To help investors harness greater mobility, we've developed the IFA App. Besides bringing our clients handheld access to powerful wealth-management tools such as links to login to their account, eMoney, Right Capital, IFA's Retirement Plan Analyzer and Index Calculator, we're making available a vast array of educational articles, videos, films, interviews, charts and market data to anyone with an iPhone, iPad or Android-based device. The app can be downloaded in Apple's app store or the Google Play Store.

So let's take an abbreviated tour. As shown below, the IFA App is designed to be very intuitive and easy to navigate. From the home screen, you can access a wealth of information by clicking icons with a similar look and feel as your phone's or tablet's home screen. Several icons take you to sub-screens, and swiping provides access to about a dozen additional screens with 200-plus icons, some of which are shown below.

The IFA App includes the Galton Board App, developed by IFA to help users visualize the randomness of stock market returns. The Galton Board App includes detailed explanations of related mathematical concepts, including probability theories, independent identically distributed (IID) random variables, regression to the mean, the law of large numbers, the random walk, the Gambler's Fallacy, and more. It also includes the Stock Market Data version and Historical Monthly Return beads, where beads fall through the board based on monthly historical returns.

As mentioned earlier, another feature provides one-click access to data and charts found on IFA.com regarding different IFA Index Portfolios. (See photos below.)

Given how much data is made available relating to global equity and fixed-income markets across a broad set of different asset classes, these mobile pages can be used by any investor, not just IFA clients. (Note: IFA Index Portfolio numbers refer to the percentage of the allocation to stock indexes. Thus, Index Portfolio 70 has a 70% allocation to stock indexes and a 30% allocation to bond indexes.)

Getting all of this information reformatted so it can easily be read in the palm of your hand has been quite a challenge. It's taken our founder, Mark Hebner, and IFA's app development team years to perfect.

Charts and information included relate to many aspects of investing. Among other graphics, the IFA App puts into an investor's hand the ability to view the annualized return, standard deviation of returns and growth of $1 for each index portfolio between any two months over the past 90-plus years. Also built into the app are various measurements of SPIEs (Simulated Passive Investor Experiences) and T-stat data relating the elusive alpha that active managers are trying to generate for their investors.

A unique value-added feature developed to help our clients take full advantage of everything IFA offers — from investment and retirement planning to Social Security optimization, college planning and charitable giving — is the "Fiduciary Services" icon. (See below). It even provides resources to tap into our set of referral services to specialists like estate planning attorneys, insurance experts and tax services offered through our tax planning and preparation group at IFA Taxes.

The IFA App, though, isn't just enhanced to help investors work alone in understanding their portfolios better and exploring different big picture wealth-management solutions. The app includes an interactive "Wealth Advisors" icon. (See below.)

While it is true we've tried to enhance communications between advisors and their clients at several different levels, you can tap the "Wealth Advisors" icon and select an IFA wealth manager by name. It's another way to initiate discussions via phone, text or email with an advisor. Each advisor's client services specialist, and team of tax, financial planning, and insurance specialists are also listed here. (The "About IFA" icon, which can be found at the top of each page and is pictured below, is another way to get more information about our team.)

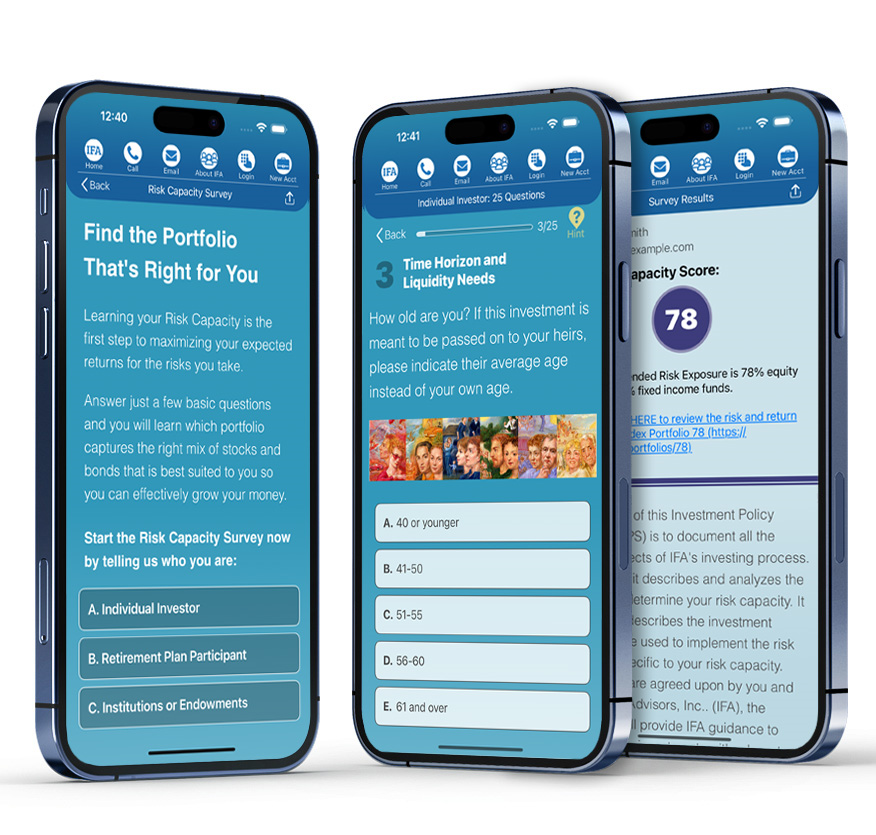

One other tip: If you haven't taken the Risk Capacity Survey for a while, it might be a good idea to re-check if your financial situation has changed enough to trigger a new discussion with your wealth advisor about a portfolio's allocations between more volatile assets (stocks) and bonds. You can also download from the app a detailed report. This report is designed to give you a fairly comprehensive breakdown of your risk capacity score, which is used by IFA's advisors to recommend the most risk-appropriate portfolio for each investor. (See screens below.)

Despite all of our work to provide investors with a cutting edge portfolio analysis and investment education tool, the IFA App is a work in-progress. Our in-house development team continues to refine and improve the app's current capabilities. As a result, we plan to add more content in the future in order to evolve the IFA App's user experience.

If you have any suggestions on features you might like to see included in future iterations of our app, please feel free to reach out to your IFA wealth advisor. In our role as a fiduciary working on behalf of each client's best interests, IFA strives to take advantage of the latest technologies to help educate our investors about their portfolios and holistic financial plans.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product or service. There is no guarantee investment strategies will be successful. Investing involves risks, including possible loss of principal. Performance may contain both live and back-tested data. Data is provided for illustrative purposes only, it does not represent actual performance of any client portfolio or account and it should not be interpreted as an indication of such performance. IFA Index Portfolios are recommended based on time horizon and risk tolerance. For more information about Index Fund Advisors, Inc, please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.