Investment banking and securities trading can be volatile businesses. So it's not surprising to see many leading players in these fields moving deeper into fee-based services — not only to diversify their revenue bases but also as a way of generating more consistent income streams.

One of the biggest dealmakers in this regard has been Morgan Stanley. For decades, the venerable New York-based investment banker and institutional broker has consistently ranked among the top five 'bookrunners' in terms of revenue production, according to Morningstar.

Tracing its roots back to 1935, the publicly traded company (NYSE: MS) reported first quarter profits of nearly $3 billion on net revenue of $14.5 billion. Morgan Stanley also disclosed that its wealth management unit had attracted "significant" net new assets of $110 billion in Q1 and collected net revenues of $6.6 billion.1 As of early 2023, the bank operated in 40 countries and listed a payroll of more than 80,000 employees worldwide.

In late 2020, Morgan Stanley struck a deal to buy funds manager Eaton Vance. Early estimates projected the $7 billion acquisition to nearly double assets under management for the bank's investment management unit to around $1.2 trillion, according to Reuters. (By the end of the first quarter in 2023, that division had reported assets under management of $1.4 trillion.)

In announcing the deal, company executives expressed hope of making "minimal" changes to the Eaton Vance lineup and Morgan Stanley's family of funds. But in a review of the deal, Barron's pointed out that large mergers in asset management typically "prompt" fund closures and other cost-cutting measures. "That can cause headaches for fund investors," the magazine noted.3

The Eaton Vance acquisition followed on the heels of Morgan Stanley agreeing in early 2020 to buy E-Trade Financial. The discount brokerage came with a reported price tag of $13 billion and more than five million client accounts. The bank's executives indicated at the time they were planning to retain the E-Trade brand and operate it as a distinct platform.

Morgan Stanley's expansion in asset and wealth management includes purchasing Smith Barney in early 2009, a time when investors were still gripped in the Great Recession's throes. That deal added more than 17,000 financial advisors and $2 trillion in client assets to the parent's fold.

Given its rather expansive designs to move deeper into investment management and brokerage services, we thought it'd be worthwhile to put under our research microscope Morgan Stanley's active mutual funds. This analysis is part of our ongoing Deeper Look series, which investigates claims by managers of peer performance superiority by holding them to a higher standard — i.e., how they've done over longer periods against their respective indexes.

Controlling for Survivorship Bias

It's important for investors to understand the idea of survivorship bias. While there are 43 active mutual funds with five or more years of performance-related data currently offered by Morgan Stanley, it doesn't necessarily mean these are the only strategies this company has ever managed. In fact, there are 120 mutual funds that no longer exist. This can be for a variety of reasons including poor performance or the fact that they were merged with another fund. We will show what their aggregate performance looks like shortly.

Fees & Expenses

Let's first examine the costs associated with Morgan Stanley's surviving 43 strategies. It should go without saying that if investors are paying a premium for investment "expertise," then they should be receiving above average results consistently over time. The alternative would be to simply accept a market's return, less a significantly lower fee, via an index fund.

The costs we examine include expense ratios, sales loads — front-end (A), back-end (B) and level (C) — as well as 12b-1 marketing fees. These are considered the "hard" costs that investors incur. Prospectuses, however, do not reflect the trading costs associated with mutual funds.

Commissions and market impact costs are real expenses associated with implementing a particular investment strategy and can vary depending on the frequency and size of the trades executed by portfolio managers.

We can estimate the costs associated with an investment strategy by looking at its annual turnover ratio. For example, a turnover ratio of 100% means that the portfolio manager turns over the entire portfolio in one year. This is considered an active approach, and investors holding these funds in taxable accounts will likely incur a higher exposure to tax liabilities, such as short- and long-term capital gains distributions, than those incurred by passively managed funds.

The table below details the hard costs as well as the turnover ratio for all 43 surviving active funds offered by Morgan Stanley that have at least five years of complete performance history. You can search this page for a symbol or name by using Control F in Windows or Command F on a Mac. Then click the link to see the individial Alpha Chart. Also, remember that this is what is considered an in-sample test; the next level of analysis is to do an out-of-sample test (for more information see here).

| Fund Name | Ticker | Turnover Ratio % | Prospectus Net Expense Ratio | Global Broad Category Group | Global Category |

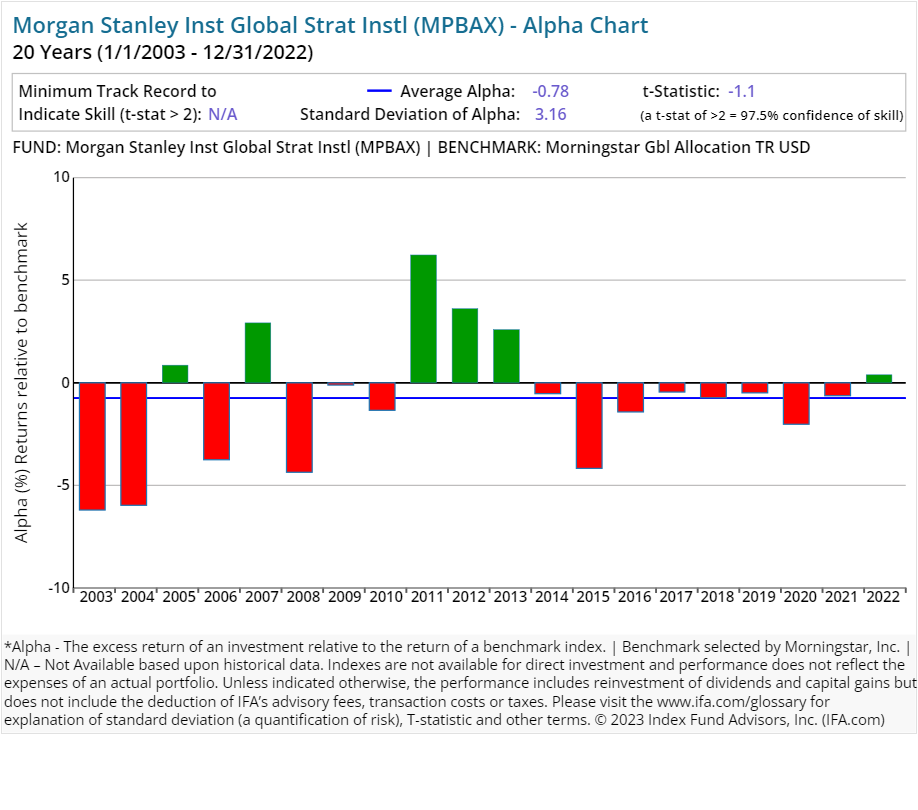

| Morgan Stanley Inst Global Strat Instl | MPBAX | 93.00 | 0.75 | Allocation | Moderate Allocation |

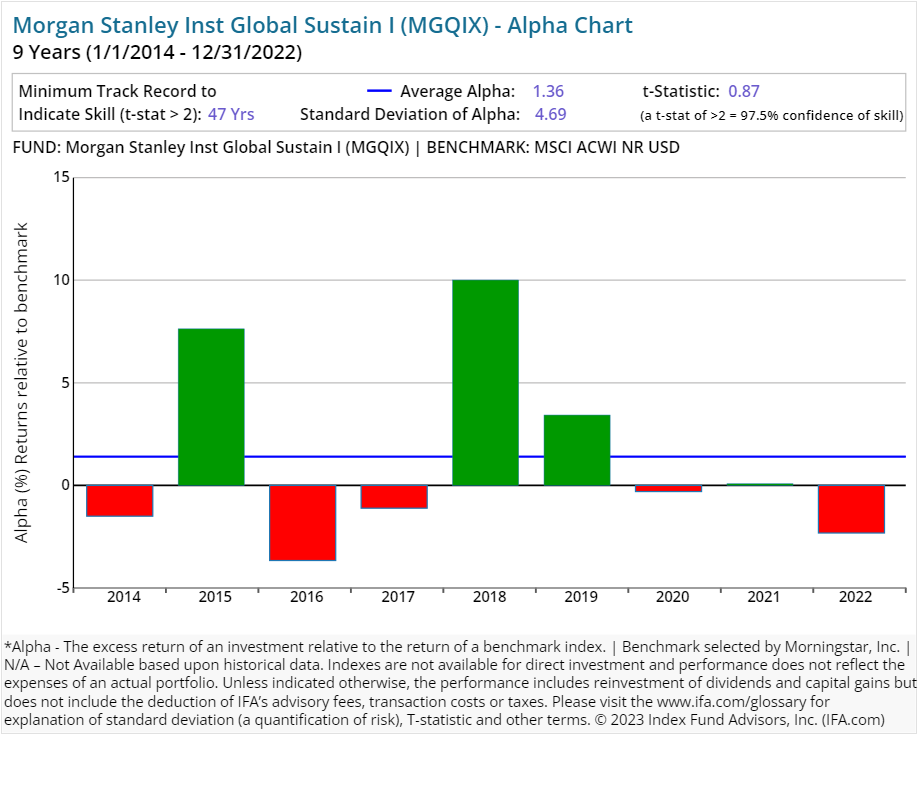

| Morgan Stanley Inst Global Sustain I | MGQIX | 11.00 | 0.90 | Equity | Global Equity Large Cap |

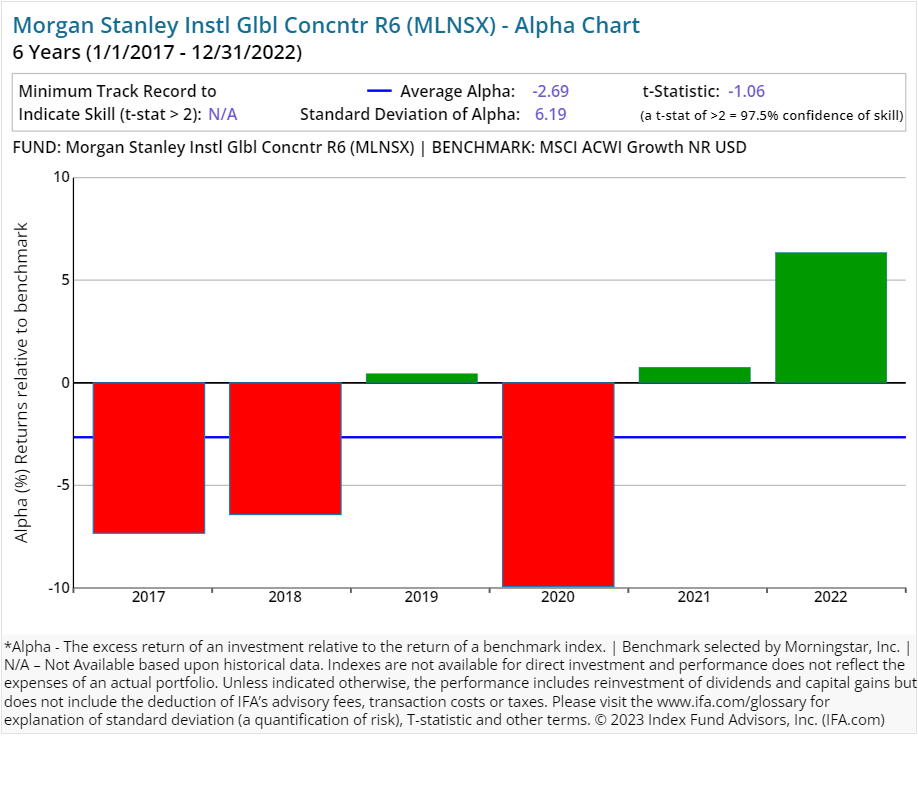

| Morgan Stanley Instl Glbl Concntr R6 | MLNSX | 33.00 | 0.96 | Equity | Global Equity Large Cap |

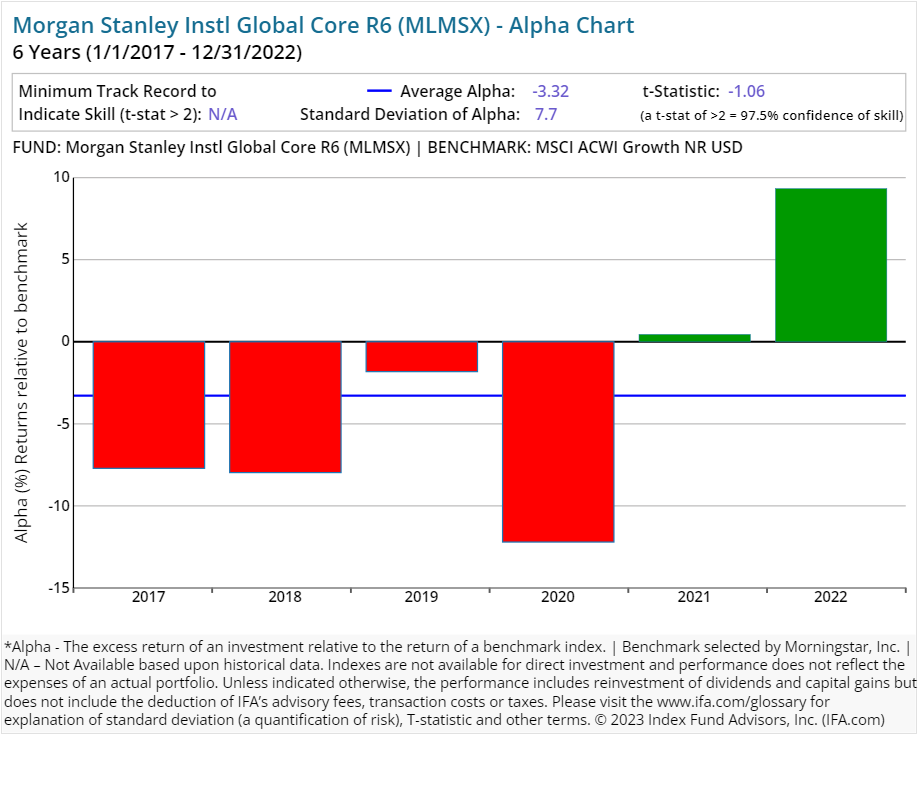

| Morgan Stanley Instl Global Core R6 | MLMSX | 23.00 | 0.95 | Equity | Global Equity Large Cap |

