If Eeyore were a value investor, he would probably be among those who feel that a positive value premium can only come at the cost of a growth stock tumble. This view implies value stocks can post strong relative returns only because growth stocks underperformed, not because value delivered strong absolute performance. While growth underperformance was the case for July's US value premium resurgence1, this has not been the norm for the value premium historically.

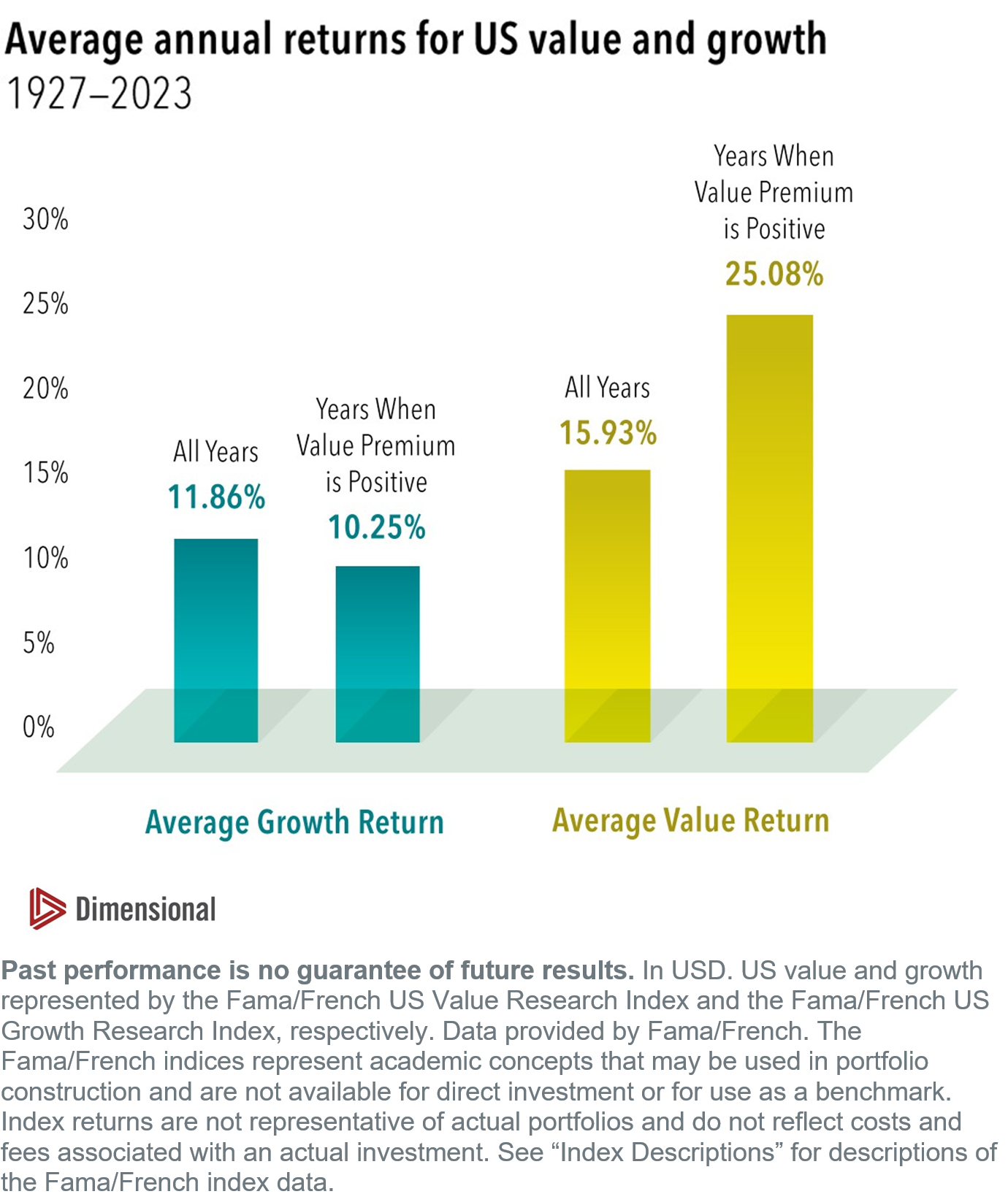

Since 1927, US value stocks outperformed US growth stocks in 58 out of 97 calendar years. During positive value premium years, growth stocks returned an average of 10.25% compared to their average across all years of 11.86%—lower, but not exactly a tank job. Only in 17 out of 58 of positive value premium years was growth's return negative. On the other hand, value's average return in positive value premium years, 25.08%, markedly exceeded its long-run average return, 15.93%.

1. The Russell 3000 Growth Index returned -1.27% in July 2024. Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Indices are not available for direct investment, therefore their performance does not reflect the expenses associated with the management of an actual portfolio.

This article originally appeared August 22, 2024 in Above the Fray, a weekly newsletter from Dimensional Fund Advisors. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Index Descriptions

Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE American-listed equivalents since July 1962 and Nasdaq equivalents since 1973).

Disclosures

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.