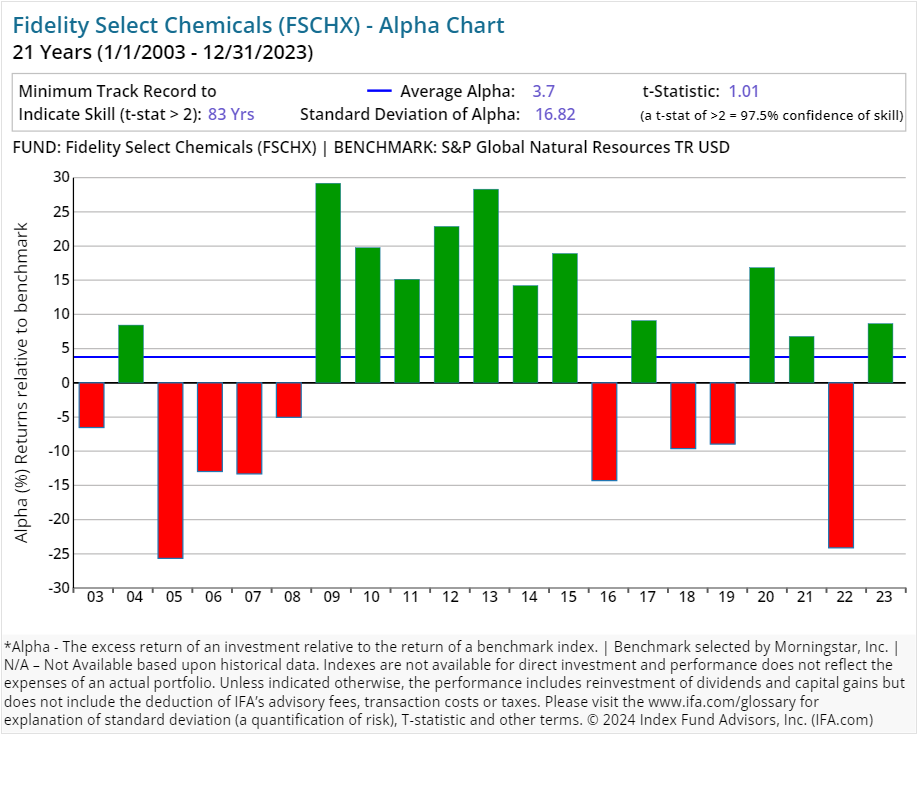

| Fidelity Select Chemicals | FSCHX | 54.00 | 0.75 | Equity | ||

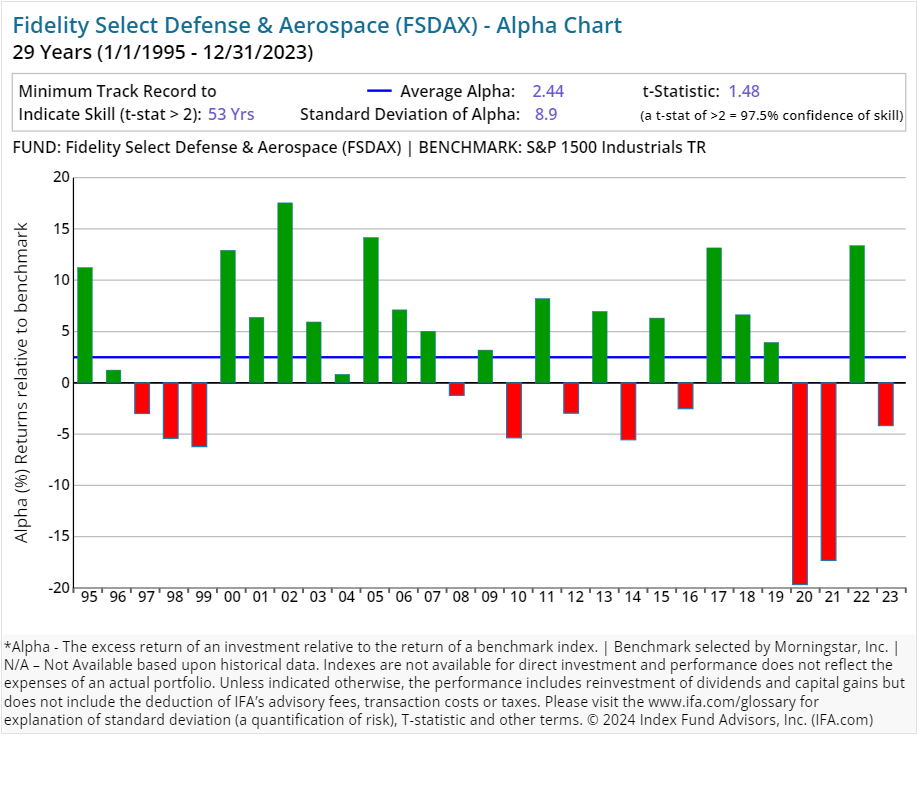

| Fidelity Select Defense & Aerospace | FSDAX | 15.00 | 0.75 | Equity | ||

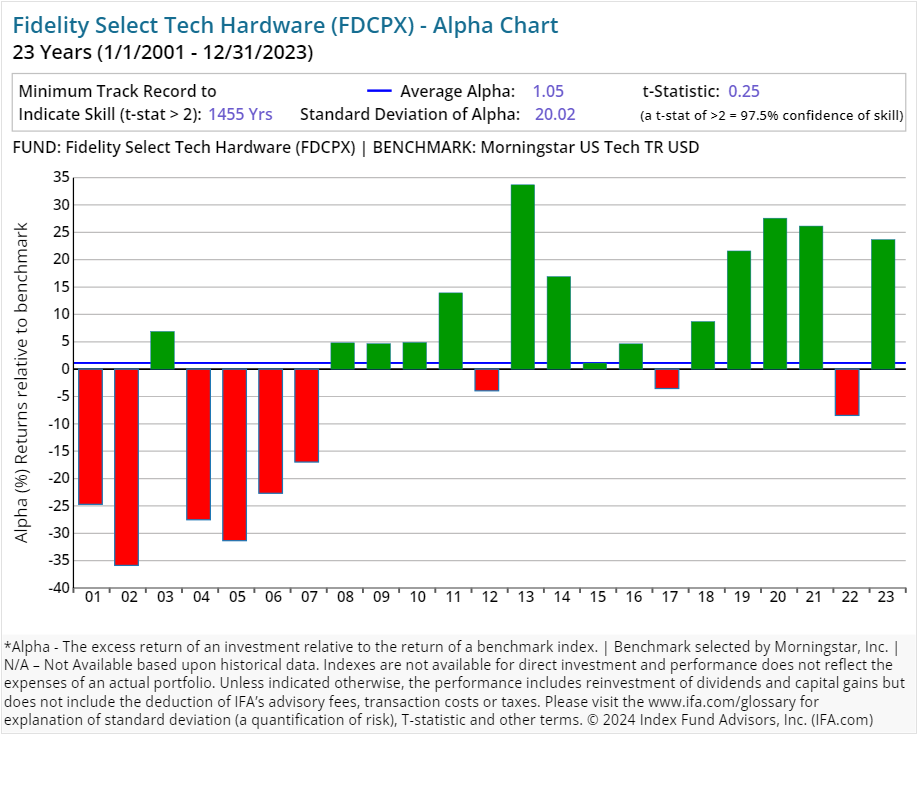

| Fidelity Select Tech Hardware | FDCPX | 30.00 | 0.73 | Equity | ||

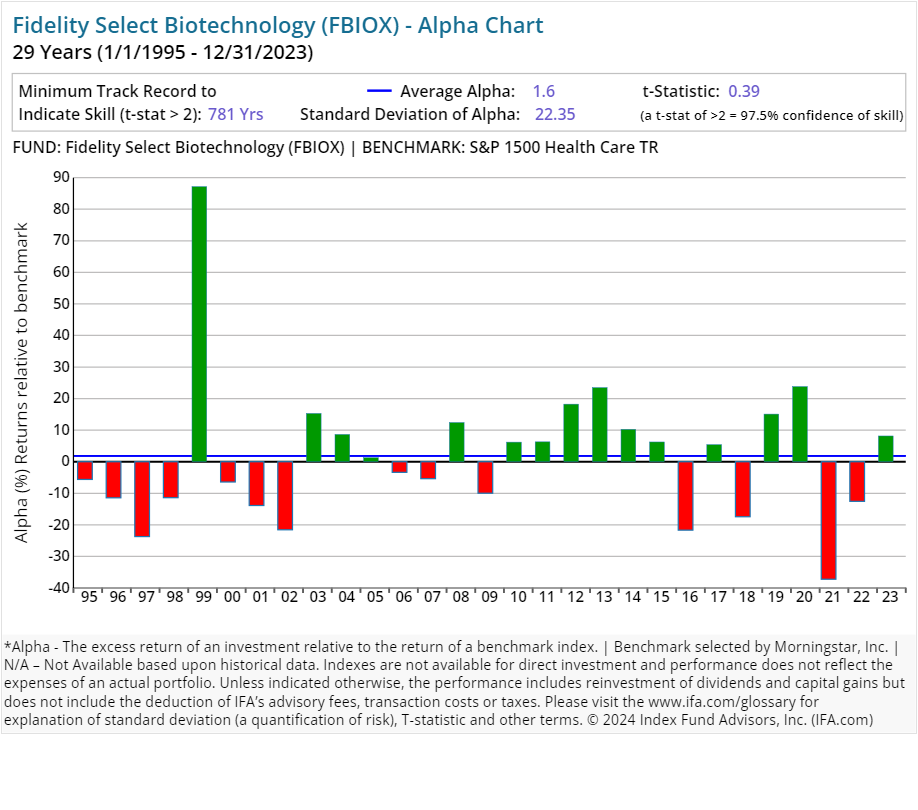

| Fidelity Select Biotechnology | FBIOX | 51.00 | 0.72 | Equity | ||

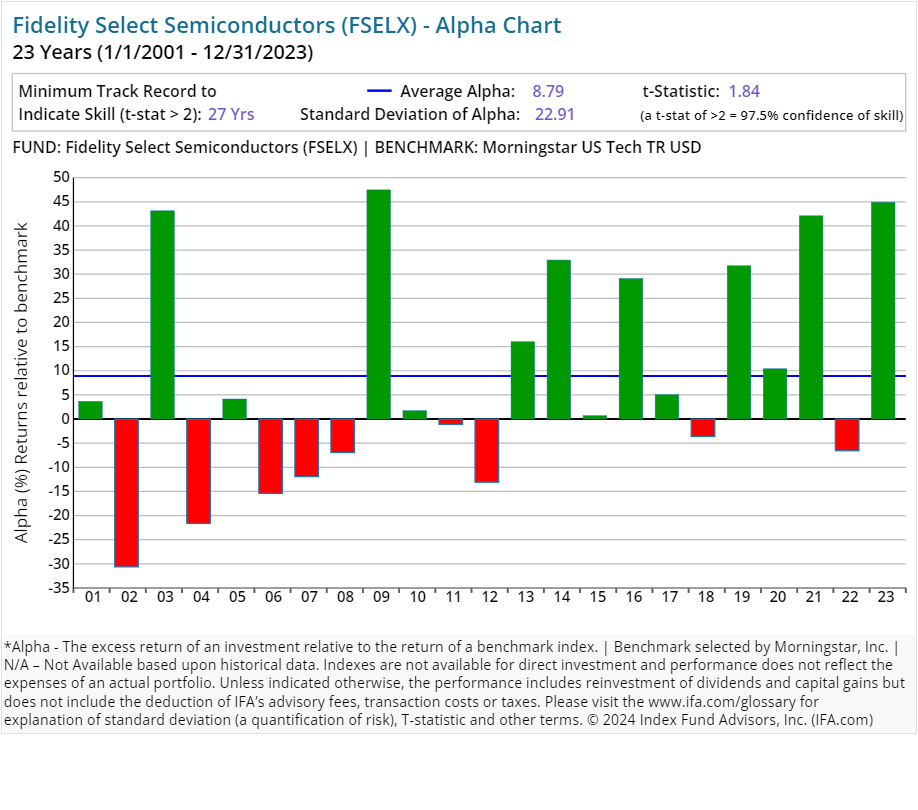

| Fidelity Select Semiconductors | FSELX | 35.00 | 0.69 | Equity | ||

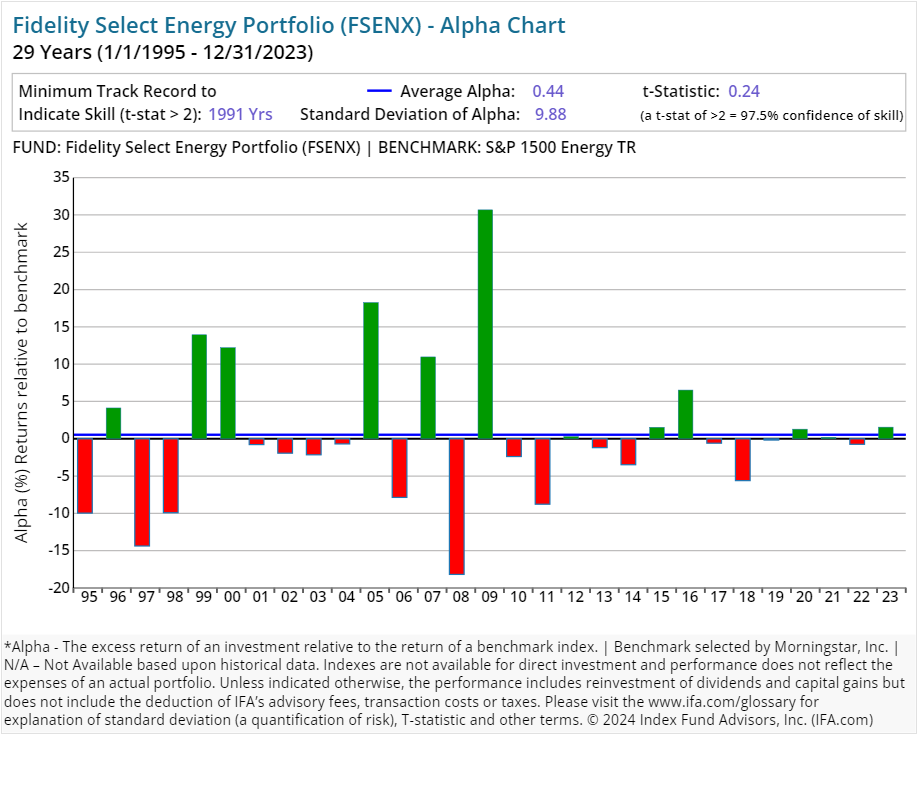

| Fidelity Select Energy Portfolio | FSENX | 43.00 | 0.73 | Equity | ||

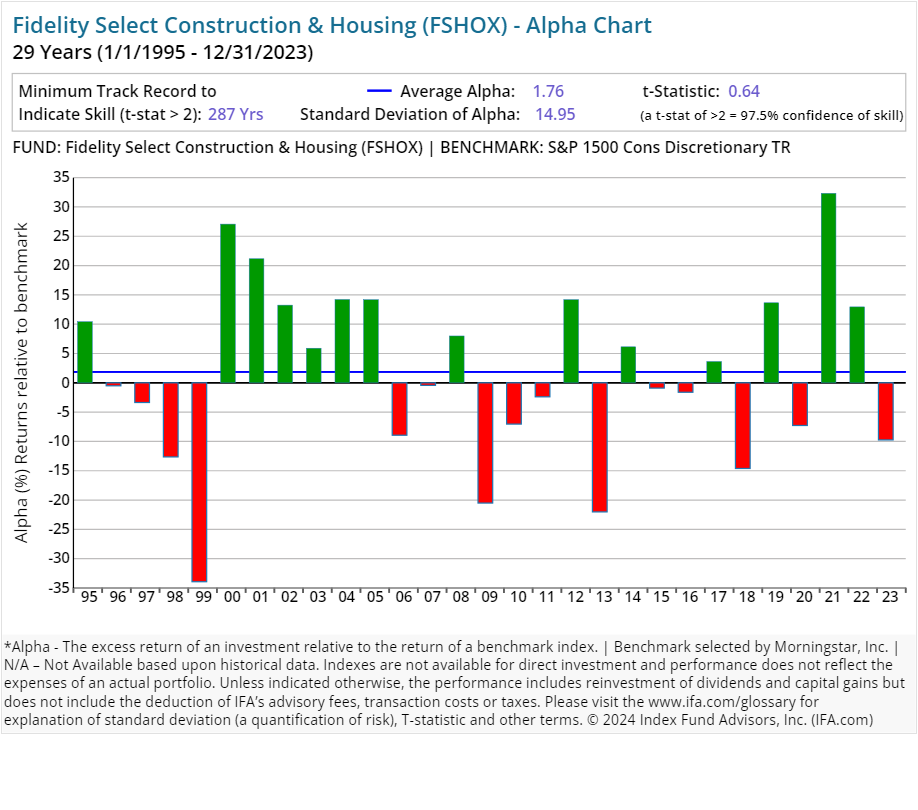

| Fidelity Select Construction & Housing | FSHOX | 20.00 | 0.77 | Equity | ||

