As workplace retirement plans keep shifting investment decisions to employees, a throwback to traditional pensions is gaining popularity with corporate sponsors of 401(k) and 403(b) plans.

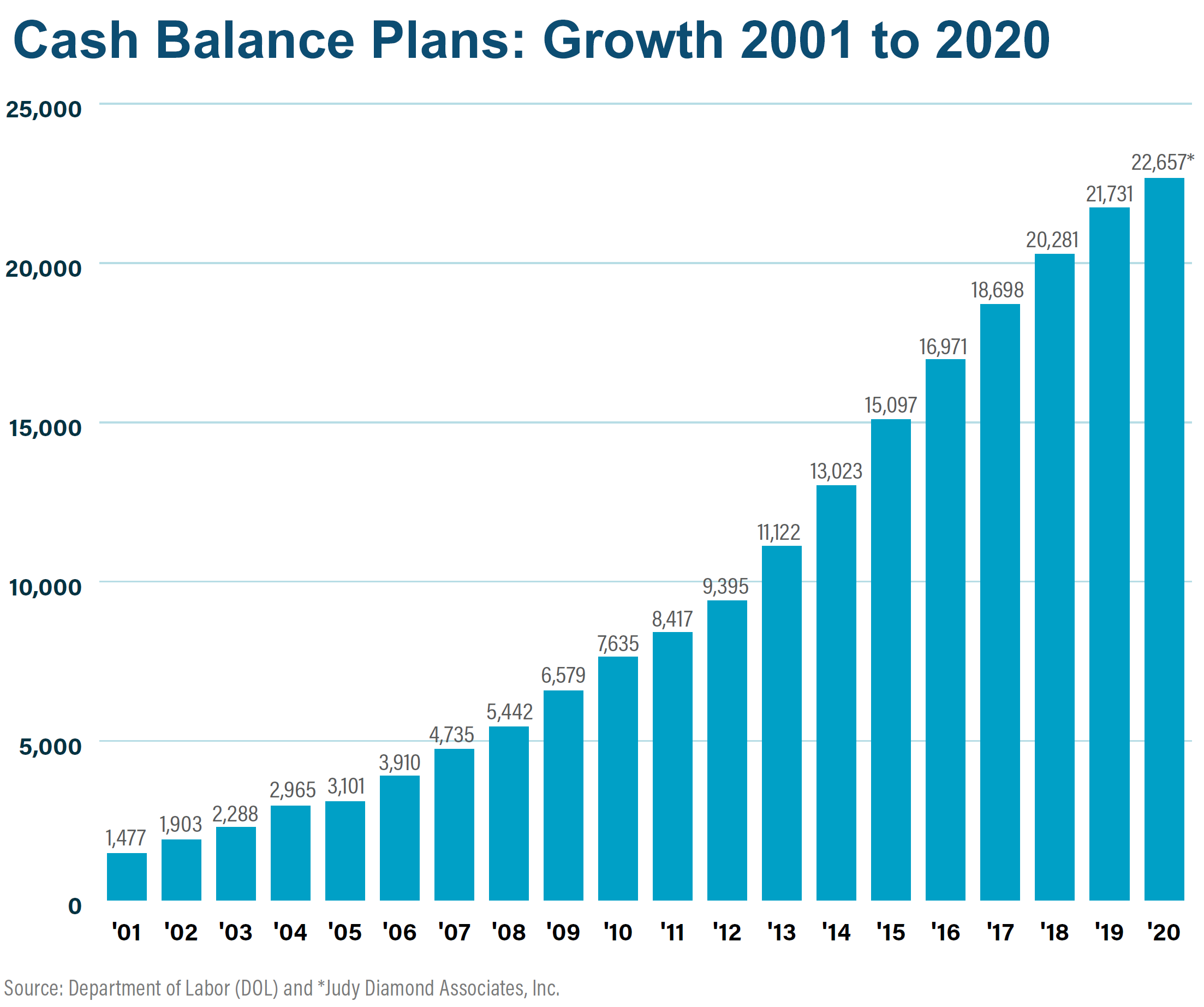

The number of so-called Cash Balance Plans (CBPs) increased by nearly 1,434% between 2001 and 2020, according to the 2023 National Cash Balance Research Report. Based on the latest data available, such retirement plan assets exceed $1.2 trillion and include more than nine million retirement plan participants.

