A well-documented behavioral bias among investors is home bias — the tendency to favor domestic investments over international ones.

There are a number of reasons for it. One is that people feel more comfortable investing in companies based close to home, which, rightly or wrongly, they think they know more about. (Believe it or not, there used to be a LocalShares Nashville Area ETF.)

Pride and patriotism can also contribute to home bias. You might think, for example, that domestic markets are safer or more trustworthy, or you may just want to support American companies as a matter of principle.

But however laudable your reasons for allocating 80, 90 or 100 percent of your equity exposure to the United States, it's not a rational thing to do from a purely investment perspective. Allocating, say, 40% of your stock portfolio to international equities instead would give you much greater diversification. It would also reduce risk and volatility, and may, in long term, produce superior risk-adjusted returns as well.

Is International Exposure Strictly Necessary?

But how essential is it to invest in overseas markets when the U.S. economy and stock market are so dominant? U.S. companies currently make up around 60 percent of the global equity market. Even Warren Buffett and Vanguard founder John Bogle have argued that most equity investors should simply own an S&P 500 index fund.

Here at IFA, we have huge respect for both Buffett and Bogle. But, on this particular point, we respectfully disagree. True it may not be strictly necessary to invest in foreign markets. Investors who invest, passively and patiently, in U.S. equities only are likely to enjoy successful long-term outcomes. But would they be better advised to own non-U.S. stocks as well? The overwhelming evidence is that they would.

Broadening Your Horizons Reduces Risk

The case for owning overseas, as well as U.S., stocks is essentially based on what I call the golden rule of investing — diversification. The primary reason for diversifying is to reduce risk and volatility. All investing entails risk, and diversifying certainly doesn't eradicate risk entirely. But what it does protect you from is concentration risk, or non-systematic risk.

Every country face risks, including the U.S. There's a risk, for instance, that the U.S. economy could enter a recession, or that another close election result could spark civil unrest or perhaps a long-drawn-out legal battle and stalemate on Capitol Hill. And then there are the risks that none, or very few of us has even thought about. As the economist and author Nassim Nicholas Taleb once said, "risk is what you didn't see happen." Think of 9/11, for example.

The point is, if your portfolio is globally diversified, the impact of a negative event affecting any one country, including the U.S, will be substantially reduced.

Potential For Higher Returns

Diversification, though, isn't just about managing risk. As the late Nobel laureate Harry Markowitz showed, diversification can also improve returns by giving investors access to a wider range of investment opportunities.

