https://www.ifa.com/eugene-fama

Academics are a hallmark of the investment strategy that we recommend to our clients. While there are plenty of sales pitches professing some sort of new or "hot" idea on how to get rich quick, we rely on peer-reviewed academic research to guide the decisions that we make within our own practice.

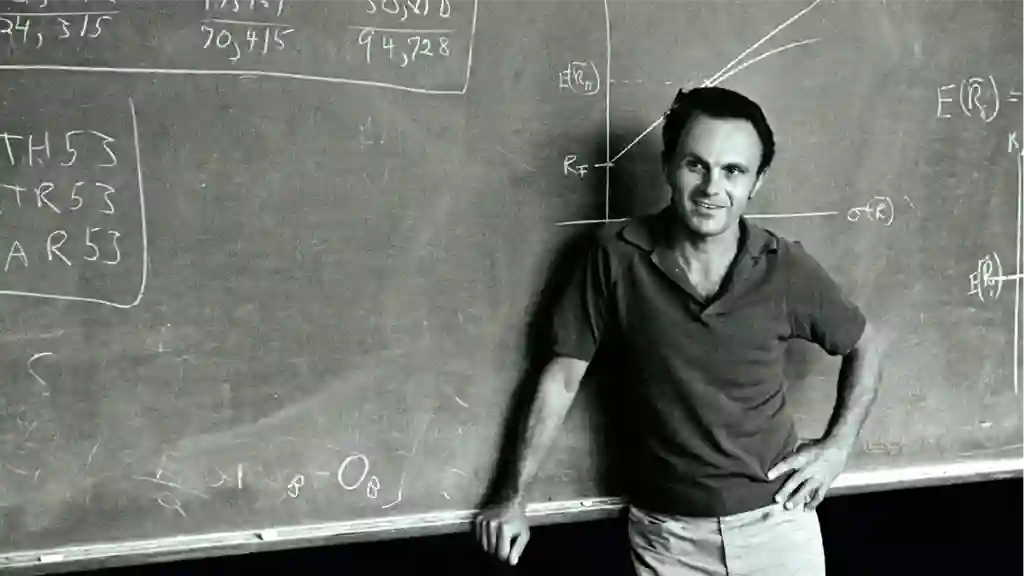

One of the most prominent figures in the field of financial economics is Professor and Nobel Laureate Eugene Fama from the University of Chicago. With 110 individual research papers across six decades under his belt, Professor Fama is one of the most accomplished in his field. Research Papers in Economics has ranked Professor Fama as one of the top 20 most influential economists of all time.[i] From the beginning of his tenure at the University of Chicago, he was surrounded by the learned minds of colleagues such as Merton Miller, Harry Roberts, Lester Telser and Benoit Mandelbrot — who each has been credited by Fama as key contributors in the pursuit of his life's work.

One of the most prominent figures in the field of financial economics is Professor and Nobel Laureate Eugene Fama from the University of Chicago. With 110 individual research papers across six decades under his belt, Professor Fama is one of the most accomplished in his field. Research Papers in Economics has ranked Professor Fama as one of the top 20 most influential economists of all time.[i] From the beginning of his tenure at the University of Chicago, he was surrounded by the learned minds of colleagues such as Merton Miller, Harry Roberts, Lester Telser and Benoit Mandelbrot — who each has been credited by Fama as key contributors in the pursuit of his life's work.

Developing important concepts -- such as the "Random Walk Theory, the "Efficient Market Hypothesis," running multiple regressions using panel data (Fama-MacBeth Regressions) or the Fama-French 5 Factor Model — Professor Fama has helped to shape not only how we think about the financial markets, but also how we can measure and quantify them. He was awarded The Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel in 2013 for his work in the empirical analysis of asset prices.

We have included a copy of his curriculum vitae below for readers to see the depth of Professor Fama's career. It should go without saying that we are very proud of Professor Fama and there should be no question as to why he is a part of the company that we keep. He gives credence to the investment philosophy we profess and should give confidence to our investors that their money is being managed based off the work of one of the best. Very few can say the same.

