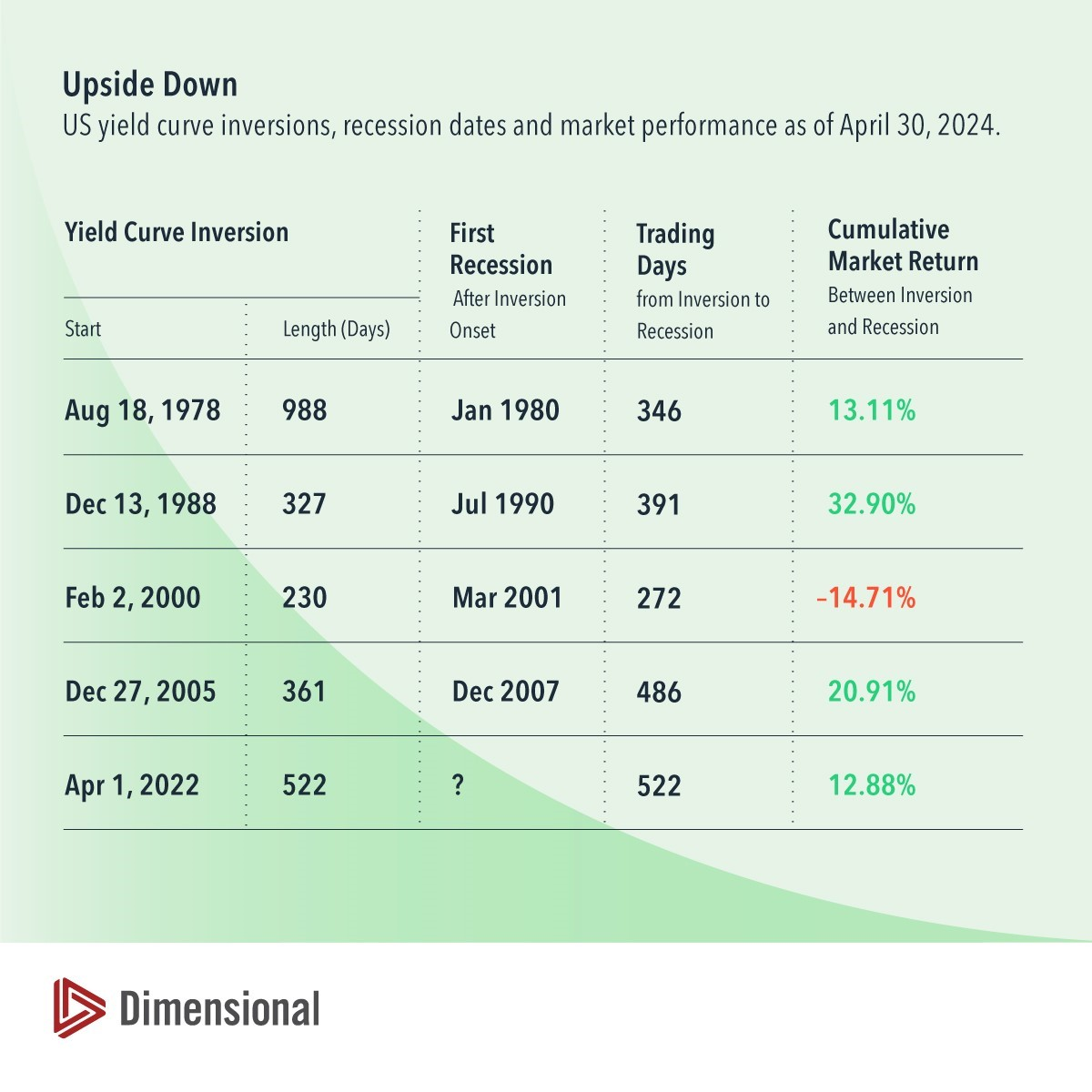

Since April 1, 2022, the yield on the 2-year US Treasury has exceeded that of the 10-year Treasury. This so-called inverted yield curve shape, where longer-dated bonds yield less than shorter-dated bonds, is considered by some as a harbinger of economic recession. While the previous four inversions were eventually followed by a recession, the link between the two is questionable.

For starters, it took between 272 and 486 trading days from the inversion onset for the recessions to arrive. That's about 1-2 years. To put that in perspective, the average US economic expansion has been about five years. That means the average waiting time for a recession, regardless of the rate environment, has been about 2.5 years. And in three out of the four cases, the inversion was over before the recession began.

We also had one recession without a yield curve inversion—that was in 2020, occurring under circumstances we can fairly characterize as unrelated to past bond yields.

So, an inversion doesn't really narrow down the timetable to an economic downturn. There's also not much evidence inversions are cause for concern with investments. The stock market has posted substantial gains between inversion and recession in three out of four past cases—and is up double digits so far during the current inversion.

One of my favorite quotes from Nobel laureate Robert Merton is: "Just because people are talking about something doesn't make it important." People are talking about the current inversion because it hit 522 days as of April 30, making it the longest inversion yet without a recession. History suggests that doesn't make it important for investment decisions.

Inversion when the yield on the 2-year Treasury exceeded the yield on the 10-year Treasury. Recession dates represent the peak month of the business cycle. Individual inversion onset defined as those lasting at least 50 trading days with no inversion in the prior 250 trading days. Number of days and return since onset of current inversion are through April 30, 2024. 10-year and 2-year constant maturity Treasury yields from FactSet. Business cycle dates from NBER.

Market return represented by the Fama/French Total US Market Research Index. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP. See "Index Descriptions" for descriptions of the Fama/French index data

This article originally appeared May 31, 2024 in Above the Fray, a weekly newsletter from Dimensional Fund Advisors. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Past performance is not a guarantee of future results. Actual returns may be lower.

Index Descriptions

Fama/French Total US Market Research Index: July 1926–present: Fama/French Total US Market Research Factor + One-Month US Treasury Bills. Source: Kenneth R. French - Data Library (dartmouth.edu).

Results shown during periods prior to each index's inception date do not represent actual returns of the respective index. Other periods selected may have different results, including losses. Backtested index performance is hypothetical and is provided for informational purposes only to indicate historical performance had the index been calculated over the relevant time periods. Backtested performance results assume the reinvestment of dividends and capital gains. Profitability is measured as operating income before depreciation and amortization minus interest expense scaled by book. Eugene Fama and Ken French are members of the Board of Directors of the general partner of, and provide consulting services to, Dimensional Fund Advisors LP.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.