When it comes to investing, we can identify many risks investors assume, either knowingly or not. At Index Fund Advisors, we see it as our core mission to get investors to take the risks that are worth taking (e.g. market, size, value, term, and default) and avoid the ones that are not (e.g. concentration risk, manager selection risk, market timing risk). In our opinion, there is one other risk that may overshadow all of them—the risk related to the selection of an advisor, including an investor choosing to be his own advisor. We call it "Advisor Risk" because it is the investor's advisor who chooses whether or not to engage in the potentially destructive investing strategies of stock picking, market timing, manager picking, and style drifting. Furthermore, it is also the advisor who chooses when and how to engage in the potentially helpful activities of asset allocation, asset location, rebalancing, tax loss harvesting, tax management, withdrawal strategies, and glide path methods. The advisor also ultimately determines the costs borne by the investor such as fund management fees, transaction costs, taxes, and the advisory fees themselves. An advisor who fails to properly assess the risk capacity of his client will eventually face one of two bad situations: The client bails out in a bear market because he was carrying more risk than was appropriate, or the client fails to capture the long-term returns that were available to him because he did not take on the amount of risk that his capacity allowed. So there are many areas where bad advice from an advisor can have a substantial negative impact on a clients returns.

Another area of advisor risk lies in fraud. Case in point, financial advisor Scott Mason out of Pennsylvania was recently charged in a $20 million dollar fraud scheme where he used dozens of clients funds for his own personal expenses such as country club dues, and a stake in a miniature golf course according to the SEC and DOJ*. Who you choose as an advisor is very important, and you should due your due diligence before selecting an advisor.

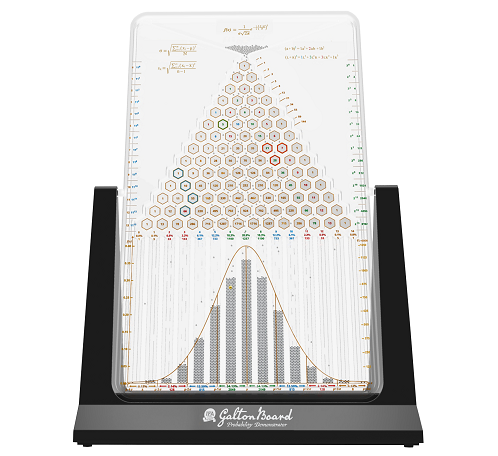

In 2018, IFA conducted an internal study of the behavior of our clients over a ten-year period ending 12/31/2018. This period includes the global financial crisis of 2008-2009 and the subsequent recovery. As the chart below shows, the average client that did not follow IFA's advice (i.e. they chose to become their own advisors) only captured 77.93% of their benchmark portfolio return (the index portfolio determined by their initial risk capacity survey).

IFA considers it the duty of every investment advisor to demonstrate their knowledge through education and documentation and to provide transparency of fees and the strategy they plan to follow in the future. Following these practices will serve to minimize Advisor Risk to their clients, and advisors who fail to live up to these standards will inherently have more uncertainty associated with their advice in the future. We think of an investor's risk budget as an amount of uncertainty an investor is capable of accepting.

The less investors know about their advisor's knowledge, fees and strategy, the higher they should rate their exposure to Advisor Risk. Since investors have a limited risk budget, a risky advisor means investors should have less investment risk in order to maintain their risk budget. Of course, with lower investment risk comes lower expected returns. Therefore, advisors who have invested less in the demonstration of their understanding of how markets work may have actually lowered the expected return of their clients who should properly allocate a higher portion of their risk budget to Advisor Risk.

For example, lets say an individual investor scores a 70 on IFA's Risk Capacity Survey. That would equate to an IFA Index Portfolio 70, which has an investment risk of 11.50% (that is standard deviation of the 50 year return as of 12/31/2024) and has had an annualized return of 11.20% over the last 50 years ending 12/31/2024. According to IFA strategies, this investor's risk budget is 11.50%. Now, lets assume that the investor decides to hire an advisor other than IFA or to invest on their own, both of which had provided less evidence, documentation and data as to their knowledge about how markets work. Just for sake of discussion, lets also say we assign an Advisor Risk of 3% to that riskier advisor. This would mean that the investor may want to reduce their risk exposure to an IFA Index Portfolio 50, which has an investment risk of 8.40% (About 3% less than IFA Index Portfolio 70) and an annualized expected return of 9.44%. This would reduce the investors expected return by 1.76%, due to the larger allocation of 3% Advisor Risk. Compare that reduction in expected return of 1.76% to the fee paid to a lower risk advisor.

In our humble opinion, IFA has provided vast evidence of our knowledge through our website and advisors and therefore, positioned IFA to be a minimum risk advisor. This allows our clients to accept near zero Advisor Risk and an investment risk that is equal to their risk capacity.

Can Your Advisor Say This?

* Pennsylvania FA Charged in $20M Fraud Scheme, by Alex Padalka, Financial Advisor IQ, January 22, 2025 - https://www.financialadvisoriq.com/c/4742814/637403/pennsylvania_charged_fraud_scheme

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There are no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. IFA Index Portfolios are recommended based on an investor's risk capacity, which considers their time horizon, attitude towards risk, net worth, income, and investment knowledge. Take the IFA Risk Capacity Survey to determine which index portfolio matches your risk capacity. For detailed information on the hypothetical back-tested performance data shown in this article, including sources, updates and important disclosures, see https://www.ifabt.com Consider the investment objectives, risks, charges and expenses of the mutual funds carefully before investing. Please read the prospectus carefully before investing. IFA utilizes "standard deviation" as a quantification of risk, see the definition of "standard deviation" in the IFA Glossary.