Fama's research is sometimes criticized by others and we like to remind investors that before they throw Fama's research out the window, you might want to compare the resumes of individuals in the debate. So you will have Fama's curriculum vitae handy, we submit an updated version for your review and have included references to many of his notable research papers.

EUGENE F. FAMA

Born: February 14, 1939 - Boston, Massachusetts. Marital Status: Married with four children and 10 grandchildren

Education

- Undergraduate: Tufts University, Medford, Massachusetts; B.A., 1960.

- Graduate: Graduate School of Business (now the Booth School), University of Chicago; 1960-63; MBA, 1963; Ph.D., 1964, Dissertation: The Behavior of Stock Market Prices.

Honors and Activities

- Nobel Prize in Economic Sciences, 2013.

- Fellow, American Academy of Arts and Sciences, 1989.

- Fellow of the American Finance Association, January 2001 (first elected fellow).

- Deutsche Bank Prize in Financial Economics, 2005, (first recipient).

- Morgan Stanley American Finance Association Award for Excellence in Finance, 2007, (first recipient).

- Onassis Prize in finance, April 2009, (first recipent).

At Tufts: Dean's List (1956-60); Society of Scholars (1957-60)--a group consisting of the top two students in each of the sophomore, junior and senior classes; Phi Beta Kappa; Omicron Chi Epsilon; Class of 1888 Prize Scholarship (1959)--given each year to the school's outstanding student-athlete; graduated Magna Cum Laude with honors in Romance Languages.

- At the University of Chicago: Dean's List, Beta Gamma Sigma

- Chaire Francqui (Belgian National Science Prize), 1982.

- Doctor of Law, University of Rochester, 1987.

- Doctor of Law, DePaul University, 1989.

- Doctor Honoris Causa, Catholic University of Leuven, Belgium, 1995.

- Doctor of Science Honoris Causa, Tufts University, 2002.

- Fellow, Econometric Society.

- Malden Catholic High School Athletic Hall of Fame, 1992.

- American Enterprise Institute Irving Kristol Award, 2014.

- Malden Catholic High School Lifetime Achievement Award, 2015.

- March 2001. Membre correspondant, Acadamie des sciences morales et politique, section economie, politique, statistique et finance, de l'Institut de France.

- Nicholas Molodovsky Award from the CFA Institute, 2006, presented for "outstanding contributions to the investment profession of such significance as to change the direction of the profession and raise it to higher standards of accomplishment."

- CME Fred Arditti Innovation Award, April 24, 2007.

- Smith-Breeden Prize (with co-author Kenneth R French) for the best paper in the Journal of Finance in 1992, "The Cross-Section of Expected Stock Returns."

- Fama-DFA Prize for the best paper published in 1998 in the Journal of Financial Economics in the areas of capital markets and asset pricing, "Market Efficiency Long-Term Returns and Behavioral Finance."

- Jensen Prize (second place) for the best paper in corporate finance and organizations published in the Journal of Financial Economics in 2001. "Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay," (with Kenneth R. French)

- Jensen Prize (second place) for the best paper in corporate finance and organizations published in the Journal of Financial Economics in 2006. "Profitability, Investment, and Average Returns," (with Kenneth R. French).

- Graham and Dodd Best Perspectives Award from the Financial Analysts Journal, 2012

Work Experience

1968-1973 — Professor of Finance, University of Chicago, Graduate School of Business.

1973-1984 — Theodore O. Yntema Professor of Finance, University of Chicago, Graduate School of Business.

1975-1976 — Visting Professor, Catholic University of Leuven and European Institute for Advanced Studies in Management, Belgium.

1984-93 — Theodore O. Yntema Distinguished Service Professor of Finance Graduate School of Business, University of Chicago.

1993 - Robert R. McCormick Distinguished Service Professor of Finance, Graduate School of Business, University of Chicago.

