Denise Delaney, CFP®

As a Senior Vice President and Wealth Advisor at Index Fund Advisors, I understand that each client has a unique set of circumstances that require a comprehensive plan designed to address their financial needs and goals.

I have more than three decades of experience and professional training, including the CFP (Certified Financial Planner) professional designation and a bachelor's degree in business administration.

I believe that building a relationship with an investor is much more than just a business transaction.

Over the years, my practice has evolved to specialize in serving High Net Worth clients. As a seasoned wealth advisor, I am very cognizant of the fact that each client has a different level of investing knowledge and distinct financial and emotional needs. My experience allows me to tailor my communications and guidance to best meet these needs.

I build lifetime relationships with my clients. I have seen firsthand the benefits of multi-generational planning with clients. I utilize my experience helping clients understand investment solutions best suited to their own needs and to facilitate the eventual smooth transfer of their wealth to their children and grandchildren. I take great pride in guiding clients through the complex financial challenges associated with various life stages. My goal is to help clients pursue financial success and peace of mind through thoughtful planning and disciplined investing.

How does it work? Patience and trust!

Over the years I've developed a great deal of patience – not only in developing a holistic and comprehensive plan for each client, but also in providing ongoing education and support to help them become a better investor. My objective with each client is to bring them investing success and peace of mind.

It is crucial to create a sense of trust and competency with my clients.

