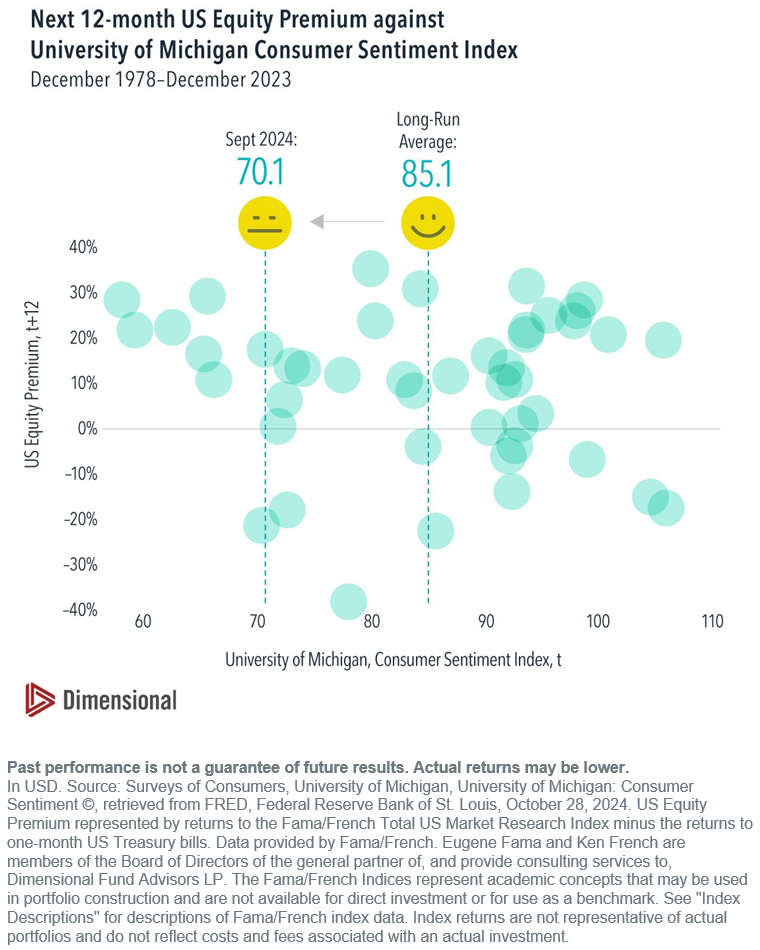

Does your neighbor know where the economy is headed in the next 12 months? Since the 1960s, the University of Michigan has published the popular Consumer Sentiment Index, which asks everyday folk questions like: "Are you better off or worse off financially than you were a year ago?" or "Do you think that a year from now you will be better off financially, worse off financially, or just about the same as now?"1 This index is sometimes viewed as a beacon of how investors feel about the direction of the economy.

The index currently sits at 70.1, pessimistic relative to its long-run average of 85.1.2 Investors interpreting this as an ominous sign for markets may not have anything to fear though, as the data show this index has not been great at predicting future returns. Plotting the level of the Consumer Sentiment Index against subsequent 12-month stock market returns shows no discernible pattern, except that stocks tend to go up more often than they go down. Out of the 226 months where the sentiment index was below the long-run average, the average equity premium over the next year was 10.6%.

If your neighbor is feeling sour, that doesn't necessarily mean you should be changing your outlook or your investment portfolio. Markets tend to price in the latest views on the economy, including consumer optimism.

1. Surveys of Consumers, The University of Michigan. Copyright © 2024, The Regents of the University of Michigan. All Rights Reserved.

2. Current index level as of September 30, 2024. Long-run monthly average includes December 1978–December 2023.

This article originally appeared October 31, 2024, in the DFA's "Above the Fray" series. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Index Descriptions

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor One-Month US Treasury Bills. Source: Ken French website.

Results shown during periods prior to each index's index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.