The number of stocks in the US market has declined from a high of more than 6,600 in 1997 to about 4,000 at the end of 2022. Several reasons have been proposed. For example, some investors suggest private equity activity has reduced the number of small cap stocks. However, "Why?" is probably less pertinent to investors than the question: "Does it matter?"

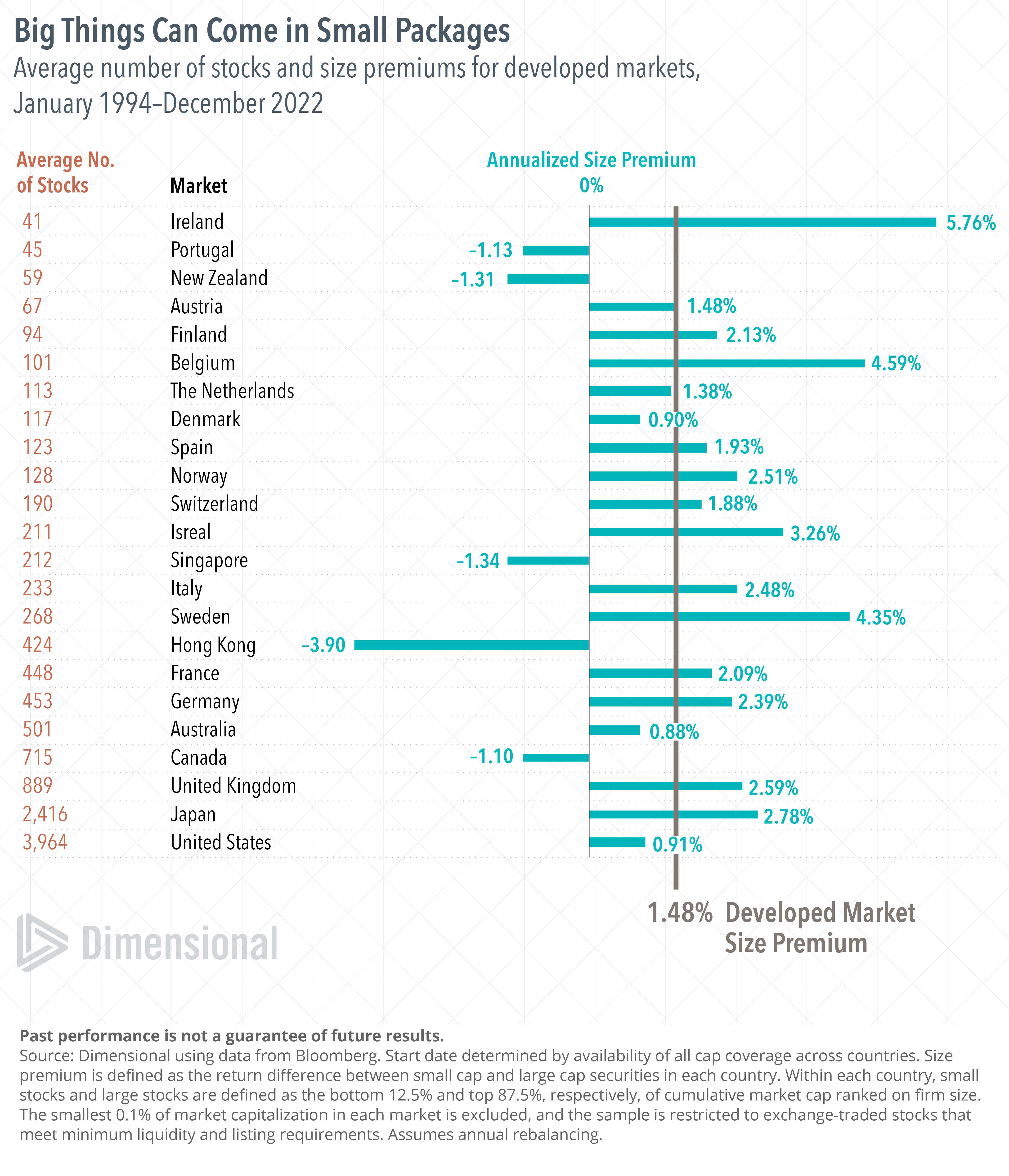

One way to think about concerns with a shrinking opportunity set is to look at the relation between number of securities and size premium across different markets. While the historical magnitude of the size premium has varied across countries, there's no evidence this variation is tied to number of stocks. The largest size premium observed within developed markets, 5.76%, came from Ireland with a stock market population of just 41 on average. On the other hand, the similarly sized market of Portugal (45 stocks on average) produced a negative size premium. Larger markets are found on both sides of the size premium spectrum as well. Japan (2,416 stocks) has been in the top quartile; Canada (715 stocks) in the bottom quartile.

While the average premium has been insensitive to stock count, holding more stocks provides greater diversification. The size premium in individual markets can be volatile, so global diversification may give investors a more reliable avenue to outperform the market.

The article on this page was republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.