After a four-year research effort to reconstruct the financial history of the United States from the late 18th century through modern times, historian and institutional investment advisor Mark J. Higgins has written a new book, "Investing in U.S. Financial History: Understanding the Past to Forecast the Future."

After a four-year research effort to reconstruct the financial history of the United States from the late 18th century through modern times, historian and institutional investment advisor Mark J. Higgins has written a new book, "Investing in U.S. Financial History: Understanding the Past to Forecast the Future."

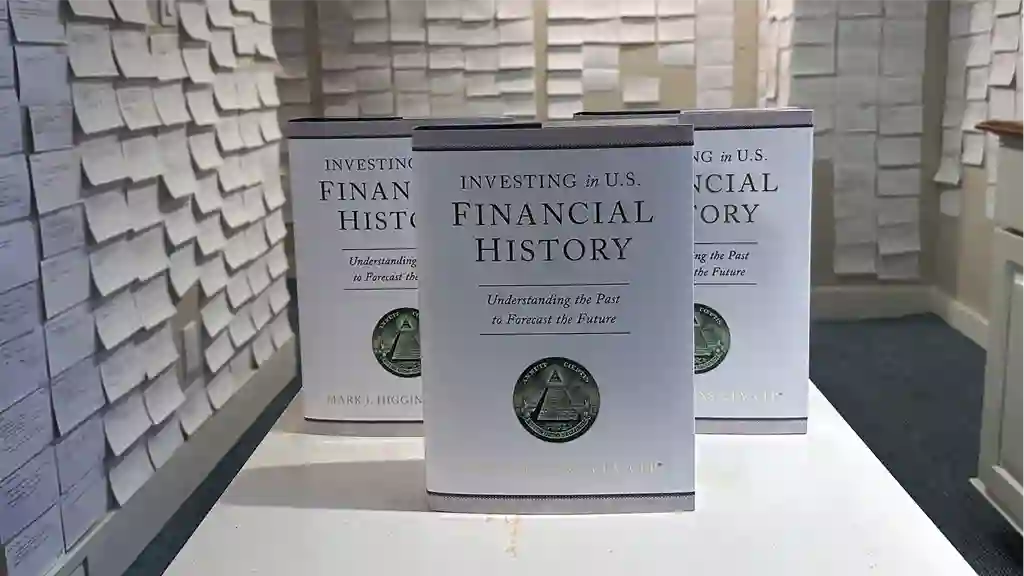

How intensive was his research? "Lining the walls of my basement are approximately 3,000 notecards documenting key events, critical principles and memorable quotes," said Higgins, who is a Senior Vice President and Institutional Advisor at Index Fund Advisors Inc.

As depicted in the photo below, these thousands of notecards — serving as a compendium of sorts from his broader historical collection — highlighted key excerpts drawn from hundreds of books, journal articles, government studies, periodicals, personal experiences and original source documents.

Such research zeal hasn't gone unnoticed, either. Leading academics and investment management professionals have lauded his book as "eminently readable" yet "sweeping" in coverage and perspective. Gregory Zuckerman, one of the Wall Street Journal's most decorated investigative reporters, praised the end result as "thorough, engaging and comprehensive." He added that Higgins' book "gives the reader a true understanding of the scope and arc of speculation on Wall Street."

Indeed, many important lessons can be gleaned by investors from all of his notes and research, agreed Higgins. "It wasn't easy to sort through and pack all of the important information into a cohesive and digestible 523-page book," he said.

At IFA, we highly recommend that investors of all stripes — from novices to more experienced institutional investors — take time to read the full work in order to gain a better understanding of how U.S. financial markets have evolved to become such a dominant force across the world.

Providing a sample of the insights in the book, Higgins has noted several of the more important lessons for investors. "I realized it was going to be really difficult to condense so much information into a highly readable and enlightening book," he said. "Even so, I thought it might be valuable to spotlight five insights that could prove extremely valuable and practical for investors."

Ultimately, according to Higgins, "my hope is that this sneak peek of the book will help to demonstrate the importance of studying financial history." He added: "Perhaps it might inspire investors to begin supplementing their personal experiences with those of our ancestors."

