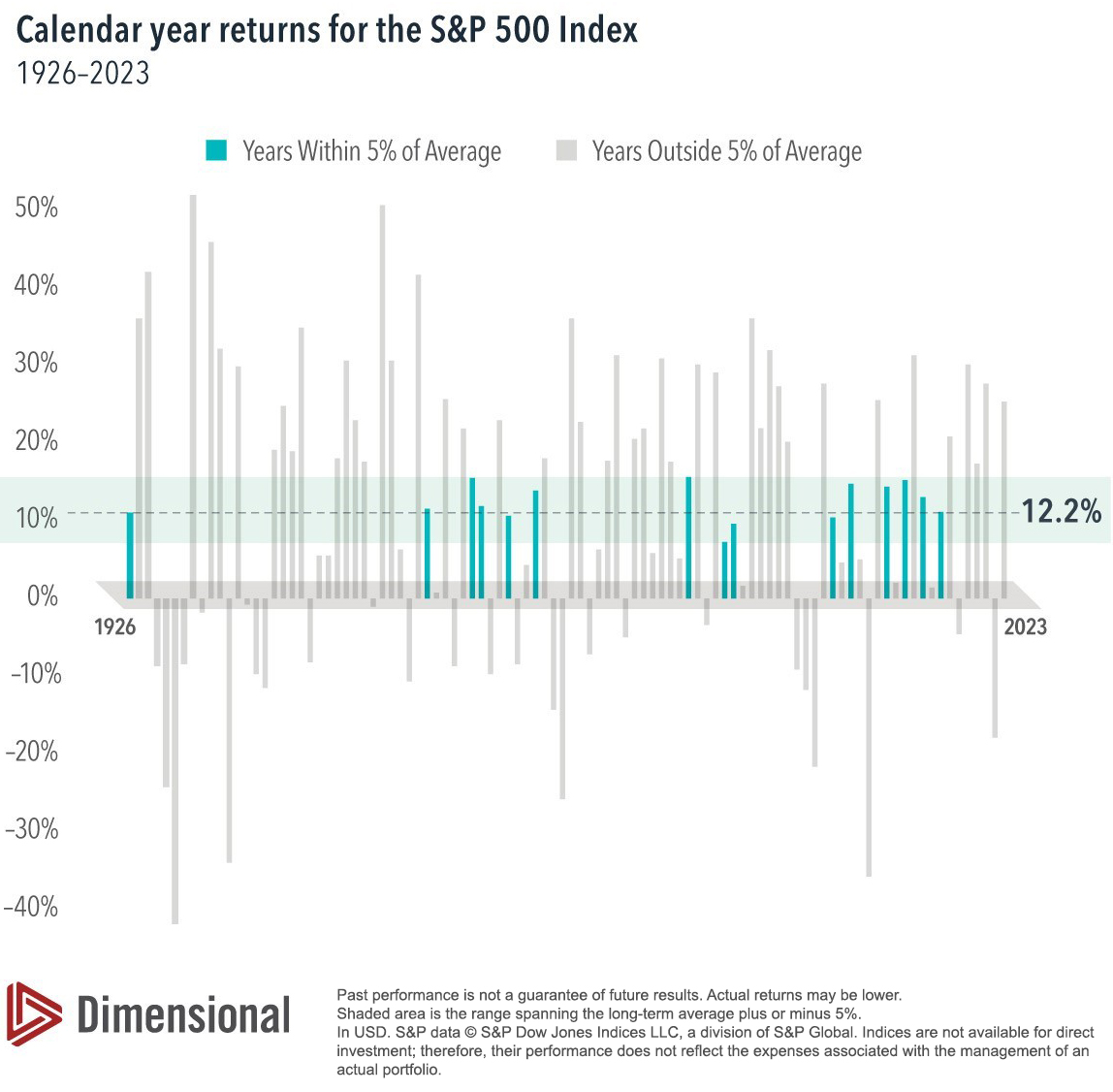

Ask investors what kind of return they expect out of stocks in any given year, and many will respond with the market's historical average return. For the S&P 500 Index from January 1926 through December 2023, that's been a little over 12%. Unless you have a crystal ball, that's a reasonable guess in any given year.

And yet, history shows us what we end up getting from stocks is likely to be far from the average. Since 1926, only 15 out of 98 years had returns within five percentage points of the 12.2% average. In the other 83 years, the average deviation was over 18 percentage points. Talk about an uncommon average!

Actual returns can deviate from expected returns because information and circumstances change. If the news is better than expected, markets may go up. Of course, the reverse is true if the news is disappointing. In a world with so many potential sources of news—the economy, elections, geopolitical conflict—it shouldn't be surprising that we often receive returns either much higher or lower than the long-run average.

This article originally appeared September 26, 2024 in Above the Fray, a weekly newsletter from Dimensional Fund Advisors. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.