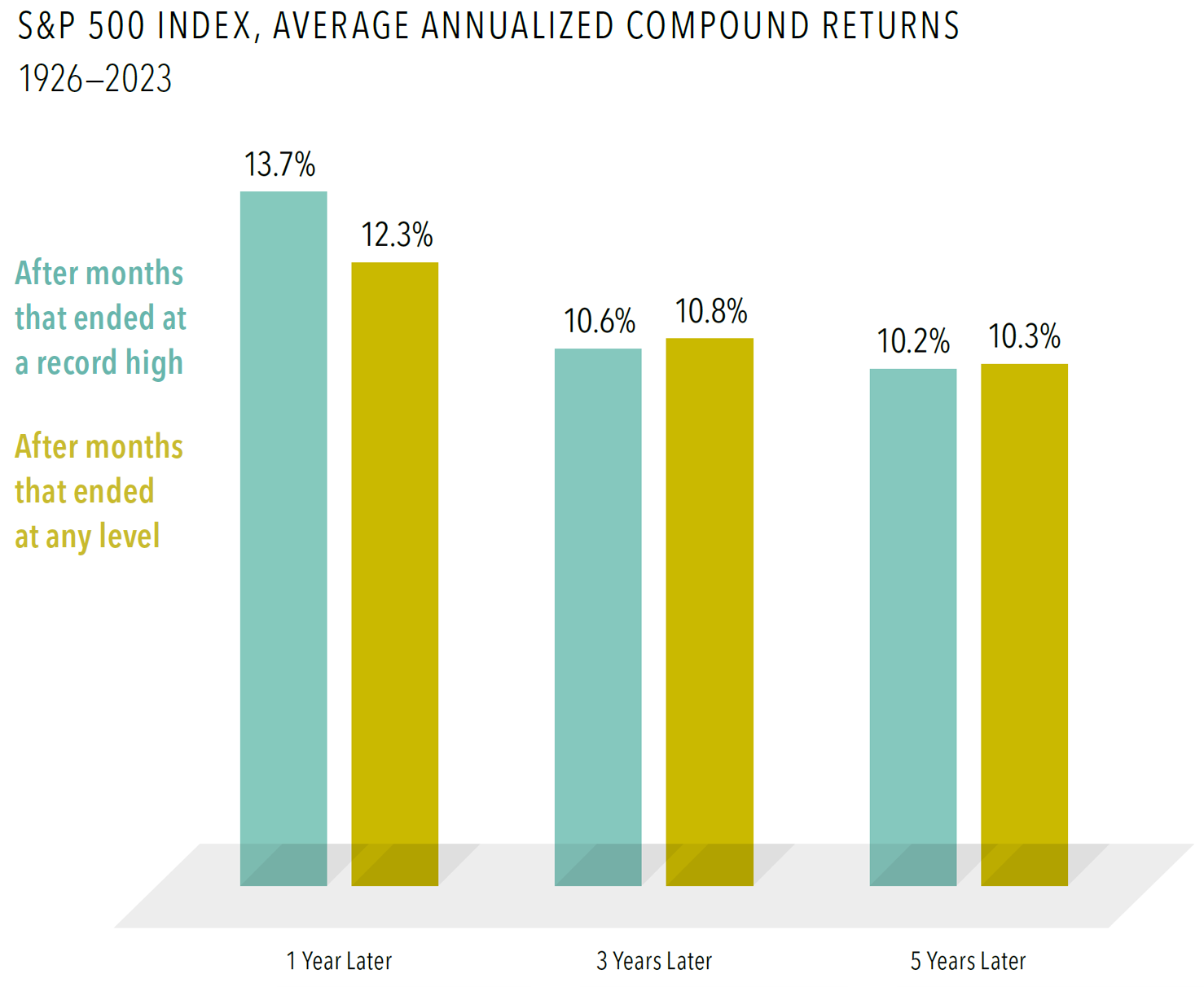

Many investors may think a market high is a signal stocks are overvalued. However, they may be surprised to find that the average returns one, three, and five years after a new month-end market high are similar to those after months that ended at any level.

- In looking at all monthly closing levels between 1926 and 2023 for the S&P 500 index; 31% of them were new highs.

- After those highs, the annualized returns ranged from almost 14% one year later to more than 10% over the next five years, which were close to average returns over any period of the same length.

Stocks are priced to deliver a positive expected return for investors, so reaching record highs regularly is the outcome one would expect.

In US dollars. For illustrative purposes only. New market highs are defined as months ending with the market above all previous levels for the sample period. Annualized compound returns are computed for the relevant time periods subsequent to new market highs and averaged across all new market highs observations. There were 1,175 observation months in the sample. January 1926–December 1989: S&P 500 index, Stocks, Bonds, Bills and Inflation Yearbook™, Ibbotson Associates, Chicago. January 1990–present: S&P 500 index (total return), S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved.

This article originally appeared February 21, 2024. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

This information is provided for registered investment advisors and institutional investors and is not intended for public use. Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission. Consider the investment objectives, risks, and charges and expenses of the Dimensional funds carefully before investing. For this and other information about the Dimensional funds, please read the prospectus carefully before investing. Prospectuses are available by calling Dimensional Fund Advisors collect at (512) 306-7400 or at dimensional.com. Dimensional funds are distributed by DFA Securities LLC.