The five overarching themes that Higgins likes to spotlight when discussing the book with clients, academics, trustees and individual investors include:

Insight #1: Normalizing the Occurrence of ‘Extreme' Market Events.

During the past 230-plus years, noted Higgins, the United States has experienced numerous manias, panics and crashes.

So far, the most notable ones occurred in 1792, 1819, 1837, 1857, 1873, 1893, 1907, 1914, 1929, 1987, 2000, 2008 and 2020. "Despite the relative frequency of such events, Americans often react as if they were the first to witness one," said Higgins.

But much like a pilot prepares for unexpected crises in the air by spending hundreds of hours in a simulator," investors can use financial history to reenact extreme events and thereby bolster their preparedness for future ones," he said.

After years of working with large institutional investment plans across the country, Higgins has found that "the potential rewards for those investing in such an exercise include becoming more likely to react calmly and thoughtfully when extreme events repeat." Meanwhile, he observed "those who rely only on their life experience are more likely to be caught flat-footed."

At a minimum, he has found that investors who learn to supplement their "financial memories" by becoming more educated about what has happened in markets tend to gain greater conviction and discipline in taking a passive approach to wealth management.

"History teaches us in very clear terms about the importance of getting the basics of Modern Portfolio Theory right," said Higgins. "It teaches us that long-term financial success can be greatly enhanced by remaining disciplined in fundamental — but refreshingly simple — investment strategies such as rebalancing your portfolio on a regular basis."

Insight #2: Appreciation of the Bi-Polar Peril of Price Instability.

The Federal Reserve has made many mistakes during the past 100-plus years, notes Higgins.

"The consequences of most mistakes were akin to leaks in a ship in the sense that the damage was costly but manageable," he said.

During two periods, however, the Federal Reserve made "mistakes of such magnitude that they nearly sank the ship," according to Higgins.

Financial history clearly reveals, he added, that "the costliest error" by the Fed was the failure to prevent the collapse of the banking system in the early 1930s.

"This triggered a self-reinforcing deflationary spiral that deepened the Great Depression and created economic desperation that led to the outbreak of World War II," said Higgins.

The second set of errors, which occurred from 1965-1982, resulted in an era commonly referred to as the "Great Inflation" period.

"For a variety of reasons, the Federal Reserve failed to maintain restrictive policies to contain inflation," noted Higgins. "This allowed higher inflation expectations to become entrenched in the economy. As a result, the relatively draconian policies enacted by (Fed) Chairman Paul Volcker were necessary to re-establish price stability."

This lesson in monetary policy is notable, he added, since it underscored a heightened "understanding of the underlying dynamics and consequences of extreme deflation and inflation."

Such an analysis was critical, added Higgins, to help understand actions by the Federal Reserve and federal government during the COVID-19 pandemic in 2020 and its aftermath.

"The visceral fear of a Great Depression-level event explains the speed and size of the monetary and fiscal stimulus in 2020 and 2021," he said, "while the fear of repeating the ‘Great Inflation' explains why the Fed suddenly shifted to hawkish policies at the end of 2022."

In short, a deep understanding of U.S. financial history could've helped more educated investors to better-understand the Fed's actions — and, according to Higgins — put relatively short-term market events into a broader perspective fraught with less speculation.

Insight #3: Understanding the Value and Purpose of the Public Credit.

In 1790, Alexander Hamilton established several financial programs to repair the damaged credit of the newly formed United States of America.

Two fundamental principles underlying this system were that:

- The public credit should be used primarily for "loans in times of public danger."

- Such debt should then be repaid once the emergency subsided.

The U.S. largely abided by these principles until the mid-1960s. "Then, Americans became emboldened by exceptional — but deceptively temporary — wealth acquired in the aftermath of World War II," said Higgins, "and subsequently abandoned the second Hamiltonian principle."

Ever since, he added, the nation has run annual fiscal deficits with almost no exceptions.

"This has placed the United States on an unsustainable path, yet few people realize how abnormal this behavior is in the full context of the nation's history," said Higgins.

