A common investor focus after elections is speculating on what types of businesses stand to benefit from the new administration's political agenda. While there's always uncertainty over how much of this agenda will be implemented, investors may feel they have a sense for which sectors will be impacted. But those expectations may not help predict which stocks will outperform.

Markets quickly incorporate new expectations following election outcomes. Once the ballots are counted, stock prices reflect, in real-time, investor expectations about things such as regulatory or tax policy changes. When these new expectations are baked into prices, we should not expect an election effect to persist.

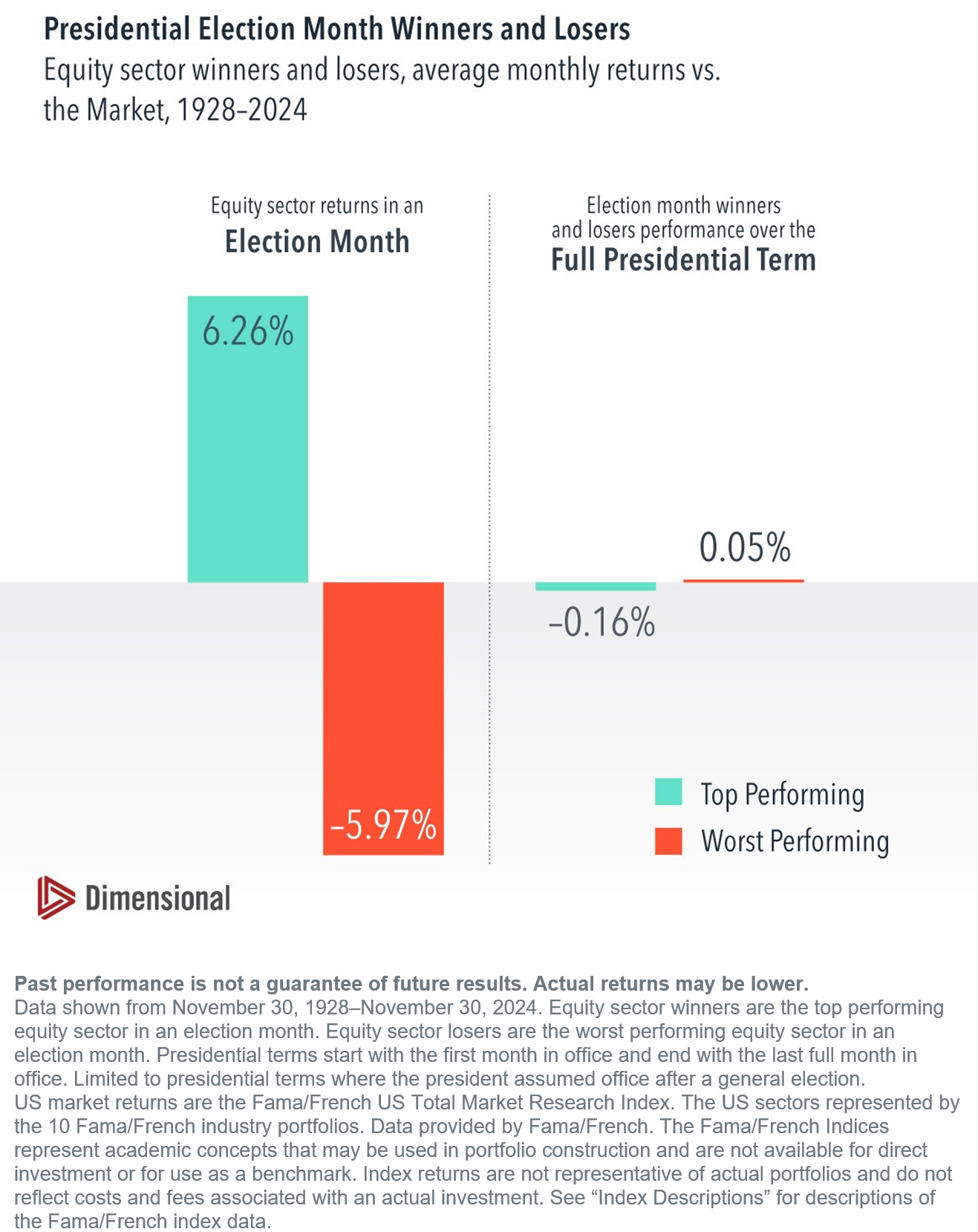

This is supported by tracking top- and bottom-performing sectors post-election. For example, the election sector winners outperformed the US market by over six percentage points on average during the election month but performed in line with the market during the newly elected president's full term. Election month losers showed similar lack of persistence.

The beneficiaries of the new administration may seem predictable, but be careful about letting that factor into your asset allocation decisions.

This article originally appeared in Above the Fray, a weekly newsletter for Dimensional clients. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Index Descriptions

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Ken French website.

Results shown during periods prior to each index's index inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.