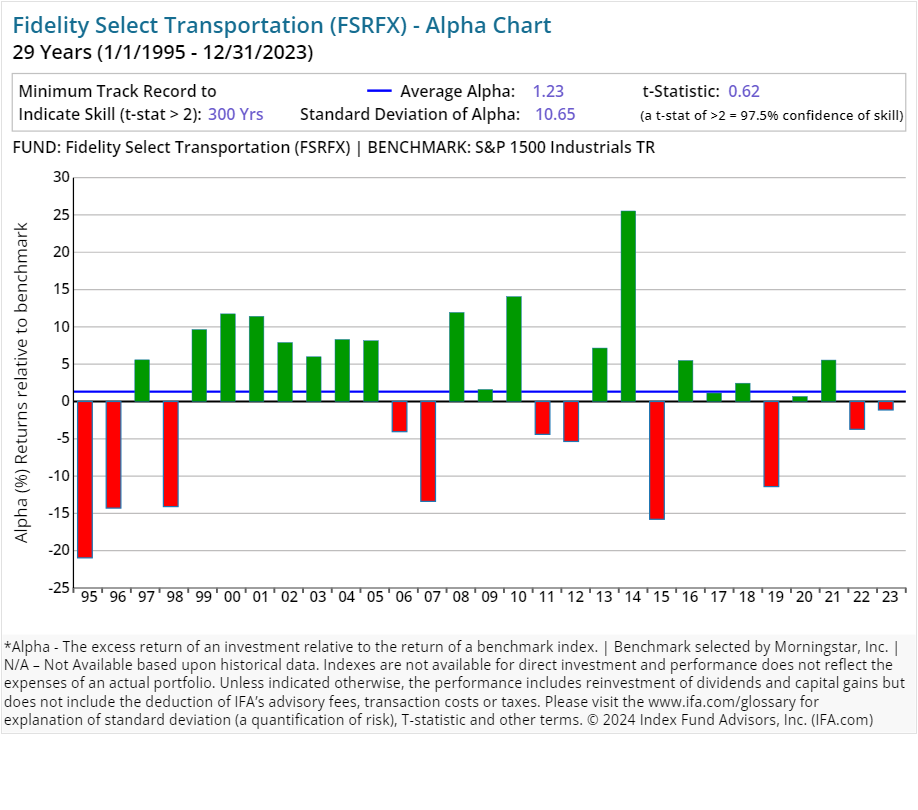

| Fidelity Select Transportation | FSRFX | 23.00 | 0.76 | Equity | ||

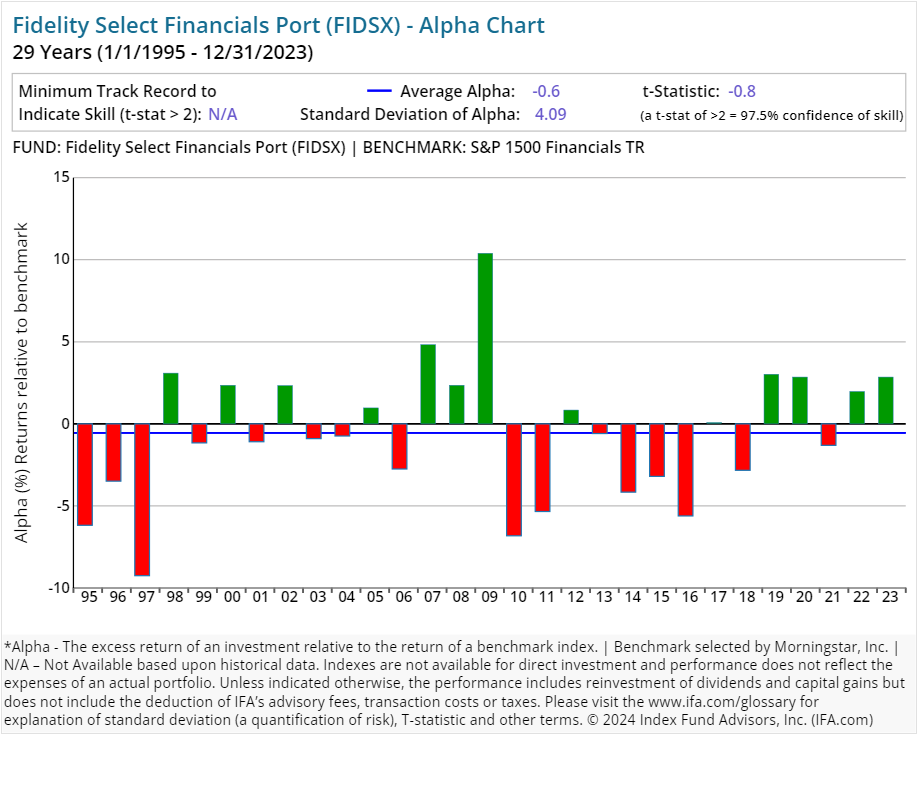

| Fidelity Select Financials Port | FIDSX | 46.00 | 0.75 | Equity | ||

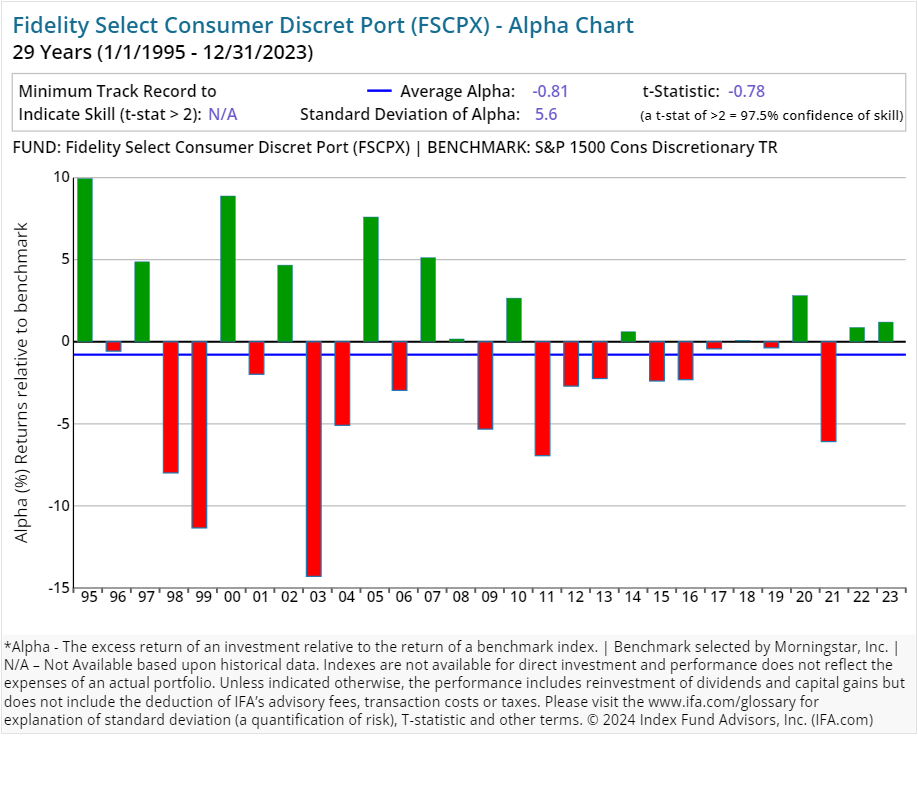

| Fidelity Select Consumer Discret Port | FSCPX | 46.00 | 0.76 | Equity | ||

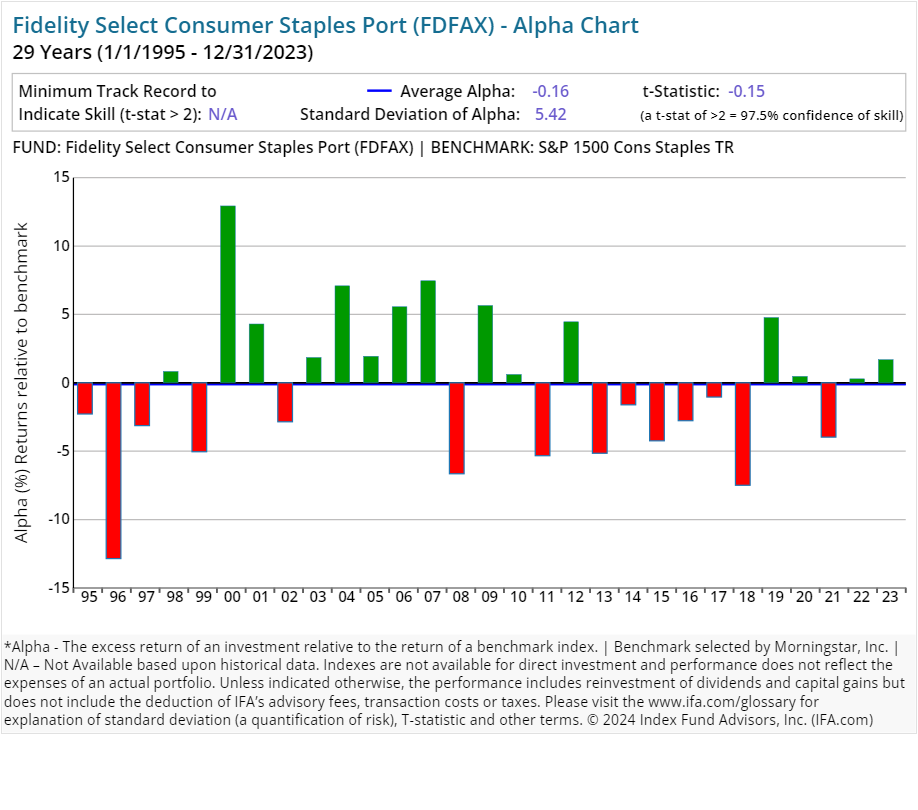

| Fidelity Select Consumer Staples Port | FDFAX | 46.00 | 0.73 | Equity | ||

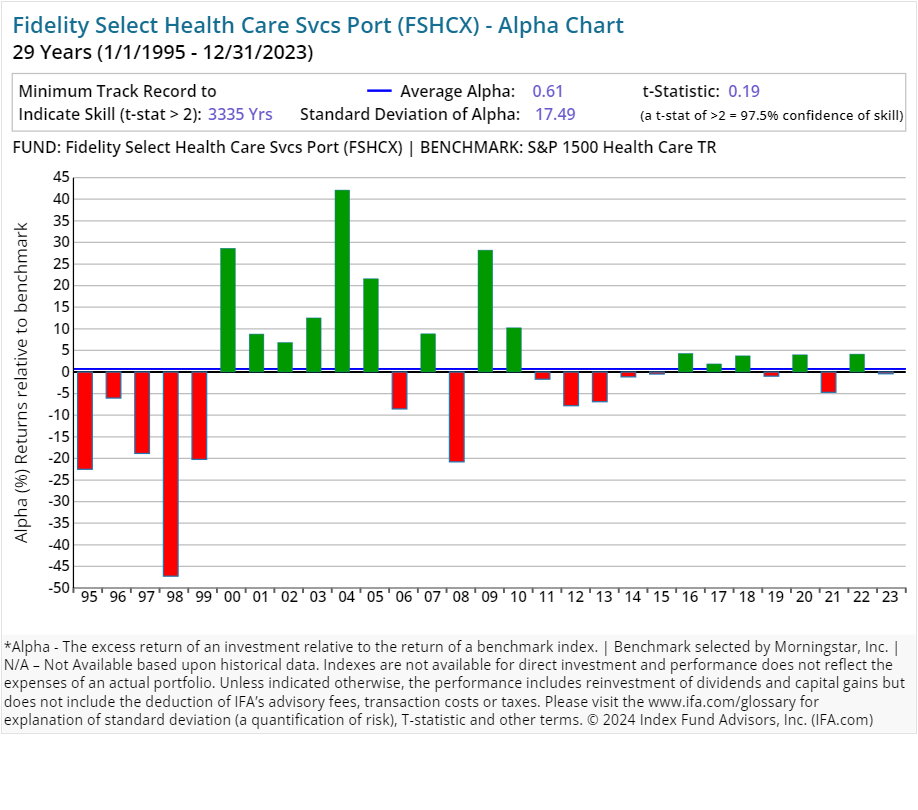

| Fidelity Select Health Care Svcs Port | FSHCX | 30.00 | 0.73 | Equity | ||

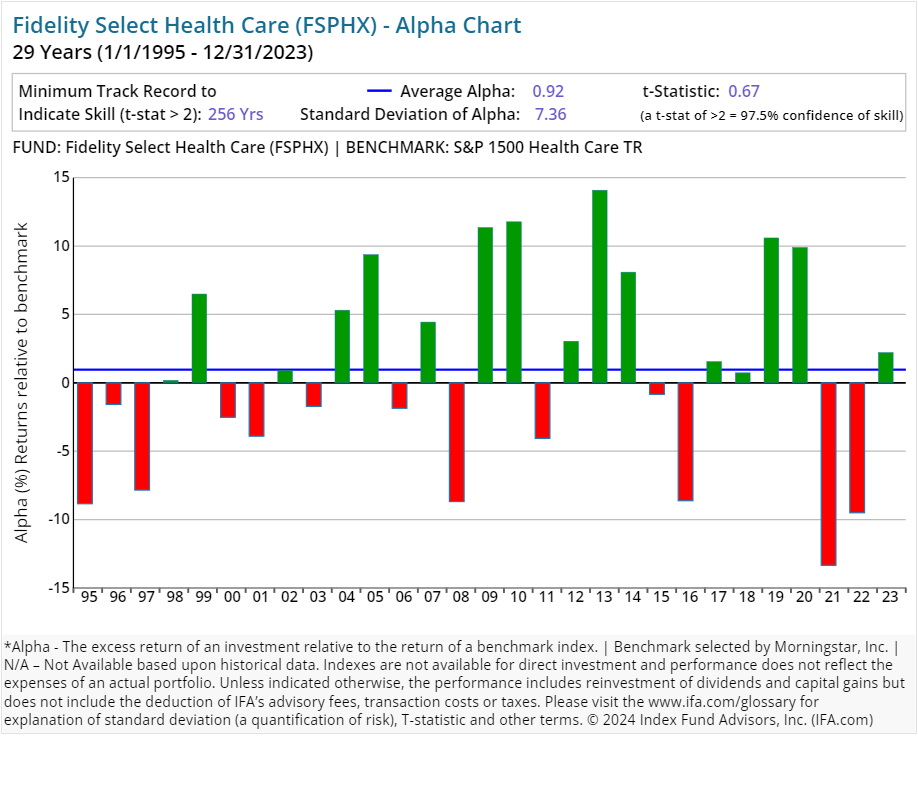

| Fidelity Select Health Care | FSPHX | 40.00 | 0.69 | Equity | ||

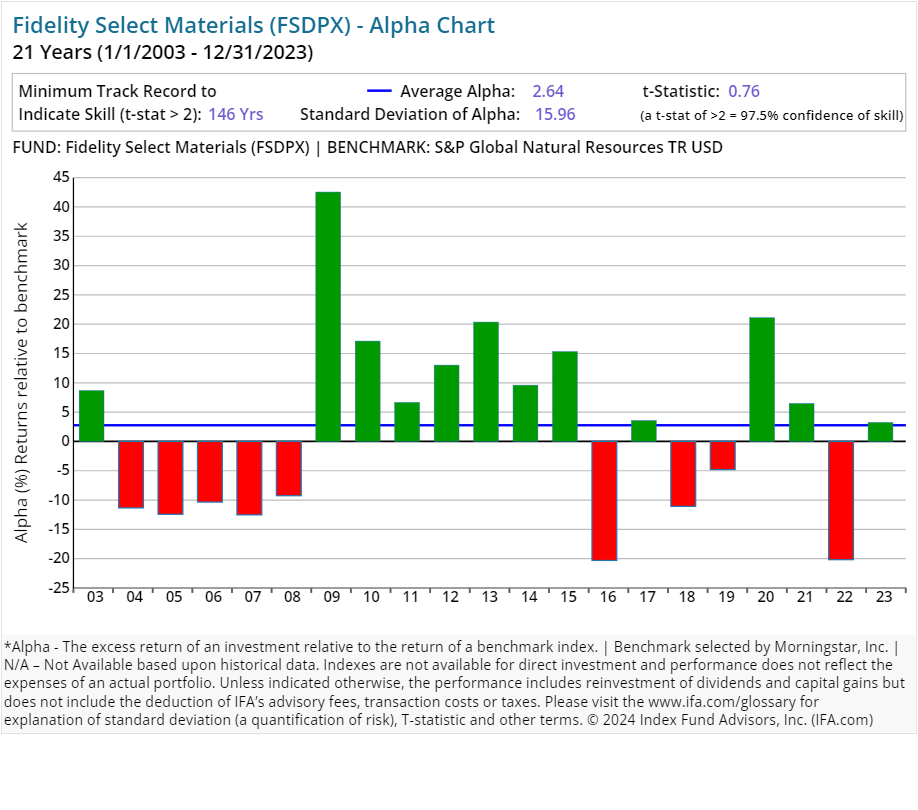

| Fidelity Select Materials | FSDPX | 47.00 | 0.76 | Equity | ||