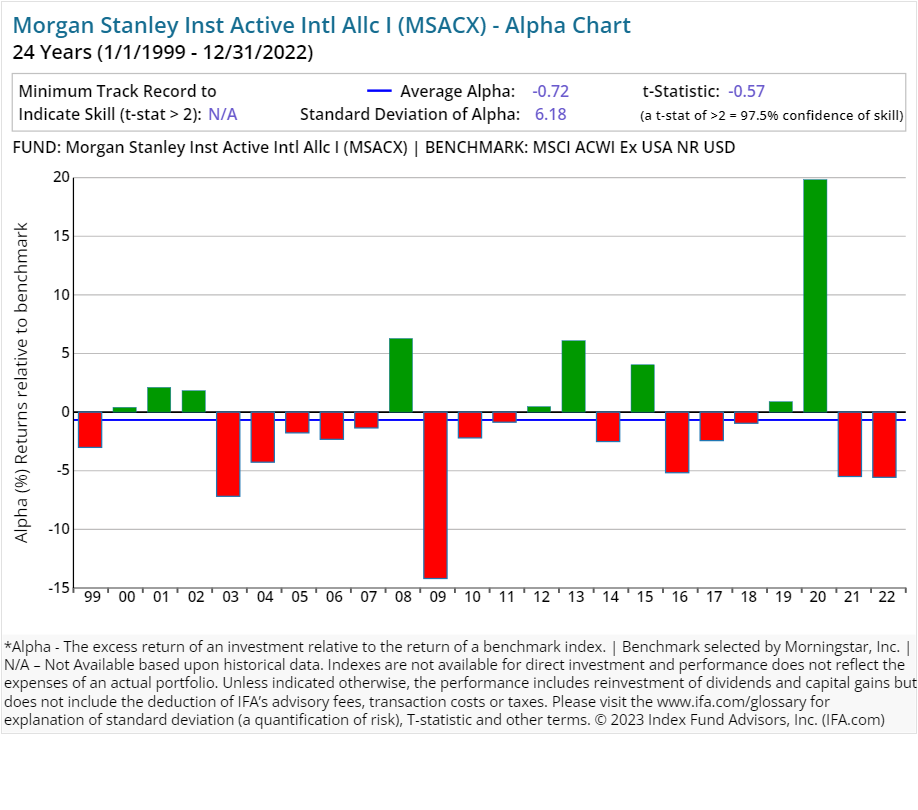

| Morgan Stanley Inst Active Intl Allc I | MSACX | 39.00 | 0.90 | Equity | Global Equity Large Cap |

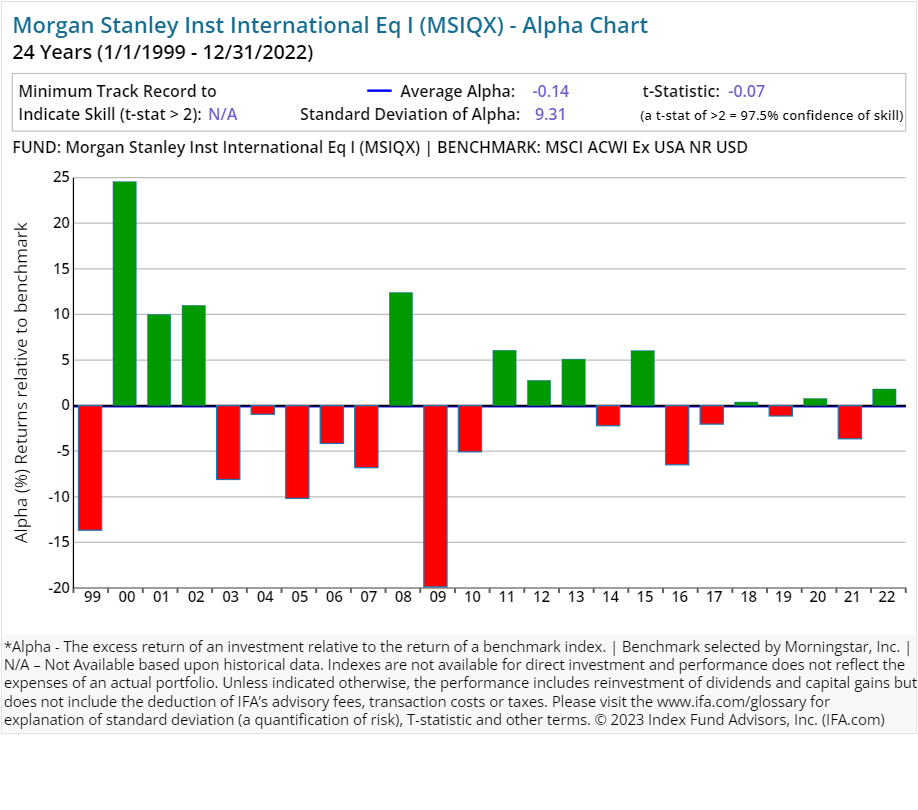

| Morgan Stanley Inst International Eq I | MSIQX | 20.00 | 0.95 | Equity | Global Equity Large Cap |

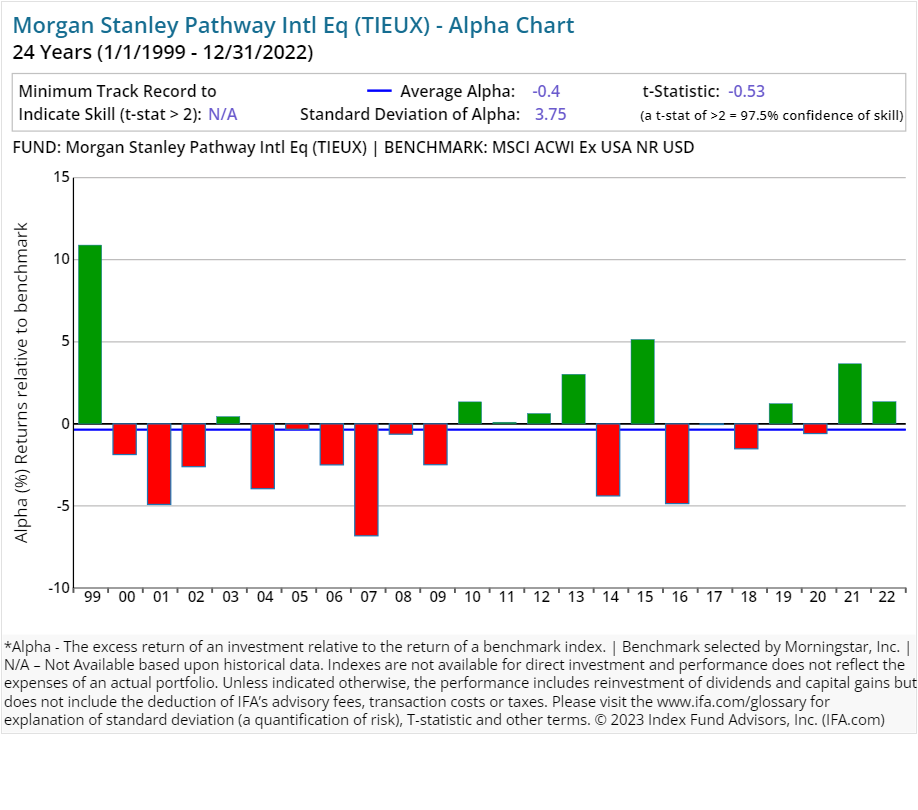

| Morgan Stanley Pathway Intl Eq | TIEUX | 38.00 | 0.67 | Equity | Global Equity Large Cap |

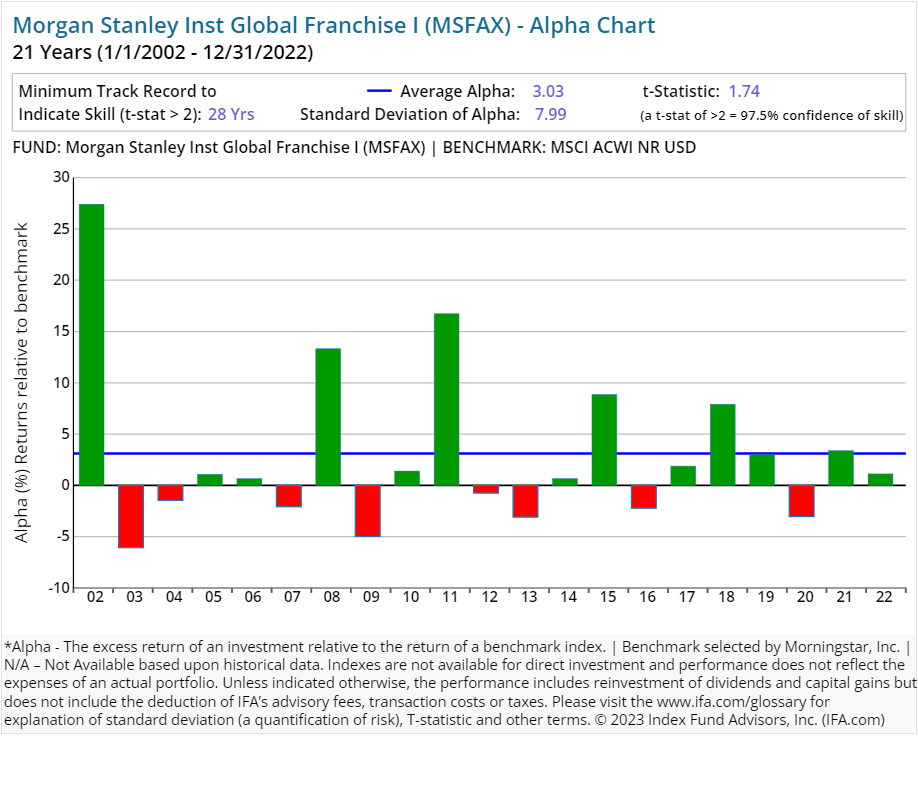

| Morgan Stanley Inst Global Franchise I | MSFAX | 17.00 | 0.91 | Equity | Global Equity Large Cap |

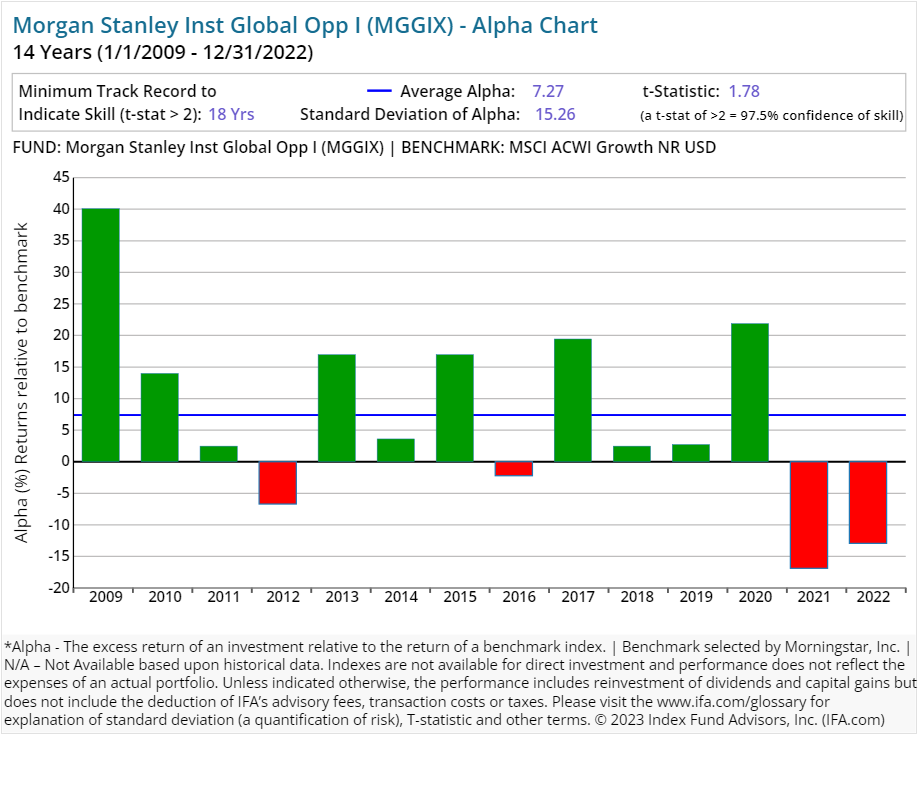

| Morgan Stanley Inst Global Opp I | MGGIX | 21.00 | 0.92 | Equity | Global Equity Large Cap |

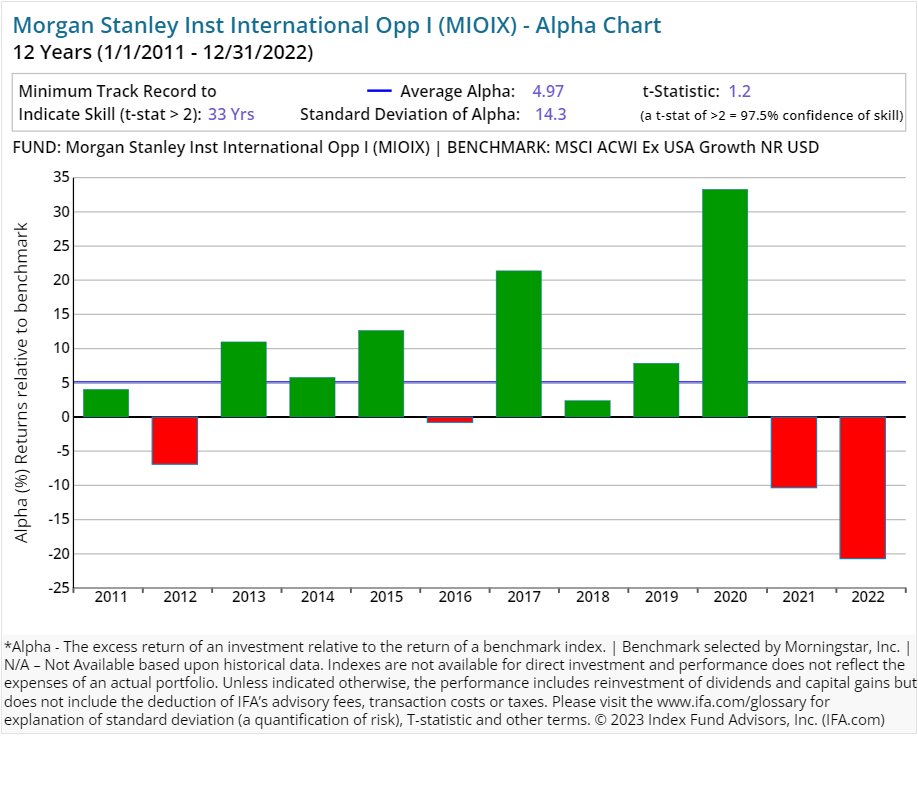

| Morgan Stanley Inst International Opp I | MIOIX | 36.00 | 0.99 | Equity | Global Equity Large Cap |

