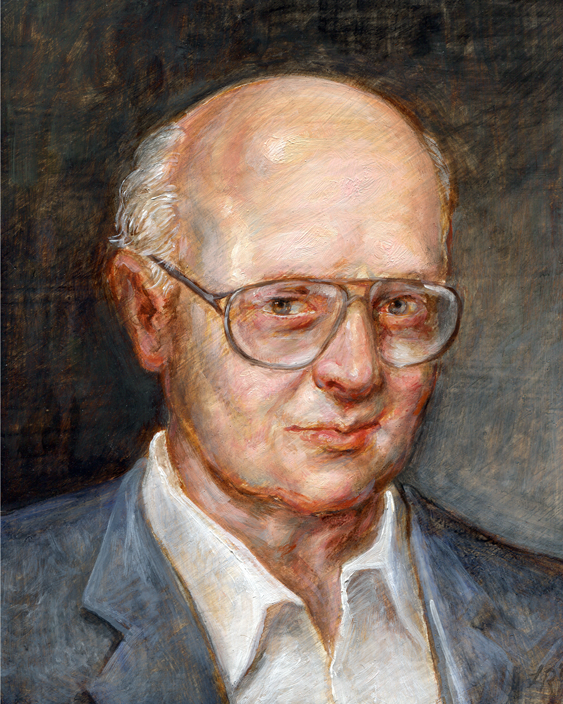

Harry M. Markowitz, whose pioneering research into portfolio diversification helped revolutionize modern finance, passed away in San Diego on June 22, 2023. The cause of his death at age 95 was pneumonia and sepsis, according to news reports.

Harry M. Markowitz, whose pioneering research into portfolio diversification helped revolutionize modern finance, passed away in San Diego on June 22, 2023. The cause of his death at age 95 was pneumonia and sepsis, according to news reports.

Commonly referred to as the father of Modern Portfolio Theory (MPT), Markowitz was awarded the Nobel Prize in economics in 1990 along with Merton Miller and William Sharpe.

"After several decades of economic breakthroughs, the science of investing was recognized in 1990," observed Mark Hebner, Founder and CEO of IFA in his book "Index Funds: The 12-Step Recovery Program for Active Investors."

In particular, Markowitz was honored for his research regarding portfolio construction in relation to risk and return. Along with studies by Miller and Sharpe, his findings formed the basis of what's now known as Modern Portfolio Theory. As Hebner put it in his Index Funds book: "After years of work they were credited with collectively reforming the way the world invests and forming conclusions that continue to inspire financial economists today."

Indeed, the groundbreaking studies of Markowitz "launched a revolution in finance, upending traditional thinking about buying stocks," wrote the New York Times shortly after his death.1

The Growth of MPT

Markowitz began his studies into stock markets in the early 1950s while working on his graduate dissertation at the University of Chicago. Portfolio construction in those days didn't focus on an investor's exposure to risk.

As he explained in a 2012 interview with IFA's Hebner, a popular theory at the time was "the way you maximize the expected value of a portfolio is to put all of your money into a stock that has the highest expected value."

In other words, "you put all of your eggs in one basket," he added. (See a video of Hebner's full interview with Markowitz below. Also, IFA's complete online library of videos about Markowitz can be found here.)

Markowitz built his research around a fundamental premise of economics: A scarcity of resources means money-related decisions typically involve choosing between different variables, noted Suresh Sethi, a management professor at the University of Texas in Dallas. In a 2021 review of the Nobel laureate's career, he summarized:

"Markowitz had a brilliant flash of insight, realizing that investors diversify out of a concern for risk as well as return. In other words, investors do not simply choose the stock that yields the maximum expected return regardless of its risk; they consider their own risk tolerance when selecting stocks for their portfolios." 2

Separating Risk & Return

Research by Markowitz revealed that investors need to be as concerned with the volatility (i.e., risk) of stocks as they are with expected returns. In 1952, his research piece "Portfolio Selection" was published by the Journal of Finance. Seven years later he authored an often-cited book, "Portfolio Selection: Efficient Diversification."

