— As defined by Merriam-Webster

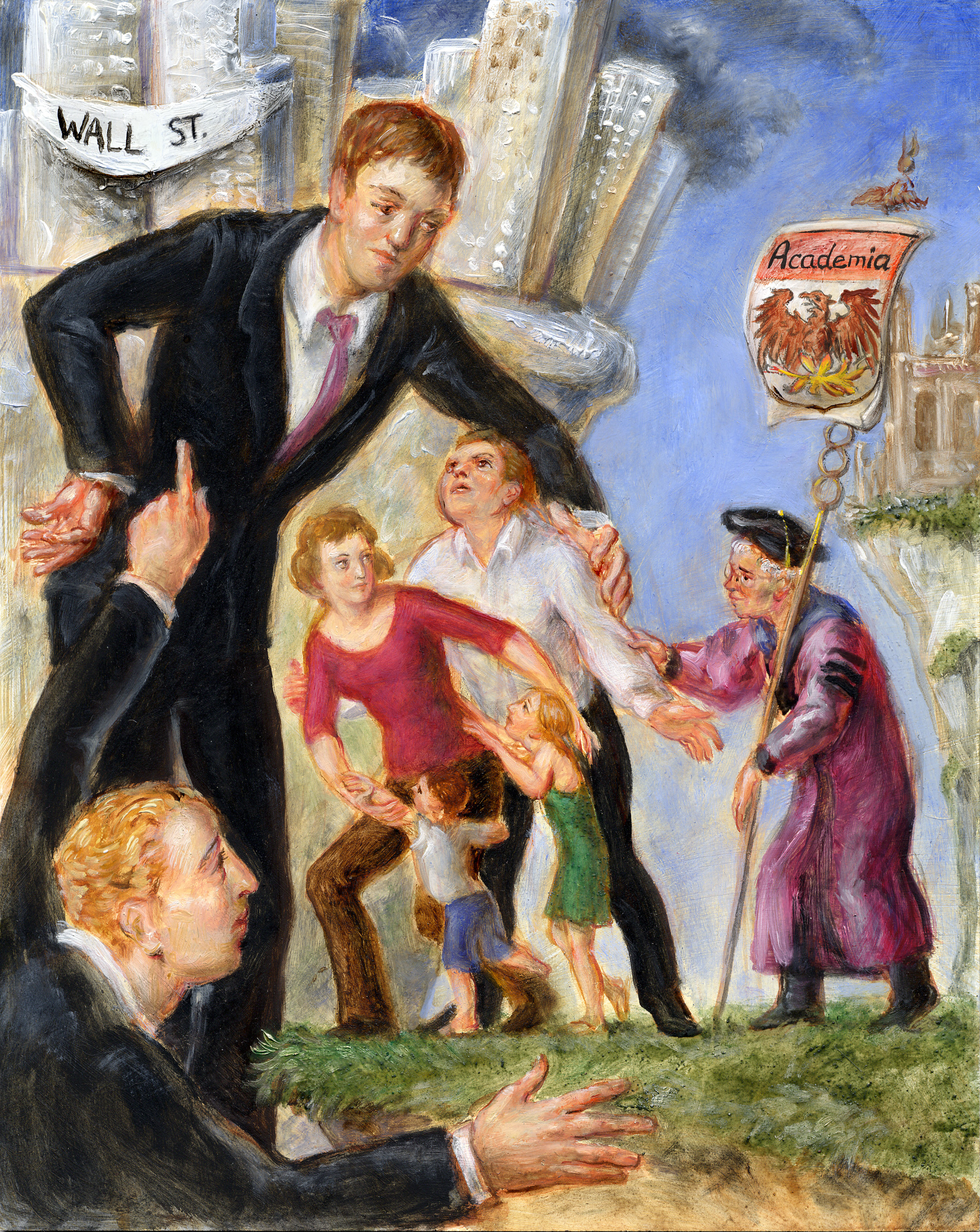

In the past, we've chronicled cases of misdeeds by brokers working with investors in the U.S. as well as around the world. These abuses have come despite a push by regulators to raise legal standards for how brokers work with investors. At the same time, registered investment advisors (RIAs) are facing a higher bar these days in terms of acting as fiduciaries for their clients.