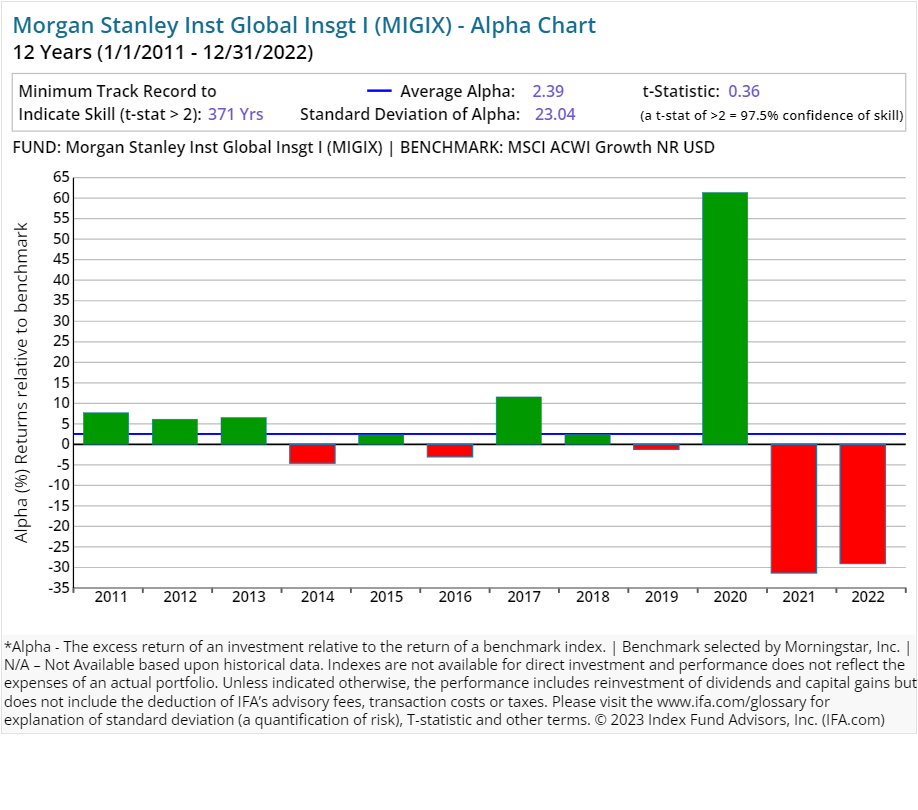

| Morgan Stanley Inst Global Insgt I | MIGIX | 112.00 | 1.00 | Equity | Global Equity Large Cap |

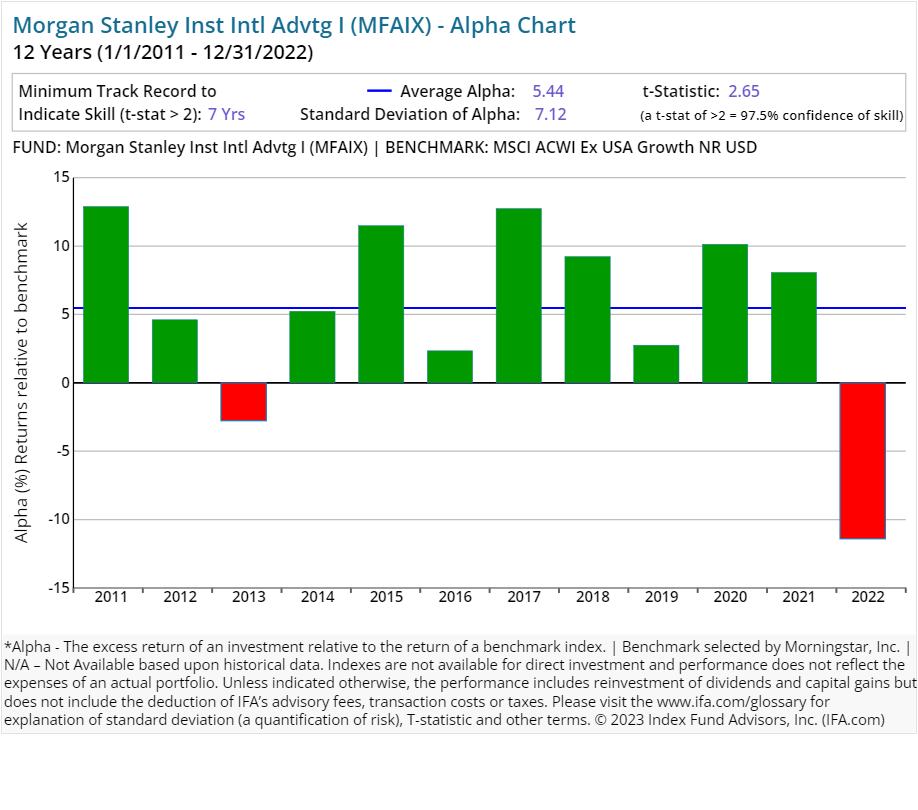

| Morgan Stanley Inst Intl Advtg I | MFAIX | 22.00 | 0.97 | Equity | Global Equity Large Cap |

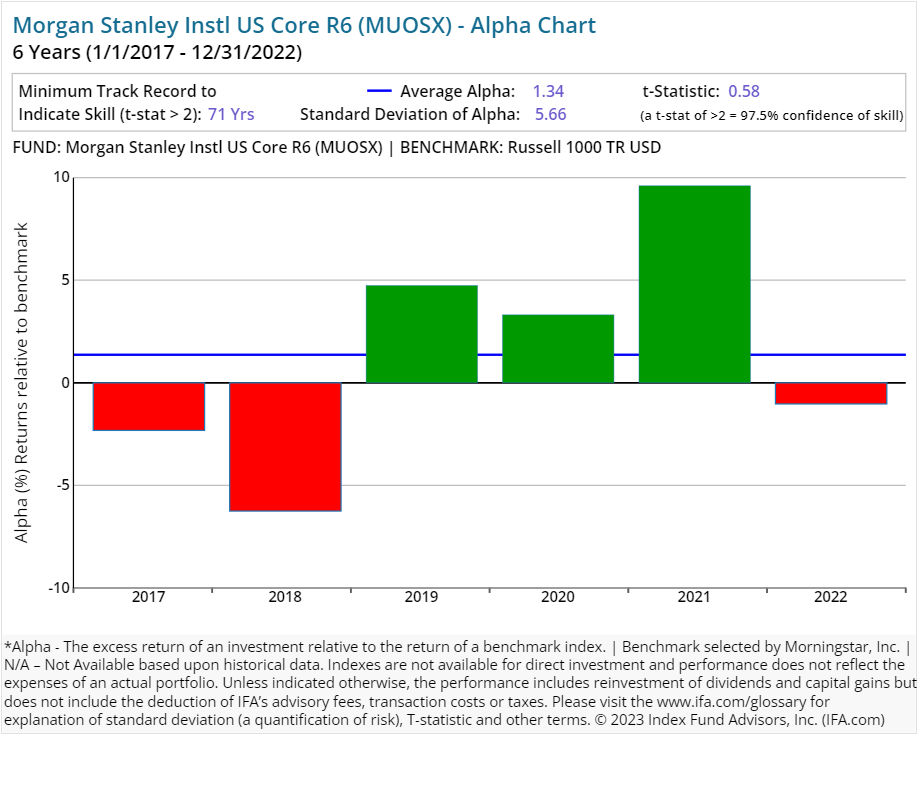

| Morgan Stanley Instl US Core R6 | MUOSX | 26.00 | 0.75 | Equity | US Equity Large Cap Blend |

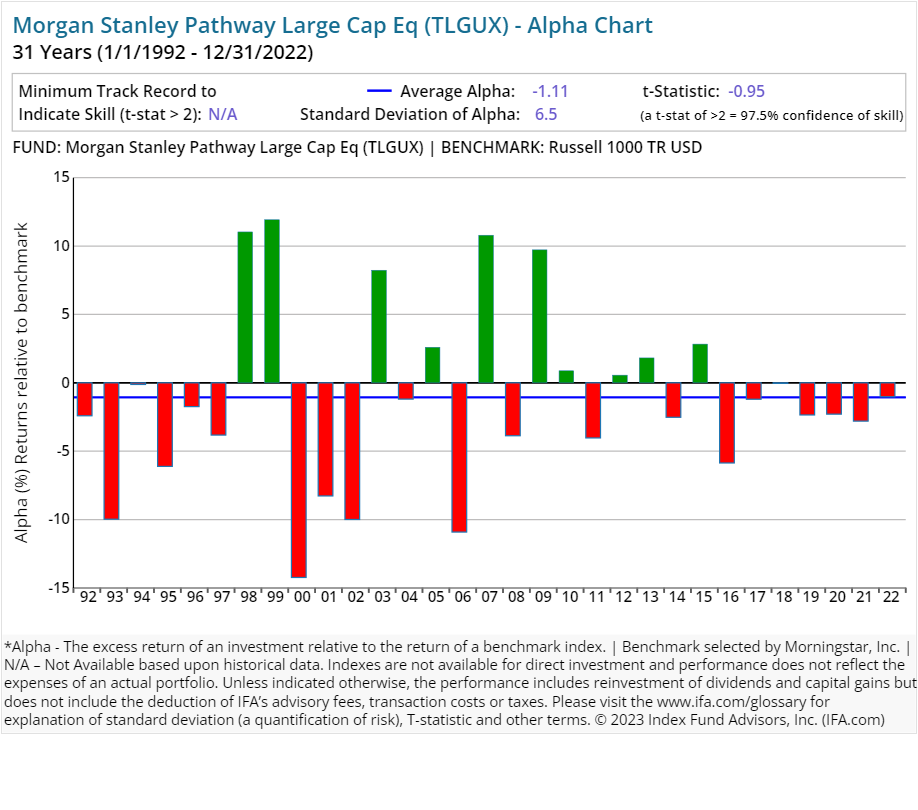

| Morgan Stanley Pathway Large Cap Eq | TLGUX | 20.00 | 0.48 | Equity | US Equity Large Cap Blend |

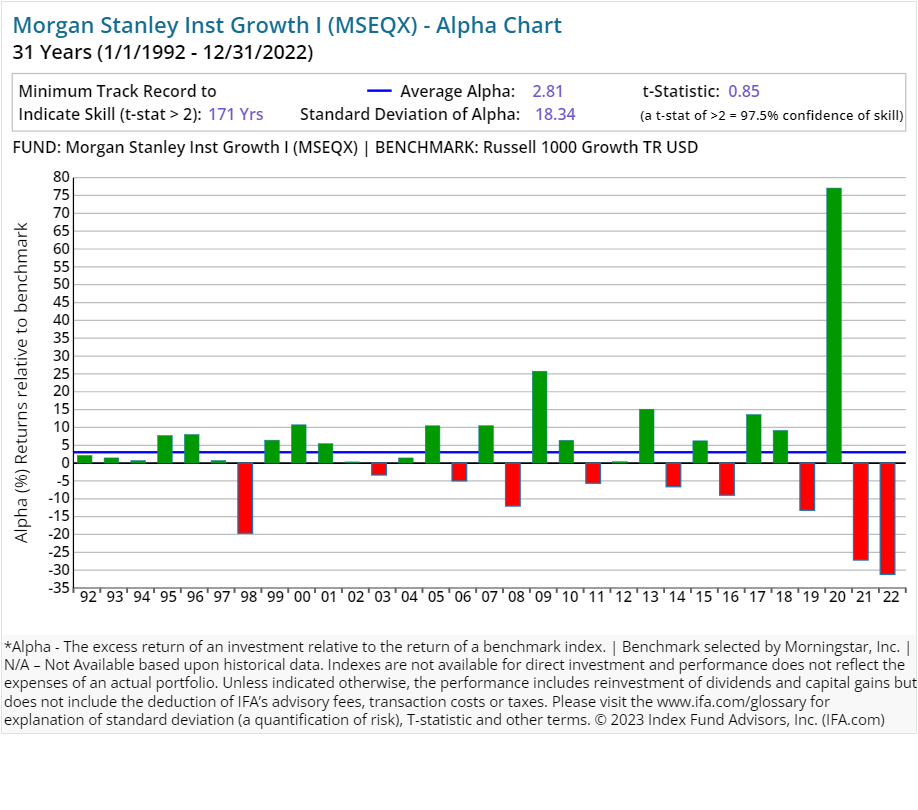

| Morgan Stanley Inst Growth I | MSEQX | 59.00 | 0.56 | Equity | US Equity Large Cap Growth |

