When you read a book like Mark Hebner's Index Funds: The 12-Step Program for Active Investors, it can be tempting to try to manage your investments on your own. But is it a good idea?

True, Index Funds is an extraordinary book. It equips you with all the information you need on the best way to invest. But it's one thing to have the knowledge you require, and quite another to put that knowledge into practice on an ongoing basis.

The main reason why is that human beings are not cut out to be good investors. It's not our fault — it's just the way our brains have evolved over hundreds of thousands of years. We are, in short, naturally inclined to speculate rather than invest. Although most investors like to think they make rational decisions, they are more likely to act on instinct, impulse or emotion, especially when markets are volatile.

In his famous book The Intelligent Investor, Benjamin Graham wrote: "The investor's chief problem, and even his worst enemy, is likely to be himself." What investors really need, in other words, is someone to protect them from themselves.

More specifically, they need a financial advisor with a thorough understanding of investment risk, and who knows how to capture market returns efficiently using broadly diversified index-fund portfolios. The advisor should have a detailed grasp of the mathematics of investing and of statistical significance. And, crucially, they should be acutely aware of the behavioral biases that investors are prone to and know how to modify and manage investor behavior.

As Mark Hebner puts it in Step 12 of his book, "an investor may want to consider the fees paid to a passive advisor as a casualty insurance premium, insuring investors against their own mistakes and lack of knowledge." Hebner goes on to say "Long-term investors understand the merits of indexing. But unfortunately, even those investors are prone to emotional decision-making. For this reason, the right passive advisor fulfills a critically important role."

For the last 40 years, the independent investment research firm Dalbar Inc. has published its annual Quantitative Analysis of Investor Behavior report, or QAIB.

What the Dalbar reports have consistently shown is that the returns investors typically receive are substantially lower than those of the funds they invest in. In other words, instead of doing what the evidence tells us they should be doing — focusing on the long term and resisting the temptation to trade — they buy and sell far too often, and usually at the wrong times.

The charts below are based on data from the latest QAIB report. They show the difference in performance as well as the growth of $100,000 between the average equity investor and the S&P 500 Index for the past 30 years (through 2023). Returns for the average investor were about 44 percent lower than the index return. That's a staggering difference.

More evidence supporting the case for using an advisor is the ongoing analysis by Vanguard of what it calls Advisor's Alpha, or how much value, financially speaking, an advisor provides. Although it's only an approximation, Vanguard believes that having an advisor can add, on average, around 3% to an investor's net returns.

