By some estimates, more than 10 million Americans are struggling with impulses that can be considered gambling addictions. Indeed, such compulsive behaviors can take many forms, from regular visits to casinos and race tracks to frequent use of betting apps and online card games.

Psychotherapists working in the field report another type of gambling addiction as a mounting concern: A wave of investors are taking advantage of technological advances to monitor and trade online in their brokerage accounts.

"Before everyone had a computer on their desks, you had to go through so many hoops to trade that it wasn't very practical for most people," says Timothy Fong, co-director of the UCLA Gambling Studies Program. "These days, it's become so easy to buy and sell stocks that your computer can almost become a slot machine."

Recognizing the Problem

Obsessively playing the the stock market is recognized by Gamblers Anonymous as a form of addiction, points out Mark Hebner in his book "Index Funds: The 12-Step Recovery Program for Active Investors." The Founder and CEO of Index Fund Advisors (IFA) notes that more than two decades ago Paul Good, a San Francisco-based clinical psychologist, developed a set of warning signs to determine whether an active investor might actually be a compulsive gambler in disguise. These include:

- A preoccupation with the financial media.

- Borrowing to speculate, which might include use of leverage in brokerage accounts.

- Inability to cease or control trading activity.

- Throwing good money after bad in order to break even.

Fong, the UCLA psychiatrist and longtime gambling researcher, agrees that "anything done to an extreme level" can lead to addictive behavior. Investors need to realize, he observes, that "if you're constantly hearing a steady feed of information from a Jim Cramer on cable television, it makes for a more difficult situation in terms of controlling your urges to trade."

The field of behavioral finance — which studies connections between investors' emotions and their trading decisions — has become a major source of academic research, notes Fong. "Studies on this problem tell us that at any given time, millions of people are going to have an addiction," he says. "We also know that a growing part of this increase in gambling-related issues is tied directly to stock trading."

Just like betting on horses or cards, trading stocks courts a certain amount of risk. And similar to other activities often cited as breeding grounds for gamblers, monitoring a portfolio's stock positions isn't necessarily an unhealthy behavior, says Keith Whyte, executive director of the National Council on Problem Gambling.

Still, he finds that addictive behavior tends to ferment in less-structured environments. "If you're feeling a certain amount of psychological distress, you're probably not following a plan," says Whyte. That's important, he adds, since if you don't have a plan for how to deal with market stress, "investing can turn into a less-structured activity where your behavior is dictated by chance and the current state of your emotions."

Emotions-Based Investing

In his 12-Step book, Hebner references studies into different types of "behavioral biases" identified by psychologists as negatively impacting investment decisions. Here are a few such emotional predispositions he spotlights for investors, along with a recap of the behavioral red flags each presents:

- Overconfidence: "People mistakenly believe they can outperform the market."

- Hindsight Bias: "Investors think past events were predictable and obvious and believe they should have known better," notes Hebner, "when in truth news is what moves the markets and past events could not have been predicted in advance."

- Familiarity Bias: "Investors invest only in stocks they know, which provides a false sense of security."

- Regret Avoidance: "Investors vow to never repeat the same decision if it resulted in a pervious loss or missed gain, not accepting that the future cannot be predicted."

- Self-Attribution Bias: "Investors tend to take full credit for investment gains and blame outside factors for losses, wrongly attributing success to personal skill instead of luck."

- Extrapolation: "Investors base decisions on recent market movements, assuming the perceived trend will repeat."

Such behavioral biases "cause investors to believe they have control in areas where they actually have little or none," adds Hebner. "A disciplined, rules-based investing approach involves the understanding of the factors we can and cannot control, planning ahead and not giving into emotions when making investment decisions."

Drawing A Fine Line

Indeed, a fine line does exist between gambling and trading, suggests Tony Marini. "A lot of traders don't even realize their emotions are getting the best of them," says the senior gambling therapist at U.K.-based Castle Craig Hospital's addiction clinic. "It can take years for an addiction to materialize, especially when it comes to how people deal with the stress of handling their portfolios."