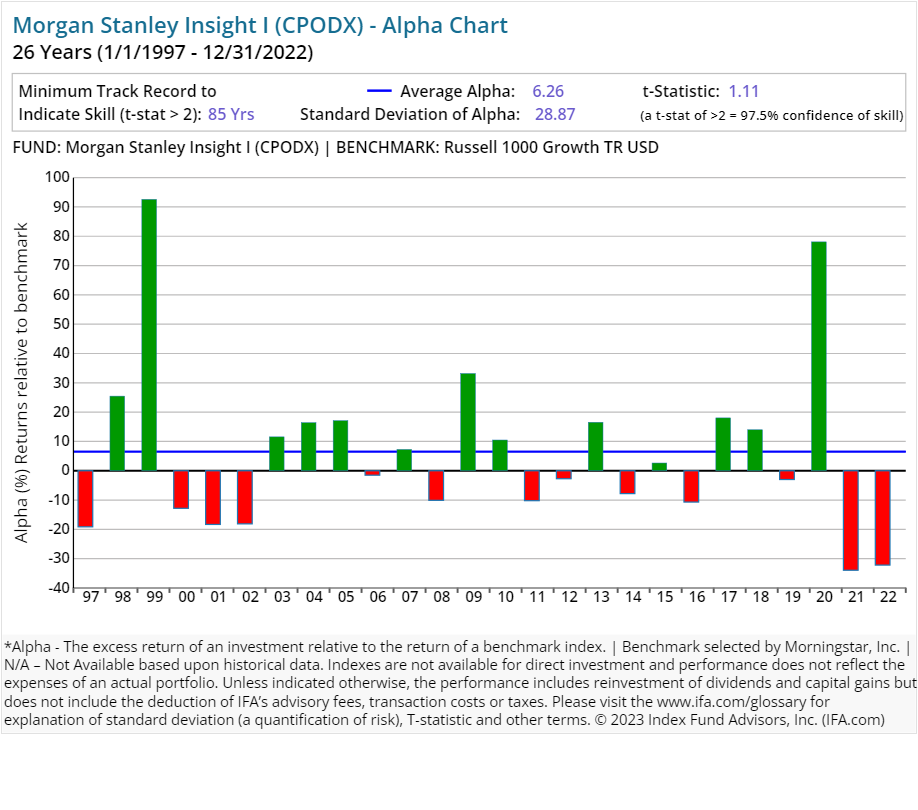

| Morgan Stanley Insight I | CPODX | 72.00 | 0.83 | Equity | US Equity Large Cap Growth |

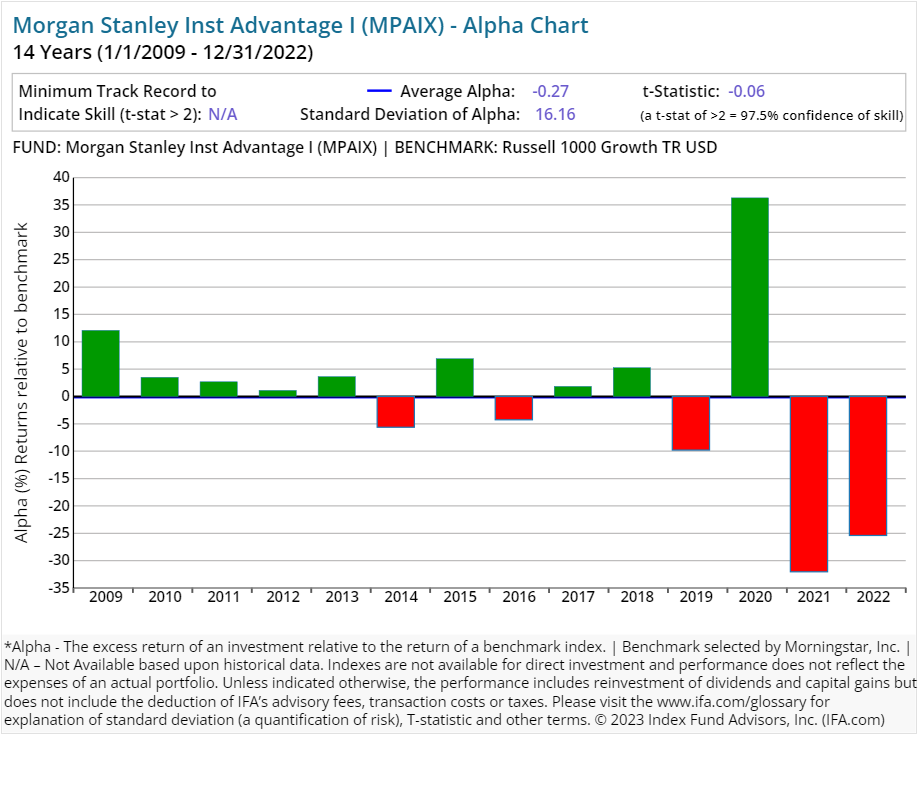

| Morgan Stanley Inst Advantage I | MPAIX | 69.00 | 0.85 | Equity | US Equity Large Cap Growth |

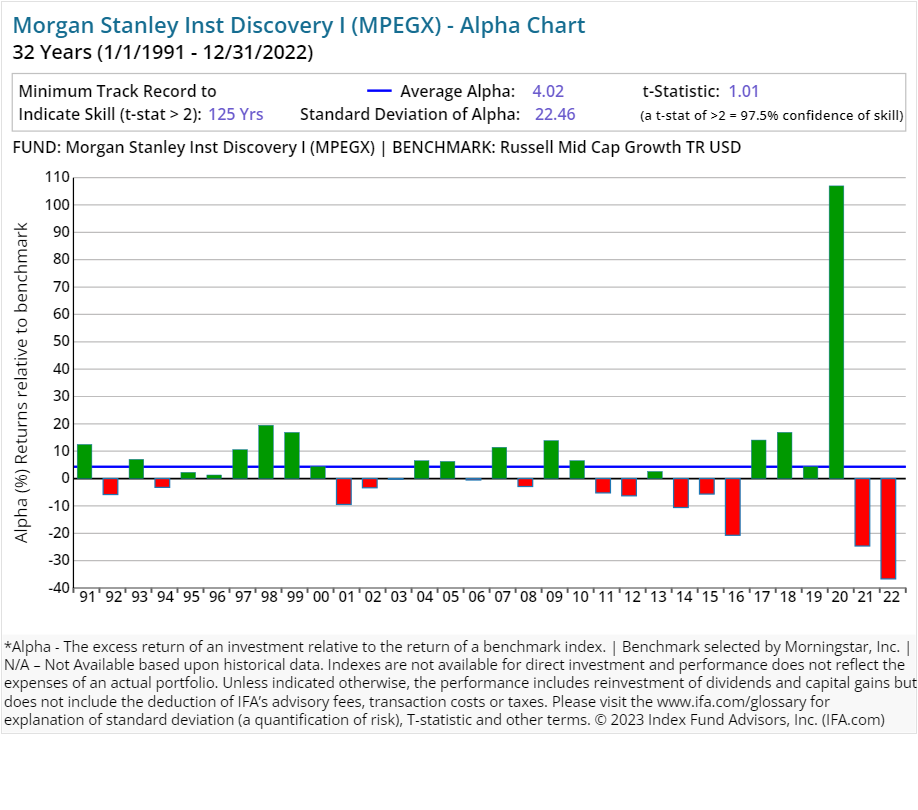

| Morgan Stanley Inst Discovery I | MPEGX | 67.00 | 0.77 | Equity | US Equity Mid Cap |

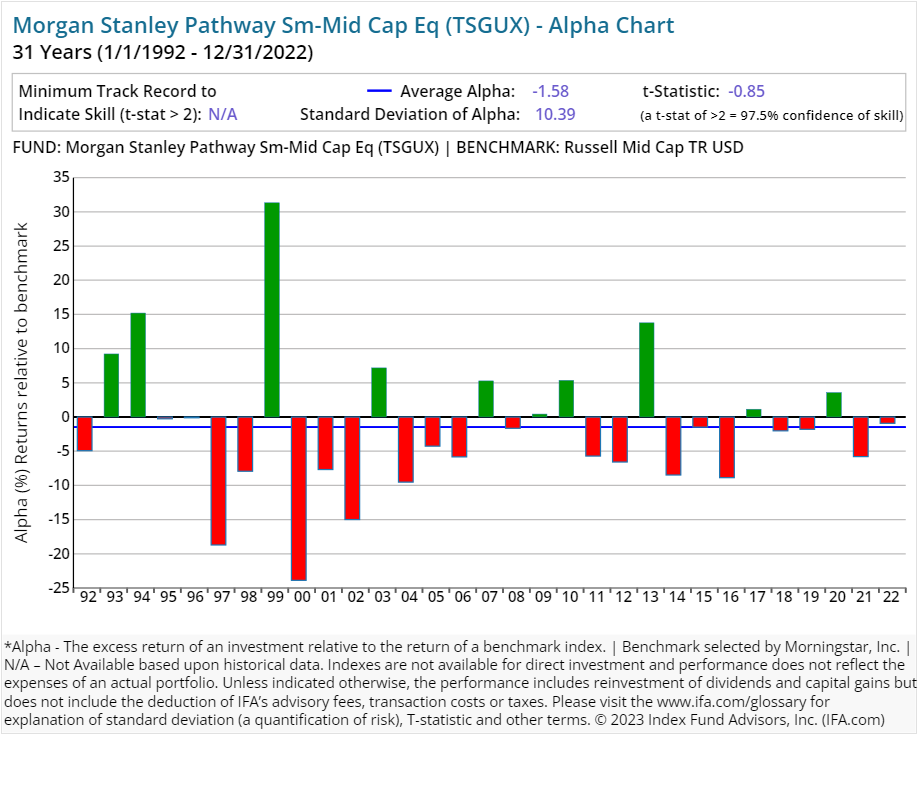

| Morgan Stanley Pathway Sm-Mid Cap Eq | TSGUX | 41.00 | 0.59 | Equity | US Equity Mid Cap |

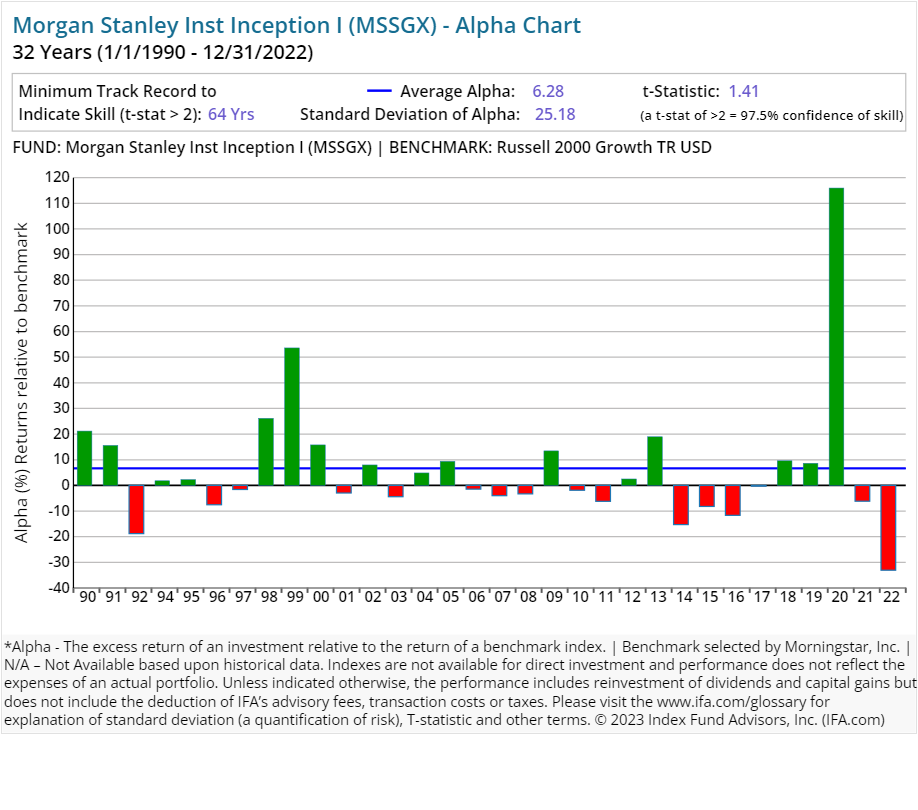

| Morgan Stanley Inst Inception I | MSSGX | 111.00 | 1.04 | Equity | US Equity Small Cap |

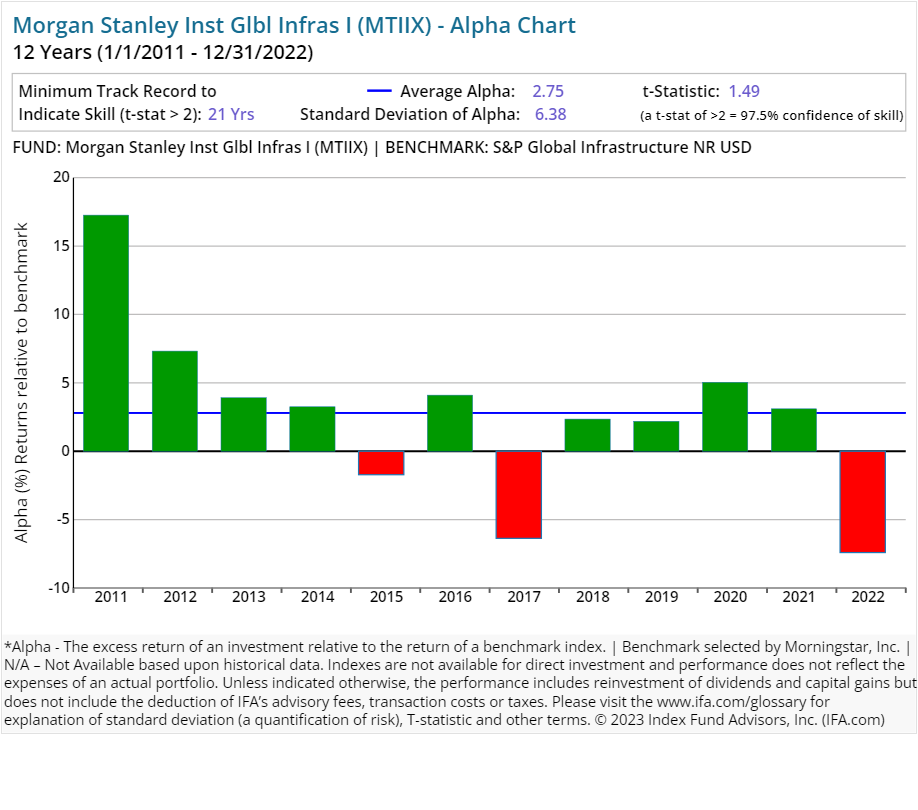

| Morgan Stanley Inst Glbl Infras I | MTIIX | 61.00 | 0.97 | Equity | Infrastructure Sector Equity |