A lack of appreciation for what this country has gone through in the past, he noted, is a major reason credited by many economists for a general sense of fiscal apathy about curbing government debt. "The research for this book shows that few Americans remember what it was like when the nation lived within its means," said Higgins. "In my opinion, returning to fiscal sustainability represents the greatest challenge for the United States in the 21st century."

He added: "Understanding that the past 60 years were an aberration rather than the norm is critical to appreciating the reality of this challenge."

Insight #4: Respecting the Dreadful Odds of Active Management.

Prior to the Securities Exchange Act of 1934, according to Higgins, "the stock operators who dominated Wall Street profited primarily by employing the Gilded Age dark arts of market manipulation and insider trading."

Even in the late 1800s, investors "recognized that using only publicly available information to identify mispriced securities was little more than a crapshoot," he said. One of his favorite quotes comes from Daniel Drew, an infamous stock operator during the Gilded Age. In the 1870s, he reportedly complained "to [speculate] on Wall Street without inside information is like buying cows in candlelight."

Only after the Securities Exchange Act of 1934, noted Higgins, did Wall Street start to embrace securities analysis. "But this was only because it was the last legal technique remaining — the odds of outsmarting efficient markets remained low," he related.

Still, most investors today "continue to cling to a misguided belief that active management is expected to produce returns superior to comparable, low-cost index funds," noted Higgins.

Such a dated and historically uninformed view, he lamented, fails to recognize a mountain of evidence that reveals the futulity of active management for the vast majority of individual and institutional investors.

"Standing in the way of reform is an entrenched industry populated by institutional investment consultants, individual investment advisors, institutional plan staff — and even the financial media," said Higgins. "All have a strong financial interest in promoting the status quo, and few are willing to jeopardize it."

Lesson #5: Recognizing the Long-Wave Cycles of Alternative Asset Classes.

Over the past 30 years or so, institutional investment plan managers have substantially increased their allocations to alternative asset classes — such as venture capital, buyout funds, hedge funds and more recently private-credit funds.

"These asset classes are much riskier than investors often assume because they are expensive, illiquid and highly prone to inappropriate benchmarking," said Higgins. "They also suffer from over-investment due to the herd instinct of institutional investors."

Another key issue, he suggested, is frequently dismissed by investors. While some early movers in alternative asset classes have found success in the past, a closer review of historical risk and return measures shows these illiquid asset classes have become "crowded with less-skilled and less experienced investment managers," said Higgins.

As a result, he noted, "investors who arrive late to-the-game are often disappointed by the returns produced by this crowded field."

But examples of such "long-wave" investing fads into highly speculative markets aren't anything new, Higgins noted in his book. Prime examples he described include a rush of money into the whaling industry in the mid-1800s and enthusiasm by institutional investors in closed-end funds in the 1930s. Buyout funds in the 1990s and hedge funds in the 2000s are more recent examples, he added, "but they are hardly unique."

Similar to past "long-wave economic cycles," Higgins says private-credit funds are likely to wind up disappointing those investors who are just now entering the market or increasing existing allocations.

"These five insights are hardly the only ones discussed in Investing in U.S. Financial History," said Higgins, "but they are the ones that have thus far offered more practical value."

Learning from the past doesn't guarantee financial success in the future, he added.

"Internalizing these principles, though, might make the present less frightening, the future less surprising — and the widely accepted status quo of investing less compelling," said Higgins. "My hope is this synopsis of the book inspires readers to pursue a similar educational journey."

Mark J. Higgins, a Senior Vice President and Institutional Advisor at Index Fund Advisors Inc., is also an author and financial historian. Mark is a member of the Museum of American Finance's editorial board. His works appear regularly in publications such as the Museum of American Finance's Financial History Magazine and the CFA Institute's Enterprising Investor. His book "Investing in U.S. Financial History: Understanding the Past to Forecast the Future" was published by Greenleaf Book Group Press in 2024. Mark is a frequent speaker domestically and internationally at financial conferences for institutional investors, academics and market researchers. He has earned both the Chartered Financial Analyst (CFA) and the Certified Financial Planner (CFP) designations. Mark holds an MBA from the University of Virginia's Darden School of Business and graduated Phi Beta Kappa with a BA degree from Georgetown University.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.