At Index Fund Advisors, our clients are provided complimentary financial plans — including access to a broad range of investing and planning tools. Since 2015, for example, we've been offering an interactive software suite, eMoney. The idea is to provide investors with a greater choice of high-tech applications to use in analyzing their personal financial situations.

"Providing capable financial planning software is important for a client to sort and identify key components of a holistic financial plan," said Kirk Ito, a financial planning analyst at IFA and a Certified Financial Planner (CFP).

In recent years, eMoney has made some interesting changes, both in terms of presentation and function. These improvements are helping our wealth advisors to efficently and effectively continue to build holistic financial plans.

As a result, we thought it might be helpful to take a fresh look at eMoney and its various planning applications, from household budgeting and setting retirement goals to financing educational needs and meeting healthcare requirements over a lifetime.

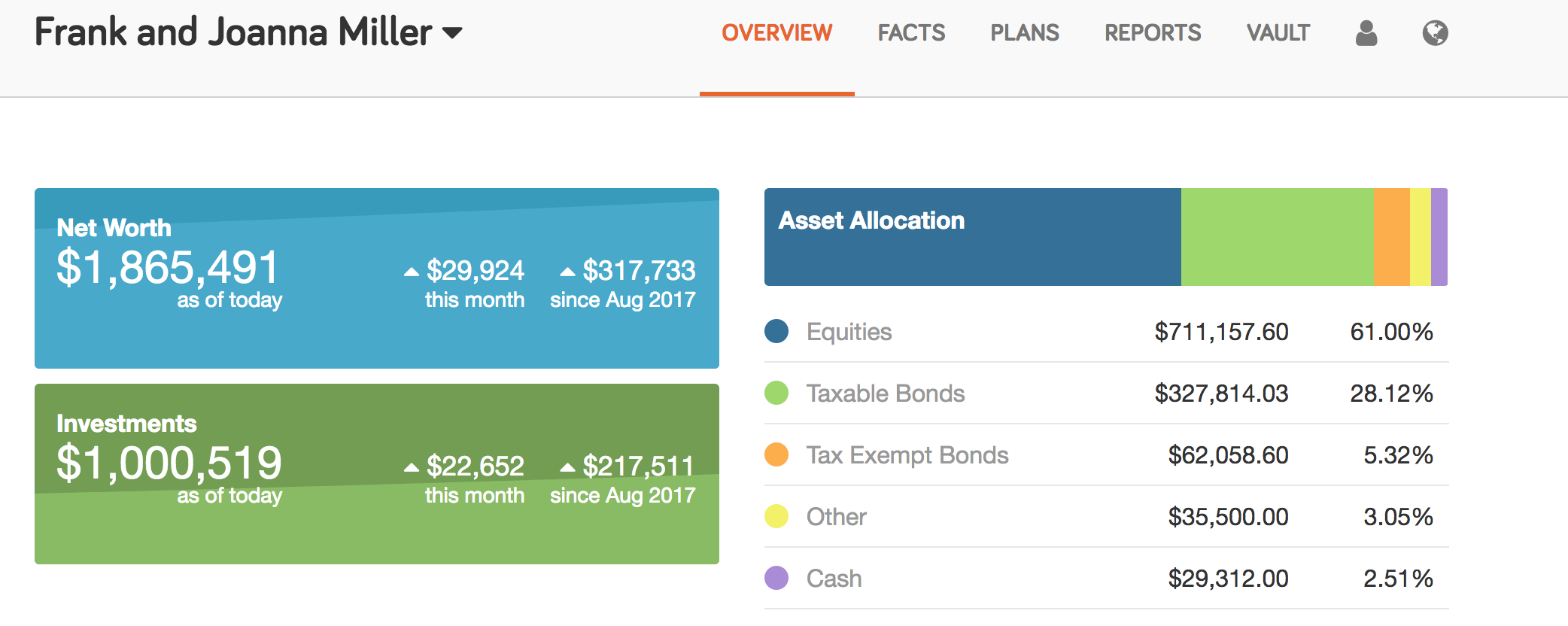

Functionally, at least, eMoney remains much the same as before. But some of the screens and organizational structures are different from years past. The main client portal, for example, still includes aggregated data across a wide range of investments. (See screenshot below, which uses fictitious names and data for illustrative purposes only.)

But eMoney, which is now owned by Fidelity, has cleaned up all of these different data points to give a more streamlined overview page, something akin to each person's personal financial "dashboard."

In one place, investors can track all sorts of investments, including insurance policies and educational plan contributions for their children. The program also allows individual inputs to be added into eMoney's dashboard view. Those can include items such as credit card balances, individual loans, properties and stock options.