Professional Activities

American Economic Association, American Finance Association. Associate Editor, Journal of Finance (1971-73, 1977-80). Advisory Editor, Journal of Financial Economics (1974-). Associate Editor, American Economic Review (1975-77). Associate Editor, Journal of Monetary Economics (1984-96)

Publications — (first in chronological order, then by category)

- "Mandelbrot and the Stable Paretian Hypothesis," Journal of Business (October 1963); reprinted in Paul Cootner (ed.), The Random Character of Stock Prices (MIT Press, 1964).

- "The Behavior of Stock Market Prices," Journal of Business (January 1965).

- "Portfolio Analysis in a Stable Paretian Market," Management Science (January 1965).

- "Tomorrow on the New York Stock Exchange," Journal of Business (July 1965).

- "Random Walks in Stock Market Prices," paper number 16 in the series of Selected Papers of the Graduate School of Business, University of Chicago, reprinted in the Financial Analysts Journal (September-October 1965), The Analysts Journal, London (1966), The Institutional Investor, 1968.

- "Filter Rules and Stock Market Trading Profits," (with Marshall Blume), Journal of Business, Supplement (January 1966).

- "Solutions for Cash Balance and Simple Dynamic Portfolio Problems," (with Gary Eppen), Journal of Business (January 1968).

- "Some Properties of Symmetric Stable Distributions," (with Richard Roll), Journal of the American Statistical Association (September 1968).

- "Risk, Return, and General Equilibrium: Some Clarifying Comments," Journal of Finance (March 1968).

- "Dividend Policy of Individual Firms: An Empirical Analysis," (with Harvey Babiak), Journal of the American Statistical Association (December 1968).

- "Risk and the Evaluation of Pension Fund Portfolio Performance," Bank Administration Institute, Park Ridge, Illinois, 1968.

- "The Adjustment of Stock Prices to New Information," (with L. Fisher, M. Jensen, and R. Roll), International Economic Review (February 1969).

- "Cash Balance and Simple Dynamic Portfolio Problems with Proportional Costs," (with Gary Eppen), International Economic Review (June 1969).

- "Multi-Period Consumption-Investment Decisions," American Economic Review (March 1970).

- "Efficient Capital Markets: A Review of Theory and Empirical Work," Journal of Finance (May 1970).

- "Three Asset Cash Balance and Dynamic Portfolio Problems," (with Gary Eppen), Management Science (January 1971).

- "Risk, Return and Equilibrium," Journal of Political Economy (January-February 1971).

- "Parameter Estimates for Symmetric Stable Distributions," (with Richard Roll, Journal of the American Statistical Association (June 1971).

- "Information and Capital Markets," (with Arthur Laffer), Journal of Business (July 1971).

- "The Theory of Finance," (with Merton Miller). (Holt, Rinehart and Winston, 1972).

- "Ordinal and Measurable Utility," In Studies in the Theory of Capital Markets, edited by Michael Jensen. New York: Praeger, 1972.

- "Components of Investment Performance," Journal of Finance (June 1972).

- "The Number of Firms and Competition," (with Arthur Laffer), American Economic Review (September 1972).

- "Perfect Competition and Optimal Production Decisions under Uncertainty," Bell Journal of Economics and Management Science (Autumn 1972).

- "Risk, Return, and Equilibrium: Empirical Tests," (with J. MacBeth), Journal of Political Economy (May-June 1973).

- "A Note on the Market Model and the Two-Parameter Model," Journal of Finance (December 1973).

- "Tests of the Multiperiod Two-Parameter Model," (with J. MacBeth), Journal of Financial Economics (March 1974).

- "Long-Term Growth in a Short-Term Market," (with J. MacBeth), Journal of Finance (June 1974).

- "The Empirical Relationships between the Dividend and Investment Decisions of Firms," American Economic Review (June 1974).

- "Short-Term Interest Rates as Predictors of Inflation," American Economic Review (June 1975).

- "Foundations of Finance," (New York: Basic Books, 1976).

- "Inflation Uncertainty and Expected Returns on Treasury Bills," Journal of Political Economy (June 1976).

- "Forward Rates as Predictors of Future Spot Rates," Journal of Financial Economics (October 1976).