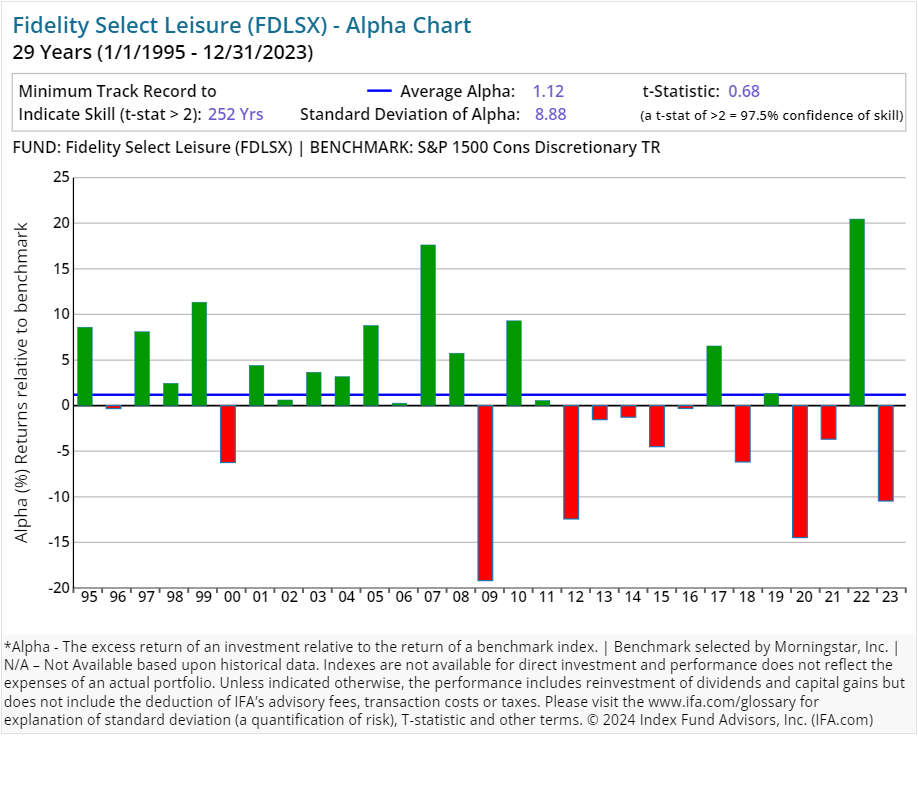

| Fidelity Select Leisure | FDLSX | 46.00 | 0.74 | Equity | ||

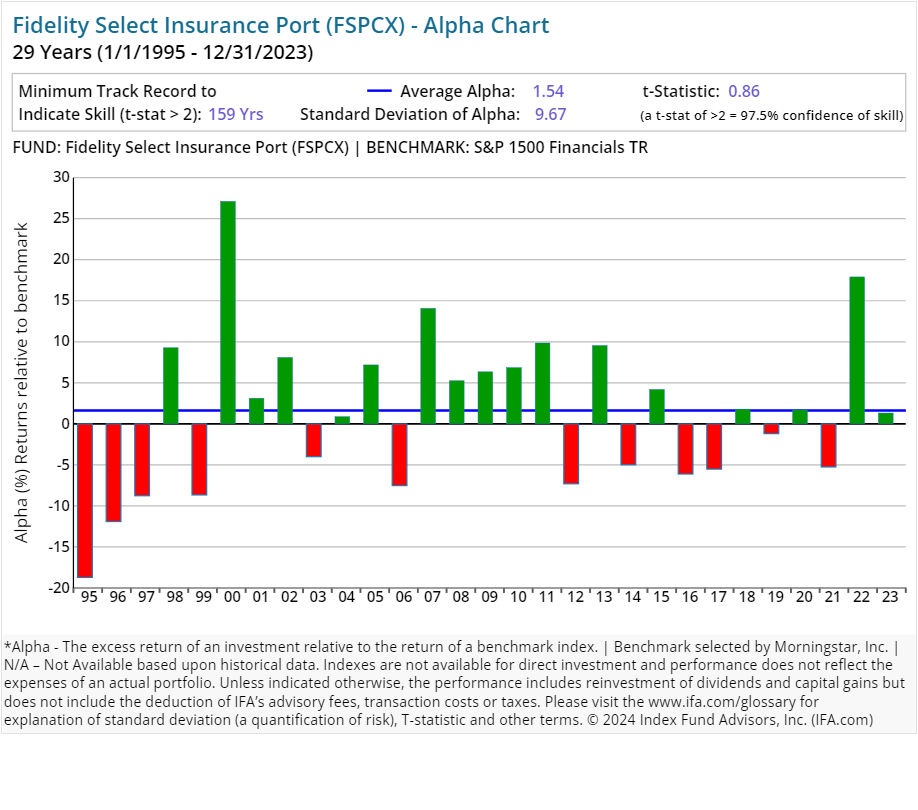

| Fidelity Select Insurance Port | FSPCX | 48.00 | 0.81 | Equity | ||

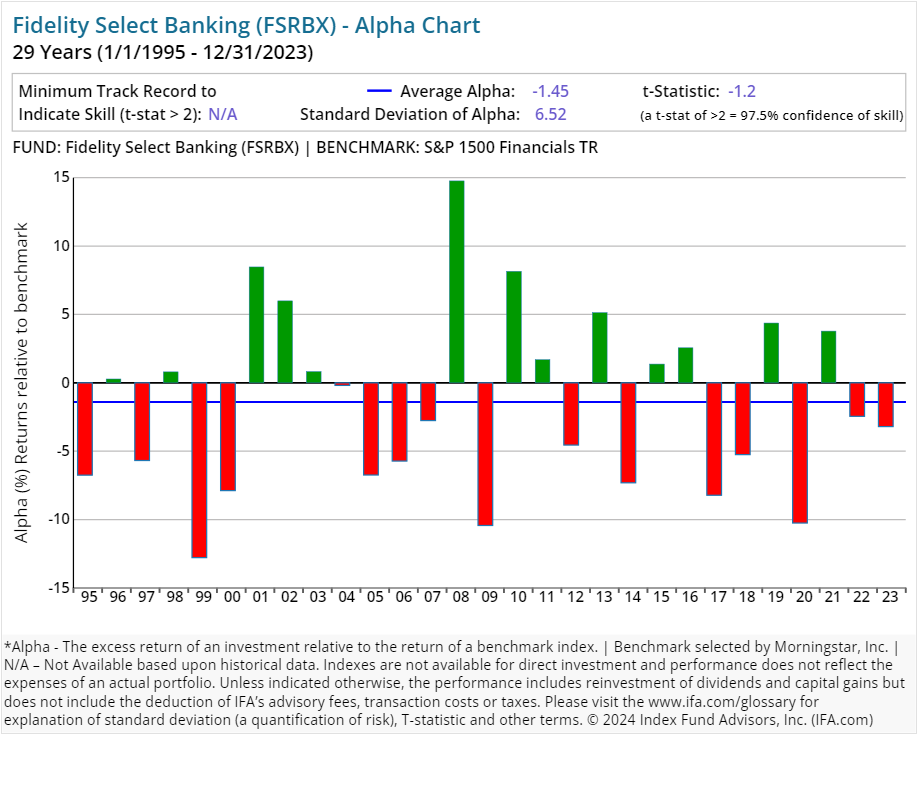

| Fidelity Select Banking | FSRBX | 21.00 | 0.75 | Equity | ||

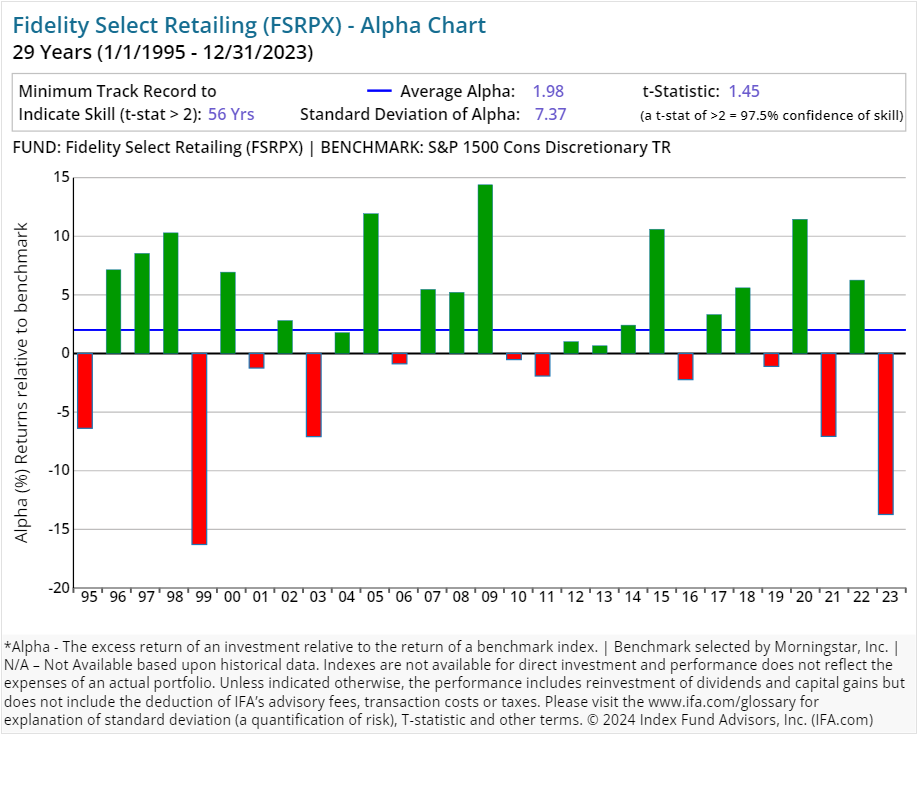

| Fidelity Select Retailing | FSRPX | 32.00 | 0.72 | Equity | ||

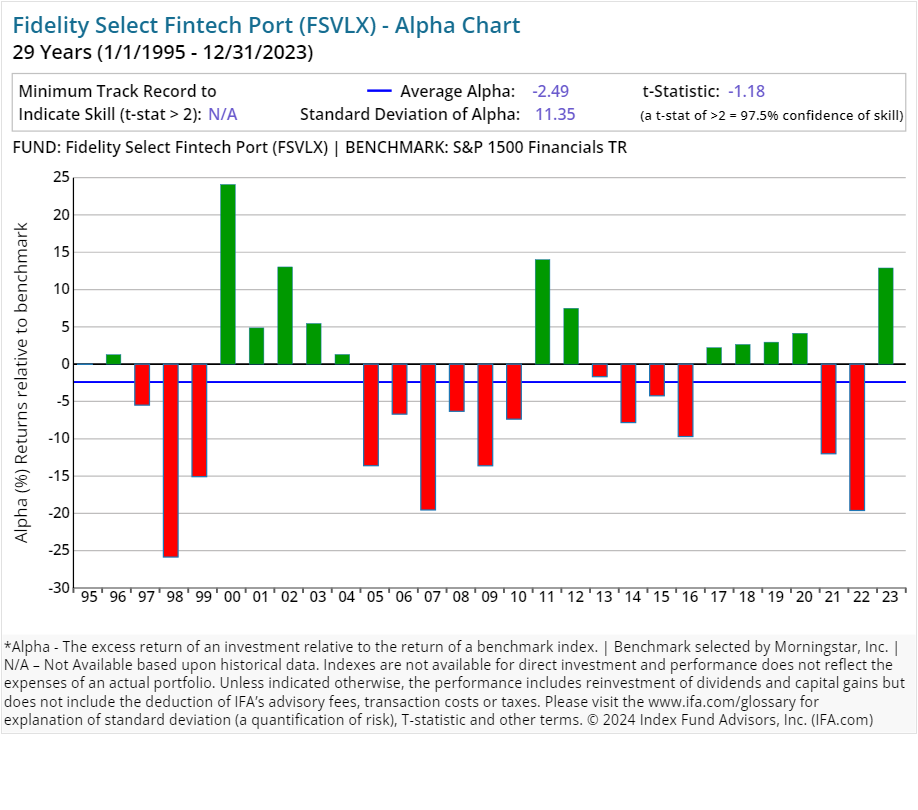

| Fidelity Select Fintech Port | FSVLX | 15.00 | 0.87 | Equity | ||

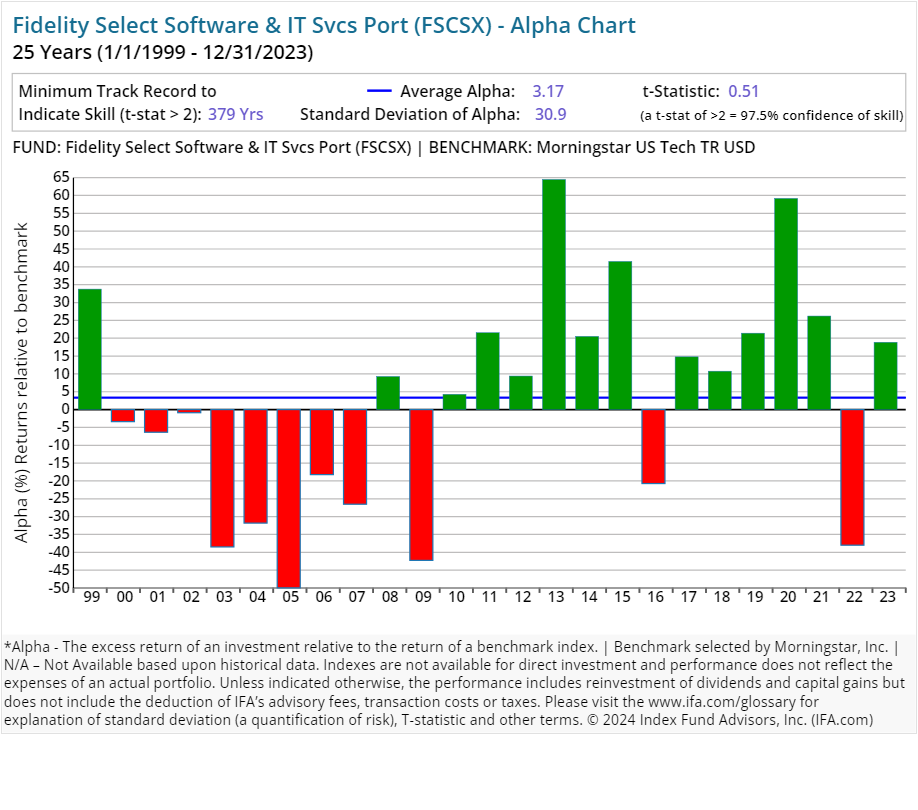

| Fidelity Select Software & IT Svcs Port | FSCSX | 4.00 | 0.69 | Equity | ||

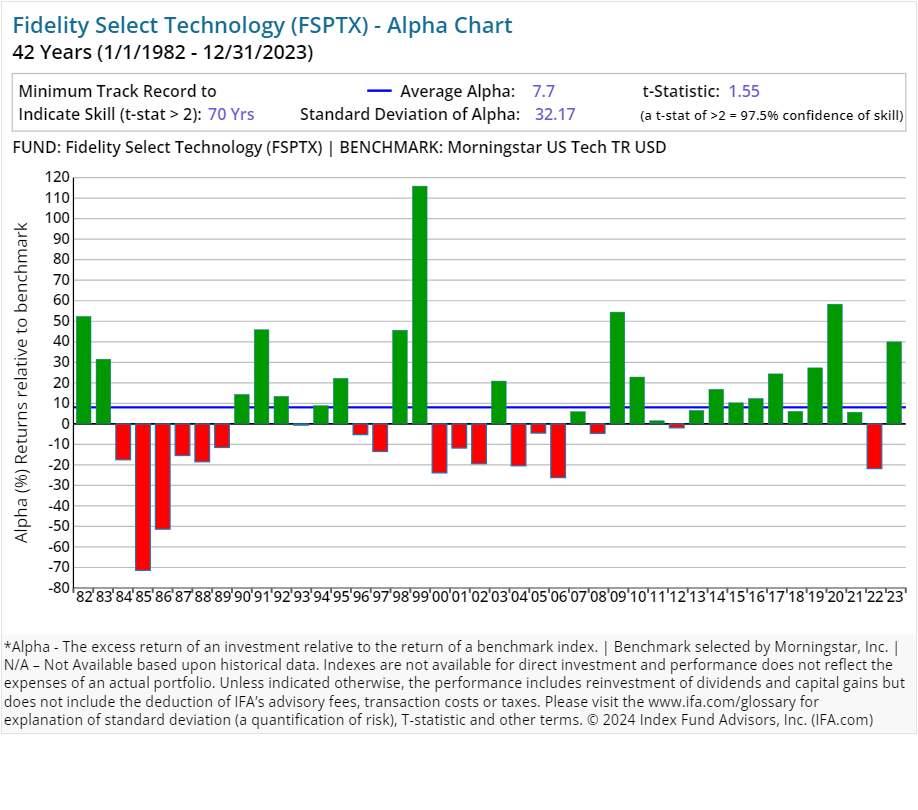

| Fidelity Select Technology | FSPTX | 24.00 | 0.70 | Equity | ||

