When trying to outperform an index, many investors will try to trade between funds focused on different market segments and asset classes. But such an active investment approach isn't without costs. In fact, market timing can increase return volatility and add unnecessary uncertainty to the overall experience of investing in stocks and bonds. (See "Market Timing: More Evidence Why It Doesn't Work.")

Along these lines, IFA's wealth advisors like to point investors to work by researchers at our preferred funds provider, Dimensional Fund Advisors. Besides considering the ill-effects of market timing, they've looked at issues relating to behavioral finance and the science of risk management.

In applying their findings at the portfolio level, Dimensional's researchers have identified several overarching principles that can be key to investors in pursuit of a better investment experience — i.e., maximizing a portfolio's performance over time given each person's unique risk capacity.

Below are 10 short tips — each with an informational graphic below the text — summarizing key research findings they've uncovered to help investors take advantage of a more reliable investment approach for capturing what the market has to offer.

1: Embrace Market Pricing

The market is an effective information-processing machine. Each day, the world equity markets process billions of dollars in trades between buyers and sellers —and the real-time information they bring helps set prices.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a Better Investment Experience." In USD. Source: Dimensional, using data from Bloomberg LP. Includes primary and secondary exchange trading volume globally for equities. ETFs and funds are excluded. Daily averages were computed by calculating the trading volume of each stock daily as the closing price multiplied by shares traded that day. All such trading volume is summed up and divided by 252 as an approximate number of annual trading days.

