Amazingly, more than a decade has passed since the IBM Watson supercomputer overthrew legendary Jeopardy contestant Ken Jennings.1 This felt like a watershed moment for computing technology, and my mind reeled at the thought of what Watson might tackle next. In hindsight, I should have guessed it would be stock picking.

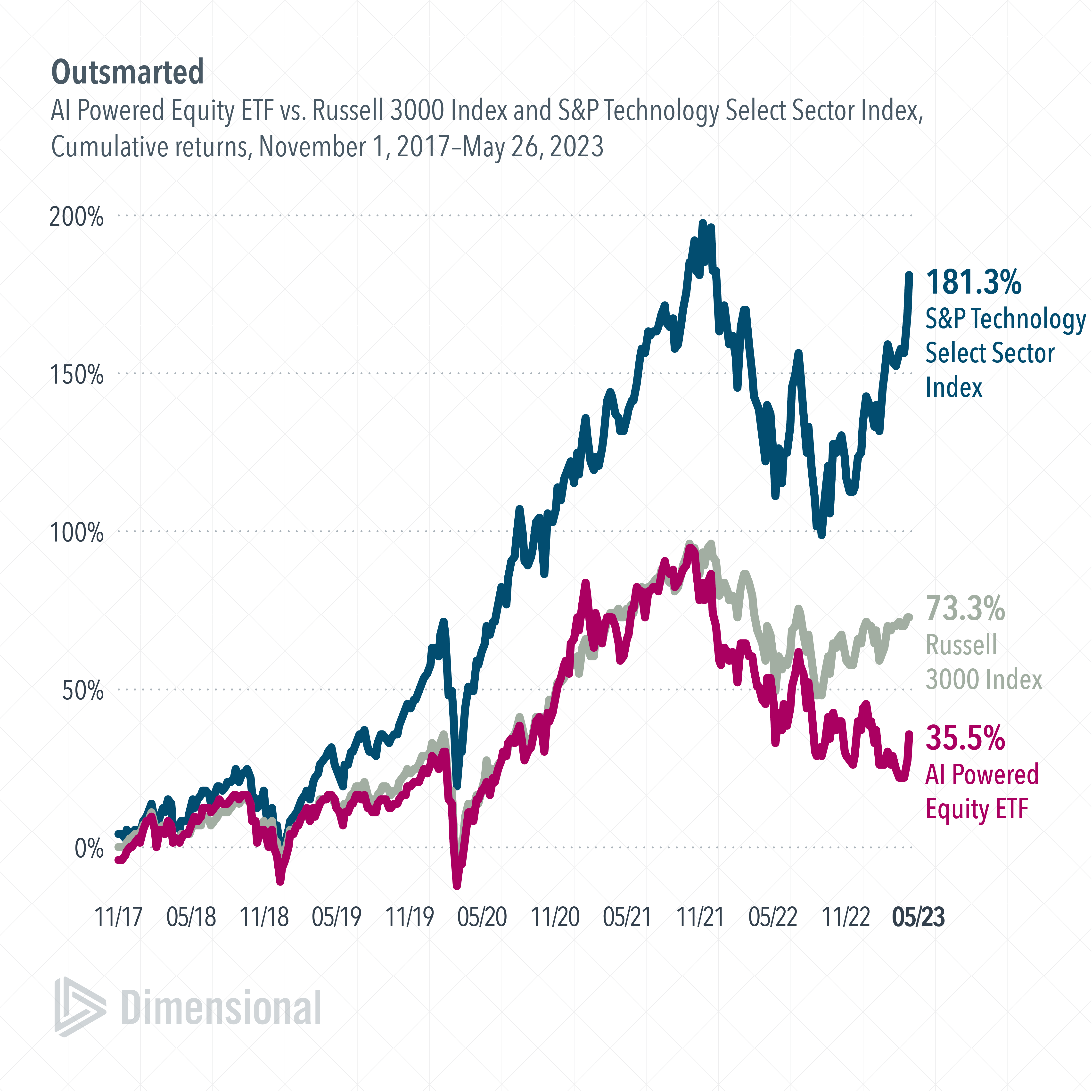

The AI Powered Equity ETF, launched in 2017, employs IBM Watson's artificial intelligence to analyze publicly available information and attempt to pick US stocks that will outperform the US market. But while Watson may be able to outwit an individual, even one as intellectually gifted as Ken Jennings, its intelligence pales in comparison to the aggregate wisdom of the millions of individuals trading in stock markets each day. It is perhaps unsurprising2 then that the Watson-powered ETF has lagged the broad US market and, by a wide margin, the US technology sector since its inception.

Source: Bloomberg. Sample period begins with the first full month of returns for AI Powered Equity ETF.

Past performance is not a guarantee of future results. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

Footnote:

1. My wife and I met a few months later, so I need to be careful how I characterize the passing of time.

2. Or as Sherlock Holmes would say to Dr. Watson, "Elementary."

The article on this page was republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures:

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment

decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.