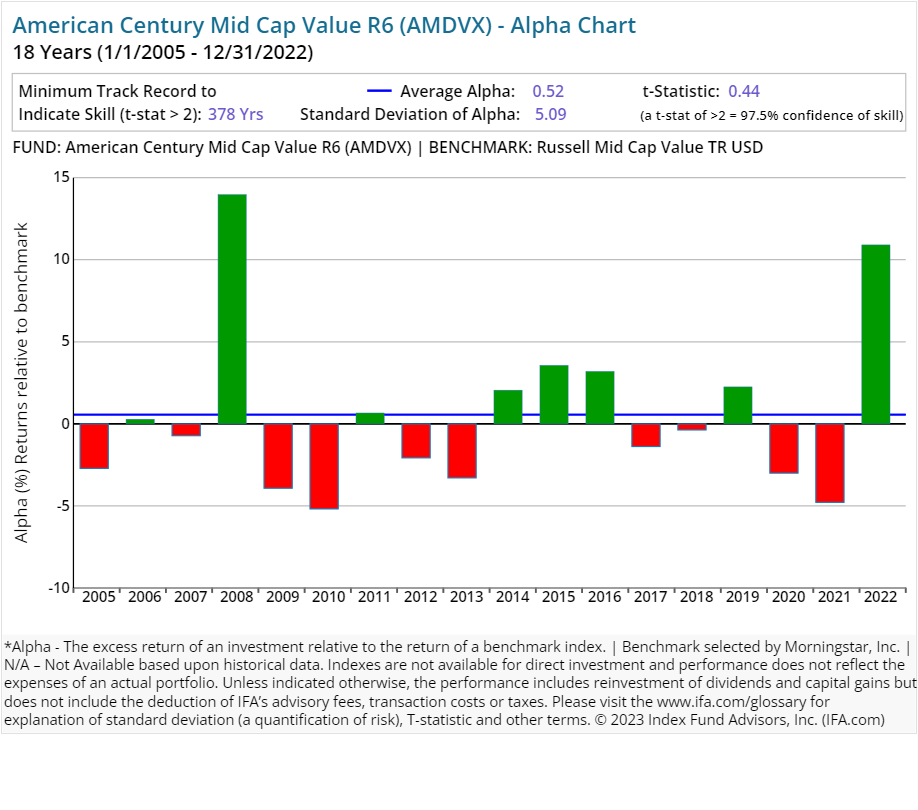

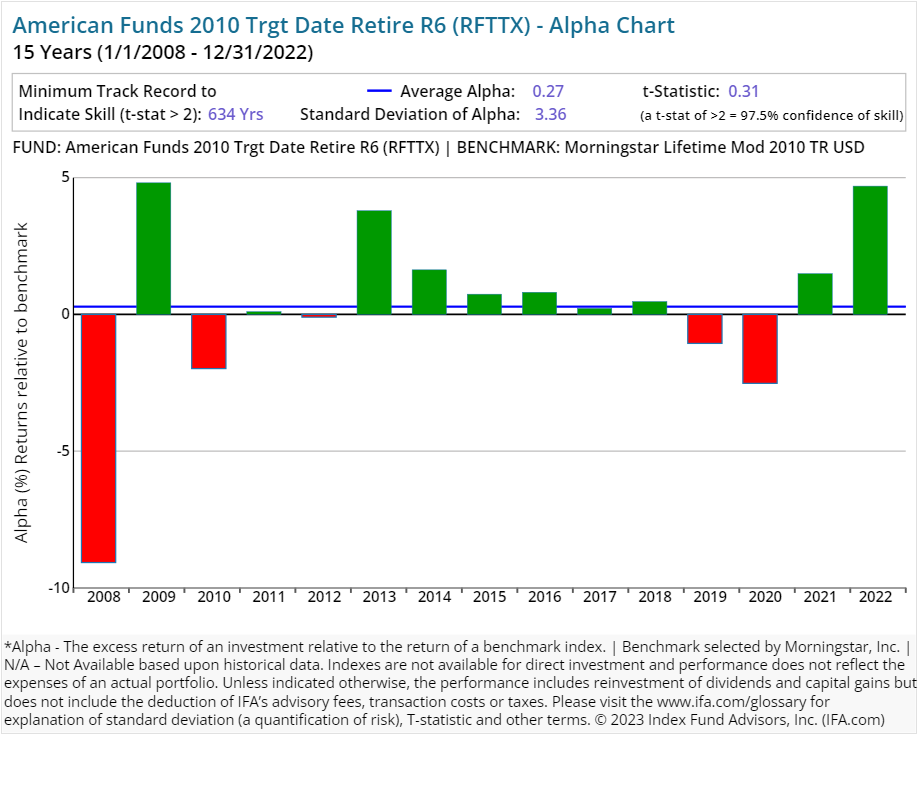

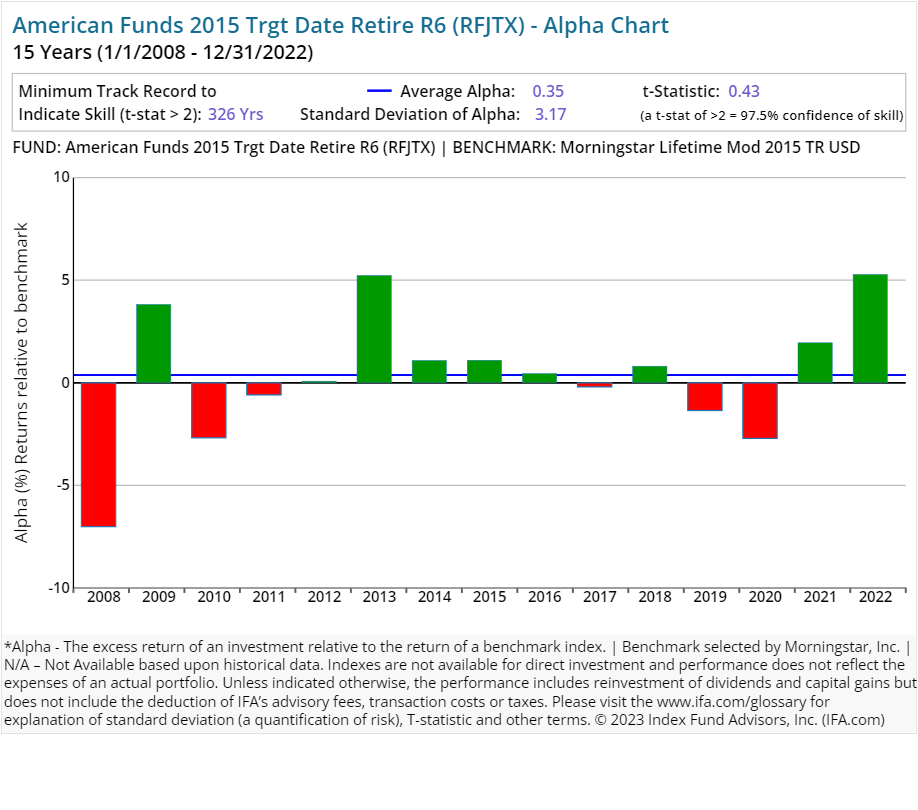

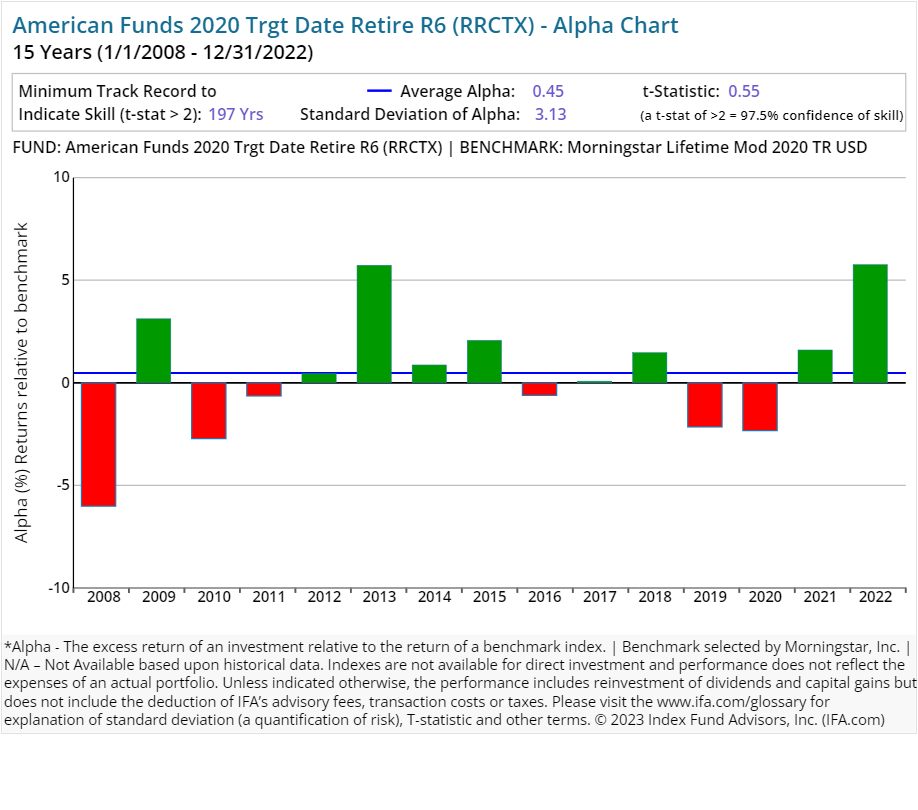

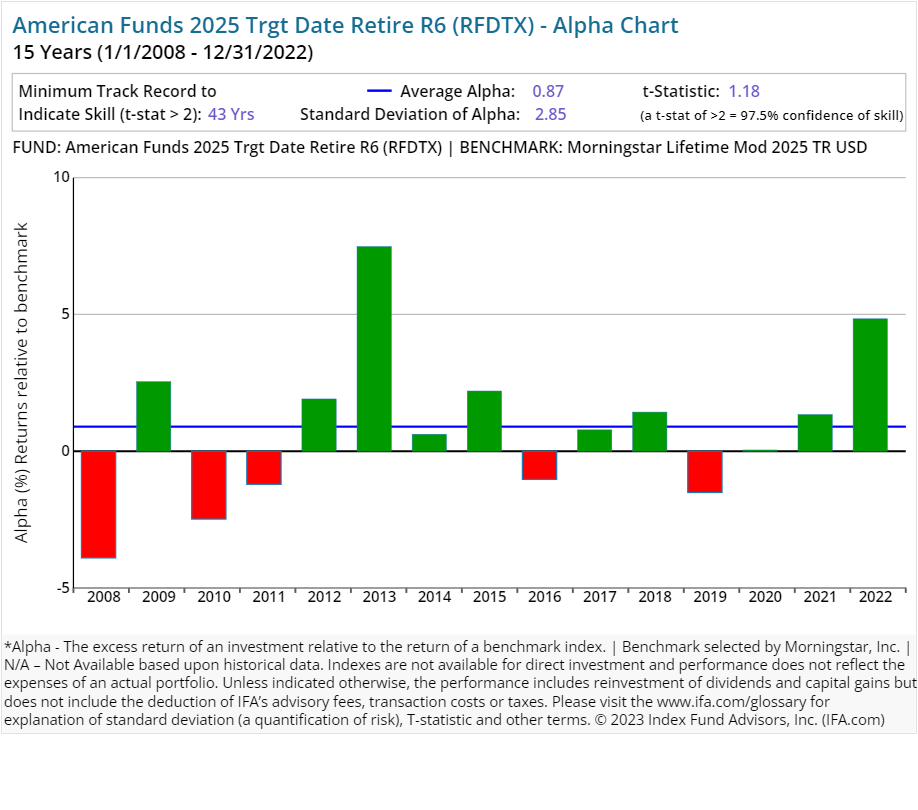

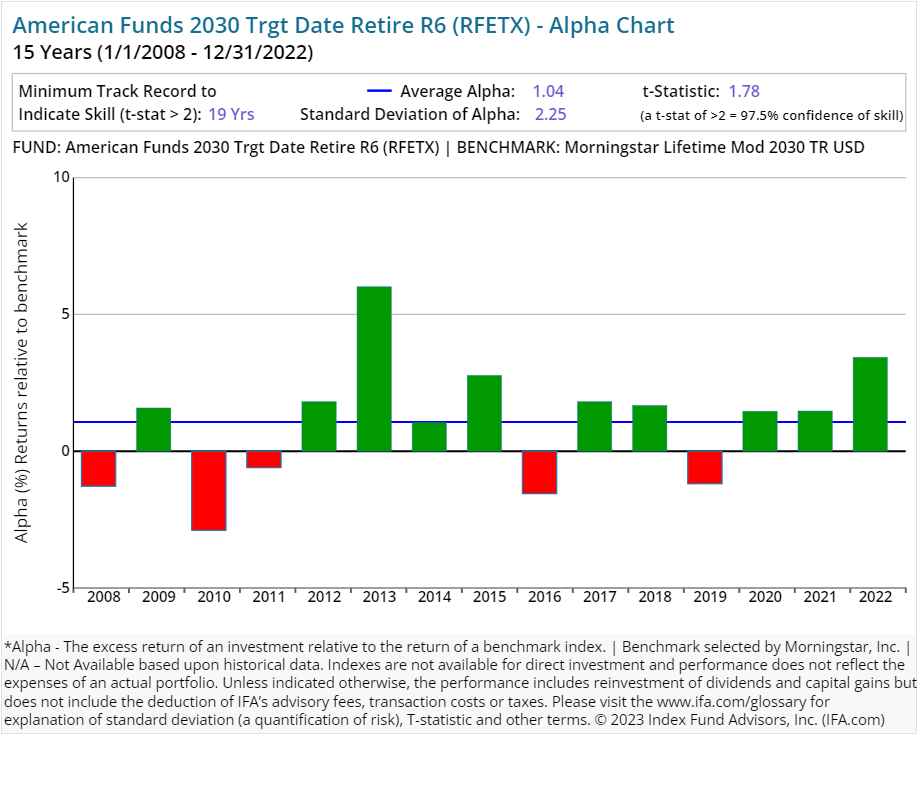

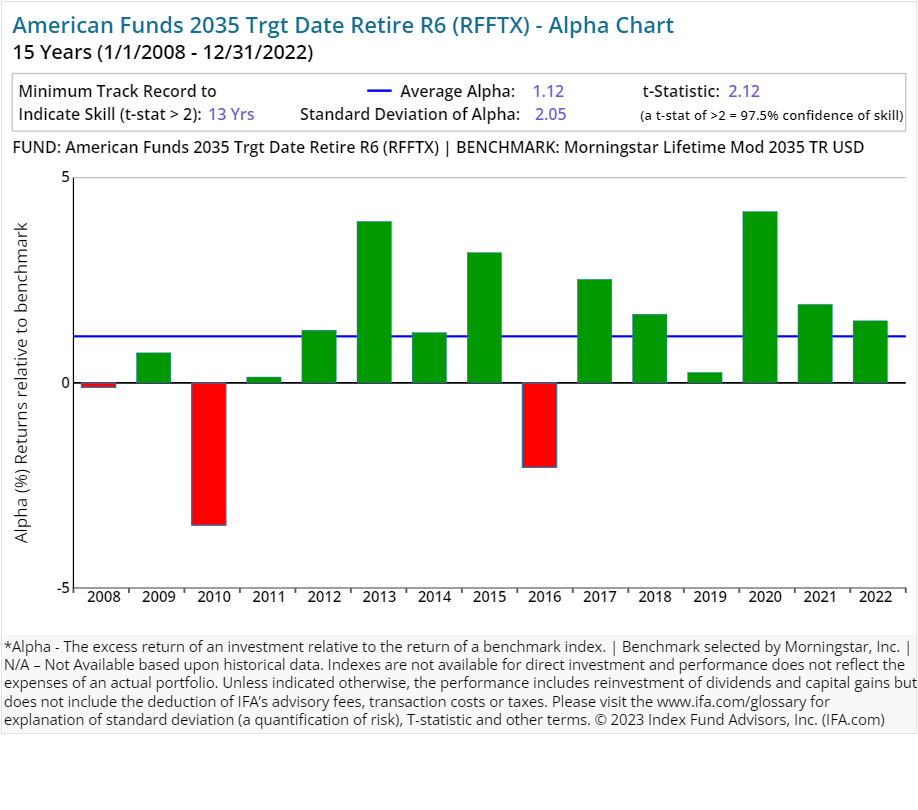

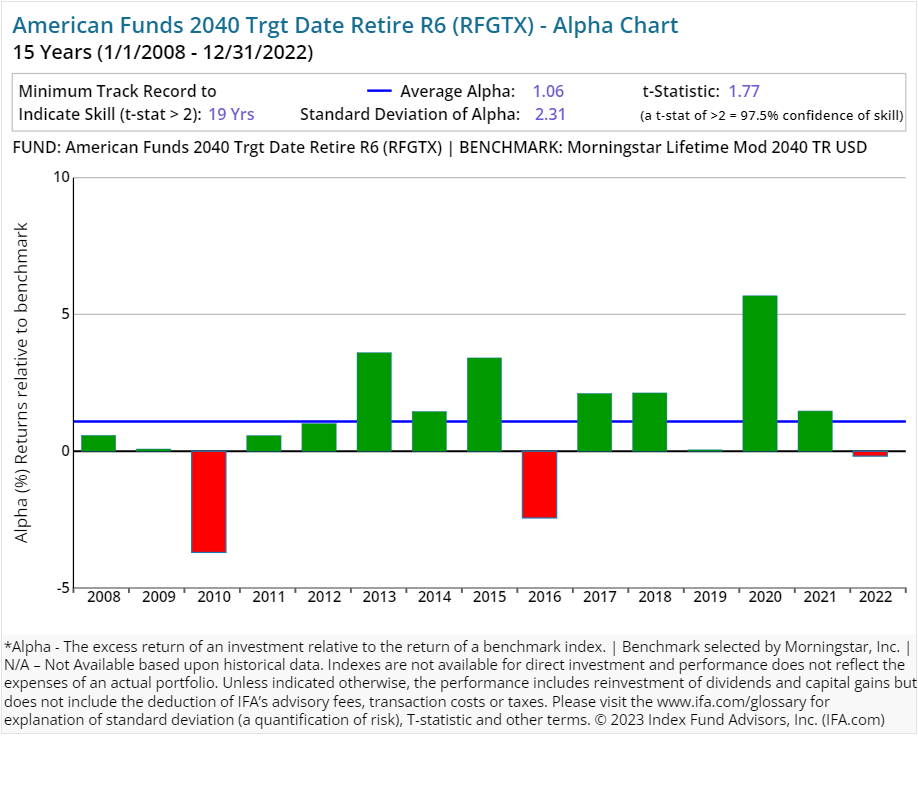

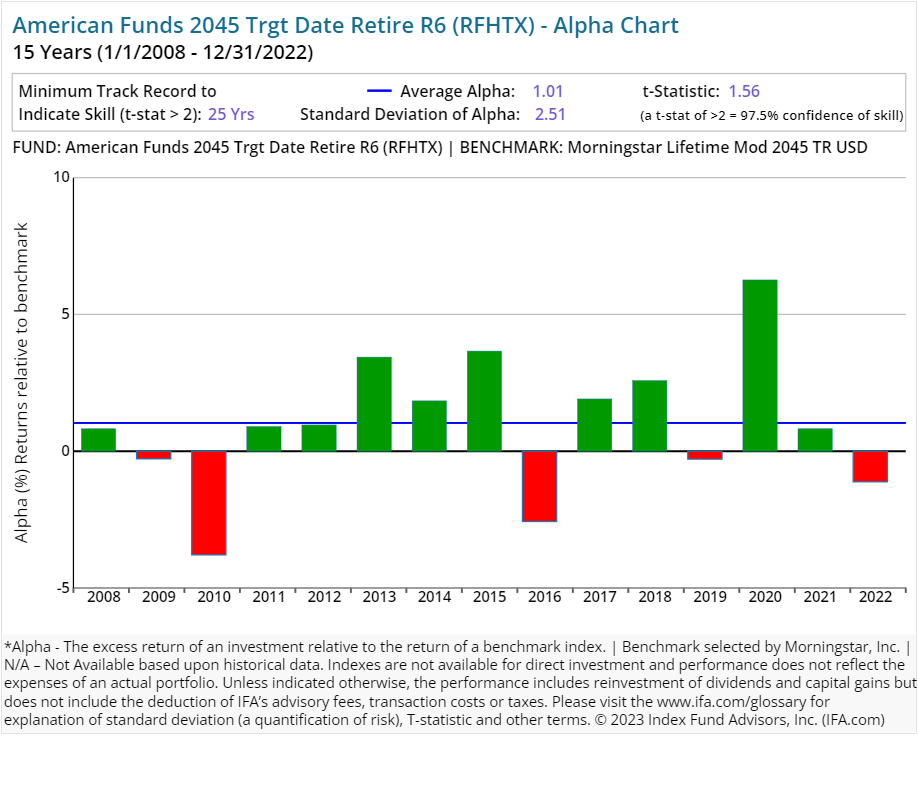

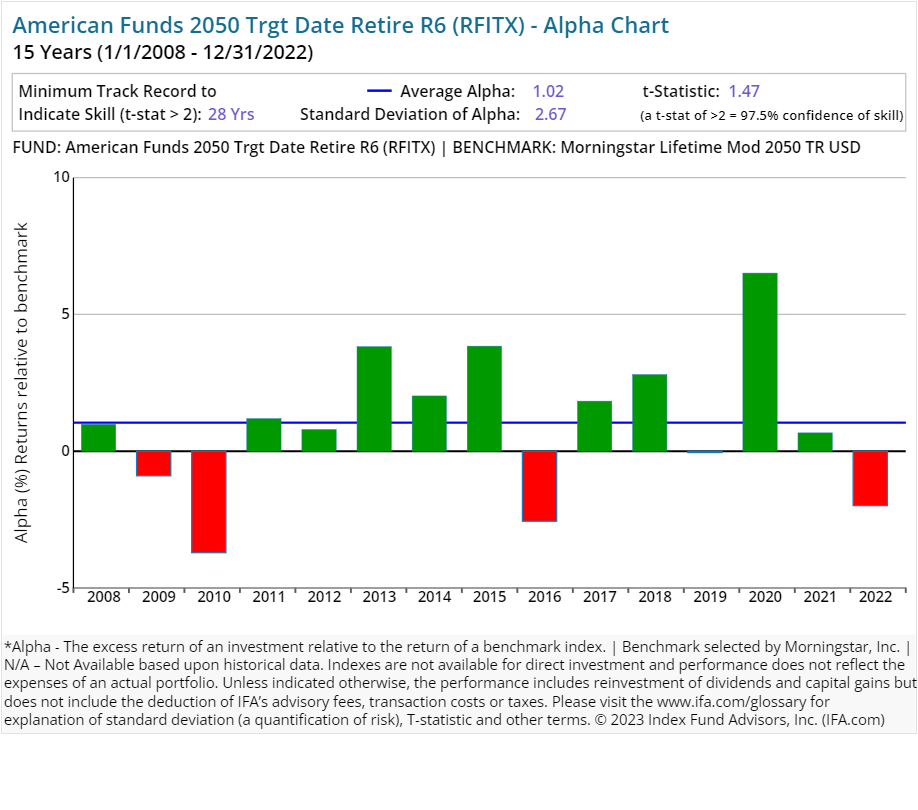

