At Index Fund Advisors, our clients are provided financial plans — including access to a broad range of investing and planning tools. Since 2015, for example, we've been offering an interactive software suite, eMoney. The idea is to provide investors with a greater choice of high-tech applications to use in analyzing their personal financial situations.

"Providing capable financial planning software is important for a client to sort and identify key components of a holistic financial plan," said Kirk Ito, a financial planning analyst at IFA and a Certified Financial Planner (CFP)*.

To further add to our financial planning tools, we have included Right Capital. Right Capital is another powerful financial planning tool that enables us to provide added features not available in eMoney, such as:

- Dynamic retirement spending strategies

- Student loan management

- Visuals for household finances and cash flows

- Advanced social security optimization such as government pension offset, etc.

- Medicare planning and premium calculation

- Debt management

- Various integrated risk assessment tools

Our goal is to offer powerful financial planning tools to help you reach your retirement goals.

After the wealth advisor engages with the client, our planning process is consolidated into these 6 steps:

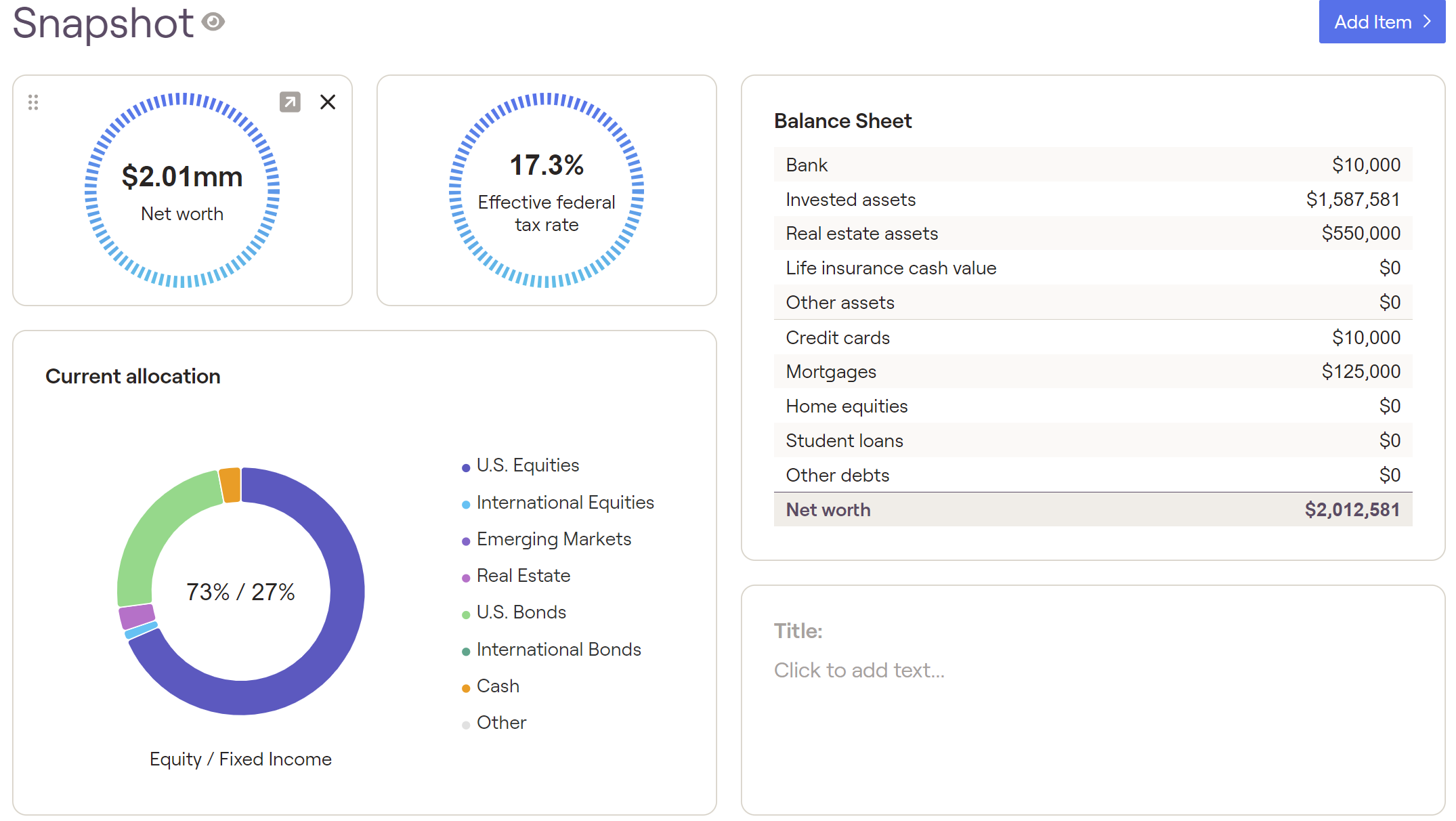

1. Client Snapshot

When a client first logs onto Right Capital, they are greeted by the "Snapshot" page, which serves as the central hub for all their financial data. This page is designed to offer a comprehensive, high-level view of the client's overall financial situation, and it is fully customizable by both the client and the financial planner. This flexibility allows the page to be tailored to reflect the most relevant financial information for each individual's unique situation and goals. It consolidates complex data in an easy-to-understand format, allowing for quick insights and immediate identification of important trends or concerns. Whether used as a quick overview or as a foundation for deeper planning discussions, the Snapshot page is an invaluable resource for creating a more organized, transparent, and actionable financial plan.