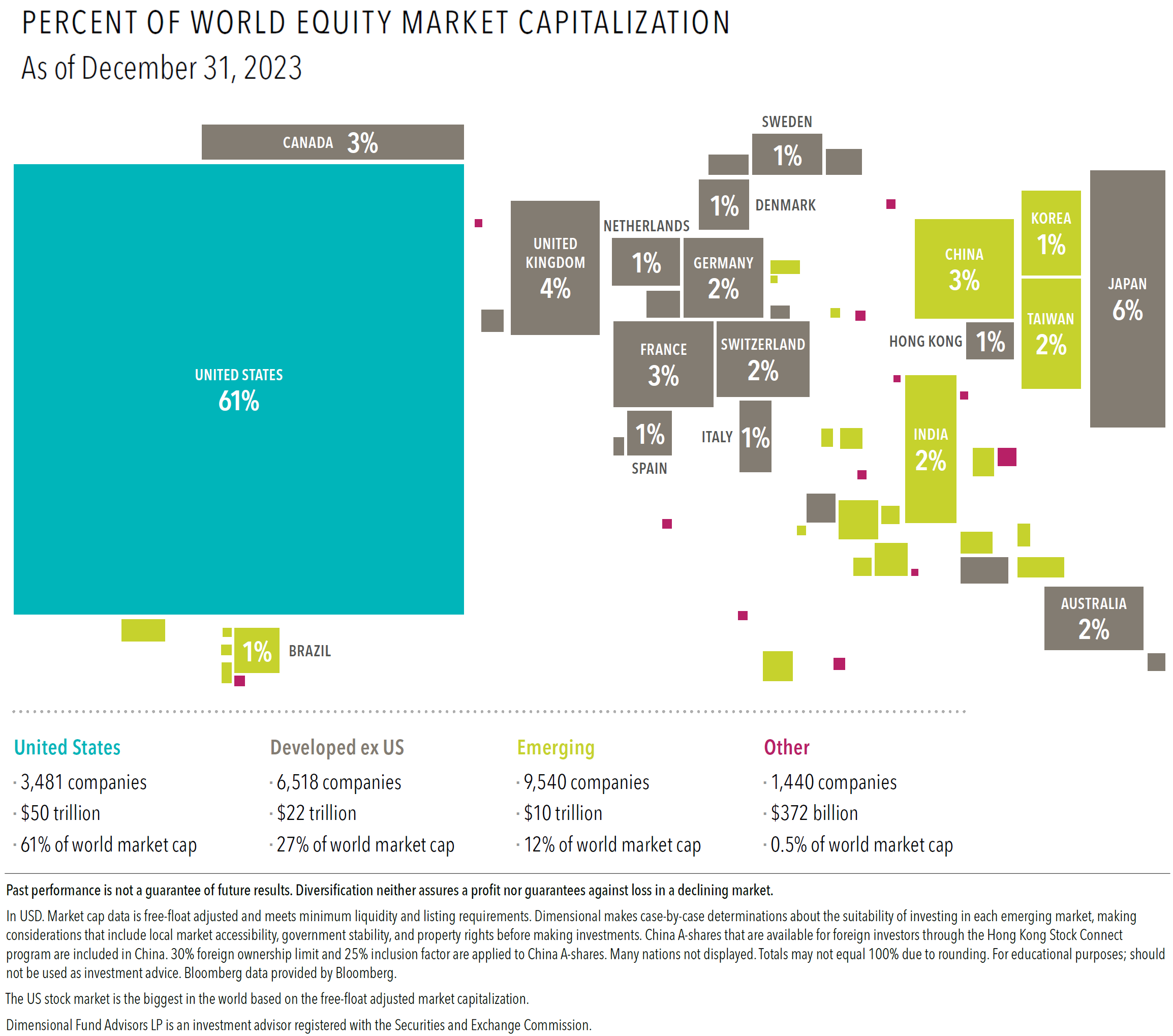

Investors today have a whole world of opportunities to choose from. As you can see from the chart below, stocks of the roughly 17,500 companies trading outside the U.S. represent almost 40% of the $82 trillion global equity market.

Even countries that are geographically small, or that have small populations or gross domestic product, provide attractive investment opportunities. Japan, for example, accounts for six percent of the value of the world's equity market, with more than 2,500 publicly listed companies, including familiar names like Toyota, Sony, Mitsubishi, SoftBank and Nintendo.

Switzerland has a population of fewer than nine million people, but its stock market includes some of the world's largest multinational corporations, like Nestlé, Roche, Novartis, UBS and Zurich. The Swedish population is only slightly bigger, and yet Sweden is home to globally recognized companies like Ericsson, Volvo, H&M and Skanska.

Of course, it's very hard to identify which countries are going to outperform from one year to the next, as you can see from the chart below. But if you hold a globally diversified portfolio for the long term, you can be sure to have exposure to the best-performing countries every year.

So, by looking outside the U.S., investors can expand their opportunities for higher expected returns. Of course, a global approach is not guaranteed to produce strong returns every year, but it can deliver more reliable outcomes over time, helping investors stay on track toward achieving their long-term goals.

Dispelling Three Common Myths

Unfortunately, there are several myths about global diversification that put people off investing in overseas markets. Here are three examples.

Myth #1: Global Diversification Doesn't Work Anymore

There is no denying that U.S. stocks have performed very well, relative to non-U.S. stocks, over the last ten or 15 years or so. But, over the very long term, the performance of U.S and international stocks has been remarkably similar.

Take the MSCI EAFE index for example. The index covers developed markets outside North America, specifically in Europe, Australasia, and the Far East, and has a track record dating back to 1970. Over the next 40 years, the EAFE index returned an average of 10.2 per cent a year – slightly outperforming the S&P 500's yearly average of 9.9 percent. Over rolling ten-year periods, the EAFE index outperformed 56% of the time.