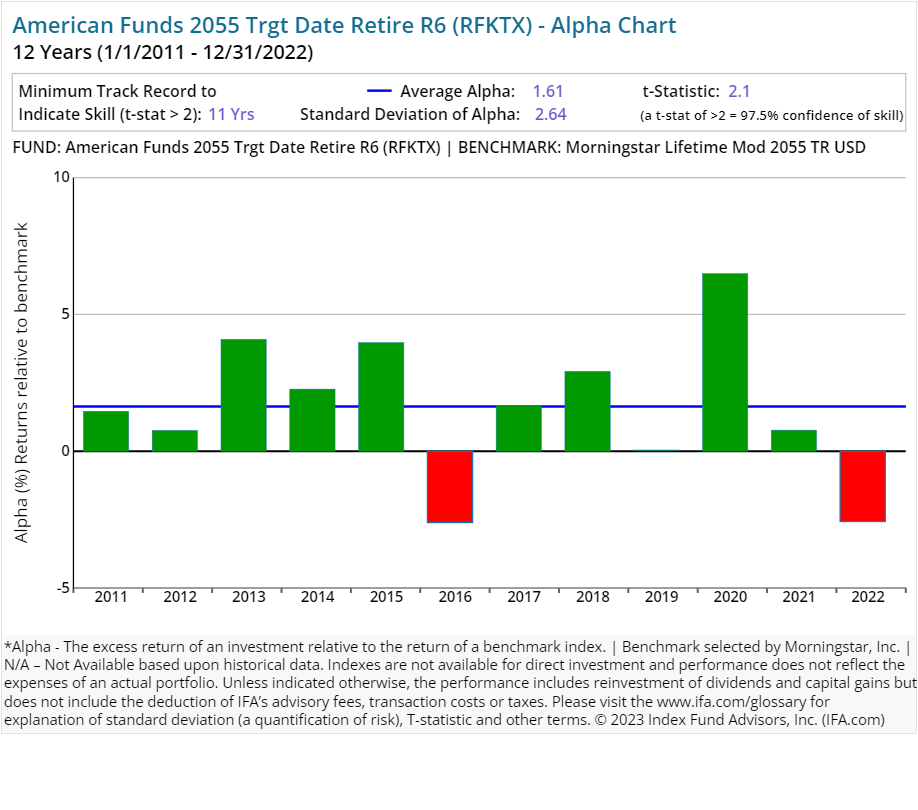

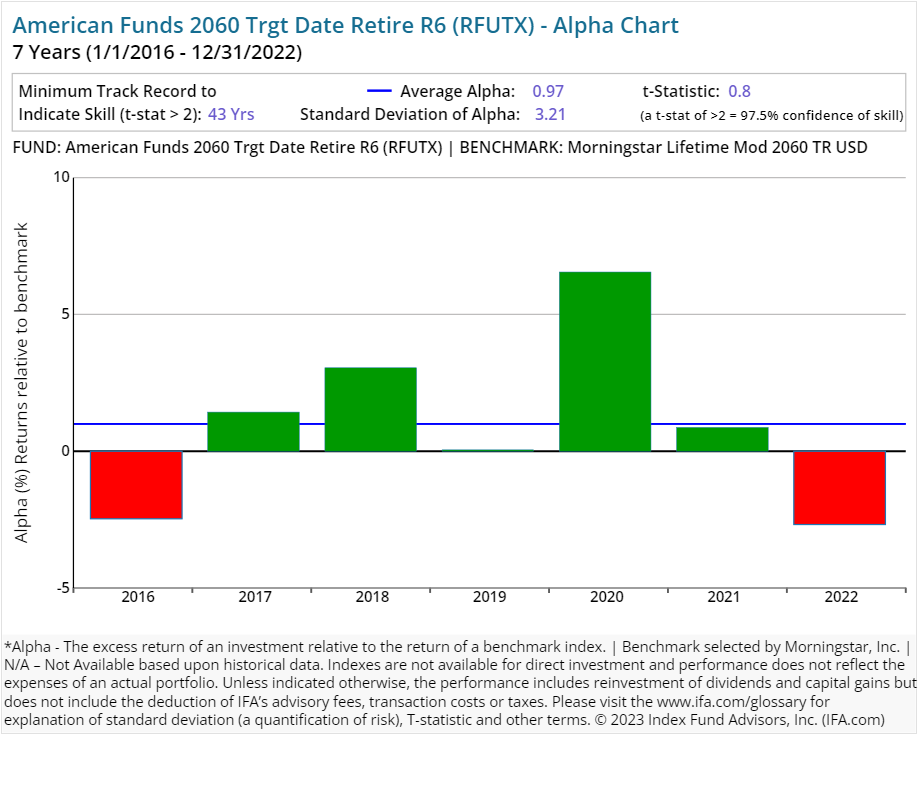

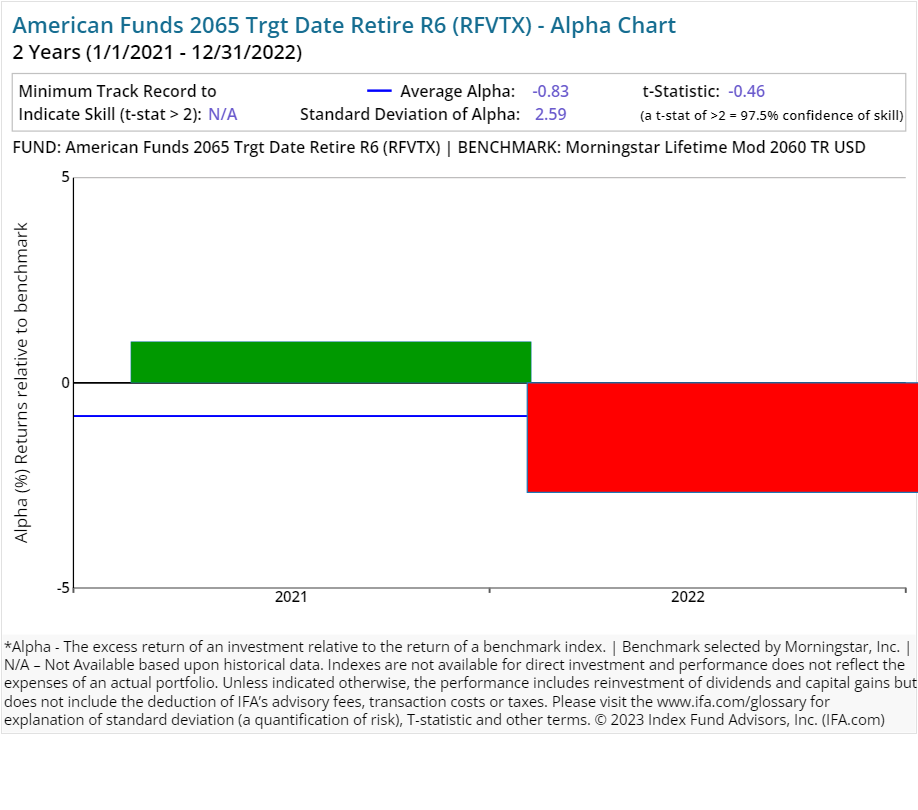

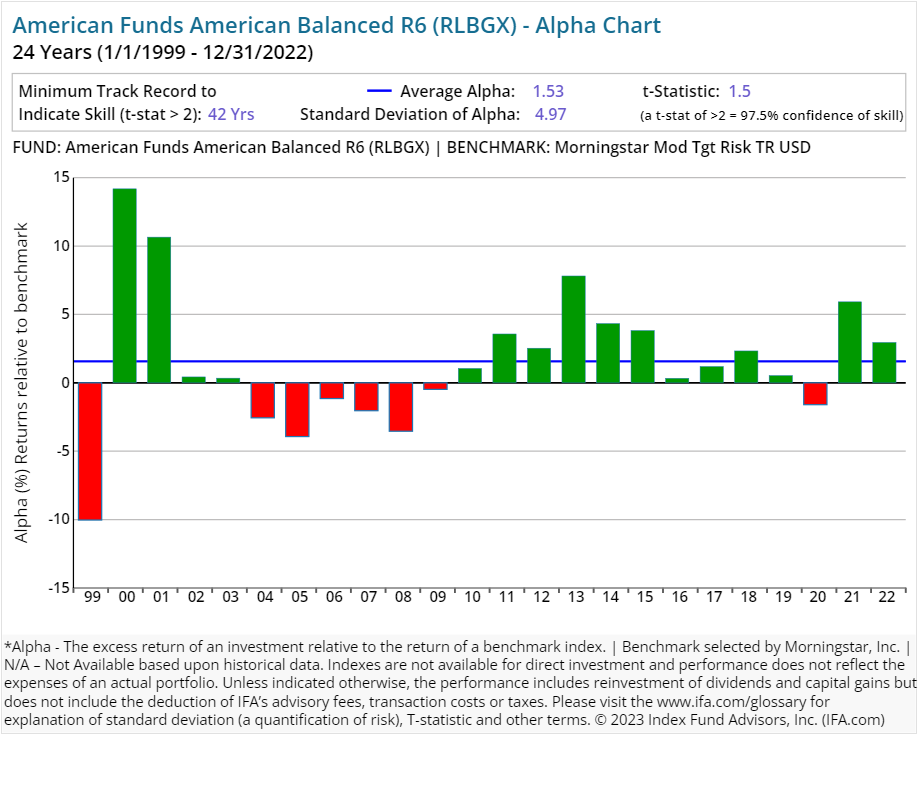

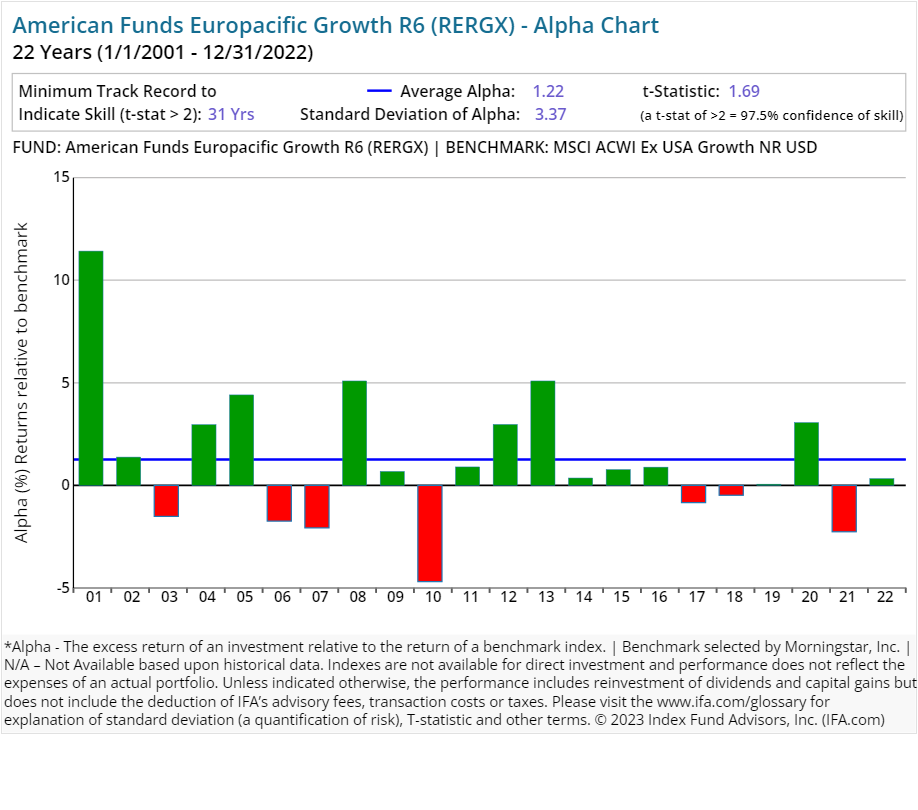

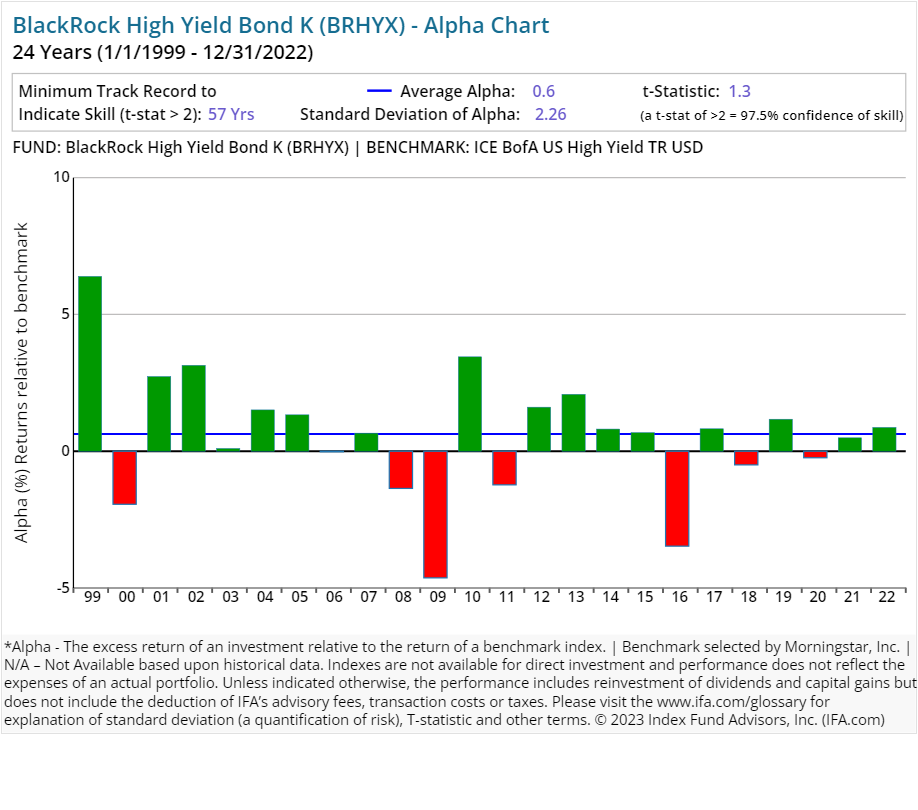

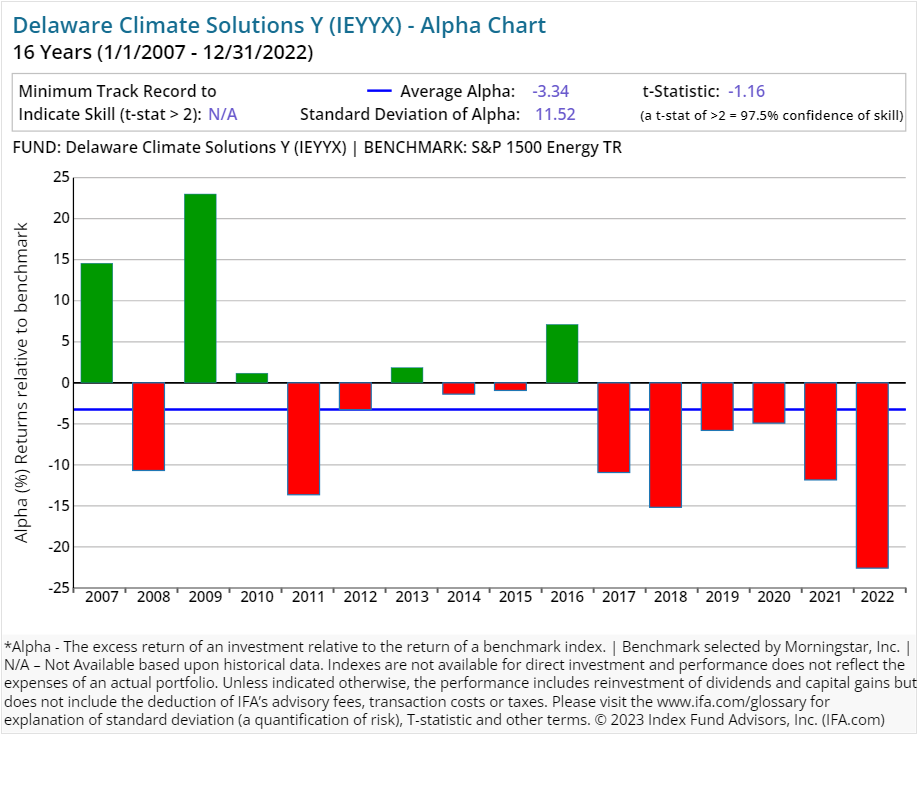

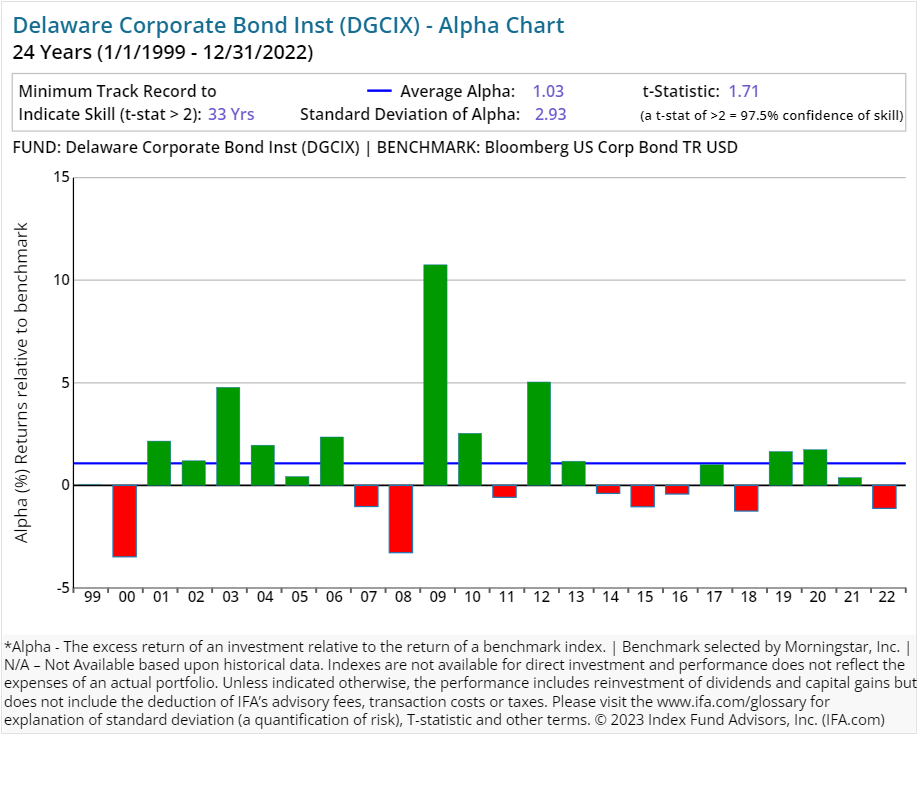

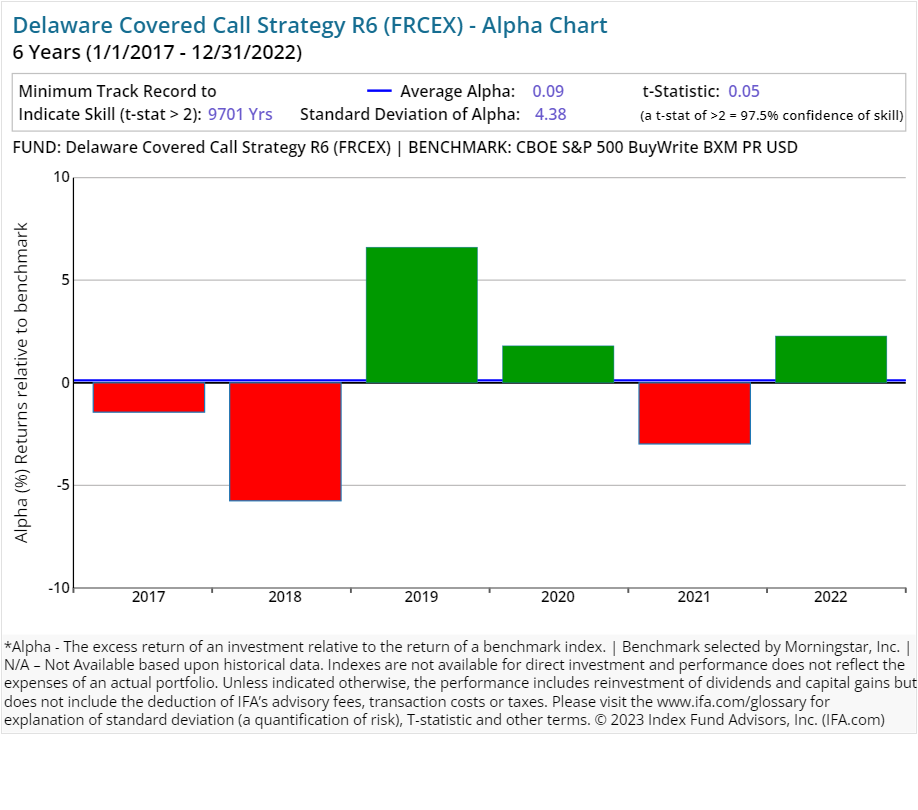

