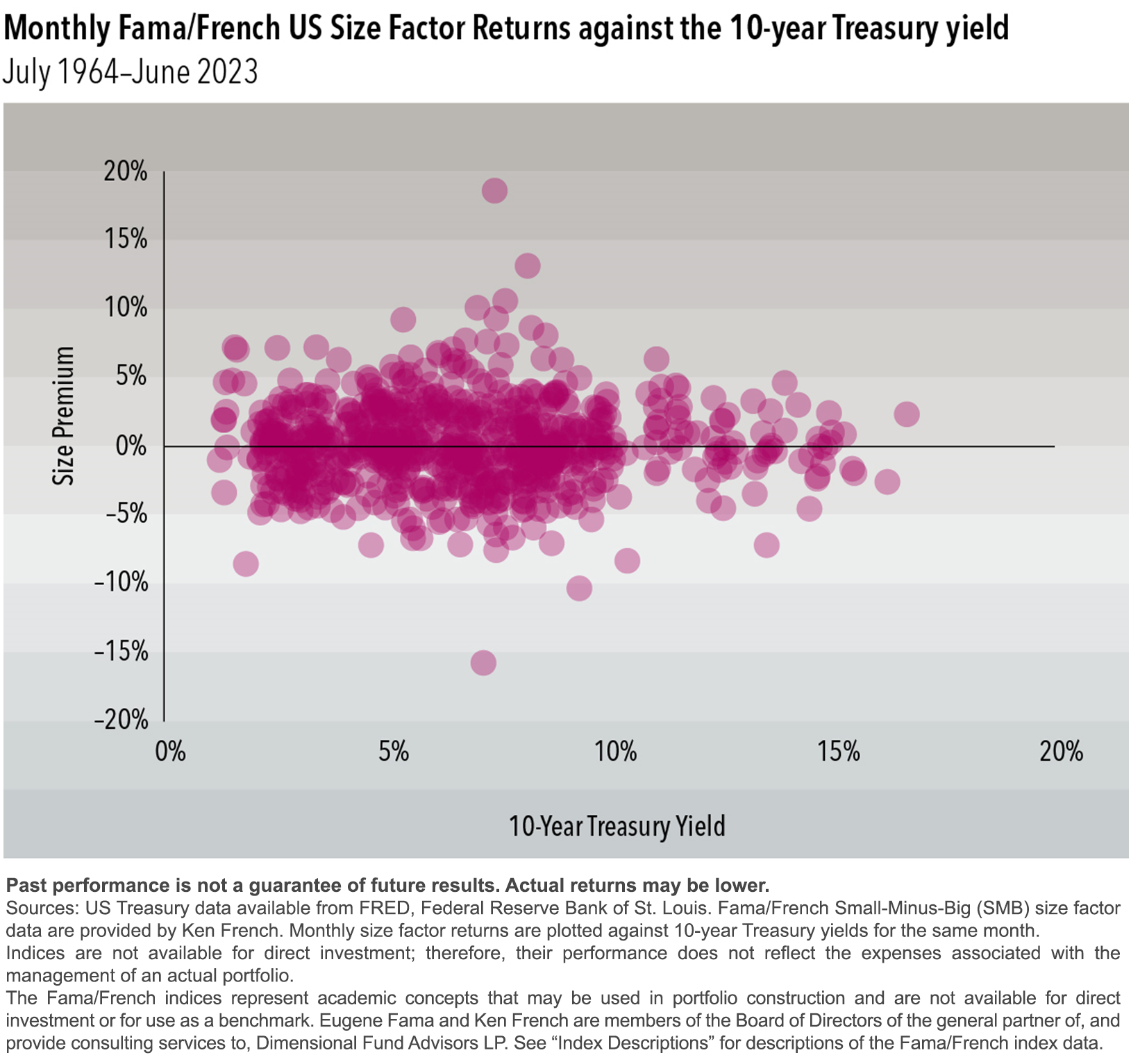

While the market sees an increasing likelihood of Fed rate cuts later this year, the highest probability outcome for the December Fed meeting is a target range of 425-450 basis points—still above the historical median Fed funds rate.1 That leaves some investors wondering what's in store for small cap stocks, which are often perceived to be more sensitive to interest rates than large cap stocks. Fortunately for small cap investors, this relation hasn't exactly panned out in the data.

Plotting monthly returns for the Fama/French size factor versus 10-year Treasury yields shows little correlation between the two. Months with high interest rates have been associated with both positive and negative relative returns for small caps. The same is true for low interest rate months. There's no clear trend among the observations, good or bad.

This is not to imply small companies are insensitive to interest rates. Rather, the market's expectations for interest rates and their impact on cash flows for small cap companies are incorporated into current market prices. The expected size premium should therefore be positive regardless of the prevailing interest rate outlook.

1. Based on the Effective Federal Funds rate from July 1954–June 2024. Data from FRED.

Index Descriptions

Fama/French Small-Minus-Big (SMB) Size Factor Data: July 1926–present: For July of year t to June of t 1 includes all NYSE, AMEX, and NASDAQ stocks for which we have market equity data for December of t-1 and June of t, and (positive) book equity data for t-1. Source: Kenneth R. French - Data Library (dartmouth.edu)

Results shown during periods prior to each index's inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. Disclosures All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

This article originally appeared August 15, 2024 in Above the Fray, a newsletter for advisors of Dimensional Fund Advisors. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.