- "Human Capital and Capital Market Equilibrium," (with G. William Schwert), Journal of Financial Economics (January 1977).

- "Interest Rates and Inflation: The Message in the Entrails," American Economic Review (June 1977).

- "Risk-Adjusted Discount Rates and Capital Budgeting under Uncertainty," Journal of Financial Economics (August 1977).

- "Asset Returns and Inflation," (with G. William Schwert), Journal of Financial Economics (November 1977).

- "The Effects of a Firm's Investment and Financing Decisions on the Welfare of Its Securityholders," American Economic Review (June 1978).

- "Inflation, Interest and Relative Prices," (with G. William Schwert), Journal of Business (April 1979).

- "Money, Bonds and Foreign Exchange," (with Andre Farber), American Economic Review (September 1979) .

- "Banking in the Theory of Finance," Journal of Monetary Economics 6 (January 1980), 39-57.

- "Agency Problems and the Theory of the Firm," Journal of Political Economy (April 1980).

- "Stock Returns, Real Activity, Inflation and Money," American Economic Review (September 1981).

- "Inflation, Output and Money," Journal of Business (April 1982).

- "Inflation, Real Returns and Capital Investment," (with Michael Gibbons), Journal of Monetary Economics (May 1982)

- "Separation of Ownership and Control," (with Michael Jensen), Journal of Law and Economics (June 1983).

- "Agency Problems and Residual Claims," (with Michael Jensen), Journal of Law and Economics (June 1983).

- "Financial Intermediation and Price Level Control," Journal of Monetary Economics (July 1983).

- "A Comparison of Inflation Forecasts," (with Michael Gibbons), Journal of Monetary Economics (May 1984).

- "The Information in the Term Structure," Journal of Financial Economics, (December 1984).

- "Forward and Spot Exchange Rates," Journal of Monetary Economics, (November 1984).

- "Term Premiums in Bond Returns," Journal of Financial Economics, (December 1984).

- "What's Different About Banks?" Journal of Monetary Economics, 15 (January 1985)., 29-39.

- "Organizational Forms and Investment Decisions," (with Michael Jensen), Journal of Financial Economics, (March 1985).

- "Term Premiums and Default Premiums in Money Markets," Journal of Financial Economics, (September 1986).

- "Commodity Futures Prices: Evidence on Forecast Power and Premiums," (with Kenneth R. French), Journal of Business, (January 1987).

- "The Information in Long-Maturity Forward Rates," (with Robert R. Bliss), American Economic Review, (September 1987).

- "Permanent and Temporary Components of Stock Prices," (with Kenneth R. French), Journal of Political Economy, (April 1988).

- "Dividend Yields and Expected Stock Returns," (with Kenneth R. French), Journal of Financial Economics, 22 (October 1988), 3-25.

- "Business Cycles and the Behavior of Metals Prices," (with Kenneth R. French), Journal of Finance, (December 1988).

- "Perspectives on October 1987, or, What Did we learn from the Crash?" in Black Monday and the Future of Financial Markets, edited by R.W. Kamphuis, Jr., R.C. Kormendi, and J.W.H. Watson (Homewood: Dow-Jones-Irwin, Inc.), 1989.

- "Business Conditions and Expected Returns on Stocks and Bonds," (with Kenneth R. French), Journal of Financial Economics, 25 (November 1989), 23-49.

- "Contract Costs and Financing Decisions," Journal of Business, 63 (January 1990), S71-S91.

- "Term Structure Forecasts of Interest Rates, Inflation, and Real Returns," Journal of Monetary Economics, 25 (January 1990), 59-76.

- "Stock Returns, Expected Returns, and Real Activity," Journal of Finance, 45 (September 1990), 1089-1109.

- "Time, Salary, and Incentive Payoffs in Labor Contracts," Journal of Labor Economics, 9 (January 1991), 25-44.

- "Efficient Markets: II," Fiftieth Anniversary Invited Paper," Journal of Finance, 46 (December 1991), 1575-1617.