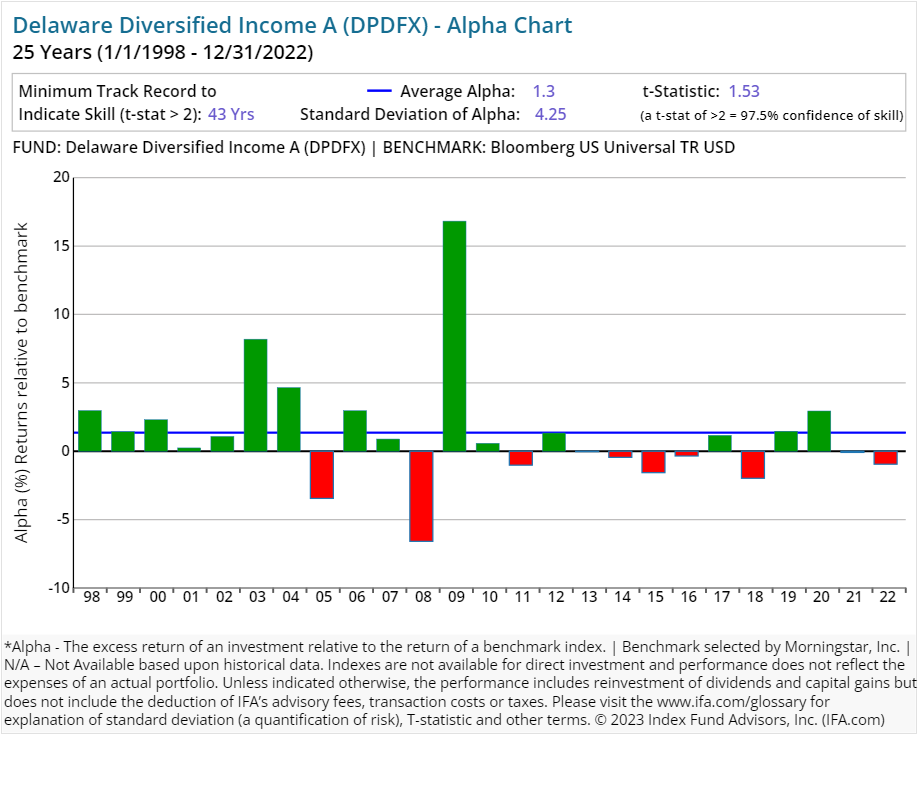

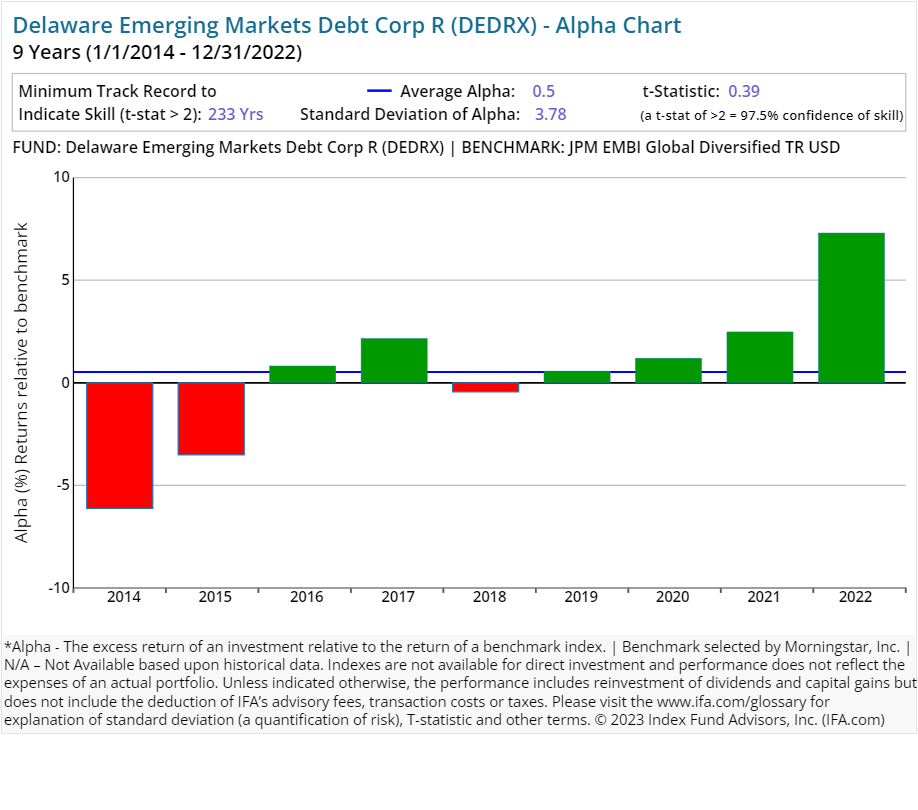

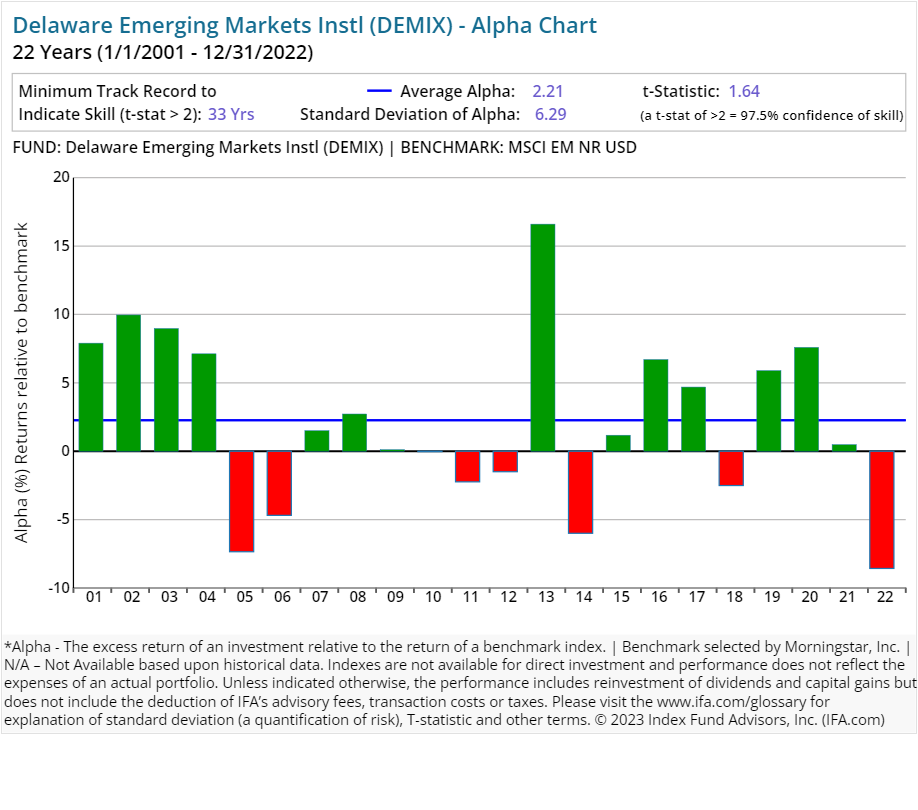

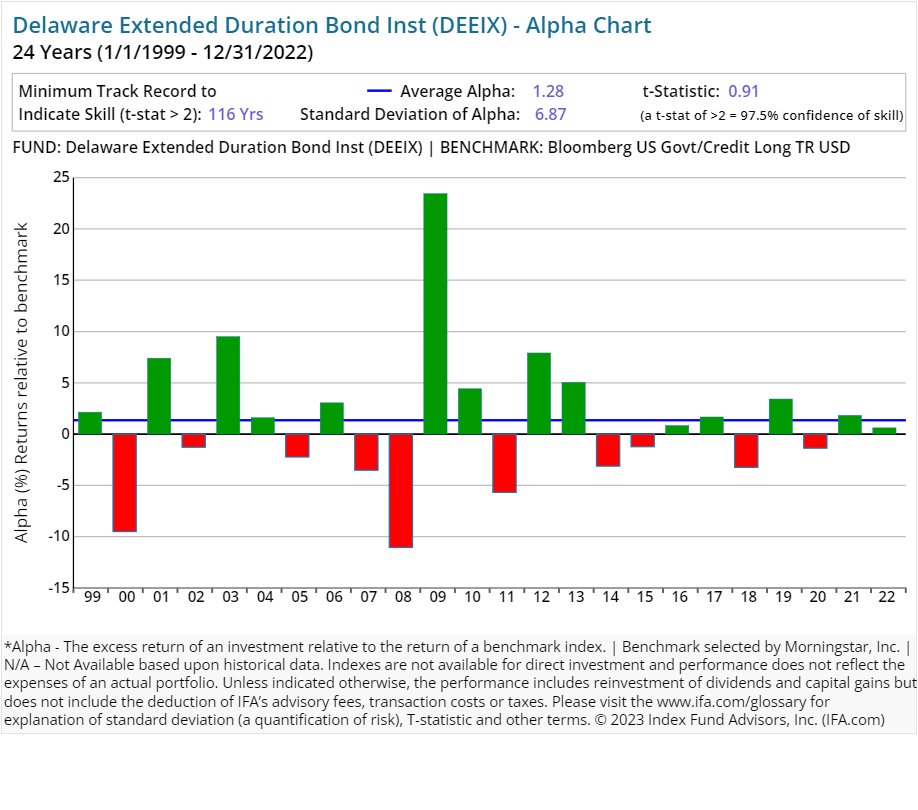

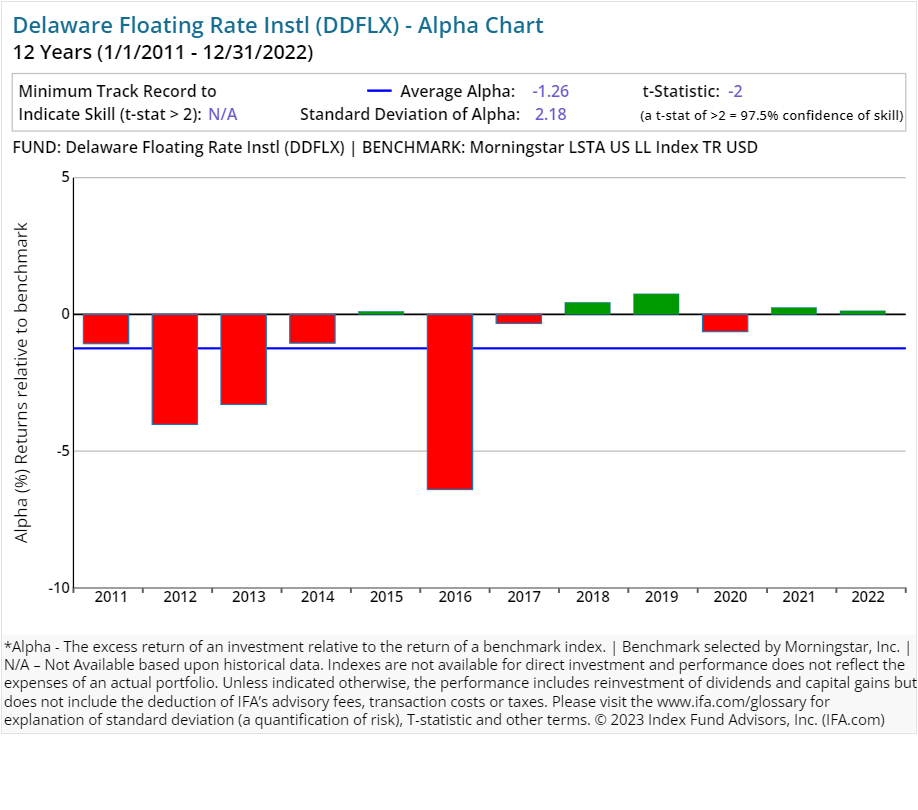

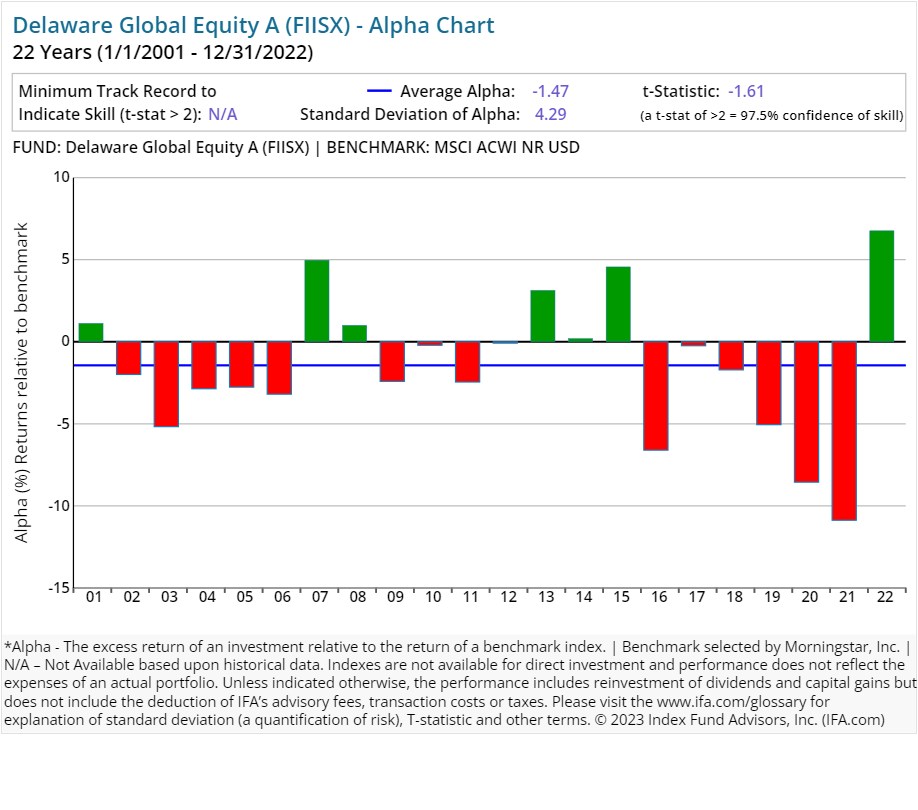

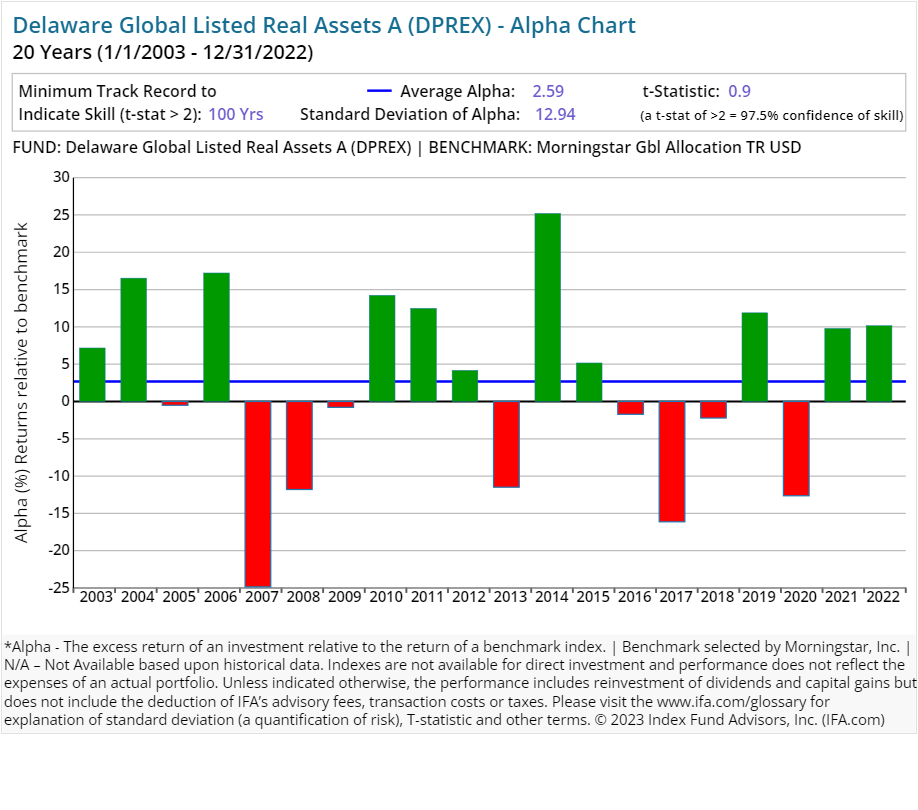

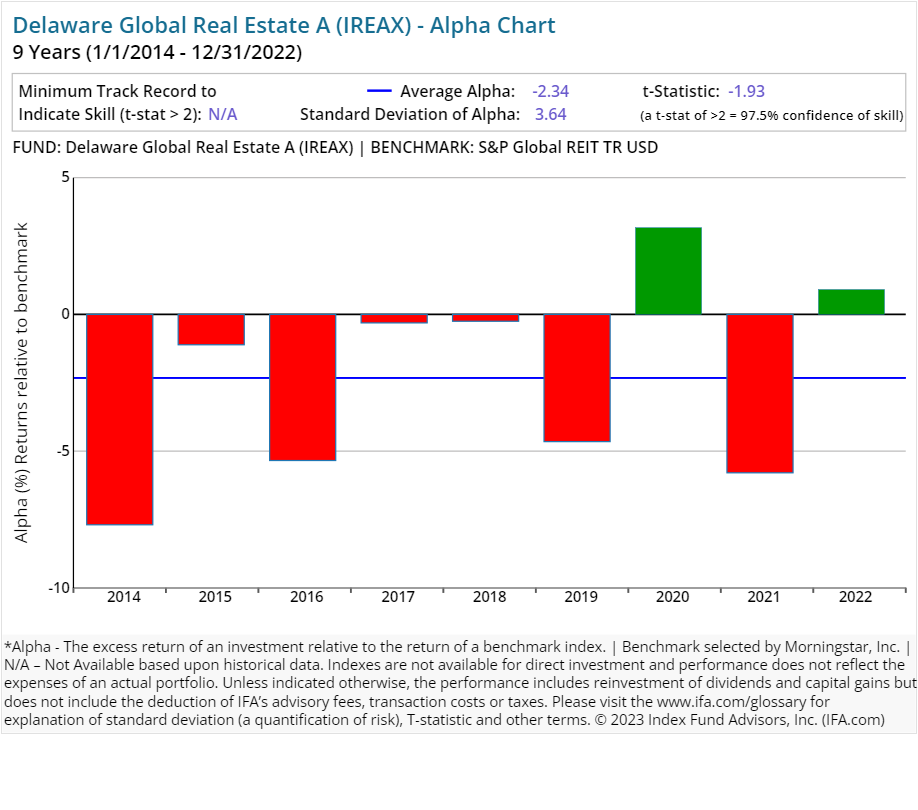

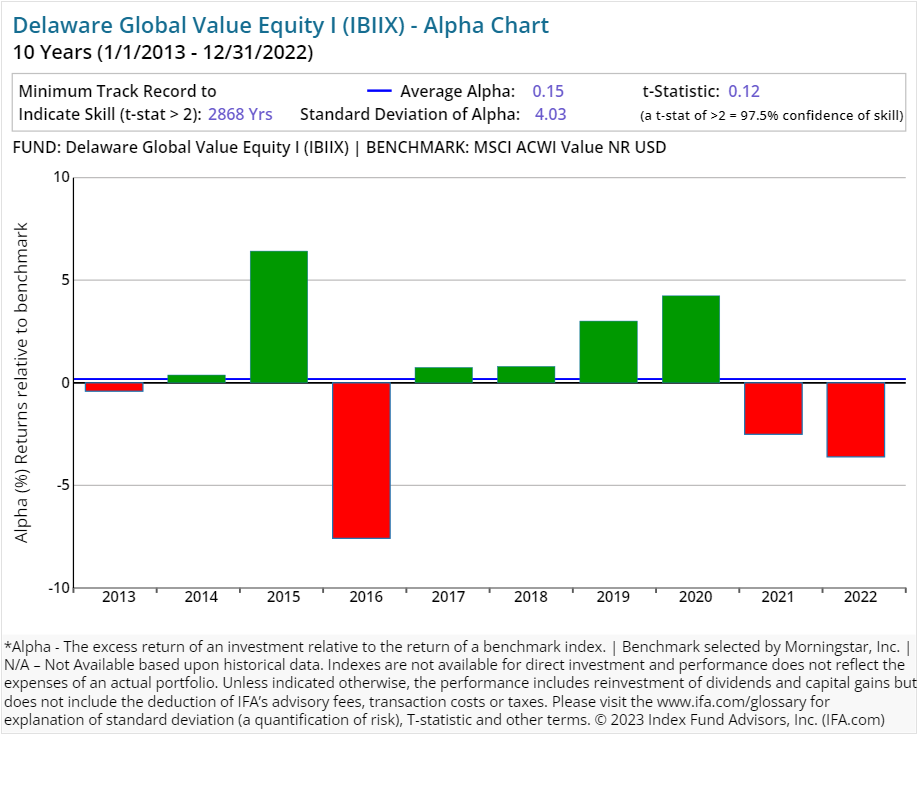

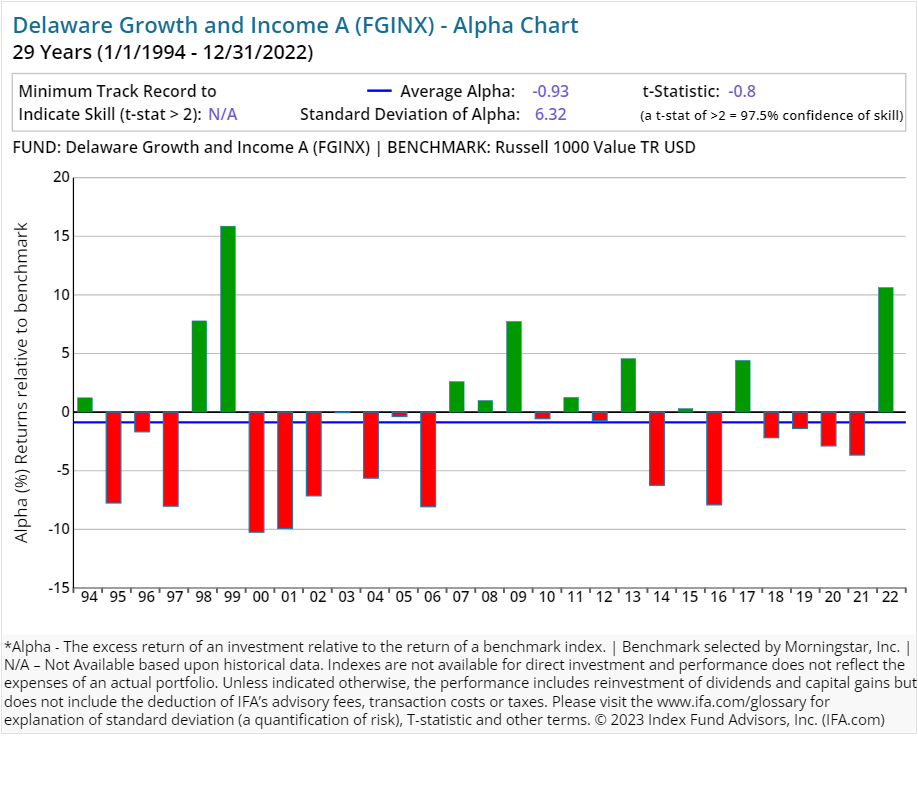