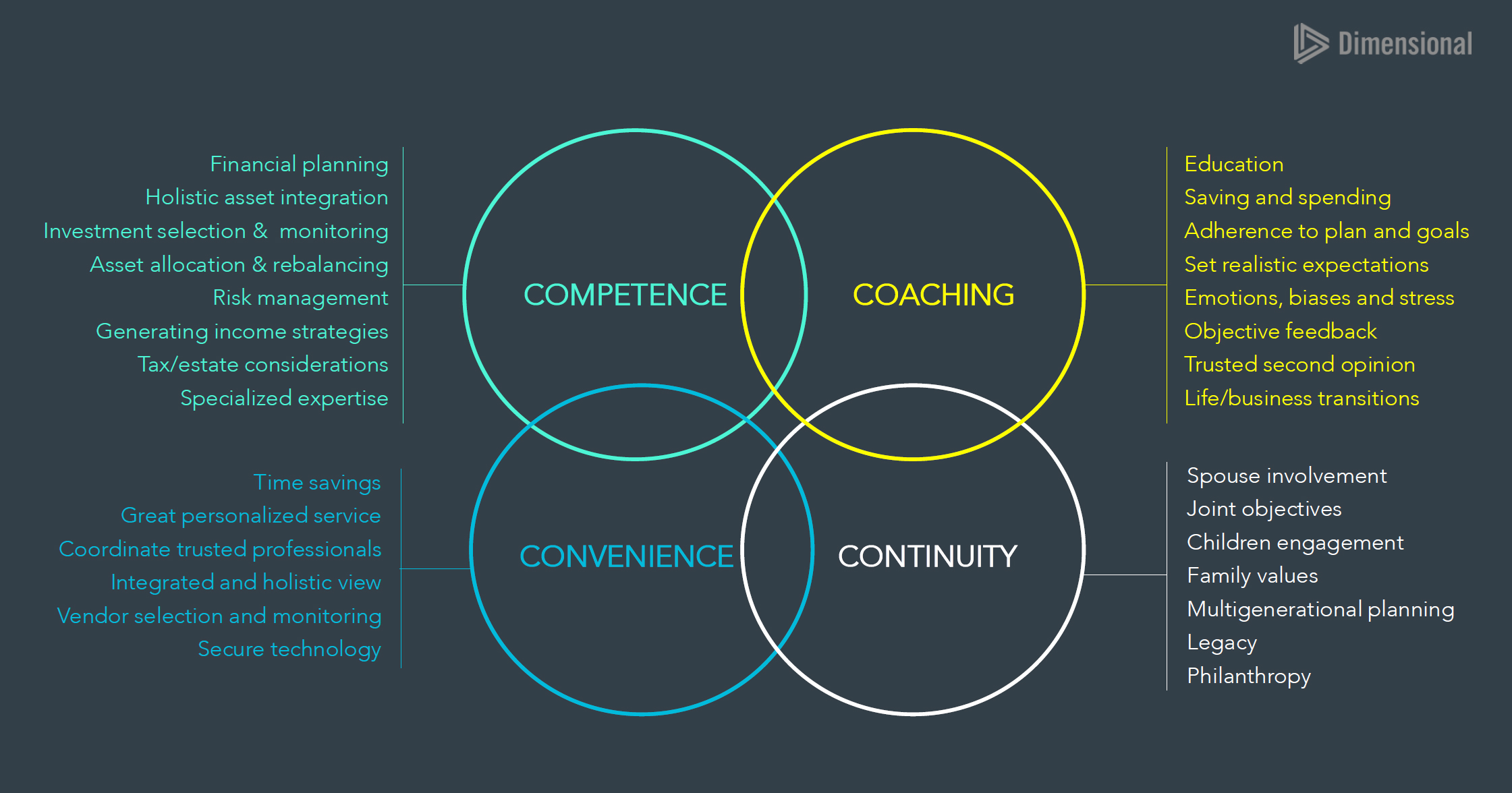

Important areas which overlap are:

My decades of experience in wealth management has taught me the value of bringing dedication to the client relationship including the following:

- Being a great listener

- Initiating discovery conversations about each person's financial goals regardless of what stage of life:

- Retirement Planning

- Asset Management

- Working with client's estate attorney to support wealth transfer and estate planning strategies

- Adjusting my communication style to guide ongoing conversations

- Developing a path to work toward an appropriate and solution tailored to individual circumstances and goals, which requires:

- Clearly spelling out options and having full transparency

- Setting clear expectations about the process of moving forward

- Presenting recommended solutions

- Working in phases, if necessary

- Serving as a central point of focus where I can help investors overcome the confusion of working with multiple professionals

- Educating my clients about how to review and track their personal finances

Access to IFA's enormous library of resources about the benefits associated with a passive investment strategy allows me to help educate clients and their families during our discussions.

A Tour of IFA's Services

IFA Senior Vice President, Denise Delaney takes you through a tour of IFA's many services.

LINKS FROM VIDEO:

Development of Optimal Asset Allocation

Selection & Monitoring of Investments

Cash Management Considerations

Portfolio Comparison Service

Estate and Gift Tax

IFA Senior Vice President, Denise Delaney, sits down with Lauren Doyle from Tredway Lumsdaine & Doyle LLP to discuss various aspects of the Estate and Gift Tax. What are the current exemptions? What might they be in the future?

At IFA, we are dedicated to acting with a fiduciary standard of care. In addition, I am able to tap into a multitude of tools and resources to help explain and meet a client's financial objectives.

For more information about my services, please feel free to contact me to schedule a complimentary introductory conversation.

Denise Delaney at 949-428-0457 or email me at [email protected]

Certified Financial Planner™ (CFP) is a designation received upon passing the course work and exam administered by the Certified Financial Planner Board of Standards, Inc. (CFP Board).

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Investing involves risks, including possible loss of principal. Advisors may collaborate with other professionals, such as estate planning attorneys or tax professionals, to provide a comprehensive financial planning experience. For more information about Index Fund Advisor, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.

Disclosures:

All videos are being provided for informational purposes only and should not be considered a solicitation, recommendation, or endorsement of any particular security, product or service, or considered to be investment or tax advice. There is no guarantee any investment strategies will be successful. Investing involves risks, including possible loss of principal. Past performance does not guarantee future returns. No investment decisions should be made solely based on the information in any of these videos. The views and opinions expressed herein are those of the participants and do not necessarily reflect the views of Index Fund Advisors, Inc. All opinions referenced within are as of the date of each video recording and are subject to change without notice. Information provided by third party sources is not endorsed or guaranteed by IFA. Where hypothetical back-tested performance is presented, please be sure to use the pause button at the end of the video to fully read the important disclosures including disclosures related to the use of this data. When charts and tables are used in this video, many may be viewed at a Video Resource section above.

What's your Risk Capacity?

Calculating risk capacity is the first step to deciding which portfolio will generate optimal returns for each investor.

Each investor has a unique risk capacity and can be identified by a risk capacity score — a measure of

how much risk one can manage.