- "The Cross-Section of Expected Stock Returns," (with Kenneth R. French), Journal of Finance, 47 (June 1992), 427-465. Winner of the Smith Breeden Prize for the best paper in the Journal during 1992.

- "Diversification Returns and Asset Contributions," (with David G. Booth), Financial Analysts Journal, (May/June 1992), 26-32.

- "Transitory Variation in Investment and GNP," Journal of Monetary Economics, 30 (December 1992), 467-480.

- "Differences in the Risks and Returns of NYSE and NASD Stocks," (with Kenneth R. French, David G. Booth, and Rex Sinquefield), Financial Analysts Journal, (January/February 1993).

- "Common Risk Factors in the Returns on Stocks and Bonds," (with Kenneth R. French), Journal of Financial Economics, 33 (February 1993), 3-56.

- "Size and Book-to-Market Factors in Earnings and Returns," (with Kenneth R. French), Journal of Finance, 50 (March 1995), 131-156 .

- "Multifactor Explanations of Asset Pricing Anomalies," (with Kenneth R. French), Journal of Finance, 51 (March 1996), 55-84.

- "Discounting under Uncertainty," Journal of Business, 69 (October 1996), 415-428.

- "The CAPM Is Wanted, Dead or Alive," (with Kenneth R. French), Journal of Finance, 51 (December 1996), 1947-1958.

- "Multifactor Portfolio Efficiency and Multifactor Asset Pricing," Journal of Financial and Quantitative Analysis, 31 (December 1996), 441-465.

- "Industry Costs of Equity," (with Kenneth R. French), Journal of Financial Economics, 43 (February 1997), 153-193.

- "Determining the Number of Priced State Variables in the ICAPM," Journal of Financial and Quantitative Analysis, 33 (June 1998), 217-231.

- "Taxes, Financing Decisions, and Firm Value," (with Kenneth R. French), Journal of Finance, 53 (June 1998), 819-843.

- "Market Efficiency, Long-Term Returns, and Behavioral Finance," Journal of Financial Economics, 49 (September 1998), 283-306. Winner of the Fama-DFA Prize for the best asset pricing paper in the journal during 1998.

- "Value versus Growth: The International Evidence," (with Kenneth R. French), Journal of Finance, 53 (December 1998), 1975-1999.

- "The Corporate Cost of Capital and the Return on Corporate Investment," (with Kenneth R. French), Journal of Finance, 54 (December 1999), 1939-1967.

- "Characteristics, Covariances, and Average Returns: 1929-1997," (with James L. Davis and Kenneth R. French), Journal of Finance, 55 (February 2000), 389-406.

- "Forecasting Profitability and Earnings," (with Kenneth R. French), Journal of Business, 72 (April 2000), 161-175.

- "Disappearing Dividends: Changing Firm Characteristics or Lower Propensity to Pay," (with Kenneth R. French), Journal of Financial Economics, 60 (April 2001), 3-43. Jensen Prize (second place) for the best 2001 paper in corporate finance and organizations.

- "Testing Tradeoff and Pecking Order Predictions about Dividends and Debt," (with Kenneth R. French), Review of Financial Studies, 15 (Spring 2002), 1-33.

- "The Equity Premium," (with Kenneth R. French), Journal of Finance, 57 (April 2002), 637-659.

- "New Lists: Fundamentals and Survival Rates," (with Kenneth R. French), Journal of Financial Economics, 72 (August 2004), 229-269.

- "The Capital Asset Pricing Model: Theory and Evidence," (with Kenneth R. French), Journal of Economic Perspectives, (Summer 2004), 25-46.

- "Financing Decisions: Who Issues Stock?" (with Kenneth R. French), Journal of Financial Economics, 76 (June 2005), 549-582.

- "The Behavior of Interest Rates," Review of Financial Studies, 19 (Summer 2006), 359-379.

- "The Value Premium and the CAPM," (with Kenneth R. French), Journal of Finance, 61 (October 2006), 2163-2185.

