Investors often ask if globally diversified stock portfolios are necessary when the US stock market has many multinational companies or those earning revenues from non-US countries. The data suggest these companies are no more successful at global diversification than a faux mane is at turning a golden retriever into a lion.

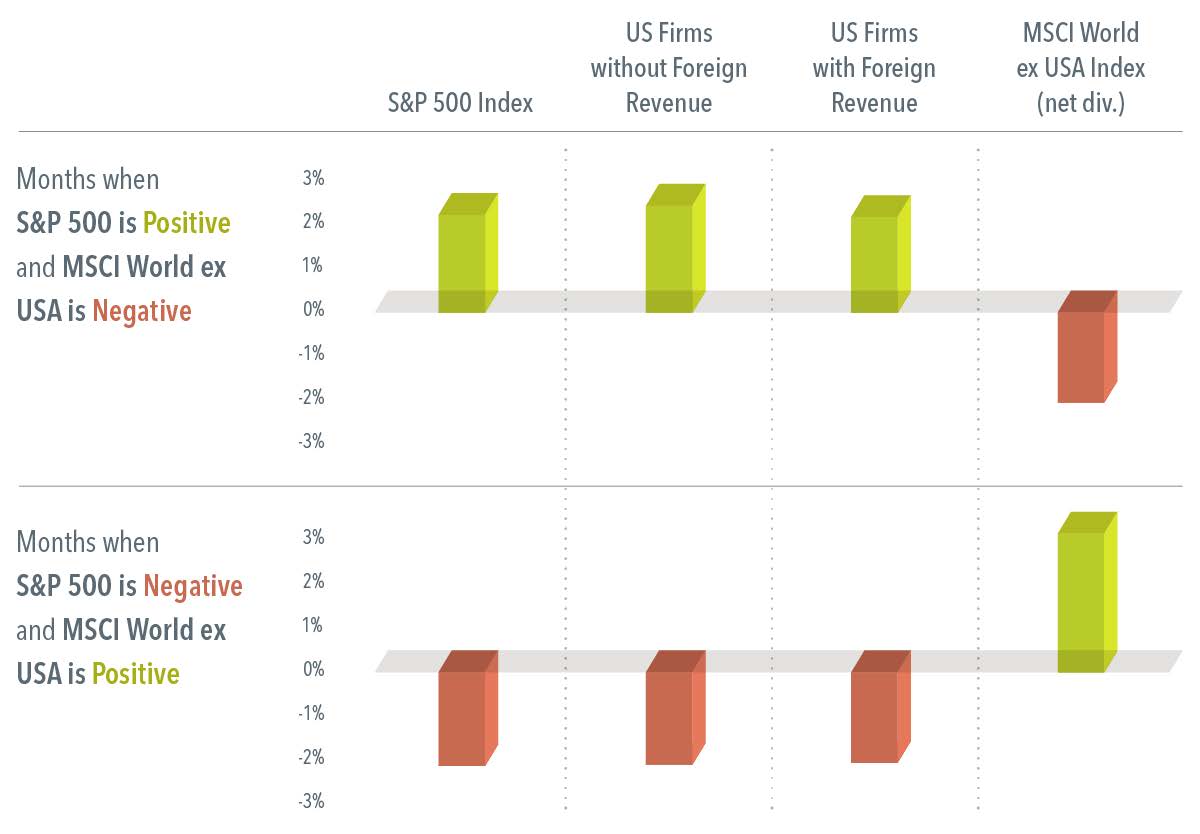

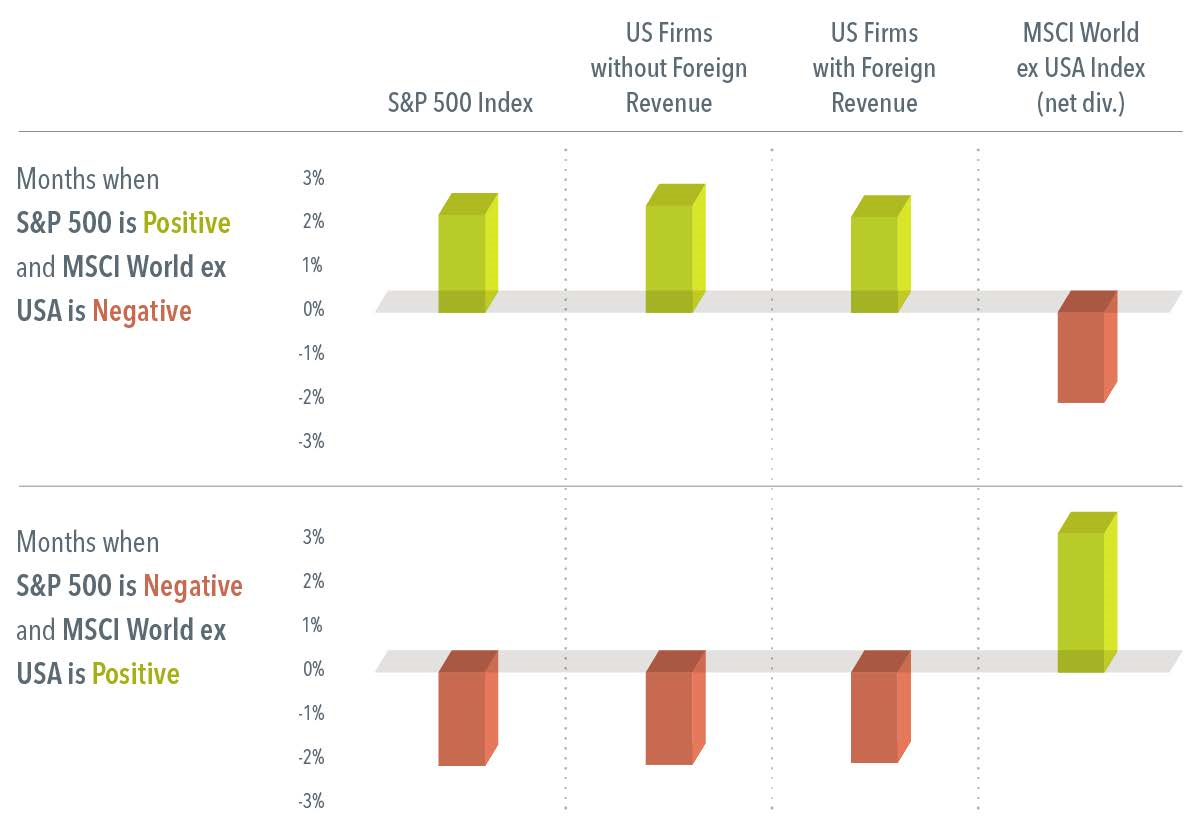

We can test the global diversification benefit of companies with non-US revenues by looking at their average returns in months when US stock returns and international returns diverge. Stocks offering sufficient non-US exposure should presumably move more in line with the international market. However, companies with non-US revenues appear to merely track the broader US market on average. In particular, when the US market is down—and investors would hope for global diversification to kick in— companies with non-US revenues are similarly down. These results echo academic evidence showing that stock prices tend to move based on where they trade more than where the business resides.1

Developed ex US and emerging markets stocks combine for about 39% of the global stock market.2 That's a meaningful chunk of the equity investment opportunity set, and based on these results, they have potential to be a pivotal complement to the US market.

Exhibit 1

One of These Things Is Not Like the Other

Average monthly returns when US and developed ex US stock returns have opposite signs, January 1979–December 2022

Past performance is not a guarantee of future results.

Source: Dimensional, using CRSP and Compustat data. The eligible universe includes ordinary common US stocks of all capitalizations traded on NYSE, NASDAQ, and NYSE MKT. We identify a company with and without foreign sales exposure using Compustat's annual geographic segment data. Value-weighted portfolios are formed on eligible stocks with and without foreign sales. Portfolios are rebalanced annually in January based on the annual geographic segment data. S&P data © 2024 S&P Dow Jones Indices LLC, a division of S&P Global. All rights reserved. MSCI data © MSCI 2024, all rights reserved.