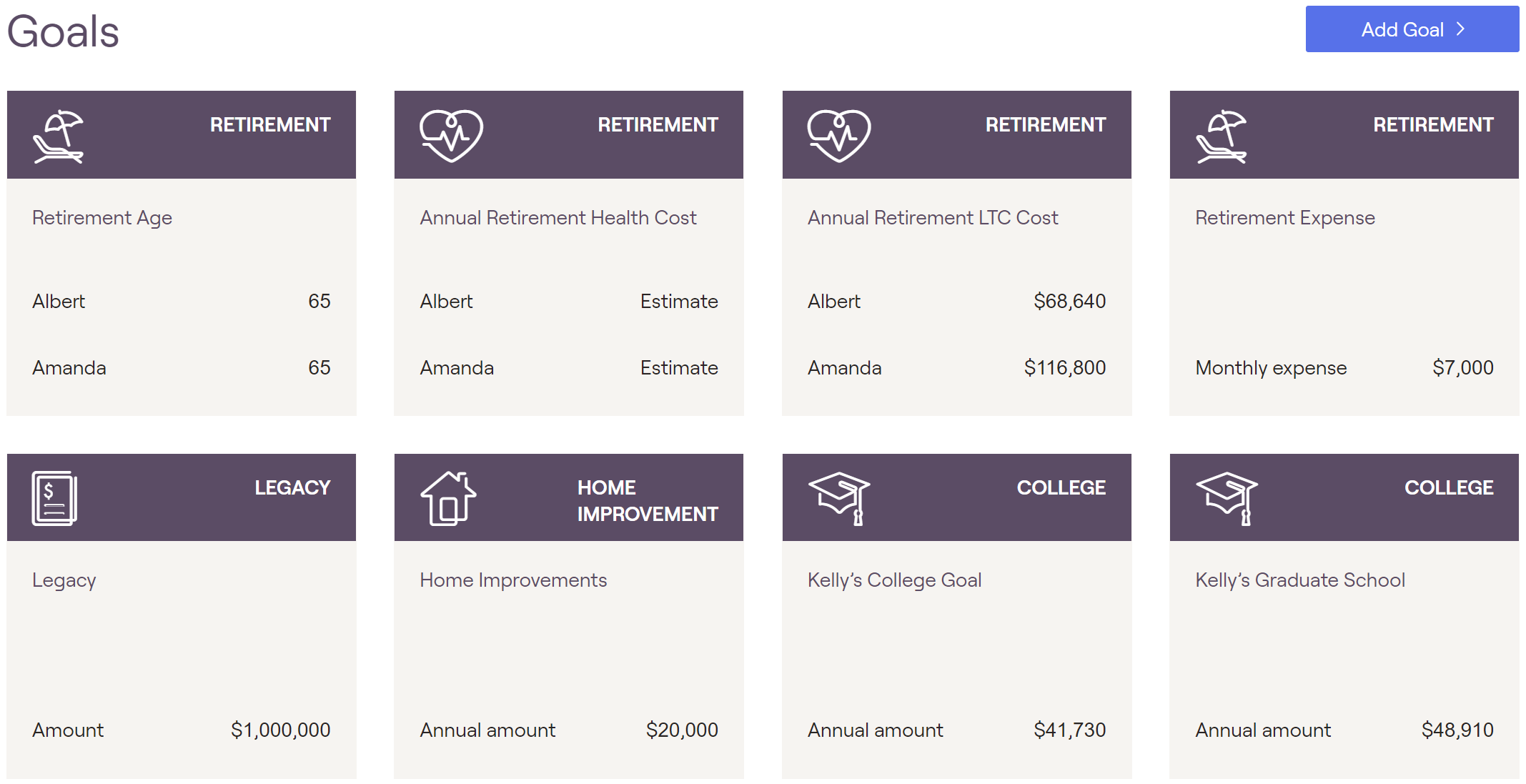

2. Goal Discussion and Data Review

The "Goals" page on Right Capital provides a more in-depth view of the client's future goals that can be easily incorporated into their future financial plan. These goals can include the client's retirement age, an annual estimate for their retirement healthcare costs as well as Long-Term Care costs, and the clients expected monthly retirement expenses. Right Capital doesn't limit clients to only the "big-ticket" items like retirement or healthcare. Clients can also add other future financial goals, such as starting a business, buying a vacation home, paying off significant debt, or funding large personal projects. This flexibility makes the Goals page a powerful tool for managing any financial aspirations, no matter how unique. This page is designed to seamlessly integrate these goals into the client's overall financial plan, ensuring that their financial strategies are aligned with their long-term objectives.