- "Profitability, Investment, and Average Returns," (with Kenneth R. French), Journal of Financial Economics, 82 (December 2006), 491-518.

- "Disagreement, Tastes, and Asset Pricing," (with Kenneth R. French), Journal of Financial Economics, 83 (March 2007), 667-689.

- "Migration,"(with Kenneth R. French), Financial Analysts Journal, 63, number 3 (May/June 2007), 48-58. Awarded a Graham and Dodd Scroll by the editorial board of the journal.

- "The Anatomy of Value and Growth Stock Returns," (with Kenneth R. French), Financial Analysts Journal, 63, number 3 (November 2007), 44-54. Awarded a Graham and Dodd Scroll by the editorial board of the journal.

- "Dissecting Anomalies," (with Kenneth R. French), Journal of Finance, 63 (August 2008), 1653-1678.

- "Average Returns, B/M, and Share Issues," (with Kenneth R. French) Journal of Finance, 63 (December 2008), 2971-2995.

- "Luck versus Skill in the Cross-Section of Mutual Fund Returns," (with Kenneth R. French) Journal of Finance, 65 (October 2010), 1915-1947.

- "My Life in Finance," Annual Review of Financial Economics, 3 (December 2011), 1-15.

- "Capital Structure Choices," (with Kenneth R. French) Critical Finance Review, 1 (2012), 59-101.

- "Size, Value, and Momentum in International Stock Returns," (with Kenneth R. French) Journal of Financial Economics, 105 (September 2012), 457-472.

- "An Experienced View on Markets and Investing," (with Robert Litterman) Financial Analysts Journal, 68 (November December 2012), 15-19.

- "Does the Fed Control Interest Rates?" Review of Asset Pricing Studies, 2013 3: 180-199.

- "Was There Ever a Lending Channel?" European Financial Management, (2013) 19 5: 837-851.

- "Two Pillars of Asset Pricing,"American Economic Review 104 (2014): 1-20. This is the print version of my Nobel Lecture.

- "A Five-Factor Asset Pricing Model,"(with Kenneth R. French) Journal of Financial Economics, 116 (April 2015), 1-22.

- "Incremental Variables and the Investment Opportunity Set," (with Kenneth R. French) Journal of Financial Economics, (Sept. 2015), 470-488.

- "Dissecting Anomalies with a Five-Factor Model," (with Kenneth R. French) Journal of Financial Studies, (January, 2016), 69-103.

- "International Tests of a Five-Factor Asset-Pricing Model," (with Kenneth R. French) Journal of Financial Economics, 441-463.

- "Finance at the University of Chicago," Commemorative essay in "The Past, Present and Future of Economics: A Celebration of the 125 Year Anniversary of the JPE and of Chicago Economics, Journal of Political Economy, December 2017, 1790-1797.

- "Choosing Factors," (with Kenneth R. French), Journal of Financial Economics, 2018, 234-252.

- "Volatility Lessons," (with Kenneth R. French), Financial Analysts Journal, Third Quarter 2018, 42-53.

- "Long-Horizon Returns," (with Kenneth R. French), Review of Asset Pricing Studies, 2019, 232-252.

- "Interest Rates and Inflation Revisited," Review of Asset Pricing Studies, 2019, 197-209.

- "Comparing Cross-Section and Time-Series Factor Models," (with Kenneth R. French), Review of Financial Studies, 2020, 1891-1926.

Publications by Category — Books

- "The Theory of Finance," (with Merton Miller). (Holt, Rinehart and Winston, 1972).

- "Foundations of Finance," (New York: Basic Books, 1976).

Portfolio Theory and Asset Pricing — Theoretical

- "Mandelbrot and the

- "Portfolio Analysis in a Stable Paretian

- "Random Walks in

- "Solutions for Cash Balance and Simple

- "Risk, Return, and General Equilibrium: Some

- "Risk and the Evaluation of Pension Fund Portfolio

- "Cash Balance and Simple Dynamic Portfolio

- "Multi-Period Consumption-Investment

- "Efficient Capital

- "Three Asset Cash Balance and Dynamic

- "Risk, Return and Equilibrium," Journal of Political Economy (January-February

- "Information and Capital Markets," (with Arthur Laffer), Journal of Business (July

- "Components of Investment Performance," Journal of Finance (June 1972).