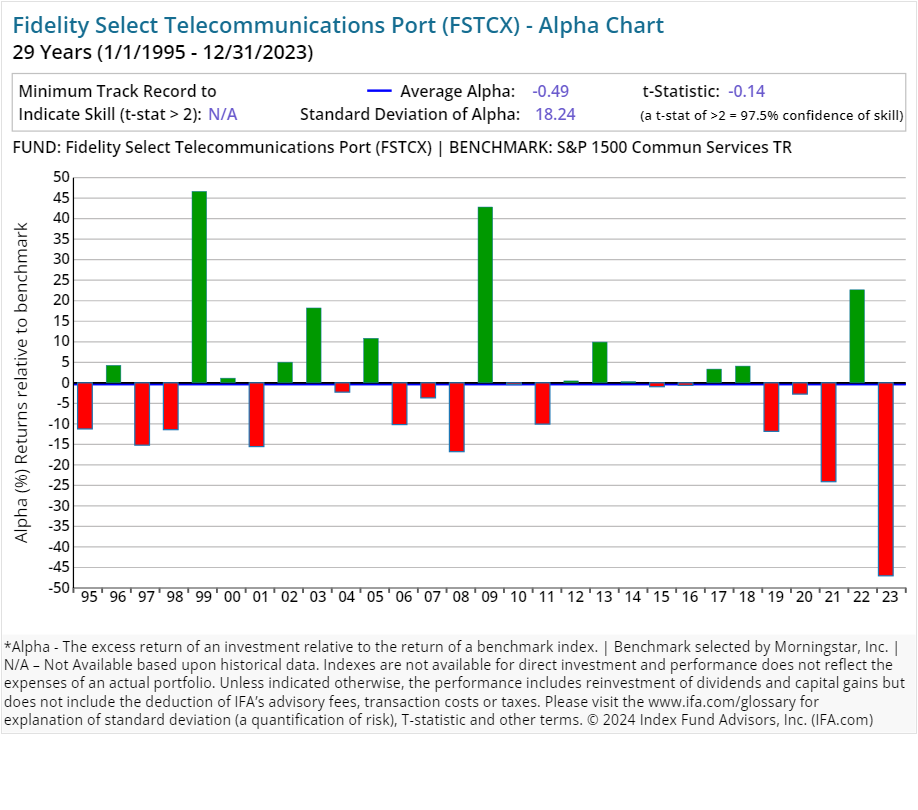

| Fidelity Select Telecommunications Port | FSTCX | 24.00 | 0.82 | Equity | ||

| Fidelity Select Utilities | FSUTX | 53.00 | 0.74 | Equity | ||

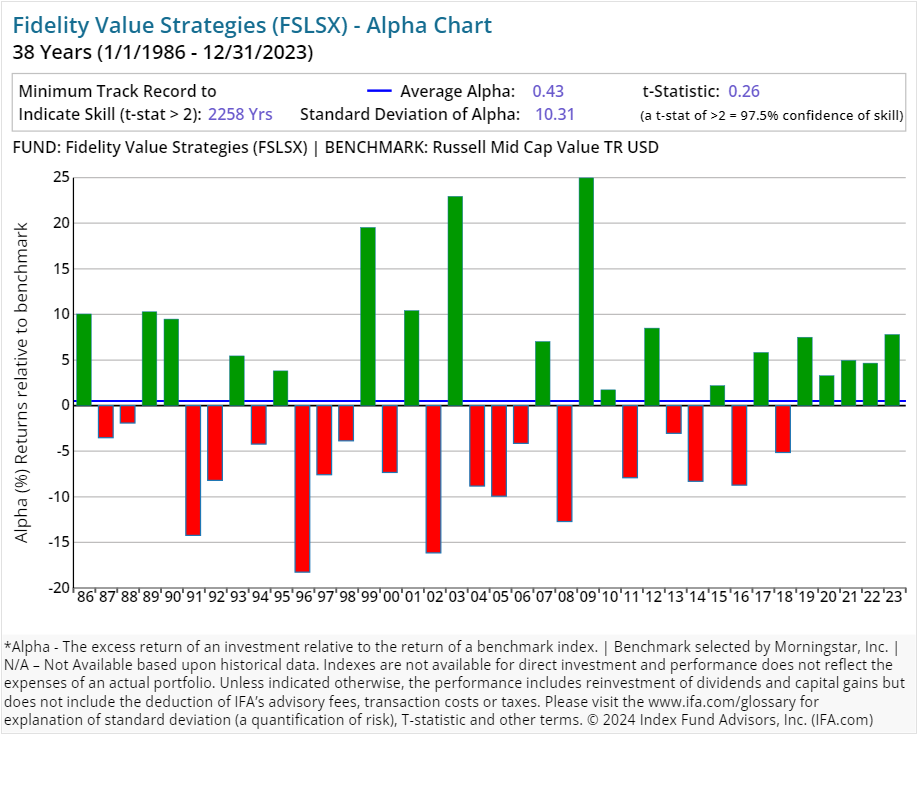

| Fidelity Value Strategies | FSLSX | 59.00 | 0.90 | Equity | ||

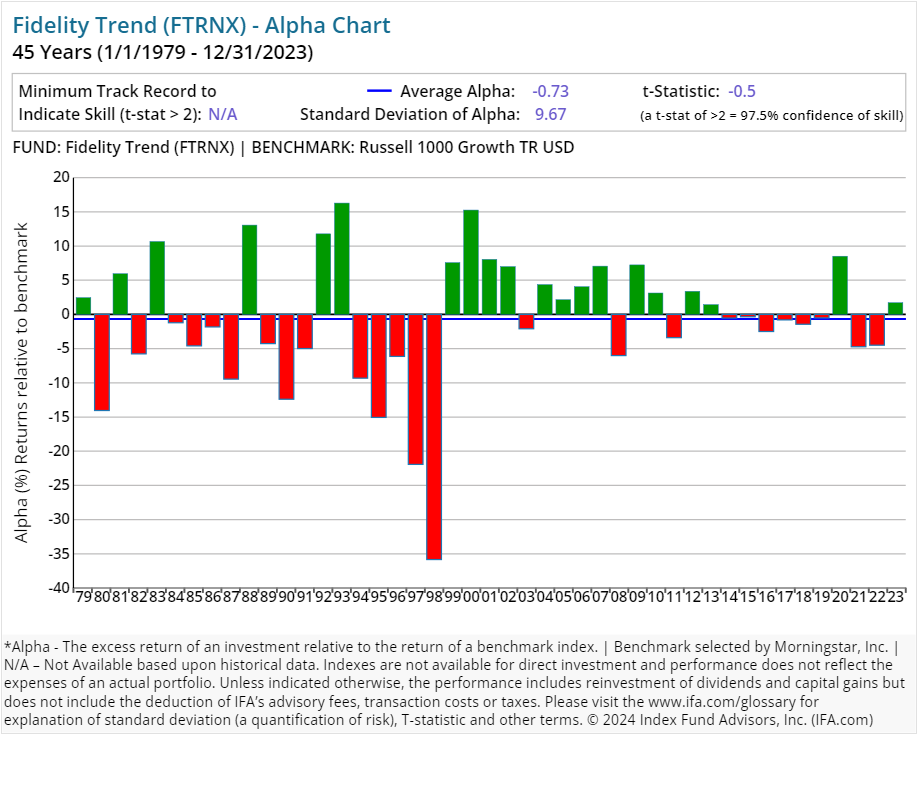

| Fidelity Trend | FTRNX | 38.00 | 0.49 | Equity | ||

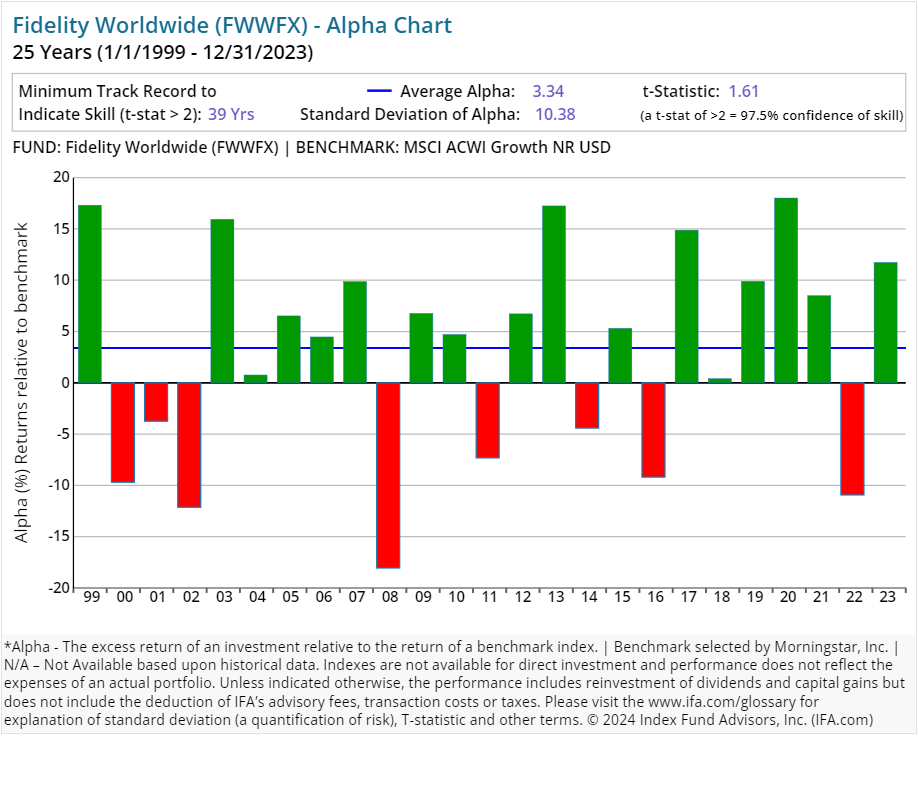

| Fidelity Worldwide | FWWFX | 114.00 | 0.66 | Equity | ||

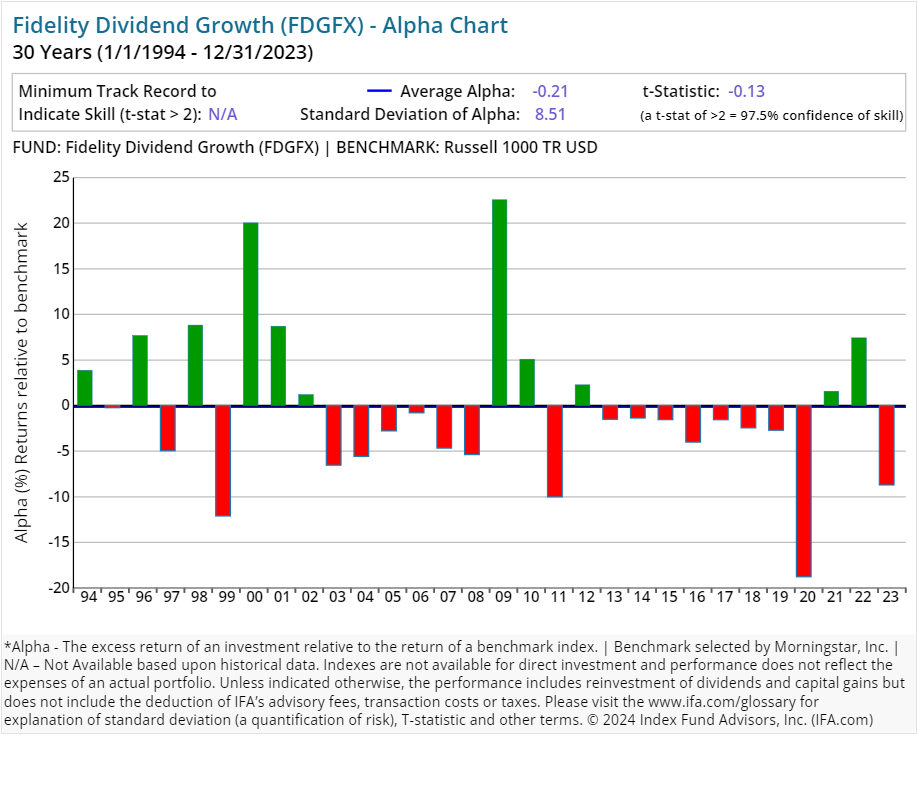

| Fidelity Dividend Growth | FDGFX | 66.00 | 0.58 | Equity | ||

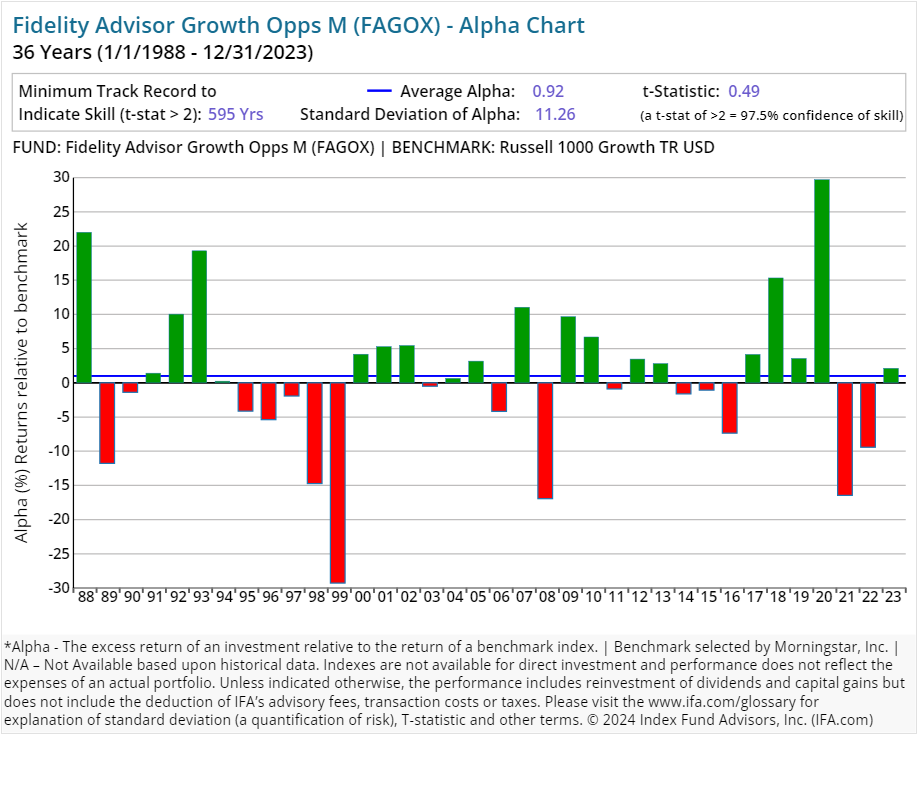

| Fidelity Advisor Growth Opps M | FAGOX | 50.00 | 0.96 | 0.50 | 3.50 | Equity |

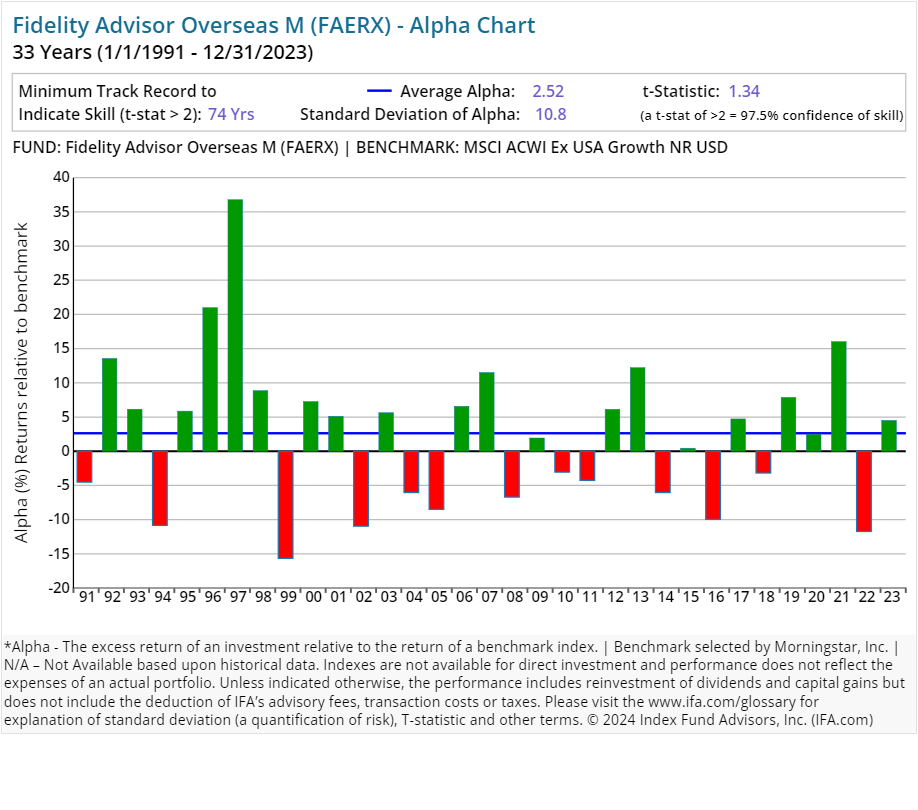

| Fidelity Advisor Overseas M | FAERX | 37.00 | 1.33 | 0.50 | 3.50 | Equity |

