Value's recent turnaround has rewarded investors who remained disciplined following its prolonged slump. In addition to reminding us how quickly premiums can show up, the past few years reinforce an important factor in determining how much one should tilt toward higher expected returns: The upside is beneficial only if you can stay invested through the down times.

The Pendulum Swings

The three-year period ending in June 2020 was one of the worst ever for the US value premium, with the Russell 1000 Value Index underperforming the Russell 1000 Growth Index by 17.2 percentage points annualized. Since then, value has been mounting a comeback, beating growth by 8.1 percentage points annualized through June 2022.

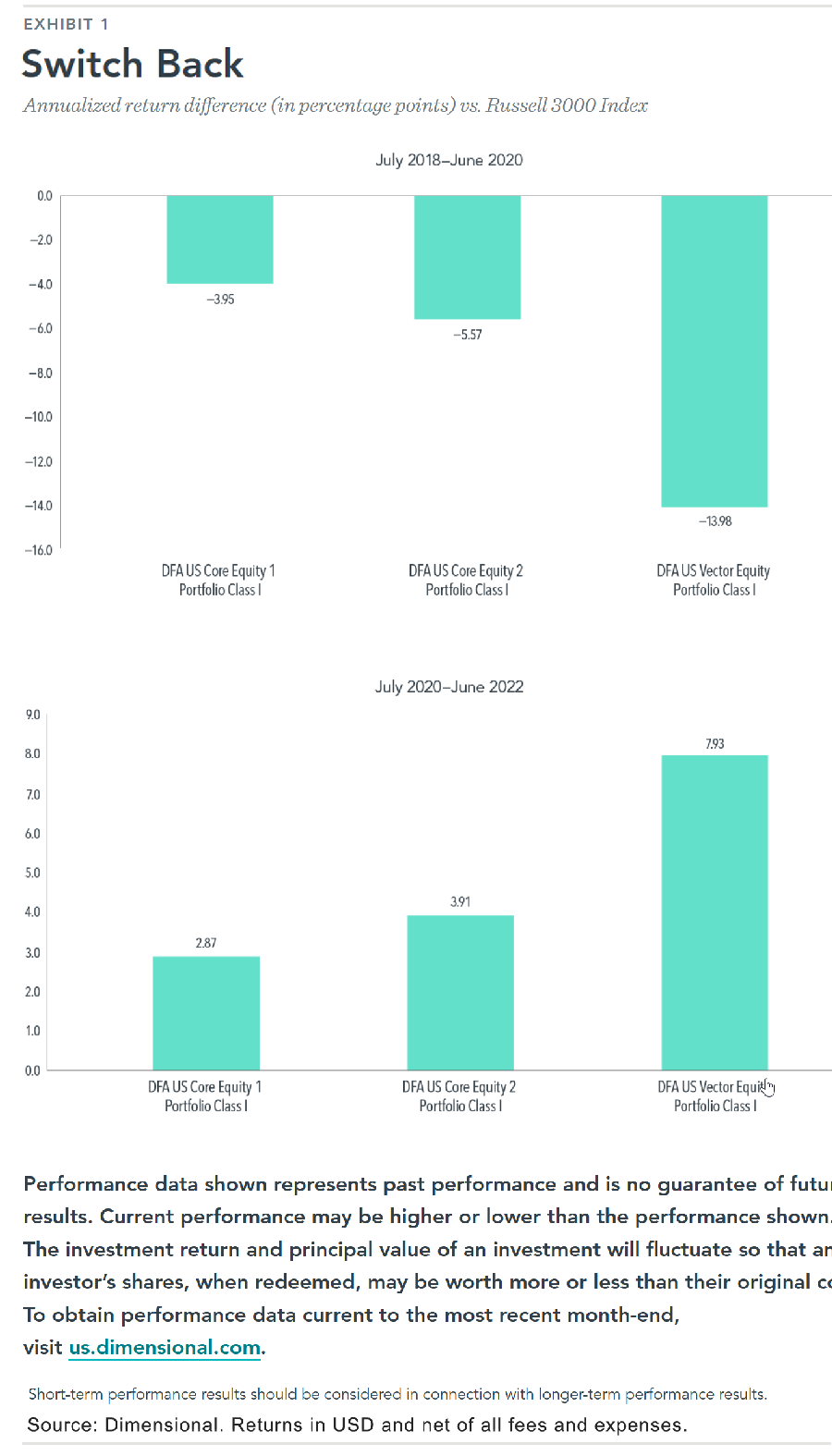

Investors' experience during these times depended, in part, on their degree of value emphasis. The more one deviates from the market along drivers of expected returns, the greater the tracking error relative to the market—but the greater the expected outperformance when targeted premiums are positive.

Three of Dimensional's US marketwide strategies convey the range of outcomes for various levels of tilt (see Exhibit 1). During the value swoon from 2018 through 2020, the relatively lower-tilted US Core Equity 1 Portfolio underperformed the Russell 3000 Index by 3.95 percentage points per year. At the other end of the spectrum, US Vector Equity trailed the index by 13.98 percentage points.

The script has since flipped.1 Value's rebound helped push Core 1 to a nearly three-percentage-point advantage over the market in the two-year period ending in June 2022. On the other hand, Vector's heavier tilt led to outperformance of nearly eight percentage points per year.

Finding Balance with Your Tilts