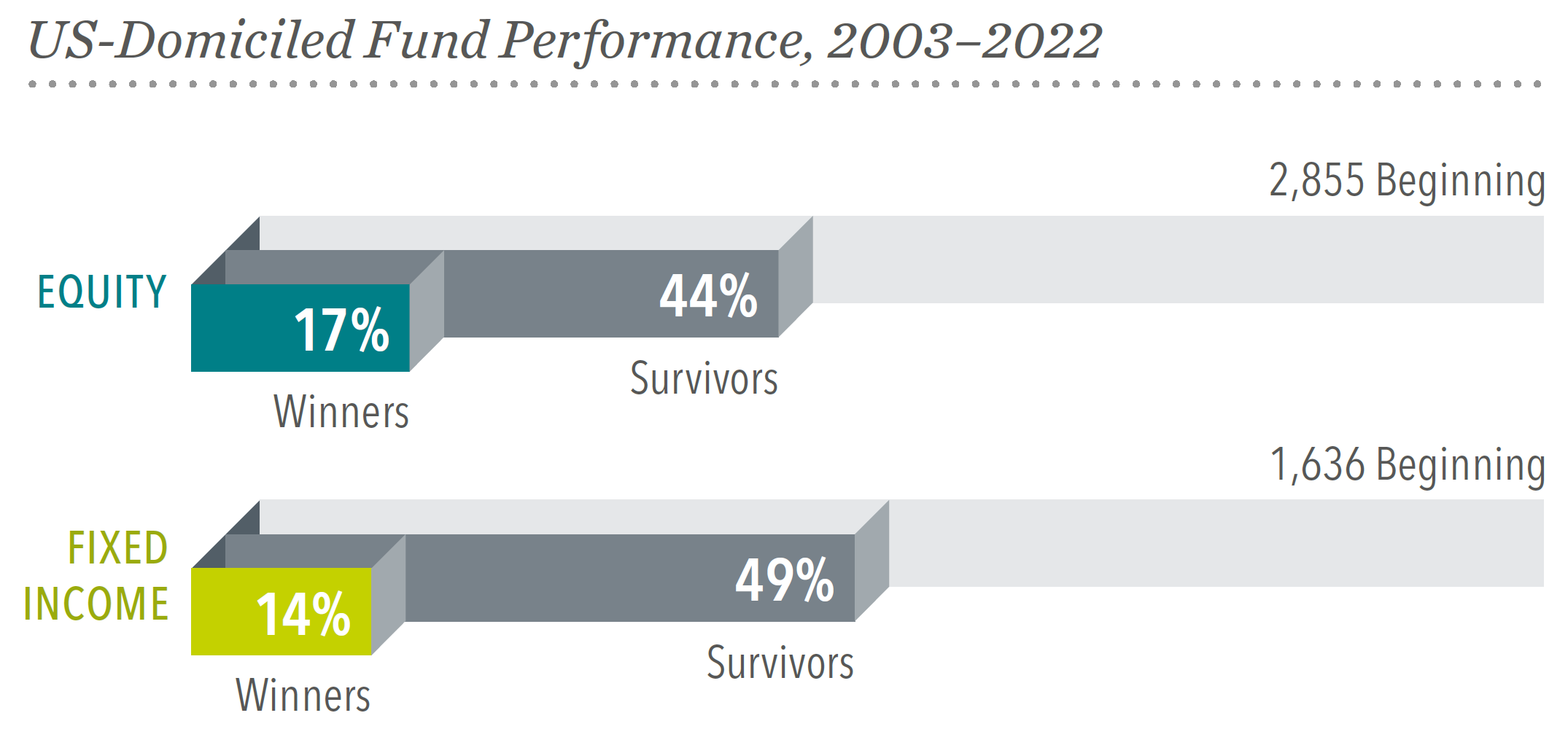

2: Don't Try to Outguess the Market

The market's pricing power works against mutual fund managers who try to outperform through stock picking or market timing. As evidence, only 17% of U.S. equity mutual funds and 14% of fixed-income funds have survived and outperformed their benchmarks over the past 20 years (through 2022).

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." The sample includes funds at the beginning of the 20-year period ending

December 31, 2022. Each fund is evaluated relative to its primary prospectus benchmark. Survivors are funds that

had returns for every month in the sample period. Each fund is evaluated relative to its primary prospectus

benchmark. Winners are funds that survived and outperformed their benchmark over the period. Where the full

series of primary prospectus benchmark returns is unavailable, non-Dimensional funds are instead evaluated

relative to their Morningstar category index. *See imporant note below regarding "Data Sample" for this

exhibit.

