If top stocks exert a gravitational pull on the broad market's return, the Magnificent 7 have acted like the TON 618 black hole1 over the US the past few years. Accounting for about one-third of the S&P 500 Index's weight2, the performance of these stocks has been a big driver of market capitalization weighted US large cap stock index returns.

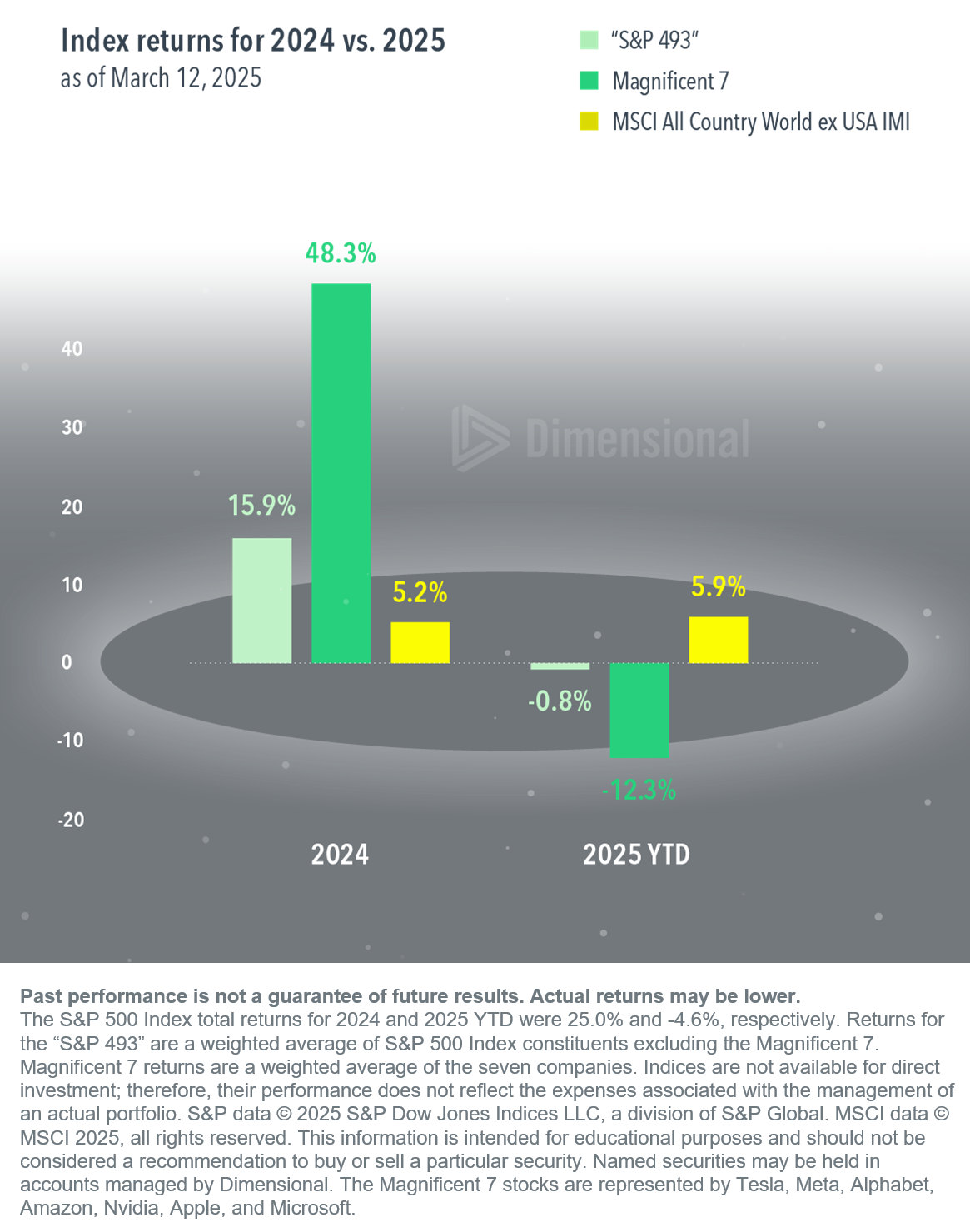

This force can pull in a positive or negative direction. In 2024, the S&P 500 returned 25.0%. This was driven heavily by the Magnificent 7, which returned 48.3%. The other 493 stocks in the index collectively returned 15.9%. This year, the opposite effect has played out: The Magnificent 7 returned -12.3% through March 12, compared to -0.8% for the "S&P 493."

The swings in performance for a US large cap index make a compelling case for global all-cap diversification, which helps lessen exposure to the Magnificent 7. While non-US stocks underperformed the US in 2024, the MSCI All Country World ex USA IMI Index is outpacing the US thus far in 2025. Diversifying across regions and market capitalization is one way to mitigate the impact of a handful of stocks.

1. NASA Animation Sizes Up the Universe's Biggest Black Holes

2. As of December 31, 2024.

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.