Proponents of active money management often use two words to make the case for it — Warren Buffett. The evidence shows that the vast majority of professional stock pickers fail to outperform on a cost- and risk-adjust basis over meaningful timeframes. But Buffett is an exception, and if he can do it, the argument goes, surely it's possible to identify other active investors with the ability to beat the market? Or perhaps you could even try to emulate Buffett's stock picking style yourself?

Unfortunately, it's not that simple. There are several reasons why, but let's start by taking a closer look at Buffett's track record.

Buffett invests through his company Berkshire Hathaway, of which, remarkably, he is still the Chairman and CEO at the age of 94. Buffett first took control of the firm in 1965, since then Berkshire has returned an annualized 19.8% through the end of 2023. That's nearly double the return of the S&P 500 over the same period.

The first thing to realize is how extraordinary this achievement is. There've been many fund managers who have delivered very impressive returns over relatively short periods — Bill Miller, David Einhorn, John Paulson, Bill Ackman, and Whitney Tilson, to name a few. But the only active investor to have produced anything like the returns that Buffett over the long term is David Swensen, the late CIO of the Yale Endowment.

Does Buffett's Success Disprove Market Efficiency?

Why has it proved so hard for active managers to outperform? The simple answer is that markets are very efficient. To put it another way, current prices fully reflect all available information, and new information is priced into assets within seconds. That makes it virtually impossible to identify securities that are either underpriced or overpriced with any consistency.

All of this begs an obvious question. If markets are efficient, how has Warren Buffett succeeded in beating the market over such a long period of time?

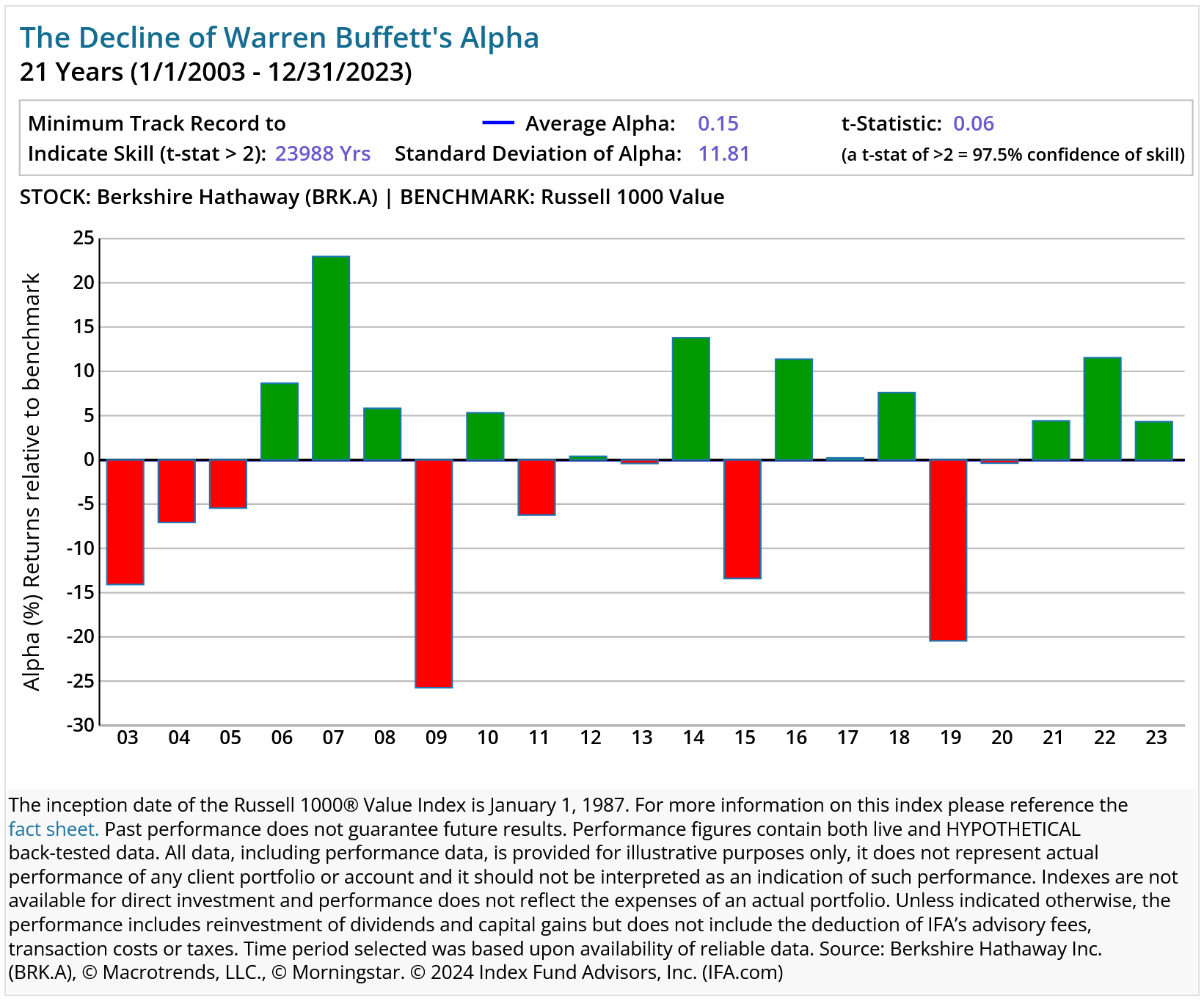

Another important point to understand is that Buffett's track record has been far less distinguished in the last 21 years. Look at the chart below, which shows Buffett's performance from 2003 through 2023. As you can see, Buffett was very successful at producing alpha, or outperformance, in the first half of the period*, but much less so in the second. In other words, his early success somewhat obscures the fact that even Buffett has failed to outperform since 2003.

Indeed, for the 21 years ending December 2023, Berkshire Hathaway has barely outperformed the Russel 1000 value index.

*For first half of the period please view the full interactive chart at the link below.

See the full interactive chart here.

Buffett Is A Consistent Proponent Of Index Funds

If you need any more persuading that actively picking stocks is a bad idea, you only need to see what Warren Buffett himself has said on this subject over many years. Buffett has clearly stated many times that most investors are better off using index funds.

In his 2016 letter to Berkshire Hathaway shareholders, for example, he wrote: "When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients. Both large and small investors should stick with low-cost index funds."

Indeed, Buffett announced a decade ago that he has directed the trustee, after his death, to invest ten percent of his sizable inheritance in short-term government bonds, and the remaining 90% in equity index funds. "I believe the trust's long-term results from this policy," he wrote at the time, "will be superior to those attained by most investors — whether pension funds, institutions, or individuals — who employ high-fee managers."

In short, tempting though it is to try to replicate the success Warren Buffett enjoyed in the first half of his career, you will almost certainly fail. After all, not even Buffett has been able to manage it. Yes, you could try to identify the next Warren Buffett, but again, your chances of spotting him or her, in advance, are very slim.

Thankfully, though, copying the greatest living investor just isn't necessary. By using non-traditional index funds that offer systematic exposure to the same factors that Buffett profited from, you'll maximize your chances of a successful investment outcome.

HOW CAN WE HELP YOU?

Do you have any questions about this subject, or any other issue related to investing? If you do, we would love to address them in future content.

Simply email your question to [email protected] with your name and where you live and we'll do our best to answer it.

*Quotes and pictures are utilized for illustrative purposes only and should not be construed as an endorsement, recommendation, or guarantee of any particular financial product, service, or advisor.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.