Investing can feel much like riding a wild stallion. Market turbulence has a way of making even experienced investors feel at times like they're on a bucking bronco.

But it's more than an abstract expression of frustration. Studying how world-class trainers work with horses can provide a host of behavioral insights to investors trying to inject more discipline into their passive investing strategies.

At least that's what I learned after attending a recent two-day workshop at Flag Is Up Farms in Solvang, Calif. It was put on by renowned horse whisperer Monty Roberts.

Fellow trainers from Europe, South America and across the U.S. gathered at The Movement 2019 symposium to share ideas and sharpen their skills. Academics from around the world were also there to present their latest advances in equine research.

The more scholarly discourse was complemented by Roberts' hands-on demonstrations in a "round pen" and a "gentling pen" of horses brought to the farm with assorted behavioral issues.

His non-violent training process has been documented on television and explored in books, including Roberts' best-selling "The Man Who Listens to Horses."

Perhaps most notably, his work has led to creation of a nonprofit organization to advance enlightened treatment of horses. Besides teaching non-violent practices to owners and trainers, the Join-Up International nonprofit has been active in applying therapeutic riding techniques to help veterans and first-responders with post-traumatic stress injuries. It also works with groups supporting at-risk youth and animal welfare programs.

Join-Up symbolizes Roberts' teachings that horses need to be "started" on a path to learning and "not broken" to act as a human rider's partner. "A good trainer knows how to get a horse to do something without causing pain," he said at this year's symposium. "But a great trainer knows how to get a horse to want to accomplish a task."

What brought me to Flag Is Up Farms was an invitation from Mark Hebner, founder and president of Index Fund Advisors, who knew about my background growing up around horses. While volunteering his time as co-chairman of Join-Up's board, he has come to see parallels between horse whispering and investor whispering.

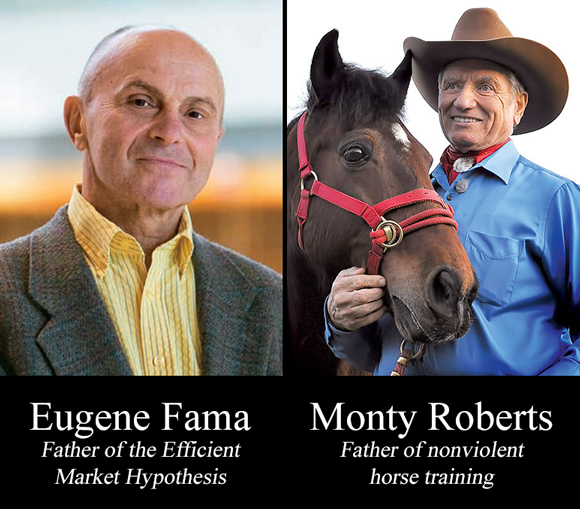

To me, this makes a lot of sense. Hebner is a student of such investment luminaries as Nobel Laureate Eugene Fama and Dimensional Fund Advisors Executive Chairman David Booth. At the same time, he watches how Roberts works to develop and motivate better communications between humans and horses. As a financial advisor, Hebner plays a role as translator and educator, trying to take advantage of cutting-edge research and best-practices coming from both fields of study.

I must admit to broaching with Hebner my observation that horse whispering has similarities to how an enlightened financial advisor works – i.e., as a sort of investor whisperer.

At the symposium, such an epiphany was driven home by a particularly impressive training session involving a high-priced racehorse. In it, Roberts patiently coaxed this Thoroughbred with a proclivity to buck in the starting gate to calmly walk along a path mirroring such a compact space. (See photo below.)

From: https://www.slohorsenews.net/moments-of-the-movement-symposium-2019/

From: https://www.slohorsenews.net/moments-of-the-movement-symposium-2019/

A big part of the solution for Roberts was working to get the horse's heartbeat to drop. Just like humans, he explained, horses can't learn when their hearts and minds are flush with anxiety.

Interestingly, Hebner has made the same observation about working with investors. "During market downturns, it's just natural for people to feel threatened and overwhelmed," he told me during a recent conversation. "That's where my role as an advisor becomes one of motivator and educator."

As Roberts does with his students, Hebner explained that his teaching methodology revolves around removing emotions from the investment experience. "My efforts are focused on getting investors to want to do what's necessary to accomplish their financial goals," he said. "Teamwork only works if you have a willing partner, which is also a central theme of Monty's horse whispering work."

Like horse whisperer Roberts, investor whisperer Hebner has supplemented his work by producing a voluminous amount of online educational and news resources. Besides writing a book and filming a documentary, Hebner has built a site where investors can find a wide range of articles, videos and charts. At IFA.com, they can also tap into a free online library of books and other academic resources.

Along with IFA advisors' individual work with clients, these educational tools are offered as alternative programming to CNBC and the like promoting a more hectic and reactionary approach to investing.

This is a constant battle that IFA's advisors fight on a daily basis. A deluge of poorly researched findings put out by proponents of active investing keeps bombarding investors, much of it spread through media outlets by financial journalists.

As I've written about in the past, such a lack of thoroughness and critical review of studies perpetuating the myth of active management is a particularly sore spot for me.

It's also a point of contention to Dr. Veronica Fowler, a U.K.-based equine studies academic who tracks what she calls "junk science." She gave a presentation at The Movement outlining numerous "half-reported" and "falsely identified" sets of data used in highly cited research about horses.

After her presentation, I approached Dr. Fowler and explained what she was so passionate about -- detecting and bringing to light problematic research that led to dangerous assumptions -- reminded me of what many of us battle on a daily basis at IFA.

As we talked, her eyes lit up. She instantly saw the connection and asked: "I've of course heard of Mark Hebner -- is he around?" Then, this renowned animal sciences researcher headed off to find him and compare notes.

Such an exchange was another confirmation to me that horse whispering and investor whispering are in many respects very analogous.

My experiences at the Roberts' farm showed that in the right hands, both an enlightened wealth manager and a natural horsemanship trainer succeed by patiently offering disciplined education and guidance in a caring and highly communicative manner to all sorts of students, whether of the equine or human variety.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.