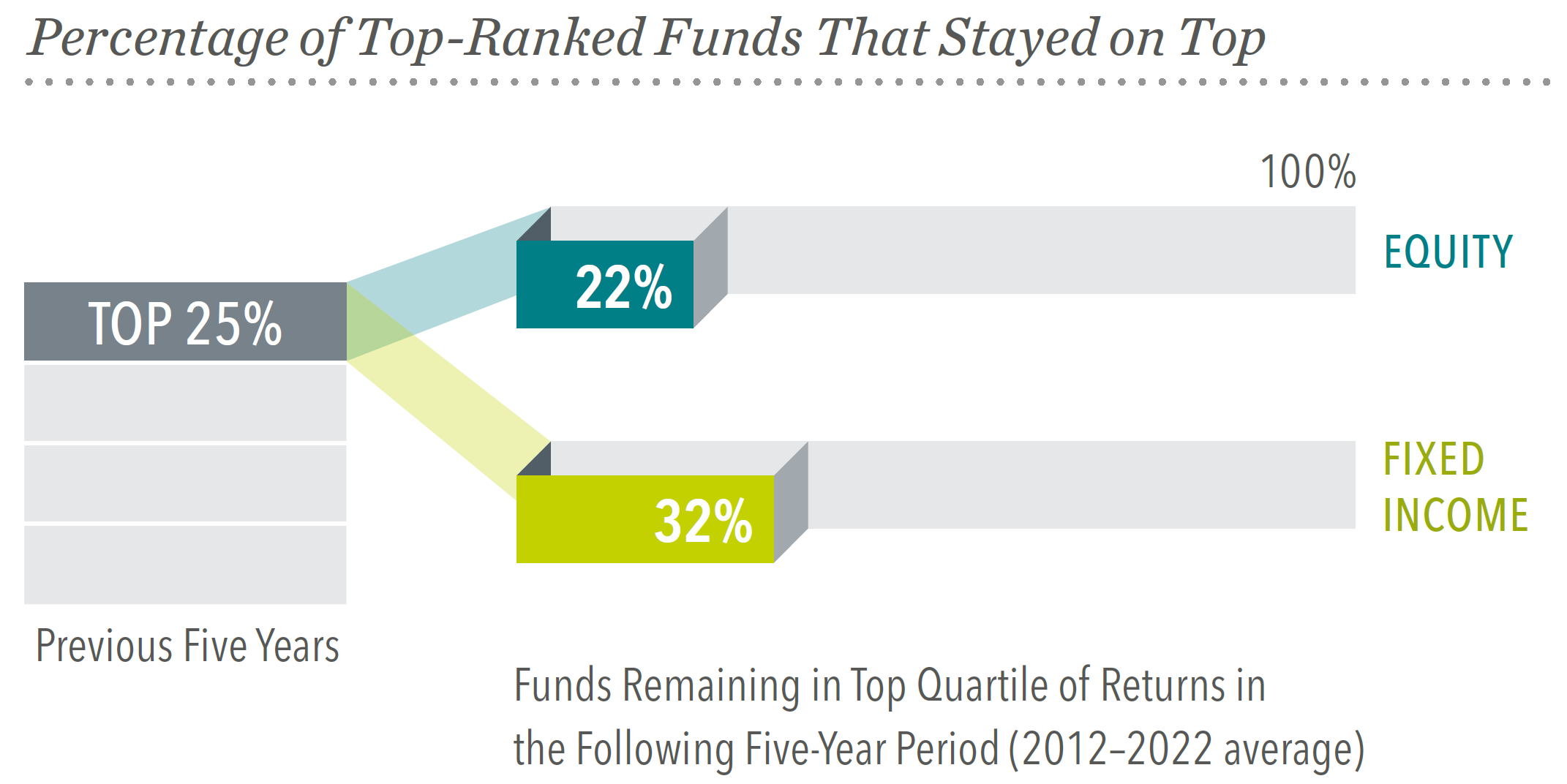

3: Resist Chasing Past Performance

Some investors select mutual funds primarily based on historical returns. Yet, past performance offers little insight into a fund's future returns. For example, most funds in the top quartile (25%) of previous five-year returns did not maintain a top‐quartile ranking in the following five years.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." This study evaluated fund performance over rolling periods from 2003

through 2022. Each year, funds are sorted within their category based on their previous five-year total return.

Those ranked in the top quartile of returns are evaluated over the following five-year period. The chart shows

the average percentage of top-ranked equity and fixed income funds that kept their top ranking in the subsequent

period. *See imporant note below regarding "Data Sample" for this exhibit.