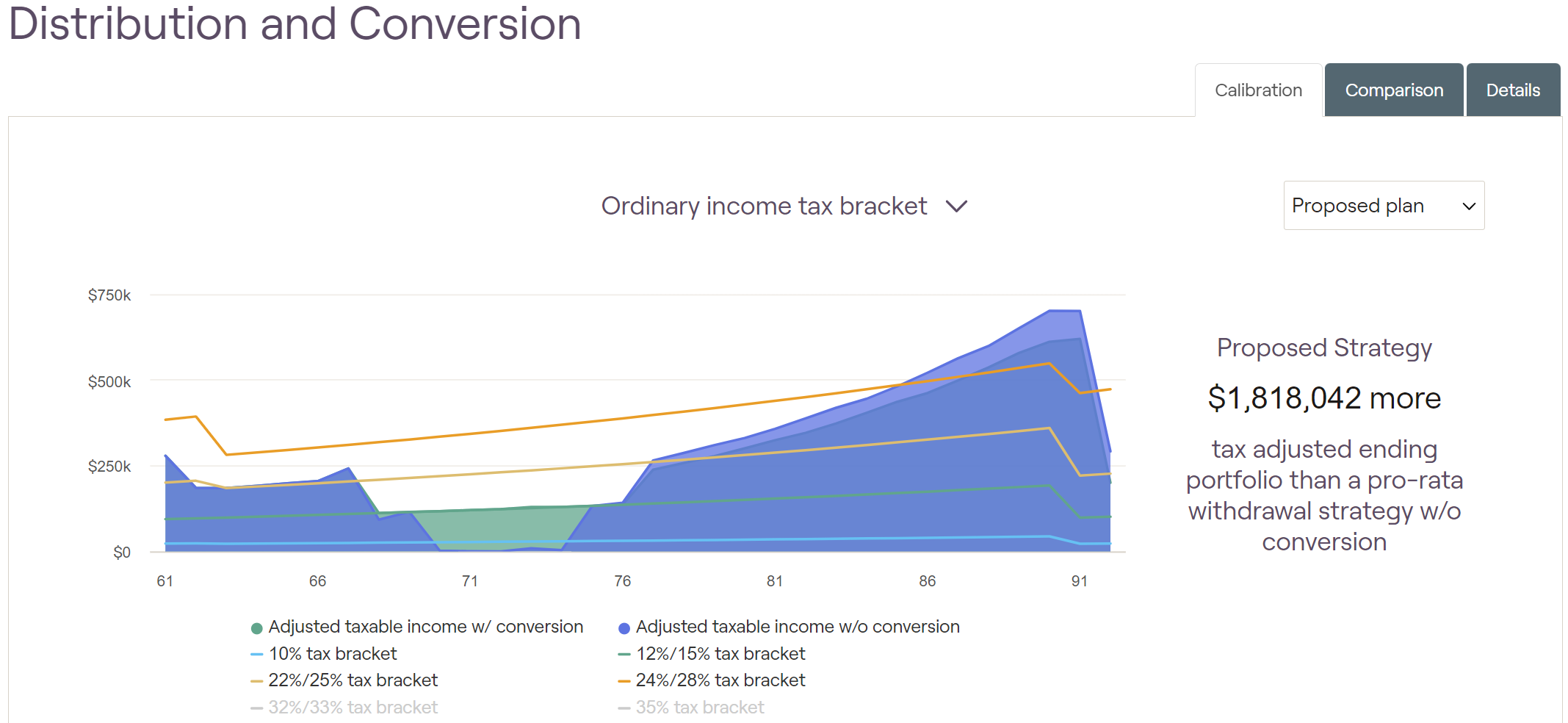

3. Withdrawal Strategy and Roth Conversion Modeling

In recent years, one of the most common questions we receive relates to Roth conversions. A Roth conversion involves moving assets from a Traditional IRA, 401(k), or other pre-tax retirement account into a Roth IRA. The key advantage of a Roth conversion is that the funds in the Roth IRA will grow tax-free, and qualified withdrawals made during retirement are also tax-free, assuming certain conditions are met. However, it's important to note that the amount converted is subject to income tax in the year of the conversion.

To help clients navigate the decision-making process, Right Capital's tax tool provides valuable insights into when and how a Roth conversion strategy might be most beneficial within their overall financial plan. This tool can help determine whether a conversion makes sense based on factors like current tax brackets, expected future income, and long-term retirement goals.