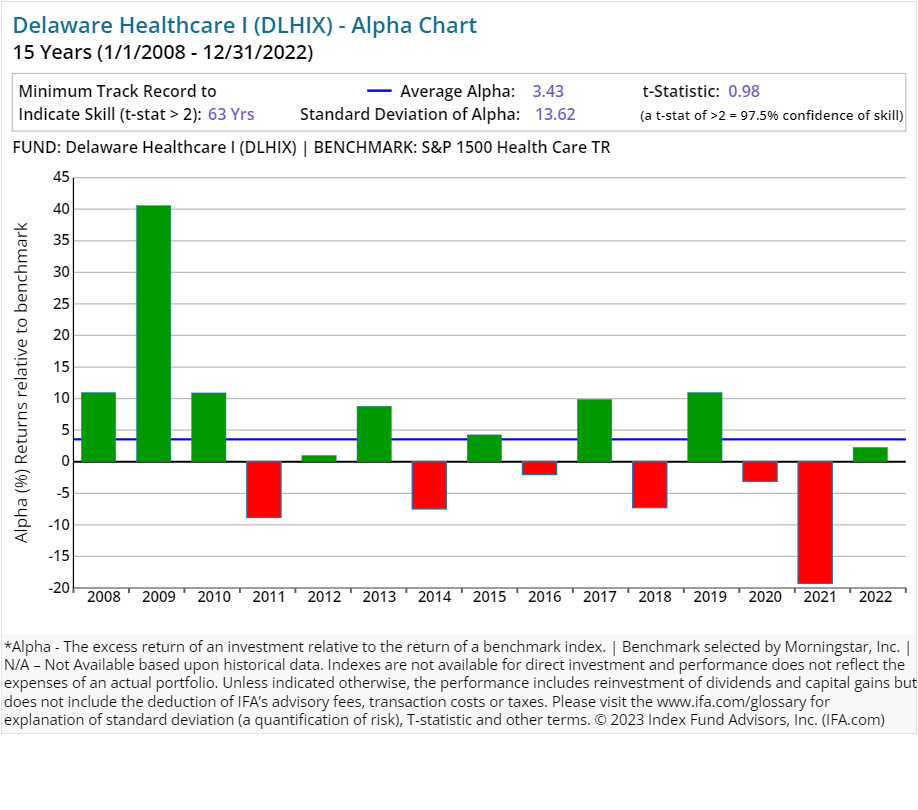

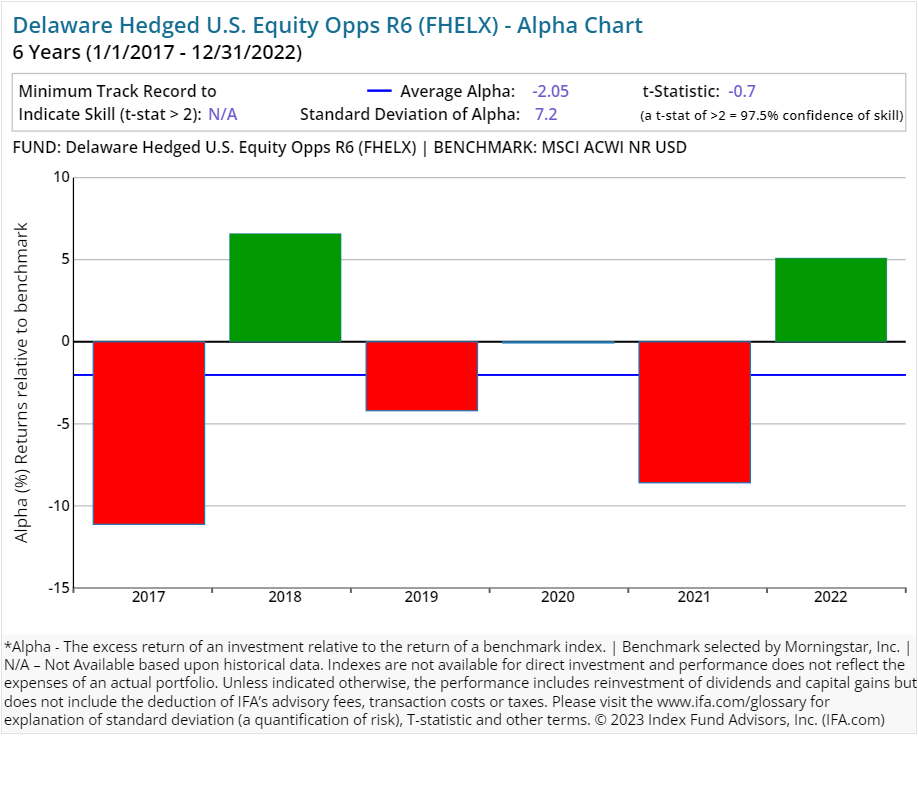

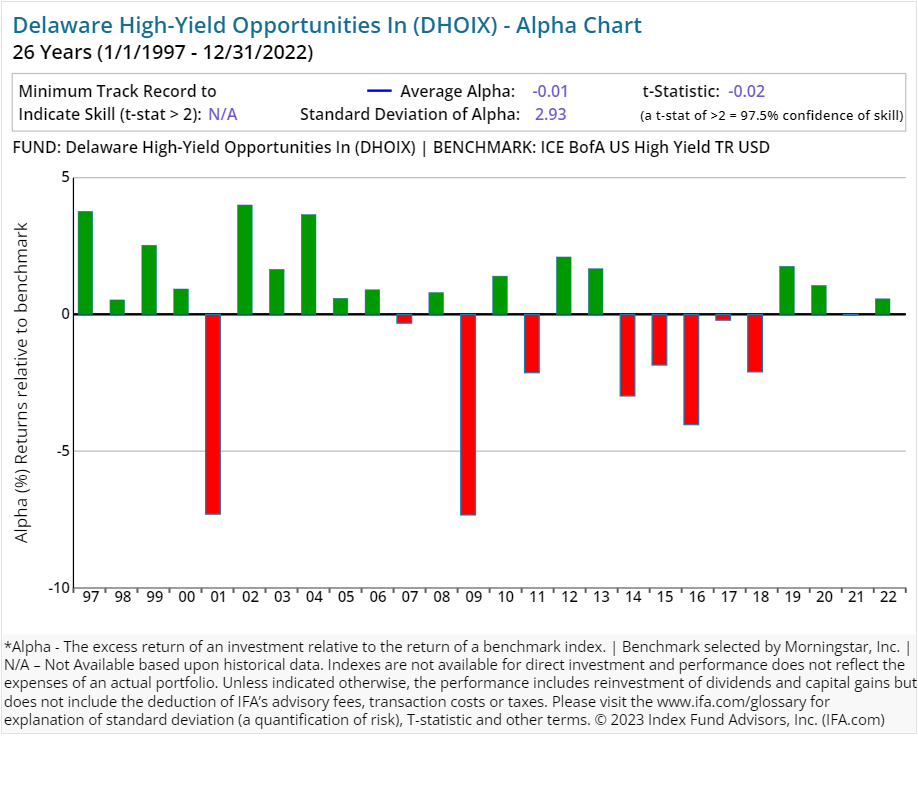

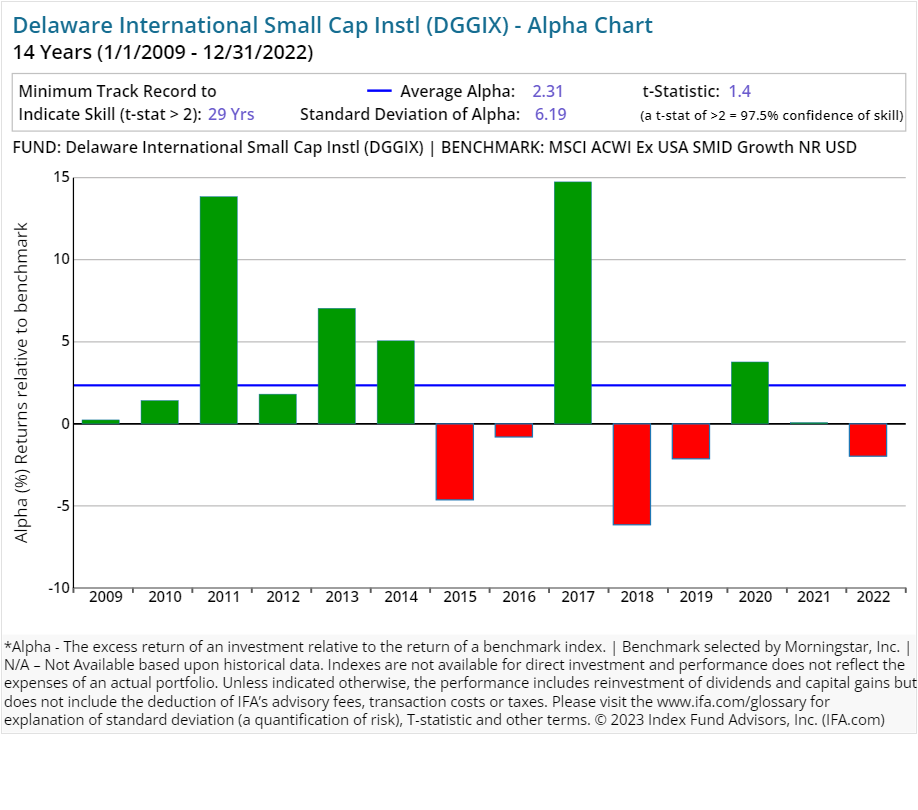

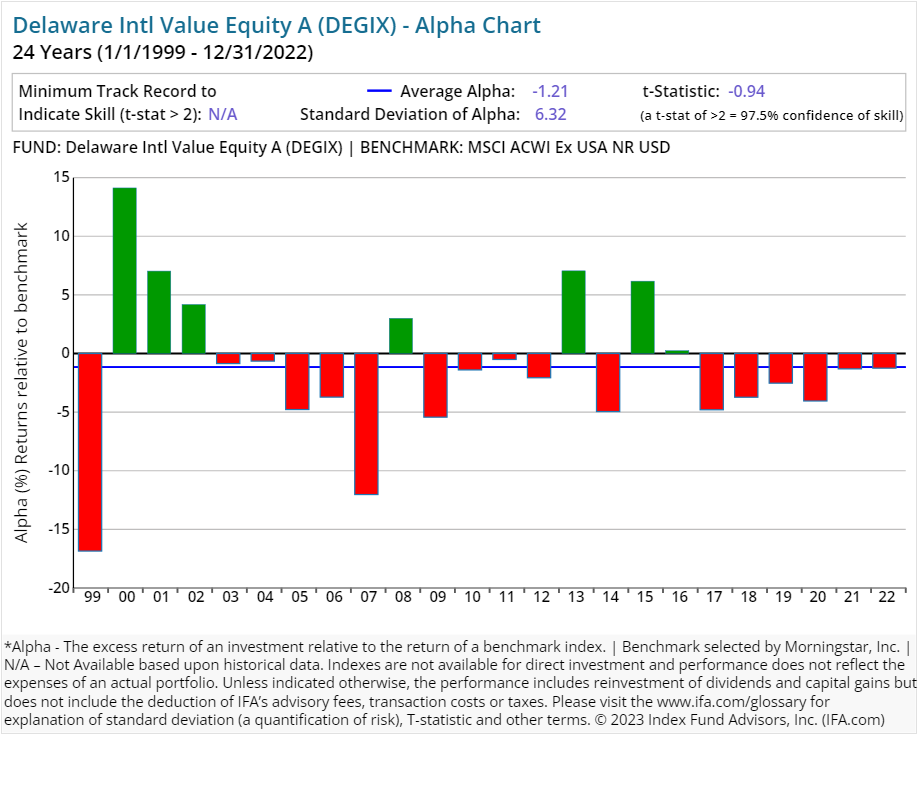

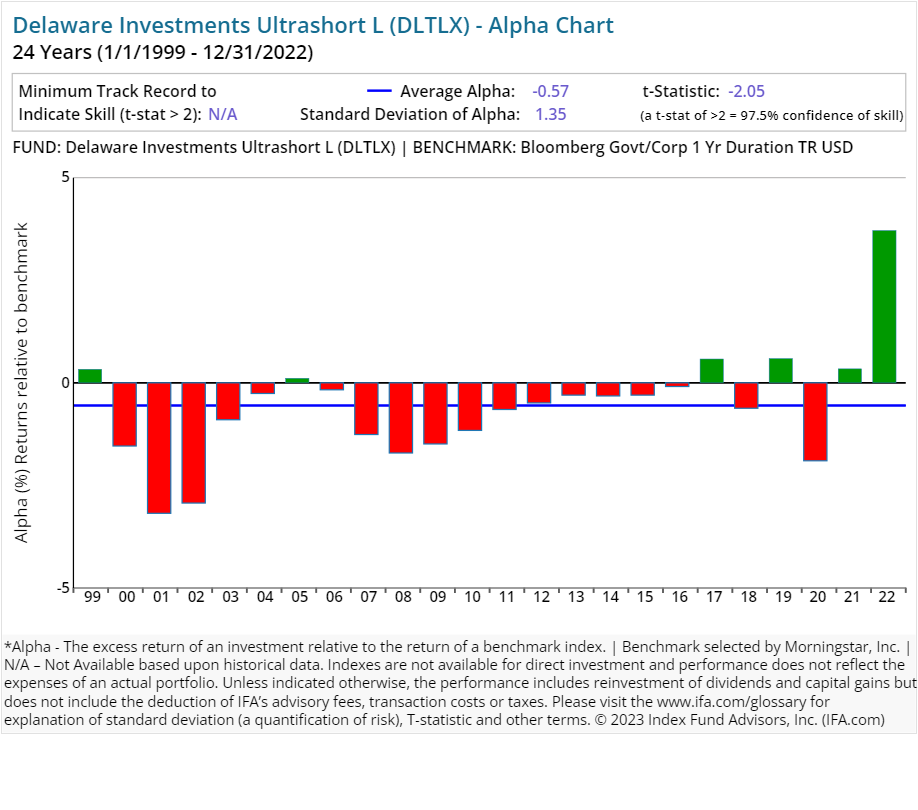

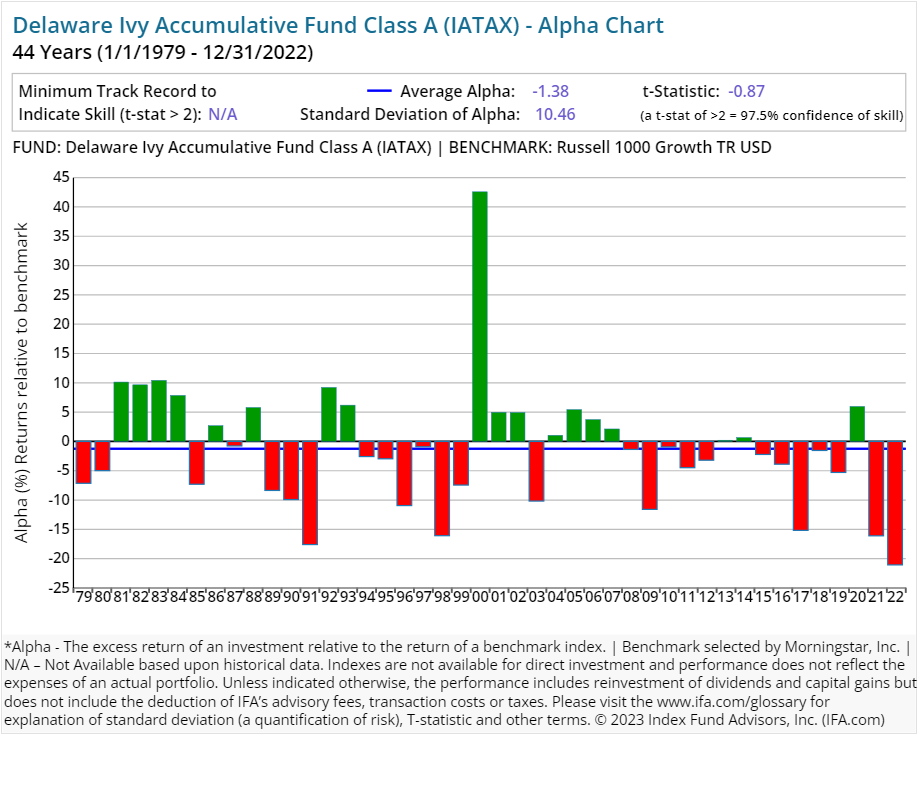

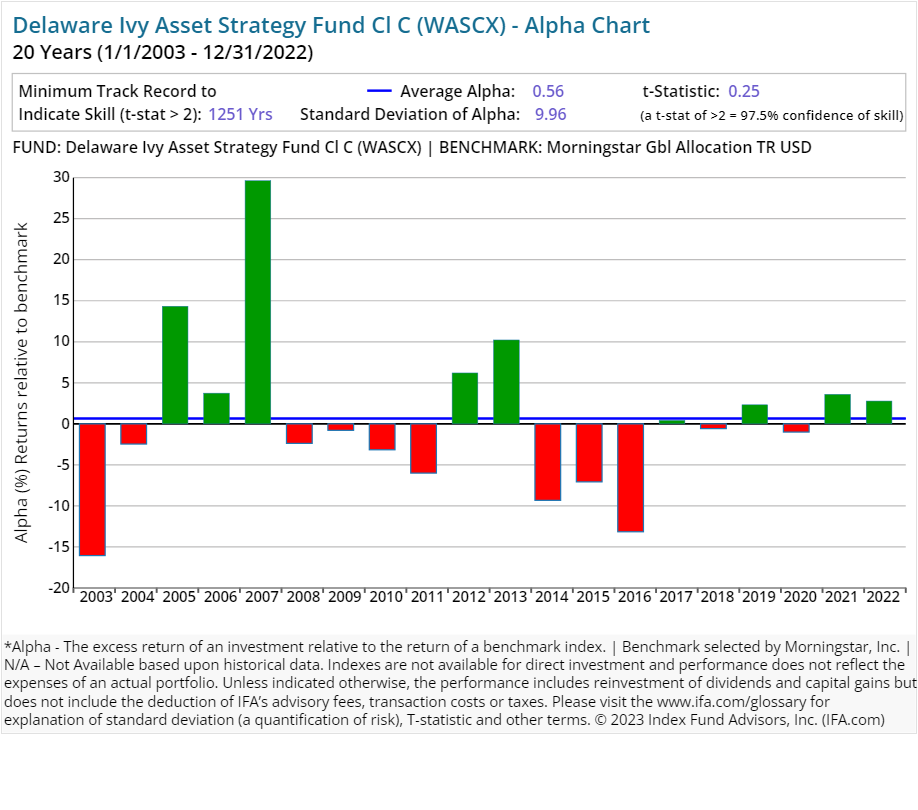

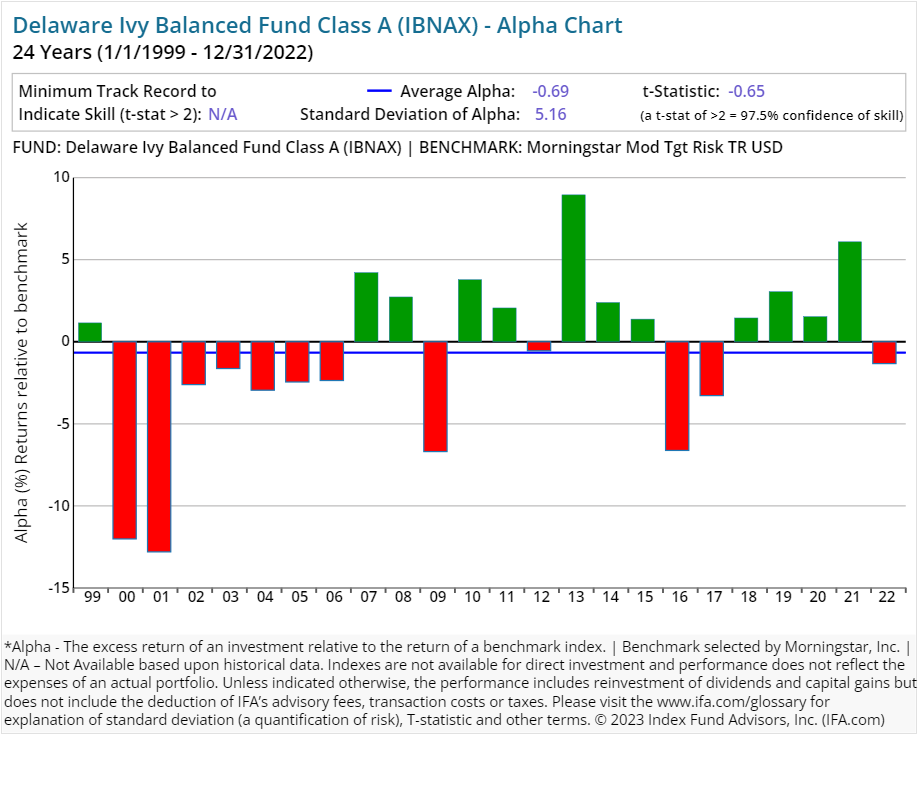

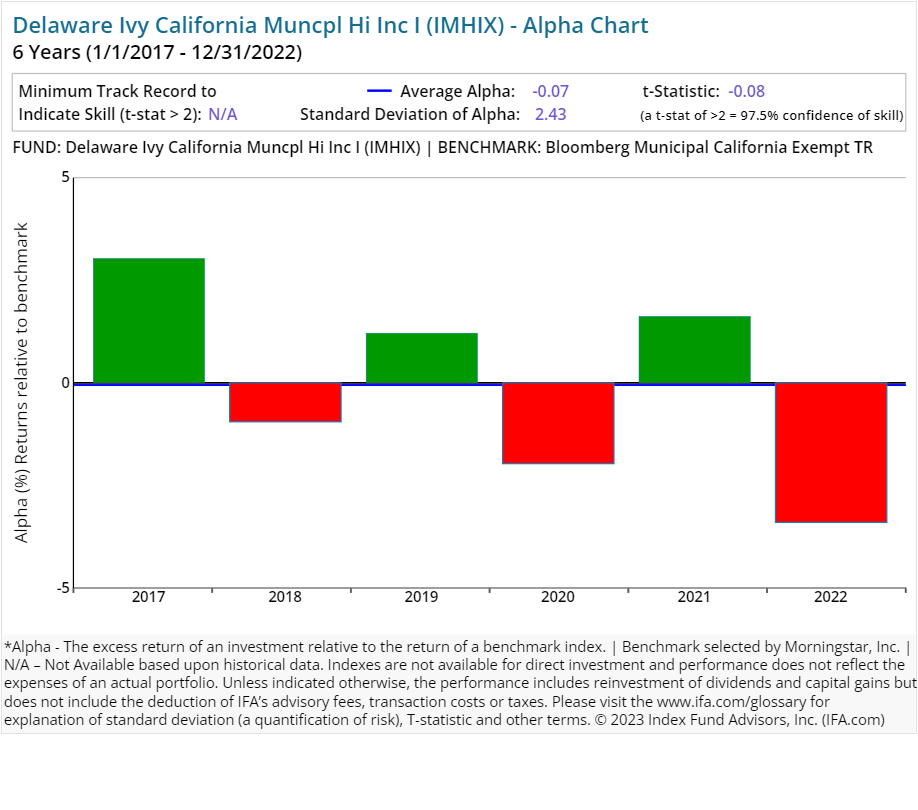