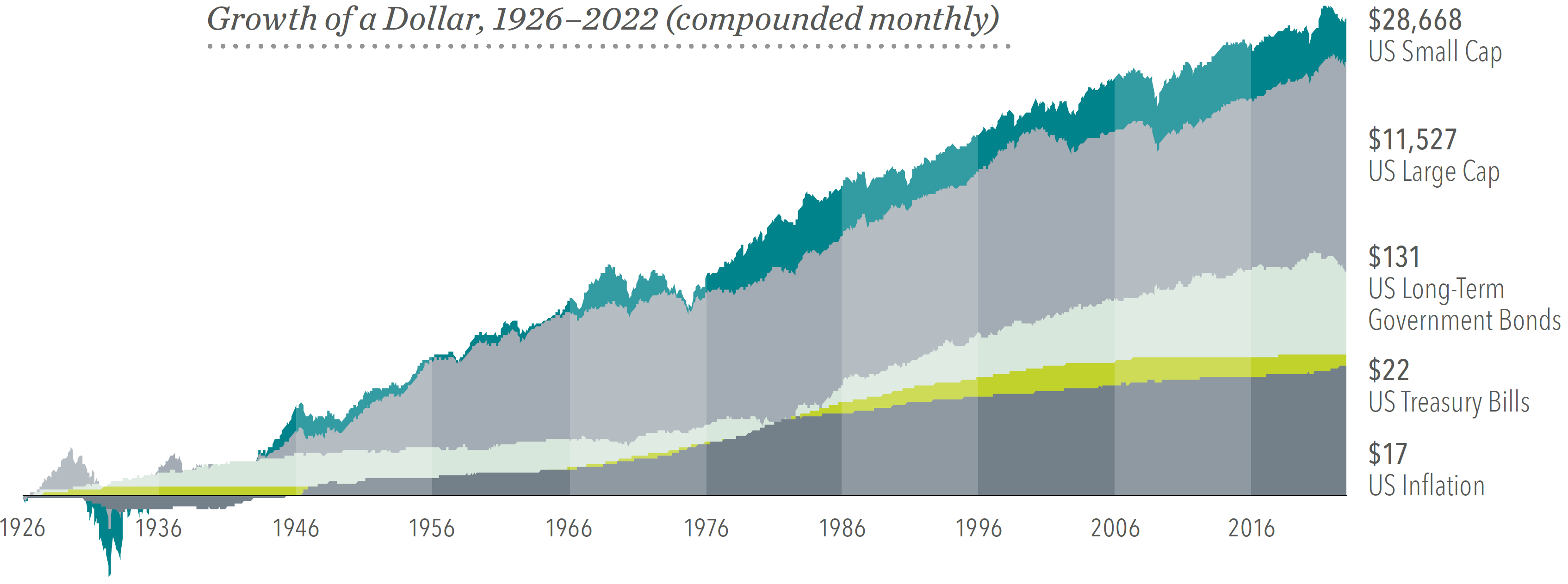

4: Let Markets Work for You

The financial markets have rewarded long-term investors. People expect a positive return on the capital they supply, and historically, the equity and bond markets have provided growth of wealth that has more than offset inflation.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." In USD. US Small Cap is the CRSP 6–10 Index. US Large Cap is the S&P

500 Index. US Long-Term Government Bonds is the IA SBBI US LT Govt TR USD. US Treasury Bills is the IA SBBI US

30 Day TBill TR USD. US Inflation is measured as changes in the US Consumer Price Index. CRSP data is provided

by the Center for Research in Security Prices, University of Chicago. S&P data © 2023 S&P Dow Jones

Indices LLC, a division of S&P Global. All rights reserved. US long-term government bonds and Treasury bills

data provided by Ibbotson Associates via Morningstar Direct. US Consumer Price Index data is provided by the US

Department of Labor, Bureau of Labor Statistics. Data presented in the Growth of a Dollar chart is

hypothetical.

5: Consider the Drivers of Returns

There is a wealth of academic research into what drives returns. Expected returns depend on current market prices and expected future cash flows. Investors can use this information to pursue higher expected returns in their portfolios. Equity funds used in IFA Index Portfolios tilt to prominent factors such as size, value (relative price) and profitability. In fixed-income, our portfolios implement mutual funds and ETFs that screen bonds by characteristics relating to term-length, credit quality and measures of currency exposure.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." Relative price is measured by the price-to-book ratio; value stocks are

those with lower price-to-book ratios. Profitability is measured as operating income before depreciation and

amortization minus interest expense scaled by book.