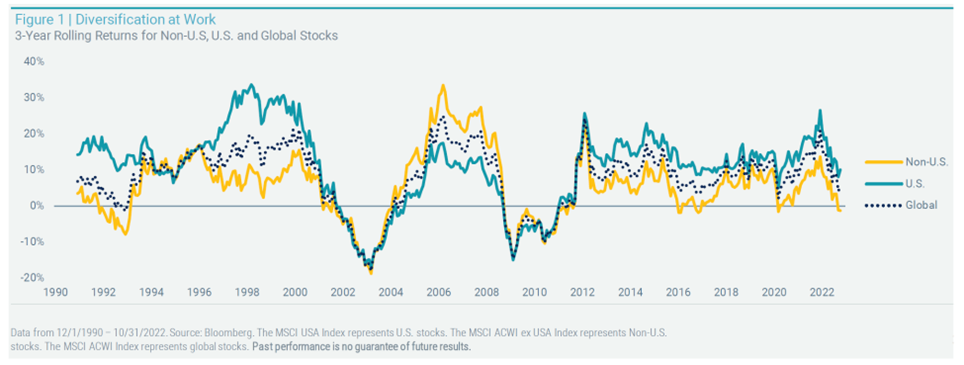

The chart below provides another illustration of the value of global diversification. It shows rolling three-year returns for U.S., non-U.S. (developed and emerging) and global (both U.S. and non-U.S.) stocks from December 1990 through October 2022.

Yes, in some periods U.S. stocks have outperformed, but non-U.S. stocks have been on top in others. For example, over the eight years from April 2002 through March 2010, 88 of the 96 three-year rolling periods returns were higher for non-U.S. stocks, with an average return difference of 6.7% annualized.

The dotted line represents global (U.S. and non-U.S.) stocks. Over the entire period, global stocks were always somewhere in the middle — neither the highest nor the lowest — which highlights the diversification benefits of investing across global markets.