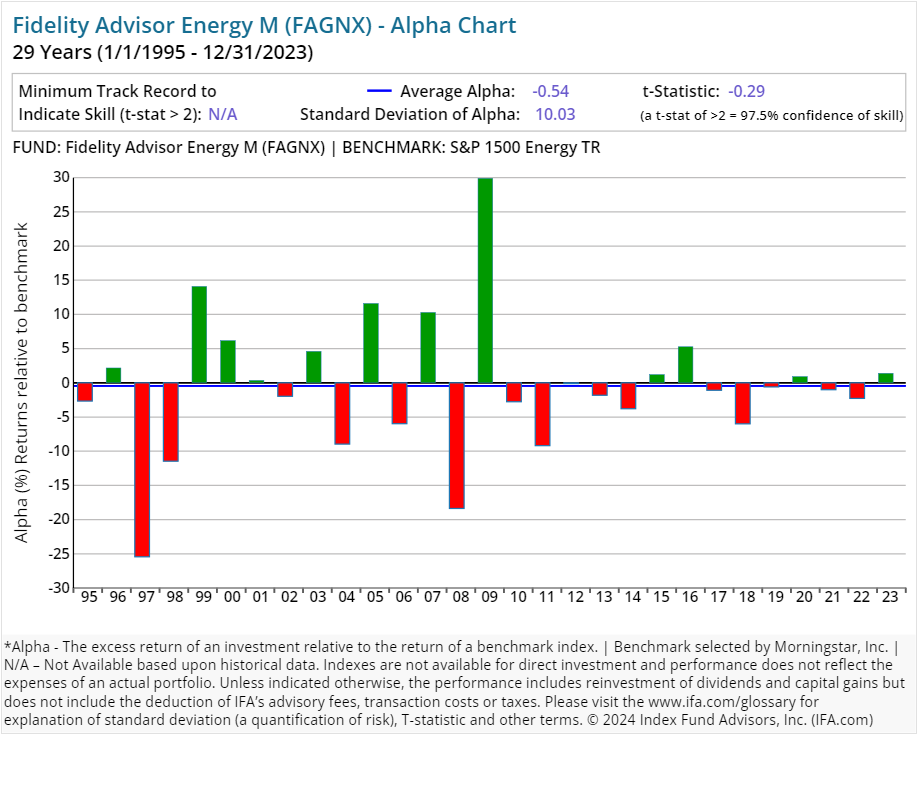

| Fidelity Advisor Energy M | FAGNX | 21.00 | 1.27 | 0.50 | 3.50 | Equity |

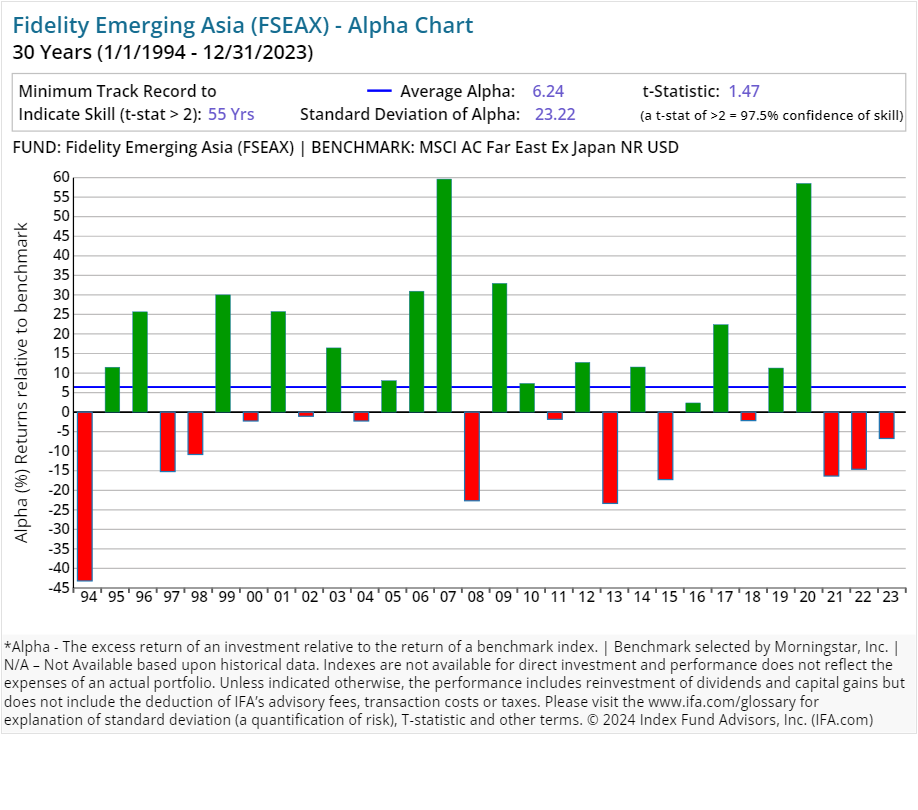

| Fidelity Emerging Asia | FSEAX | 50.00 | 0.87 | Equity | ||

| Fidelity Latin America | FLATX | 37.00 | 1.02 | Equity | ||

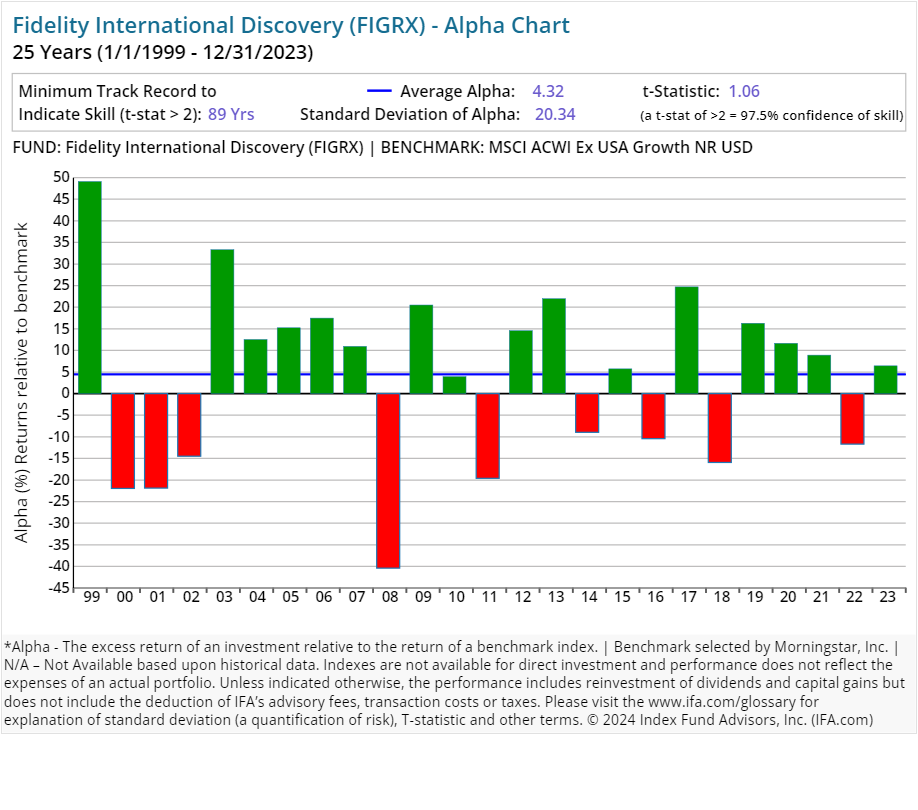

| Fidelity International Discovery | FIGRX | 49.00 | 0.65 | Equity | ||

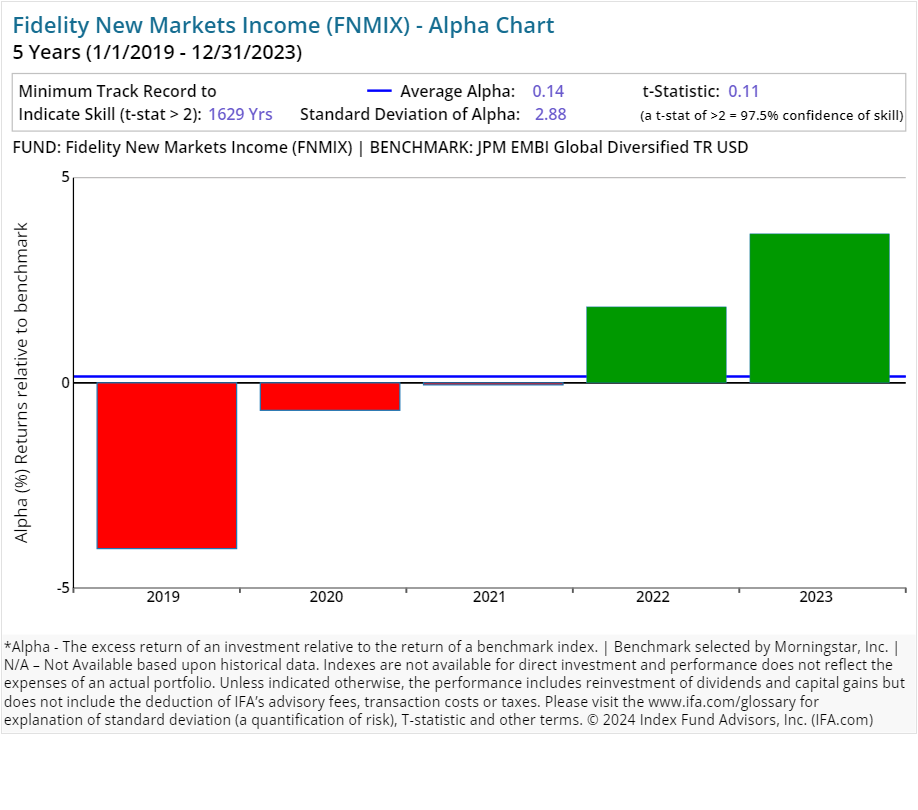

| Fidelity New Markets Income | FNMIX | 19.00 | 0.79 | Fixed Income | ||

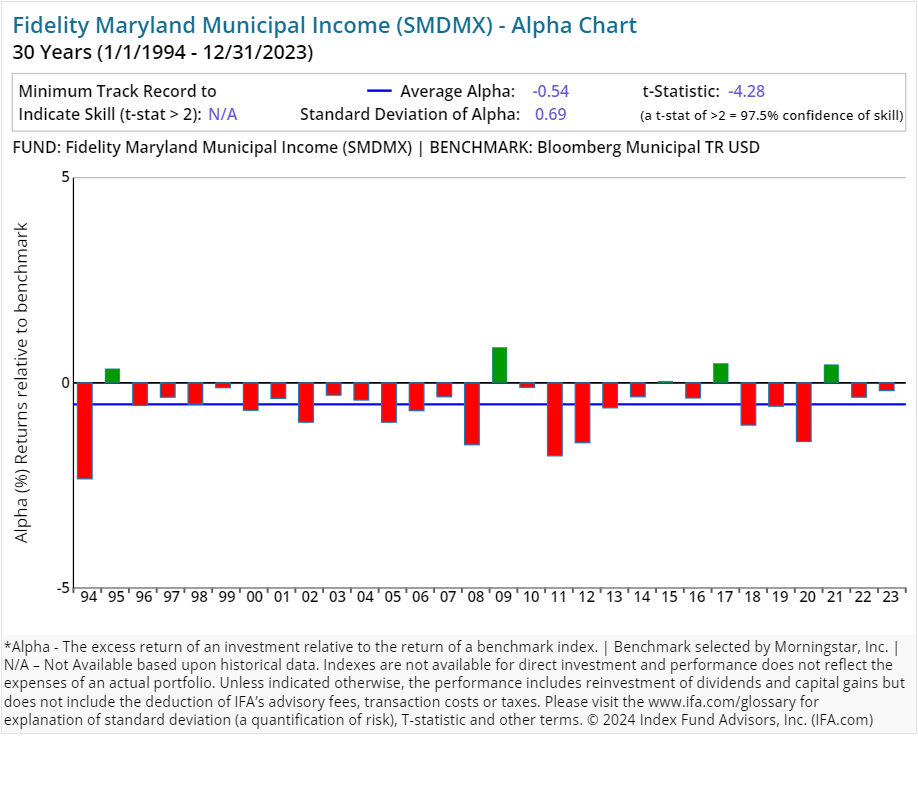

| Fidelity Maryland Municipal Income | SMDMX | 12.00 | 0.55 | Fixed Income | ||

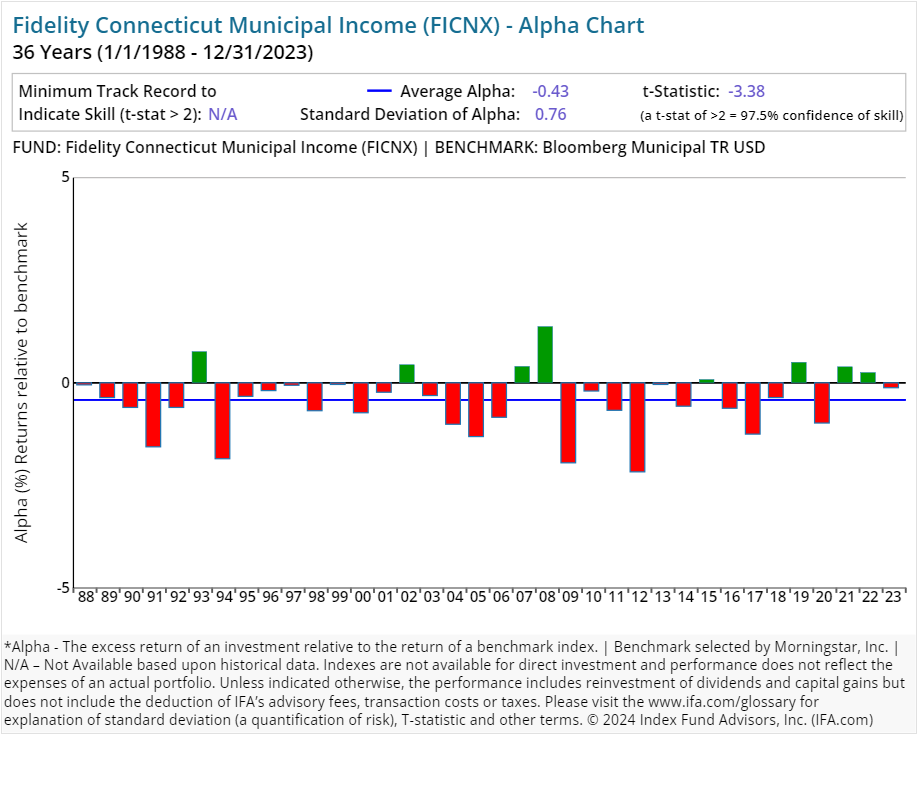

| Fidelity Connecticut Municipal Income | FICNX | 15.00 | 0.49 | Fixed Income | ||

