Errol Morris on the Art and Science of Markets

In learning about markets, I’m confronted with questions: What governs their behavior? What do they really represent? What are they telling us? What do they mean?

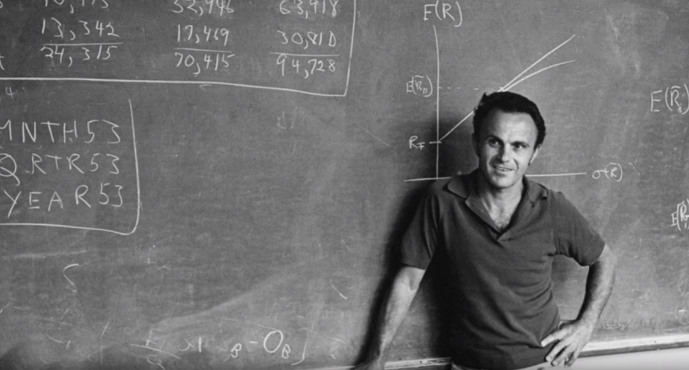

Couple these quandaries with the deep human need to learn something from the past, not just make sense out of it. What governs boom and bust? Why one price rather than another? And one of the deepest questions: Can we predict the future? The 1950s and ’60s saw as great a revolution in finance as the one in science during the early Renaissance. We’ve witnessed the growth of computers and come to the realization that the markets themselves might be a real-world computer, with investors playing the role of processors.

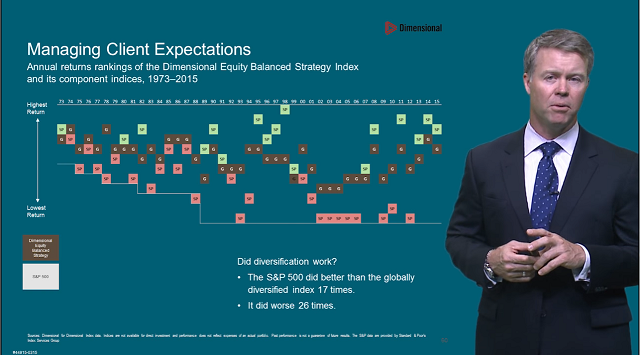

What science does is try to make visible the hidden, the unknown, the potentially indecipherable. People are always hoping that scientists will reveal to them the true meaning of things. But even if science takes us deeper into the behavior of the world around us, it does not reveal deeper meaning. Why do things behave the way they do? Why do certain phenomena commandeer our attention, directing it to hidden patterns cloaked in the ubiquity of noise? As in art, so in science that eternal question remains: What is defined by us and what is out there to be discovered by us?

We’re trying to discover a reality beyond what is manifest. We’re learning to look at the world in a different way than the familiar or the expected—realizing that subtle shapes and strange forms can often reveal something new and unexpected. Art and science show us that there is often something beyond our ken, beyond our reach. Ironically, modern finance doesn’t tell us about what will happen next. It takes us into that mystery.

—Errol Morris