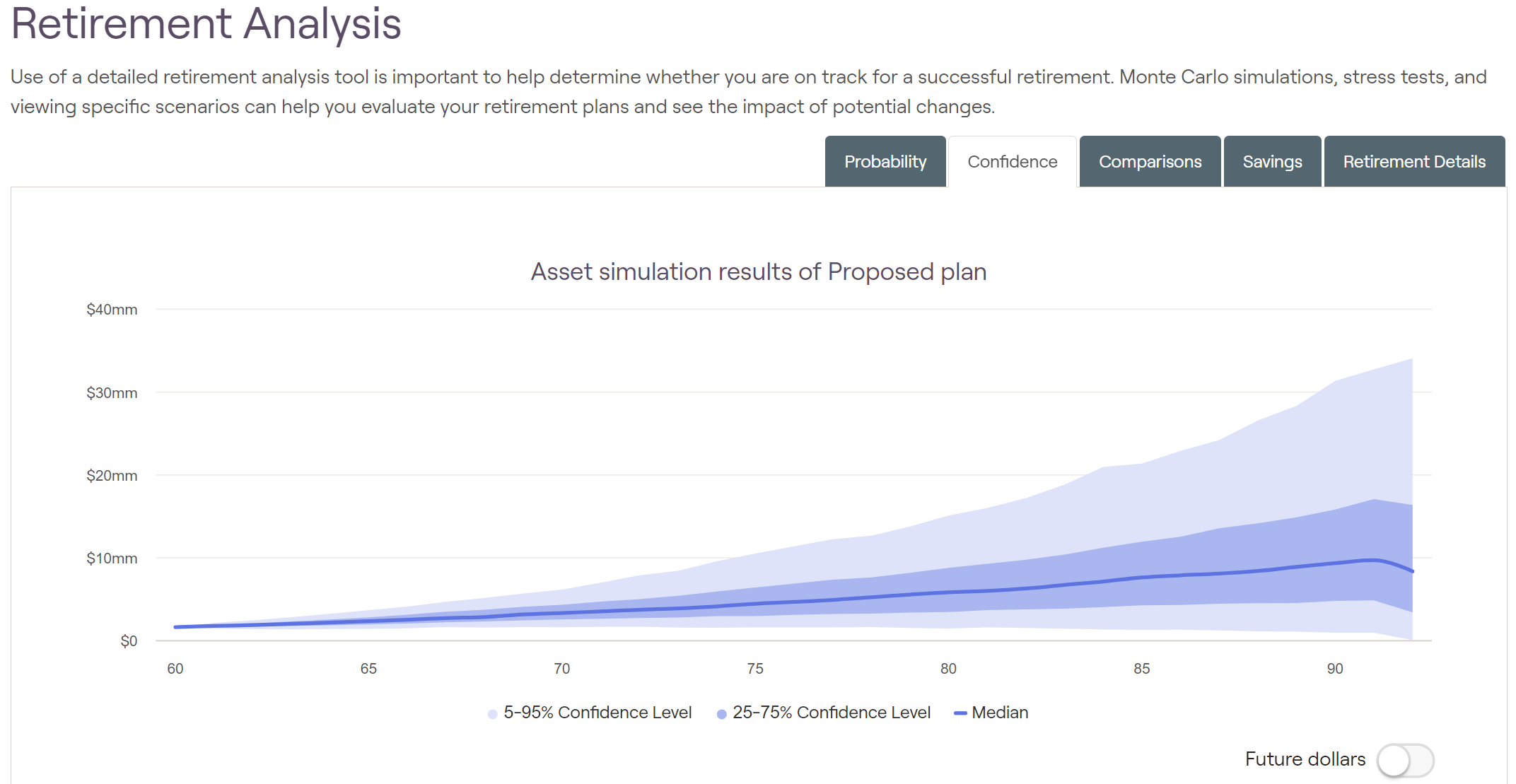

4. Monte Carlo Simulation

In the world of financial planning, forecasting future outcomes can be a daunting task. It's nearly impossible to predict with certainty how markets will behave, how long you'll live, or the many other variables that can affect your financial future. This is where the Monte Carlo simulation comes into play. The Monte Carlo simulation provides a powerful way to assess the likelihood of achieving your financial goals under different scenarios. This tool with Right Capital runs thousands of iterations on the financial plan to come up with a projection and a rough draft of the client's financial success.