This article originally appeared June 6, 2024 in Above the Fray, a weekly newsletter for Dimensional clients. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

1. Kenneth A. Froot and Emil Dabora, "How Are Stock Prices Affected by the Location of Trade?" (working paper, National Bureau of Economic Research, May 1998).

2. As of December 31, 2023

DISCLOSURES

The information in this material is intended for the recipient's background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss

arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

Dimensional" refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investmentnmay fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

CANADA

These materials have been prepared by Dimensional Fund Advisors Canada ULC. The other Dimensional entities referenced herein are not

registered resident investment fund managers or portfolio managers in Canada.

This material is not intended for Quebec residents.

Commissions, trailing commissions, management fees, and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise noted, any indicated total rates of return reflect the historical annual compounded total returns, including changes in share or unit value and reinvestment of all dividends or other distributions, and do not take into account sales, redemption, distribution, or optional charges or income taxes payable by any security holder that would have reduced returns. Mutual funds are not guaranteed, their values change frequently, and past performance may not be repeated.

WHERE ISSUED BY DIMENSIONAL IRELAND LIMITED

Issued by Dimensional Ireland Limited (Dimensional Ireland), with registered office 3 Dublin Landings, North Wall Quay, Dublin 1, Ireland.

Dimensional Ireland is regulated by the Central Bank of Ireland (Registration No. C185067).

WHERE ISSUED BY DIMENSIONAL FUND ADVISORS LTD.

Issued by Dimensional Fund Advisors Ltd. (Dimensional UK), 20 Triton Street, Regent's Place, London, NW1 3BF. Dimensional UK is

authorised and regulated by the Financial Conduct Authority (FCA) - Firm Reference No. 150100.

Dimensional UK and Dimensional Ireland do not give financial advice. You are responsible for deciding whether an investment is suitable for your personal circumstances, and we recommend that a financial adviser helps you with that decision

Dimensional UK and Dimensional Ireland issue information and materials in English and may also issue information and materials in certain other languages. The recipient's continued acceptance of information and materials from Dimensional UK and Dimensional Ireland will

constitute the recipient's consent to be provided with such information and materials, where relevant, in more than one language.

NOTICE TO INVESTORS IN SWITZERLAND: This is advertising material.

JAPAN

For Institutional Investors and Registered Financial Instruments Intermediary Service Providers. This material is deemed to be issued by Dimensional Japan Ltd., which is regulated by the Financial Services Agency of Japan and is registered as a Financial Instruments Firm conducting Investment Management Business and Investment Advisory and Agency Business.

Dimensional Japan Ltd.Director of Kanto Local

Finance Bureau (FIBO) No. 2683

Membership: Japan Investment Advisers Association

SINGAPORE

This material is deemed to be issued by Dimensional Fund Advisors Pte. Ltd., which is regulated by the Monetary Authority of Singapore and

holds a capital markets services license for fund management.

This advertisement has not been reviewed by the Monetary Authority of Singapore.

FOR PROFESSIONAL INVESTORS IN HONG KONG

This material is deemed to be issued by Dimensional Hong Kong Limited (CE No. BJE760) ("Dimensional Hong Kong"), which is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

This material should only be provided to "professional investors" (as defined in the Securities and Futures Ordinance [Chapter 571 of the Laws of Hong Kong] and its subsidiary legislation) and is not for use with the public. This material is not intended to constitute and does not constitute marketing of the services of Dimensional Hong Kong or its affiliates to the public of Hong Kong. When provided to prospective investors, this material forms part of, and must be provided together with, applicable fund offering materials. This material must not be provided to prospective investors on a standalone basis. Before acting on any information in this material, you should consider whether it is suitable for your particular circumstances and, if appropriate, seek professional advice.

Neither Dimensional Hong Kong nor its affiliates shall be responsible or held responsible for any content prepared by financial advisors. Financial advisors in Hong Kong shall not actively market the services of Dimensional Hong Kong or its affiliates to the Hong Kong public.