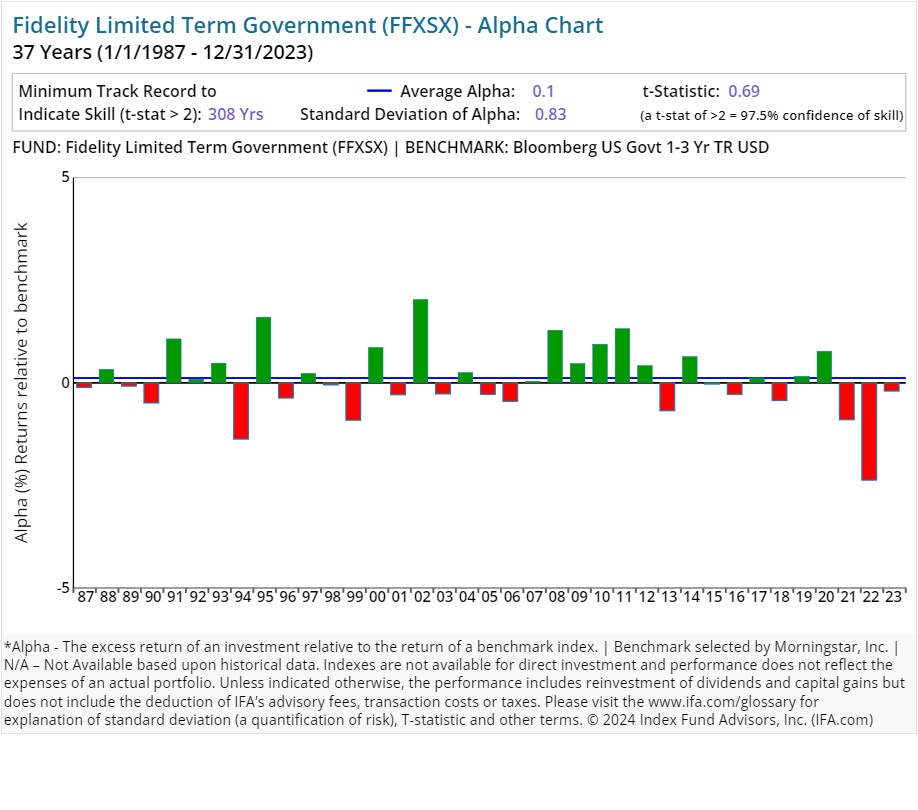

| Fidelity Limited Term Government | FFXSX | 149.00 | 0.30 | Fixed Income | ||

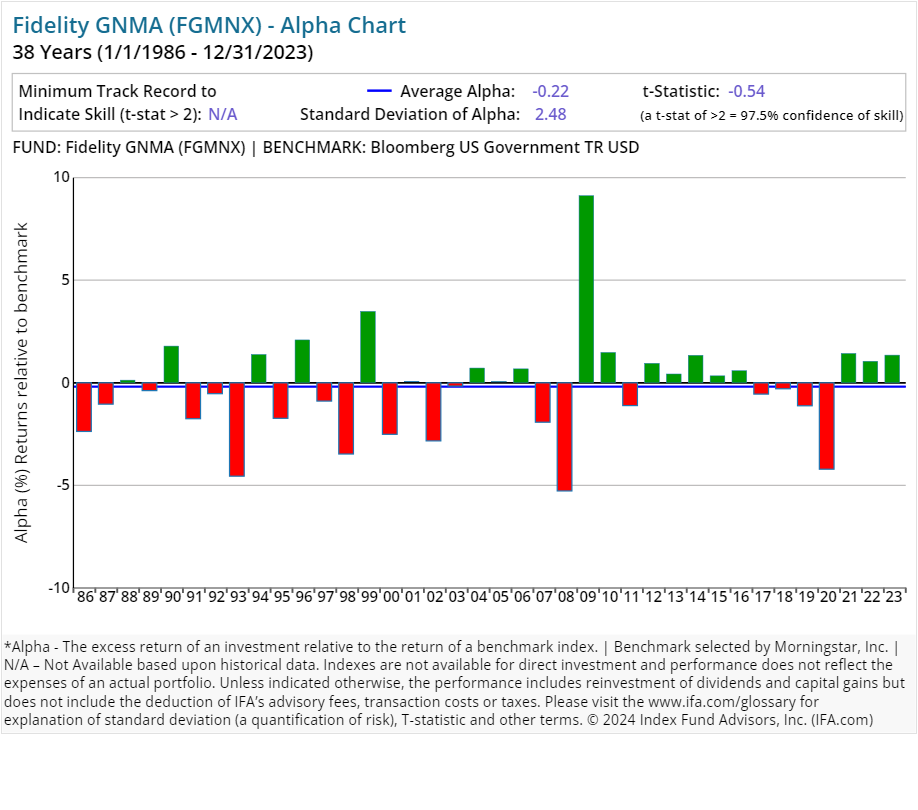

| Fidelity GNMA | FGMNX | 776.00 | 0.45 | Fixed Income | ||

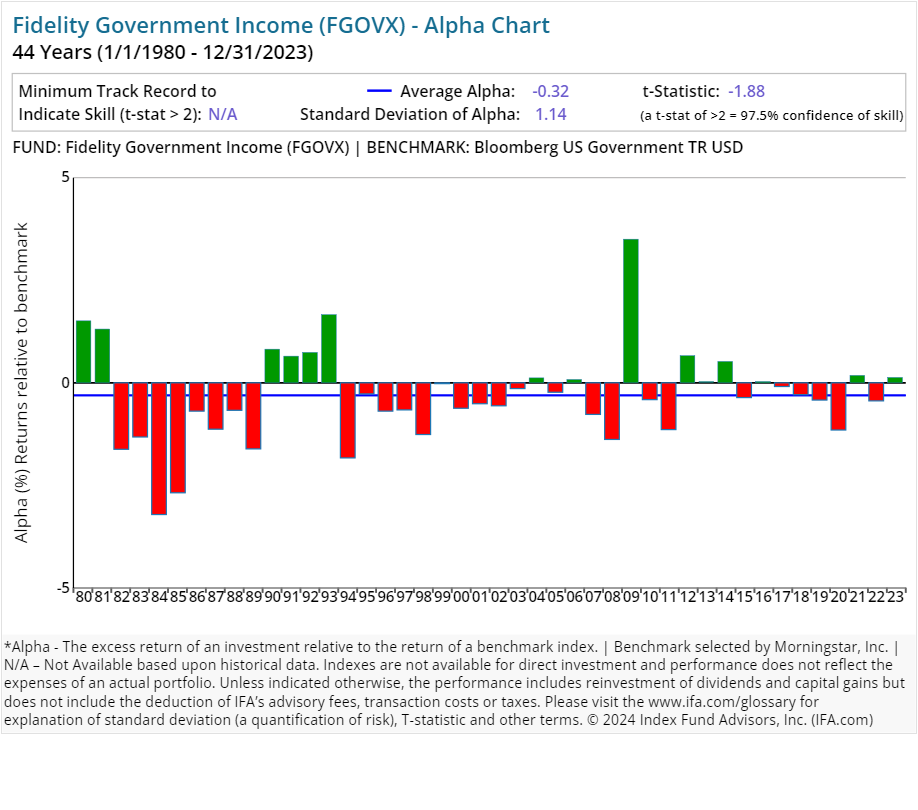

| Fidelity Government Income | FGOVX | 354.00 | 0.45 | Fixed Income | ||

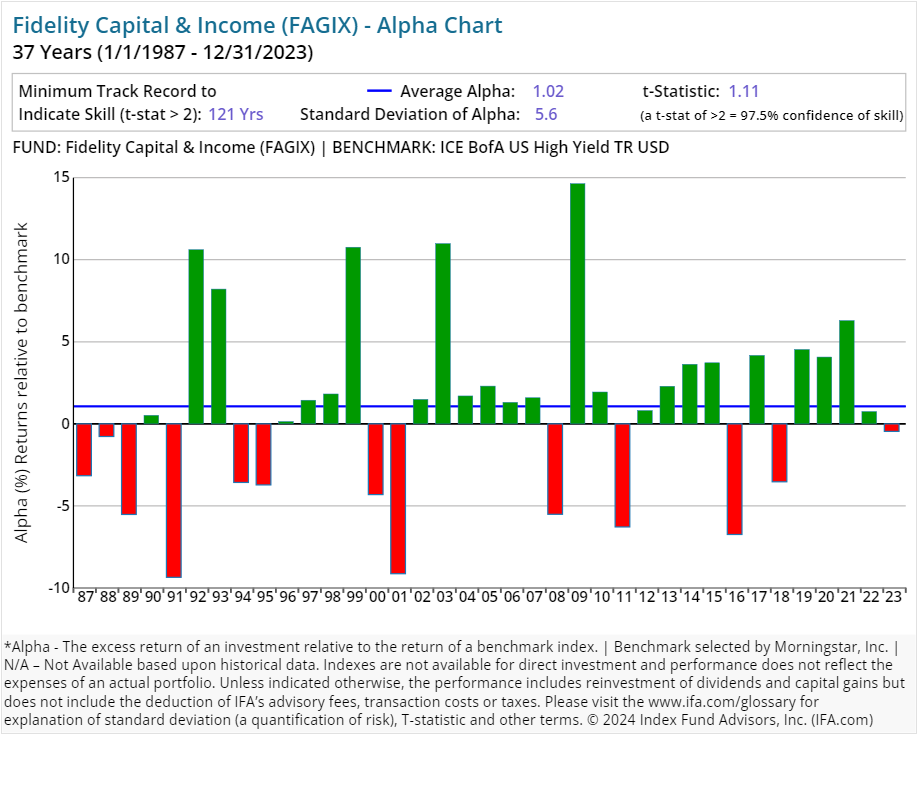

| Fidelity Capital & Income | FAGIX | 20.00 | 0.93 | Fixed Income | ||

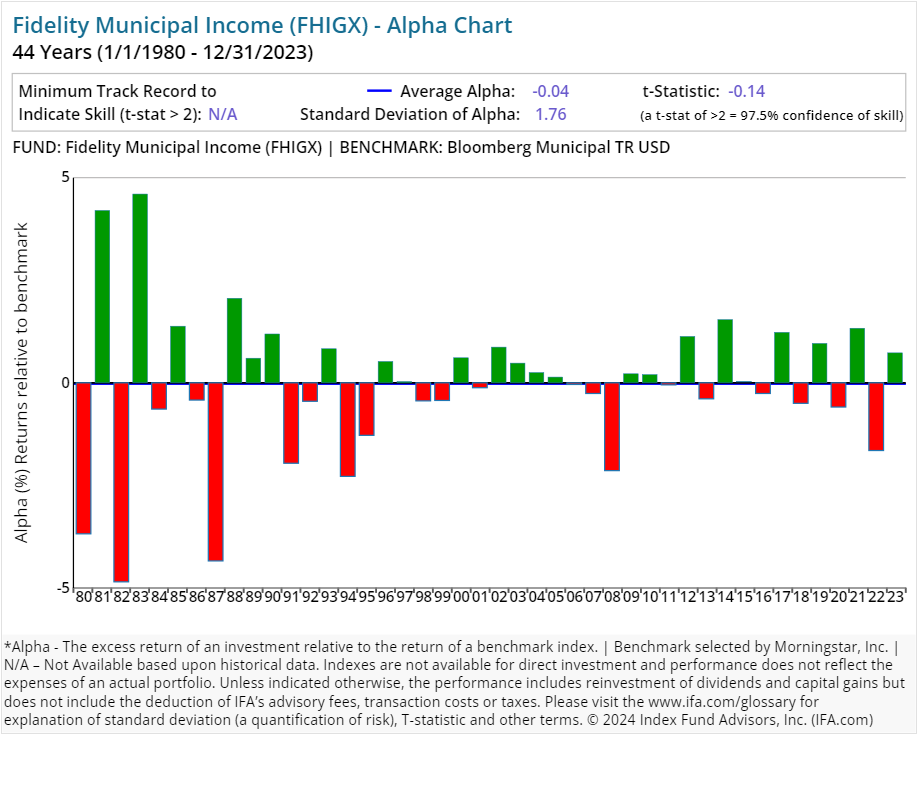

| Fidelity Municipal Income | FHIGX | 4.00 | 0.44 | Fixed Income | ||

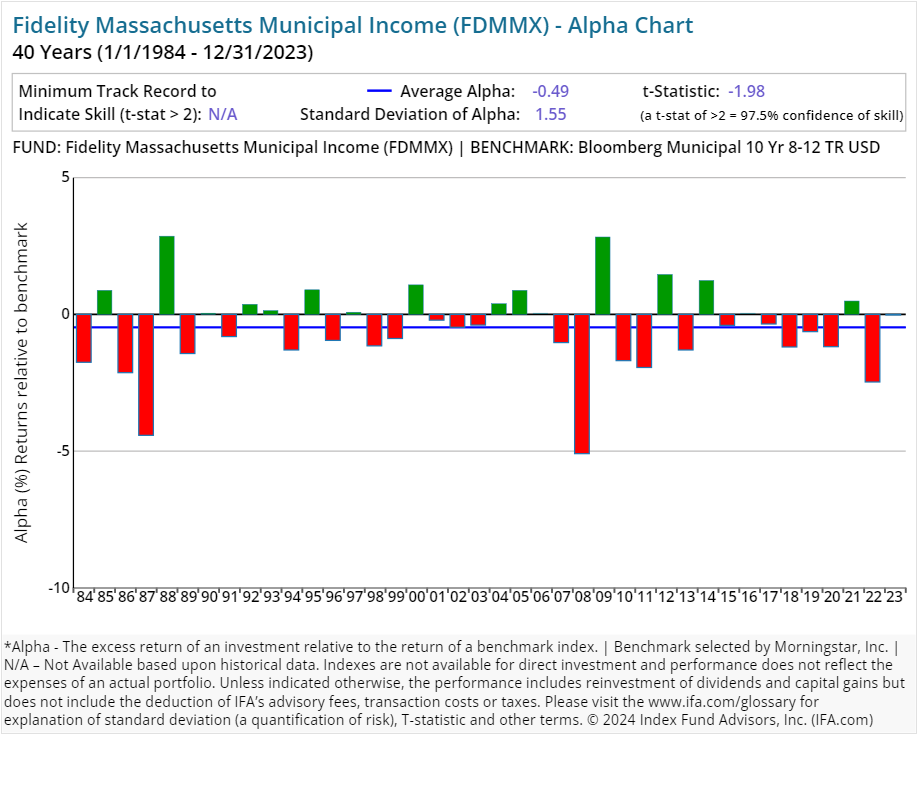

| Fidelity Massachusetts Municipal Income | FDMMX | 25.00 | 0.46 | Fixed Income | ||

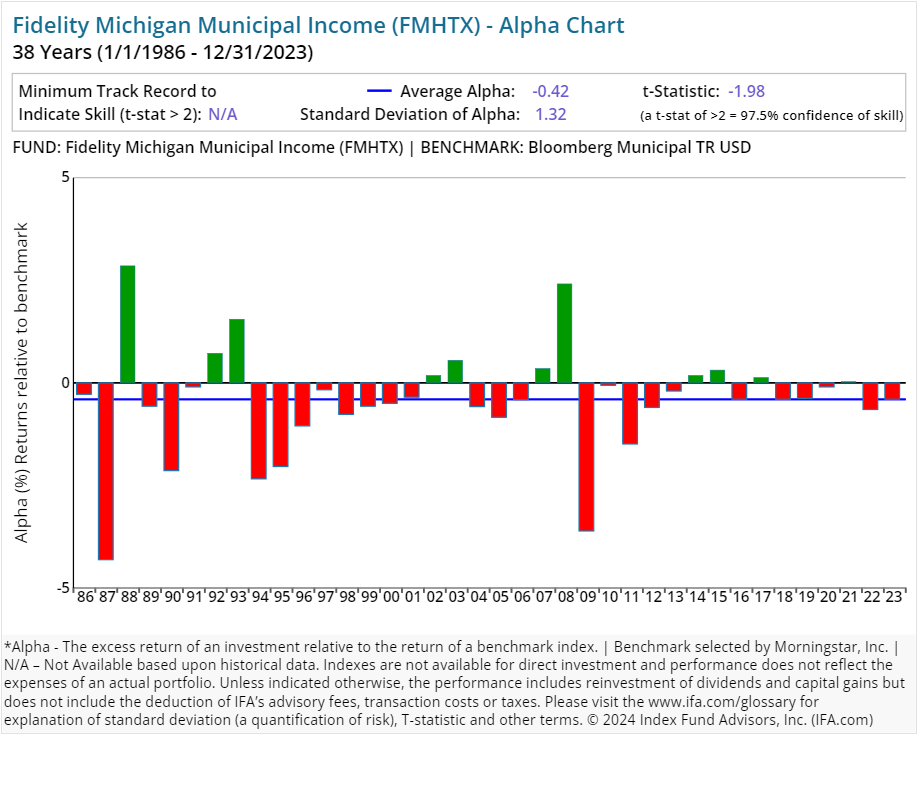

| Fidelity Michigan Municipal Income | FMHTX | 21.00 | 0.46 | Fixed Income | ||

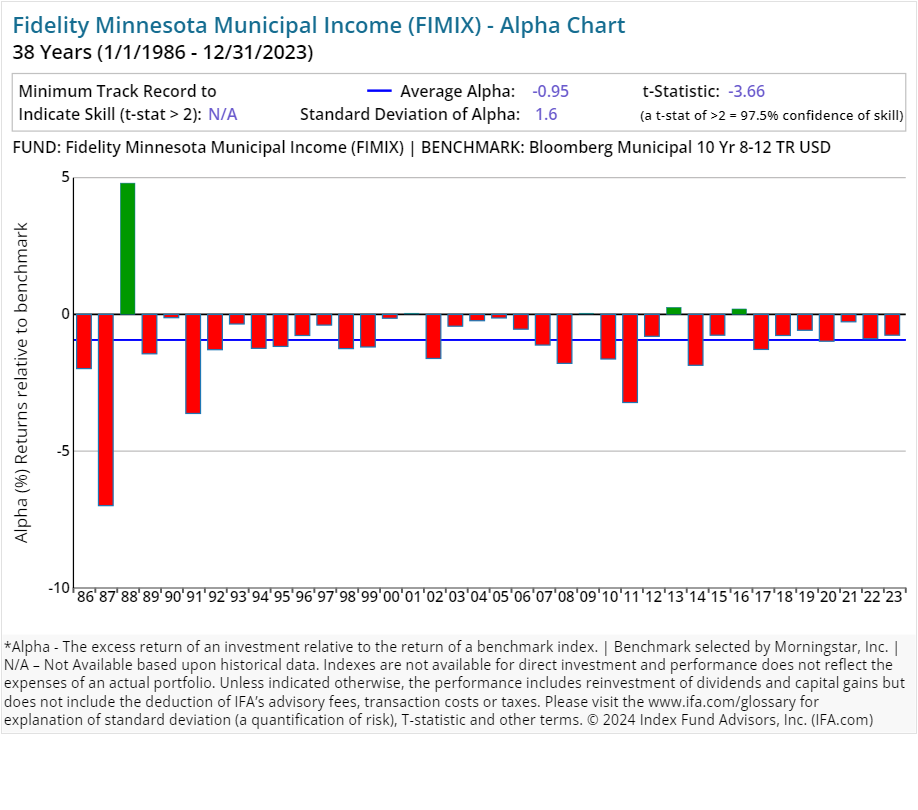

| Fidelity Minnesota Municipal Income | FIMIX | 19.00 | 0.47 | Fixed Income | ||

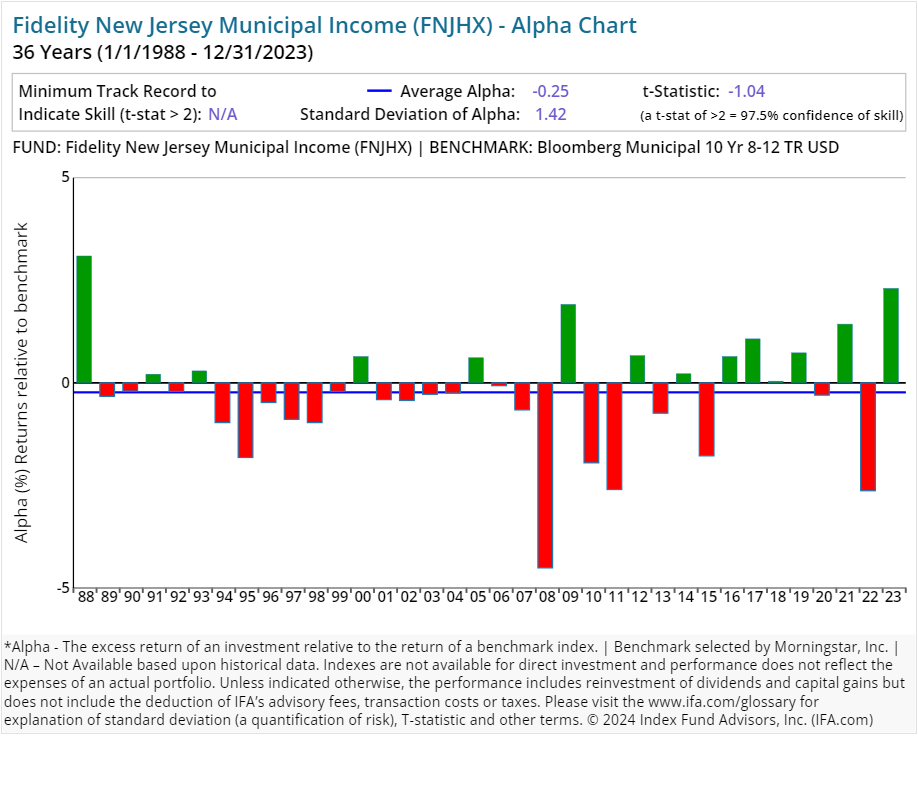

| Fidelity New Jersey Municipal Income | FNJHX | 29.00 | 0.48 | Fixed Income | ||

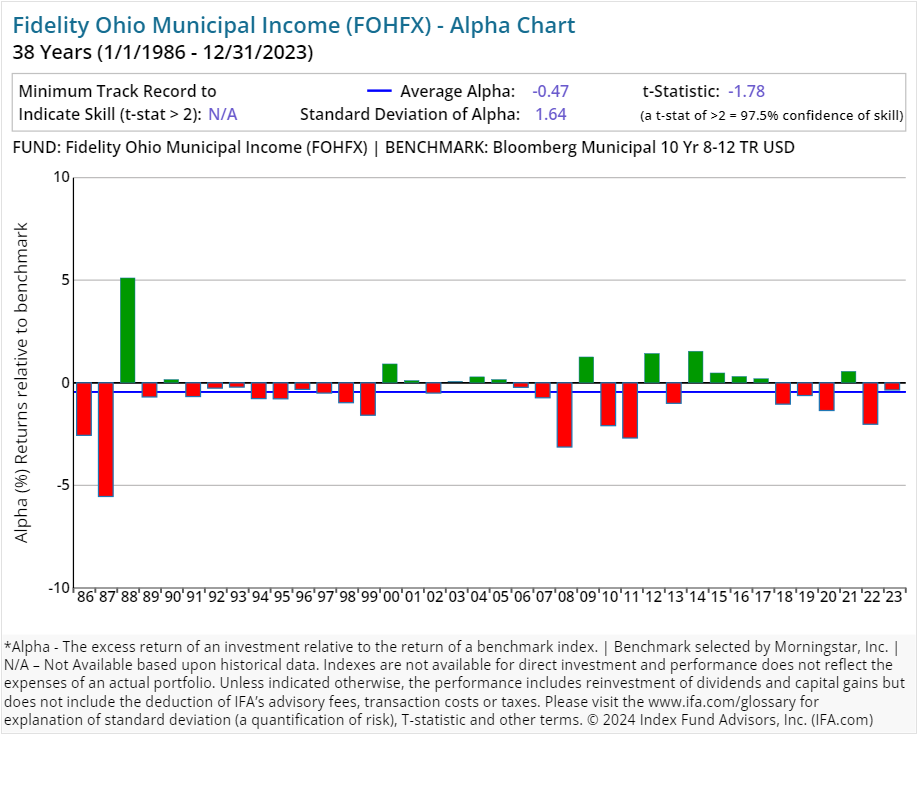

| Fidelity Ohio Municipal Income | FOHFX | 21.00 | 0.46 | Fixed Income | ||

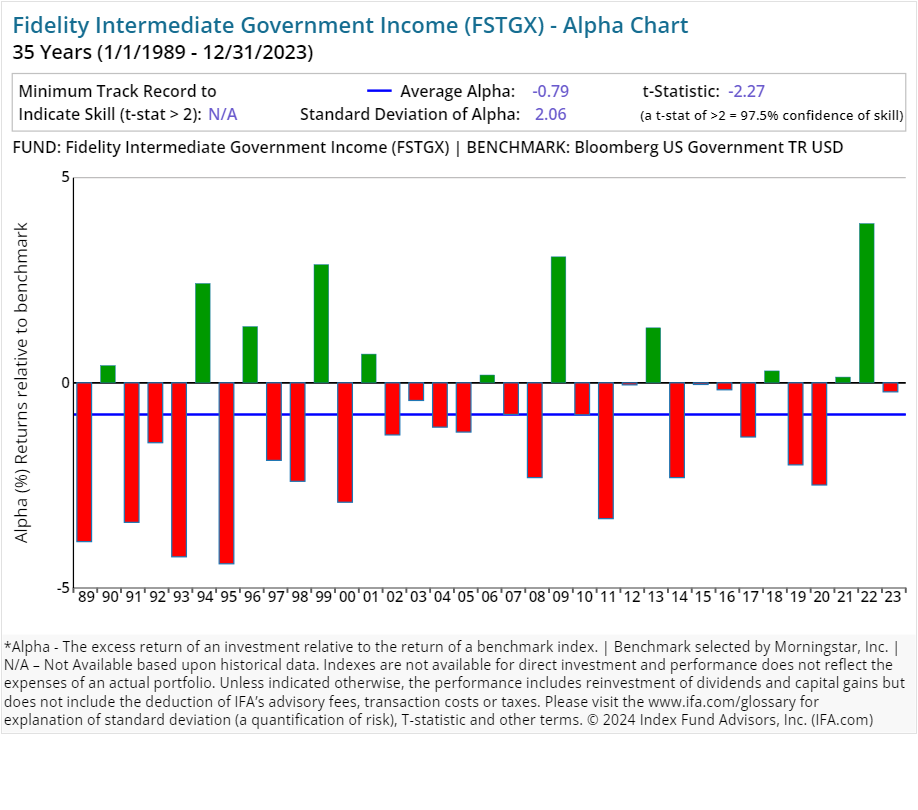

| Fidelity Intermediate Government Income | FSTGX | 113.00 | 0.45 | Fixed Income | ||