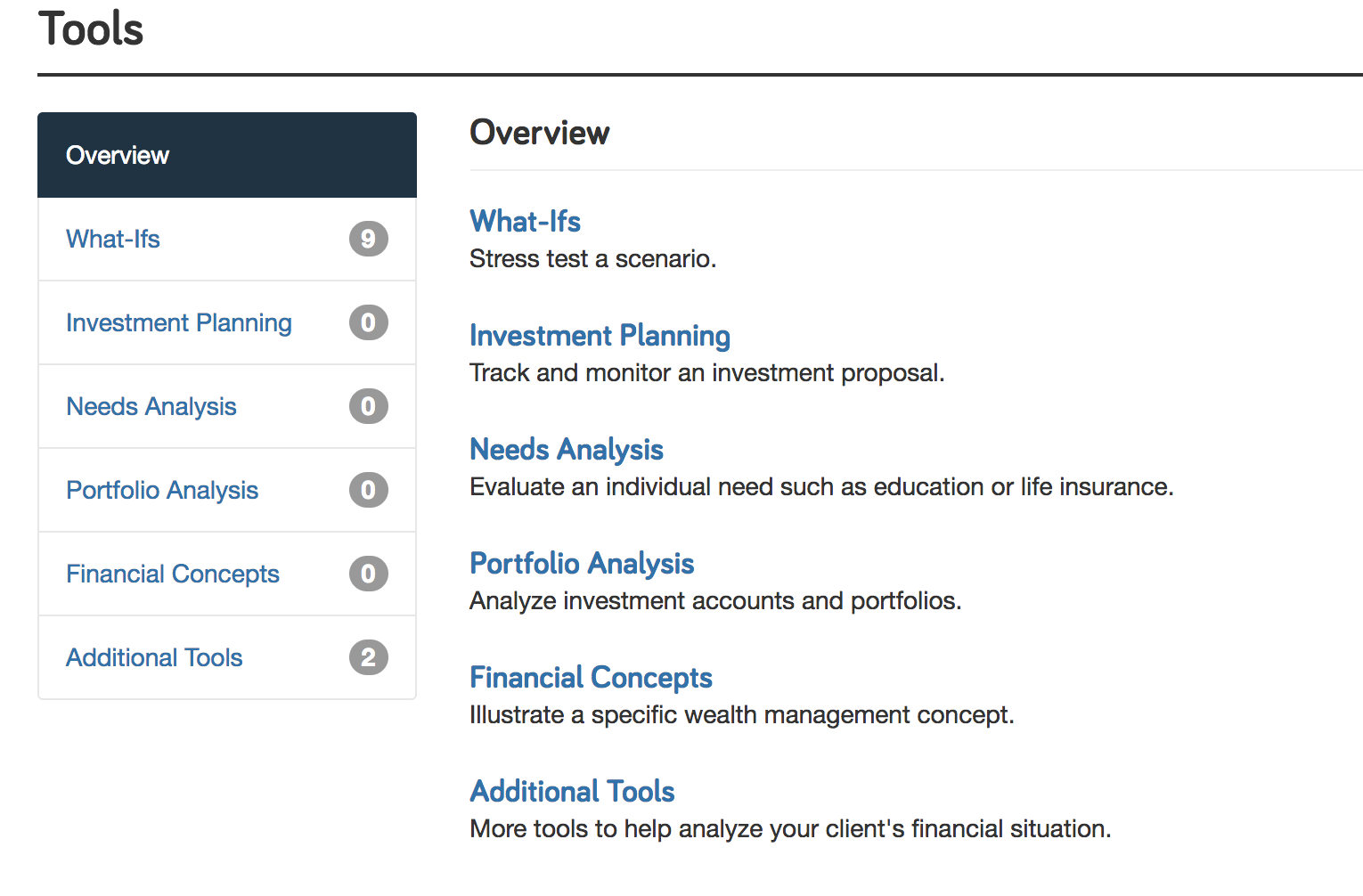

A separate "Tools" section lets clients and their advisors run different "What-If" scenarios. (See screenshot below.) "The What-If scenarios represent a way for people to simulate an event they might be particularly concerned about taking place in the future," said Ito. "This type of scenario analysis allows us to model the potential long-term effects of different situations on their investment and retirement plans."

For example, adjustments can be made to data for items such as retirement ages, life expectancy ranges, taxes as well as savings and contribution rates. To help in such a scenario-building process, the program comes with several pre-established baseline scenarios relating to long-term care needs, inflation rate changes, premature death and disability.

Besides being able to change inputted data and specific planning assumptions, eMoney lets IFA's advisors in consultation with their clients tweak content for developing and refining individual estate planning strategies — including an ability to drill into estate "transfer" and "liquidity" issues.

For all information that is adjusted, eMoney can be used to run simulated results for overall household cash flow impacts and ramifications on a detailed balance sheet basis for each client.

The deep dive into combining all of this data culminates in a master "Plans" section. Two ways to cull such information are presented — Goal Planner and Decision Center. (See screenshot above, which uses fictitious names for illustrative purposes only.)