Recent growth in CBPs "confirms two guiding principles," noted the report, which was authored by FuturePlan, a third-party workplace benefits administrator and part of retirement plan record-keeping giant Ascensus. In particular, researchers credited increased usage by employers and workers to:

- Small business owners becoming more educated about alternative ways to accelerate their retirement savings on a tax-advantaged basis other than 401(k)-type of defined contribution plans.

- The increasing acceptance by certified public accountants (CPAs) and retirement plan investment advisors of "the many benefits of offering Cash Balance plans as part of their retirement plan strategy," according to the study.

Since it makes heavy use of government data (specifically IRS Form 5500 filings), this research series typically has a multi-year lag time between compiling and reporting the latest figures. Nevertheless, the National Cash Balance report, which was started in 2008 by market analyst Dan Kravitz, is still considered a pioneering set of research within the industry for sizing up such a fast-evolving retirement plan marketplace.

The report's research finds the number of these plans being implemented in the U.S. steadily rose from 1,477 in 2001 to a projected 22,657 in 2020. (See chart below.) This represents a 15-fold increase over 20 years, according to FuturePlan.

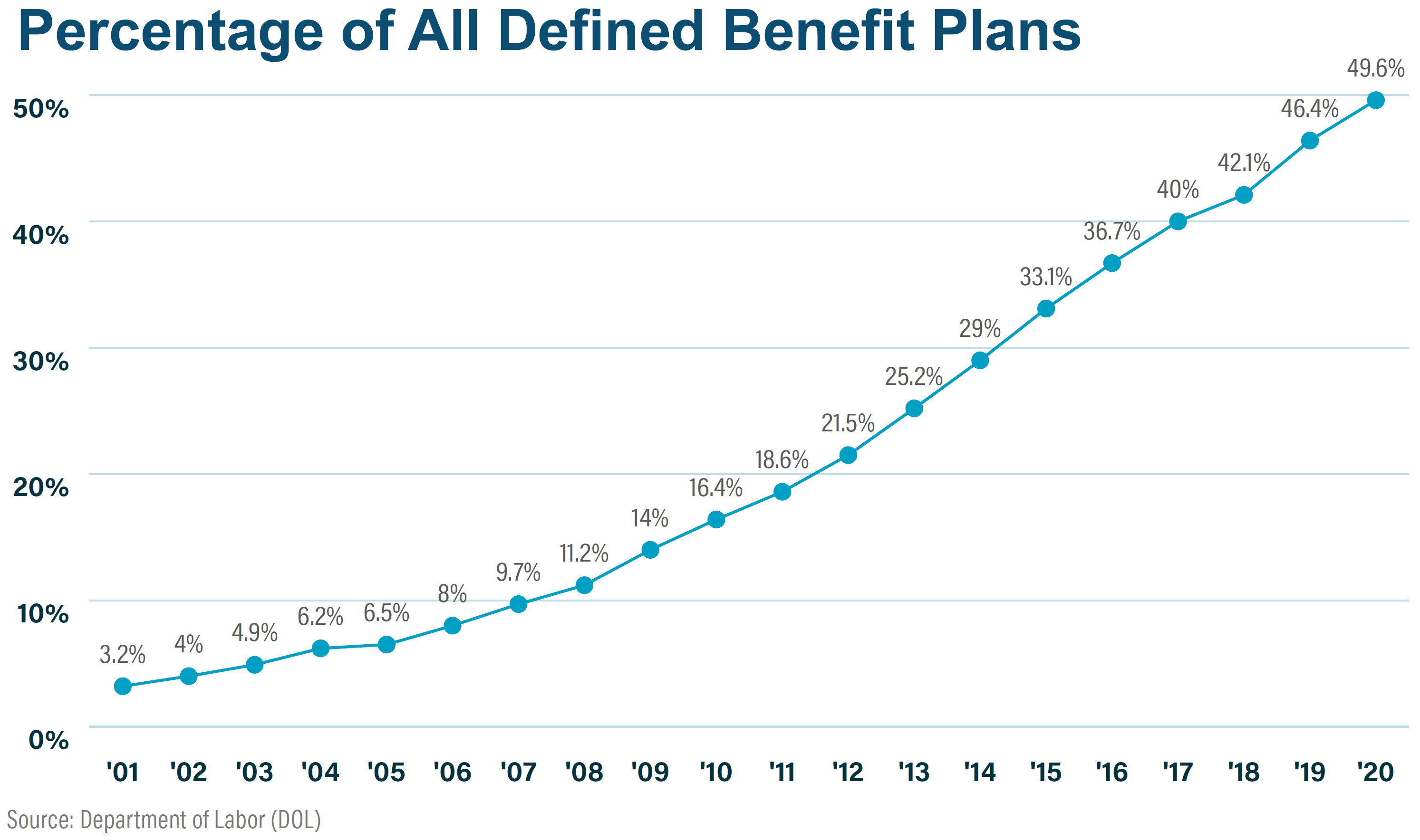

Meanwhile, Cash Balance Plans have increasingly become a major part of the retirement marketplace. Based on the most recent Department of Labor statistics, FuturePlan found by the end of 2020 CBPs had increased from 3.2% to nearly half (49.6%) of all defined benefit plans. (See chart below.)

Traditional defined benefit plans have been steadily declining since the mid-1980s, according to FuturePlan. Its researchers credit a number of factors for a decline in traditional pension plans. In particular, business owners are increasingly combining cash balance plans along with 401(k) plans to increase how much they can save for retirement as well as another way to help defray rising health insurance costs.

The maximum amount that a small business owner can accumulate in a CBP at age 62 increased to $3.4 million in 2023, the report noted. That was up from $3.1 million a year earlier. "This change benefits plan sponsors who may be dealing with a higher cost of living, increased longevity or who may want to defer more taxes," FuturePlan pointed out.