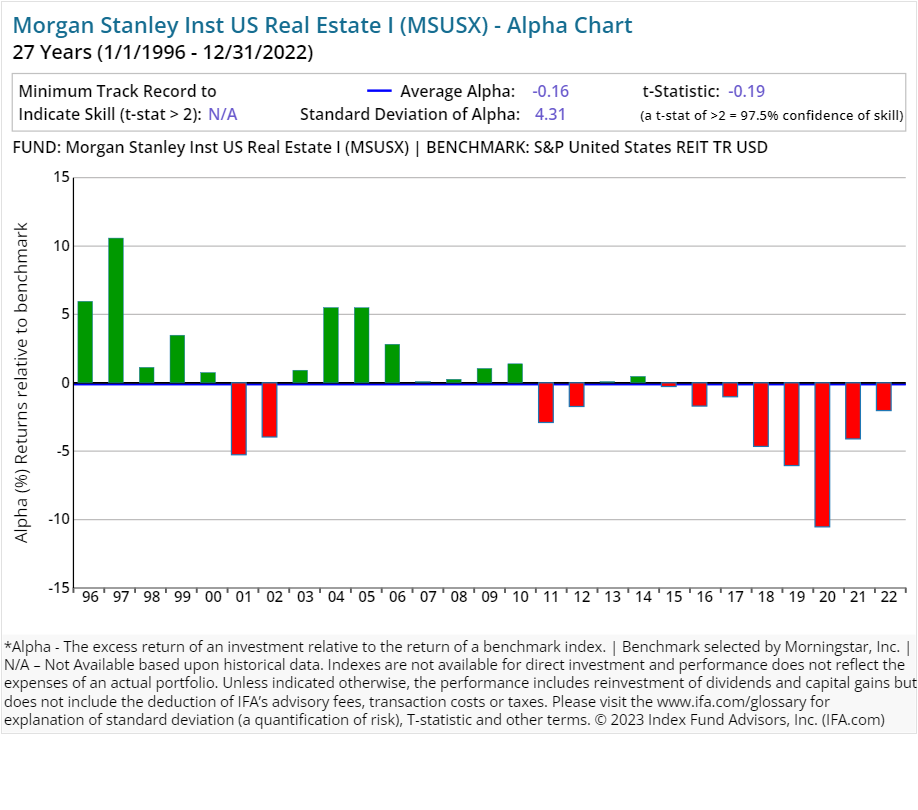

| Morgan Stanley Inst US Real Estate I | MSUSX | 132.00 | 0.90 | Equity | Real Estate Sector Equity |

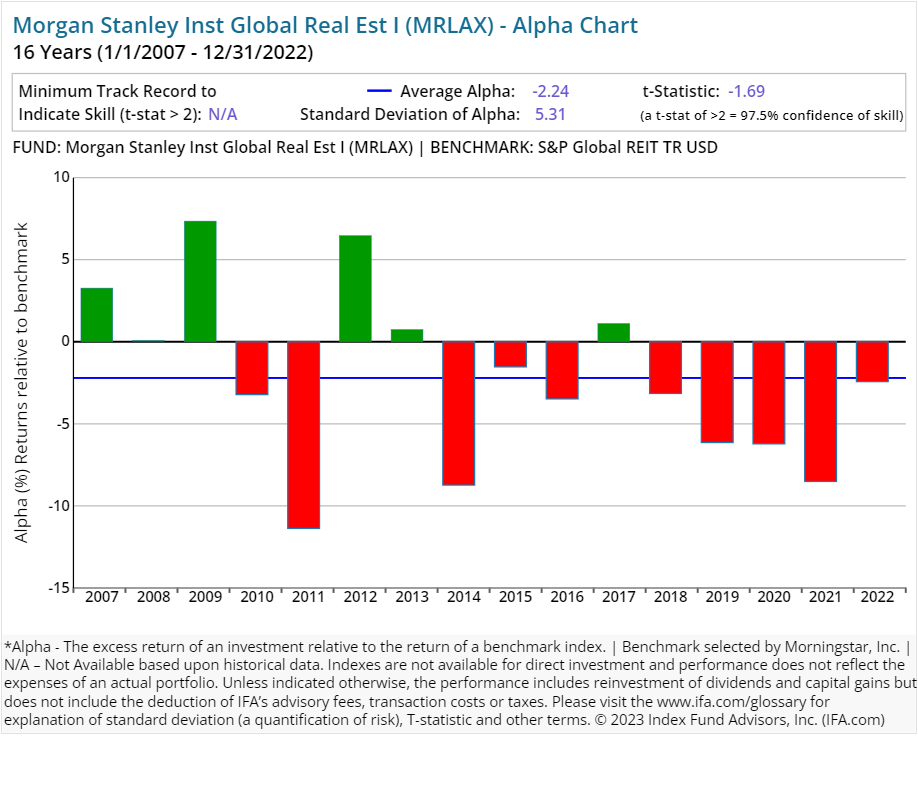

| Morgan Stanley Inst Global Real Est I | MRLAX | 135.00 | 1.01 | Equity | Real Estate Sector Equity |

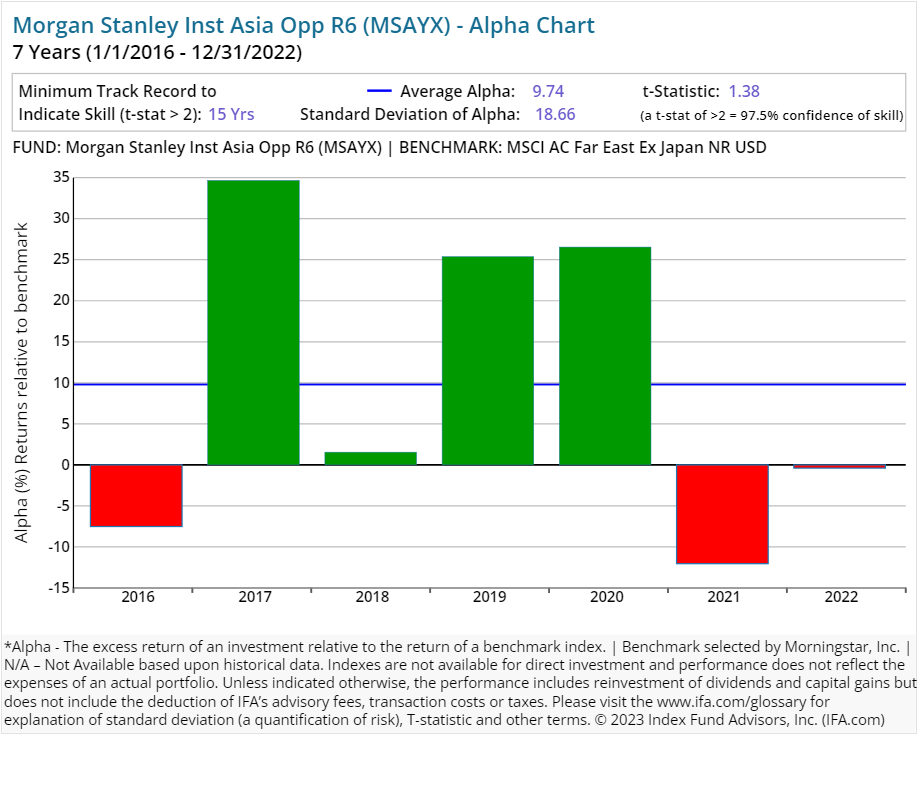

| Morgan Stanley Inst Asia Opp R6 | MSAYX | 65.00 | 0.98 | Equity | Asia ex-Japan Equity |

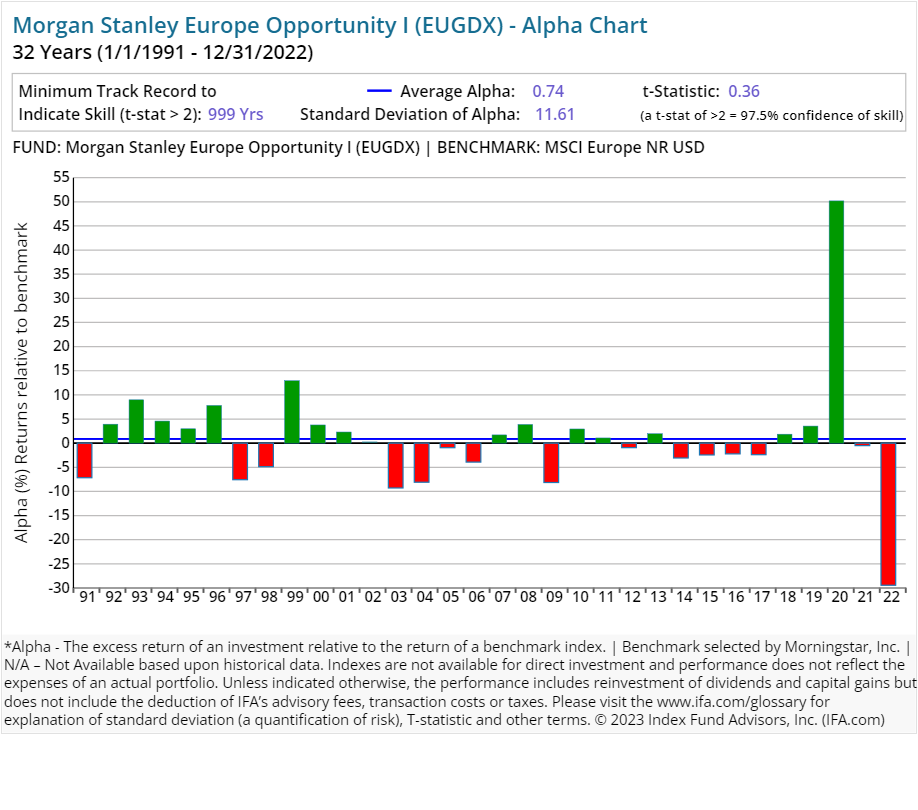

| Morgan Stanley Europe Opportunity I | EUGDX | 17.00 | 1.05 | Equity | Europe Equity Large Cap |

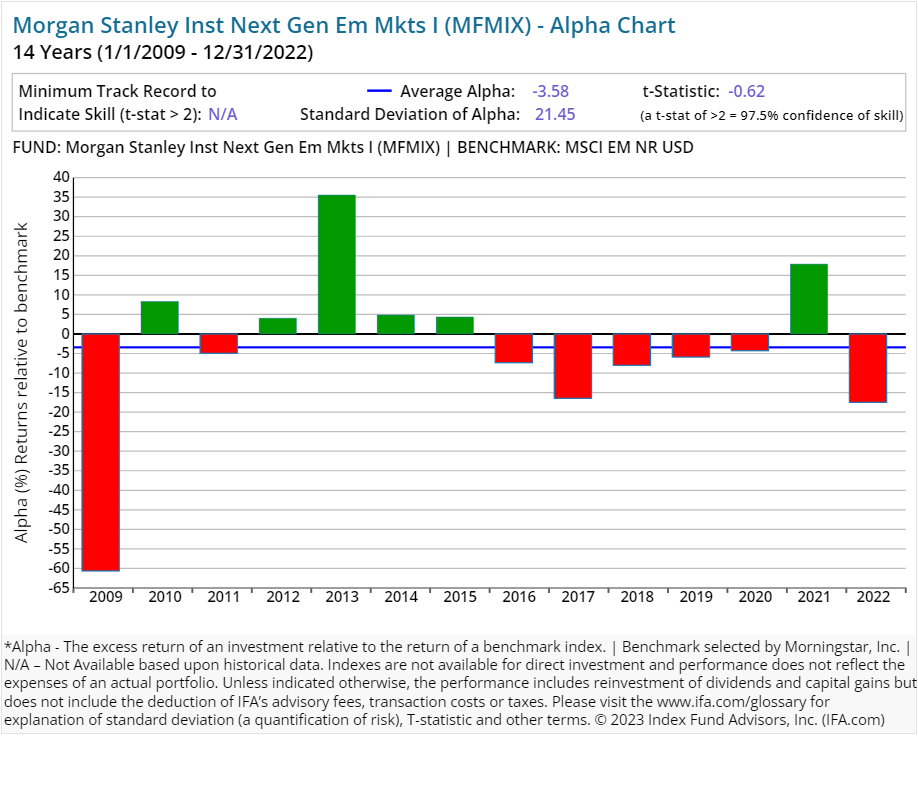

| Morgan Stanley Inst Next Gen Em Mkts I | MFMIX | 56.00 | 1.25 | Equity | Global Emerging Markets Equity |

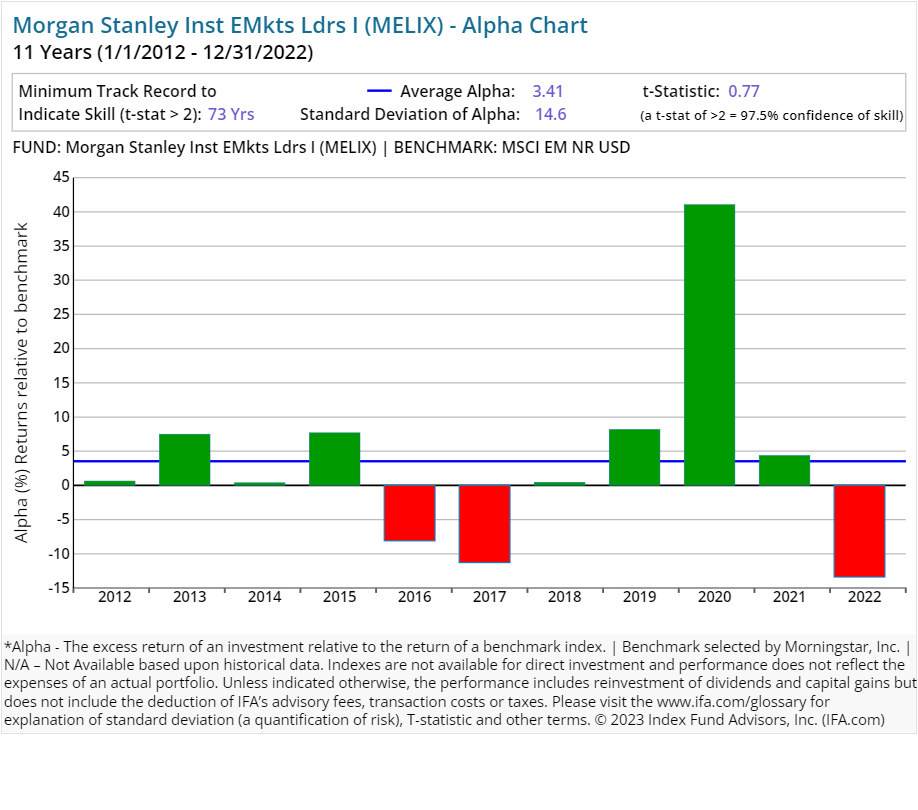

| Morgan Stanley Inst EMkts Ldrs I | MELIX | 27.00 | 1.05 | Equity | Global Emerging Markets Equity |