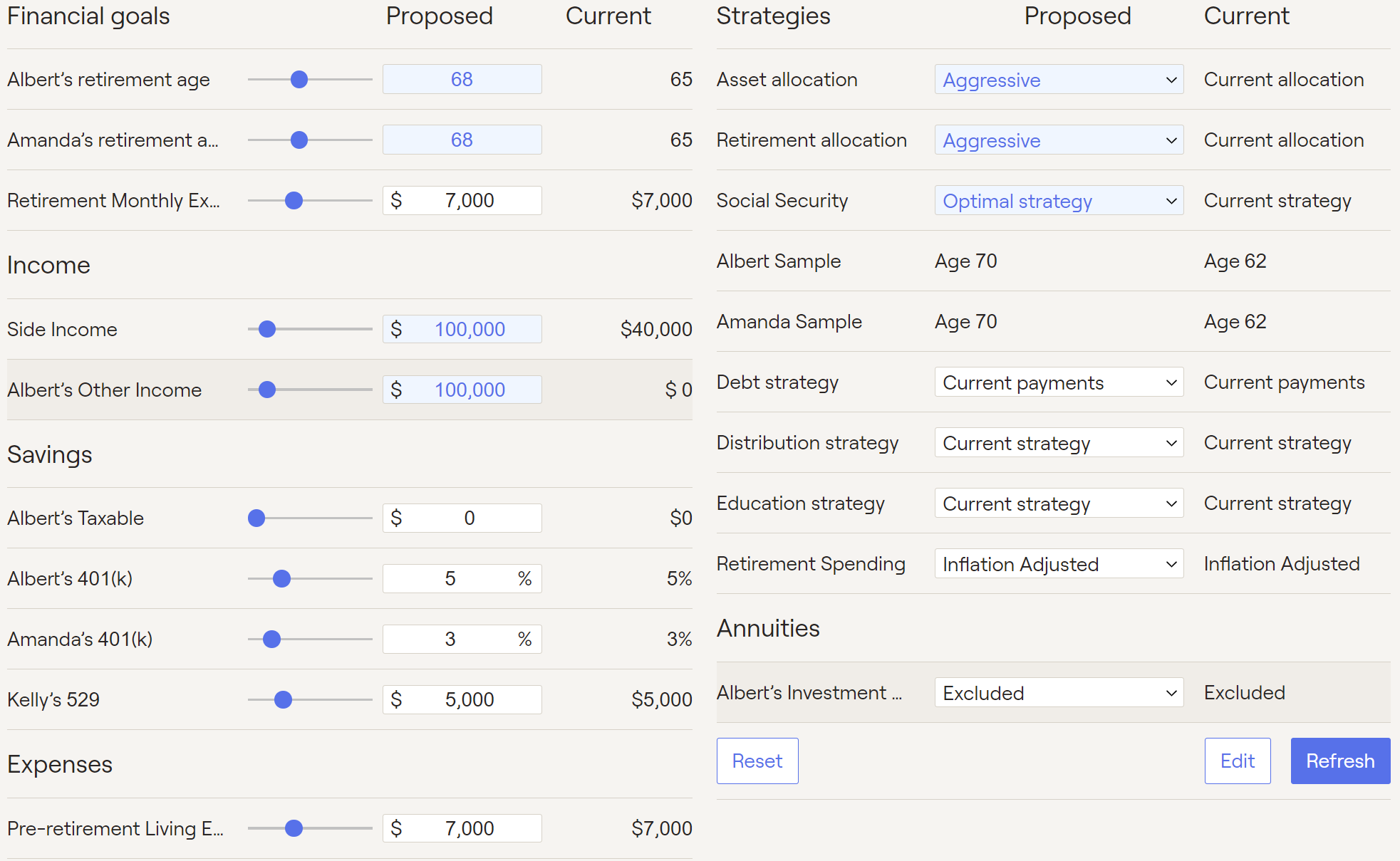

5. Strategy Comparison

One of the key advantages of Right Capital is its ability to quickly model alternative scenarios and adjustments to a financial plan. The "Retirement Analysis" tab allows clients to modify various variables in their plan and instantly see how these changes could impact the success of their financial goals. For example, in the image above, the client adjusted their retirement timeline and planned retirement income, and Right Capital immediately showed that the new strategy is projected to result in a $4.8 million net positive change to the plan. This flexibility empowers clients to make informed decisions and refine their approach based on real-time projections.