"These 'hybrid' plans combine the high contribution limits of a traditional defined benefit plan with the flexibility and portability of a 401(k) plan," the CBP study noted. "They also avoid the common risk factors and runaway costs involved in traditional defined benefit plans."

Cash Balance Plans are considered a type of defined benefits plan. Like traditional pension plans, employers are required to handle investment decisions for plan participants. Employers are also responsible for making all contributions to the plan. As a result, defined benefit plans are designed to provide retirement savers with a greater amount of income assurance over the longer-term.

By contrast, defined contribution plans — such as 401(k) and 403(b) savings platforms — come with a menu of funds but leave most asset allocation and specific investment decisions to participants. Also, individual workers typically fund at least some of those benefits through their own salary deferrals. The balance is made up by matching contributions as well as any discretionary profit-sharing money thrown into the retirement pot by an employer.

In CBPs, employers can take advantage of existing tax rules to fund new and separate accounts for each participant, observed Shareen Balkey, head of IFA Retirement Services. "What really makes these types of tax-advantaged accounts attractive to both employers and employees is that they can be funded over-and-above what's being contributed to an existing 401(k) plan," she said.

Since CBPs are characterized by the IRS as a type of defined benefits plan, Balkey noted that employers are still responsible for making contributions — depending on that person's age and role within a company's hierarchy. That can be a key consideration for business owners who decide they'd like to defer taxes on more of their retirement savings than what's normally allowed in a 401(k) or similar type of plan.

For more information on the costs involved with covering employees using a CBP — as well as any possible impact on employee contribution levels — business owners and plan sponsors can reach out to an IFA advisor. "In some cases," said Balkey, "adding a cash balance plan alongside a 401(k) or similar defined contribution retirement plan can raise contribution levels for everyone in a cost-effective manner."

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.