- "A Note on the Market Model and the

- "Money, Bonds and Foreign Exchange," (with Andre Farber), American Economic Review (September 1979)

- "Efficient Markets: II," Fiftieth Anniversary

- "Diversification Returns and Asset

- "Market Efficiency, Long-Term Returns, and

- "Multifactor Portfolio Efficiency and

- "Determining the Number of Priced State

- "The Capital Asset Pricing Model: Theory and Evidence," (with Kenneth R. French), Journal of Economic

- "Disagreement, Tastes, and Asset Pricing," (with Kenneth R. French), Journal of Financial

- "An Experienced View on Markets and Investing," (with Robert Litterman), Financial Analysts

- "Two Pillars of Asset Pricing," Amercan Economic

- "Finance at the University of Chicago," Commemorative essay in "The Past, Present and Future of Economics: A Celebration of the 125 Year Anniversary of the JPE and of Chicago Economics, Journal of Political Economy, December 2017, 1790-1797.

Portfolio Theory and Asset Pricing — Empirical

- "The Behavior of

- "Tomorrow on the New York Stock Exchange," Journal of Business (July 1965).

- "Filter Rules and Stock Market Trading

- "The Adjustment of Stock Prices to New

- "Risk, Return, and Equilibrium: Empirical

- "Tests of the Multiperiod Two-Parameter Model," (with J. MacBeth), Journal of Financial

- "Long-Term Growth in a Short-Term Market," (with J. MacBeth), Journal of Finance (June

- "Short-Term Interest Rates as Predictors of

- "Inflation Uncertainty and Expected Returns

- "Forward Rates as Predictors of Future Spot

- "Human Capital and Capital Market Equilibrium," (with G. William Schwert), Journal of

- "Interest Rates and Inflation: The Message in

- "Asset Returns and Inflation," (with G. William Schwert), Journal of

- "Inflation, Interest and Relative Prices," (with G. William Schwert), Journal of

- "Stock Returns, Real Activity, Inflation and

- "The Information in the Term Structure," Journal

- "Forward and Spot Exchange Rates," Journal of Monetary Economics, (November 1984).

- "Term Premiums in Bond Returns," Journal of Financial Economics,

- "Term Premiums and Default Premiums in Money

- "The Information in Long-Maturity Forward

- "Permanent and Temporary Components of Stock

- "Dividend Yields and Expected Stock Returns," (with Kenneth R. French), Journal of

- "Perspectives on October 1987, or, What Did we

- "Business Conditions and Expected Returns on Stocks

- "Term Structure Forecasts of Interest Rates,

- "Stock Returns, Expected Returns, and Real

- "Differences in the Risks and Returns of NYSE

- "Common Risk Factors in the Returns on Stocks

- "Size and Book-to-Market Factors in Earnings

- "Multifactor Explanations of Asset Pricing

- "The CAPM Is Wanted, Dead or Alive," (with Kenneth R. French), Journal of Finance,

- "Industry Costs of Equity," (with Kenneth R. French), Journal of Financial

- "Value versus Growth: The International

- "Characteristics, Covariances, and Average

- "The Equity Premium," (with Kenneth R. French), Journal of Finance, 57 (April 2002),

- "New Lists: Fundamentals and Survival Rates," (with Kenneth R. French), Journal of Financial

- "The Behavior of Interest Rates," Review of Financial Studies, 19 (Summer

- "The Value Premium and the CAPM," (with Kenneth R. French), Journal of Finance,

- "Profitability, Investment, and Average

- "Migration,"(with Kenneth R. French), Financial Analysts Journal, 63, number 3

- "The Anatomy of Value and Growth Stock

- "Dissecting Anomalies," (with Kenneth R. French), Journal of Finance,

- "Average Returns, B/M, and Share Issues," (with Kenneth R. French) Journal of Finance,

- "Luck versus Skill in the Cross-Section of

- "Size, Value, and Momentum in International

- "Does the Fed Control Interest Rates?" Review of Asset Pricing Studies, 2013 3:

- "Was There Ever a Lending Channel?" European

- "Two Pillars of Asset Pricing," Amercan Economic

- "A Five-Factor Asset

- "Incremental Variables and the Investment Opportunity Set," (with Kenneth R. French) Journal of Financial Economics, (Sept. 2015), 470-488.