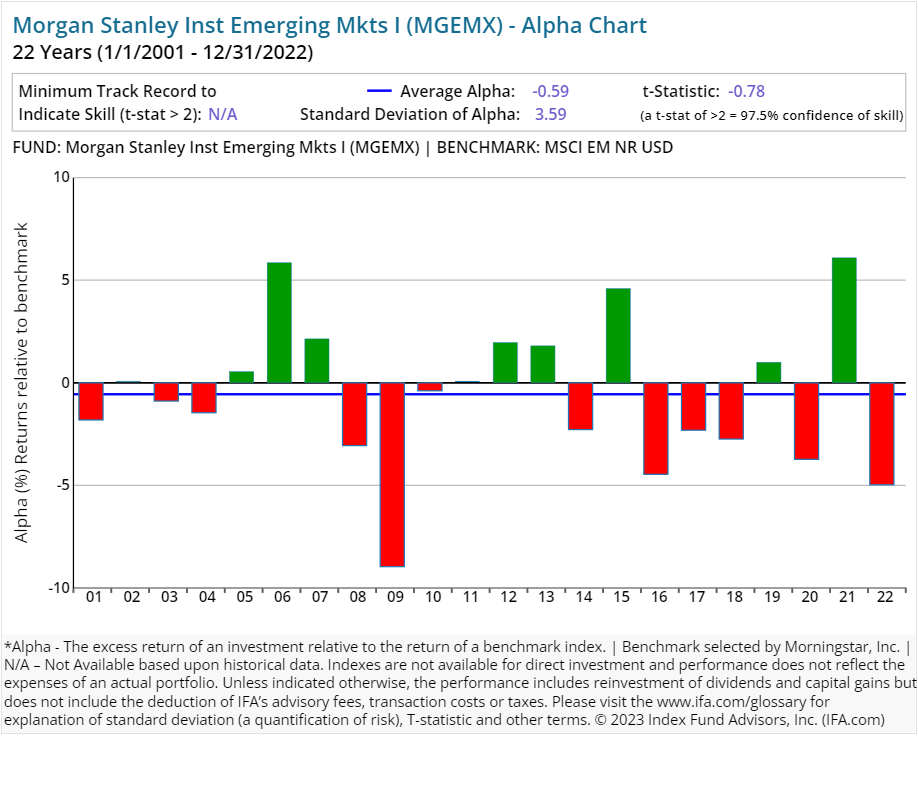

| Morgan Stanley Inst Emerging Mkts I | MGEMX | 39.00 | 1.05 | Equity | Global Emerging Markets Equity |

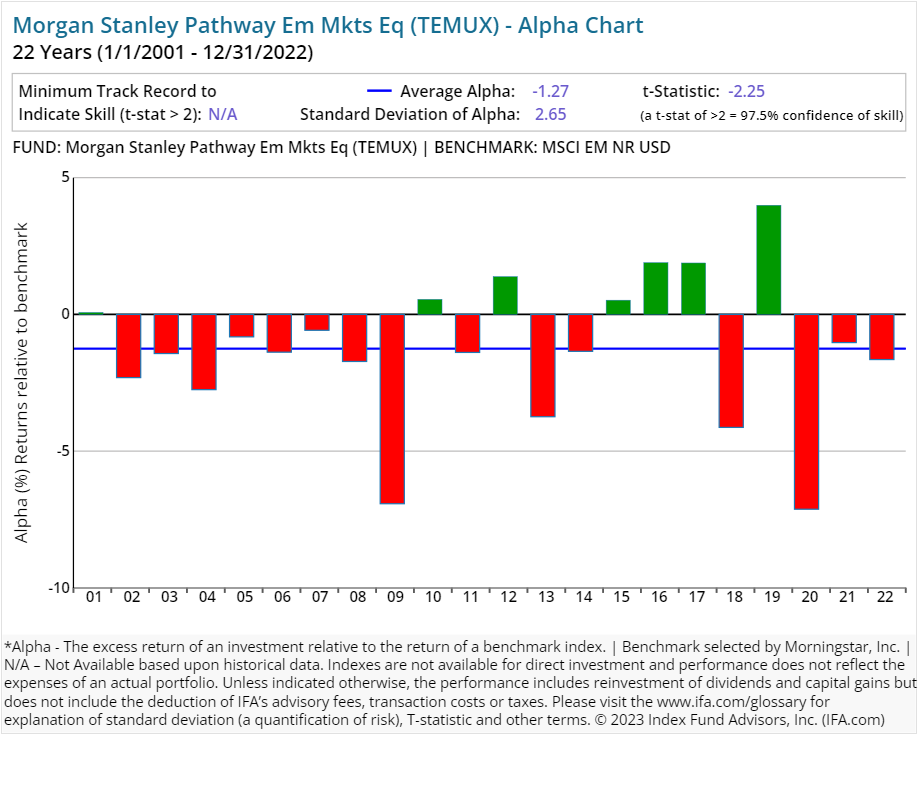

| Morgan Stanley Pathway Em Mkts Eq | TEMUX | 14.00 | 0.81 | Equity | Global Emerging Markets Equity |

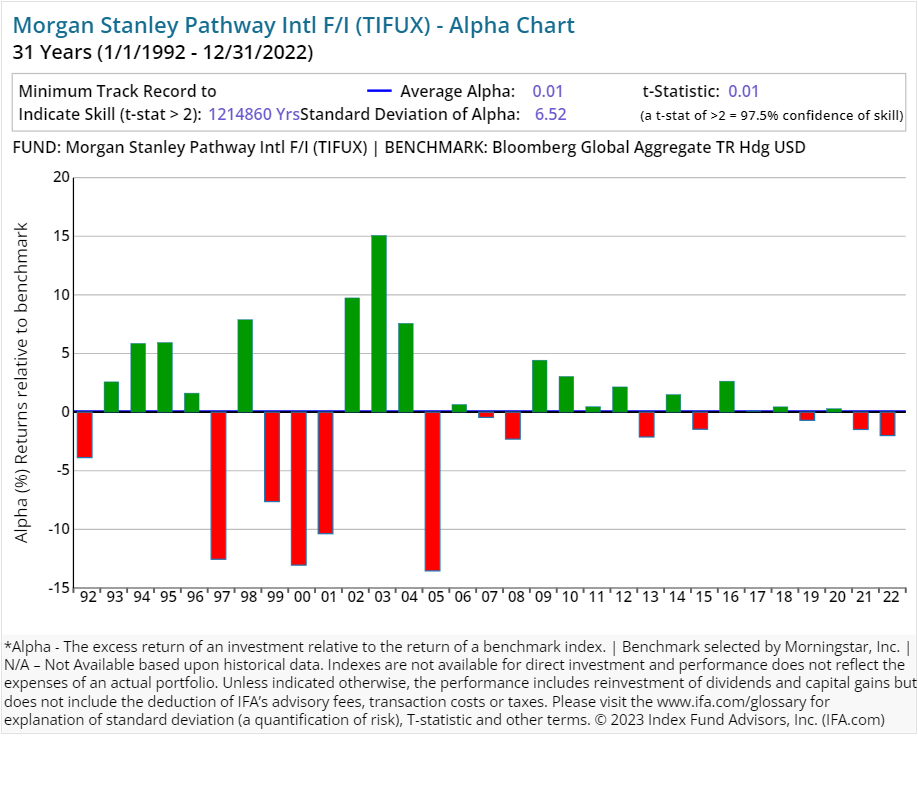

| Morgan Stanley Pathway Intl F/I | TIFUX | 312.00 | 0.88 | Fixed Income | Global Fixed Income |

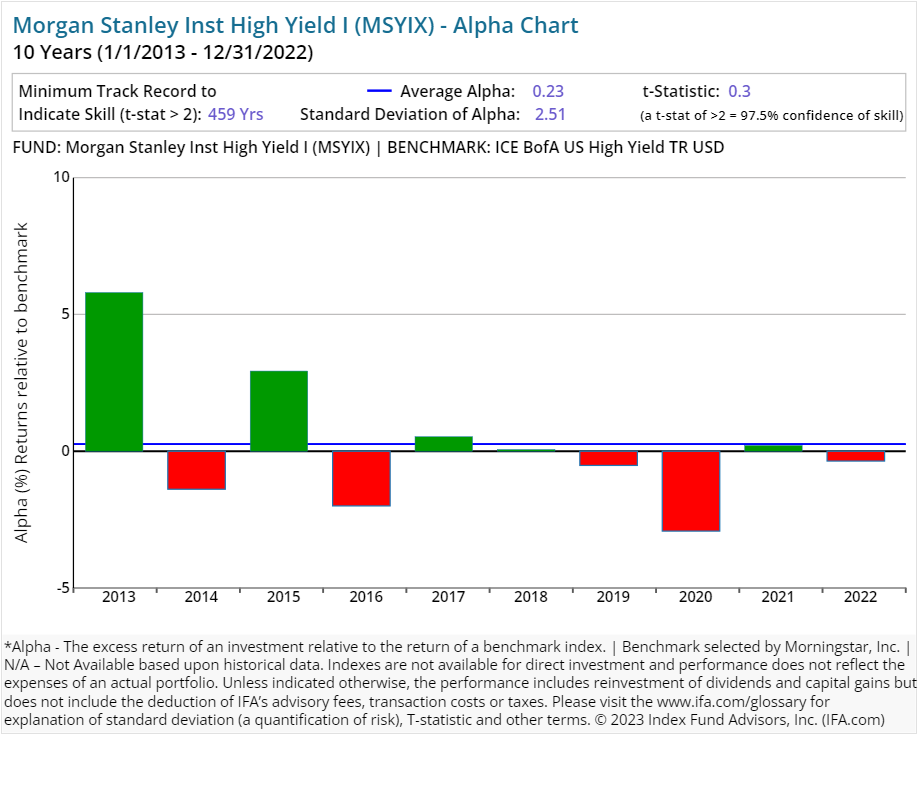

| Morgan Stanley Inst High Yield I | MSYIX | 28.00 | 0.65 | Fixed Income | US Fixed Income |

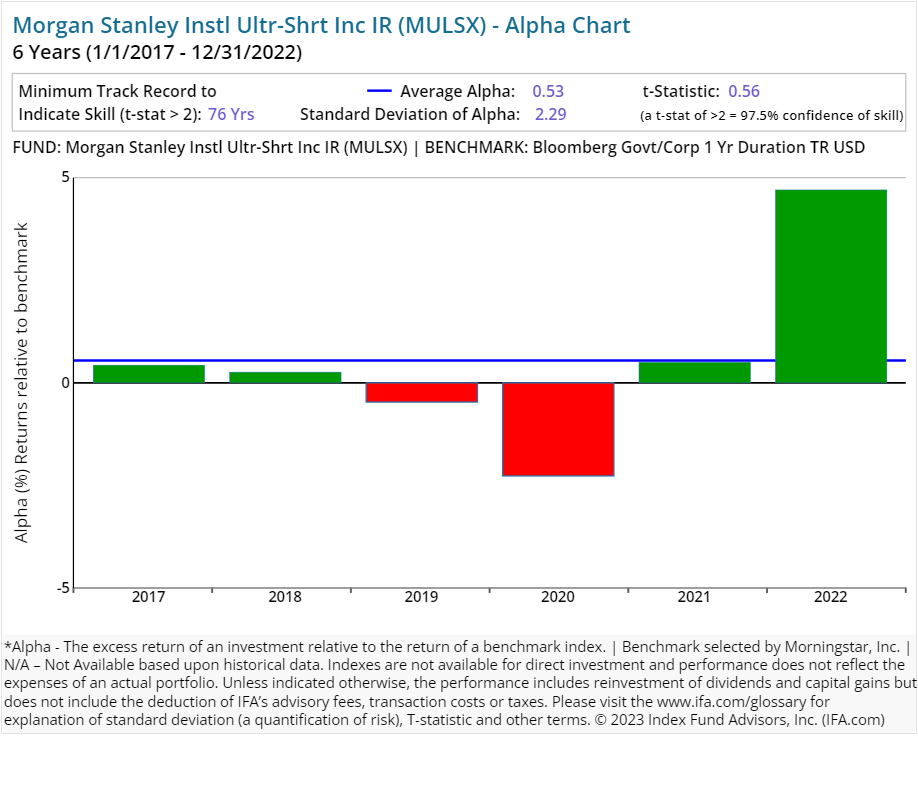

| Morgan Stanley Instl Ultr-Shrt Inc IR | MULSX | 0.25 | Fixed Income | US Fixed Income | |

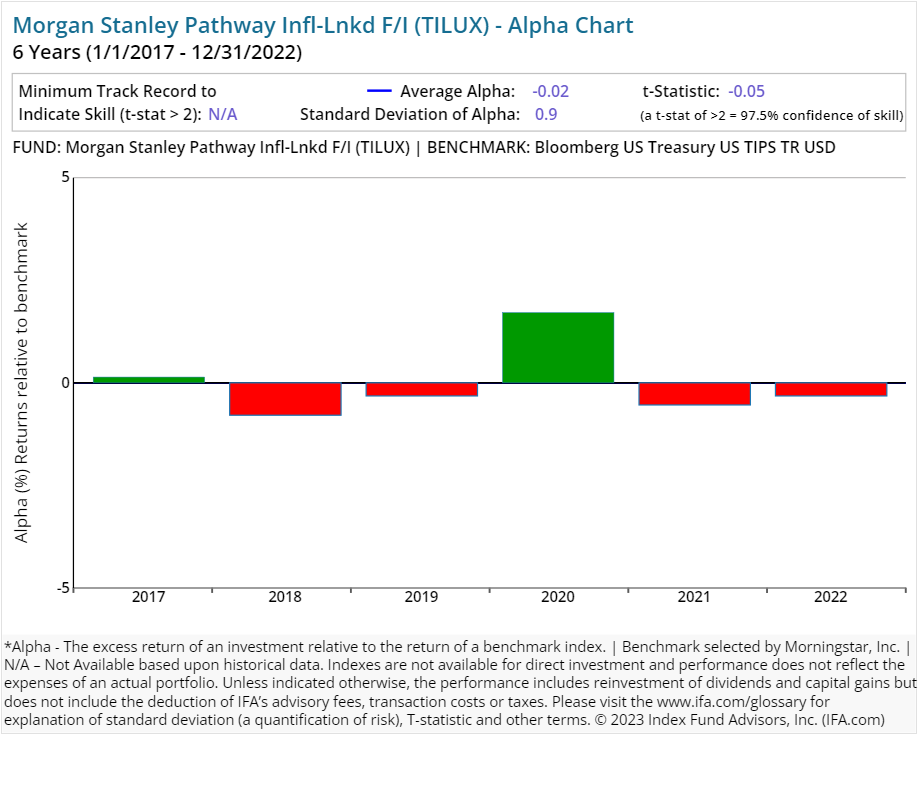

| Morgan Stanley Pathway Infl-Lnkd F/I | TILUX | 57.00 | 1.03 | Fixed Income | US Fixed Income |