In Goal Planner, clients can track how they're meeting financial targets related to lifestyle issues by current income levels, expenses and savings. The "probability of success" to each person's holistic financial plan for retirement (by expected retirement age and living expenses) can also be managed in this part of the program. Also, tools are available to check educational goals and monitor plans to leave money to heirs.

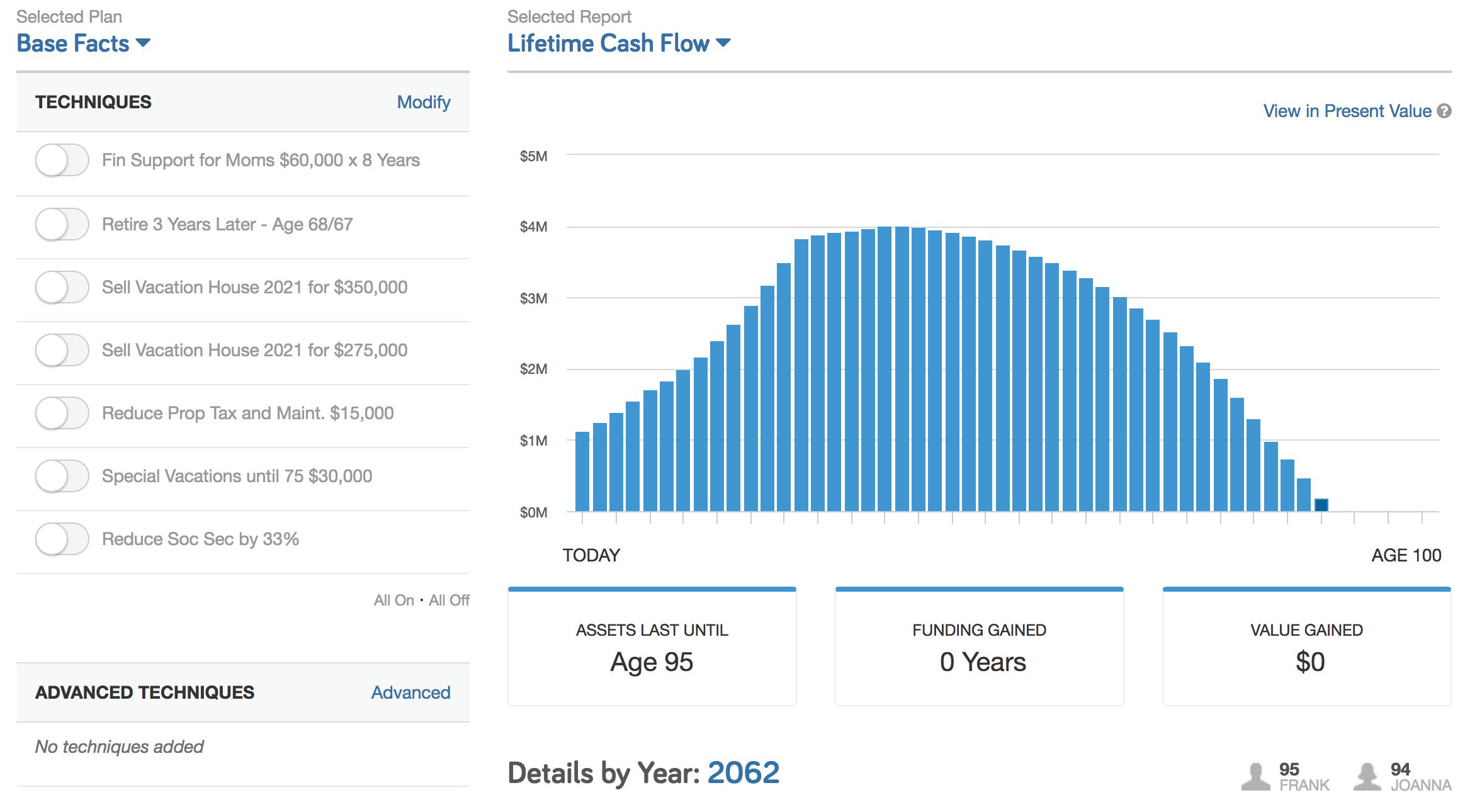

The Goal Planner, like other parts of eMoney, feeds into a "Decision Center" app. (See screenshot above.) This pulls everything together to show how specific goals — from when to retire, sell a house or take a vacation — play out as part of your broad-based IFA financial plan. It includes estimates on cash flow and projected asset levels at different ages.

"The combination of these two features really can help our clients to map out their overall financial goals in a more precise fashion," said Ito. "If you want to downsize or retire early, for instance, this portion of the program gives you a way to see what type of impact these types of decisions can have down-the-road in terms of meeting your longer-term financial goals."