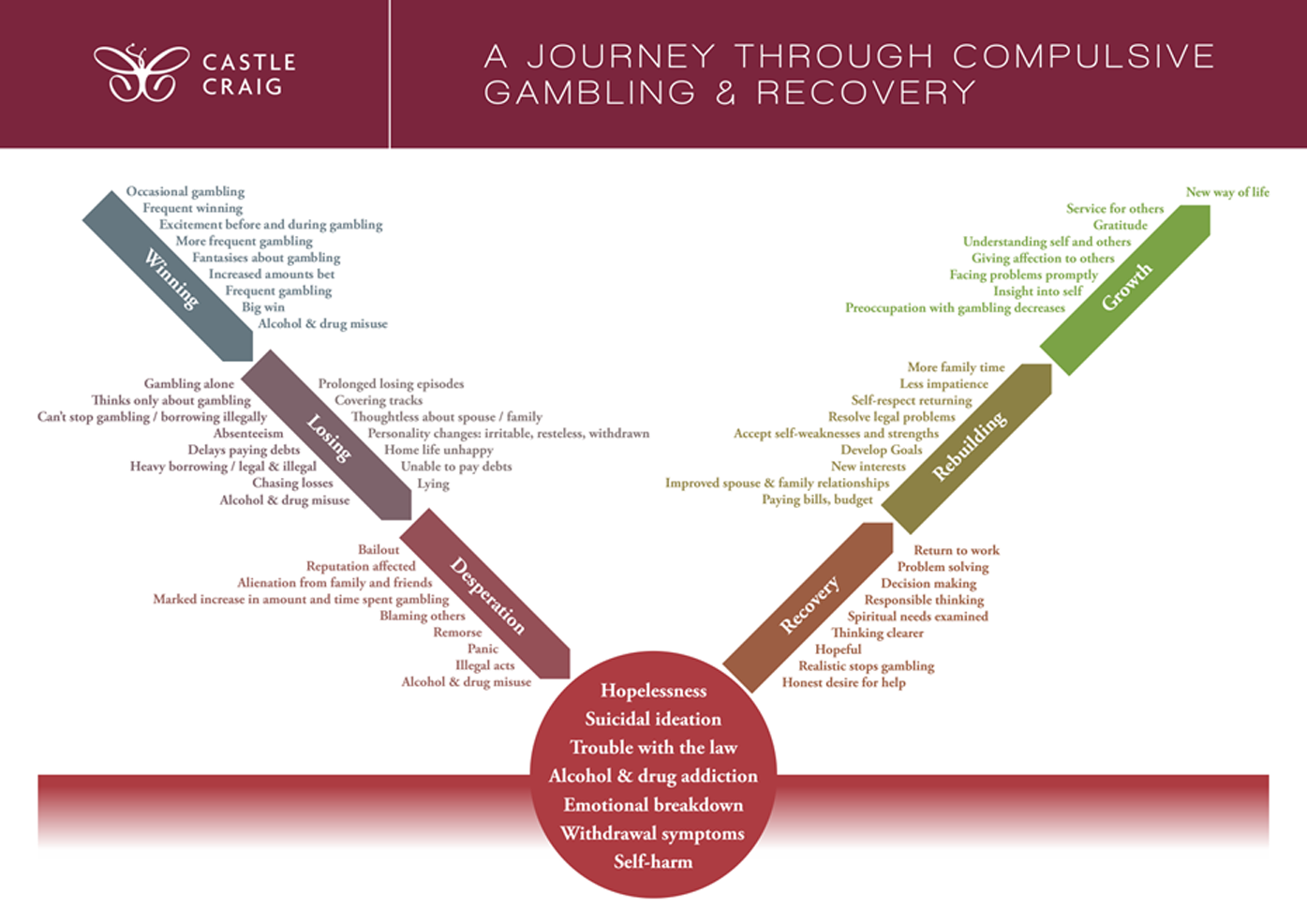

At Castle Craig, which works with gamblers across Europe and the U.S., psychiatrists and gambling therapists have developed a broad cycle of behavior they typically see in gambling addicts. Those are:

- Winning

- Losing

- Desperation

- Hopelessness

- Destitution

Similar to his patients who actively trade in cryptocurrencies, Marini finds that obsessed stock traders are prone to falling prey to the same addictive impulses as other forms of gambling. "The activity might be different," he says, "but the range of emotions and how they deal with financial stress usually lands obsessive stock traders into the same general cycle of addiction."

When times are good, trading stocks can lead to "a sense of euphoria" as the body produces more endorphins, according to Marini. A losing trade, however, can spur what's known as euphoric recall. "That's where you remember the high of winning, and after losing, you want to recapture that feeling even more strongly than before," he says.

Trading stocks in an excessive manner is fundamentally an "irrational" behavior, notes Marini. "As you trade more and more, the odds are increasingly against you," he says. "But a higher level of risk can be seductive and make your emotions work against your brain's ability to make more rational decisions."

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.