- "Dissecting Anomalies with a Five-Factor Model," (with Kenneth R. French) Journal of Financial Studies (2016), 69-103.

- "International Tests of a Five-Factor Asset-Pricing Model," (with Kenneth R. French) Journal of Financial Economics (2017), 441-463.

- "Choosing Factors," (with Kenneth R. French), Journal of Financial Economics, 2018, 234-252.

- "Volatility Lessons," (with Kenneth R. French), Financial Analysts Journal, Third Quarter 2018, 42-53.

- "Long-Horizon Returns," (with Kenneth R. French), Review of Asset Pricing Studies, 2019, 232-252.

- "Interest Rates and Inflation Revisited," Review of Asset Pricing Studies, 2019, 197-209.

- "Comparing Cross-Section and Time-Series Factor Models," (with Kenneth R. French), working paper, Sept. 2018.

Corporate Finance — Theoretical

- "Perfect Competition and Optimal Production

- "Risk-Adjusted Discount Rates and Capital

- "The Effects of a Firm's Investment and

- "Contract Costs and Financing Decisions," Journal of Business, 63 (January 1990),

- "Discounting under Uncertainty," Journal of Business, 69 (October 1996), 415-428.

Corporate Finance — Empirical

- "Dividend Policy of Individual Firms: An

- "The Empirical Relationships between the

- "Taxes, Financing Decisions, and Firm Value," (with Kenneth R. French), Journal of Finance,

- "The Corporate Cost of Capital and the Return

- "Disappearing Dividends: Changing Firm

- "Testing Tradeoff and Pecking Order

- "Financing Decisions: Who Issues Stock?" (with Kenneth R. French), Journal of Financial

- "Capital Structure Choices," (with Kenneth R.

General Economics — Theory

- "The Number of Firms and Competition" (with Arthur Laffer), American Economic

- "Ordinal and Measurable Utility." In Studies

- "Banking in the Theory of Finance," Journal of Monetary Economics (January

- "Agency Problems and the Theory of the Firm," Journal of Political Economy (April

- "Separation of Ownership and Control," (with Michael Jensen), Journal of Law and

- "Agency Problems and Residual Claims," (with Michael Jensen), Journal of Law and

- "Financial Intermediation and Price Level

- "What's Different About Banks?" Journal of Monetary Economics, (January

- "Organizational Forms and Investment

- "Time, Salary, and Incentive Payoffs in Labor

General Economics — Empirical

- "Inflation, Output and Money," Journal of Business (April 1982).

- "Inflation, Real Returns and Capital

- "A Comparison of Inflation Forecasts," (with Michael Gibbons), Journal of Monetary

- "Commodity Futures Prices: Evidence on

- "Business Cycles and the Behavior of Metals

- "Transitory Variation in Investment and GNP," Journal of Monetary Economics, 30 (December 1992), 467-480.

- "Forecasting Profitability and Earnings," (with Kenneth R. French), Journal of Business,

- "Does the Fed Control Interest Rates?" Review of Asset Pricing Studies, 2013 3: 180-199.

- "Was There Ever a Lending Channel?" European

General Statistics

- "Some Properties of Symmetric Stable

- "Parameter Estimates for Symmetric Stable

[i] Research Papers in Economics. "Economist Ranking at IDEAS – Top 10% Authors, as of April 30th, 2016.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. IFA Index Portfolios are recommended based on investor's risk capacity, which considers their time horizon, attitude towards risk, net worth, income, and investment knowledge.