A development that's made headlines more recently involved 15 of the industry's biggest broker-dealers and an affiliated Wall Street investment advisor. In the second half of 2022, the Securities and Exchange Commission (SEC) announced charges against a select list of broker-dealers for "widespread and longstanding failures by the firms" in use of electronic communications used to "maintain and preserve" client records.

The misbehaving — some might say 'bad' actors — named by the SEC included the securities trading arms of: Morgan Stanley, UBS, Goldman Sachs, Citigroup and Bank of America. Also cited were Barclays Capital, Credit Suisse Securities (USA) and Deutsche Bank Securities (together with DWS Distributors and DWS Investment Management Americas). At the same time, two other firms agreed to pay penalties of $50 million each: Jefferies and Nomura Securities International.

A Failure of Trust

According to the regulator, these firms "admitted the facts set forth in their respective SEC orders, acknowledged that their conduct violated recordkeeping provisions of the federal securities laws" and agreed to pay penalties totaling more than $1.1 billion.

"Finance, ultimately, depends on trust. By failing to honor their recordkeeping and books-and-records obligations, the market participants we have charged today have failed to maintain that trust," said SEC Chair Gary Gensler in a public statement. 1

Just a few months later, Morgan Stanley agreed to a censure and to pay more than $802,000 — plus interest — in restitution to clients holding more than 2,000 accounts at the firm. The Financial Industry Regulatory Authority, commonly referred to by its Finra acronym, charged that waivers and fee rebates on certain mutual fund transactions weren't passed along to some investors. In many cases, Finra cited failure by Morgan Stanley to provide proper breaks to those assessed with paying front-end sales charges and contingent sales charges. As noted in a report by industry trade publication Financial Advisor IQ, front-end charges are typically related to Class A fund share classes sold by brokerages. 2

The Ongoing Wells Fargo Saga

Of course, brokers behaving badly isn't a new story. In case you don't recall, Wells Fargo has wound up paying over the past several years billions of dollars to settle investigations into its handling of fraudulent accounts, sales practices and lending activities. Starting in 2016, the beleaguered bank was hit with complaints about aggressive cross-selling of services across different banking, brokerage and mortgage loan units.

By 2018, top officials admitted to an internal probe of sales practices in its wealth management arm. According to a report by USA Today, such action was initiated after whistleblowers told federal agencies about "inappropriate referrals or recommendations." In a separate filing to regulators, Wells Fargo related that such questionable practices included "rollovers for 401(k) plan participants, certain alternative investments, or referrals of brokerage customers to the company's investment and fiduciary services business." 3

The saga, however, hasn't faded from news headlines. Faced with ongoing government scrutiny, the financial services conglomerate decided to sell its asset management arm for a reported $2.1 billion to private equity firms GTCR and Reverence Capital Partners.

In an early 2023 regulatory filing, Wells Fargo disclosed that it's under investigation by the SEC and the Commodity Futures Trading Commission over "records-retention requirements" using "unapproved electronic messaging channels." As pointed out by InvestmentNews, JPMorgan Chase & Co. agreed to pay $200 million in late 2021 over similar charges relating to employee communications deemed as not accessible enough by regulators to conduct their own due diligence. 4

Raymond James & Investing in a Musical

Regulatory concern about unfriendly behavior towards investors keeps cropping up at other big broker-dealer networks. A few other examples include:

- False Trade Confirmations

Raymond James agreed to pay a fine of $300,000 to settle charges that it sent customers almost two million inaccurate trade confirmations, according to a regulatory filing as reported by Financial Advisor IQ on Feb. 1, 2023.

