The US government temporarily averted a shutdown after the House and Senate passed a 45-day funding deal on September 29. But the specter of a shutdown still looms if a longer-term funding resolution fails to materialize before the stopgap ends.

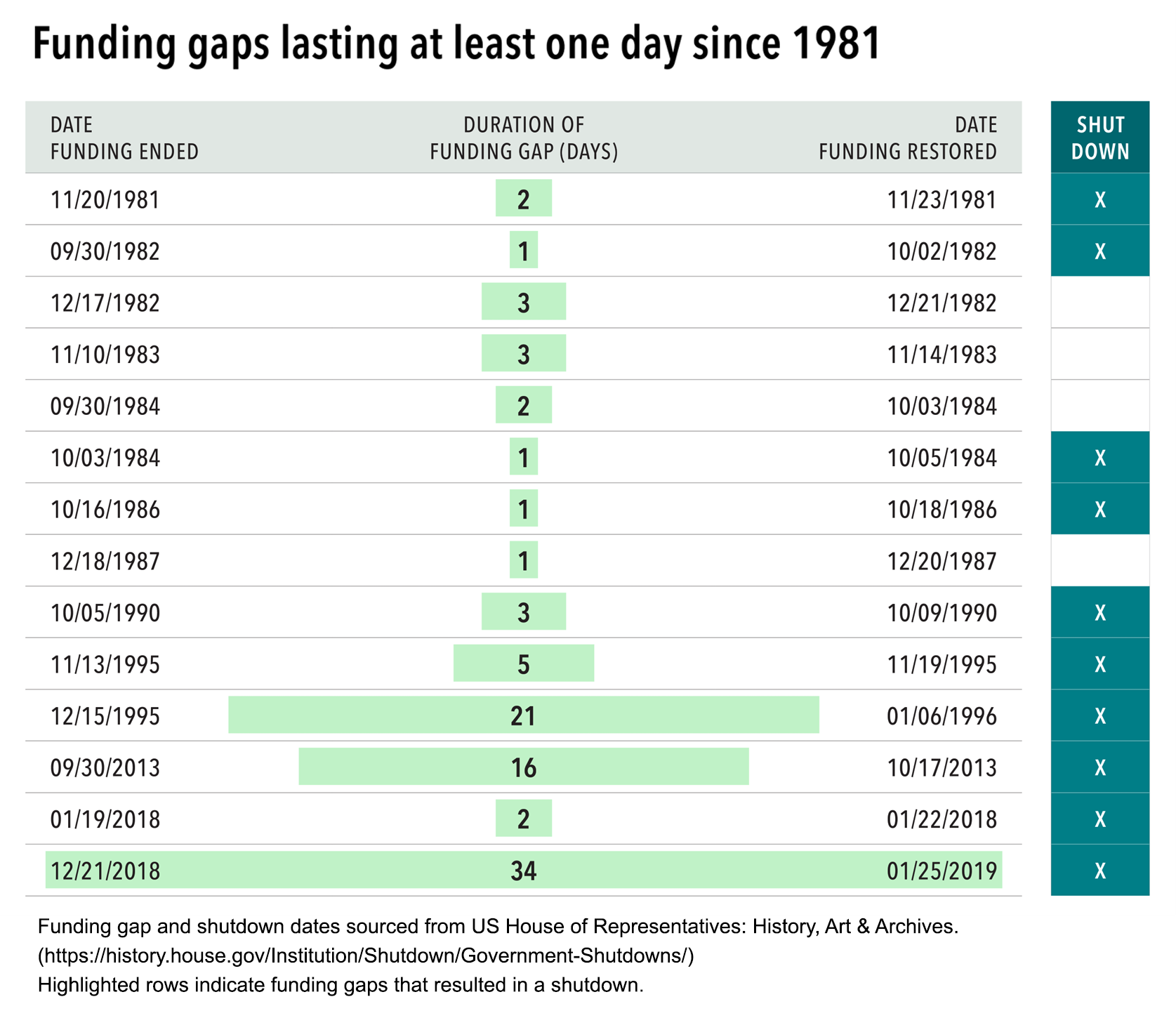

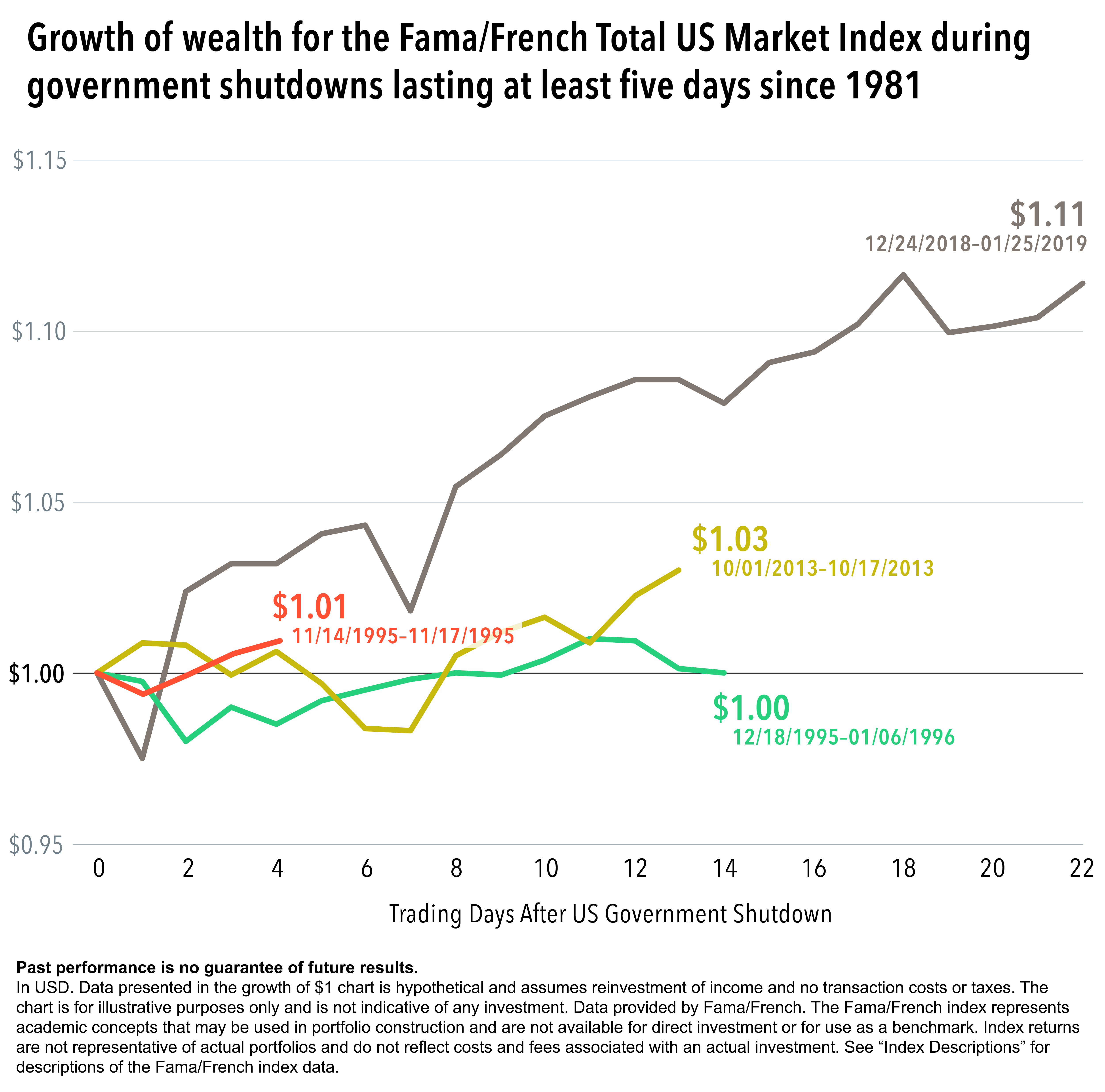

The US government has faced 14 funding gaps since 1981, ten of which resulted in shutdowns.1 During these shutdowns, many non-essential functions of the government cease. In most cases, the fiscal shortfall was resolved within a few days. Some impasses, like the December 1982 episode, lasted merely a weekend. However, four shutdowns lasted at least one week. How did stocks fare during these prolonged episodes? The US market ended higher at the conclusion of three and was flat in the other.

So, while a shutdown may be a nuisance,2 history suggests it's probably not cause for concern in your portfolio

1. The appropriations process through which the federal government budget is allocated became stricter about shutting down government operations in the event of a funding gap after legal opinions issued in 1980 and 1981.

2. Especially for those with travel plans, since the impacted services may include the TSA.

The article on this page was republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Index Descriptions

Fama/French US Total Market Index: Fama/French Total US Market Research Factor One-Month US Treasury Bills. Source: Kenneth R. French - Data Library (dartmouth.edu).

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.