Warren Buffett is generally accepted as the world's most successful living investor. His company Berkshire Hathaway, of which he is still the chairman and CEO at the age of 93, produced market-beating investment returns for decades. Buffett's net worth is estimated to be around $115 billion, and he has already donated more than $50 billion to charitable causes.

Thankfully, Buffet has willingly shared with investors the lessons he has learned over the course of his career, mainly through his famous annual letters to Berkshire Hathaway shareholders.

The advice he has given has been consistently unequivocal. In a nutshell, Buffett says, investors should:

- Keep things simple

- Focus on the long term;

- Stay humble;

- Keep calm in volatile markets; and

- Avoid active investing.

People are often surprised by that final tip. After all, Buffett made his name through active investing.

As my colleague Murray Coleman explained in an article in February, there are reasons to explain Berkshire Hathaway's historical outperformance. Suffice to say, the company has failed to beat the broader stock market since the global financial crisis, and, in his most recent letter, Buffett warned that Berkshire has virtually "no possibility of eye-popping performance" in the years ahead.

Buffett Has Consistently Advocated Indexing

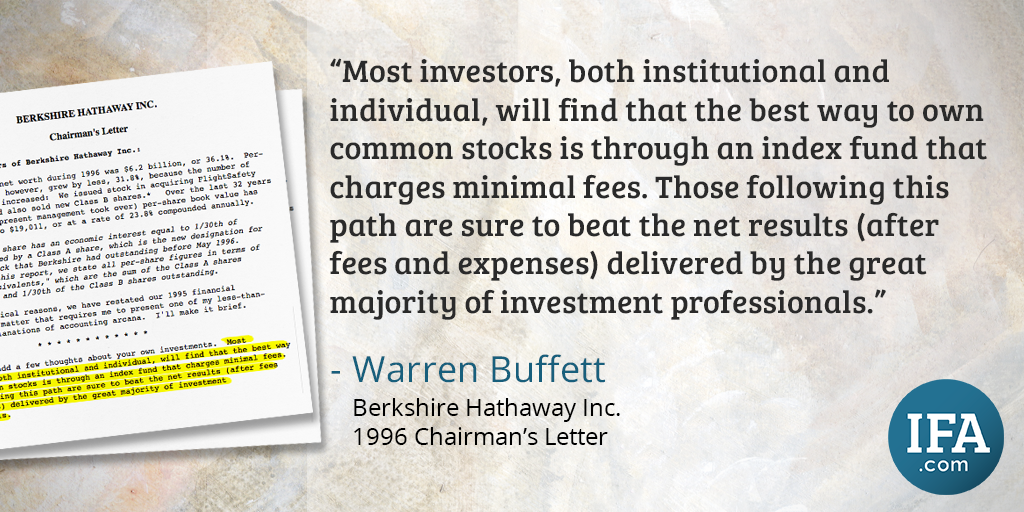

Buffett has repeatedly said that the vast majority of investors would be better off indexing. In his 1993 letter, for example, he wrote: "By periodically investing in an index fund the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb' money acknowledges its limitations, it ceases to be dumb."

Buffett has also made it abundantly clear that his advice applies just as much to institutional investors as it does to individuals. In his 2016 letter, for instance, he wrote: "Both large and small investors should stick with low-cost index funds."

In that same letter, Buffett expressed dismay at how many people ask for his advice and then ignore it. "To their credit," he wrote, my friends who possess only modest means have usually followed my suggestion.

"I believe, however, that none of the mega-rich individuals, institutions or pension funds has followed that same advice when I've given it to them. Instead, these investors politely thank me for my thoughts and depart to listen to the siren song of a high-fee manager or, in the case of many institutions, to seek out another breed of hyper-helper called a consultant."

Consultants Have An Incentive Problem

It's fair to say that Warren Buffett has a very low opinion of traditional investment consultants. Speaking at Berkshire Hathaway's annual shareholder meeting in 2016, he explained how most consultants just aren't commercially incentivized to provide the best advice.

"No consultant in the world is going to tell you, ‘just buy an S&P index fund and sit for the next 50 years,' he said. "You don't get to be a consultant that way. And you certainly don't get an annual fee that way.

"So the consultant has every motivation in the world to tell you, ‘this year I think we should concentrate more on international stocks,' or ‘this manager is particularly good on the short side,' and so they come in and they talk for hours, and you pay them a large fee, and they always suggest something other than just sitting on your rear end and participating in the American business without cost. And then those consultants, after they get their fees, they in turn recommend to you other people who charge fees, which… cumulatively eat up capital like crazy.

"I've talked to huge pension funds, and I've taken them through the math, and when I leave, they go out and hire a bunch of consultants and pay them a lot of money. It's just unbelievable."

The Case For An Indexed OCIO

At Index Fund Advisors, we agree with Buffett that indexing is the rational strategy for all investors, including institutional ones. We work with pension funds, charities and endowments to establish their goals and provide them with carefully tailored portfolios of non-traditional index funds that match their time horizon and capacity for risk. We also provide ongoing portfolio management with clear and timely reporting.

If you're the trustee of a pension fund or endowment and you still aren't using index funds for at least the core of your portfolio, I invite you to join a webinar called It Pays to be Different: The Rationale for an Indexed OCIO, presented by my colleague Mark Higgins, Senior Vice President at IFA Institutional on Tuesday July 16th.

Mark will be explaining why consultants who claim to have "beaten the market" over the long term almost invariably haven't. He'll also explain why switching to a simpler, cheaper and broadly passive investment strategy is likely to yield substantially higher returns than investing in high-fee active funds and alternative investments such as hedge funds or private equity.

As Buffett says, "you don't need to have extraordinary effort to achieve extraordinary results."

So why not up for the webinar? Spaces are limited, so register now to avoid disappointment. We look forward to having you join us.

*Quotes and pictures are utilized for illustrative purposes only and should not be construed as an endorsement, recommendation, or guarantee of any particular financial product, service, or advisor.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.