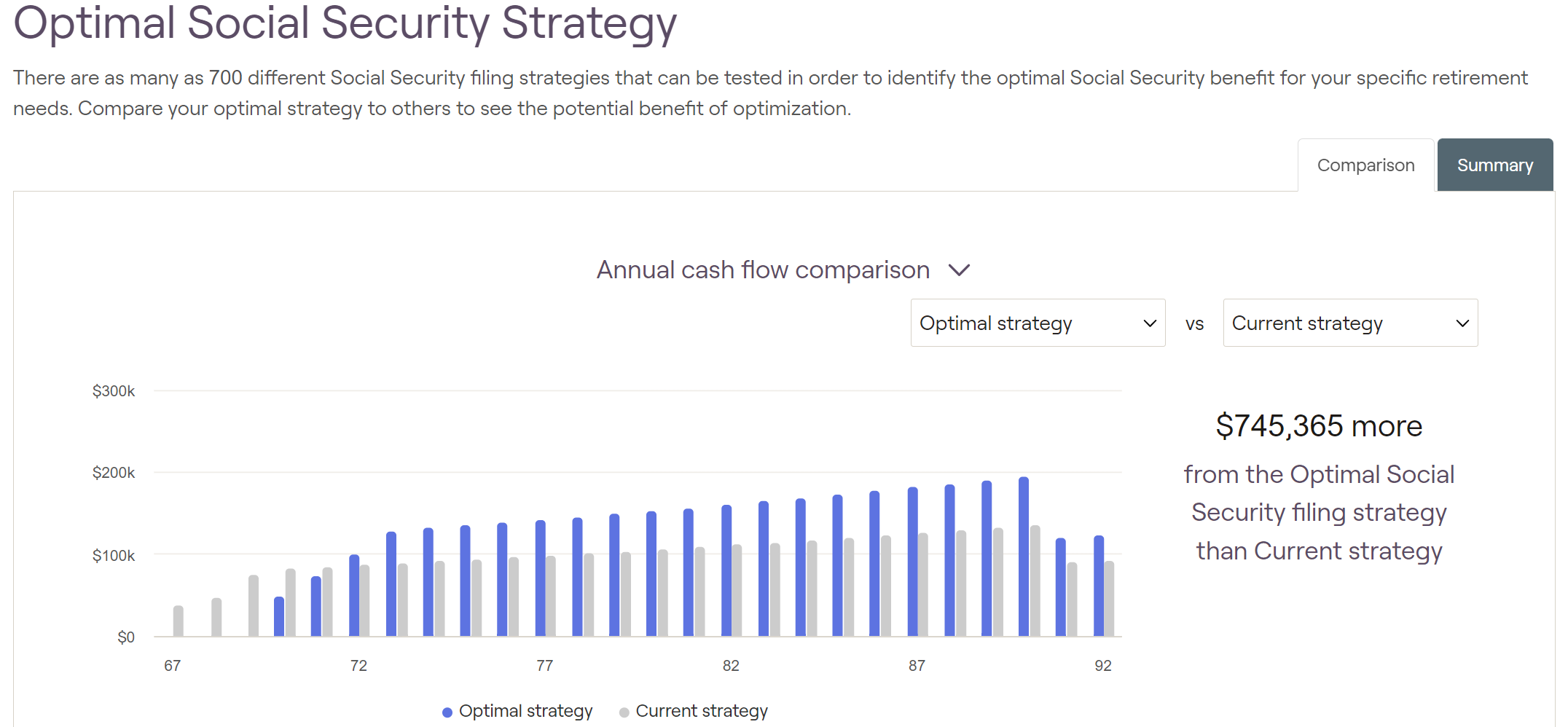

6. Social Security Strategy

Navigating the complexities of Social Security can be a daunting task, especially for those approaching or already in retirement. Social Security plays a critical role in providing a reliable income stream during retirement but deciding when and how to claim benefits can have a significant impact on the total amount of benefits you receive over your lifetime. With numerous factors to consider—including your age, marital status, health, earnings history, and future income needs—making the right decision can be overwhelming. This is where Right Capital stands out. The platform is equipped to run up to 700 different Social Security filing strategies, taking into account a wide range of individual circumstances. This allows Right Capital to provide tailored, data-driven recommendations on the optimal strategy for claiming Social Security benefits.

Action Item controls:

As mentioned earlier, Right Capital offers a powerful feature that allows financial planners and clients to quickly model alternative scenarios and make adjustments to a financial plan. This flexibility is crucial in creating a dynamic financial strategy that can adapt to changing circumstances over time. One of the standout tools within Right Capital that enables this level of adaptability is the "Action Item Control Panel." This tool is designed to give clients and financial planners the ability to easily modify key variables in their plan, ensuring that they can explore multiple strategies and instantly see how these changes affect their financial outlook. These changes can include alternative retirement ages, different savings strategies, changes to asset allocation, changing the approaches to paying off debt, and even increased retirement spending.

Between both Right Capital and eMoney our goal is to help our clients meet their most important savings goal "that of retirement". For any questions related to your retirement goals and the use of any of our financial planning tools please reach out to your wealth advisor.

The Right Capital illustrations, including performance data contained herein, is provided for illustrative purposes only. They do not represent actual performance of any client portfolio or account and should not be interpreted as an indication of such performance.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Investing involves risks, including possible loss of principal.

*Certified Financial Planner ™ (CFP®) is a designation received upon passing the course work and exam administered by the Certified Financial Planner Board of Standards, Inc. (CFP Board).