The second step in a 12-step program is to acknowledge a higher power.

Investors have their own higher power — empirical evidence.

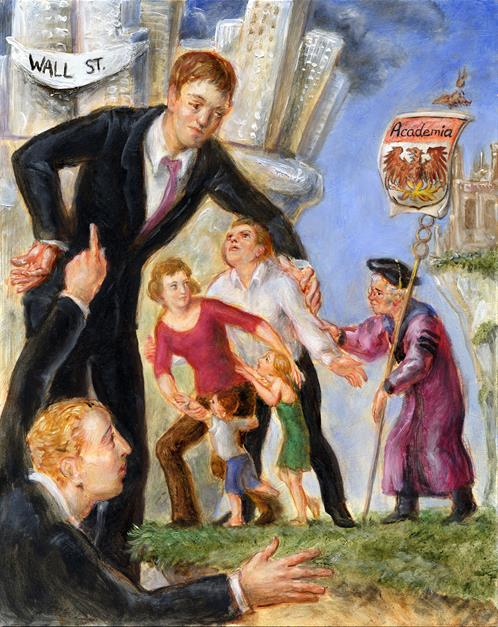

A huge amount of academic brainpower has been applied to the question of how to invest.. and yet many investors just aren't aware of it.

This makes them highly susceptible to the lure of active investing, and slick financial salespeople, so they engage in risks they do not understand and cannot quantify.

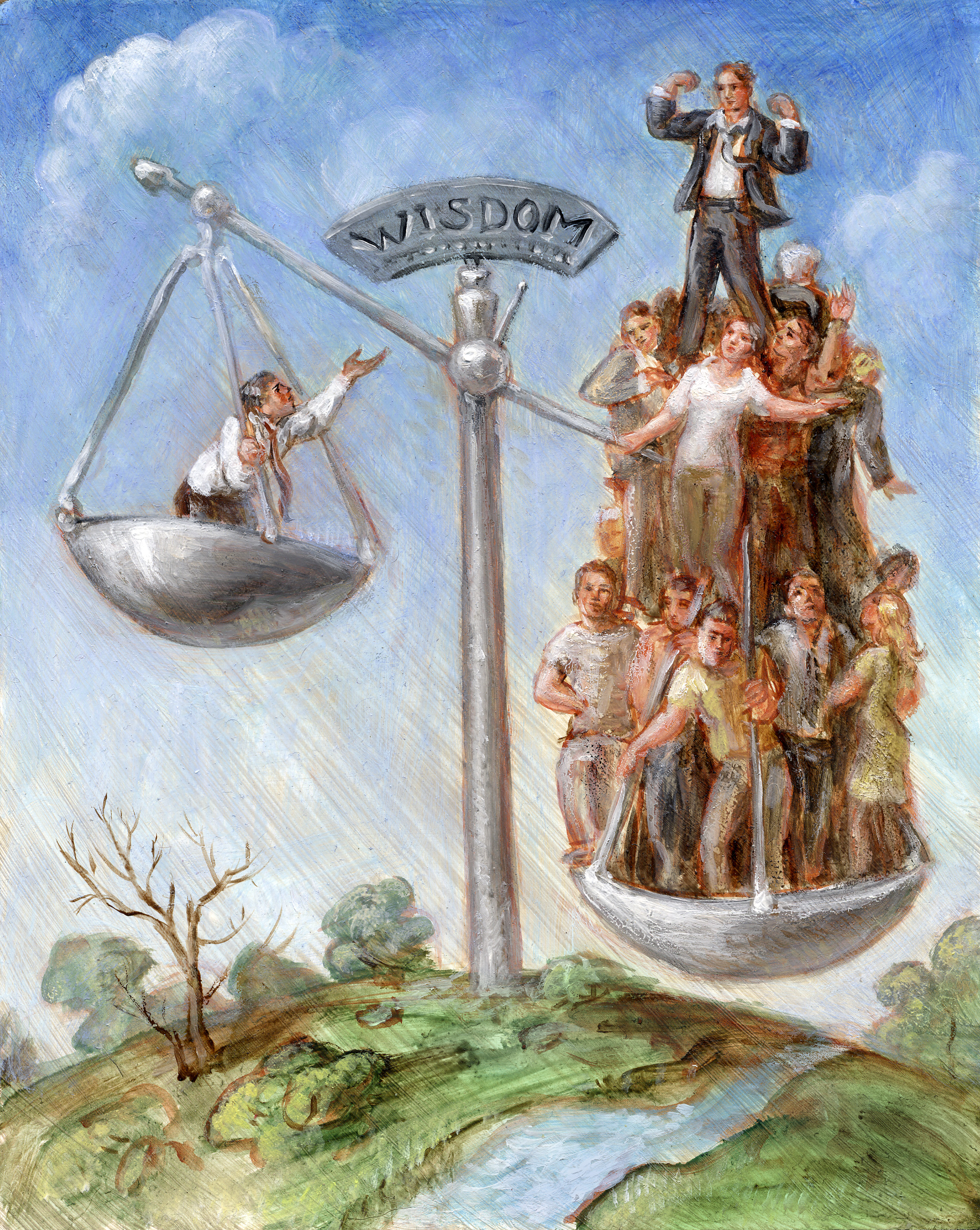

One of the founding principles of evidence-based investing is the wisdom of the crowd, which was developed by the mathematician and polymath Sir Francis Galton.

Simply put, Galton demonstrated how a large group of people can collectively make more accurate judgements than individuals, including experts.

Every day, millions of investors around the world place millions of trades, each time expressing an opinion as to how much an asset is worth. So the market is like a giant super-computer, and therefore very hard to beat.

Another key principle is that, in the short term, movements in stock prices are completely random. In his book, A Random Walk Down Wall Street, Princeton economist Burton Malkiel showed how investors should give up stock picking altogether.

He wrote: "A blindfolded monkey throwing darts at a newspaper's financial pages, could select a portfolio that would do just as well as one carefully selected by the experts."

In fact, evidence-based investing draws on the work of several winners of The Nobel Prize in Economic Sciences.

They include Harry Markowitz, who showed how broad diversification reduces risk and improves long-term returns; William Sharpe, who helped to explain risk and volatility; and Eugene Fama, who deepened our understanding of market efficiency and the different types of risk that drive returns.

Now, you don't need to know the evidence in detail. But you do need a broad understanding of the most important lessons from academic finance.

Armed with those, you can better fund your own lifestyle and retirement, and not your broker's.

Robin Powell is the Creative Director at Index Fund Advisors (IFA). He is also a financial journalist and the editor of The Evidence-Based Investor. This article reflects IFA's investment philosophy and is intended for informational purposes only.

This article is intended for informational purposes only and reflects the perspective of Index Fund Advisors (IFA), with which the author is affiliated. It should not be interpreted as an offer, solicitation, recommendation, or endorsement of any specific security, product, or service. Readers are encouraged to consult with a qualified Investment Advisor for personalized guidance. Please note that there are no guarantees that any investment strategies will be successful, and all investing involves risks, including the potential loss of principal. Quotes and images included are for illustrative purposes only and should not be considered as endorsements, recommendations, or guarantees of any particular financial product, service, or advisor. IFA does not endorse or guarantee the accuracy of third-party content. For additional information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit our website at www.ifa.com.