On April 1, 1835, James "Jubilee Jim" Fisk, Jr. was born in Pownal, Vermont. Perhaps due to his birth on April Fool's Day, Fisk was always a mischievous child. Unable to tolerate the discipline of attending school, Fisk ran away from home at the age of 15 and joined a traveling circus. After spending a few years mastering the art of clownery, Fisk dabbled in a career as a peddler and briefly smuggled cotton across enemy lines during the Civil War. His unconventional experiences armed him with a flare for theatrics, talent for swindling, and utter lack of conscience. It turned out, however, that these traits were perfectly suited for a career on Wall Street in the Gilded Age.

From 1865-1872, Jim Fisk and his frequent co-conspirators, Jay Gould and Daniel Drew, concocted numerous schemes to fleece investors. These included a daring market corner of the gold market, insider trading, brazen fraud, and routine bribery of law enforcement, politicians, and judges. Always the comedian, Fisk once described his printing of $10 million of illegally issued shares in the railroad as his "constitutional right to freedom of the press." Unlike many of his compatriots, Fisk's career ended abruptly at the age of 36 when he suffered a fatal gunshot wound in a lover's quarrel. True to his character, he exited the world in much the same way that he lived in it. Rumor has it that his friends wagered on the hour of his death while he lay mortally wounded in bed.

An Important Lesson from the Gilded Age

The conquests of Gilded Age stock operators like Jim Fisk are covered in chapter 9 of Investing in U.S. Financial History: Understanding the Past to Forecast the Future. Understanding these schemes may seem unnecessary today, but many lessons remain surprisingly relevant. The most important is understanding why Gilded Age stock operators resorted to cheating markets in the first place. The reason was that even in the late 1800s, market efficiency rendered securities analysis a foolish endeavor for most speculators. Why struggle to predict the future when it was perfectly legal to create your own future by manipulating markets or know it in advance by acquiring insider information?

After the passage of the Securities Exchange Act of 1934, market manipulation and insider trading were outlawed, thus ending the reign of Wall Street's stock operators and marking the rise of the securities analyst profession. But overlooked during this transition was the fact that, by the mid-1930s, markets were already efficient, which prevented most securities analysts from outperforming broad market indexes. This reality persists to this day, yet most individual and institutional investors continue to ignore the low probability that active managers will outmaneuver ruthless market efficiency over a long time horizon.

By commemorating the origin of this costly fool's errand on April Fool's Day 2024, perhaps some investors will choose to respect ruthless market efficiency and embrace a more prudent strategy of using low-cost index funds.

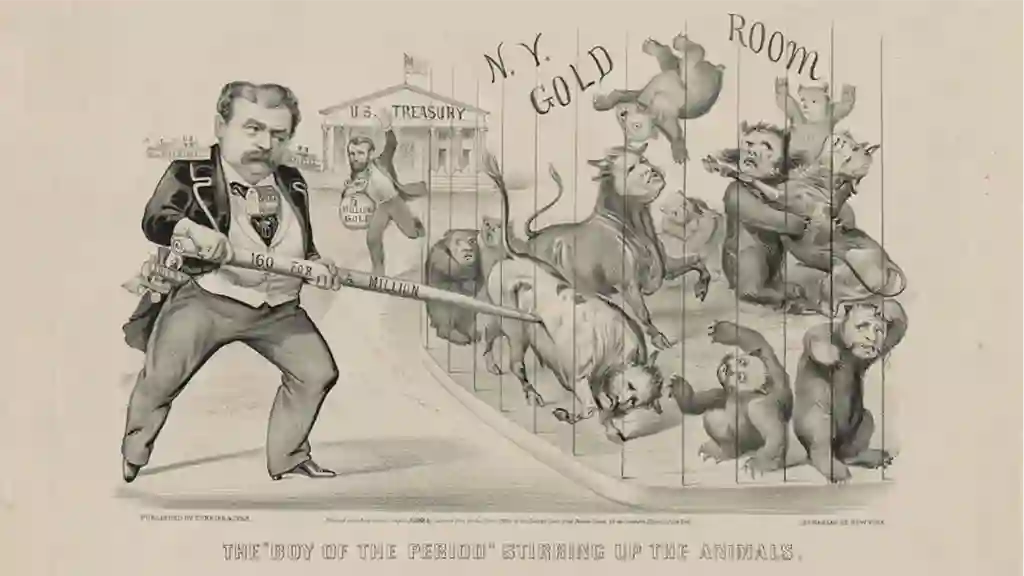

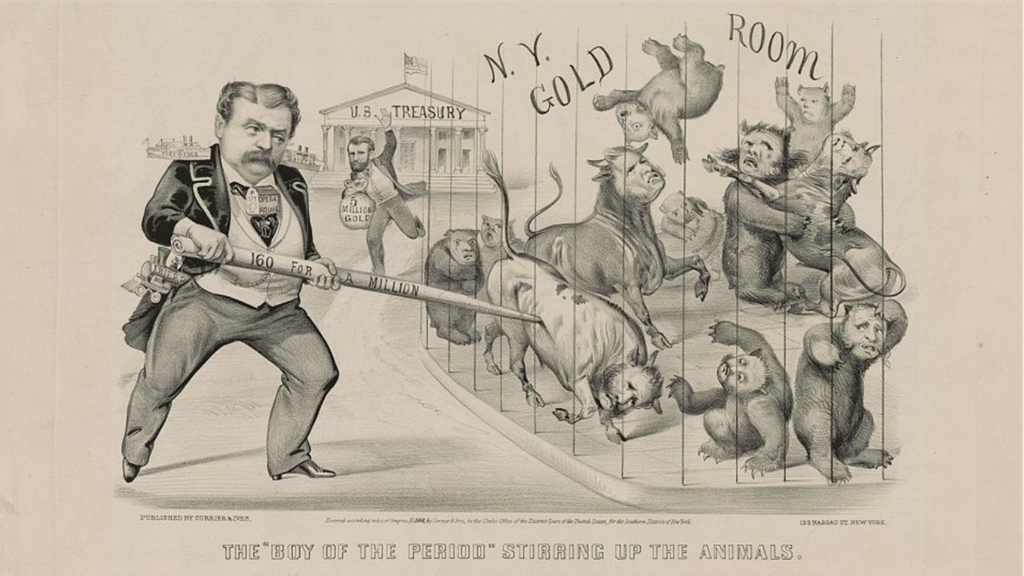

The "Boy of the period" stirring up the animals, [New York] : Currier & Ives, 1869.

Certified Financial Planner™ (CFP®) is a designation received upon passing the course work and exam administered by the Certified Financial Planner Board of Standards, Inc. (CFB Board).

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.