It's important for investors to balance their enthusiasm for higher expected returns with their tolerance for underperformance. Reining in one's tilts toward the premiums following a period of underperformance—and consequently forfeiting a portion of the eventual rebound—could lead to an unfortunate scenario. Land on a tradeoff you can stick with and you may find April showers are followed by May flowers.

Glossary

Value Premium: The return difference between stocks with low relative prices (value) and stocks with high relative prices (growth).

Appendix

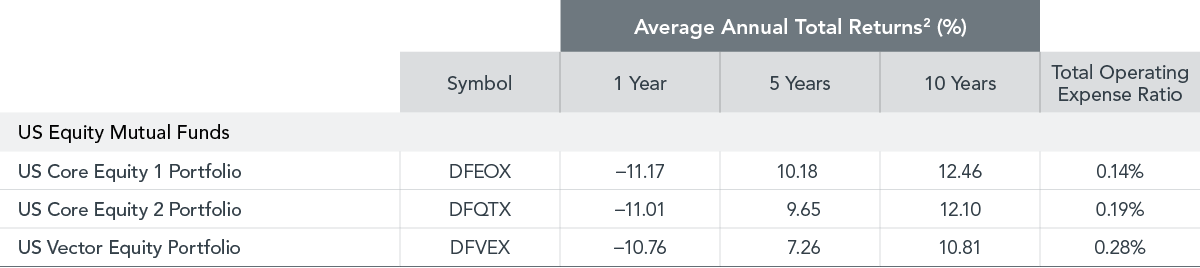

Performance information as of June 30, 2022. Performance data shown represents past performance and is no guarantee of future results. Current performance may be higher or lower than the performance shown. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost. To obtain performance data current to the most recent month-end, visit us.dimensional.com.

Footnotes

1. Wes Crill, "Expectations vs. Reality in Value Funds" Insights (blog), Dimensional Fund Advisors, July 2022.

2. Performance information as of 6/30/22.

The article on this page was republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Disclosures

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions.

Risks

Risks include loss of principal and fluctuating value. Investment value will fluctuate, and shares, when redeemed, may be worth more or less than original cost. Equity Market Risk: Even a long-term investment approach cannot guarantee a profit. Economic, market, political, and issuer-specific conditions and events will cause the value of equity securities, and the portfolio that owns them, to rise or fall. Stock markets tend to move in cycles, with periods of rising prices and periods of falling prices. Value investing is subject to risk, which may cause underperformance compared to other equity investment strategies.