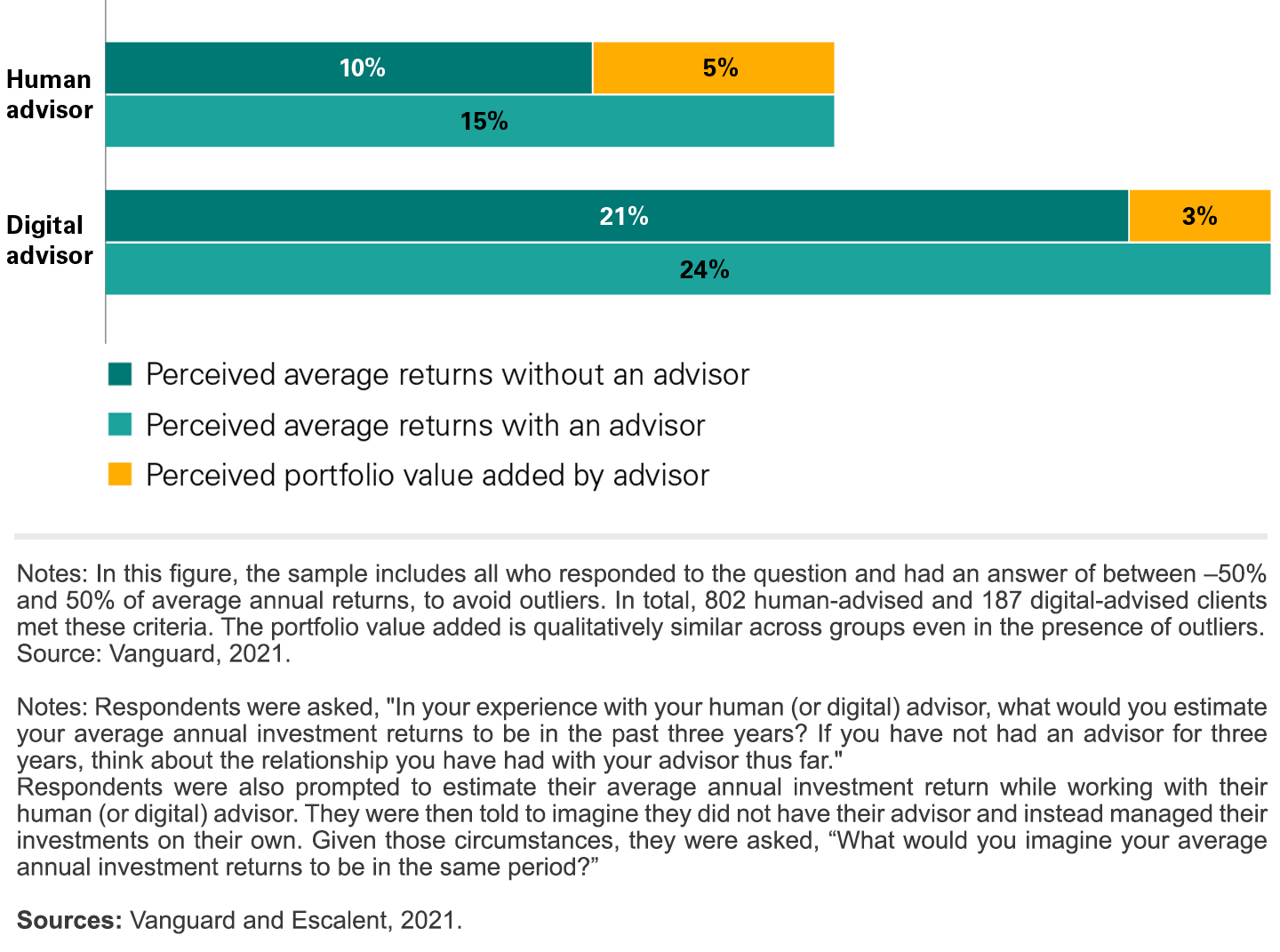

In 2022, Vanguard specifically looked at the difference in outcomes between investors who took advice from so-called "robo" advisors and those who used actual, real-life financial advisors. Robos typically rely on computer software to pick funds and allocate assets.

More than 1,500 investors were surveyed by an independent research firm, and were asked to estimate their annual portfolio returns achieved with whichever type of financial advice they used — i.e. human or computer. They were then asked to estimate what they thought their returns would be over a three-year period without the assistance of their advice service.

As you can see from the charts below, expectations varied by how much access people had to a human wealth manager. In summary, investors working with human advisors estimated their portfolios had returned an average of 15% per year. At the same time, these same investors figured they would've seen only a 10% return if they'd managed their investments alone. As a result, Vanguard pointed out the perceived "value add" of using a human advisor was a net 5%. By contrast, researchers found those using digital-only services reported a perceived average portfolio return of 24% a year. Meanwhile, robo-led investors surveyed estimated without a robo advisor such performance would've dropped to 21%. This implies a net 3% perceived value-add to yearly returns.

But what if you still think you understand investing well enough to be your own advisor, and that you have the patience and discipline to block out all the noise surrounding the financial markets and focus on your long-term goals? Well, first I would suggest that you do some honest and rigorous self-analysis. Better still, persuade a trusted friend to talk through the issues with you. It's a well-known phenomenon in behavioral psychology that we are far better at identifying behavior's in other people than we are in ourselves. After all, behavioral blind spots are called that for a reason!

Here are some of the questions I suggest you ask yourself:

- Do I have the level of mathematical sophistication required to achieve optimal investment outcomes? Can I properly analyze risk and returns? Do I know enough about sample sizes and statistical significance

- Do I completely understand the retirement system, and, for example, the tax implications of having different types of investment accounts?

- I may feel confident in my ability to stay disciplined now, but might I be tempted to change my tune if markets fall, say, 40%, and I find myself in a "hot state"?

- I may be able to put together a suitable portfolio, but do I really have the time for all those other things an advisor does — rebalancing, tax-loss harvesting, steadily reducing risk exposure as I approach retirement, and so on?

- What about financial planning, tax planning, estate planning and end-of-life planning? Do I really have expertise to manage those as well?

- And what if something happens to me? Do my loved ones have the expertise or the inclination to manage their own finances and investments and tie up all the loose ends in the event of my death? Have I told them everything they need to know?

It may be that, after careful introspection, your conclusion is that you do have what it takes to handle all of these things on your own. In that case, I wish you the best of luck. You're probably going to need it, because the bottom line is that DIY financial advice is a risk.

For me, I would much rather have the clarity and peace of mind that come with using expert professionals. And airline passengers may be relieved to know that I won't be flying any planes to Chicago anytime soon.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.