Myth #2: Owning U.S. Based Multinationals is Sufficient

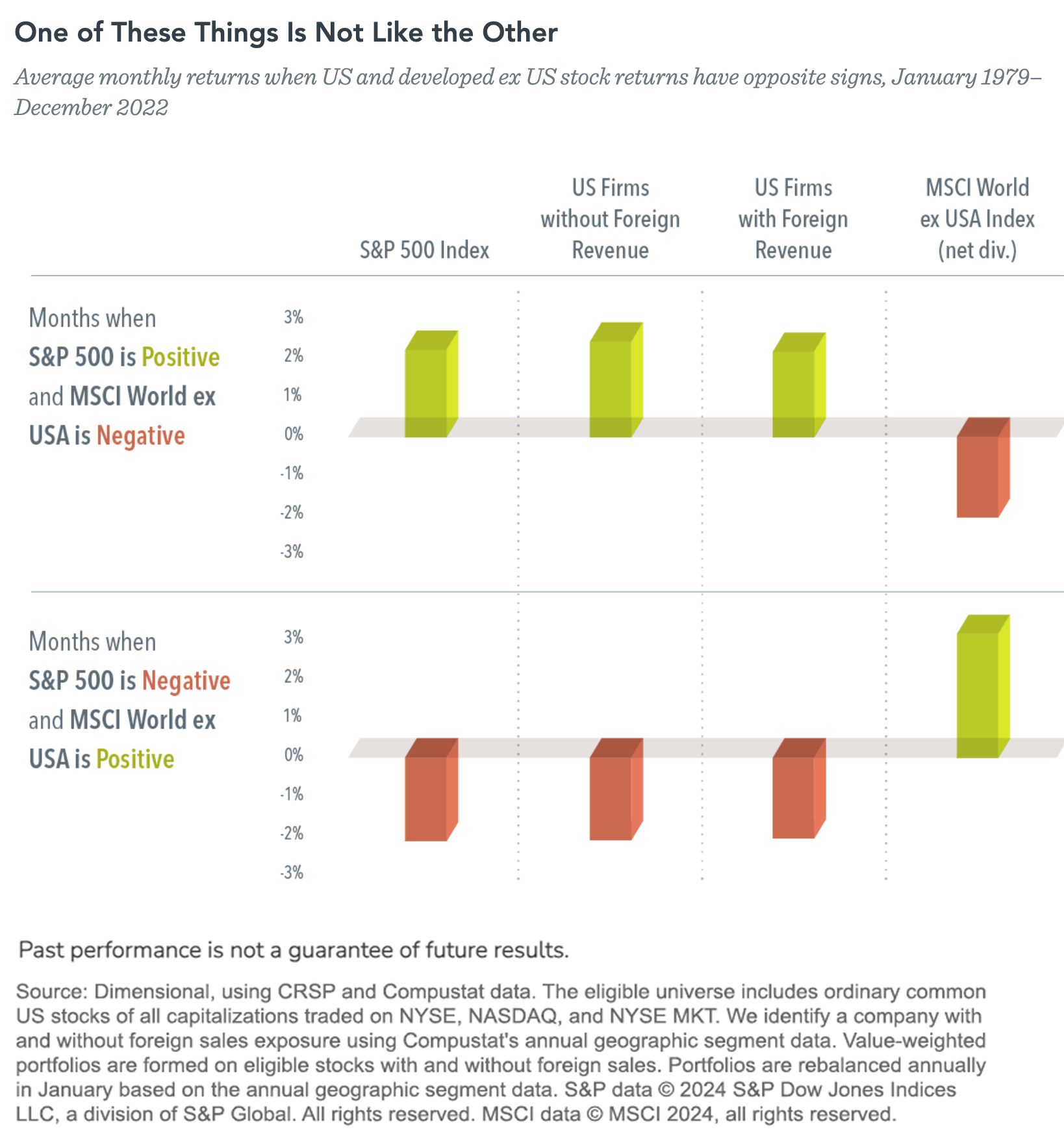

Another point made by those who advocate sticking to U.S. stocks is that the U.S. stock market contains many multi-national companies that earn large revenues from providing goods and services in foreign countries. It is of course true. However, to quote Wes Crill from Dimensional Fund Advisors, "the data suggest these companies are no more successful at global diversification than a faux mane is at turning a golden retriever into a lion."

DFA researchers tested the global diversification benefits of companies with non-U.S. revenues by looking at their average returns in months when U.S. stock returns and international returns diverge. In theory, stocks offering sufficient non-US exposure should move more in line with the international market. However, on average, as you can see from the next chart, companies with non-US revenues appear to merely track the broader U.S. market.

But what happens when the U.S. market has gone down and investors would hope for global diversification to kick in? Well, the researchers found that companies with non-U.S. revenues were similarly down. These results reinforce academic evidence showing that equity prices tend to move based on where they trade more than where the business resides.

Myth #3: The U.S. Market Provides Exposure to All Sectors

Something else that deters investors from investing internationally is that the U.S. market itself provides sufficient diversification across different types of stocks and different sectors of the economy. But, as Morningstar's 2024 Diversification Landscape report shows, the U.S. market has become increasingly tilted towards larger growth stocks. The technology sector, for example, accounts for 29% of the Morningstar U.S. Market Index, but just 12% of the Morningstar Global Markets ex-U.S. Index.

Of course, this heavier concentration of growth and technology stocks has hugely benefited U.S.-only investors over the last ten years, with big technology firms like Google, Apple and Amazon performing so strongly. But no investment trend lasts forever, and, when smaller stocks and value stocks come back into favor, investors who are globally diversified stand to gain. Non-US indexes feature a much heavier emphasis on traditional value sectors, including energy, basic materials, and financial services.

Conclusion

As we always like to remind people, no financial adviser or portfolio manager has a crystal ball. No one can tell you whether U.S. stocks will outperform non-US stocks over the next 10, 20 or 30 years. But, as the Global Investment Returns Yearbook reminds us year after year, the key takeaways of the last 125 years of market history are that investors who invested all their money in one particular country occasionally suffered catastrophic losses. Investors, on the other hand, who were globally diversified were generally well rewarded for the risk they took, as long as they remained disciplined and patient.

It's perfectly true that, on average, global investors would have achieved higher returns over the last decade and more if they had simply invested in U.S. stocks. But their portfolios have also been slightly less volatile. The ten-year standard deviation of the Morningstar U.S. Market Index is 15.5, whereas the standard deviation of the Morningstar Global Markets Index, which includes both US and non-US names, is 15.0.

The crucial point, however, is that nothing in the markets stays the same indefinitely. As the chart below shows, there have been periods since 1970 when the MSCI World index has outperformed the S&P 500 index. It is surely only a matter of time before it outperforms again.

Ask yourself then: Do you really know what the future holds? In particular, how sure can you be that the extraordinary price growth of the so-called Magnificent Seven tech stocks will continue? Their average price-to-earnings ratio is already around 35x, compared to a forward P/E ratio of about 15.5x for the rest of the S&P 500. There has to be an inflection point at some stage, and it might come sooner than the experts are predicting.

Bottom line: going all-in on U.S stocks is a gamble. So, is it a gamble you're willing and able to lose?

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.