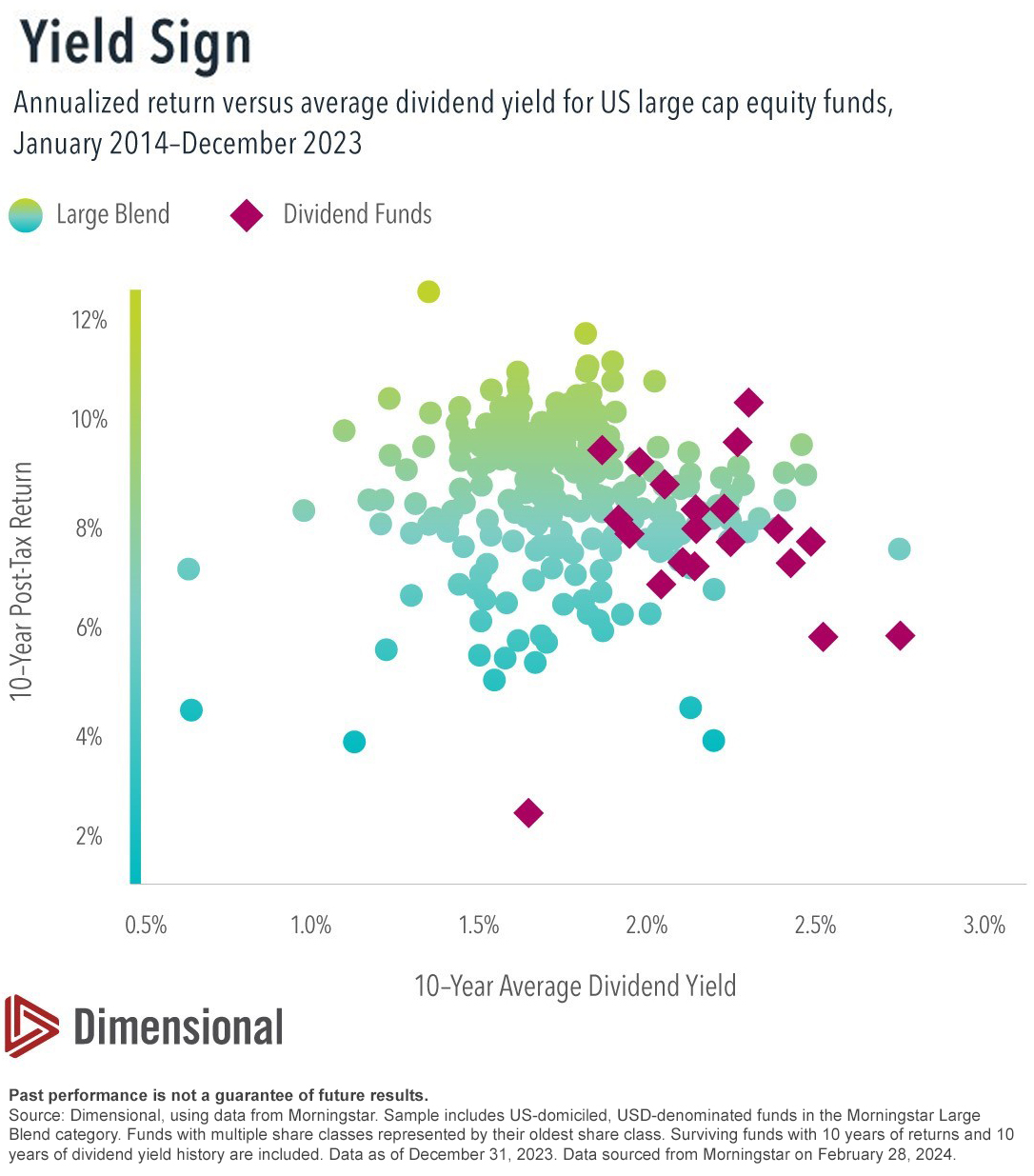

Investors selecting funds based on dividend yield should be aware that high yield is no assurance of higher expected return. Plotting 10-year annualized returns versus average dividend yield for US large cap equity funds shows no meaningful relation between the two. Many of the best-performing funds in the category had below average yields. And funds specifically targeting high yield can be found on both ends of the return spectrum.

A stock's total return comprises both capital appreciation and dividends. Emphasizing only one component may reduce diversification and, as the data show, may not increase your expected return.

The article on this page was republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.