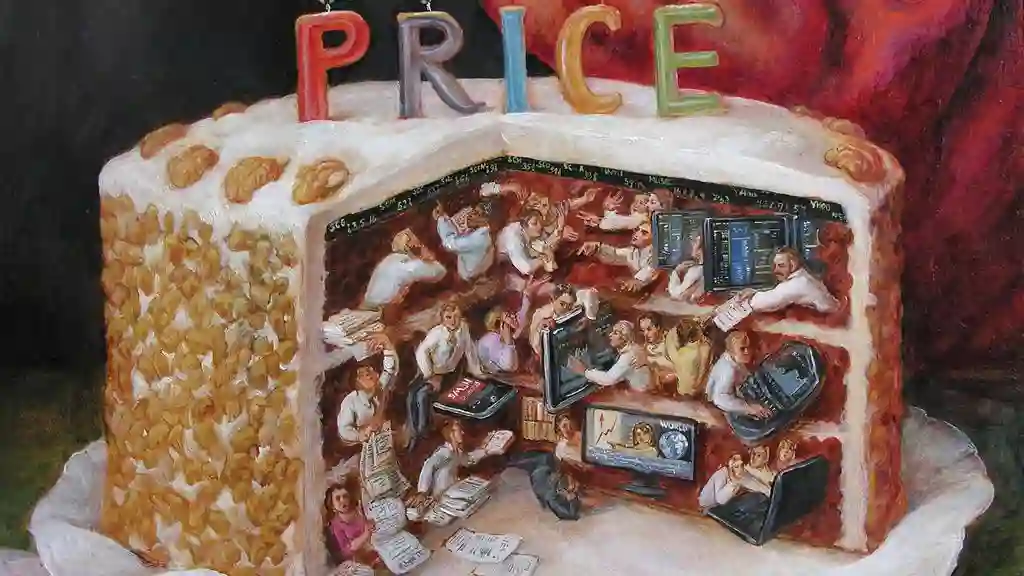

Turbulent times can lead to apprehension and a certain sense of malaise by investors. This includes everything from epidemics and natural disasters to military conflicts. Indeed, Russia's invasion of Ukraine and Middle East conflicts serve as important reminders that geopolitical risk is a part of investing in global markets.

Behavioral finance scientists have related making investment decisions during such periods of heightened volatility to driving while feeling the symptoms of vertigo. Trying to predict how markets will react in the moment based on the latest geopolitical scare too often spurs investors to shoot from the hip, so to speak.

The chart and table below show how major events in the past could've whipsawed a normally patient investor's portfolio. In a vast majority of those cases — from Japan's bombing of Pearl Harbor and North Korea invading South Korea to terrorist attacks on 9/11 — the Dow Jones Industrial Average took a precipitous fall.

Also worth noting: The latest data showed the IFA Index 100 Portfolio had no exposure to Russian stocks. Likewise, such a passively managed all-equity portfolio of index funds had 1.16% invested in the Middle East, according to Morningstar data.

The takeaway here is clear — market volatility shouldn't be considered as an anomaly. Whether caused by a military action or pandemic, a roller coaster effect in securities pricing is a regular part of investing.

As a result, we invite all IFA clients to discuss creating an individually tailored financial plan with their wealth advisors. We offer such a holistic planning tool on a complimentary basis. If you've already started such a process, we also encourage you to check back with your advisor when major life events happen or notable changes in your financial goals take place.

In the meantime, in case you're feeling tempted to make portfolio tweaks, we like to recommend you take our Risk Capacity Survey. This online tool is often used by IFA clients to reassess whether they own the most risk-appropriate portfolio given each investor's unique financial situation.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Take the IFA Risk Capacity Survey (www.ifa.com/survey) to determine which portfolio captures the right mix of stock and bond funds best suited to you. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.