Russell's annual reconstitution took place last week, and one of the notable additions to the Russell 3000 Index was Dell. Some investors may be confused as to why the stock of a company with a household name and a $98 billion market value1 was not already part of this broad US stock market index. Dell was dropped from the index during the 2023 reconstitution due to Russell's eligibility rules. Its reinstatement in 2024 signals it once again checks the box for inclusion.

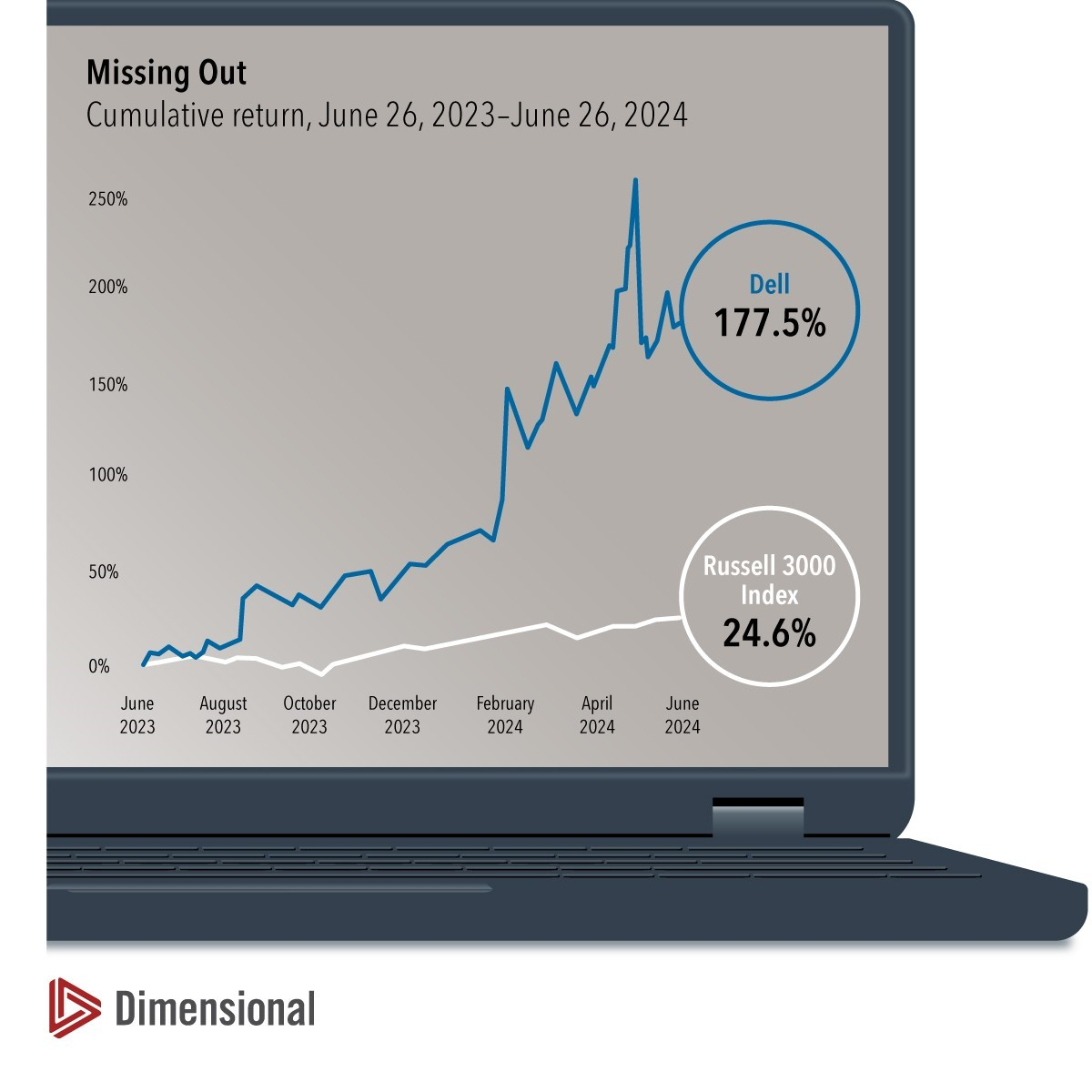

Russell 3000 Index fund investors may be more interested in Dell's performance during its one-year exile. During the stretch between Russell's 2023 and 2024 reconstitution events, Dell's stock posted a cumulative total return of 177.5%—more than seven times higher than the Russell 3000 Index.

This is another example highlighting how index rules and procedures can drive a wedge between what the market offers and what index fund investors receive, particularly if the process is conducted only once a year, as is the case for Russell indices.

This article originally appeared July 11, 2024 in Above the Fray, a weekly newsletter from Dimensional Fund Advisors. It is republished here with permission of Dimensional Fund Advisors LP. No further republication or redistribution is permitted without the consent of Dimensional Fund Advisors LP.

Past performance is not a guarantee of future results. Actual returns may be lower.

Return and market value data from FactSet.

Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices are not available for direct investment.

This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional.

1. Market value as of June 27, 2024, as reported by FactSet.

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.