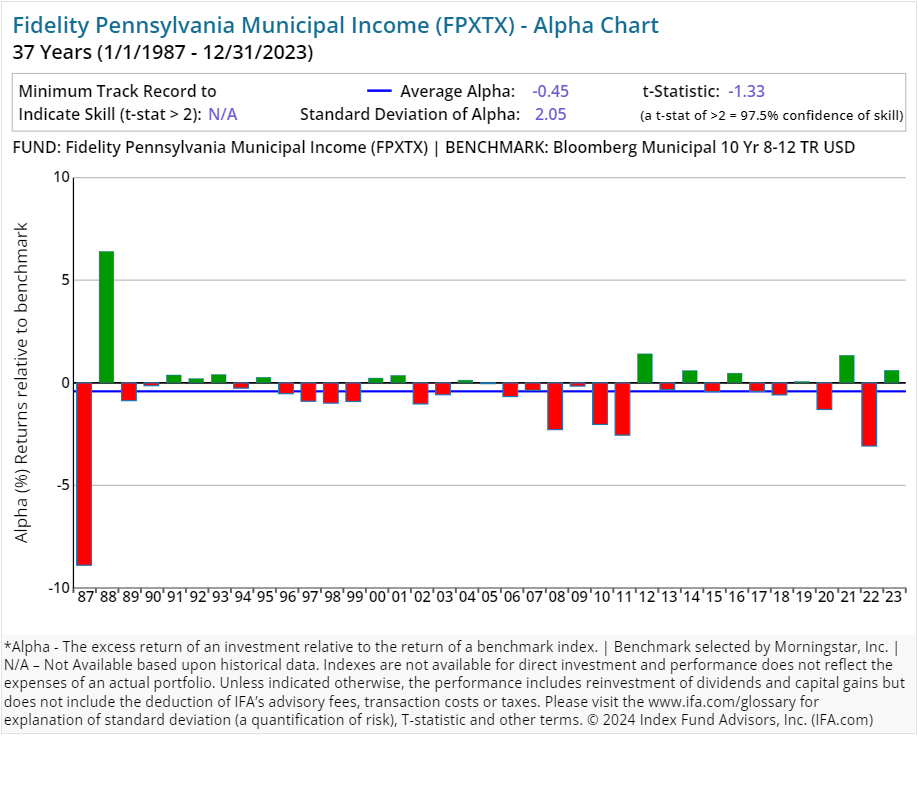

| Fidelity Pennsylvania Municipal Income | FPXTX | 21.00 | 0.47 | Fixed Income | ||

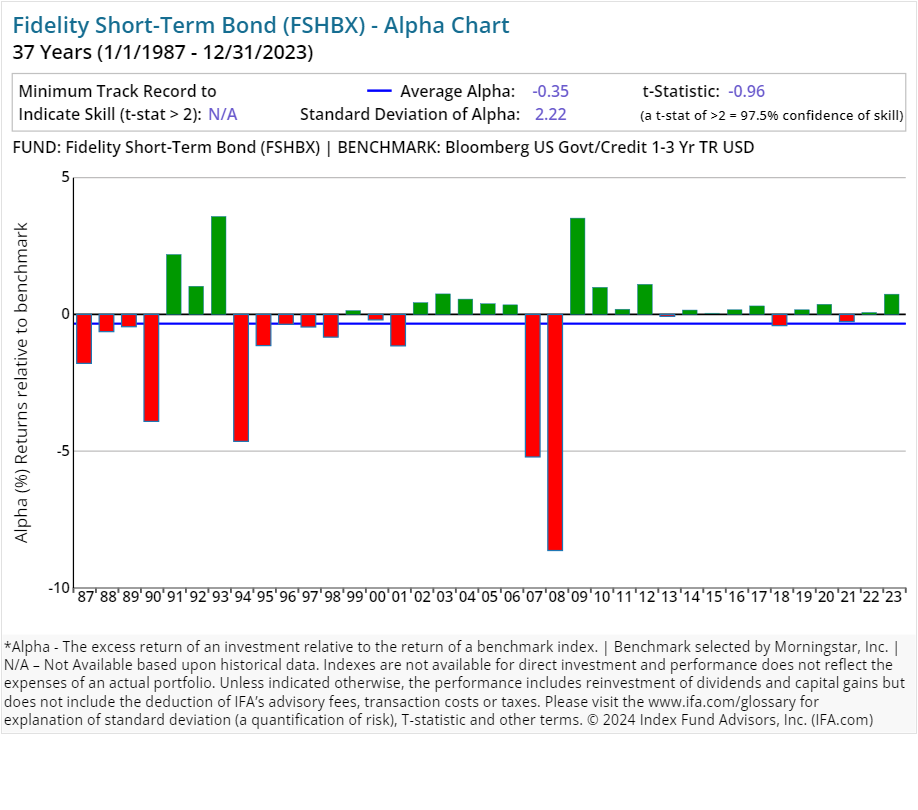

| Fidelity Short-Term Bond | FSHBX | 49.00 | 0.30 | Fixed Income | ||

| Fidelity Intermediate Bond | FTHRX | 64.00 | 0.45 | Fixed Income | ||

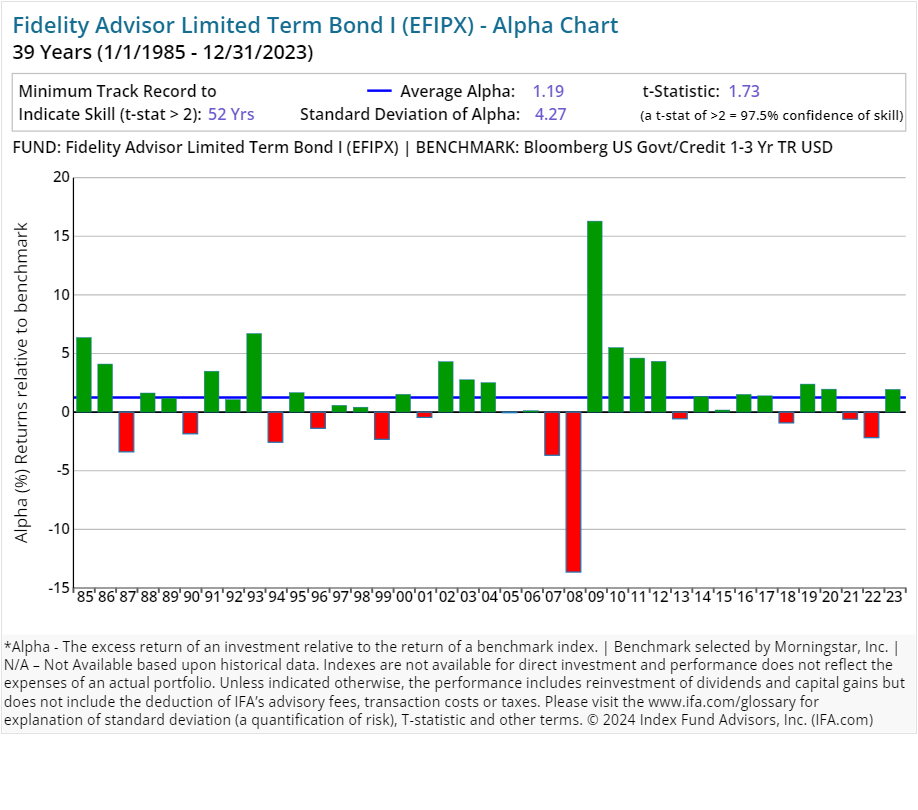

| Fidelity Advisor Limited Term Bond I | EFIPX | 26.00 | 0.30 | Fixed Income | ||

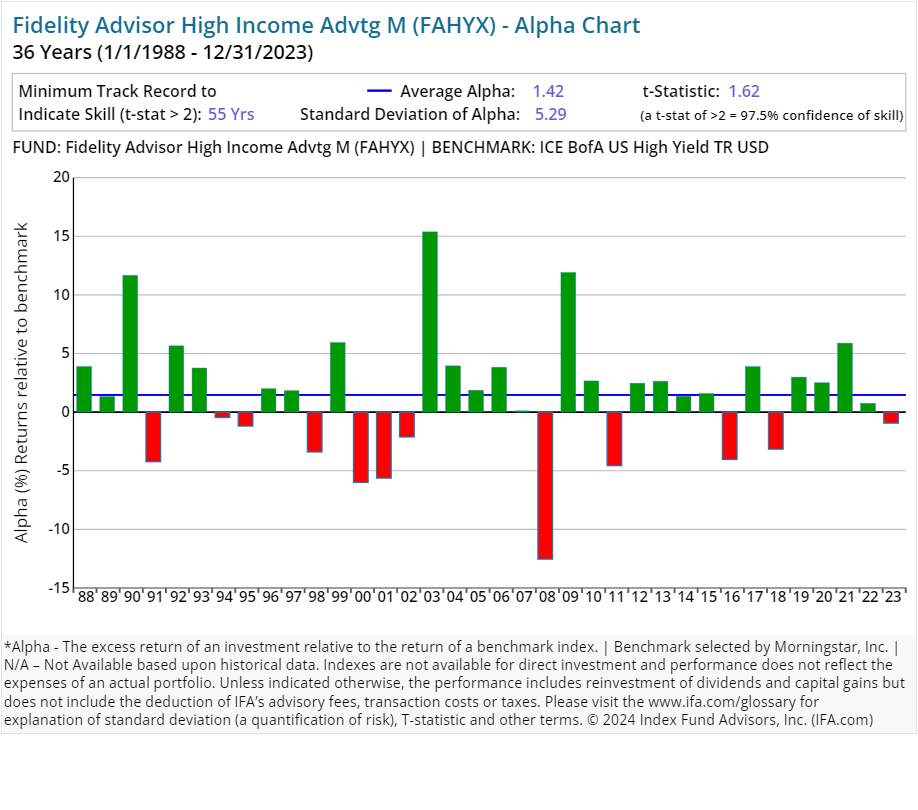

| Fidelity Advisor High Income Advtg M | FAHYX | 29.00 | 1.19 | 0.25 | 4.00 | Fixed Income |

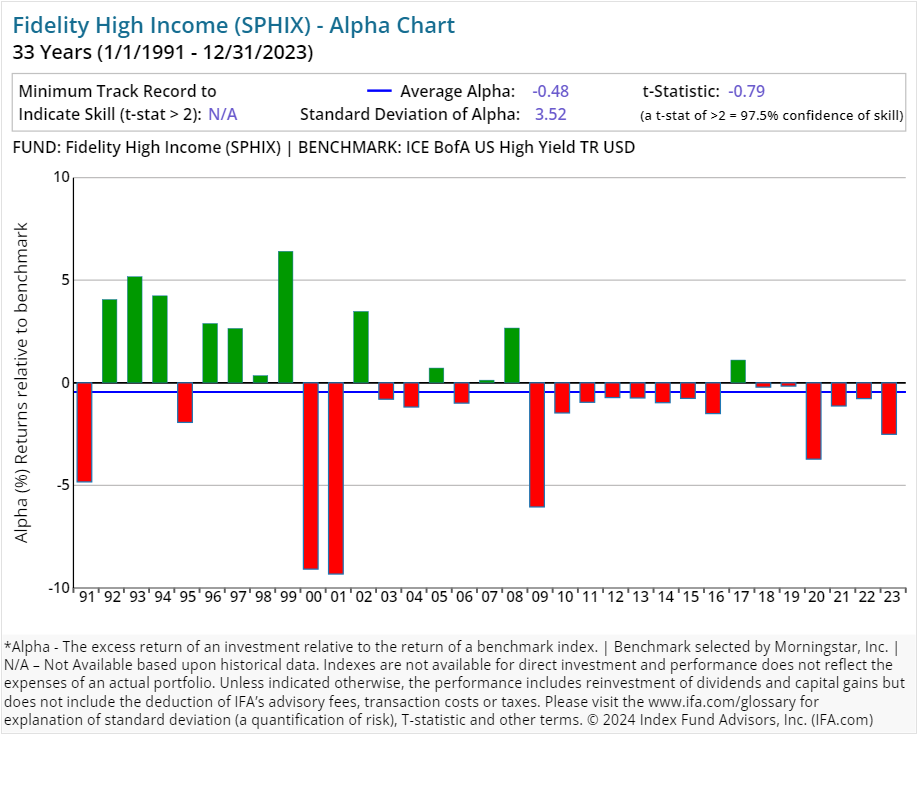

| Fidelity High Income | SPHIX | 35.00 | 0.87 | Fixed Income | ||

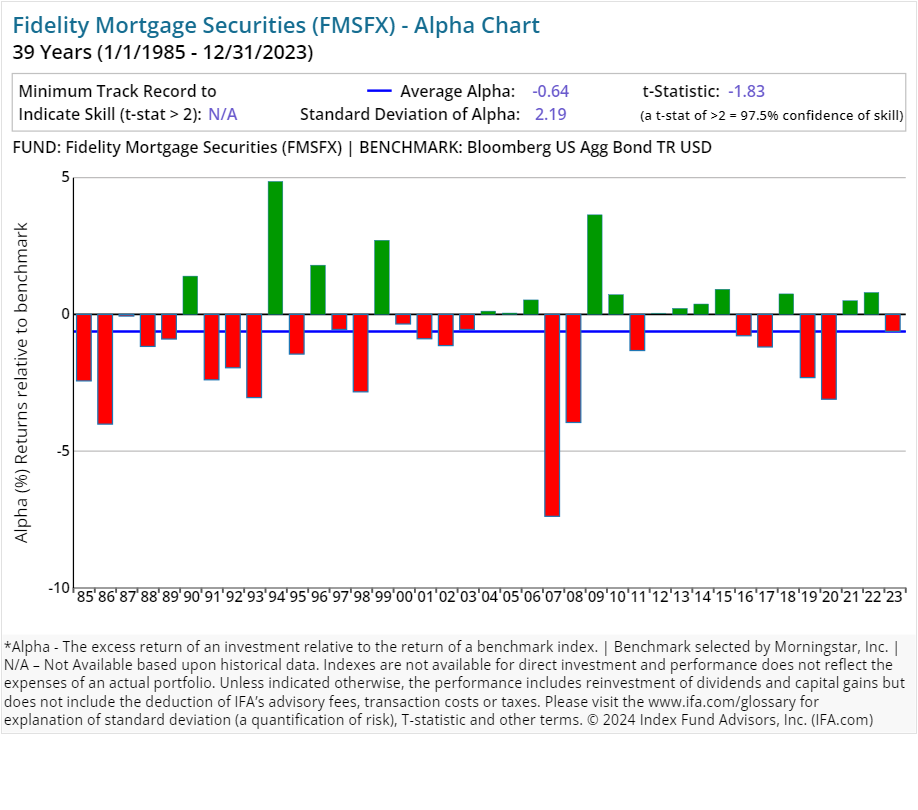

| Fidelity Mortgage Securities | FMSFX | 865.00 | 0.45 | Fixed Income | ||

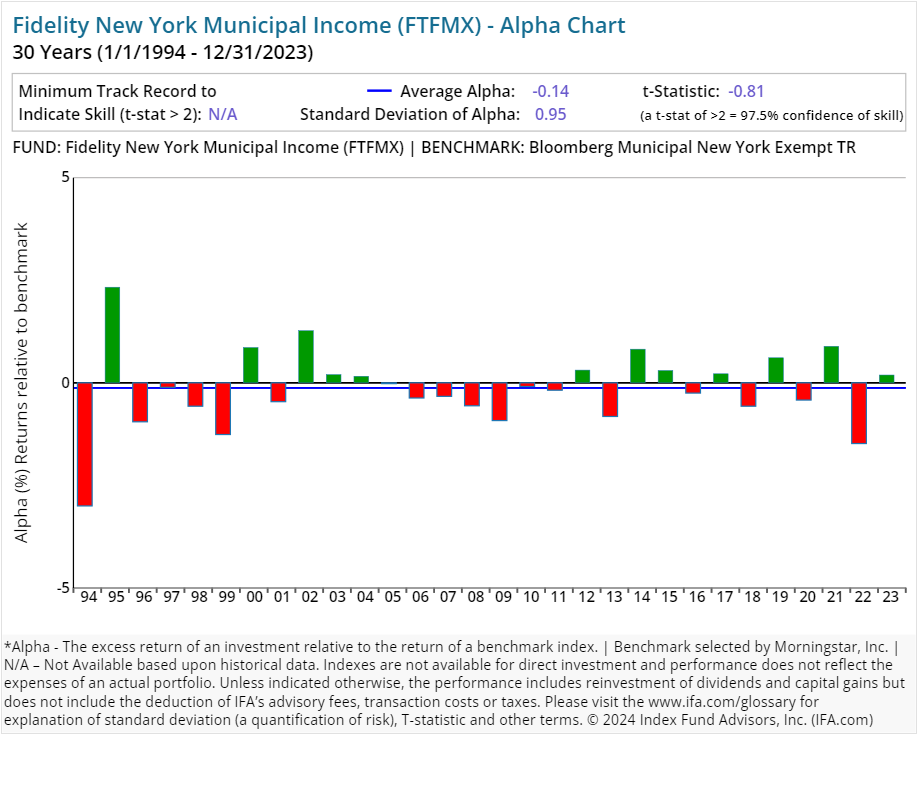

| Fidelity New York Municipal Income | FTFMX | 17.00 | 0.47 | Fixed Income | ||

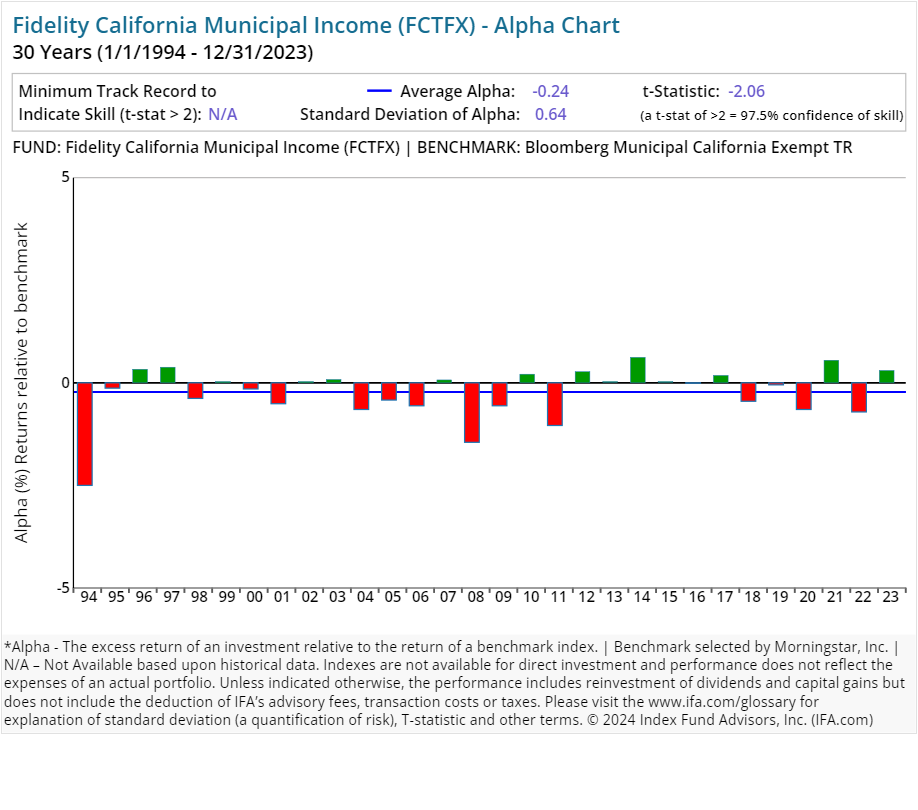

| Fidelity California Municipal Income | FCTFX | 14.00 | 0.46 | Fixed Income | ||