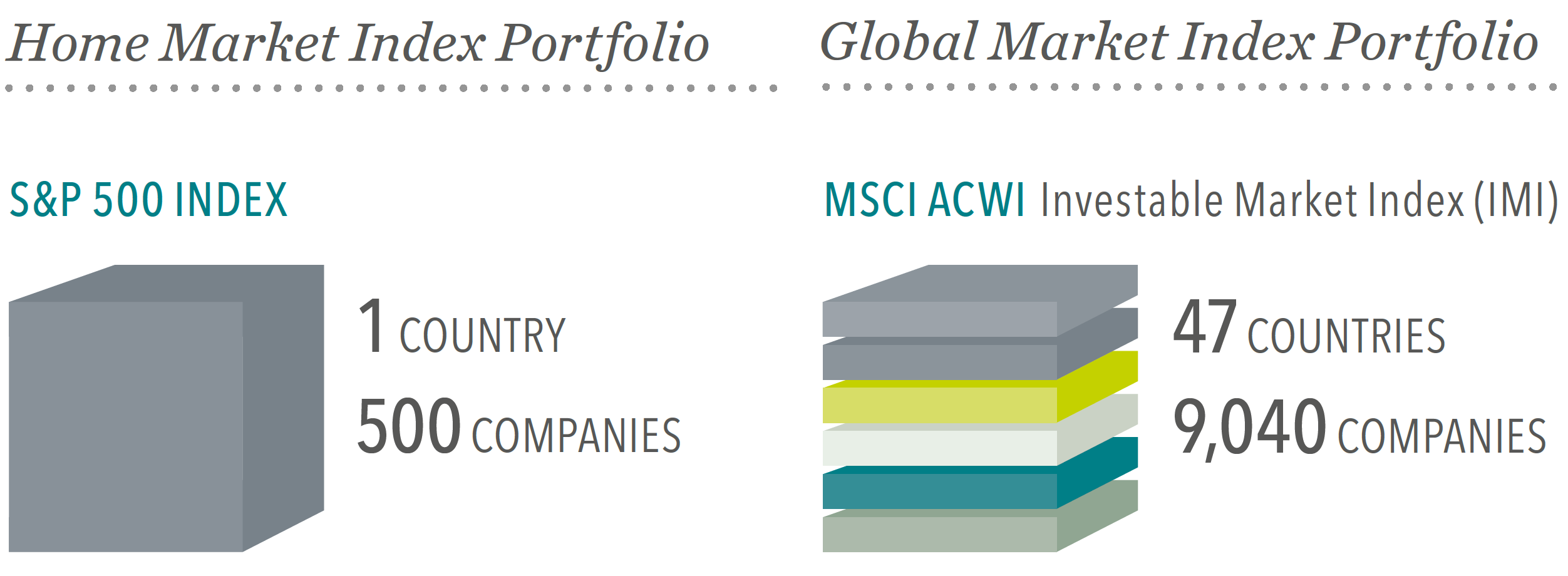

6: Practice Smart Diversification

Holding securities across many market segments can help manage overall risk. But diversifying within your home market might not be enough. Global diversification can broaden your investment universe by lowering your IFA Index Portfolio's overall risk exposure.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." Number of holdings and countries for the S&P 500 Index and MSCI ACWI

IMI (All Country World IMI Index) as of December 31, 2022. S&P data © 2023 S&P Dow Jones Indices

LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2023, all rights reserved.

International investing involves special risks, such as currency fluctuation and political instability.

Investing in emerging markets may accentuate these risks.