In his "Portfolio Selection" paper, Markowitz first developed a theory to optimally invest in stocks with different risk and return characteristics. Comparing several stocks from the New York Stock Exchange, he created the first 'efficient frontier' of portfolio management and investing. (You can read the full paper by clicking on the image to the right.)

"Investment managers and academic economists have long been aware of the necessity of taking both risk and return into account," wrote Hebner in an article reviewing the Nobel laureate's work. "Markowitz's primary contribution consisted of developing a rigorously formulated operational theory for portfolio selection under (market) uncertainty."

In the past, risk was discussed in general terms and based "on feeling and intuition" than more exacting measurements, noted Hebner. Markowitz was able to quantify the "undesirable thing" an investor tries to avoid, he added, by using a range of possible return outcomes — based on the past variability of returns.

With an enhanced mathematical framework in place, he was able to contrast in more definitive terms risk and return attributes at micro and macro portfolio levels. In his IFA article, Hebner pointed out:

"Markowitz's contribution extended to making the distinction between the risk of an individual stock and the risk of a portfolio. He showed how individual risky stocks lose much of their risk if combined with less risky stocks in a portfolio. What is remarkable about Markowitz's discovery is that an investor can reduce the volatility of a portfolio and increase its return at the same time."

A Man for All Seasons

Markowitz wasn't just a financial innovator. He also proved to be prolific in developing computer applications to support and increase his ability to conduct securities research.

The financial economist developed Simscript, a programming language used to write simulation software. This led to his helping to found CACI International Inc. in 1962, which develops training programs and related services for Simscript.

Markowitz credited his work in researching optimal mean variance portfolios to help from George Dantzig, another veteran mathematician. The two worked together when Markowitz joined RAND Corp. in the early ‘50s. He also met Sharpe at RAND when both were at the research firm.

The combination of computerized mathematical simulation techniques along with his work in formulating Modern Portfolio Theory for investors was recognized in 1989 by the Operations Research Society of America (now known as the Institute for Operations Research and the Management Sciences).

"Markowitz's portfolio theory also transformed production and operations management, with its mean-variance criterion being used extensively in supply chain management for risk-averse agents," noted University of Texas professor Sethi.

His professional career included spending a year at the Cowles Foundation, which traces its roots to the Cowles Commission for Research in Economics formed by Alfred Cowles in 1932. The prestigious organization — along with Cowles — is credited with development of modern econometric theory. (For more information, read our article, "Alfred Cowles: The Origins of the S&P 500 Index.")

In terms of academia, Markowitz worked at the University of California, Los Angeles and Baruch College of the City University of New York. In 1994, he became a research professor of economics at the University of California, San Diego.

As discussed in his video interview with Hebner, Markowitz was a student of physics, the writings of Charles Darwin and classical philosophers such as Rene Descartes and David Hume. "You're a real Renaissance man," Hebner noted during the video discussion.

Contributions to IFA's Investment Philosophy

For our clients, it's worth pointing out that Markowitz worked for about seven years (starting in the mid-2000s) as a consultant to IFA's Investment Committee.

For our clients, it's worth pointing out that Markowitz worked for about seven years (starting in the mid-2000s) as a consultant to IFA's Investment Committee.

In particular, his sharing of ideas about various market research and dialogue with Hebner helped to support continued growth of Index Fund Advisors as an independent registered investment advisor (RIA) and evidence-based wealth management firm.

"Today, Markowitz's highly acclaimed research serves as the framework for the Prudent Investor Rule, as well as for the investment strategies of institutional investors around the world," noted Hebner. "In fact, trillions of dollars in institutional assets are estimated to invest in accordance with professor Markowitz's Nobel Prize-winning discoveries."

Footnotes:

1.) Robert Hershey Jr., The New York Times, "Harry Markowitz, Nobel-Winning Pioneer of Modern Portfolio Theory, Dies at 95," June 25, 2023.

2.) Suresh Sethi, The University of Texas, "Harry Markowitz: Creator of the Modern Portfolio Theory," Spring 2021.