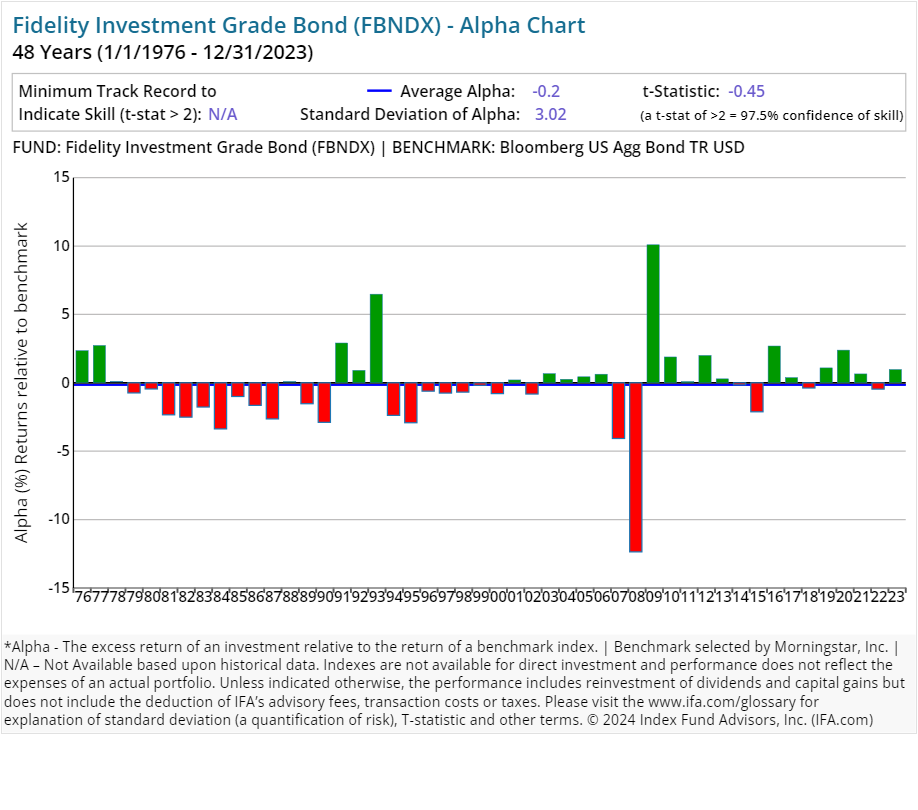

| Fidelity Investment Grade Bond | FBNDX | 131.00 | 0.45 | Fixed Income | ||

| Fidelity Limited Term Municipal Income | FSTFX | 24.00 | 0.29 | Fixed Income | ||

| Fidelity Interm Muni Inc | FLTMX | 14.00 | 0.36 | Fixed Income |

Please read the prospectus carefully to review the investment objectives, risks, charges and expenses of the mutual funds before investing. Fidelity Investment prospectuses are available at: https://www.fidelity.com

On average, an investor who utilized a surviving Fidelity active stock mutual fund strategy experienced an annual expense ratio of 0.75%. By comparison, a surviving active bond mutual fund run by Fidelity on average charged an annual expense ratio of 0.51%.

These expenses can have a substantial impact on an investor's overall accumulated wealth if they are not backed by superior performance. The average turnover ratio of a surviving active equity strategy from Fidelity was 37.79%. This implies an average holding period of 31.75 months. At the same time, the average turnover ratio of a surviving active Fidelity fixed-income mutual fund was 110.23%, or an average holding period of 10.89 months.

By contrast, most index funds have very long holding periods — decades, in fact, thus deafening themselves to the random noise that accompanies short-term market movements, and focusing instead on the long-term. Again, turnover is a cost that is not itemized to the investor but is definitely embedded in the overall performance.

Performance Analysis

The next question we address is whether investors can expect superior performance in exchange for the higher costs associated with Fidelity's implementation of active management. We compare all of its 136 strategies with data for 30 or more years — including both current mutual funds and those no longer in existence — against its Morningstar assigned benchmark to see just how well each has delivered on their perceived value proposition. We also use the oldest share class of each fund, which sometimes are older than its assigned benchmark. In those cases, comparisons can only be made for the length of time that the benchmark has data available.

We have included alpha charts for each of their current strategies at the bottom of this article. Here is what we found:

-

60.29% (82 of 136 funds) have underperformed their respective benchmarks or did not survive the period since inception.

-

39.71% (54 of 136 funds) have outperformed their respective benchmarks since inception, having delivered a positive alpha.

Here's the real kicker, however:

- 0% (0 of 136 funds) wound up outperforming their respective benchmarks consistently enough since inception to provide 97.5% confidence that such outperformance could persist (as opposed to being based simply on random outcomes).

Such a study shows that a majority of actively managed mutual funds offered as part of the Fidelity family have failed to outperform each fund's Morningstar-assigned benchmark. The inclusion of the statistical significance of alpha is key to this exercise, as it indicates which outcomes are due to a skill that is likely to repeat and those that are more likely due to a random-chance outcome.

Another caveat worth noting about this performance analysis of Fidelity is how many U.S. sector and international country or region-specific actively managed equity mutual funds are part of this family's lineup. By their very nature — i.e., taking a narrower investment focus and turning over positions at higher rates — these sort of specialty fund managers can expose investors to greater risk.

Heightened concentration risks and higher turnover rates serve to temper any top-line numbers indicating that Fidelity's actively managed stock mutual funds were consistent winners. Why? Consider one of this fund company's most popular categories — U.S. equity mutual funds. Some 18 active strategies in this group survived at least 30 years and outpeformed by delivering positive annual alpha. However, the vast majority (14) were run as sector-specific funds.

That's significant since a breakdown of such a focused investment strategy's annual alpha over an extended period — as shown in each fund's alpha chart — revealed that in too many cases removing just a few years of outperformance would've turned short-term winners into long-term laggards.

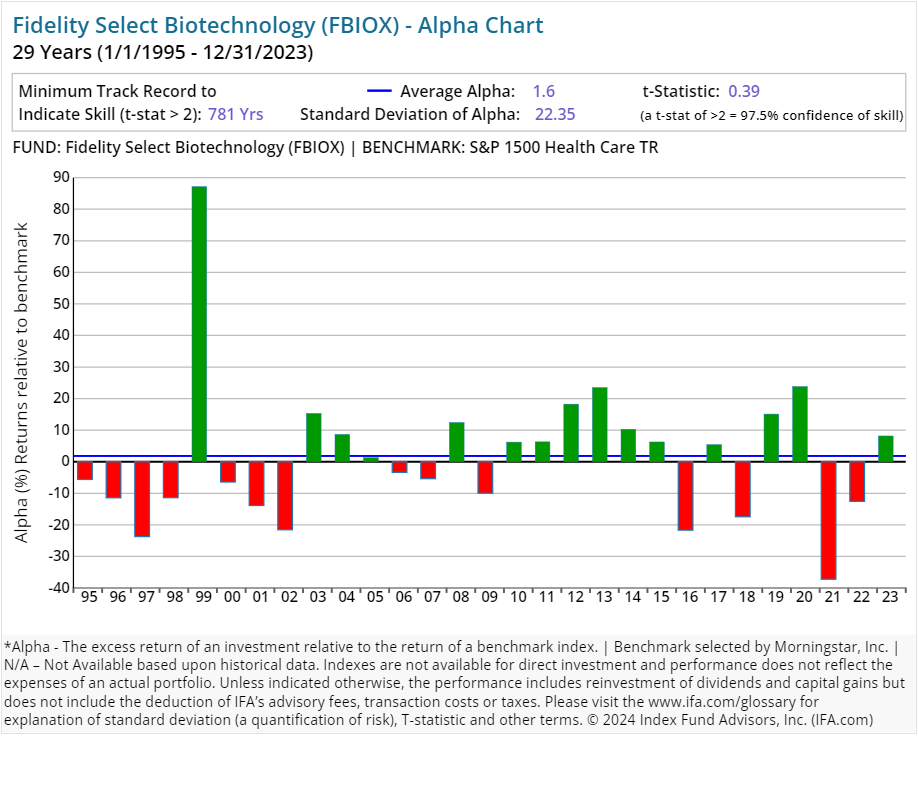

For example, see below the alpha chart for the Fidelity Select Biotechnology (FBIOX) fund. Although this sector fund managed to outperform its respective benchmark — as indicated by producing a positive average alpha reading during this period — look how much a single year (1999) boosted otherwise lackluster performance against its assigned benchmark. Remove another big year (2013) or two (2020), and this sector fund's ability to generate positive alpha looks even less rosey.

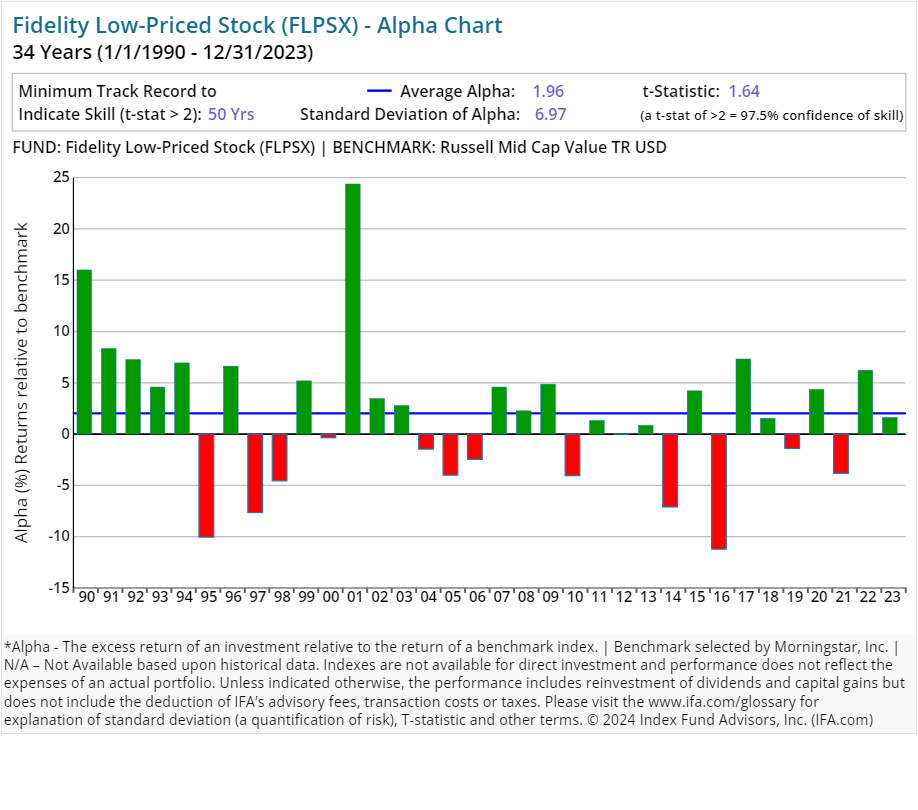

While volatility in returns can be exaggerated in such singularly focused active investment vehicles, it's still not an isolated issue. Consider the alpha chart for the diversified Fidelity Low-Priced Stock (FLPSX) fund. Again, it generated positive alpha over the 30 years studied. Take out a single year (2001), however, and this fund's ability to outperform its assigned index looks a lot more pedestrian.

Whether targeting entire asset classes or a specific industry/geographic region, too many of Fidelity's active mutual fund managers appear to have benefited from relatively short bursts of high positive alpha during this 30-year period. In such an analysis, a lack of persistence by Fidelity's active managers in sustaining outperformance against their benchmarks posed a clear hurdle for investors trying to build wealth over a lifetime.

Regression Analysis

How we define or choose a benchmark is extremely important. If we relied solely on commercial indexes assigned by Morningstar, then we may form a false conclusion that Fidelity has the "secret sauce" as active managers.

Since Morningstar is limited in terms of trying to fit the best commercial benchmark with each fund in existence, there is of course going to be some error in terms of matching up proper characteristics such as average market capitalization or average price-to-earnings ratio.

A better way of controlling these possible discrepancies is to run multiple regressions where we account for exposure to the known risks of expected return in the U.S. — market, size and value — as identified by the Fama/French Three-Factor Model.

For example, if we were to look at all of the U.S.-based equity strategies from Fidelity that've been around for at least the past 30 years, we could run multiple regressions to see what each fund's alpha looks like once we control for the multiple betas that are being systematically priced into the overall market.

The chart below displays the average alpha and standard deviation of that alpha for the past 30 years through 2023. Screening criteria include funds with holdings of 90% or greater in U.S. equities and uses the oldest available share classes.

As shown above, 18 of the mutual funds studied had positive excess returns over the stated benchmarks. Again, 14 of these funds were sector-focused strategies. At the same time, none — either diversified or sector-focused — produced a statistically significant level of alpha, based on a t-stat of 2.0 or greater. (A review of how to calculate a fund's t-stat can be found at the end of this report — right after the presentations of all Fidelity funds individual alpha charts included in this study.)

Conclusion

Like many of the other large active managers, a deep analysis into the performance of the Fidelity family of funds has yielded a not so surprising result: Active management is likely to fail many investors. This is due to market efficiency, costs and increased competition in the financial services sector.

As we always like to remind investors, a more reliable investment strategy for capturing the returns of global markets is to buy, hold and rebalance a globally diversified portfolio of index funds.

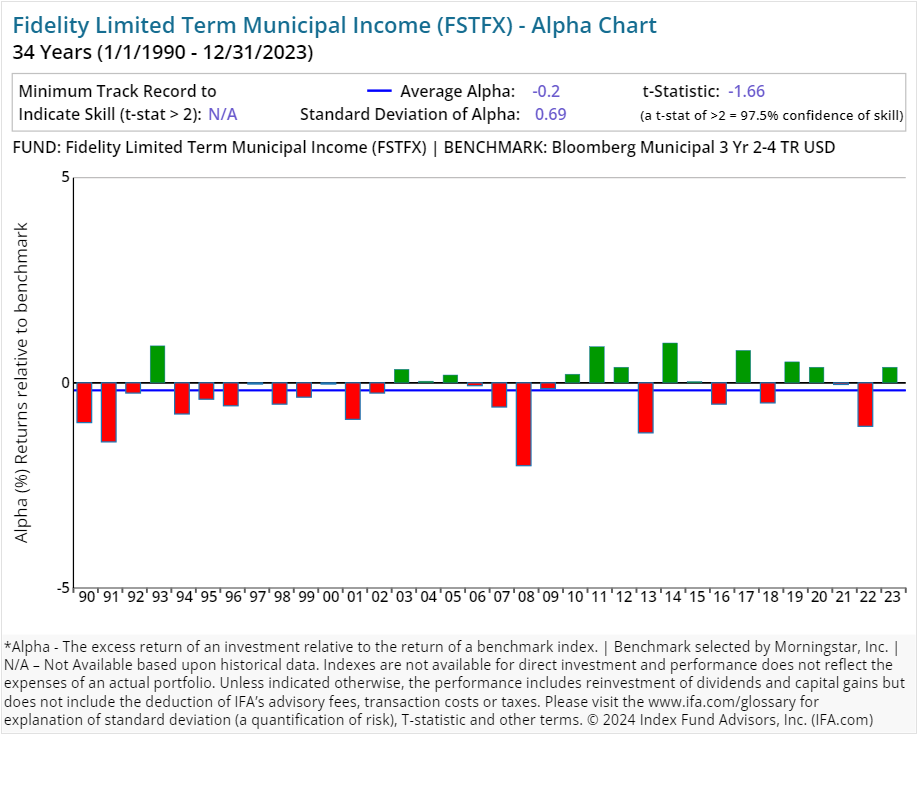

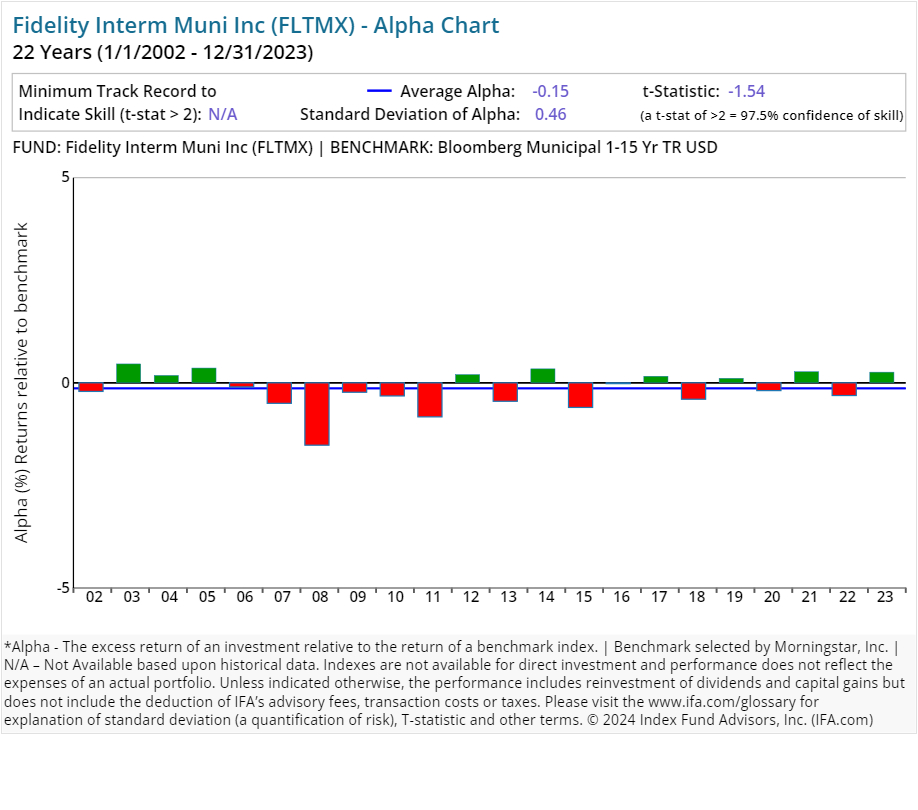

Below are the individual alpha charts for Fidelity's actively managed mutual funds. Each of these funds have 30 years or more of returns data. As we stated earlier in this report, though, some of these funds are older than the Morningstar-assigned benchmarks. In those cases, comparisons can only be made for the length of time that the benchmark has data available.

Here is a calculator to determine the t-stat. Don't trust an alpha or average return without one.

The Figure below shows the formula to calculate the number of years needed for a t-stat of 2. We first determine the excess return over a benchmark (the alpha) then determine the regularity of the excess returns by calculating the standard deviation of those returns. Based on these two numbers, we can then calculate how many years we need (sample size) to support the manager's claim of skill.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.