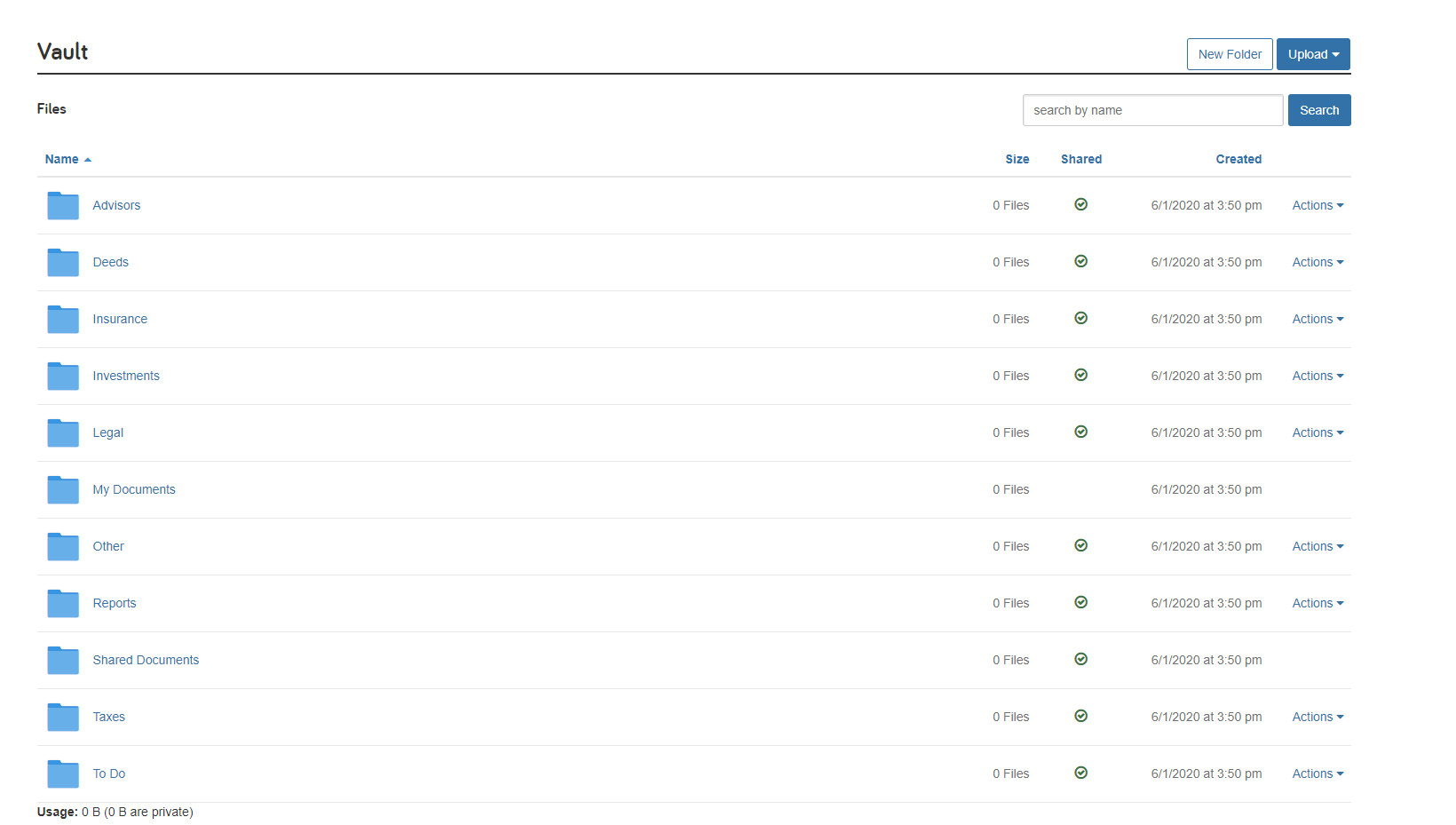

Another popular feature of eMoney, shown above, is a built-in app called "The Vault." It allows you to electronically store all sorts of documents including trusts, wills, insurance policies, tax returns and financial performance reports. "Interestingly, Fidelity gives a fairly extensive listing of its security measures taken to protect both Vault paperwork as well as eMoney's information on the whole," noted Ito.

And as we've written about in the past, eMoney has a "Reports" section that lets you — in collaboration with an IFA advisor — produce and store all sorts of customized financial planning reports, he added. "Besides specifics on balance sheet items and cash flow dynamics," said Ito, "you can get in written form different What If scenarios you'd like to discuss with your IFA wealth advisor."

The eMoney illustrations, including performance data contained herein, is provided for illustrative purposes only. They do not represent actual performance of any client portfolio or account and should not be interpreted as an indication of such performance.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Investing involves risks, including possible loss of principal.