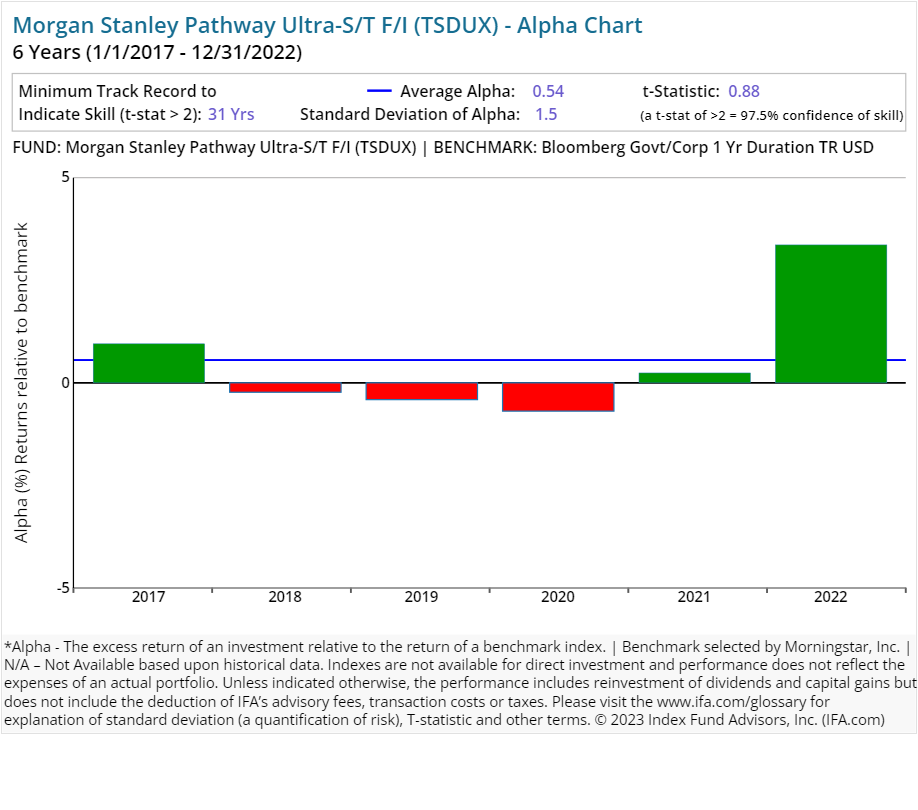

| Morgan Stanley Pathway Ultra-S/T F/I | TSDUX | 86.00 | 0.62 | Fixed Income | US Fixed Income |

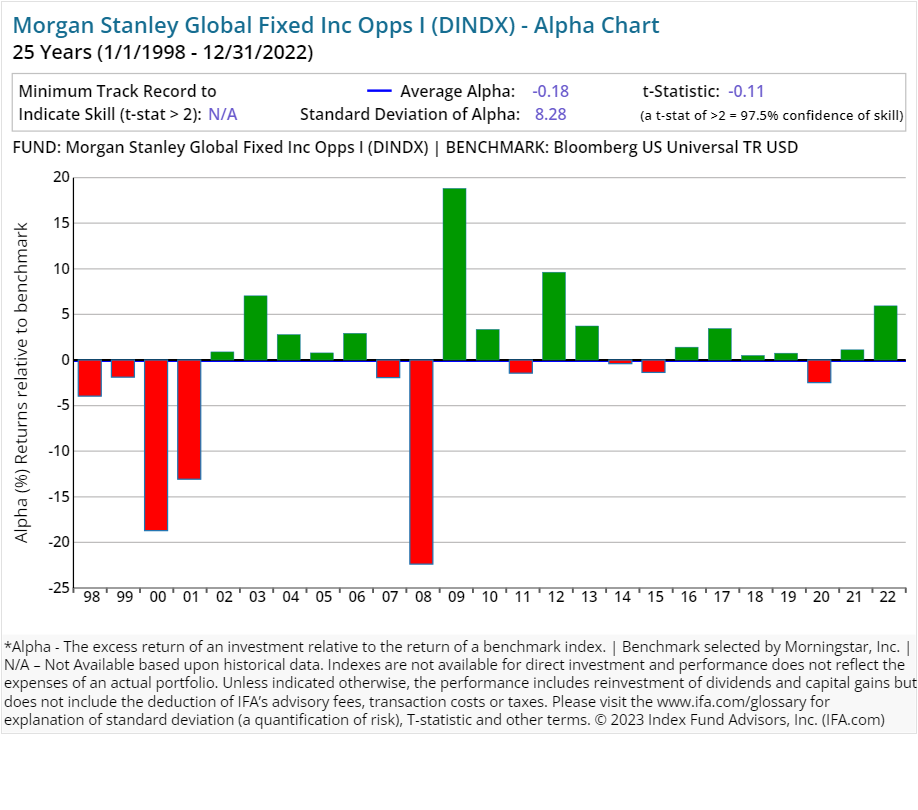

| Morgan Stanley Global Fixed Inc Opps I | DINDX | 62.00 | 0.56 | Fixed Income | US Fixed Income |

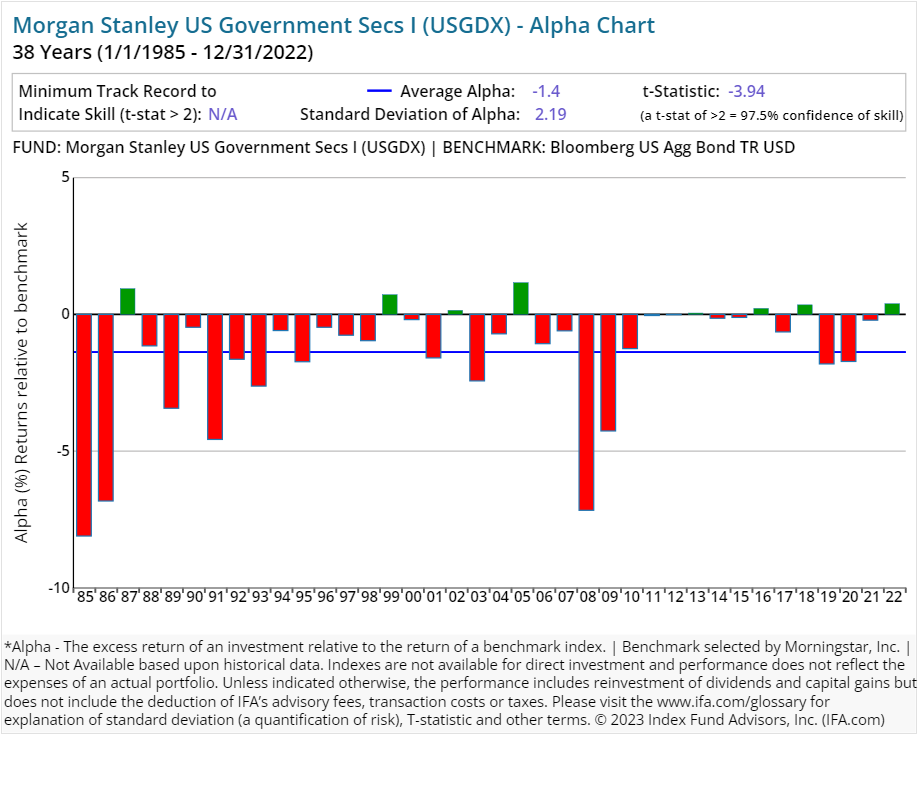

| Morgan Stanley US Government Secs I | USGDX | 376.00 | 0.52 | Fixed Income | US Fixed Income |

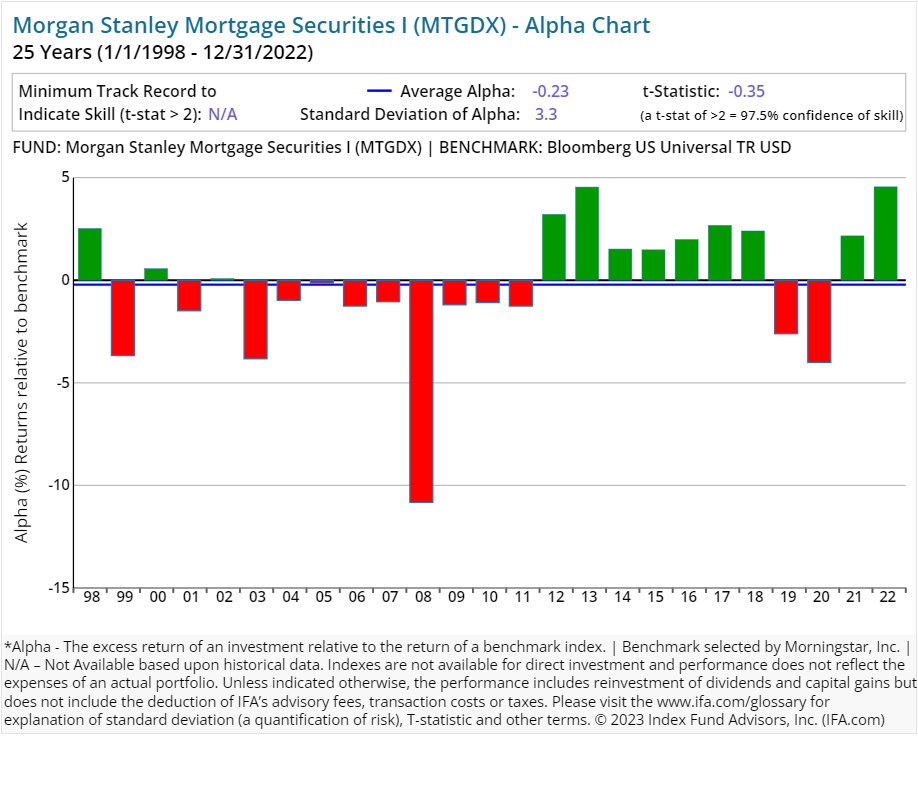

| Morgan Stanley Mortgage Securities I | MTGDX | 334.00 | 0.72 | Fixed Income | US Fixed Income |

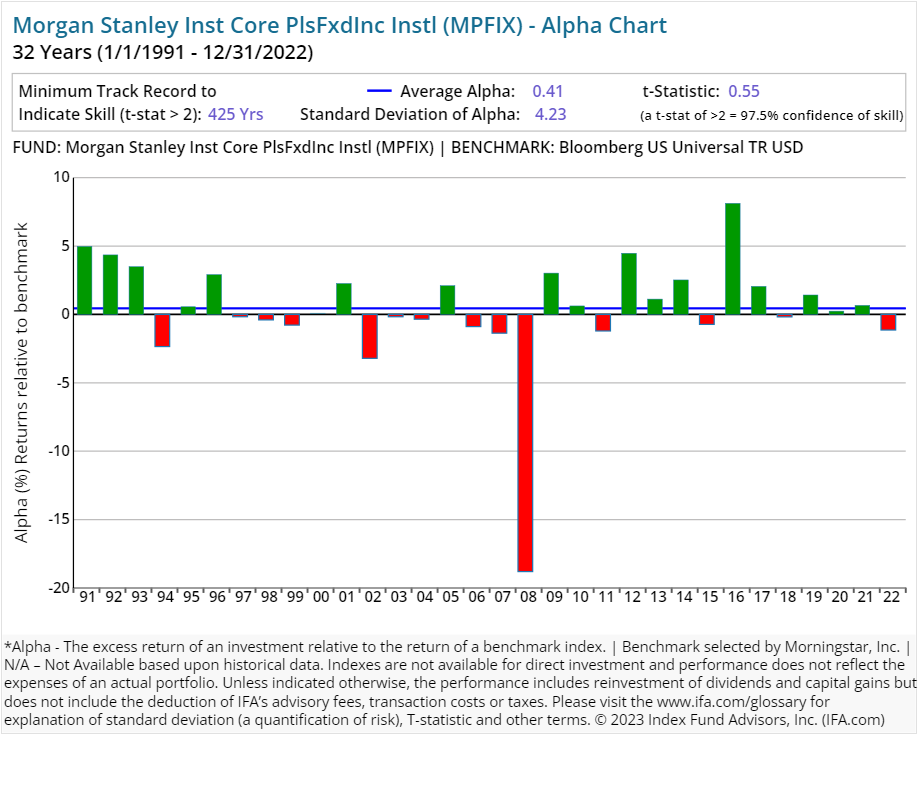

| Morgan Stanley Inst Core PlsFxdInc Instl | MPFIX | 266.00 | 0.42 | Fixed Income | US Fixed Income |

| Morgan Stanley Inst Corporate Bond I | MPFDX | 110.00 | 0.70 | Fixed Income | US Fixed Income |