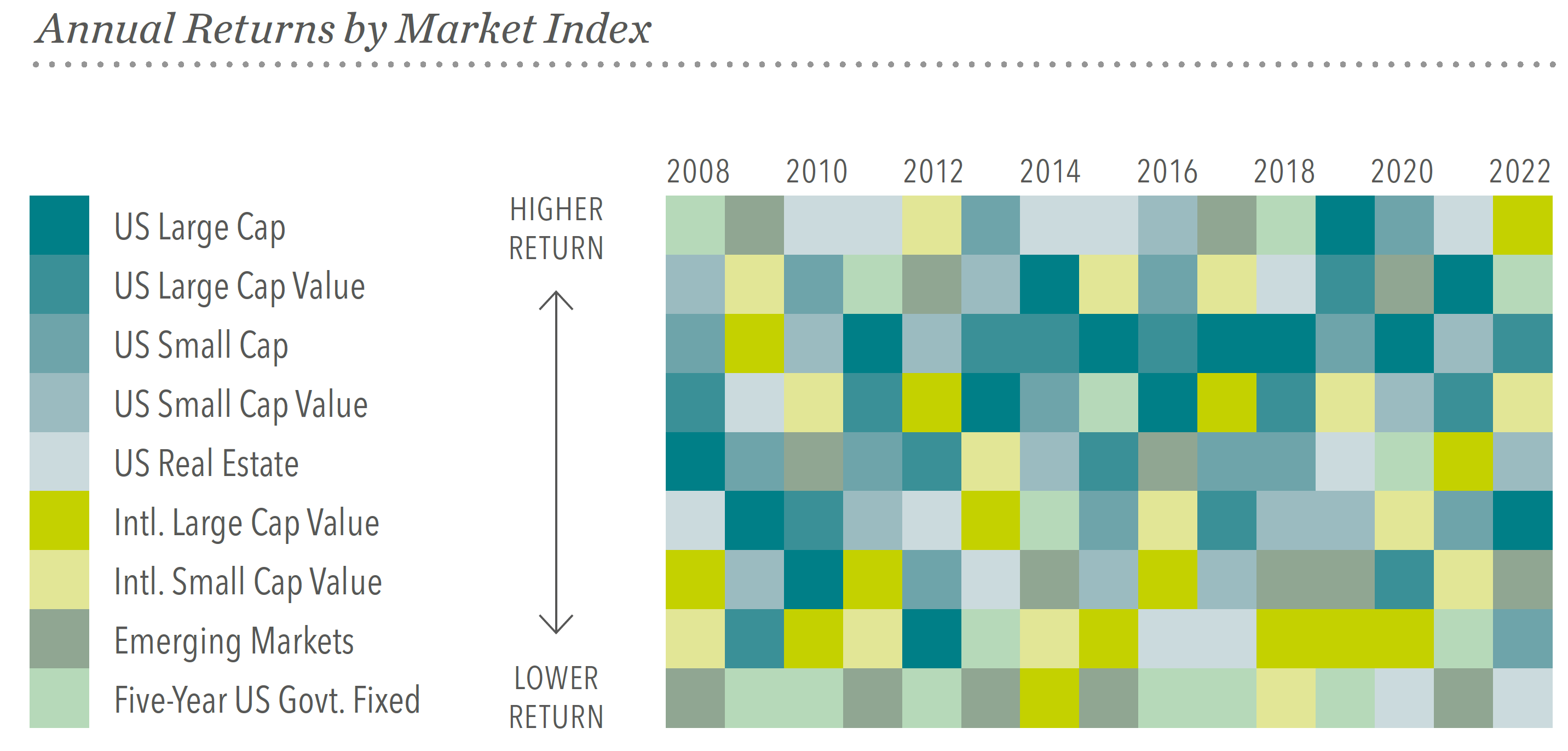

7: Avoid Market Timing

You never know which market segments will outperform from one year to the next. By holding a globally diversified portfolio, investors are well-positioned to seek returns whenever — and wherever — such gains take place.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience." In USD. US Large Cap is the S&P 500 Index. US Large Cap Value is the

Russell 1000 Value Index. US Small Cap is the Russell 2000 Index. US Small Cap Value is the Russell 2000 Value

Index. US Real Estate is the Dow Jones US Select REIT Index. International Large Cap Value is the MSCI World ex

USA Value Index (gross dividends). International Small Cap Value is the MSCI World ex USA Small Cap Value Index

(gross dividends). Emerging Markets is the MSCI Emerging Markets Index (gross dividends). Five-Year US

Government Fixed is the Bloomberg US Treasury Bond Index 1–5 Years. S&P and Dow Jones data © 2023

S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Frank Russell Company is the

source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. MSCI data

© MSCI 2023, all rights reserved. Bloomberg index data provided by Bloomberg. Chart is for illustrative

purposes only.