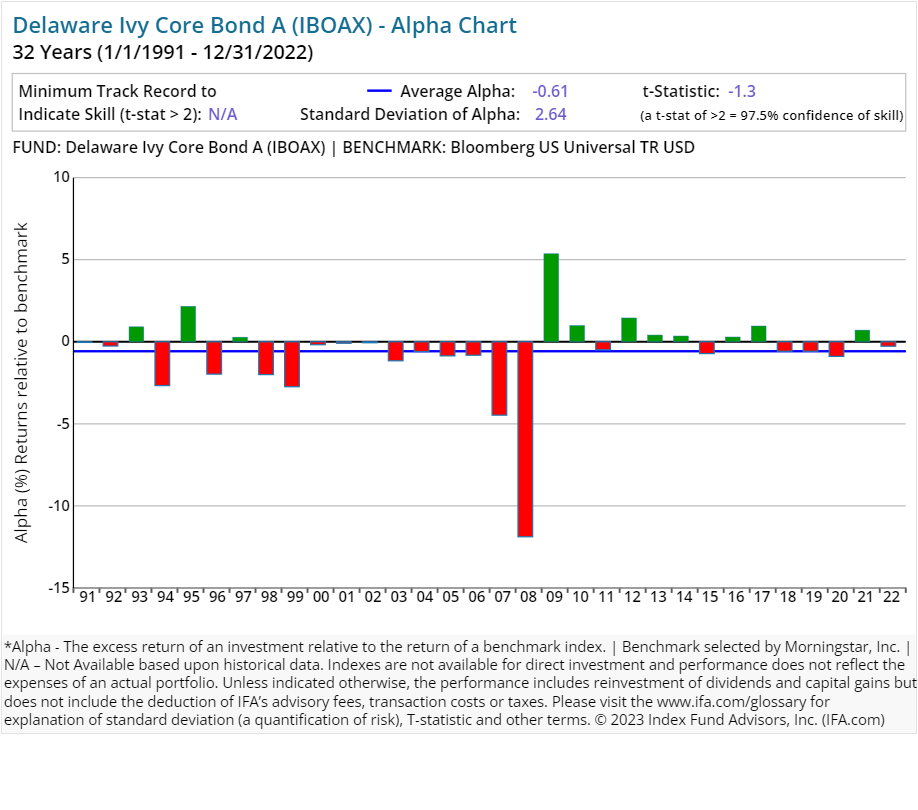

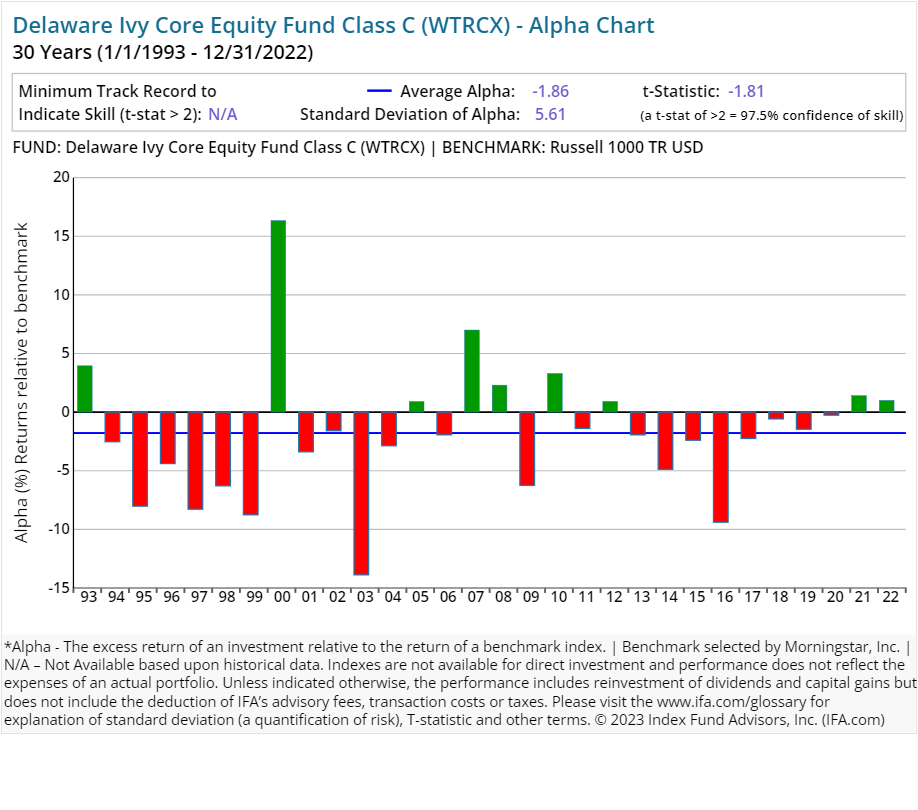

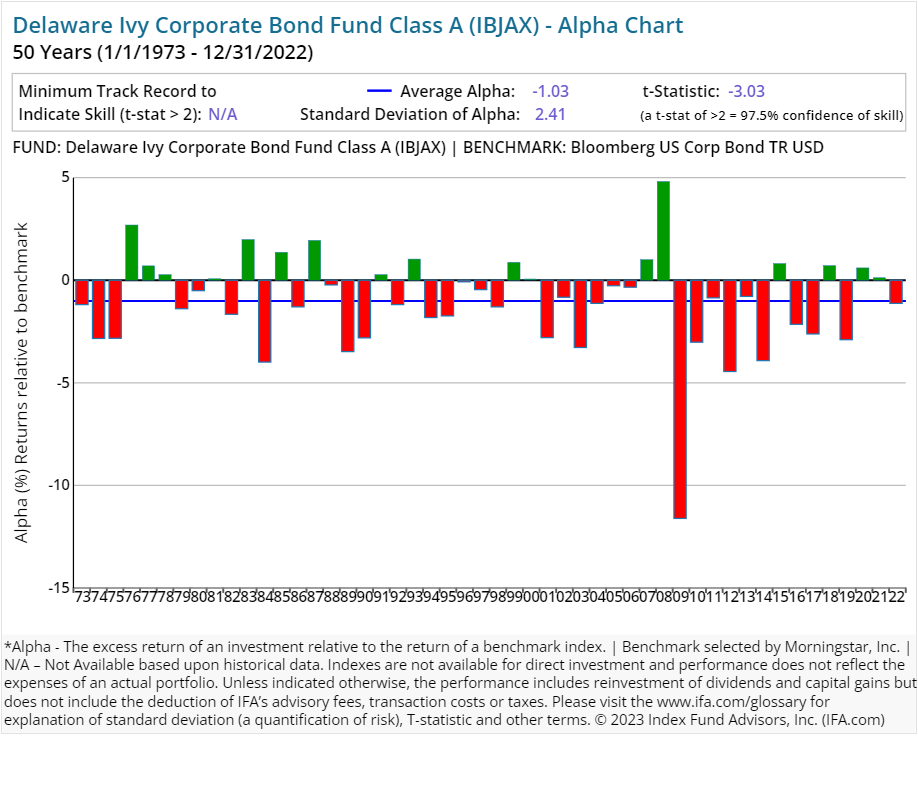

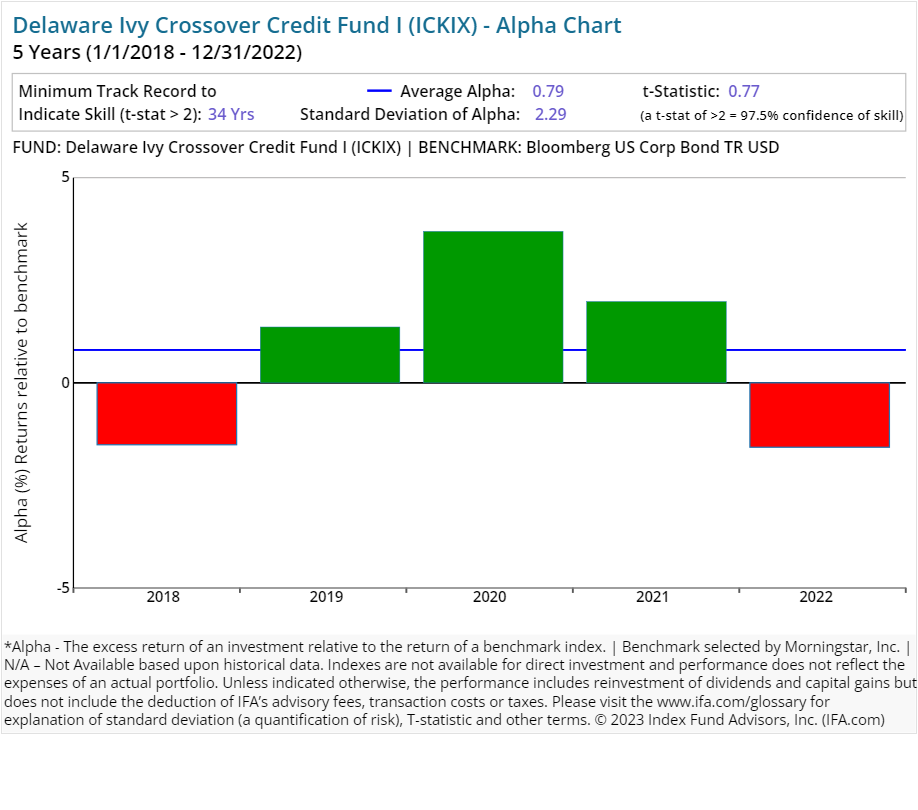

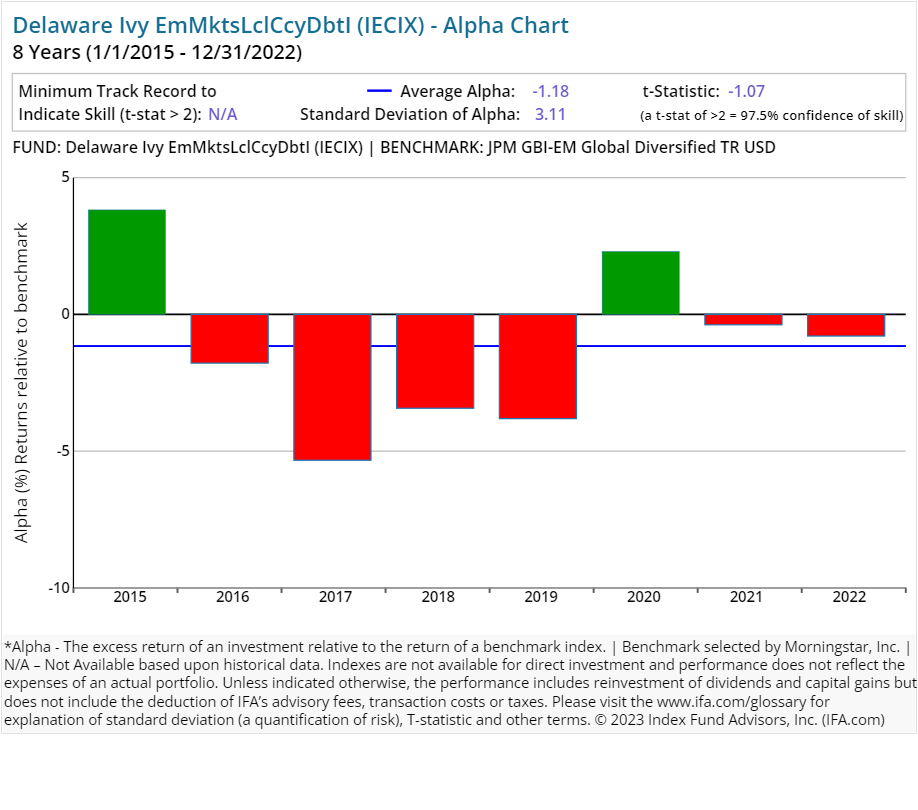

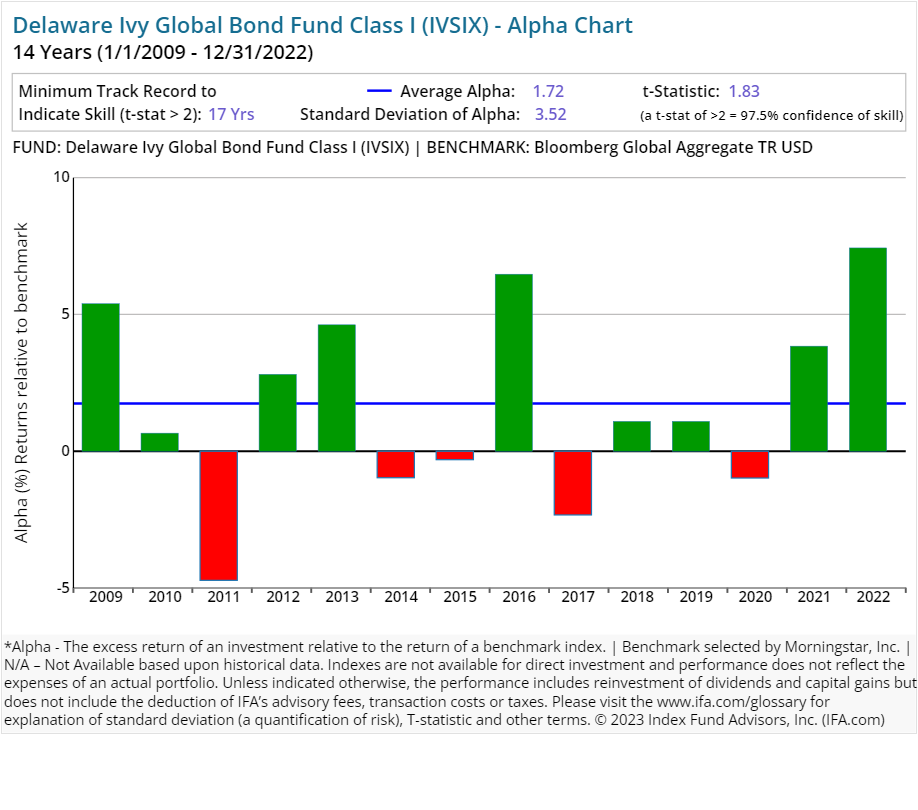

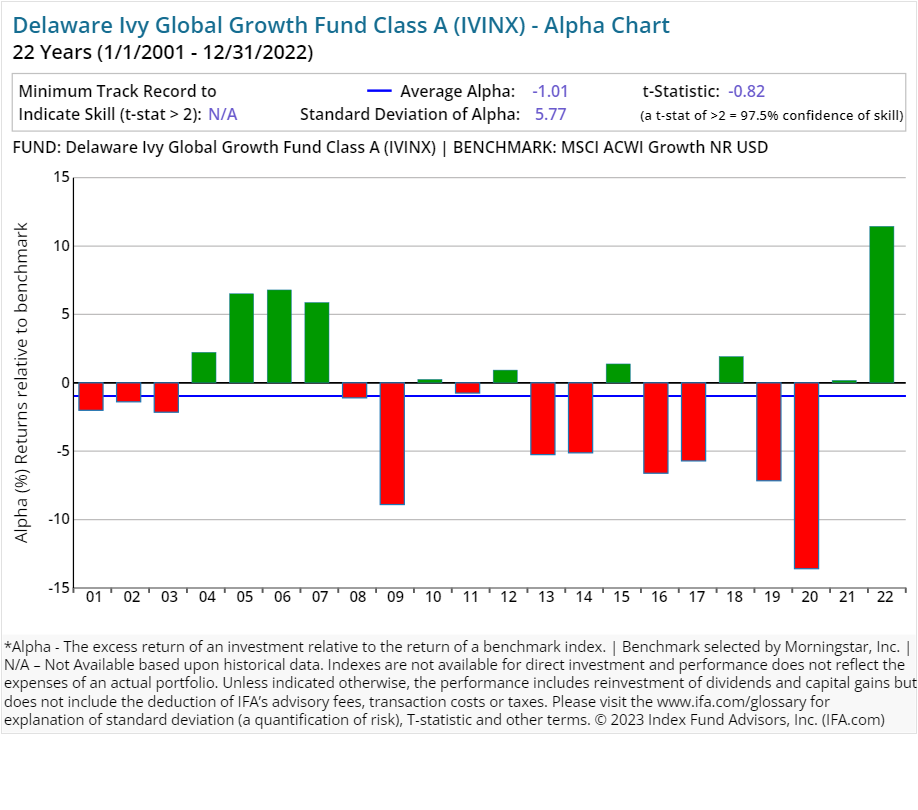

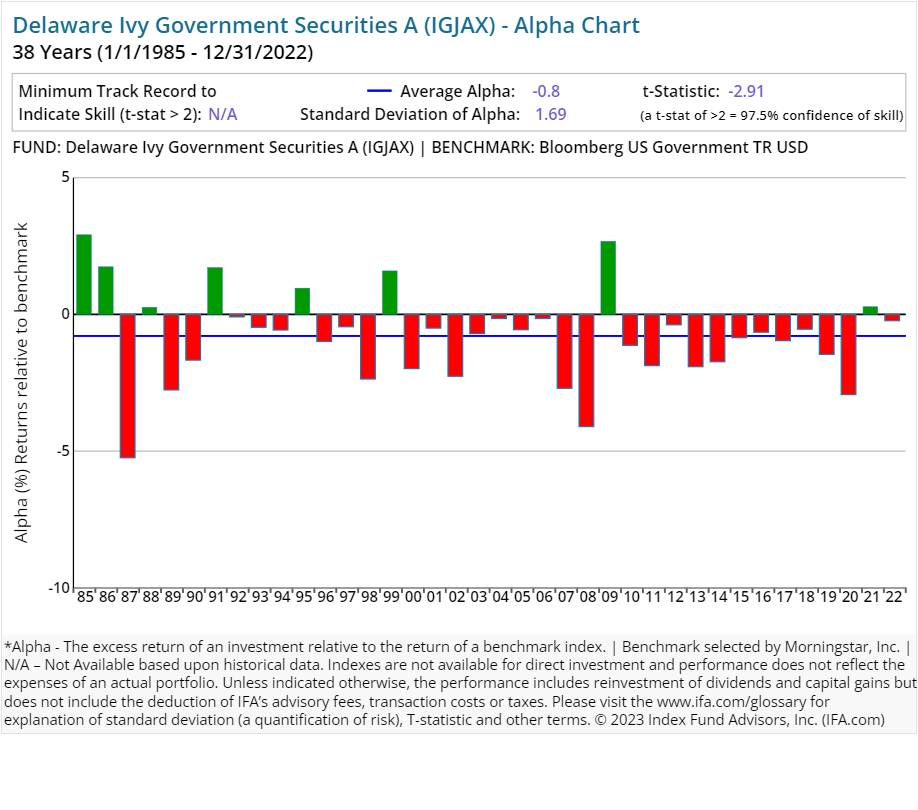

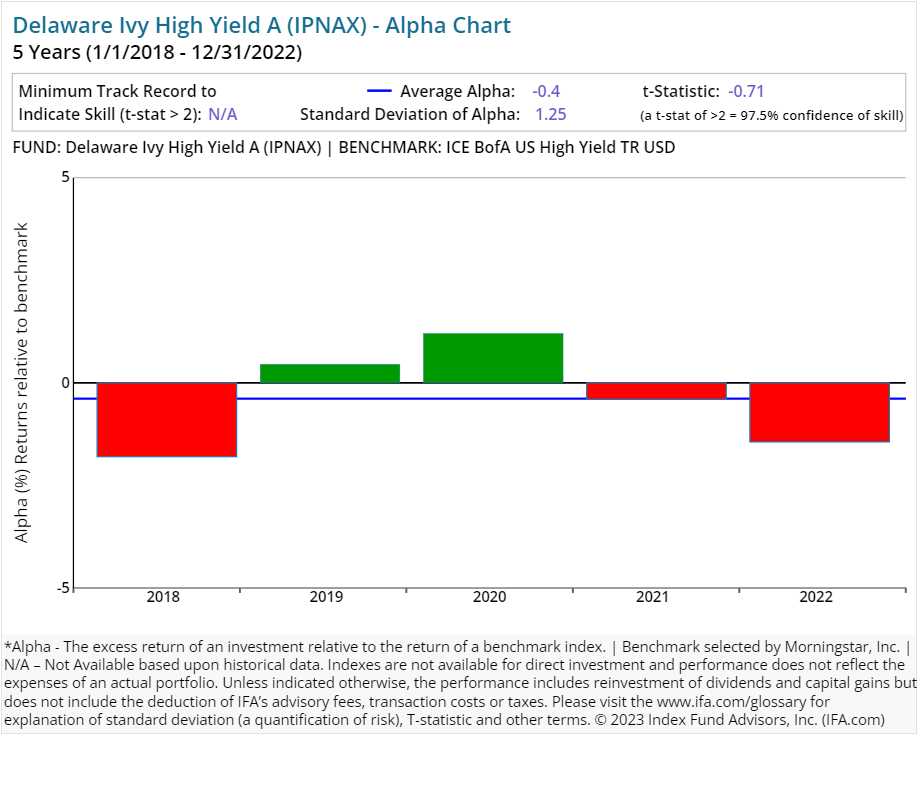