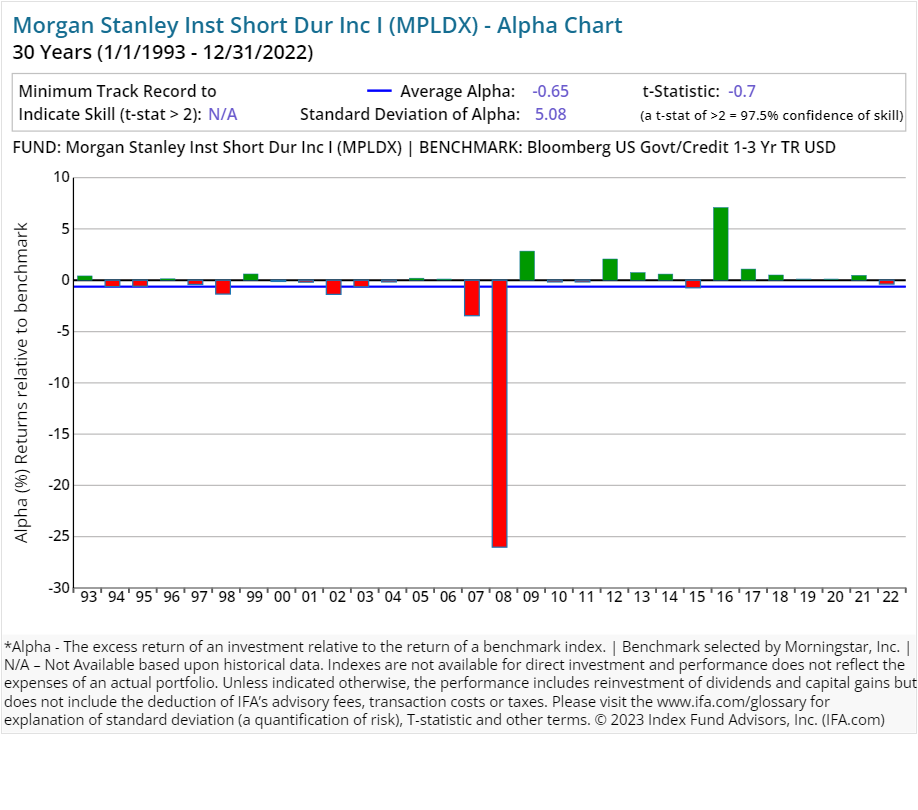

| Morgan Stanley Inst Short Dur Inc I | MPLDX | 53.00 | 0.30 | Fixed Income | US Fixed Income |

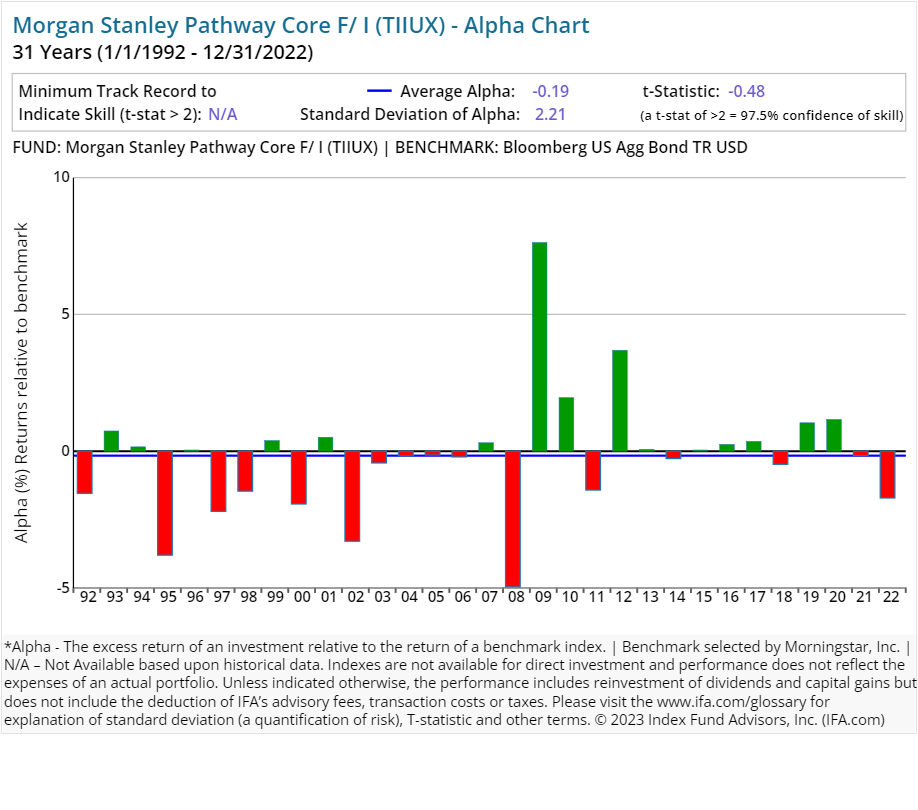

| Morgan Stanley Pathway Core F/ I | TIIUX | 238.00 | 0.53 | Fixed Income | US Fixed Income |

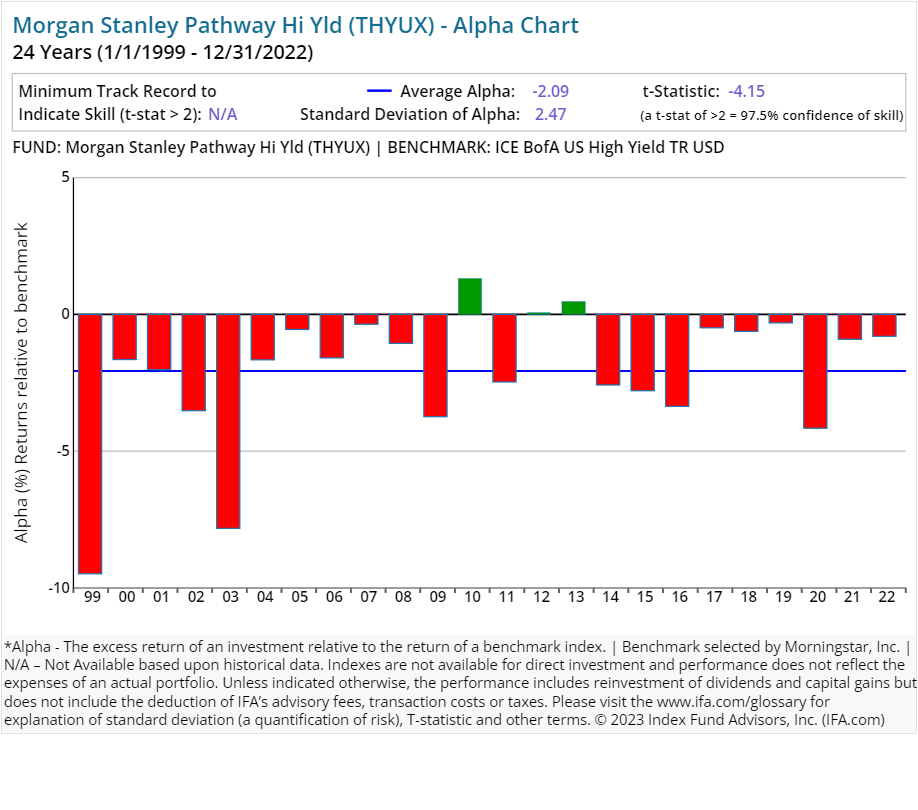

| Morgan Stanley Pathway Hi Yld | THYUX | 46.00 | 0.87 | Fixed Income | US Fixed Income |

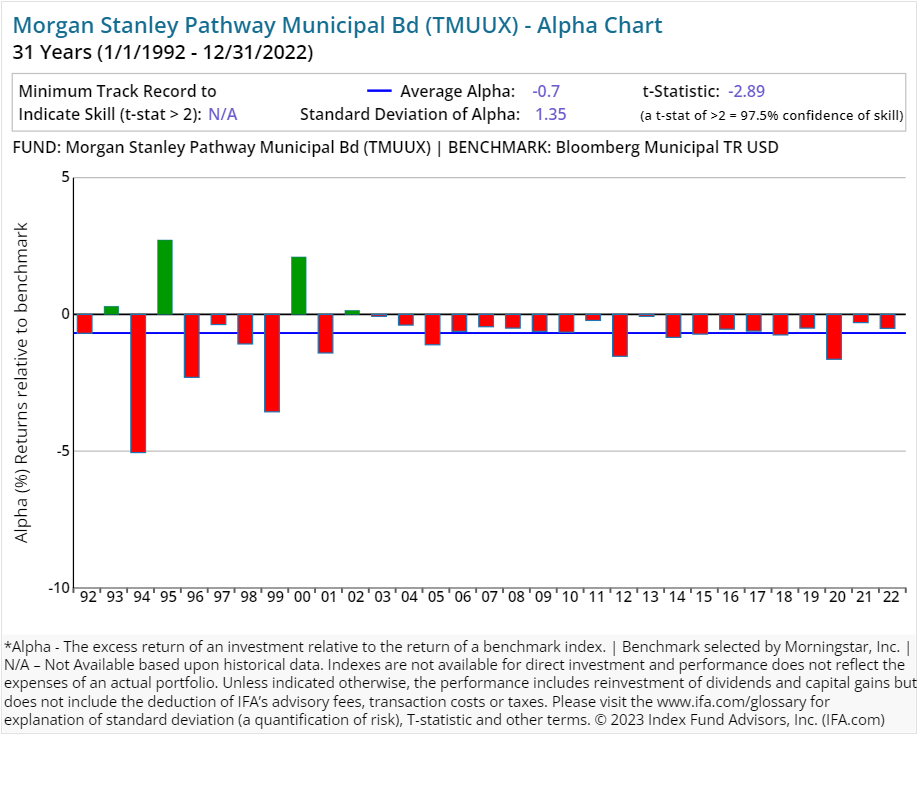

| Morgan Stanley Pathway Municipal Bd | TMUUX | 48.00 | 0.71 | Fixed Income | US Municipal Fixed Income |

Please read the prospectus carefully to review the investment objectives, risks, charges and expenses of the mutual funds before investing. Morgan Stanley mutual fund prospectuses are available at https://www.morganstanley.com/im/en-us/individual-investor/resources.desktop.html

On average, an investor who utilized a surviving active equity mutual fund strategy from Morgan Stanley experienced a 0.90% expense ratio. Similarly, an investor who utilized a surviving active bond strategy from the company experienced a 0.63% expense ratio.

These expenses can have a substantial impact on an investor's overall accumulated wealth if they are not backed by superior performance. The average turnover ratios for surviving active equity and bond strategies from Morgan Stanley were 49.39% and 144%, respectively. This implies an average holding period of 8.33 to 24.30 months.

In contrast, most index funds have very long holding periods — decades, in fact, thus deafening themselves to the random noise that accompanies short-term market movements, and focusing instead on the long-term. Again, turnover is a cost that is not itemized to the investor but is definitely embedded in the overall performance.

Performance Analysis

The next question we address is whether investors can expect superior performance in exchange for the higher costs associated with Morgan Stanley's implementation of active management. We compare all of its 163 strategies — including current funds and those no longer in existence — against the respective Morningstar-assigned benchmark to see how well each fund has delivered on its perceived value proposition.

Here is what we found:

-

87.73% (143 of 163 funds) have underperformed their respective benchmarks or did not survive the period since inception.

-

12.27% (20 of 163 funds) have outperformed their respective benchmarks since inception, having delivered a POSITIVE alpha.

Here's the real kicker, however:

- 0.61% (1 of 163 funds) wound up outperforming their respective benchmarks consistently enough since inception to provide 97.5% confidence that such outperformance would persist (as opposed to being based on random outcomes).

As a result, this study shows that a majority of funds offered by Morgan Stanley have not outperformed their Morningstar-assigned benchmark. The inclusion of the statistical significance of alpha is key to this exercise, as it indicates which outcomes are due to a skill that is likely to repeat and those that are more likely due to a random-chance outcome.

Regression Analysis

How we define or choose a benchmark is extremely important. If we relied solely on commercial indexes assigned by Morningstar, then we may form a false conclusion that Morgan Stanley has the "secret sauce" as active managers.

Since Morningstar is limited in terms of trying to fit the best commercial benchmark with each fund in existence, there is of course going to be some error in terms of matching up proper characteristics such as average market capitalization or average price-to-earnings ratio.

A better way of controlling these possible discrepancies is to run multiple regressions where we account for the known dimensions of expected return in the U.S. — i.e., market risk, size and relative price — as identified by the Fama/French Three-Factor Model.

For example, if we were to look at all of the U.S.-based strategies from Morgan Stanley that've been around for the past 10 years, we could run multiple regressions to see what each fund's alpha looks like once we control for the multiple betas that are being systematically priced into the overall market.

The chart below displays the average alpha and standard deviation of that alpha for the past 10 years through 2022. Screening criteria include funds with holdings of 90% or greater in U.S. equities and uses the oldest available share classes.

As shown above, none of the equity mutual funds reviewed was able to produce a statistically significant level of alpha, based on a t-stat of 2.0 or greater. (For a review of how to calculate a fund's t-stat, see the section of this study that follows the individual Morgan Stanley alpha charts.)

Why is this important? It means that if we wanted to simply replicate the factor risk exposures of these Morgan Stanley funds with indexes of the factors, we could blend the indexes and capture similar returns.

Conclusion

Like many of the other large active managers, a deep analysis into the performance of Morgan Stanley has yielded a not so surprising result: Active management is likely to fail many investors. This is due to market efficiency, costs and increased competition in the financial services sector.

As we always like to remind investors, a more reliable investment strategy for capturing the returns of global markets is to buy, hold and rebalance a globally diversified portfolio of index funds.

Below are the individual alpha charts for the existing Morgan Stanley actively managed mutual funds that have five years or more of a track record.

Here is a calculator to determine the t-stat. Don't trust an alpha or average return without one.

The Figure below shows the formula to calculate the number of years needed for a t-stat of 2. We first determine the excess return over a benchmark (the alpha) then determine the regularity of the excess returns by calculating the standard deviation of those returns. Based on these two numbers, we can then calculate how many years we need (sample size) to support the manager's claim of skill.

Footnotes:

1.) Morgan Stanley, "First Quarter 2023 Earnings Results," April 19, 2023.

2.) Reuters, "Morgan Stanley to buy Eaton Vance for $7 billion in investment-management push," Oct. 8, 2020.

3.) Barron's, "Morgan Stanley and Eaton Vance Could Prune Funds," Oct. 16, 2020.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.