As we've covered in the past, active management's promise of being able to outperform rival index funds hasn't proven to stand the test of time on a consistent basis. As a result, mom and pop investors are increasingly voting with their wallets by shifting more money — as measured in "fund flow" net dollar amounts — from actively managed to passively managed portfolios of mutual funds and exchange-traded funds.

Along those lines, FTSE Russell has compiled a study that raises a possible unintended consequence of the rise in popularity of index funds. In its inaugural Retail Investor Survey, the index provider found that despite recent bouts of "turbulence in financial markets," most investors would like to "increase their investments in index strategies." 1

Citing data from Refinitiv Lipper, the report noted hundreds of billions of dollars of net inflow was recorded in 2022 alone by passively managed ETFs. At the same time, actively managed mutual funds suffered heavy outflow. Such a short-term snapshot mirrors the longer-term trend that's taken place for more than a decade, said Susan Quintin, head of business management, Investment & Wealth Solutions at FTSE Russell's parent, the London Stock Exchange Group (LSEG).

"Investors are familiar with indexing," she told us. "But they're not really knowledgeable about index funds. So, there's a growing demand for more education about index strategies and how to build a diversified portfolio using index funds."

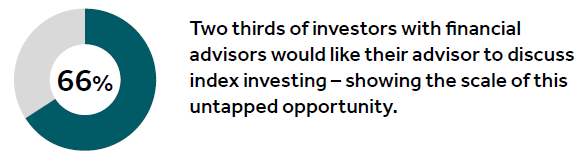

Novice investors as well as more experienced ones seem to be catching on to the groundswell of support for index funds, Quintin added. She pointed to the survey's finding that two-thirds of investors already working with a wealth manager said they'd like to discuss index investing with an advisor — suggesting they hadn't had such a conversation. (See FTSE Russell's graphic below.)

Here's the rub: Even among those investors indicating an awareness of the potential benefits of index funds, the survey found that nearly half hadn't been engaged by an advisor to talk about indexing.

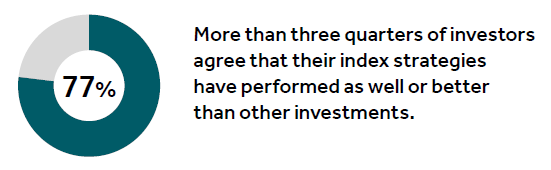

Such results were contrasted by those polled who do invest using index funds. Quintin noted "more than three-quarters of those type of investors agreed that their index strategies have performed as well or better than other investments."

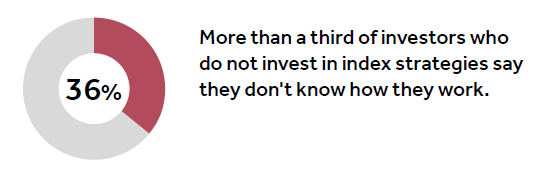

For those who don't invest in index-based strategies, according to FTSE Russell's study, "lack of knowledge is the biggest issue." In fact, more than a third of investors (36%) who use actively managed funds or try to pick individual stocks and bonds "either don't know how (index fund) strategies work or what would be suitable," the survey's authors wrote. (See FTSE Russell's graphic below.)

For their study, researchers surveyed more than 1,000 retail investors in the U.S. owning stocks, mutual funds or ETFs outside the workplace. The polling was conducted by independent marketing research firm 8 Acre Perspective in late 2022.

Overall, the survey found investors with "an intelligent eye to the long-term" appear to be able to keep "surprisingly" positive — even in turbulent times. A vast majority of respondents who were using indexing strategies (77%) indicated a high level of satisfaction with the performance. (See FTSE Russell's graphic below.)

"Investors seem to have intelligent, long-term reasons for liking index strategies," said Quintin. Along those lines, "good performance over time" was cited as the top reason why they invest — or plan to — in index funds.

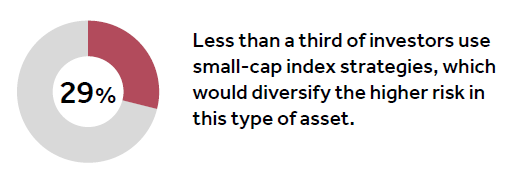

Another important characteristic highlighted in the FTSE Russell report: Index investors place a strong emphasis on "the bigger portfolio management picture," Quintin added. "Creating a diversified portfolio is viewed almost as highly as long-term performance as a major reason to use an indexing strategy," she said.

A potentially more concerning finding was how few of investors working with advisors use index funds to diversify across market-cap sizes. The survey found that less than a third of investors (29%) use small-cap index funds or similar strategies. (See FTSE Russell's graphic below.) Almost half (49%) of survey respondents investing in small caps do so by buying individual stocks. "That exposes them to enormous stock-specific risk," Quintin cautioned.

A major conclusion by the report's authors is that high-net worth clients, in particular, seem to be especially satisfied with indexing strategies. "They tell us that they don't always want to allocate to unique and alternative investments," noted FTSE Russell's researchers.

Given such strong sentiment and growing interest in index funds, the report's authors were skeptical that such mainstream acceptance would subside anytime soon. As they put it:

"Our survey indicates that the multi-year shift to index-based strategies looks set to continue in 2023, with a high rate of net ETF inflows. That contrasts with conventional wisdom that index strategies prosper in buoyant but not turbulent markets."

At IFA, we don't just pay lip service to educating investors about the benefits of owning a globally diversified and passively managed portfolio of index funds. We've also created a website, which is updated with new articles and videos on a weekly basis. It includes hundreds of original pieces of content — not to mention an electronic library of classic investment books and academic papers.

The wealth of IFA's educational materials is available for Apple iOS and Android devices via the IFA App. This free App is available to download from both the Apple App Store and the Google Play Store for Android.

Footnote:

1.) FTSE Russell, "Retail Investor Survey," March 2023.

The graphics on this page with pie charts were republished here with permission of FTSE Russell. No further republication or redistribution is permitted without the consent of FTSE Russell.