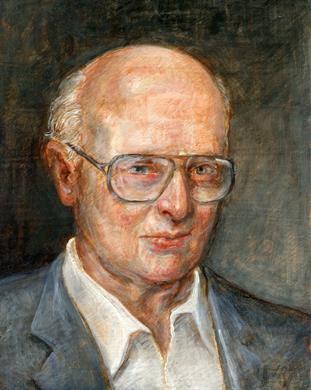

Harry Max Markowitz is best known for his pioneering work in Modern Portfolio Theory, studying the effects of asset risk, correlation and diversification on expected investment portfolio returns. His research has won several prestigious awards, including the John von Neumann Theory Prize (1989) and the Nobel Prize in Economics (1990).

Harry Max Markowitz is best known for his pioneering work in Modern Portfolio Theory, studying the effects of asset risk, correlation and diversification on expected investment portfolio returns. His research has won several prestigious awards, including the John von Neumann Theory Prize (1989) and the Nobel Prize in Economics (1990).

Today, Markowitz's highly acclaimed research serves as the framework for the Prudent Investor Rule, as well as for the investment strategies of institutional investors around the world. In fact, trillions of dollars in institutional assets are estimated to invest in accordance with Professor Markowitz's Nobel Prize winning discoveries.

Markowitz's research supports IFA's investment strategy: A portfolio that carries broad-based diversification among low-cost and passively managed indexes has shown to be the most prudent investing strategy over time. Some of the most significant conclusions from his evidence-based research can be summarized for investors in a practical sense as:

- Don't bet the ranch.

- Get more bang for your buck.

- Maximize output relative to input.

- Nothing ventured, nothing gained. Diversify instead of striving to make a killing.

- Don't put all your eggs in one basket; if it drops, you're in trouble.

- High volatility is like putting your head in the oven and your feet in the refrigerator.

These common sense sayings capture the essence of Harry Markowitz's brainstorm, sparked one afternoon as he sat in the University of Chicago library reading a book about the current thinking of stock market investing. At 25 years old, Markowitz thought investors should be equally concerned with the volatility or risk of investments as they are with the return of investments. Some 38 years later, this innovative yet practical theory earned him the 1990 Nobel Prize in Economics. Such a landmark contribution to the investment world was first published in 1952 in an essay entitled, "Portfolio Selection." He later authored a book entitled, "Portfolio Selection: Efficient Diversification" (1959).

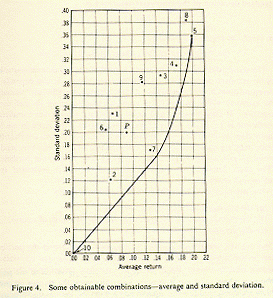

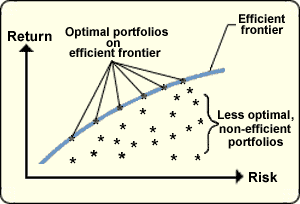

Using several stocks from the New York Stock Exchange, Markowitz created the first efficient frontier. The image to the left is reproduced from his book, "Portfolio Selection," (Cowles Monograph 16, Yale University Press, 1959). It has a line going to the origin, because Markowitz was interested in the effects of combining risky assets with a riskless asset — cash. A more modern version of the efficient frontier is found below (to the right). Notice that the axis labels have been reversed.

Using several stocks from the New York Stock Exchange, Markowitz created the first efficient frontier. The image to the left is reproduced from his book, "Portfolio Selection," (Cowles Monograph 16, Yale University Press, 1959). It has a line going to the origin, because Markowitz was interested in the effects of combining risky assets with a riskless asset — cash. A more modern version of the efficient frontier is found below (to the right). Notice that the axis labels have been reversed.

The theory developed in "Portfolio Selection" was a theory for optimal investment in stocks that differ in regard to their expected return and risk. Investment managers and academic economists have long been aware of the necessity of taking both risk and return into account. Markowitz's primary contribution consisted of developing a rigorously formulated operational theory for portfolio selection under uncertainty. His theory evolved into a foundation for further research in financial economics. Markowitz was the first to place a number on risk relative to investing. Risk was previously discussed in general terms and based more on feeling or intuition. He was able to quantify the "undesirable thing" an investor tries to avoid by using a range of possible return outcomes — based on the past variability of returns.

Under certain conditions, Markowitz showed an investor's portfolio choice can be reduced to balancing two dimensions — the expected return on the portfolio and its variance, or standard deviation. The risk of a diversified portfolio depends not only on the individual variances of the return on different assets, but also on the opposite movement of all assets. When one asset class goes up, another goes down. The opposite movement results in a higher return than if all of the assets go up or down together. He said: "Diversification is both observed and sensible. A rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim." At age 25, Markowitz already knew that focusing on return without proper consideration of risk creates portfolios that are less than desirable.

Under certain conditions, Markowitz showed an investor's portfolio choice can be reduced to balancing two dimensions — the expected return on the portfolio and its variance, or standard deviation. The risk of a diversified portfolio depends not only on the individual variances of the return on different assets, but also on the opposite movement of all assets. When one asset class goes up, another goes down. The opposite movement results in a higher return than if all of the assets go up or down together. He said: "Diversification is both observed and sensible. A rule of behavior which does not imply the superiority of diversification must be rejected both as a hypothesis and as a maxim." At age 25, Markowitz already knew that focusing on return without proper consideration of risk creates portfolios that are less than desirable.

Markowitz's contribution extended to making the distinction between the risk of an individual stock and the risk of a portfolio. He showed how individual risky stocks lose much of their risk if combined with less risky stocks in a portfolio. What is remarkable about Markowitz's discovery is that an investor can reduce the volatility of a portfolio and increase its return at the same time.

When Markowitz began to formulate his ideas in the 1950s, leading investment guides recommended that an investor should find one stock with the highest expected return, invest in it and ignore all of the others. If investing involved no amount of risk, holding investments with the highest expected returns would be a highly profitable idea.

The experienced investor knows that investing is full of risk. Risk essentially means that more can happen than will happen, which adds great uncertainty to investment decision-making. People do not expect to be in an auto accident, but they invest in auto insurance because of the unpredictable possibilities. People also do not expect a stock in their portfolio to decrease in price, but it can and will at some point. If an investor's portfolio is diversified, then the loss incurred from that one stock will be "insured" by other stocks that do not decrease in price. Markowitz knew that in the real world, investors are not only interested in return, but they are concerned with risk as well.

His conclusion: Risk is central to the whole process of investing. He then wondered how to measure the appropriate amount of risk to undertake. Markowitz came to realize the cruel truth of investing — investors cannot earn higher returns without taking on greater risk; and the greater the risk, the greater the possibility of loss.

As a result, he set out to devise ways to help investors apply tradeoffs between risk and return. Using mathematics to solve the puzzle, Markowitz discovered a remarkable new way to build an investment portfolio, which he called the "efficient portfolio." It offers an investor the highest expected return for any given level of risk, or the lowest level of risk for any given expected return.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.