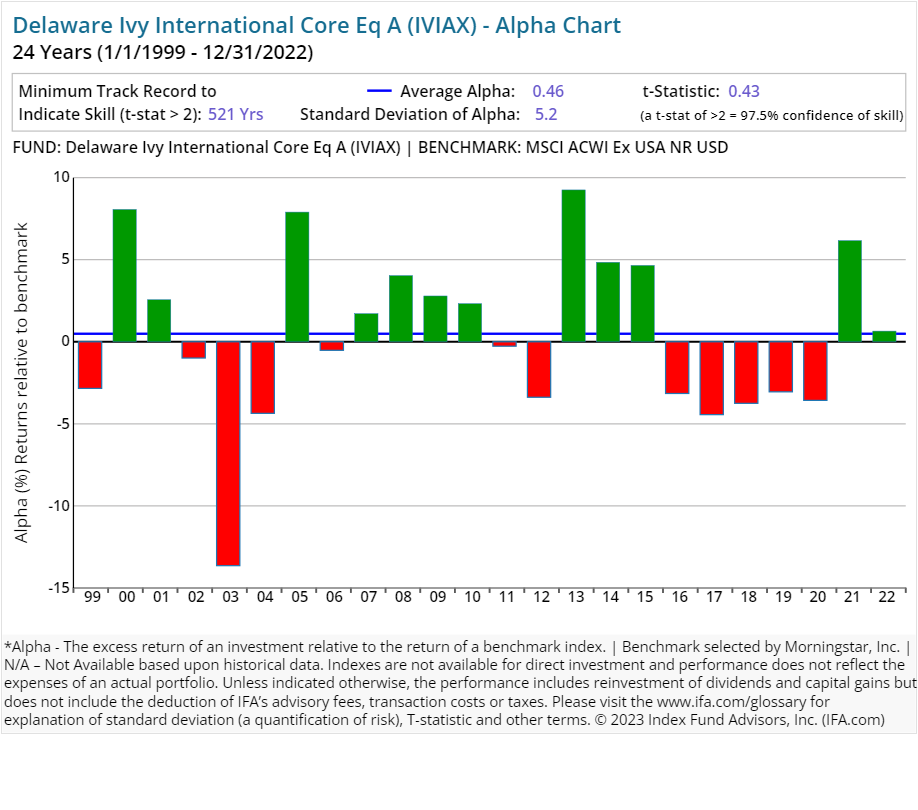

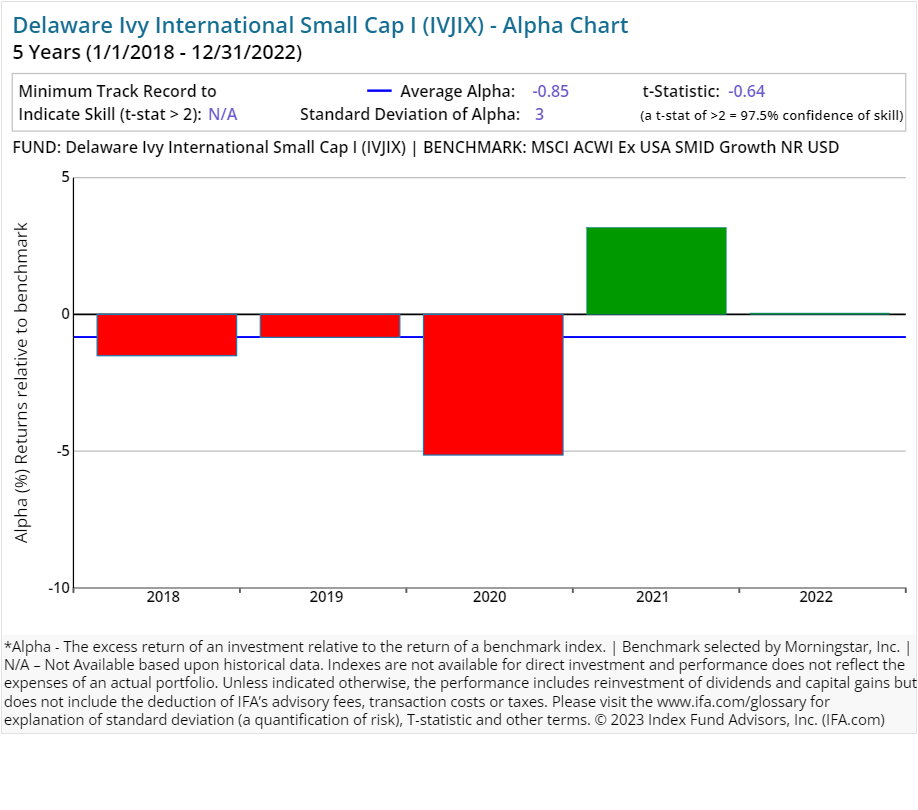

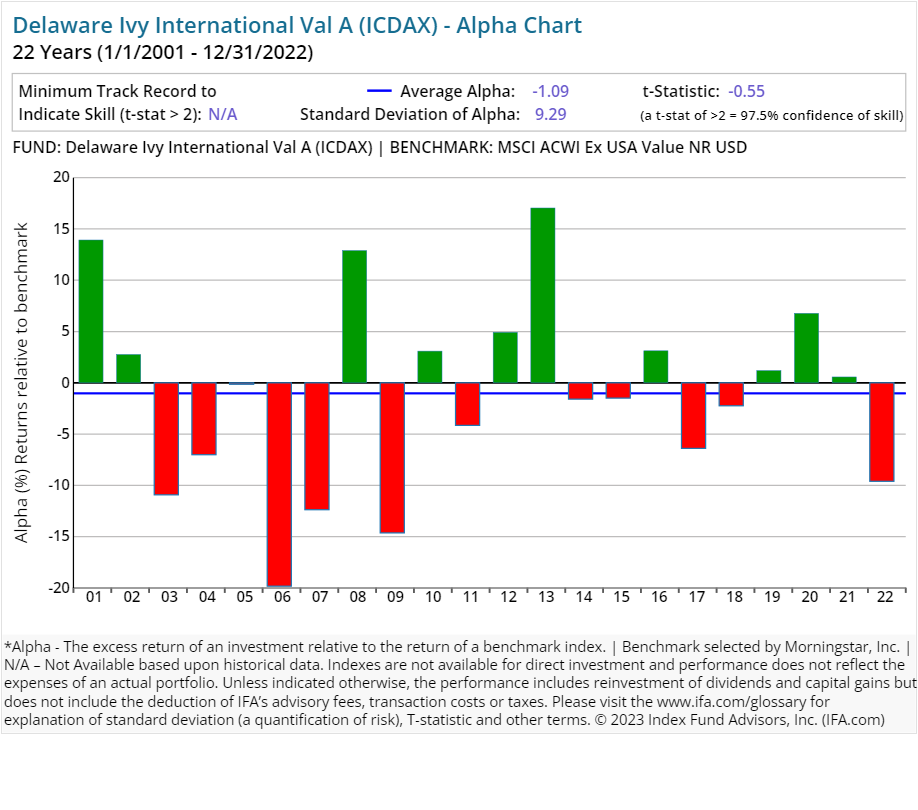

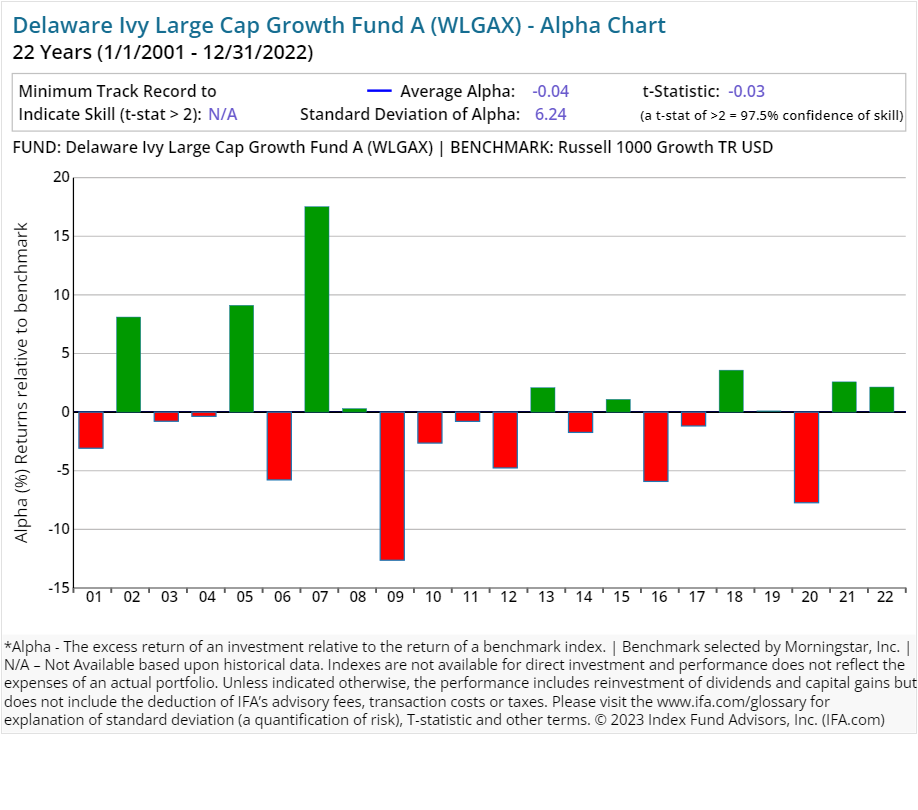

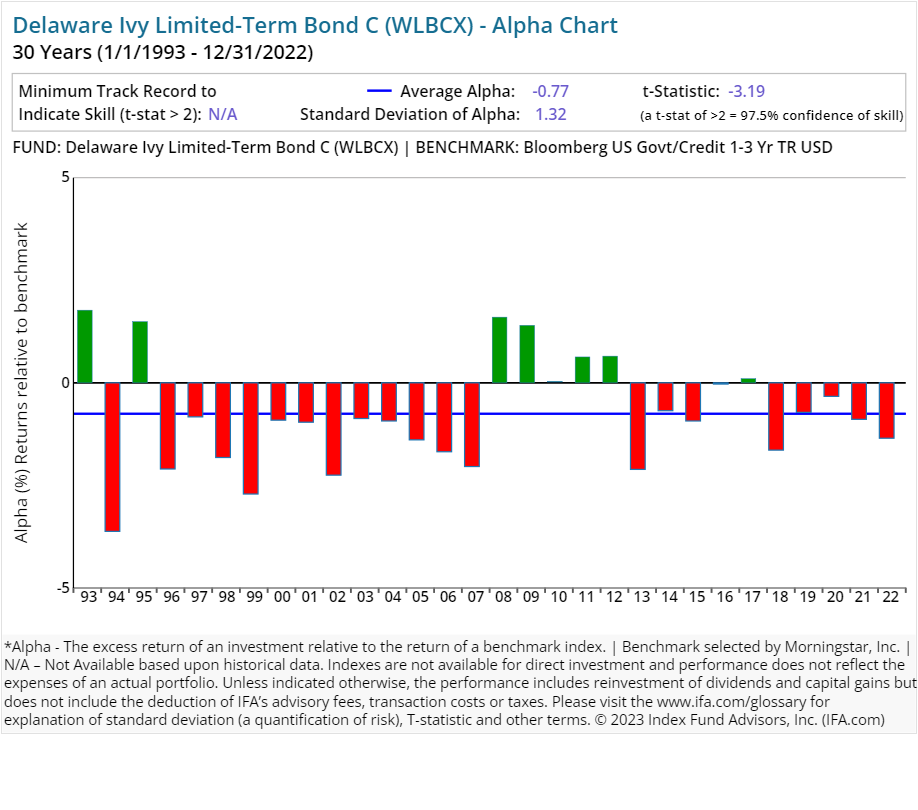

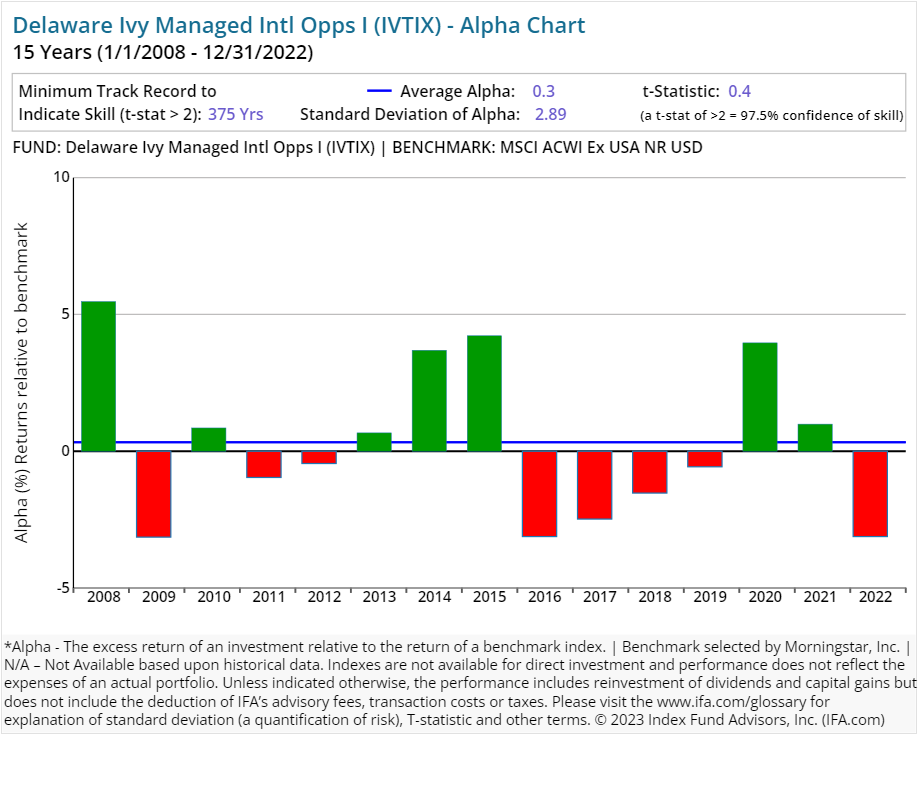

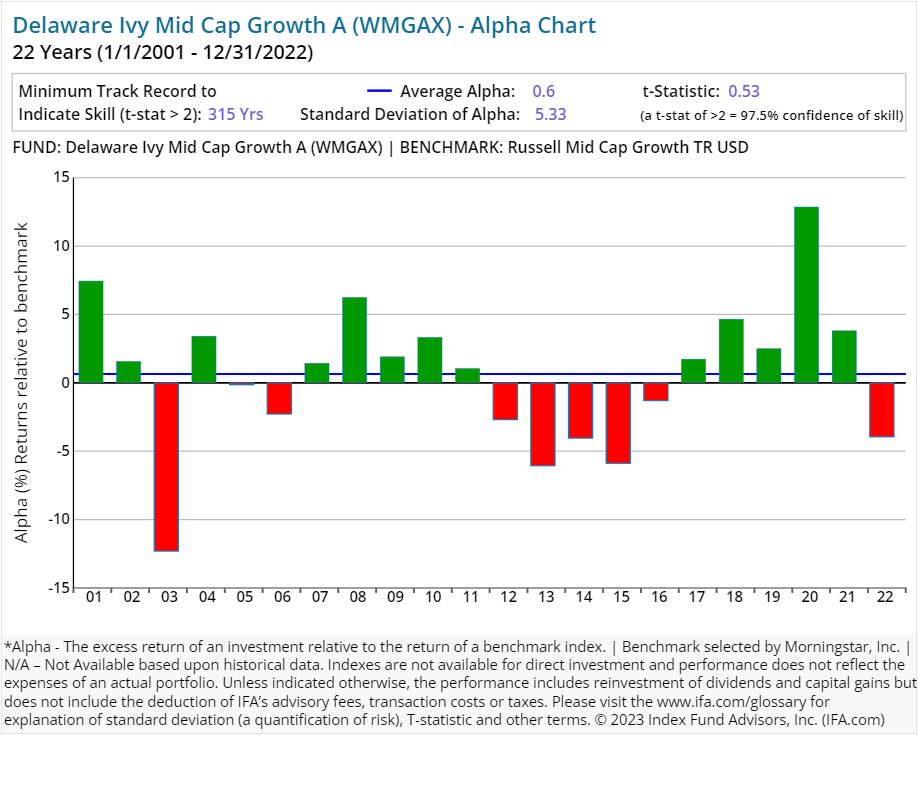

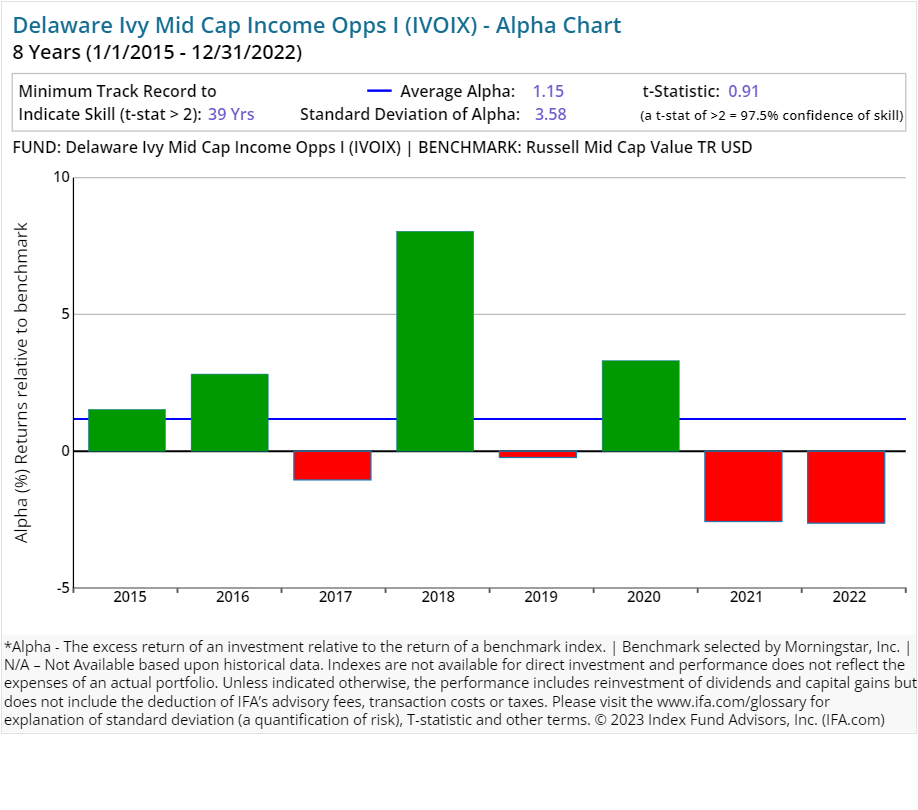

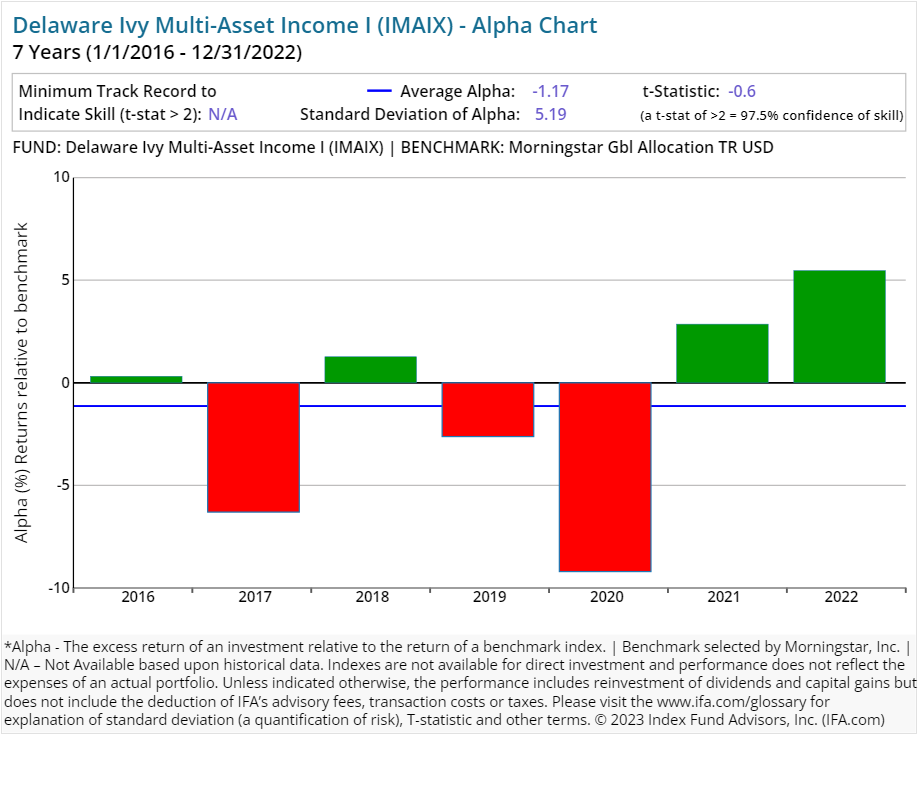

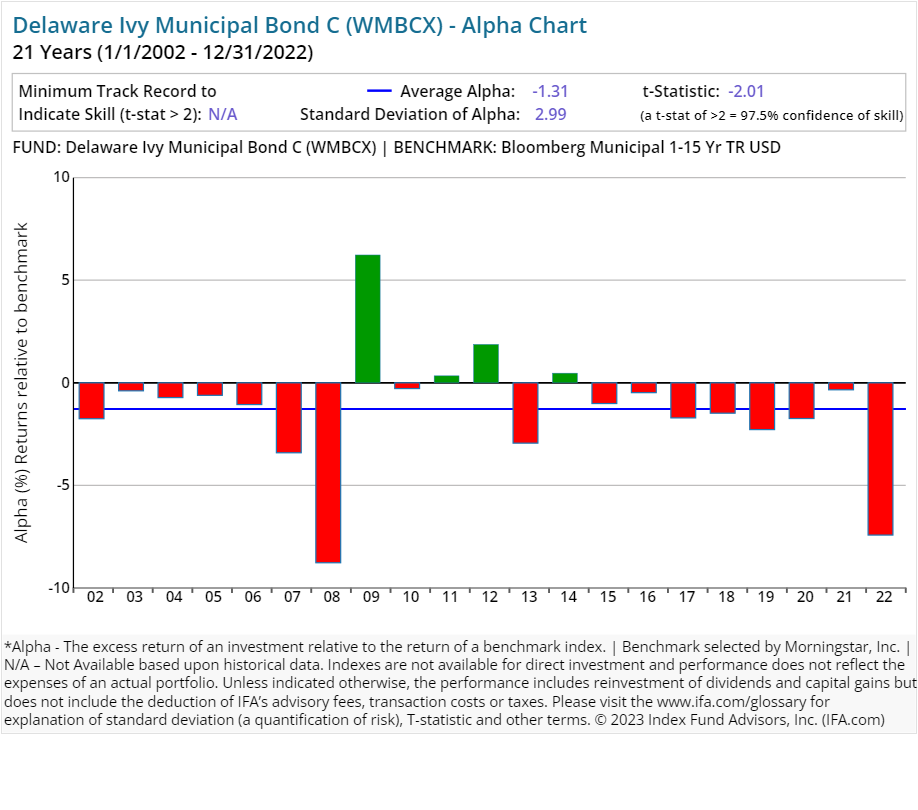