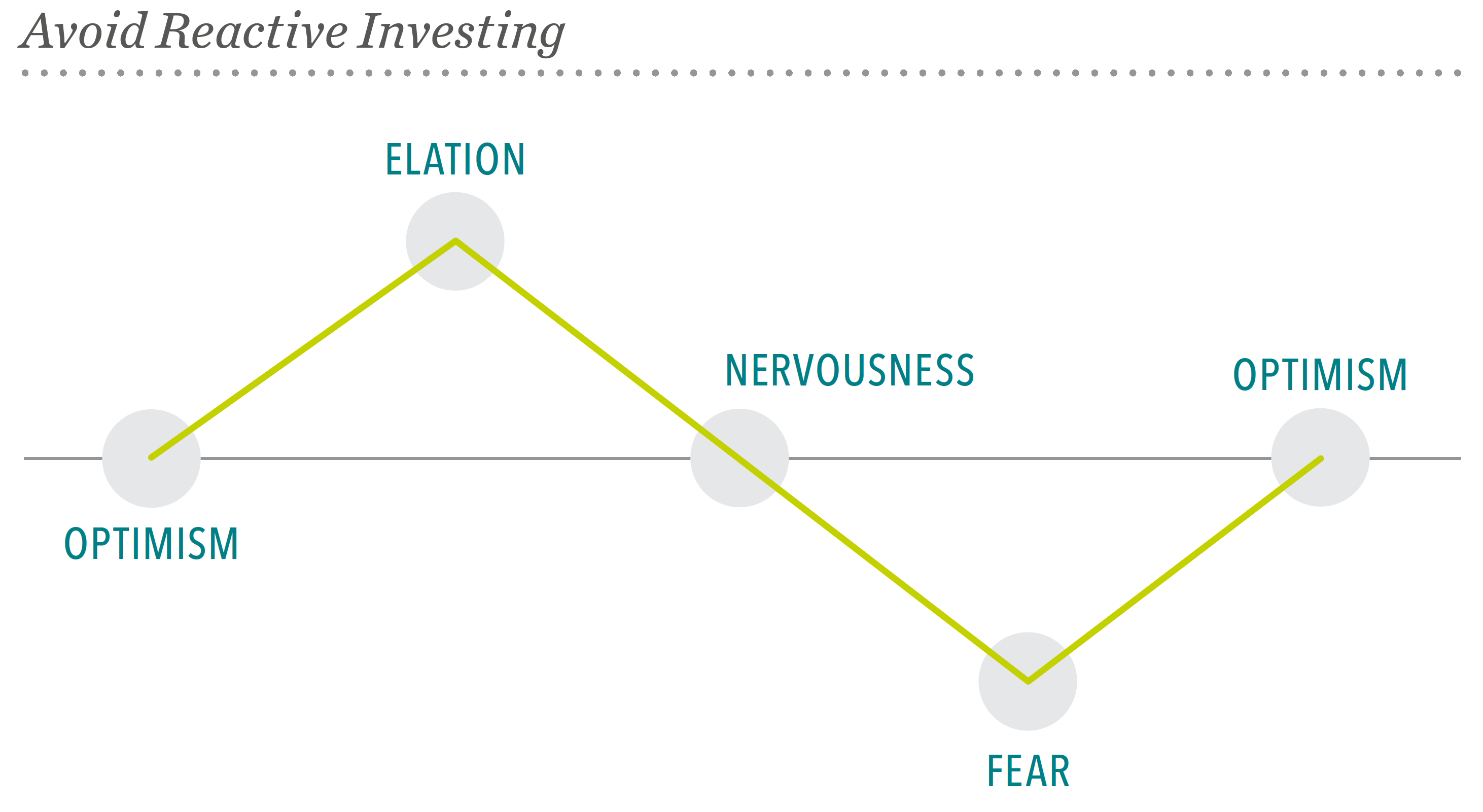

8: Manage Your Emotions

Many people struggle to separate their emotions from investing. Studies in behavioral finance, however, inform us that markets go up and down. Reacting to current market conditions in the heat of the moment, so to speak, can lead to making poor investment decisions.

