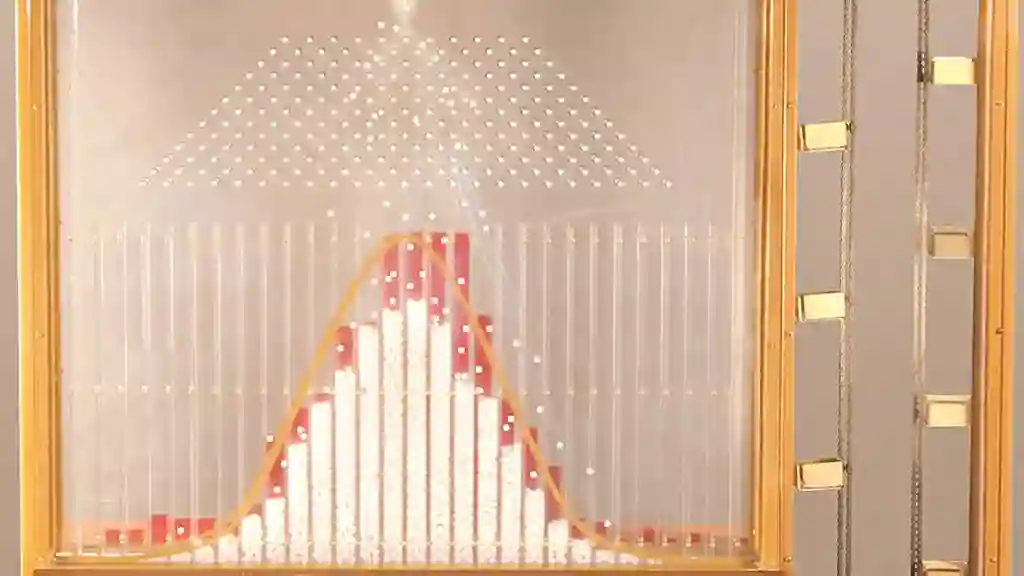

The Random Walk Theory essentially states that there are no discernible patterns in stock market prices. The logic and reasoning goes like this. News moves the markets. News is both unpredictable and random by definition. At the moment of discovery, the new knowledge or information is no longer new and quickly becomes old news. Since free financial markets are free of constraints, this new information is continuously reflected in the prices of relevant financial instruments. Therefore, the world's markets move in a random and unpredictable manner. Over time the distribution of returns form a near bell shaped curve. See several probability machines that simulate monthly returns of the market in the video playlist below:

Of course there is a positive upward movement over 15 to 20-year periods in diversified portfolios due to the compensation that investors receive for subjecting their capital to risk. The higher levels of the right risk factors correlate to higher expected returns over long periods of time. But the positive upward movement is virtually invisible when looking at returns over smaller periods of minutes, hours, days, months, or even several years. This positive movement is so small that Nobel Laureate Paul Samuelson compares it to watching grass grow. Go out in a big field and take a look.

As a side note, the reason markets trend upward is that the sun shines on capitalism, as your cash provides the fuel to fund profitable ventures. Your cash can be injected into the market through the purchase of products, services, debts or equities. On average, this free market system works better than a central government controlled system. Communism still exists in only a few countries where there is a mentality similar to that of active investors. This mentality is based on the falsehood that free markets do not reflect all information. Market speculators and communists both think they know more than the collective opinion of millions of voting market participants. They assume that they possess information that has not yet been picked up by the radar of all traders throughout the world. On the other hand, indexers invest under the assumption that markets properly price assets and risk.

To save you some time, all you need to understand about time picking is the Random Walk Theory. This theory simply states that nobody can consistently see what tomorrow will bring. Just remember that markets are moved by news--news that is unpredictable and unknowable in advance (that is the very definition of "news"). Because news is random and unpredictable, the markets move in a random and unpredictable fashion. Period. End of story.

This simple and easy to understand concept about the markets was first published over one hundred years ago. Virtually all subsequent academic studies detailing actual stock market data conclude that time picking is not likely to be a successful investment strategy--unless, of course, the Goddess Fortuna is directing your trades with whispers from above.

Rex Sinquefield is the co-founder and a director of Dimensional Fund Advisors. He is also one of the world's foremost experts on the stock market. In 1995, he was asked to represent index funds investing in a debate with an active manager at a Schwab conference. After an eloquent review of the history of capital markets from Adam Smith to Eugene Fama, he threw down the gauntlet to a room full of active managers, "So, who still believes that markets don't work? Apparently it is only the North Koreans, the Cubans, and the active managers."

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Quotes and pictures are utilized for illustrative purposes only and should not be construed as an endorsement, recommendation, or guarangee of any particular financial product, service, or advisor. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.