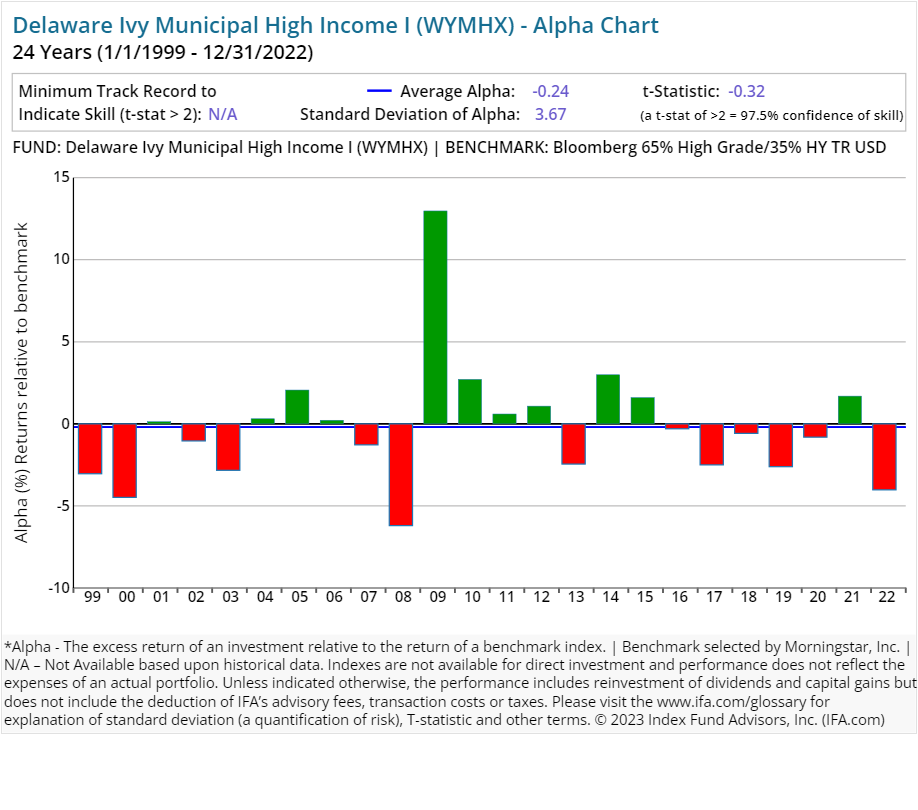

Alpha Charts

“Alpha” is defined as the excess return relative to a benchmark, which is often a market index. The charts below display the annual “alphas” or “factor gaps” for mutual funds compared to their Morningstar assigned benchmark. Also included are the simple average, standard deviation, t-statistic, and number of years required in order to generate a t-statistic greater than 2. The t-statistic is an estimate of how confident we can be that what we observed in the past is expected to persist in the future and is based off of the average alpha, the standard deviation (variability) of the annual alpha, and the number of years observed. Having a low t-statistic indicates that past performance may be due to random outcomes or luck versus actual skill.