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience."

Source: Dimensional Fund Advisors, LLC. July 2023. "Pursuing a

Better Investment Experience."

9: Look Beyond the Headlines

Daily market news and commentary can challenge your investment discipline. Some messages stir anxiety about the future, while others tempt you to chase the latest investment fad. When headlines seem rather unsettling, IFA's wealth advisors urge you to consider the source and maintain a long‑term perspective.

Source: Dimensional Fund Advisors, LLC. July

2023. "Pursuing a Better Investment Experience."

10: Focus on What You Can Control

An IFA wealth advisor stands to offer another set of experienced and objective eyes to help you focus on actions that really can add value. This can lead to a better investment experience and increase the odds of reaching your holistic financial goals. Specifically, our advisors can support you in the following ways:

- Create an investment plan to fit your needs and unique risk capacity.

- Design a portfolio of index funds along the key dimensions identified by leading academic researchers as driving expected returns in stocks and bonds.

- Make sure an IFA Index Portfolio is properly diversified across global markets to increase expected returns while decreasing overal portfolio risk.

- Manage expenses, portfolio turnover and help to minimize tax liabilities.

- Stay disciplined through market dips and swings.

The famous quote from Maimonides tells us, "Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime."

Likewise, educating investors on how to invest versus simply telling them what to do is our answer to solving such a problem in adapting the financial sciences to building wealth.

Outlining these 10 basic steps is another educational resource that we hope investors will use to help connect the dots of IFA's investment process and their efforts to achieve long-term financial success.

The exhibits on this page wererepublished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Data Sample: The sample includes US-domiciled, USD-denominated open-end and exchange-traded funds (ETFs) in the following Morningstar categories. Non-Dimensional fund data provided by Morningstar. Dimensional fund data is provided by the fund accountant. Dimensional funds or subadvised funds whose access is or previously was limited to certain investors are excluded. Index funds, load-waived funds, and funds of funds are excluded from the industry sample. Morningstar Categories (Equity): Equity fund sample includes the following Morningstar historical categories: Diversified Emerging Markets, Europe Stock, Foreign Large Blend, Foreign Large Growth, Foreign Large Value, Foreign Small/Mid Blend, Foreign Small/Mid Growth, Foreign Small/Mid Value, Global Real Estate, Japan Stock, Large Blend, Large Growth, Large Value, Mid-Cap Blend, Mid-Cap Growth, Mid-Cap Value, Miscellaneous Region, Pacific/Asia ex-Japan Stock, Real Estate, Small Blend, Small Growth, Small Value, World Large-Stock Blend, World Large-Stock Growth, World Large-Stock Value, and World Small/Mid Stock. Morningstar Categories (Fixed Income): Fixed income fund sample includes the following Morningstar historical categories: Corporate Bond, High Yield Bond, Inflation-Protected Bond, Intermediate Core Bond, Intermediate Core-Plus Bond, Intermediate Government, Long Government, Muni California Intermediate, Muni California Long, Muni Massachusetts, Muni Minnesota, Muni National Intermediate, Muni National Long, Muni National Short, Muni New Jersey, Muni New York Intermediate, Muni New York Long, Muni Ohio, Muni Pennsylvania, Muni Single State Intermediate, Muni Single State Long, Muni Single State Short, Muni Target Maturity, Short Government, Short-Term Bond, Ultrashort Bond, World Bond, and World Bond-USD Hedged. Index Data Sources: Index data provided by Bloomberg, MSCI, Russell, FTSE Fixed Income LLC, and S&P Dow Jones Indices LLC. Bloomberg data provided by Bloomberg. MSCI data © MSCI 2023, all rights reserved. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. FTSE fixed income indices © 2023 FTSE Fixed Income LLC. All rights reserved. S&P data © 2023 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. Indices are not available for direct investment. Their performance does not reflect the expenses associated with management of an actual portfolio. US-domiciled mutual funds and US-domiciled ETFs are not generally available for distribution outside the US.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.