One of the most commonly asked questions about financial advice is, "Do I really need to pay for ongoing advice?" The answer I tend to give people is this: No, it's not strictly necessary, but, in my experience, there are honestly very few people who have what it takes to manage on their own.

To be clear, there are times in life when everyone should take professional financial advice. A prime example is when you're contemplating retirement. Working out how much money you're going to need isn't just vitally important; it's also extremely complicated. If you get it wrong, the consequences can be catastrophic.

It might also be necessary to consult an advisor when, for example, you sell a business or inherit a large sum of money, or if you get a divorce.

But what about paying for an ongoing working relationship with a financial advisor? How essential is it?

Advice Is Not About Picking Funds

Before trying to answer that question, you really need to understand what it is a good advisor can do for you. Many people just don't realize how an advisor actually adds value. They think, for example, that it's all about finding someone who can tell them which are the right types of assets, and specifically the right funds, to buy and sell at the right time. However, as Mark Hebner explains in his award-winning book, Index Funds: The 12-Step Recovery Program for Active Investors, this is a total fallacy.

The financial markets are very efficient. In other words, they fully reflect all available information. New information is priced into assets within seconds, making it virtually impossible to identify securities that are either underpriced or overpriced with any consistency. As a result, only a small proportion of actively managed funds beat their benchmarks over meaningful periods of time. What's more, those very few funds are extremely hard to identify in advance.

Of course, having an asset allocation that matches, as closely as possible, to your personal capacity for risk is hugely important. But paying an advisor to pick active funds for you is, frankly, a waste of money.

What you need, then, is an advisor with an evidence-based investment philosophy, who understands that the most rational approach is to invest for the long term in a broadly passive manner.

See It As A Casualty Insurance Premium

At this point, many people say something like this: "I can invest passively on my own. Why do I need to pay for advice on that?" Well, the problem is that no matter how simple your investment strategy is, the hard part is sticking to that strategy.

All investors are prone to emotional decision-making — especially when markets are volatile. Having an advisor to keep you calm and rational, and to remind you how the financial markets have rewarded patient investors time and again in the past, is extremely valuable.

Mark Hebner sums it up neatly in Step 12 of his book when he writes: "An investor may want to consider the fees paid to a passive advisor as a casualty insurance premium, insuring investors against their own mistakes and lack of knowledge."

But there are all sorts of other reasons why trying to manage your investments and personal finances on your own is a risk.

For a start, the U.S. retirement system is not straightforward, and many investors have different types of accounts. These can include taxable accounts, traditional IRAs and Roth IRAs. A good advisor can construct one portfolio that includes multiple funds divided among these different account types. The purpose is to maximize after-tax returns.

An advisor can also rebalance your portfolio, to adjust your current asset allocation back to the target allocation. Rebalancing ensures a consistent level of risk exposure and a smoother path towards your investment goals.

Then there's tax loss harvesting. This entails realizing losses, with a view to saving on capital gains taxes in the future. The difference that tax loss harvesting makes can be very significant.

Another vital role an advisor plays is helping to ensure that you don't run out of money later in life. Surprisingly, it happens often, and there are a number of reasons for it. Some people underestimate how much money they're going to need and retire too early, before they've managed to accumulate a sufficiently large portfolio. Some people struggle when suddenly faced with huge medical or legal bills they hadn't expected. And others simply spend too much money early in retirement. That's why having an advisor after retirement can be even more important than having one while you're still earning.

Non-experts Are Prone To Make Mistakes

Here at IFA, we meet people all the time who have tried to avoid paying for financial advice. Of course, we will do whatever we can to help them, but sadly, in many cases, we find self-inflicted damage which could have been avoided. Sometimes they've done a creditable job on their own but because they weren't experts, they've overlooked something important which has ended up costing them dearly.

Other people who come to us after managing their own finances simply hadn't taken the time and effort required to be their own advisor. In some cases, they've fallen out with a friend or relative who recommended the wrong course of action, or the poor decisions they've made has put a strain on their relationship with their partner.

Another way to look at this is to think about someone you know who has worked very hard to achieve a certain level of wealth. Would they honestly come to you and say, "I'd like to pay you to look after my assets and financial wellbeing, and ensure that I'm doing the right thing." With respect, would anyone trust you enough, given your specific skillset, to do that for them? Would they honestly take that risk? More to the point, would you feel comfortable doing that job for them? And would you really want to put in all the time and effort required to ensure that you don't let them down? If the answer to any of those questions is No, you shouldn't even consider being your own advisor.

Even Finance Professors Have Advisors

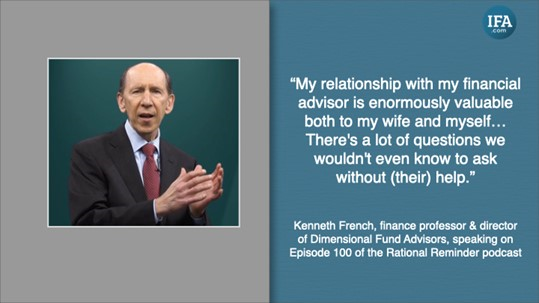

One final thing. Perhaps you feel you already know everything there is to know about investing and financial planning. Maybe you've read Mark Hebner's from cover to cover and watched dozens of our videos. Perhaps you genuinely feel you're capable of managing without ongoing advice. Well, if that's the case, I would encourage you to listen to the 100th episode of the excellent Rational Reminder podcast, which features an interview with the world-renowned professor of finance, Kenneth French.

A long-standing collaborator with Nobel Prize-winner Eugene Fama, French's work has greatly enhanced our understanding of the financial markets and how investors can achieve the highest possible expected returns. Yet, as he explains in this interview, even he pays for ongoing financial advice.

"My relationship with my financial advisor is enormously valuable both to my wife and myself," he says. "I often say it's the most valuable check (we write). (Our) advisor is enormously helpful in dealing with our taxes, dealing with our estate planning… and helping us think through… what we're trying to accomplish... and the charities we want to be involved with.

"There's a lot of questions we wouldn't even know to ask without the help from our financial advisor. So that gives you some comfort being able to sleep at night knowing somebody else is worried about my problems."

Again, it might just be possible for you to manage without an advisor. No matter how much you know, or think you know, however, the bottom line is that you'd be taking a risk. And there are all sorts of other benefits of having an advisor you could be missing out on.

If finance professor Kenneth French thinks advice is worth paying for, it's probably worth it for you as well.

HOW CAN WE HELP YOU?

Do you have any questions about this subject, or any other issue related to investing? If you do, we would love to address them in future content.

Simply email your question to [email protected] with your name and where you live and we'll do our best to answer it.

*Quotes and pictures are utilized for illustrative purposes only and should not be construed as an endorsement, recommendation, or guarantee of any particular financial product, service, or advisor.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.