The report noted that such a fine "pales in comparison to one Finra levied upon Raymond James for trade-confirmation infractions" in October 2022. That's when regulators ordered the firm to "pay a total of more than $1.1 million to resolve supervisory lapses at two of its brokerages," the article added. 5

- Investment in Musical Adaption of Movie "Ghost" Goes Awry

A Wells Fargo advisor was named in an early 2023 lawsuit by a former client who claimed fraud over a musical adaption of the 1990 movie "Ghost." The legal action, which was filed in New York County Supreme Court, alleges that Marko Gnann's investment advisor pitched an idea of investing in the project in its pre-production days in 2010. The advisor was affiliated with Morgan Stanley at the time, according to Financial Advisor IQ. Gnann followed his advisor to Wells Fargo, the suit maintains.

The complaint added that Gnann's advisor "predicted that the musical, based on the Oscar-winning movie, would be a worldwide success and that he was investing every penny of his own money in the project." The investment manager directed him to wire at different times a total of more than $3 million to an offshore account, the suit claims.

After receiving a relatively small return in 2012 and repeated assurances from the advisor that he'd receive more of a return on his investment, Gnann claims he was informed in 2020 that essentially his "entire investment was lost." Meanwhile, Financial Advisor IQ notes an attorney representing Morgan Stanley has moved for dismissal of the claims against the wirehouse.

The lawsuit comes following Gnann's filing a complaint with Finra, which describes itself as a "government-authorized" and not-for-profit firm that oversees broker-dealers across the country. (The Wall Street Journal commonly refers to the organization as Wall Street's self-regulator.) As reported by Financial Advisor IQ, Finra arbitrators dismissed the case in 2022, finding that such a complaint "had not been commenced within Finra's six-year limit for initiating an arbitration process, given that the parties had agreed that Gnann's first investment, if any, had been made before April 2012."

Gnann's lawyer, Kevin Galbraith, characterized Finra's arbitration ruling as based on a technicality. "The merits of the suit — or the lack thereof — have not changed since the suit was defeated at the Finra arbitration," he told the news portal. The court case was expected to proceed in New York later this year. 6

At IFA, which is registered as an independently owned and managed wealth management firm, we're required to act as fiduciaries. As a result, our advisors must act in the best interest of their clients — even if doing so goes against the best interest of IFA as a business. As part and parcel of such fiduciary responsibilities, fundamental to our holistic financial planning process is assessing how much risk a person really needs to be exposed to in order to meet his or her financial goals. That's why we've developed an online tool, the IFA Risk Capacity Survey, which is designed to measure how much portfolio risk is appropriate in an IFA Index Portfolio.

Along these lines, we also urge those who've already built existing relationships with us to take advantage of our complimentary offer to create an individually tailored financial plan. Such a holistic planning approach aims to take a comprehensive view of a client's investments and financial situations. As part of this process, our wealth managers can look into a range of financial issues, from household budgeting and retirement planning to educational savings and health care spending needs.

Footnotes:

1.) Securities and Exchange Commission, "SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures," Sept. 27, 2022.

2.) Financial Advisor IQ, "Morgan Stanley to Pay Clients $800K over Mishandled Mutual Fund Trades," Dec. 28, 2022.

3.) USA Today, "Wells Fargo faces yet another investigation — this time of its wealth management division," March 1, 2018.

4.) InvestmentNews, "Wells Fargo latest to face probe of use of messaging apps," Feb. 22, 2023.

5.) Financial Advisor IQ, "RayJay Fined $300K over Transaction Confirmation Statements," Feb. 1, 2023.

6.) Financial Advisor IQ, "Investor Claims Advisor Stole $3M Meant to Fund 'Ghost' Musical," Feb. 21, 2023.

This is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, product, service, or considered to be tax advice. There are no guarantees investment strategies will be successful. Investing involves risks, including possible loss of principal. For more information about Index Fund Advisors, Inc., please review our brochure at https://www.adviserinfo.sec.gov/ or visit www.ifa.com.